Rates

Long Rates Fall With Disappointing US ISM Data And Renewed Lockdowns Across Asia

The implied probability of a rate hike before 2023 has fallen to 50% (from over 90% after the June FOMC) as market reprice for lower forward growth

Published ET

Implied Fed Hikes Derived from the 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.6bp today, now at 0.1238%

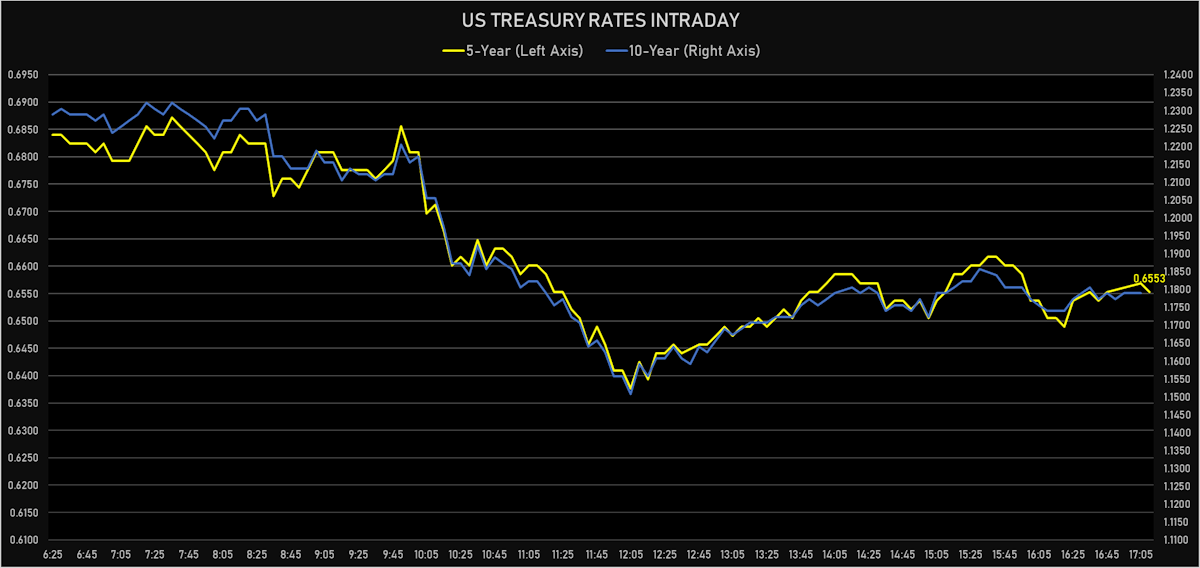

- The treasury yield curve flattened, with the 1s10s spread tightening -4.9 bp, now at 111.3 bp (YTD change: +30.8bp)

- 1Y: 0.0660% (up 0.3 bp)

- 2Y: 0.1742% (down 1.4 bp)

- 5Y: 0.6553% (down 3.8 bp)

- 7Y: 0.9537% (down 4.6 bp)

- 10Y: 1.1789% (down 4.7 bp)

- 30Y: 1.8491% (down 4.6 bp)

