Rates

US Short Rates Largely Unchanged Despite Q2 GDP Miss

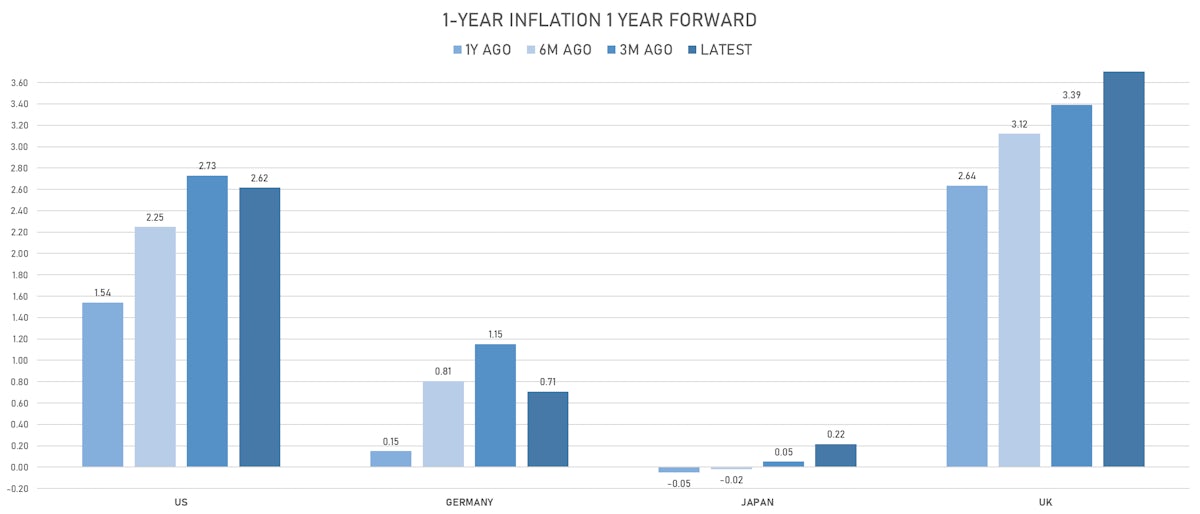

Core PCE inflation (GDP deflator) was 6.1% year on year, and the inflation swap curve is now expecting higher inflation for longer (a slower return to normal levels)

Published ET

6-month CPI Swap Forward Curve Showing Slower Return To Normal | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

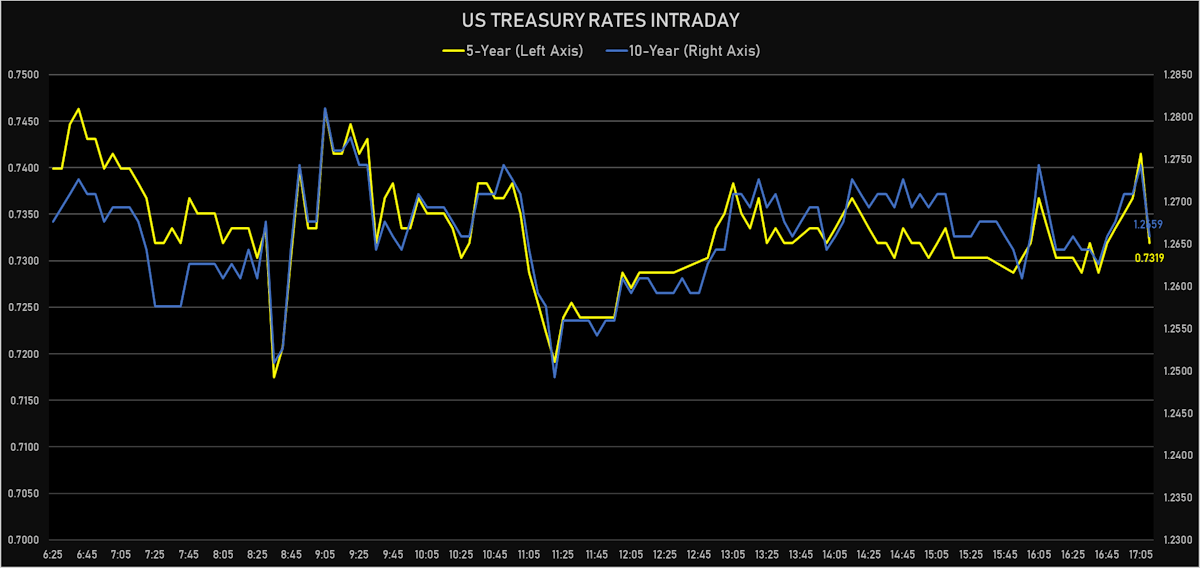

- 3-Month USD LIBOR -0.3bp today, now at 0.1258%

- The treasury yield curve steepened, with the 1s10s spread widening 3.1 bp, now at 120.0 bp (YTD change: +39.5bp)

