Rates

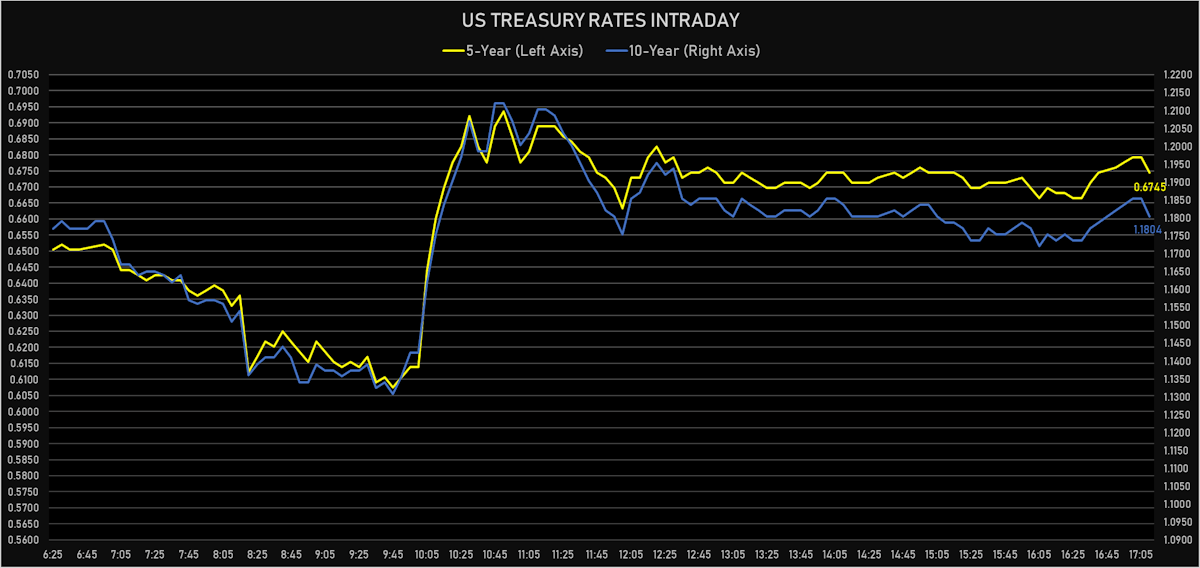

US Rates Fall On ADP Miss And Bounce Intraday After Positive ISM, With Rise Mostly In The Belly

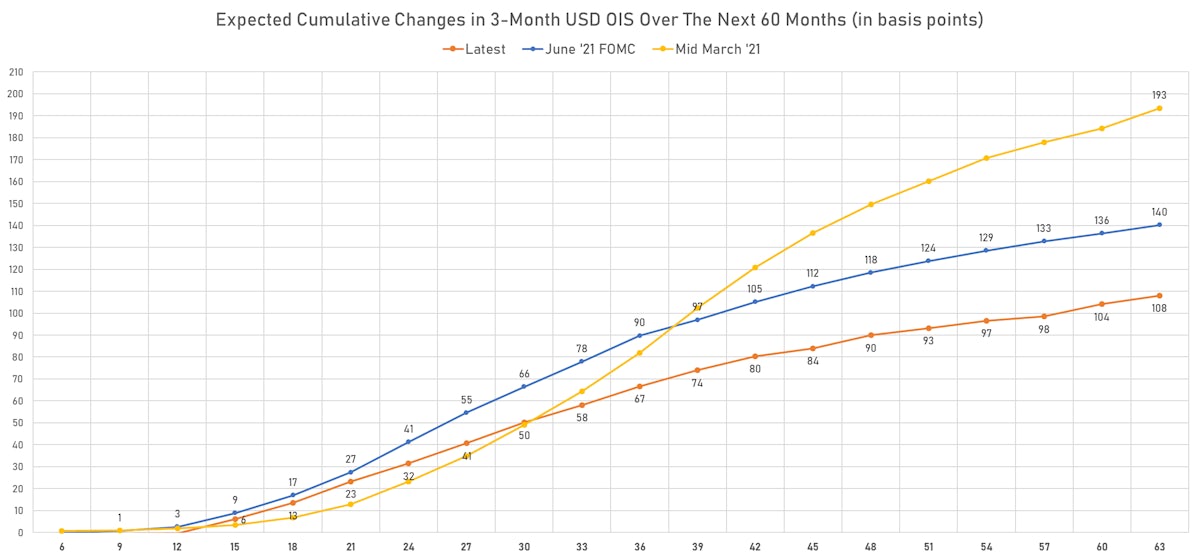

Widespread pessimism on growth, motivated by the spread of the delta variant across the US, may be overdone and a surprise in the NFP on Friday could lead to a tactical repricing of short rates higher (2 to 3 years forward)