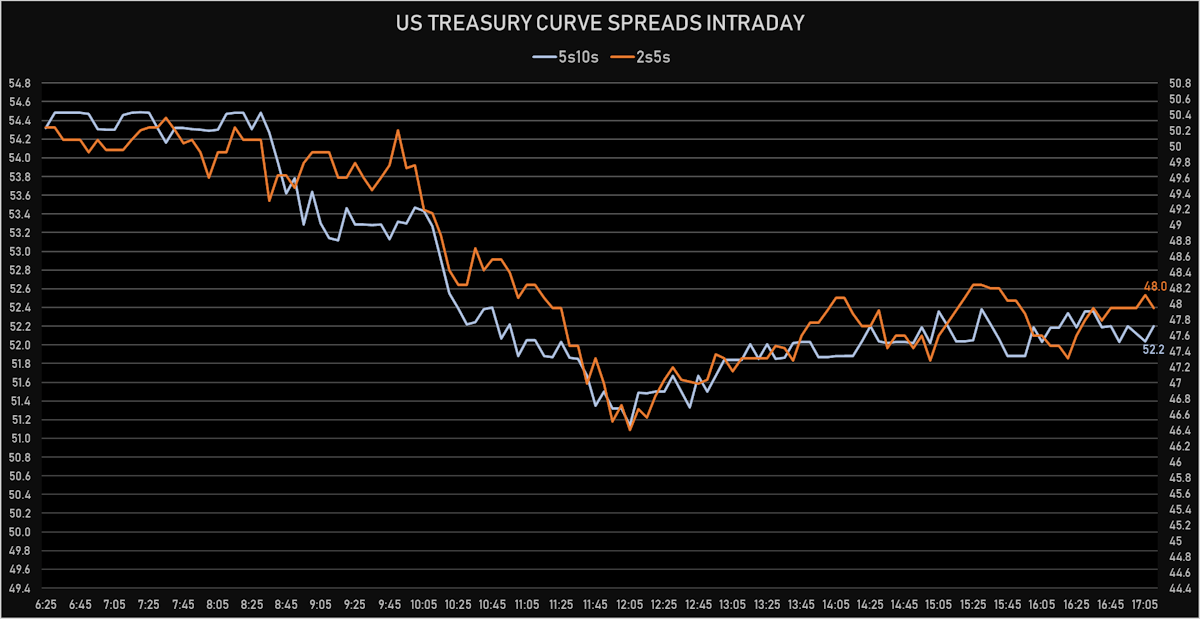

- US treasury curve spreads: 2s5s at 48.1bp (down -2.5bp), 5s10s at 52.4bp (down -0.8bp), 10s30s at 67.1bp (up 0.2bp today)

- Treasuries butterfly spreads: 2s5s10s at 3.9bp (up 1.6bp today), 5s10s30s at 14.7bp (up 1.2bp)