- 1Y: 0.0660% (down 0.3 bp)

- 2Y: 0.2035% (unchanged)

- 5Y: 0.7319% (up 1.8 bp)

- 7Y: 1.0225% (up 2.6 bp)

- 10Y: 1.2659% (up 2.8 bp)

- 30Y: 1.9182% (up 3.2 bp)

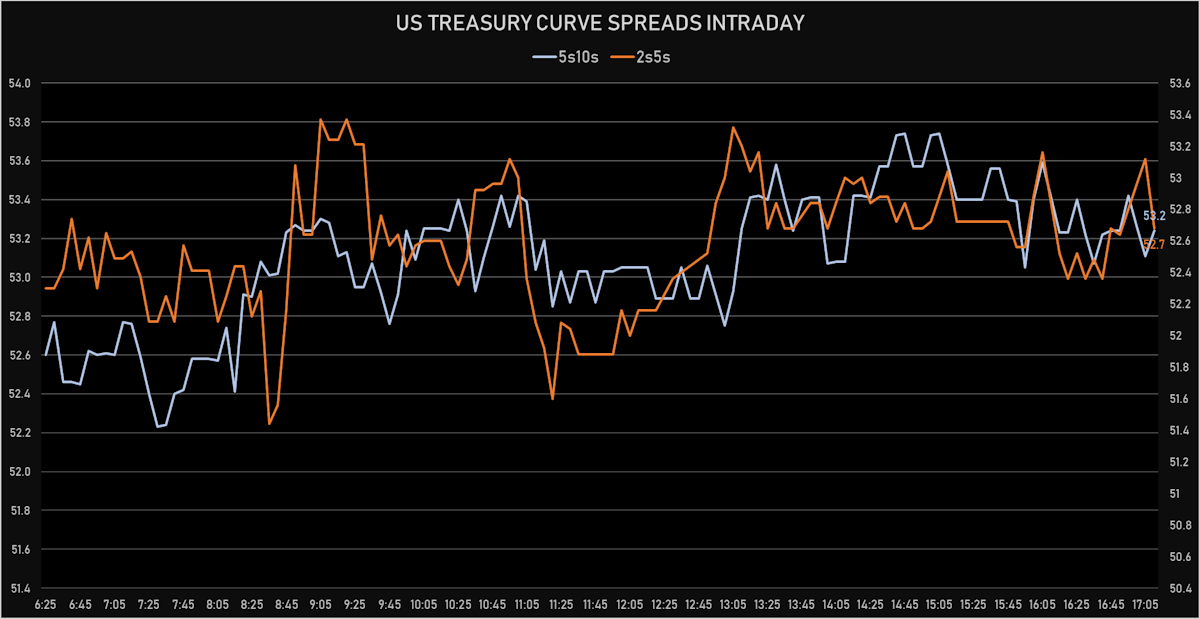

- US treasury curve spreads: 2s5s at 52.9bp (up 1.9bp today), 5s10s at 53.4bp (up 1.2bp today), 10s30s at 65.2bp (up 0.4bp today)

- Treasuries butterfly spreads: 2s5s10s at 0.2bp (down -0.5bp), 5s10s30s at 11.3bp (down -1.1bp)

- US 5-Year TIPS Real Yield: +1.0 bp at -1.9510%; 10-Year TIPS Real Yield: +2.2 bp at -1.1480%; 30-Year TIPS Real Yield: +3.3 bp at -0.3510%

RESULTS OF THE WEAK 7-YEAR AUCTION TODAY

- Total accepted bids: US$67.9 bn (vs $71.4bn prior)

- Competitive bids 77.8% (vs 81.3% prior)

