Rates

US Rates Rise Ahead Of BLS Employment Report Tomorrow

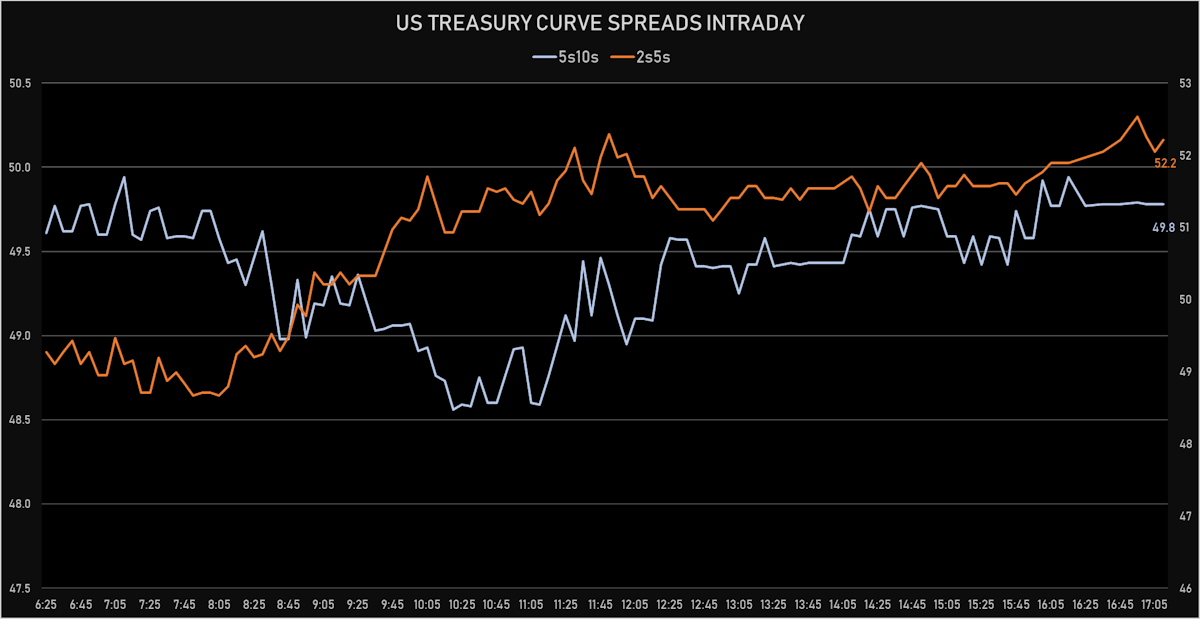

The Treasury curve steepened at the front end (1s5s up, 5s30s down), as markets brace for a potentially stronger-than-expected print, which would put the dot plot 2023 hikes back on

Published ET

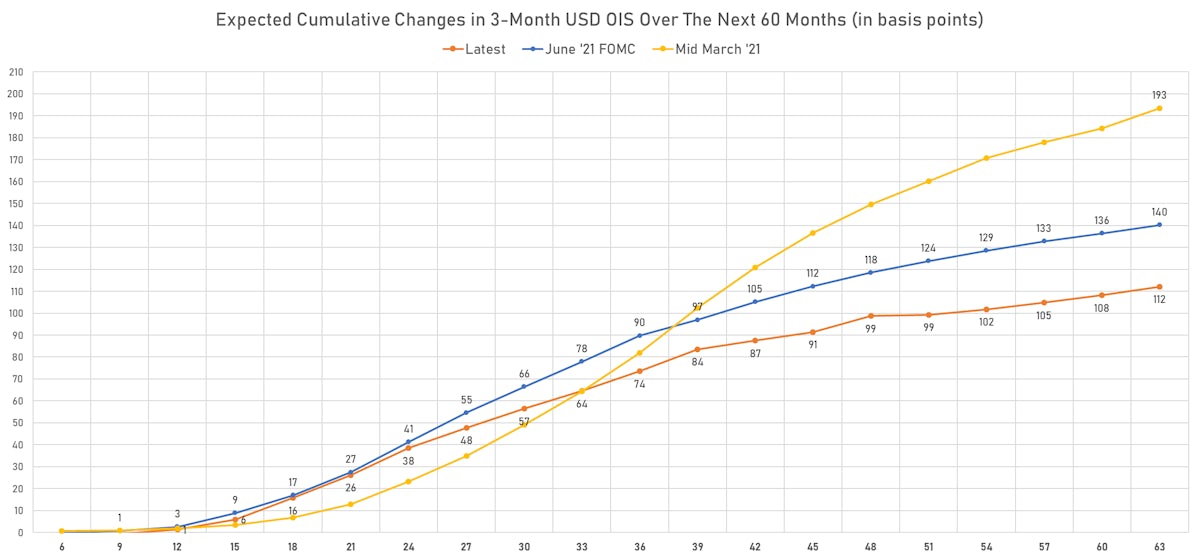

Expected Fed Hikes In The Next 3 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.4bp today, now at 0.1254%