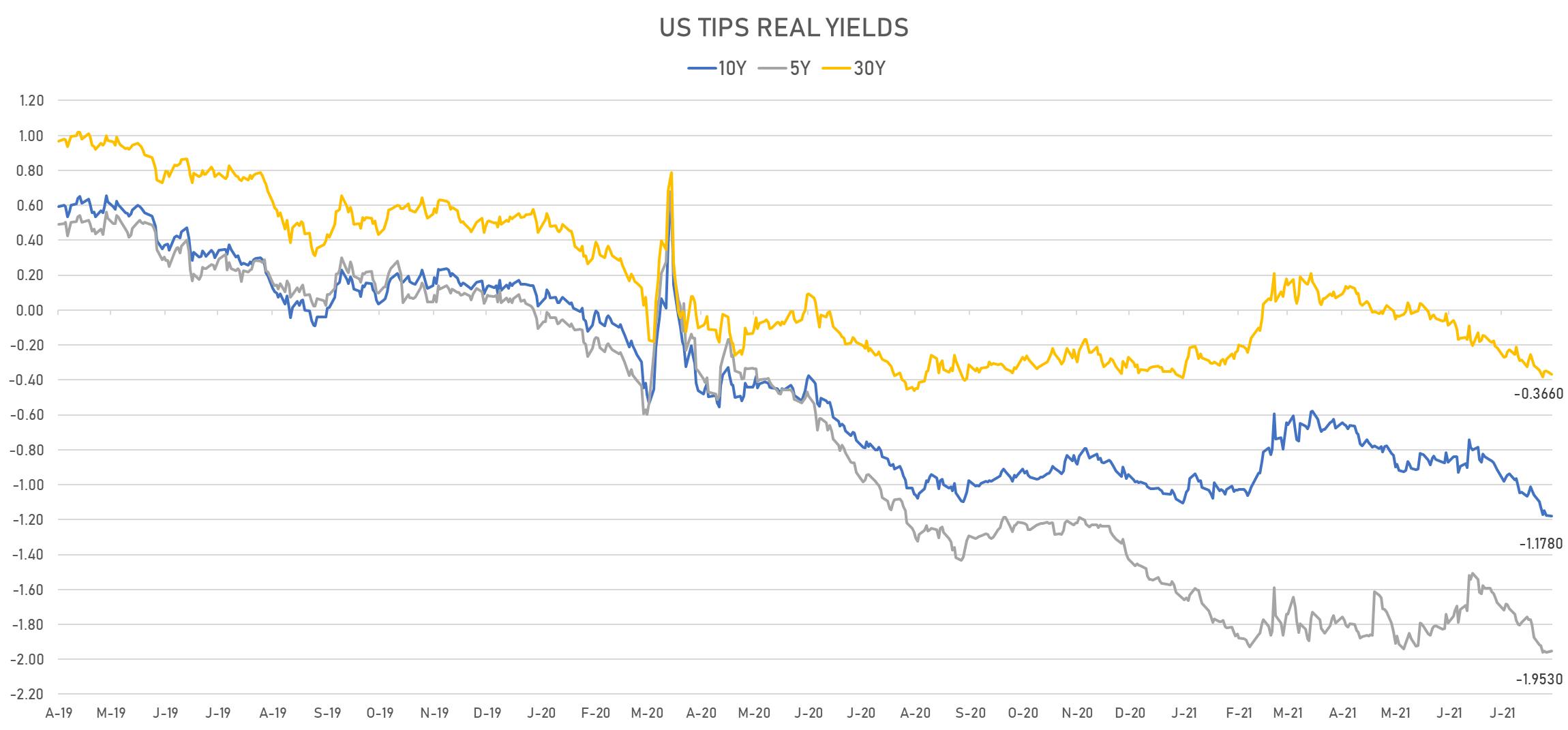

- US 5-Year TIPS Real Yield: +0.9 bp at -1.9530%; 10-Year TIPS Real Yield: -0.4 bp at -1.1780%; 30-Year TIPS Real Yield: -1.8 bp at -0.3660%

US MACRO RELEASES

- Construction Spending, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.10 %, below consensus estimate of 0.40 %

- ISM Manufacturing, Employment for Jul 2021 (ISM, United States) at 52.90

- ISM Manufacturing, New orders for Jul 2021 (ISM, United States) at 64.90

- ISM Manufacturing, PMI total for Jul 2021 (ISM, United States) at 59.50, below consensus estimate of 60.90

- ISM Manufacturing, Prices for Jul 2021 (ISM, United States) at 85.70

- PMI, Manufacturing Sector, Total, Final for Jul 2021 (Markit Economics) at 63.40