Published ET

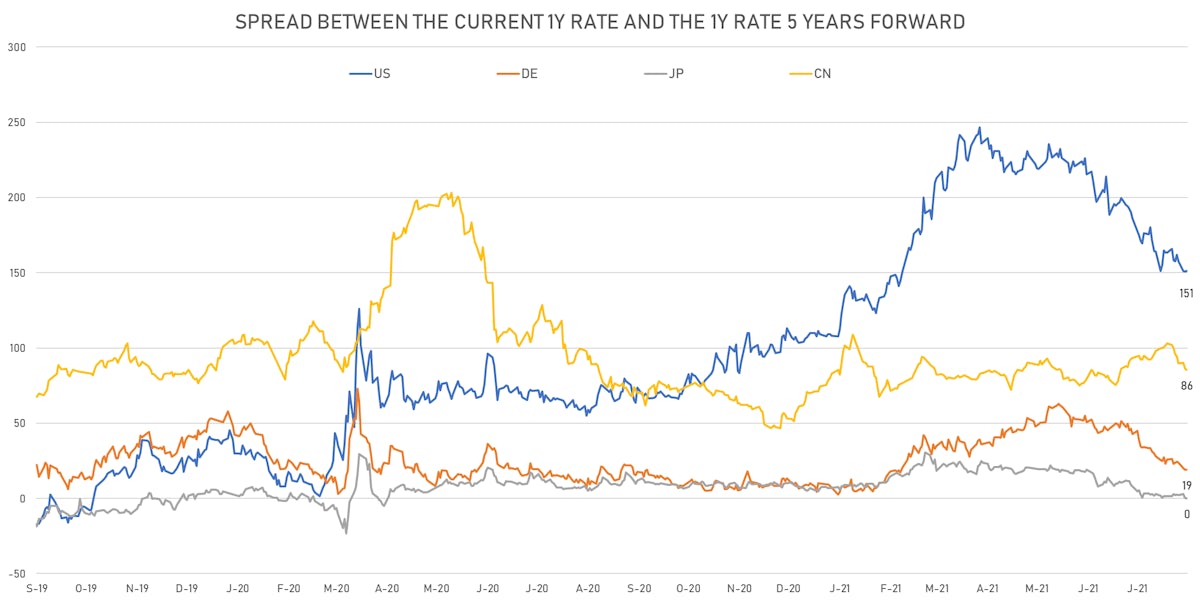

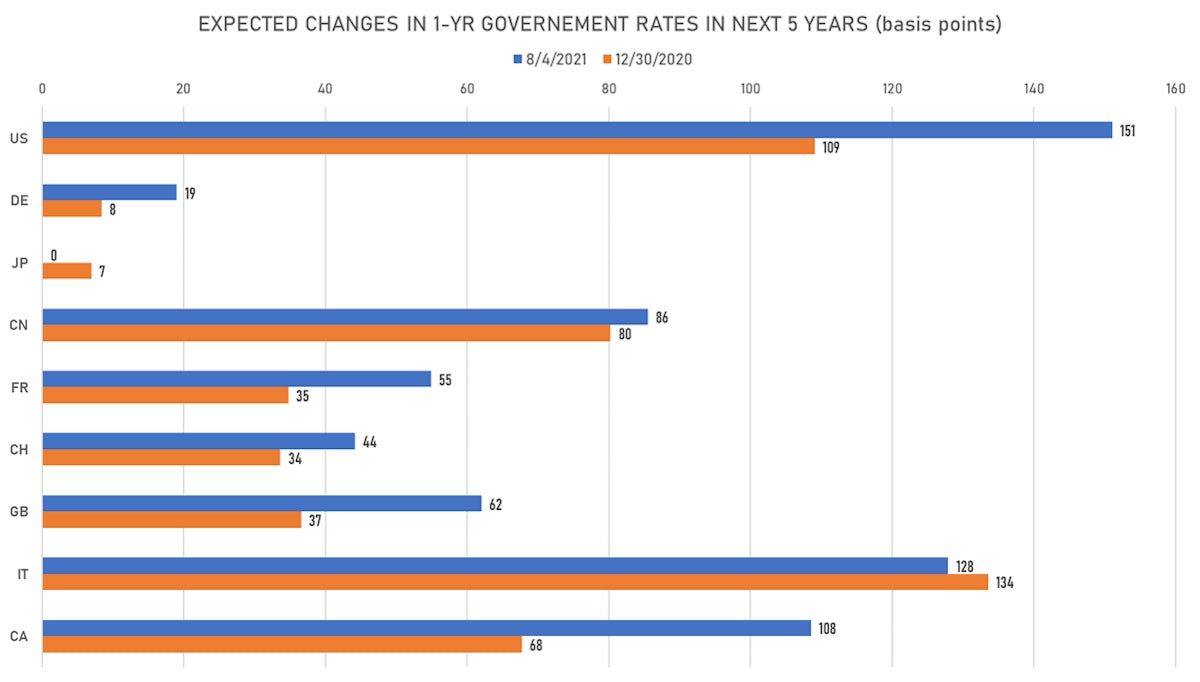

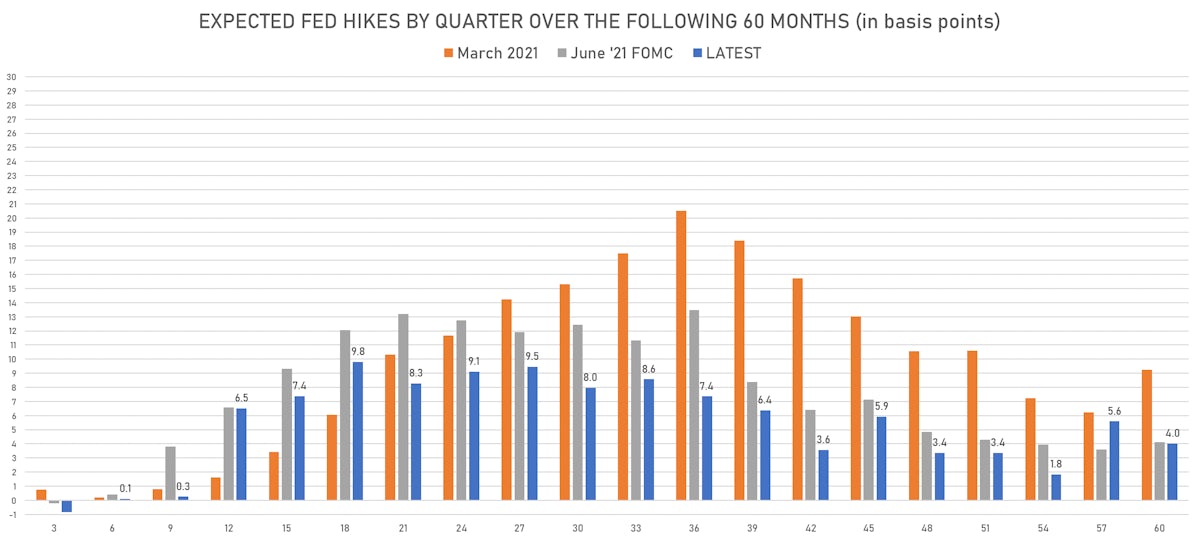

Expected Timing Of Rate Hikes Over The Next 5 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged at 0.1218%

- The treasury yield curve steepened, with the 1s10s spread widening 0.4 bp, now at 111.4 bp (YTD change: +31.0bp)

- 1Y: 0.0660% (up 0.3 bp)

- 2Y: 0.1822% (up 1.0 bp)

- 5Y: 0.6745% (up 2.7 bp)

- 7Y: 0.9652% (up 2.1 bp)

- 10Y: 1.1804% (up 0.7 bp)

- 30Y: 1.8338% (down 1.1 bp)

