Rates

Very Marginal Moves In Rates Today Despite FOMC

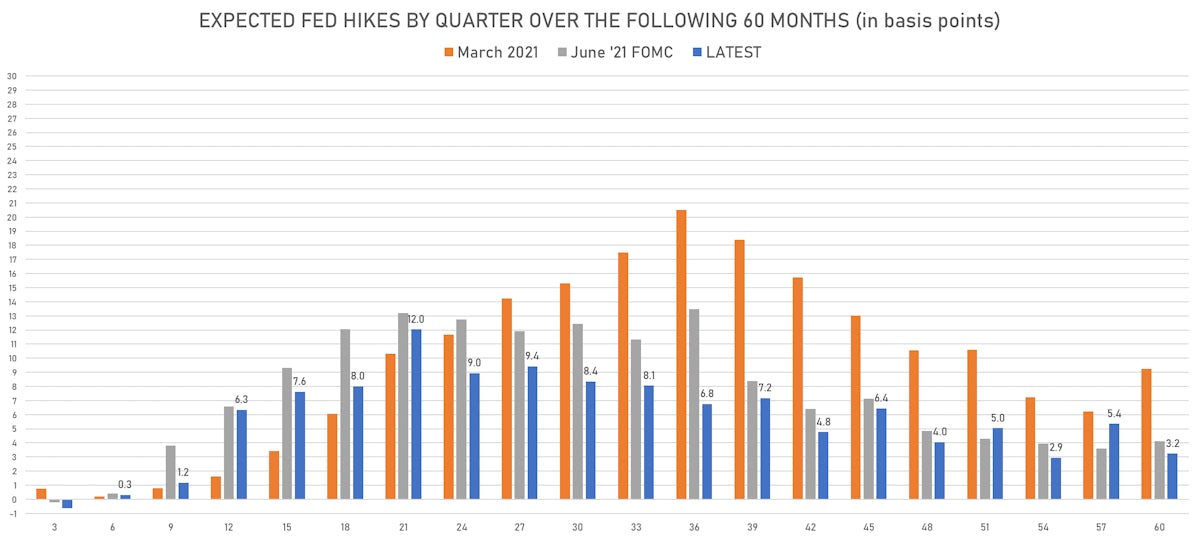

The Fed acknowledges that the economy is making progress towards its goals and is preparing to taper, though no announcement yet; that is less dovish than some expected and could lead to further flattening of the curve

Published ET

Expected Fed Rate Hikes Over The Next 5 years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.1bp today, now at 0.1285%