- The treasury yield curve steepened, with the 1s10s spread widening 4.0 bp, now at 115.9 bp (YTD change: +35.5bp)

- 1Y: 0.0660% (up 0.5 bp)

- 2Y: 0.2020% (up 2.0 bp)

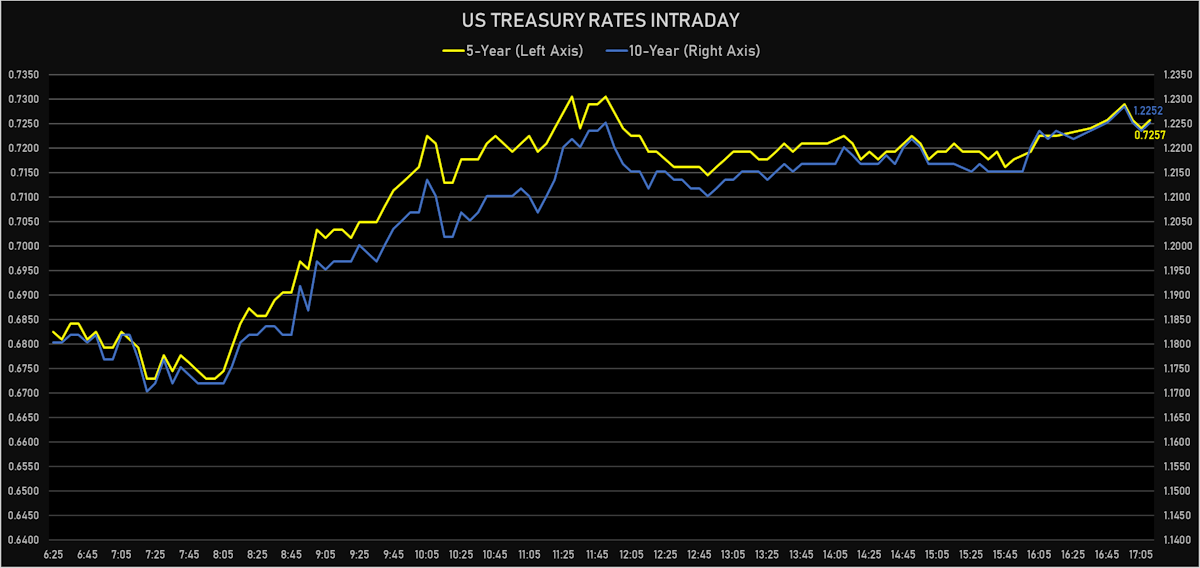

- 5Y: 0.7257% (up 5.1 bp)

- 7Y: 1.0163% (up 5.1 bp)

- 10Y: 1.2252% (up 4.5 bp)

- 30Y: 1.8638% (up 3.0 bp)

- US treasury curve spreads: 2s5s at 52.4bp (up 3.1bp today), 5s10s at 49.9bp (down -0.5bp), 10s30s at 63.9bp (down -1.5bp)

- Treasuries butterfly spreads: 2s5s10s at -2.8bp (down -3.6bp), 5s10s30s at 13.6bp (down -0.9bp)