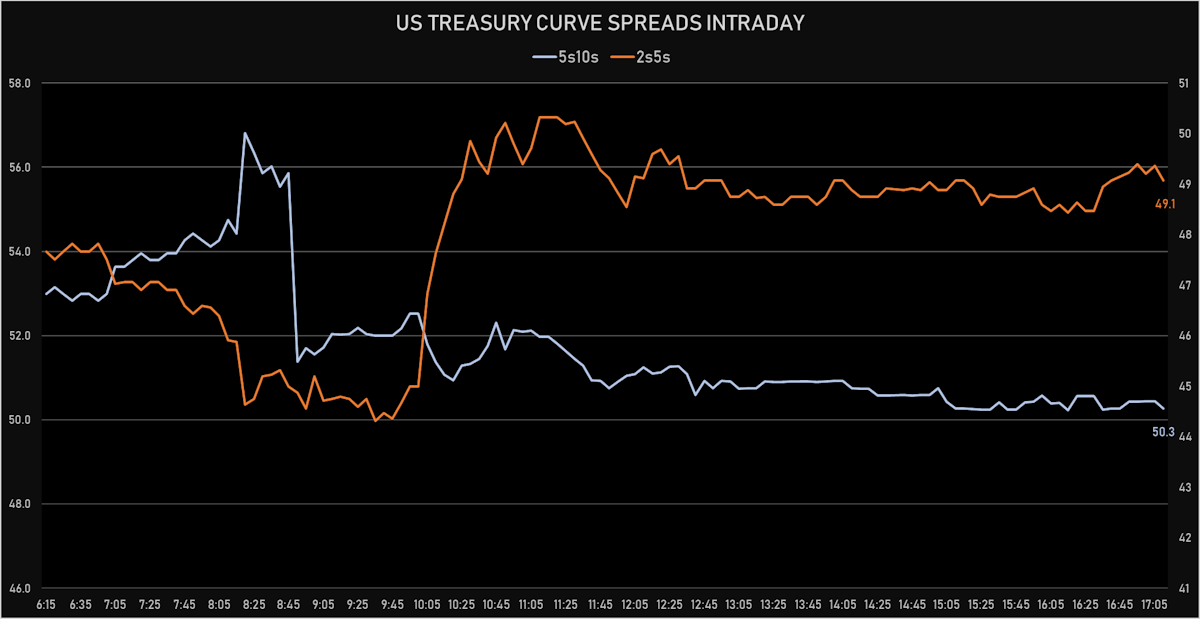

- US treasury curve spreads: 2s5s at 49.3bp (up 1.9bp today), 5s10s at 50.5bp (down -2.2bp), 10s30s at 65.4bp (down -1.8bp)

- Treasuries butterfly spreads: 2s5s10s at 0.8bp (down -4.0bp), 5s10s30s at 14.5bp (up 0.3bp)

- US 5-Year TIPS Real Yield: +6.6 bp at -1.9060%; 10-Year TIPS Real Yield: +2.9 bp at -1.1640%; 30-Year TIPS Real Yield: +0.8 bp at -0.3670%

US MACRO RELEASES

- ISM Non-manufacturing, Business activity for Jul 2021 (ISM, United States) at 67.00, above consensus estimate of 60.60

- ISM Non-manufacturing, Employment for Jul 2021 (ISM, United States) at 53.80

- ISM Non-manufacturing, New orders for Jul 2021 (ISM, United States) at 63.70

- ISM Non-manufacturing, NMI/PMI for Jul 2021 (ISM, United States) at 64.10, above consensus estimate of 60.50

- ISM Non-manufacturing, Prices for Jul 2021 (ISM, United States) at 82.30

- ADP total nonfarm private employment (estimate), Absolute change for Jul 2021 at 330.00 k, below consensus estimate of 695.00 k

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 30 Jul (MBA, USA) at -1.70 %

- Mortgage applications, market composite index for W 30 Jul (MBA, USA) at 734.30

- Mortgage applications, market composite index, purchase for W 30 Jul (MBA, USA) at 247.50

- Mortgage applications, market composite index, refinancing for W 30 Jul (MBA, USA) at 3571.30

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 30 Jul (MBA, USA) at 2.97 %

- PMI, Composite, Output, Final for Jul 2021 (Markit Economics) at 59.90

- PMI, Services Sector, Business Activity, Final for Jul 2021 (Markit Economics) at 59.90

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 0.5 bp, now at 1.5820%

- 1-Year Treasury rates are now expected to increase by 151.1 bp over the next 5 years