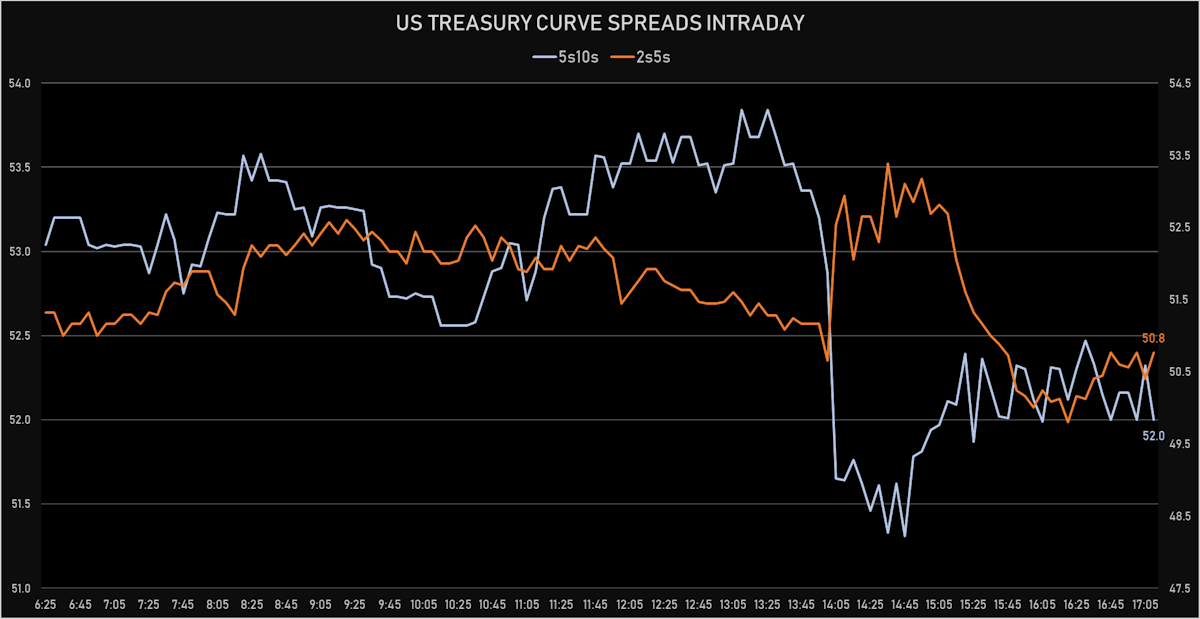

- The treasury yield curve flattened, with the 1s10s spread tightening -0.2 bp, now at 117.0 bp (YTD change: +36.5bp)

- 1Y: 0.0680% (unchanged)

- 2Y: 0.2035% (down 0.4 bp)

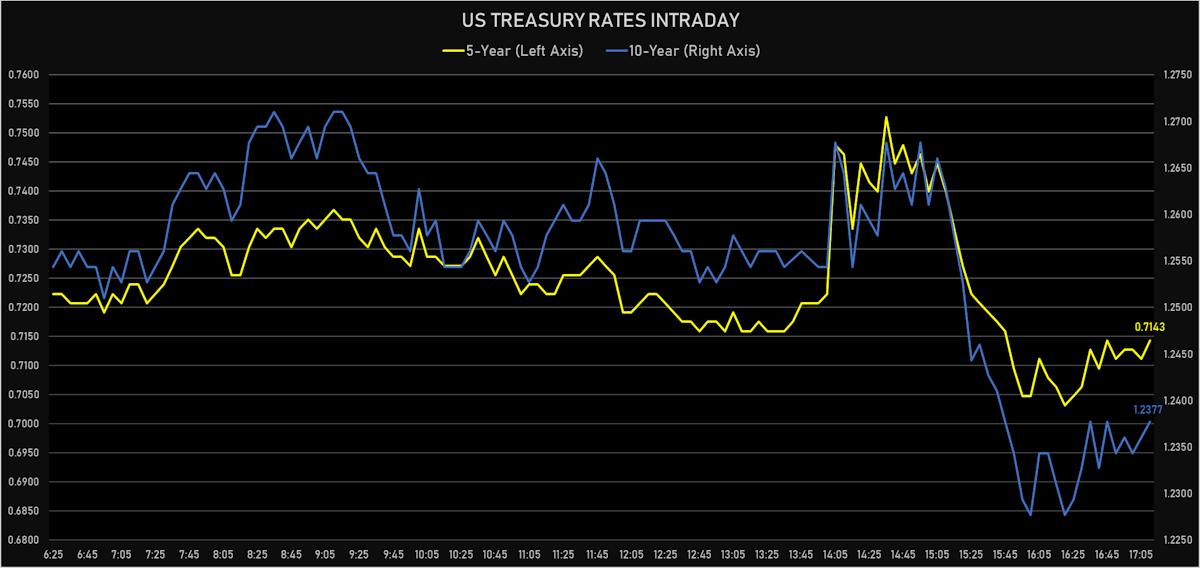

- 5Y: 0.7143% (up 1.2 bp)

- 7Y: 0.9970% (down 0.2 bp)

- 10Y: 1.2377% (down 0.2 bp)

- 30Y: 1.8865% (down 0.6 bp)

- US treasury curve spreads: 2s5s at 51.0bp (up 1.5bp today), 5s10s at 52.3bp (down -1.6bp), 10s30s at 65.0bp (down -0.6bp)