- High yield: 1.050% (vs 1.264% prior)

- Direct bids: 19.4% (vs 21.3% prior)

- Indirect bids: 58.4% (vs 60.0% prior)

- Bid-to-cover: 2.23 (vs 2.36 prior)

US MACRO RELEASES

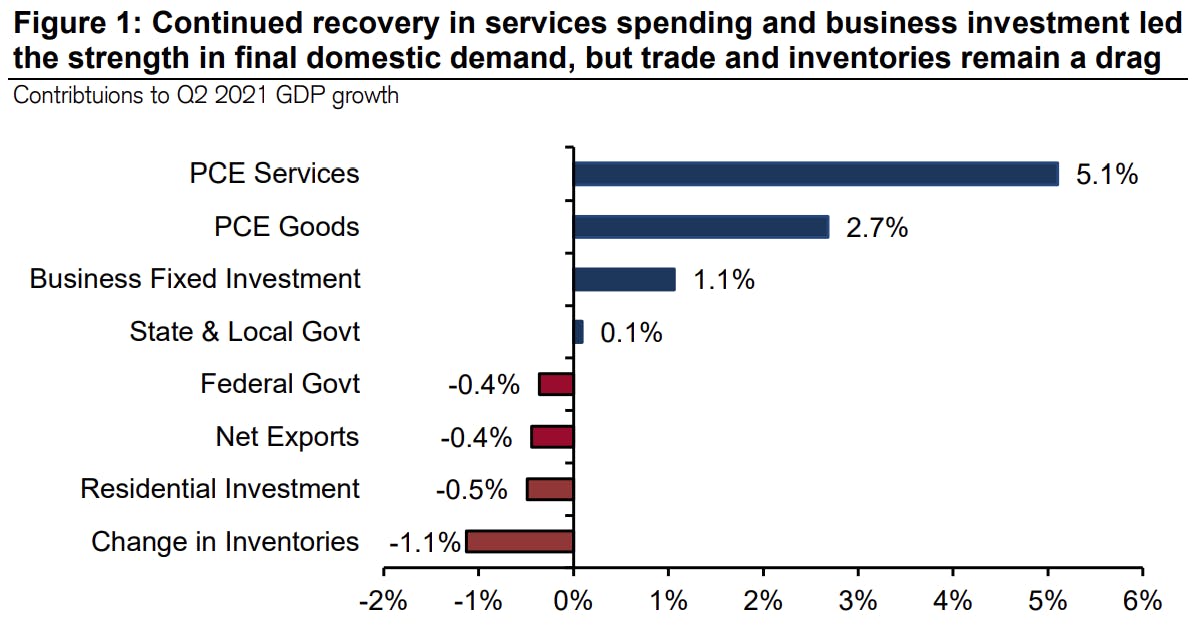

- GDP, Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.50 %, below consensus estimate of 8.50 %

- Implicit Price Deflator, GDP, Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.10 %, above consensus estimate of 5.40 %

- Jobless Claims, National, Continued for W 17 Jul (U.S. Dept. of Labor) at 3.27 Mln, above consensus estimate of 3.20 Mln

- Jobless Claims, National, Initial for W 24 Jul (U.S. Dept. of Labor) at 400k, above consensus estimate of 380k

- Jobless Claims, National, Initial, four week moving average for W 24 Jul (U.S. Dept. of Labor) at 394.50 k

- Pending Home Sales, United States for Jun 2021 (NAR, United States) at 112.80

- Pending Home Sales, United States, Change P/P for Jun 2021 (NAR, United States) at -1.90 %, below consensus estimate of 0.30 %

- Personal Consumption Expenditure, Profits after tax total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 11.80 %

- Personal Consumption Expenditure, Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.10 %, above consensus estimate of 5.90 %

- Personal Consumption Expenditure, Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.40 %