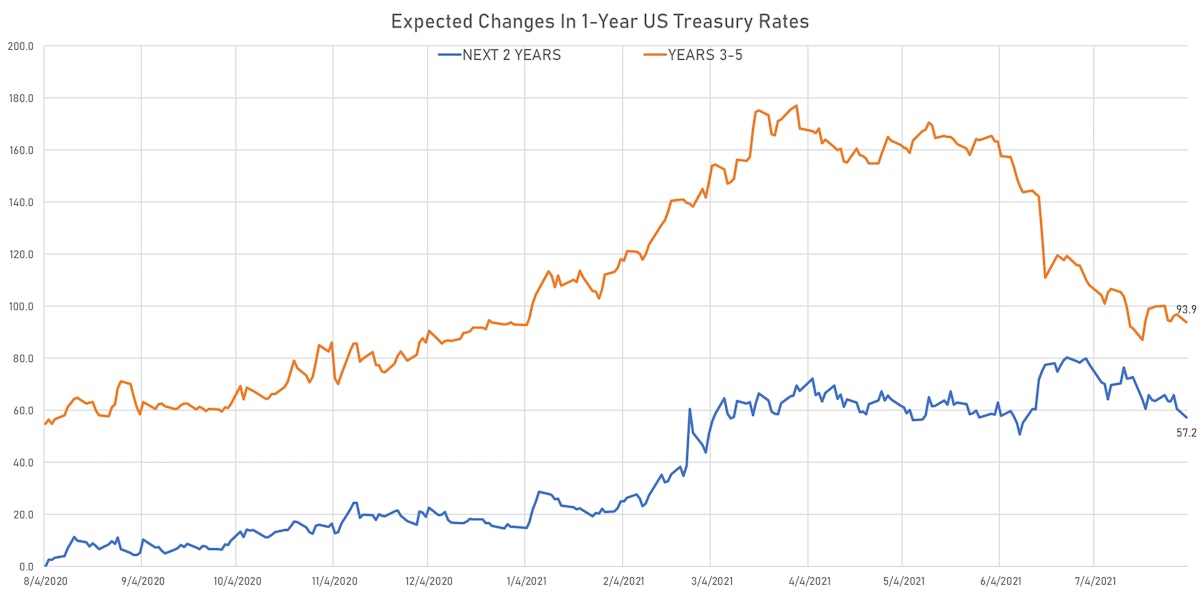

US FORWARD RATES

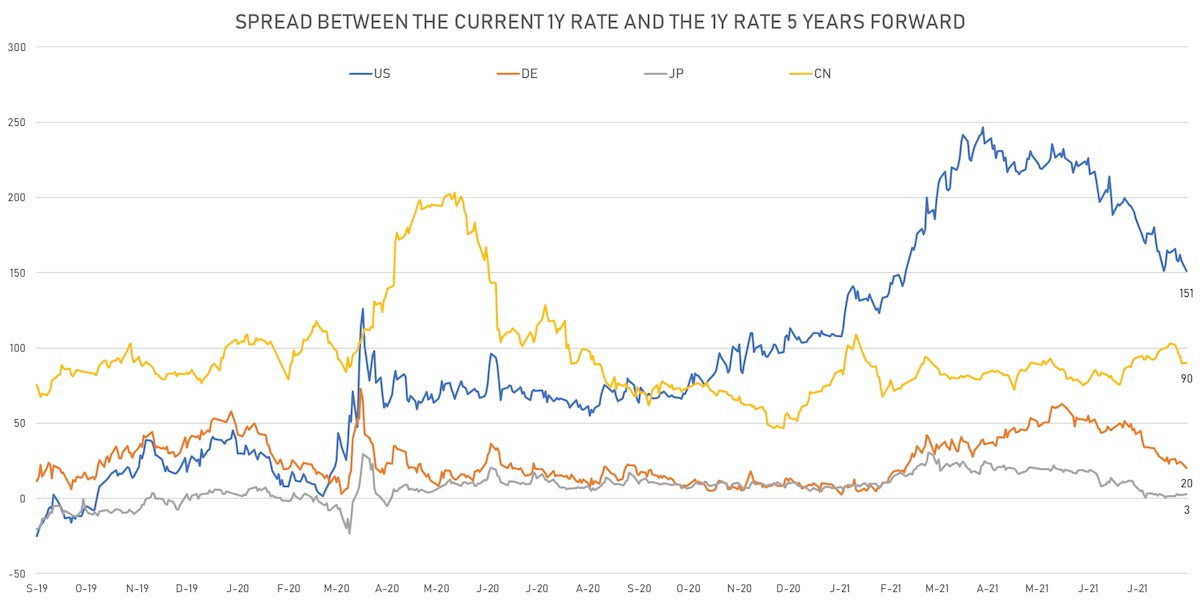

- US Treasury 1-year zero-coupon rate 5 years forward down 6.8 bp, now at 1.5823%

- 1-Year Treasury rates are now expected to increase by 151.1 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 12.5 bp by the end of 2022 (meaning the market prices 50.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 12.2 bp of rate hikes over the next 18 months (equivalent to 0.49 rate hike) and 62.2 bp over the next 3 years (equivalent to 2.49 rate hikes)