- Treasuries butterfly spreads: 2s5s10s at 0.7bp (down -3.2bp), 5s10s30s at 12.4bp (up 1.9bp)

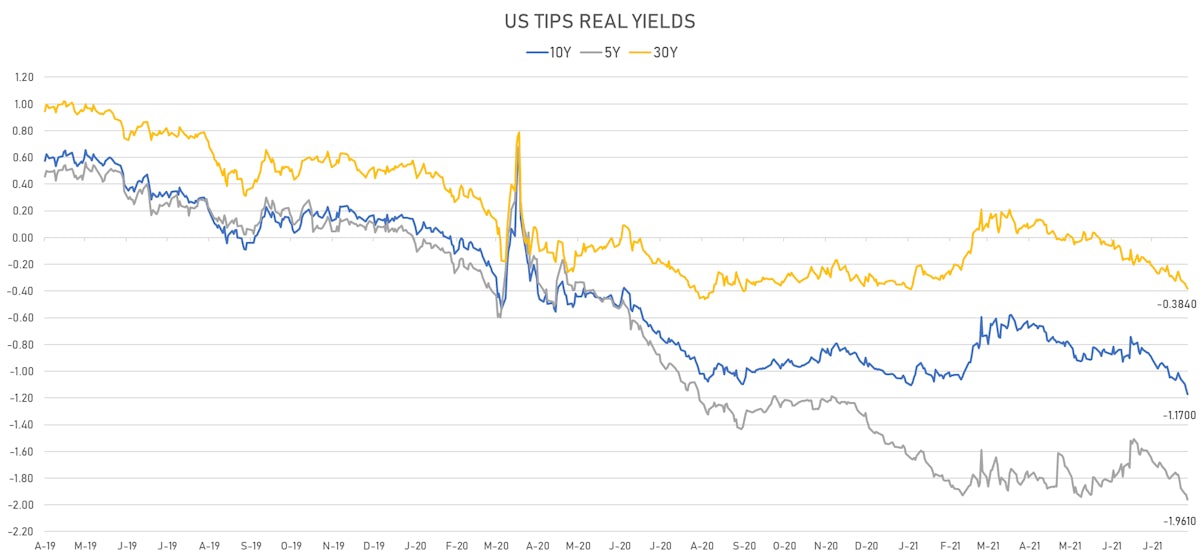

- US 5-Year TIPS Real Yield: -4.0 bp at -1.9610%; 10-Year TIPS Real Yield at record lows: -4.2 bp at -1.1700%; 30-Year TIPS Real Yield: -2.6 bp at -0.3840%