- Total-adv, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 7.70 %

Credit Suisse summary of Q2 GDP Growth

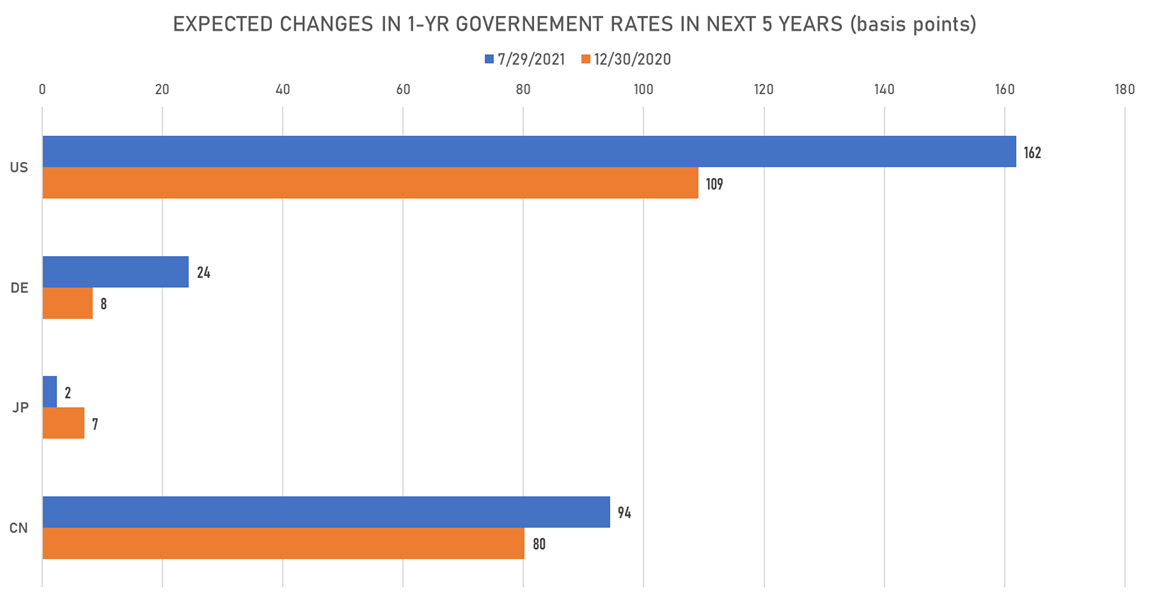

US FORWARD RATES

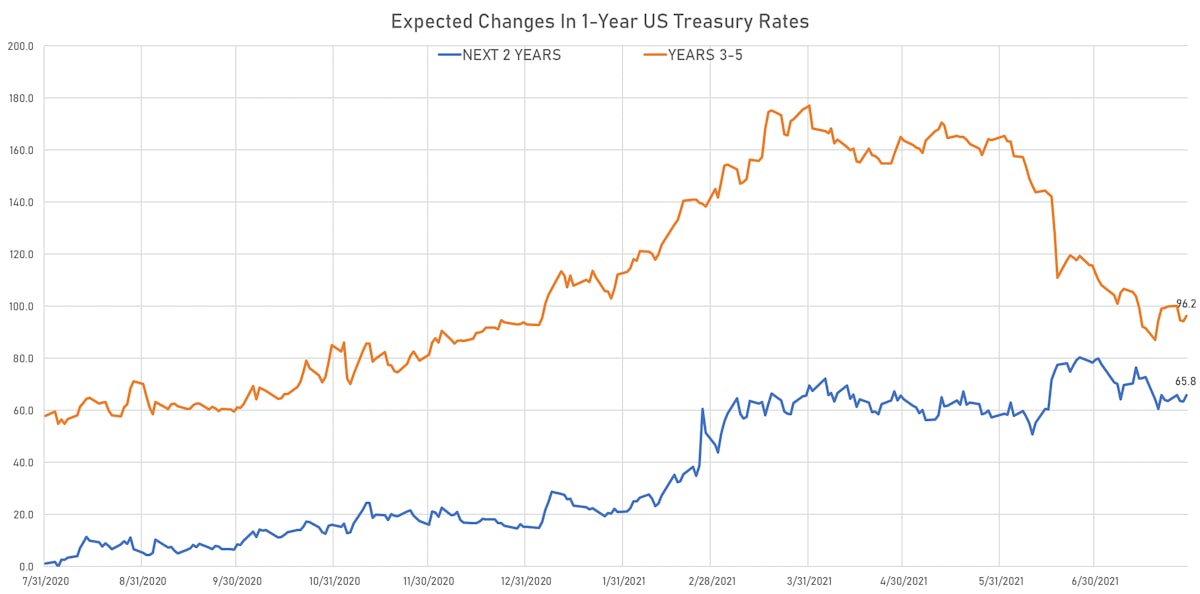

- US Treasury 1-year zero-coupon rate 5 years forward up 4.3 bp, now at 1.6939%

- 1-Year Treasury rates are now expected to increase by 162.0 bp over the next 5 years