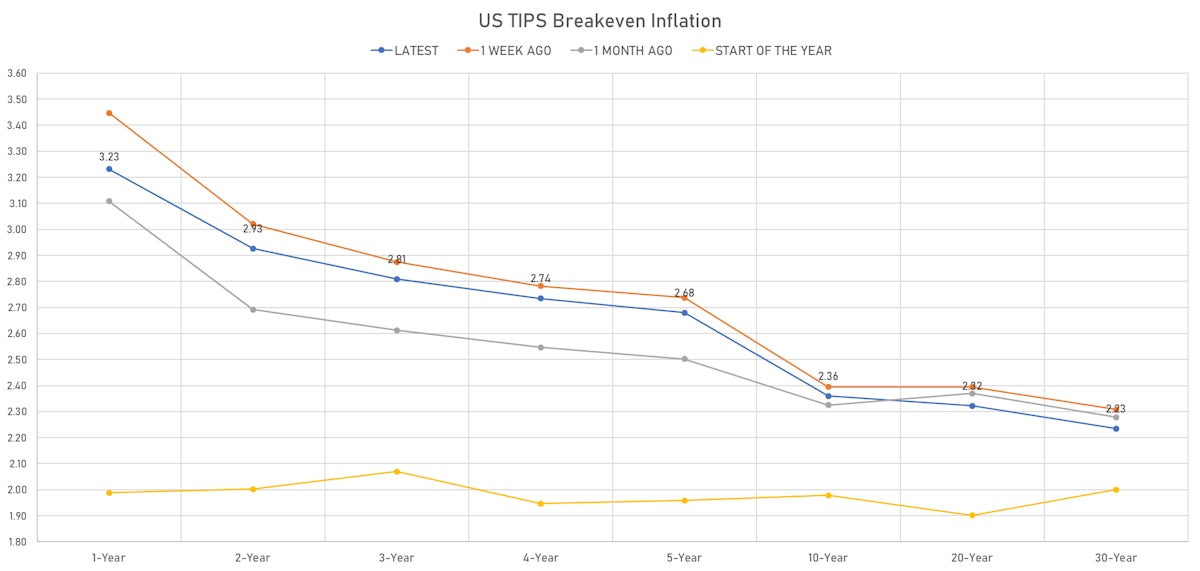

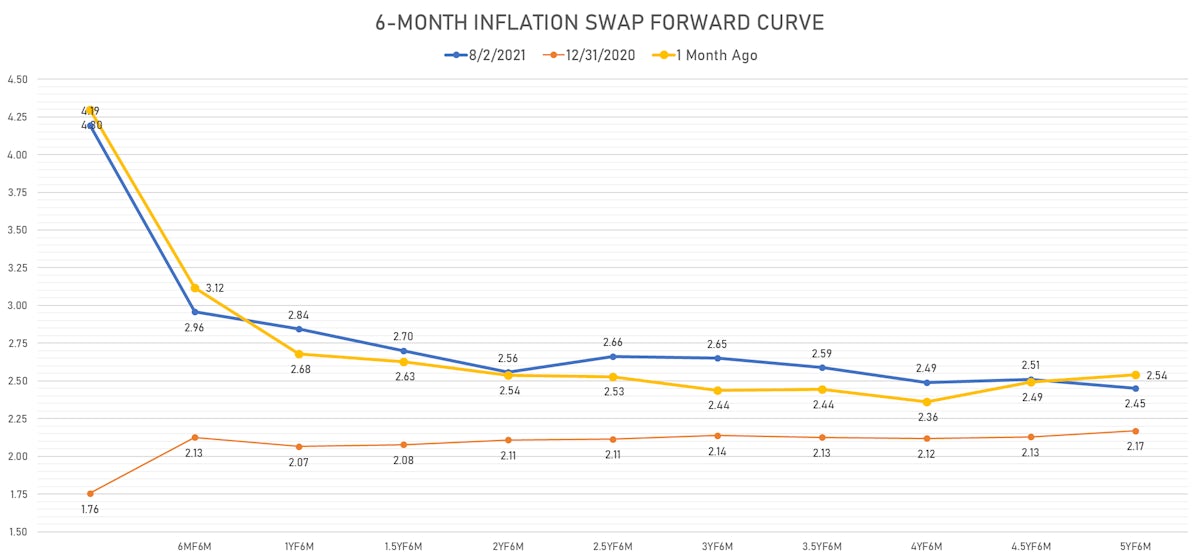

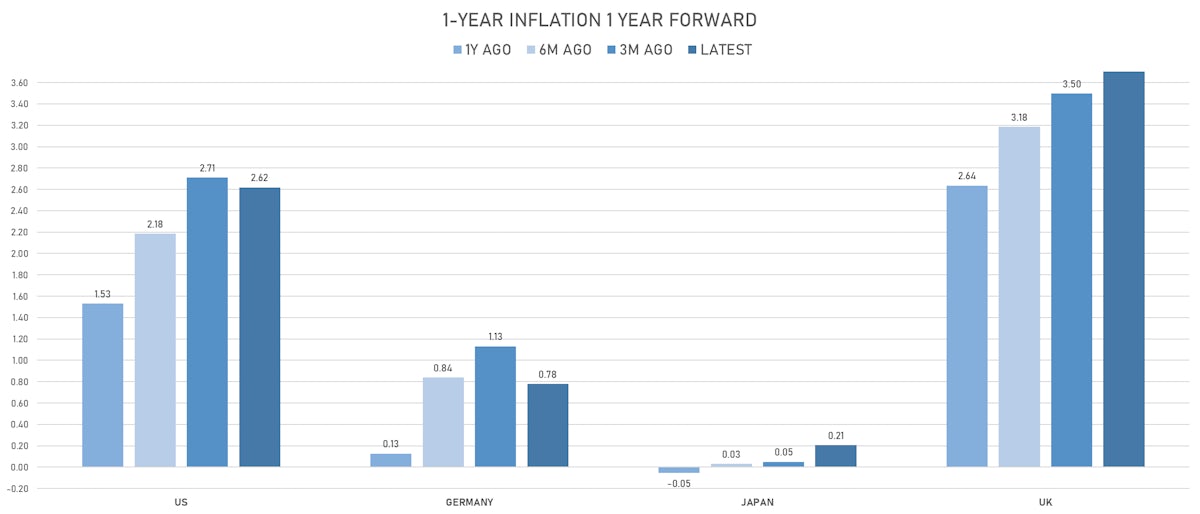

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.23% (down -13.3bp); 2Y at 2.93% (down -8.9bp); 5Y at 2.68% (down -5.3bp); 10Y at 2.36% (down -4.3bp); 30Y at 2.23% (down -2.7bp)

- 6-month spot US CPI swap down -36.5 bp to 4.193%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.9530%, +0.9 bp today; 10Y at -1.1780%, -0.4 bp today; 30Y at -0.3660%, -1.8 bp today