OUR COMMENTARY

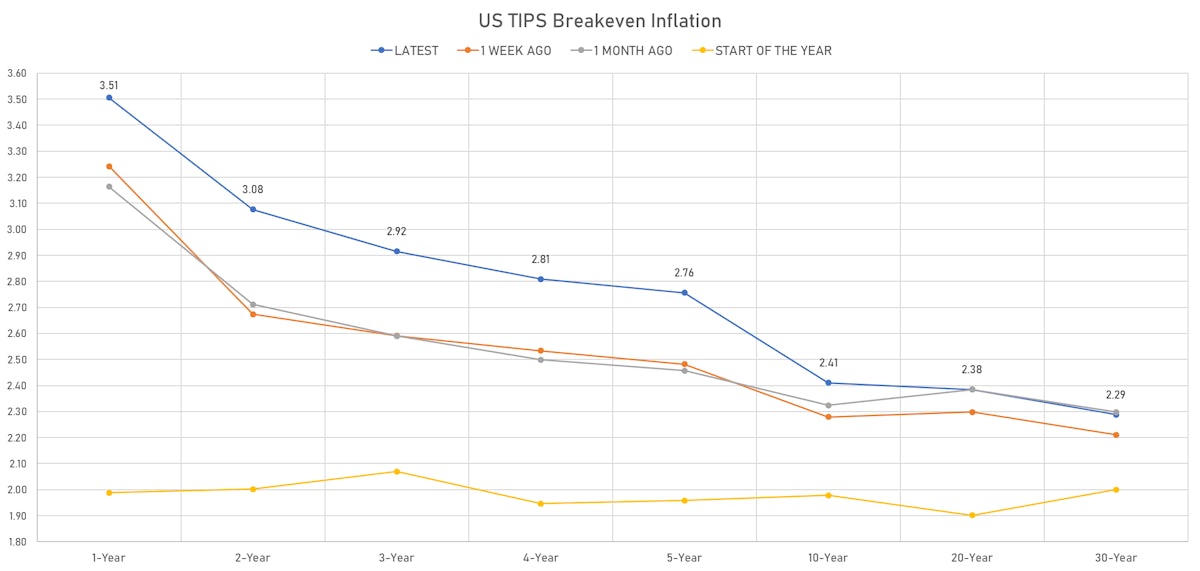

- Inflation expectations are not dropping as fast as initially expected: the TIPS breakeven inflation curve (see charts lower down the page) now shows inflation normalizing more slowly

- That puts the Fed in a difficult place: it wants to support further economic recovery, but is also committed to killing any notion that it is delinquent on the inflation front

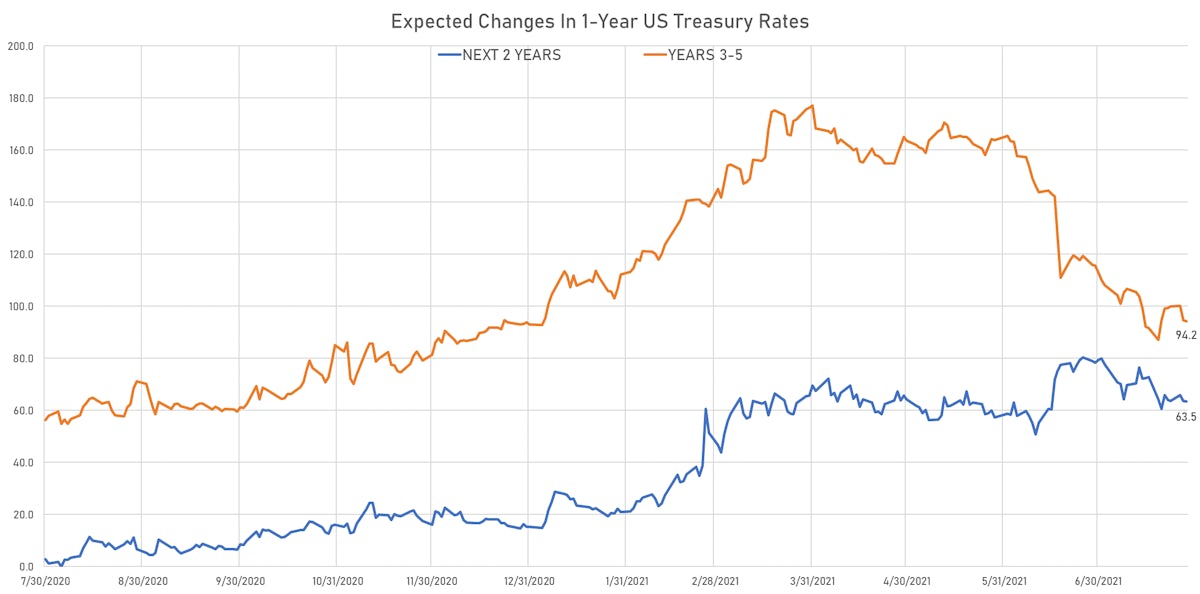

- It means that unless the economy weakens this year (Covid deaths resurgence for example), we expect short rates to rise and the June dot plot (with 2 hikes in 2023) to be realized

- That path leads to lower future growth expectations and lower terminal rates, something fixed income markets have already priced in

- In this economic Sophie's choice, the Fed chooses to kill future economic growth rather than jeopardize the credibility of the institution by letting inflation expectations rise further. It may be seen as a policy error (as it will likely lead to a reversal down the road), but it is understandable in the current context.