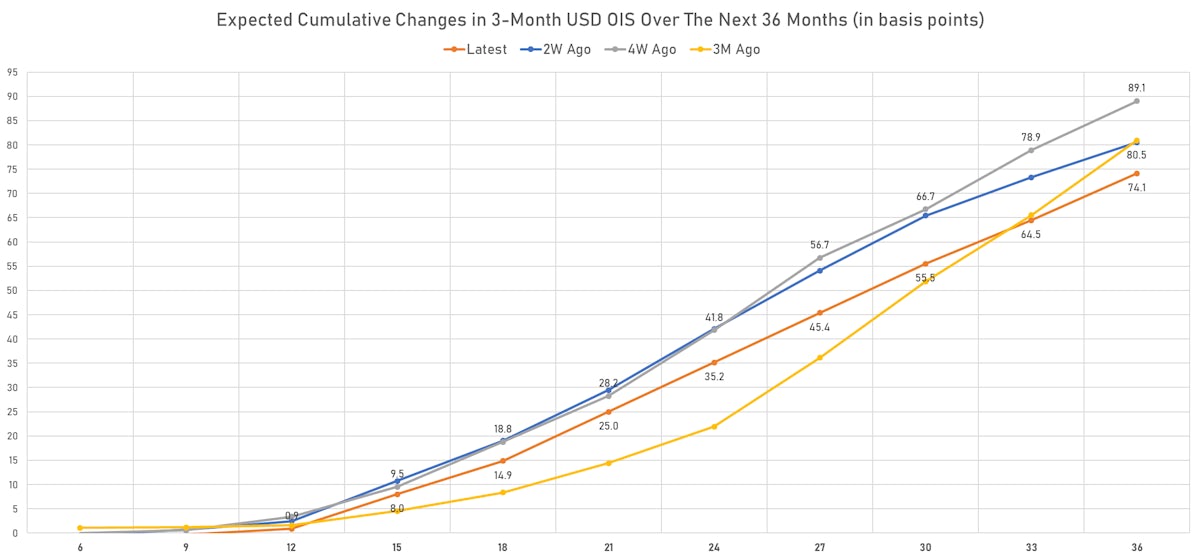

- 3-month Eurodollar futures expected hike of 15.3 bp by the end of 2022 (meaning the market prices 61.2% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 14.9 bp of rate hikes over the next 18 months (equivalent to 0.60 rate hike) and 74.1 bp over the next 3 years (equivalent to 2.97 rate hikes)