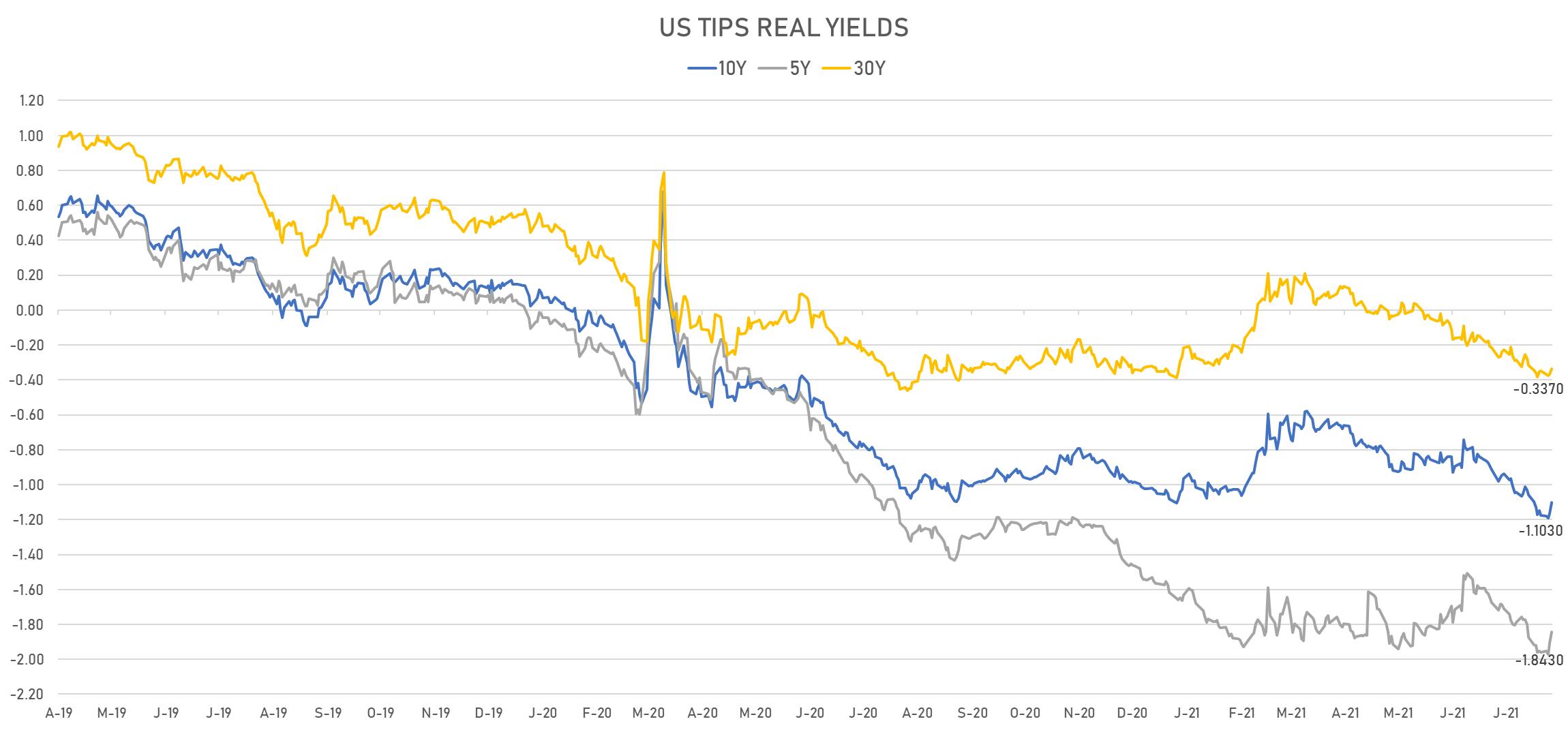

- US 5-Year TIPS Real Yield: +6.3 bp at -1.8430%; 10-Year TIPS Real Yield: +6.1 bp at -1.1030%; 30-Year TIPS Real Yield: +3.0 bp at -0.3370%

US MACRO RELEASES

- Jobless Claims, National, Continued for W 24 Jul (U.S. Dept. of Labor) at 2.93 Mln, below consensus estimate of 3.26 Mln

- Jobless Claims, National, Initial for W 31 Jul (U.S. Dept. of Labor) at 385 k, above consensus estimate of 384 k

- Jobless Claims, National, Initial, four week moving average for W 31 Jul (U.S. Dept. of Labor) at 394 k

- Unemployment, Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Jul 2021 (Challenger) at 18.94 k

- Trade Balance, Total, Goods and services for Jun 2021 (U.S. Census Bureau) at -75.70 Bln USD, below consensus estimate of -74.10 Bln USD