US MACRO RELEASES

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 23 Jul (MBA, USA) at 5.70 %

- Mortgage applications, market composite index for W 23 Jul (MBA, USA) at 737.90

- Mortgage applications, market composite index, purchase for W 23 Jul (MBA, USA) at 251.70

- Mortgage applications, market composite index, refinancing for W 23 Jul (MBA, USA) at 3,570.40

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 23 Jul (MBA, USA) at 3.01 %

- Policy Rates, Fed Funds Target Rate for 29 Jul (FOMC, U.S.) at 0.13 %, below consensus estimate of 0.13 %

- Policy Rates, Fed Interest On Excess Reserves for 29 Jul (FED, U.S.) at 0.15 %

- Retail Inventories Advance, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.60 %

- US Adv Goods Trade Balance, Current Prices for Jun 2021 (U.S. Census Bureau) at -91.21 Bln USD

- Wholesale Inventories Advance, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.80 %

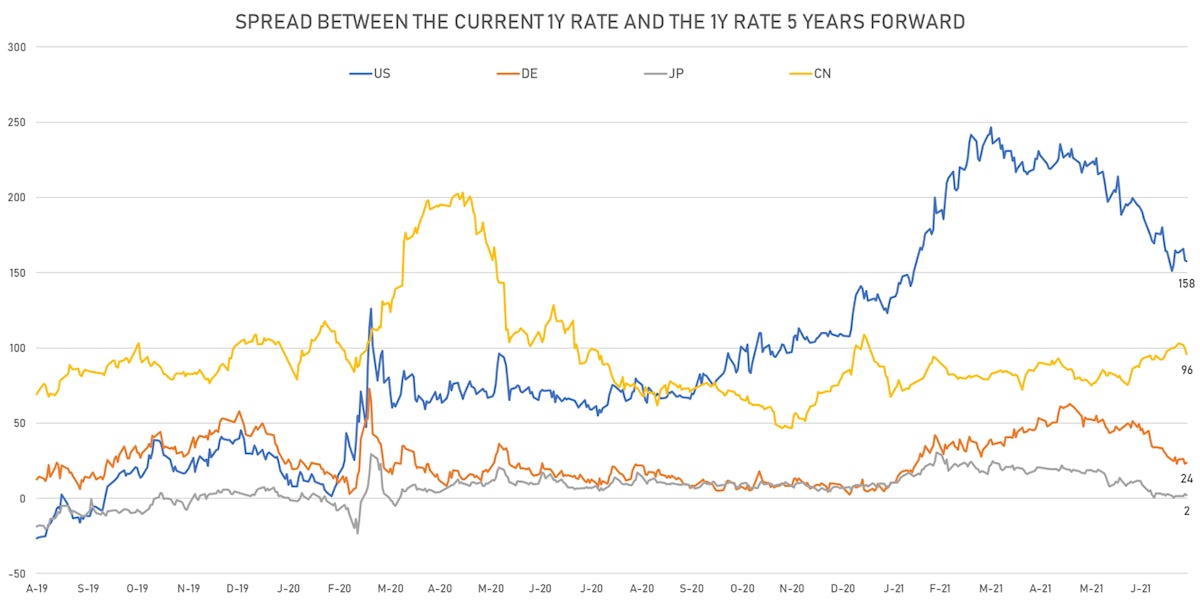

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 0.7 bp, now at 1.6511%

- 1-Year Treasury rates are now expected to increase by 157.6 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.3 bp by the end of 2022 (meaning the market prices 61.2% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 14.8 bp of rate hikes over the next 18 months (equivalent to 0.59 rate hike) and 69.7 bp over the next 3 years (equivalent to 2.79 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.51% (up 4.0bp); 2Y at 3.08% (up 5.3bp); 5Y at 2.76% (up 4.2bp); 10Y at 2.41% (up 3.9bp); 30Y at 2.29% (up 1.9bp)

- 6-month spot US CPI swap up 6.4 bp to 4.088%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.9610%, -4.0 bp today; 10Y at -1.1700%, -4.2 bp today; 30Y at -0.3840%, -2.6 bp today