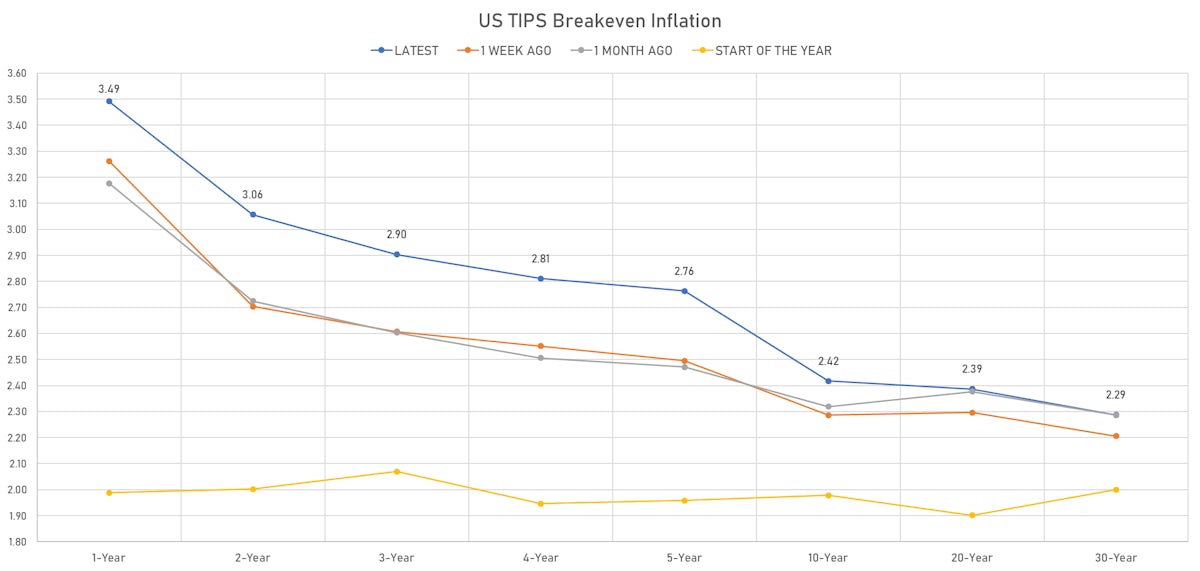

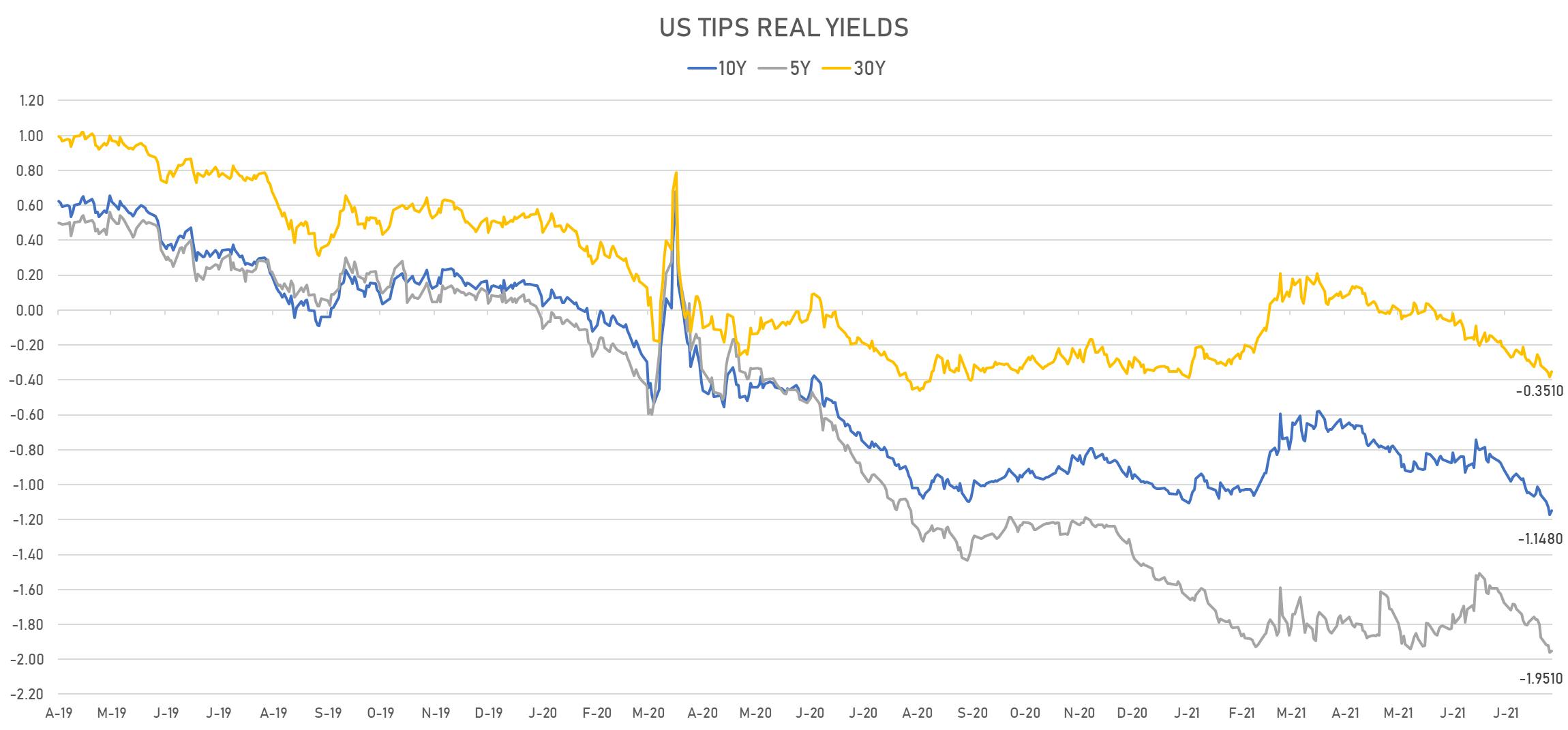

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.49% (down -1.4bp); 2Y at 3.06% (down -2.1bp); 5Y at 2.76% (up 0.7bp); 10Y at 2.42% (up 0.7bp); 30Y at 2.29% (down -0.1bp)