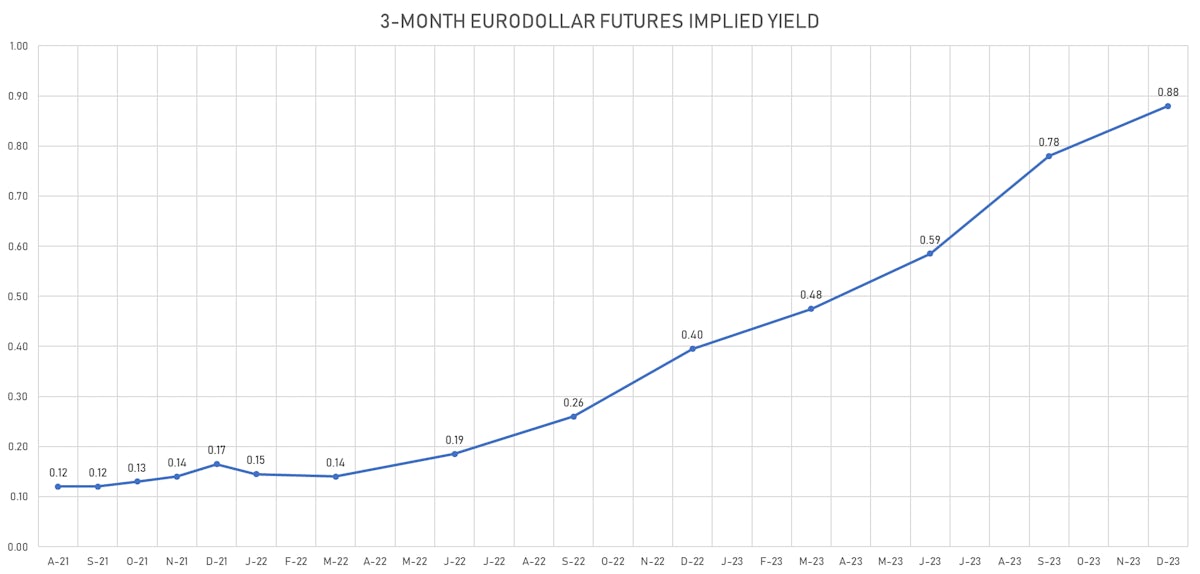

- 3-month Eurodollar futures expected hike of 14.0 bp by the end of 2022 (meaning the market prices 56.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 13.4 bp of rate hikes over the next 18 months (equivalent to 0.54 rate hike) and 66.7 bp over the next 3 years (equivalent to 2.67 rate hikes)