RATES VOLATILITY & LIQUIDITY

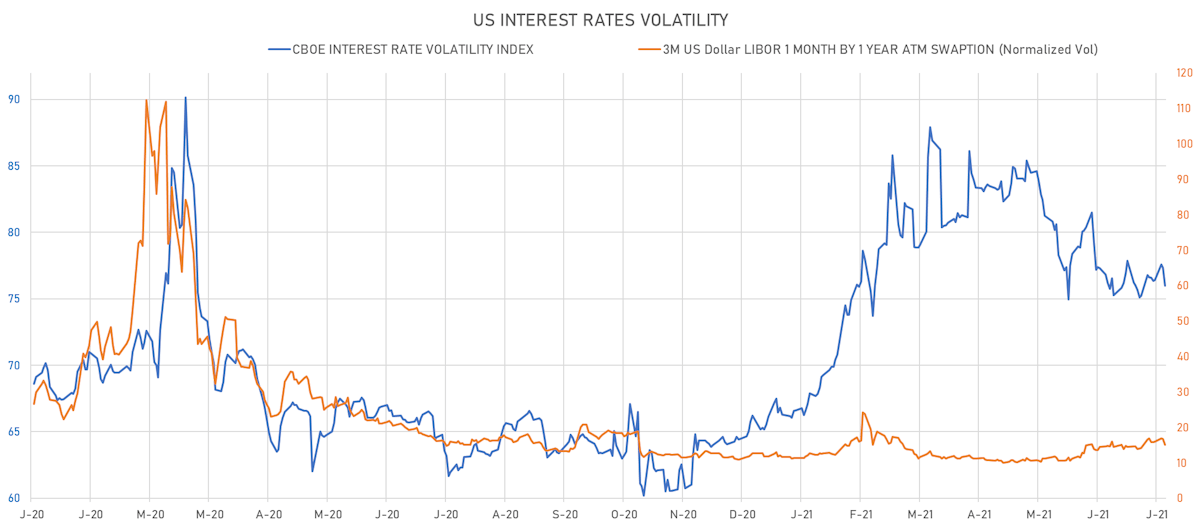

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.6% at 15.1%

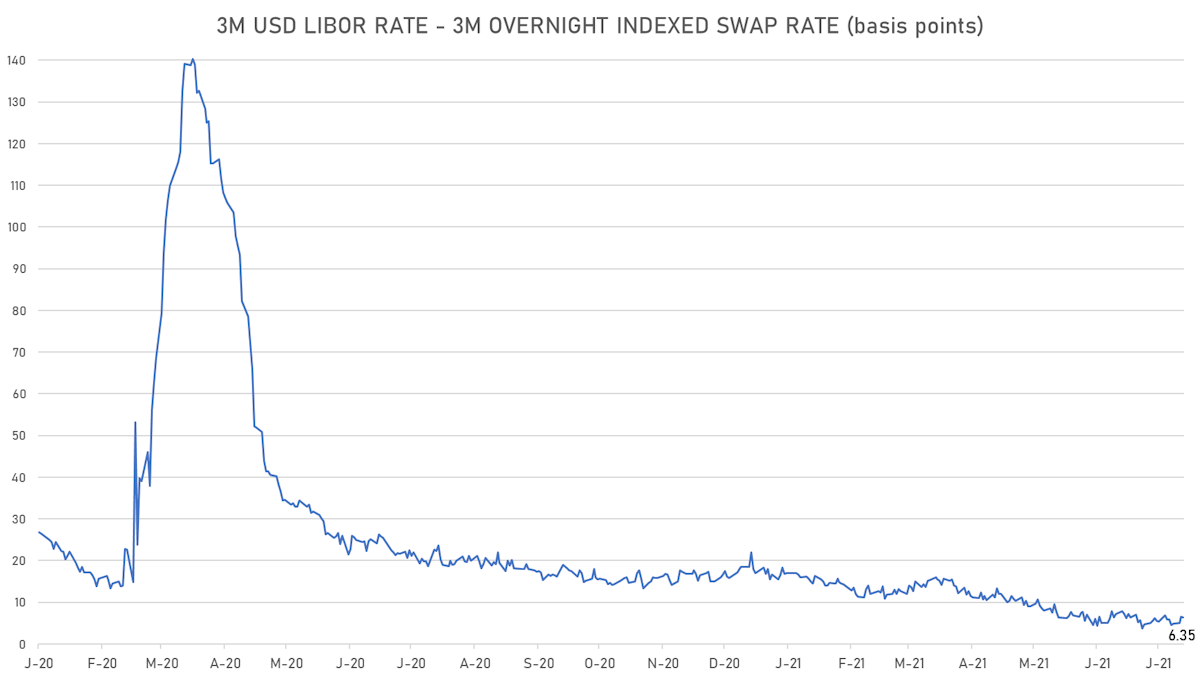

- Ample liquidity: 3-Month LIBOR-OIS spread down -0.1 bp at 6.4 bp (12-months range: 3.7-23.6 bp)

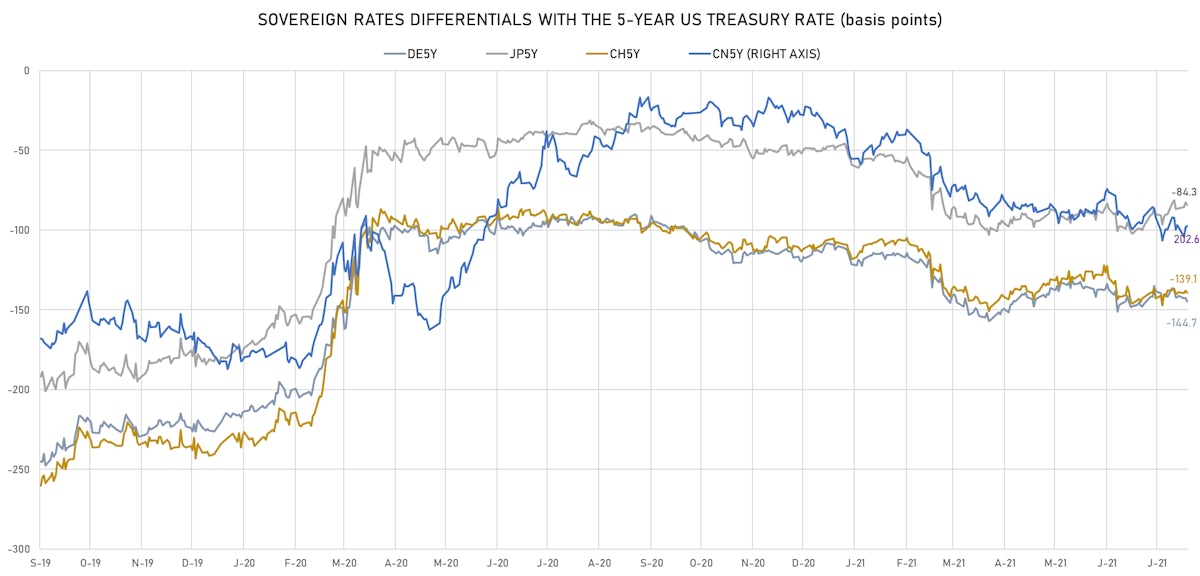

KEY INTERNATIONAL RATES

- Germany 5Y: -0.744% (down -1.1 bp); the German 1Y-10Y curve is 0.4 bp steeper at 20.1bp (YTD change: +5.5 bp)

- Japan 5Y: -0.117% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 13.8bp (YTD change: +0.1 bp)

- China 5Y: 2.740% (up 2.1 bp); the Chinese 1Y-10Y curve is 2.9 bp flatter at 92.8bp (YTD change: +46.4 bp)

- Switzerland 5Y: -0.677% (up 0.1 bp); the Swiss 1Y-10Y curve is 8.8 bp steeper at 43.2bp (YTD change: +16.8 bp)