- 6-month spot US CPI swap up 53.9 bp to 4.627%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.9510%, +1.0 bp today; 10Y at -1.1480%, +2.2 bp today; 30Y at -0.3510%, +3.3 bp today

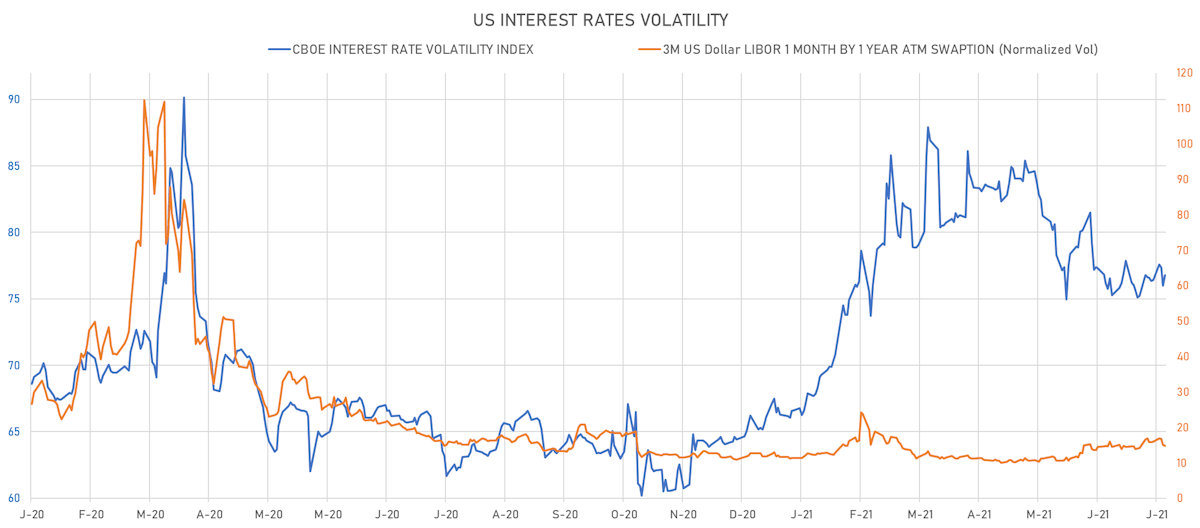

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.4% at 14.7%

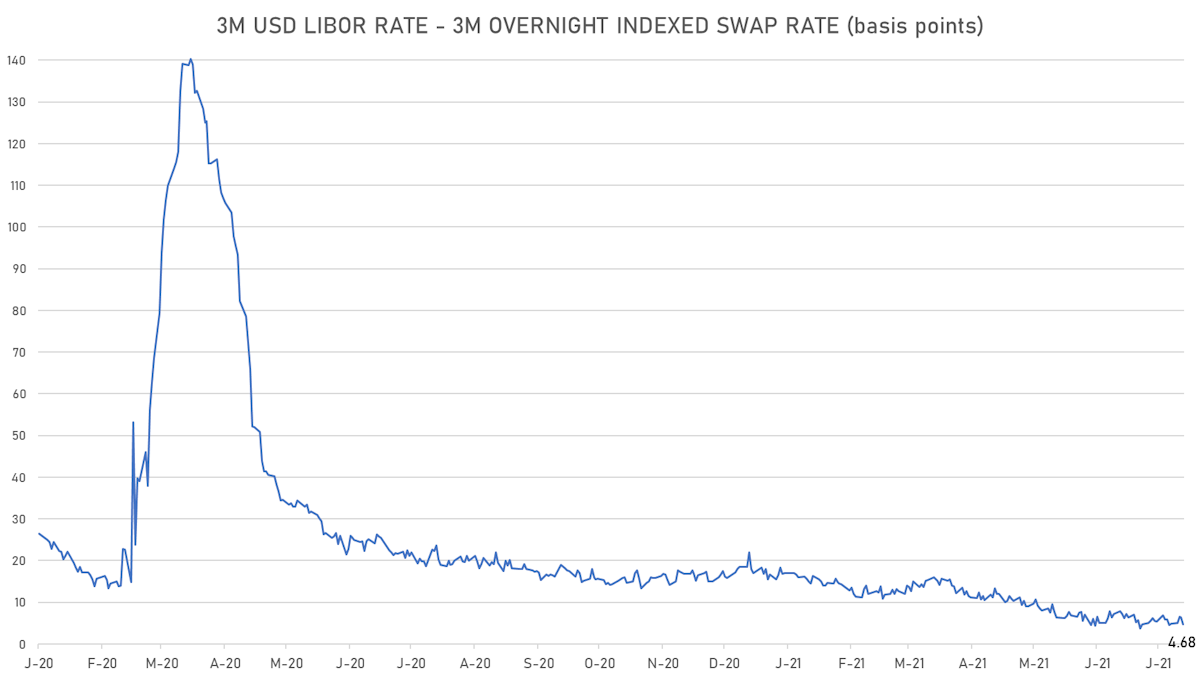

- 3-Month LIBOR-OIS spread down -1.7 bp at 4.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