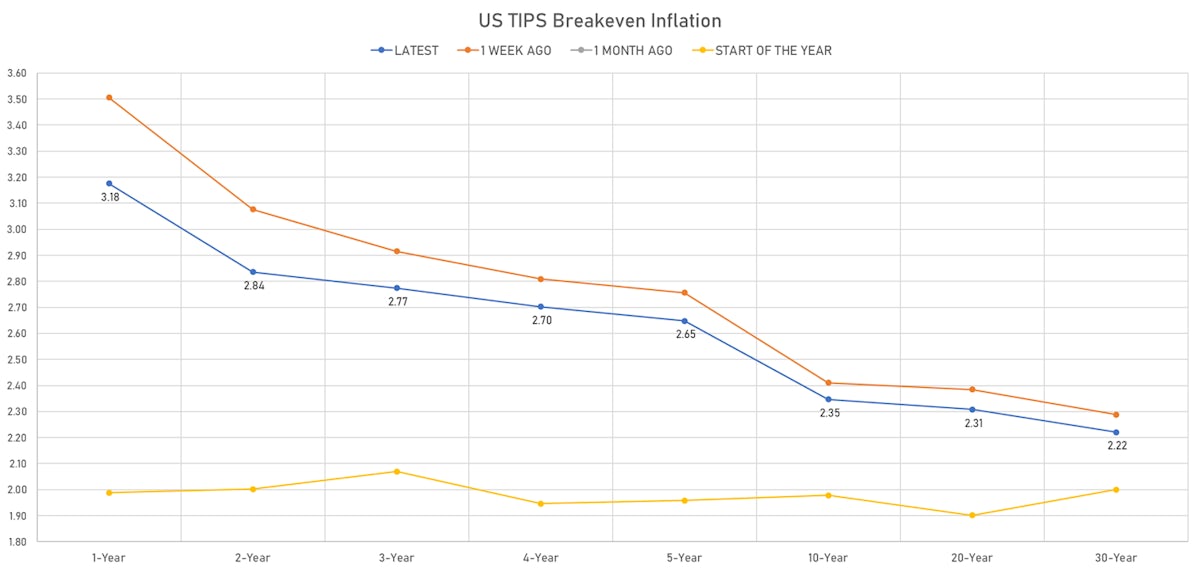

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.18% (down -8.5bp); 2Y at 2.84% (down -6.6bp); 5Y at 2.65% (down -3.8bp); 10Y at 2.35% (down -2.3bp); 30Y at 2.22% (down -1.8bp)

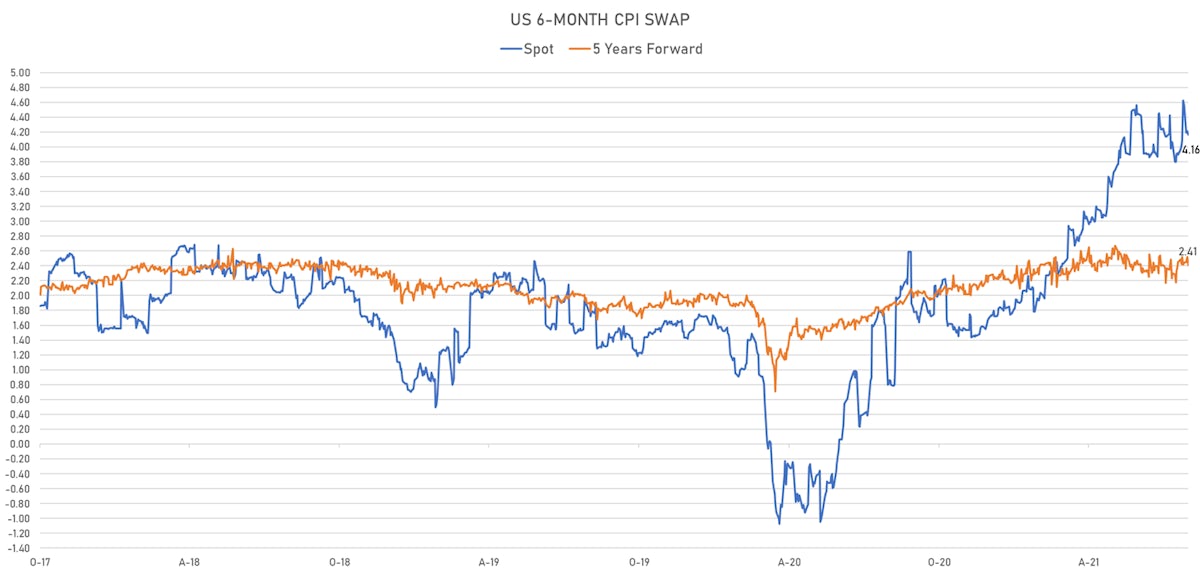

- 6-month spot US CPI swap down -5.0 bp to 4.162%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.9060%, +6.6 bp today; 10Y at -1.1640%, +2.9 bp today; 30Y at -0.3670%, +0.8 bp today