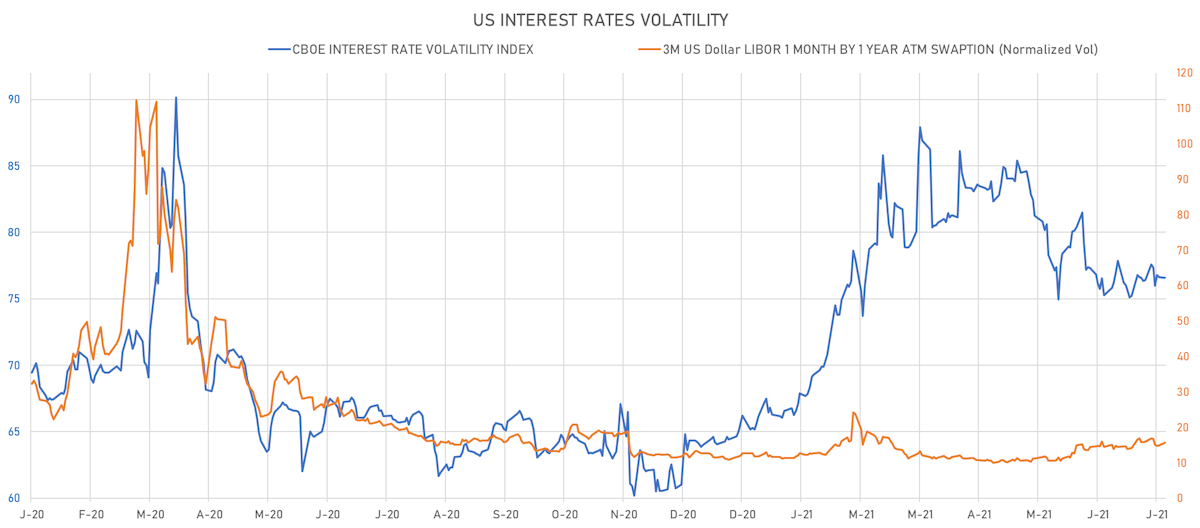

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.7% at 15.6%

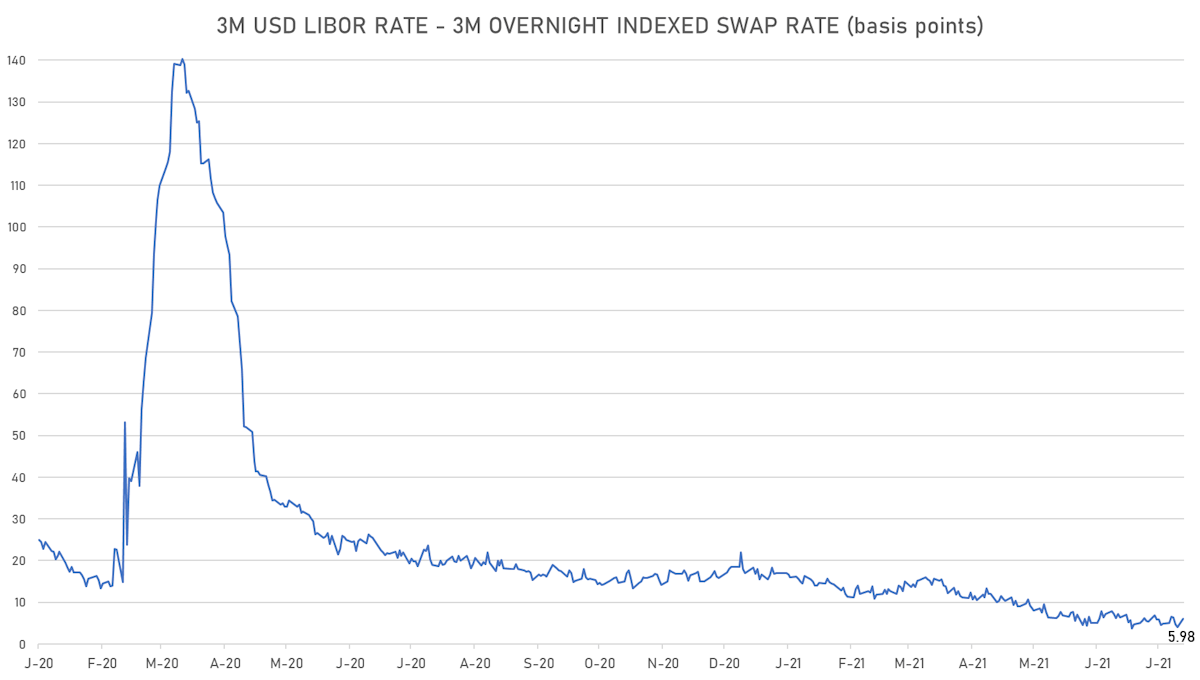

- 3-Month LIBOR-OIS spread up 2.0 bp at 6.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.749% (down -1.4 bp); the German 1Y-10Y curve is 1.8 bp flatter at 17.2bp (YTD change: +1.6 bp)

- Japan 5Y: -0.128% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 13.3bp (YTD change: +0.2 bp)

- China 5Y: 2.643% (down -3.0 bp); the Chinese 1Y-10Y curve is 18.6 bp flatter at 69.9bp (YTD change: +23.5 bp)

- Switzerland 5Y: -0.687% (down -0.9 bp); the Swiss 1Y-10Y curve is 0.3 bp steeper at 34.3bp (YTD change: +7.5 bp)