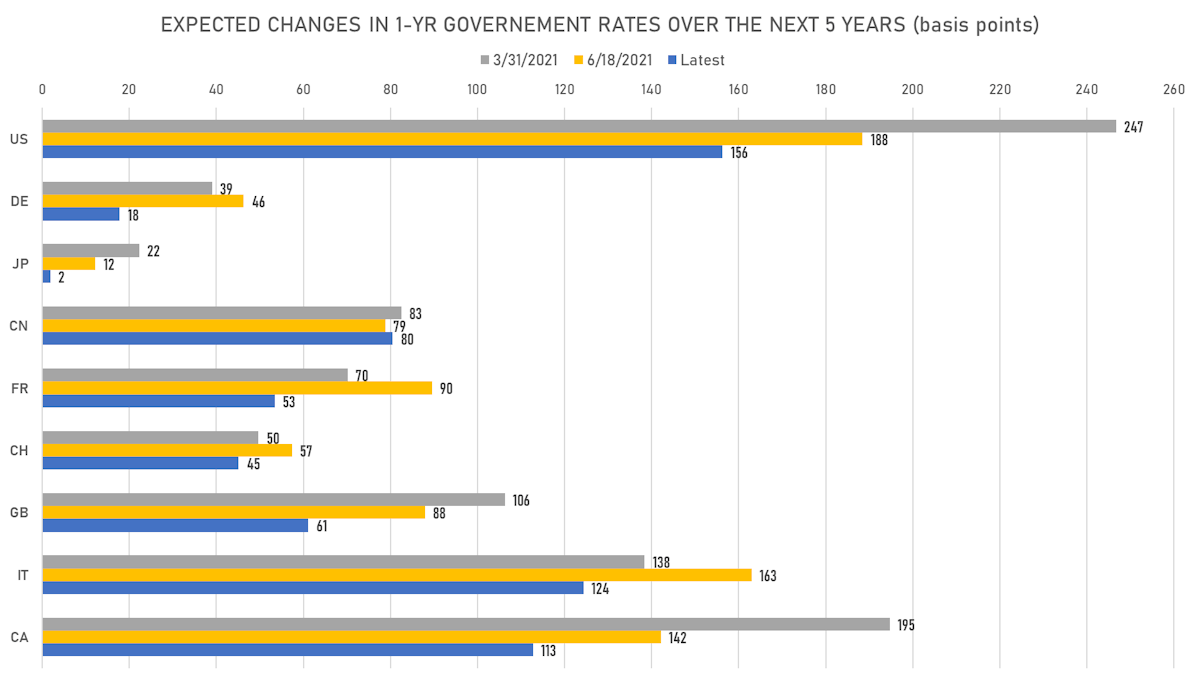

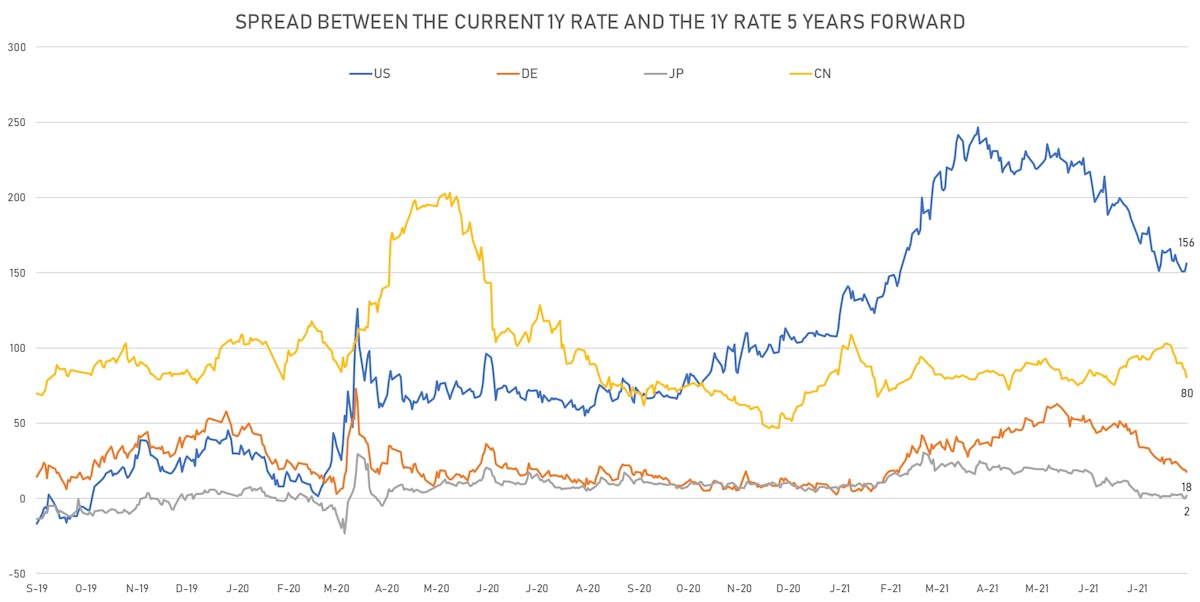

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 6.0 bp, now at 1.6416%

- 1-Year Treasury rates are now expected to increase by 156.3 bp over the next 5 years