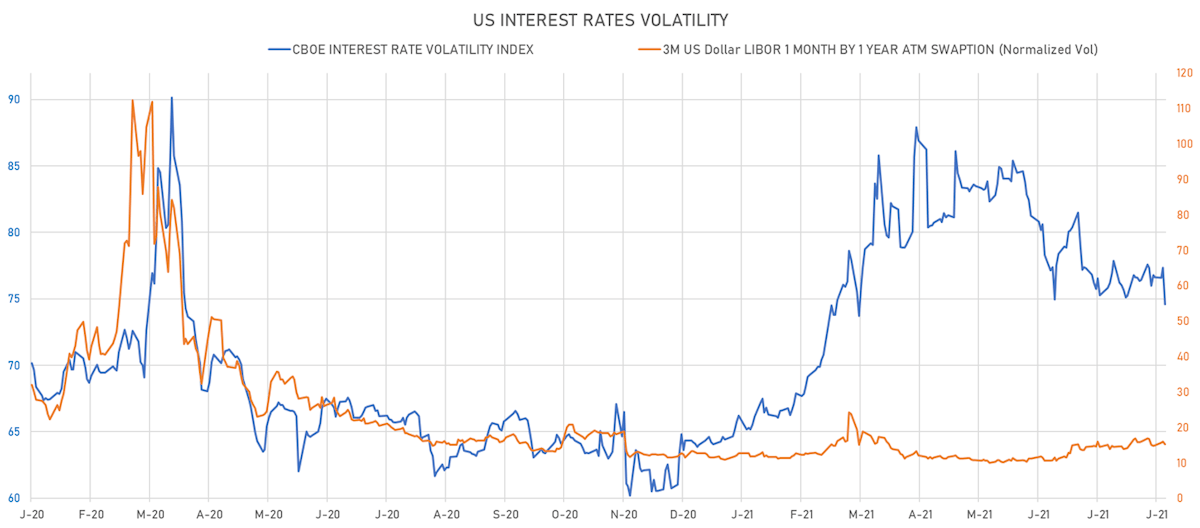

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.7% at 15.2%

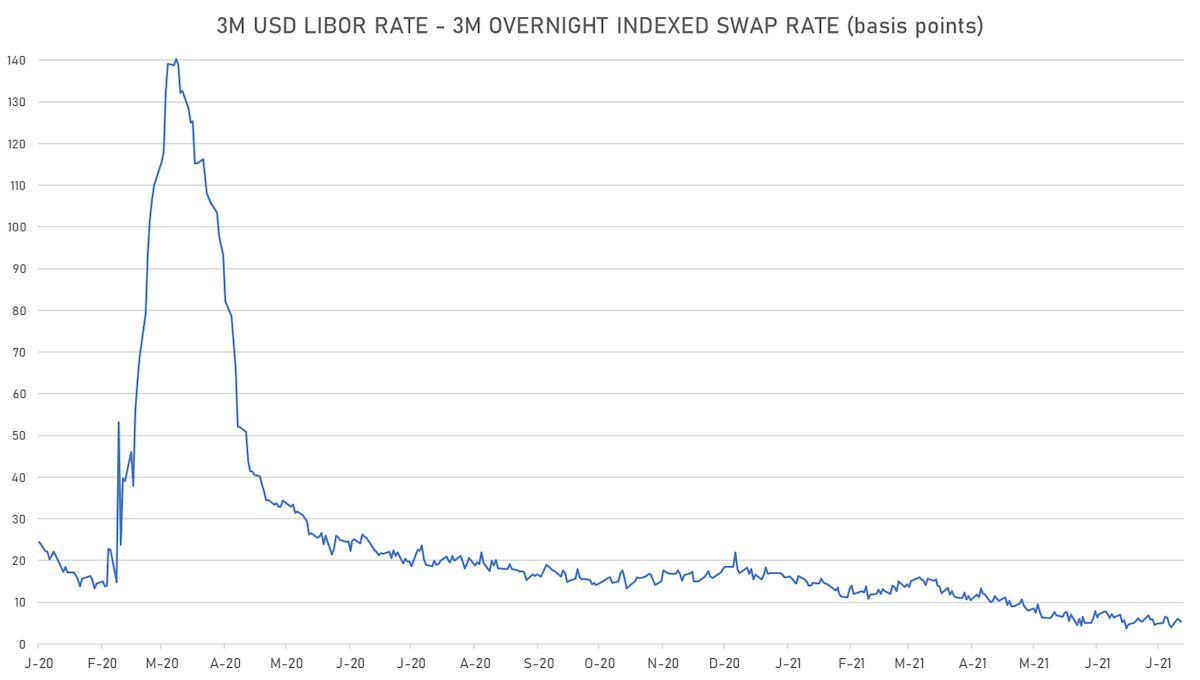

- 3-Month LIBOR-OIS spread down -0.4 bp at 5.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.768% (down -1.6 bp); the German 1Y-10Y curve is 0.1 bp steeper at 15.8bp (YTD change: +1.2 bp)

- Japan 5Y: -0.132% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp steeper at 13.8bp (YTD change: -0.3 bp)

- China 5Y: 2.679% (up 1.2 bp); the Chinese 1Y-10Y curve is 0.2 bp flatter at 71.3bp (YTD change: +24.9 bp)

- Switzerland 5Y: -0.708% (down -0.3 bp); the Swiss 1Y-10Y curve is 1.7 bp flatter at 33.3bp (YTD change: +4.9 bp)