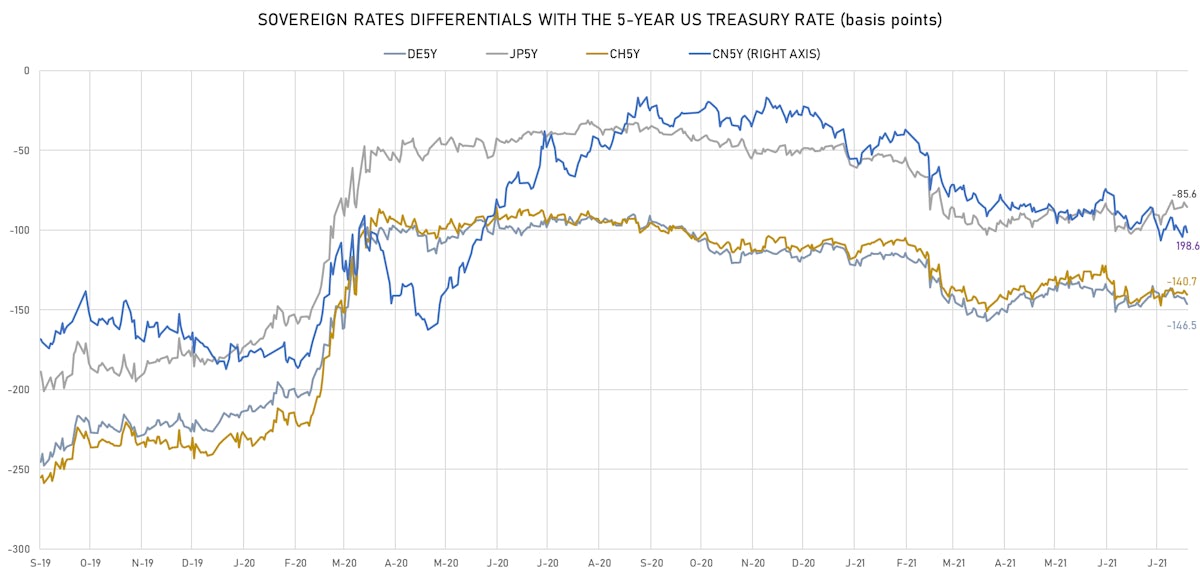

- Germany 5Y: -0.734% (unchanged); the German 1Y-10Y curve is 0.9 bp flatter at 19.9bp (YTD change: +4.6 bp)

- Japan 5Y: -0.117% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 14.4bp (YTD change: +0.6 bp)

- China 5Y: 2.718% (down -2.2 bp); the Chinese 1Y-10Y curve is 2.3 bp flatter at 90.5bp (YTD change: +44.1 bp)

- Switzerland 5Y: -0.669% (up 0.2 bp); the Swiss 1Y-10Y curve is 8.3 bp flatter at 34.9bp (YTD change: +8.5 bp)