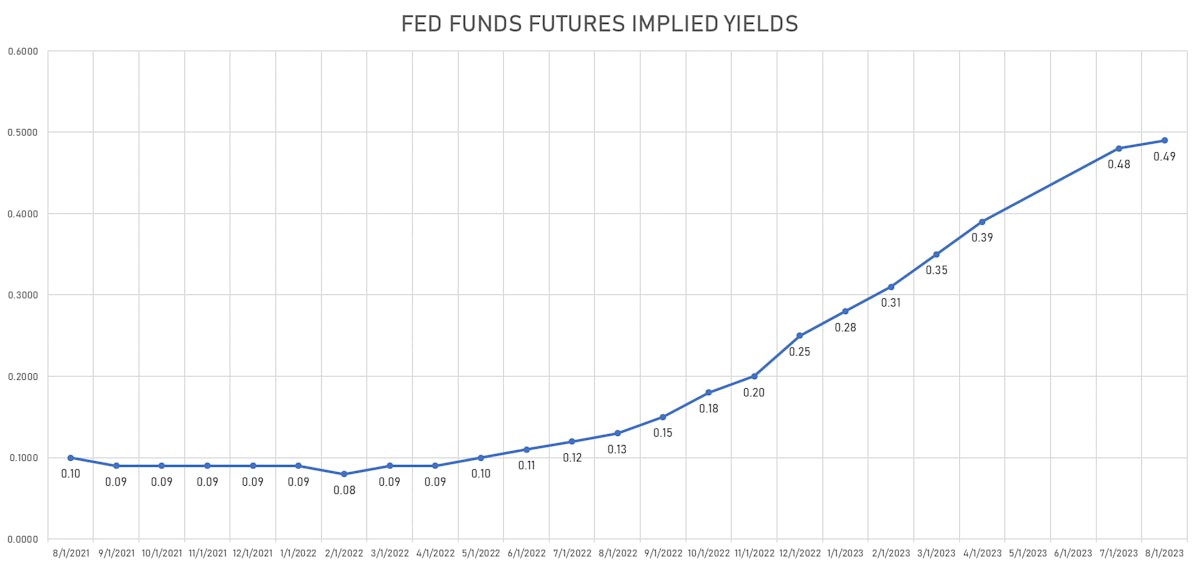

- 3-month Eurodollar futures expected hike of 15.5 bp by the end of 2022 (meaning the market prices 62.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 15.7 bp of rate hikes over the next 18 months (equivalent to 0.63 rate hike) and 73.6 bp over the next 3 years (equivalent to 2.94 rate hikes)

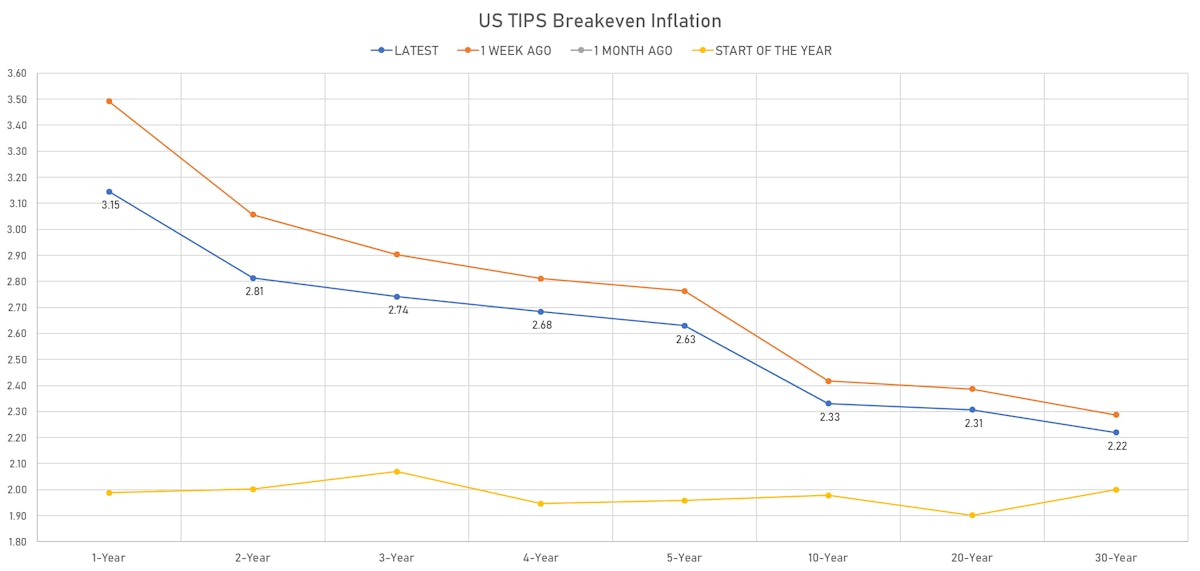

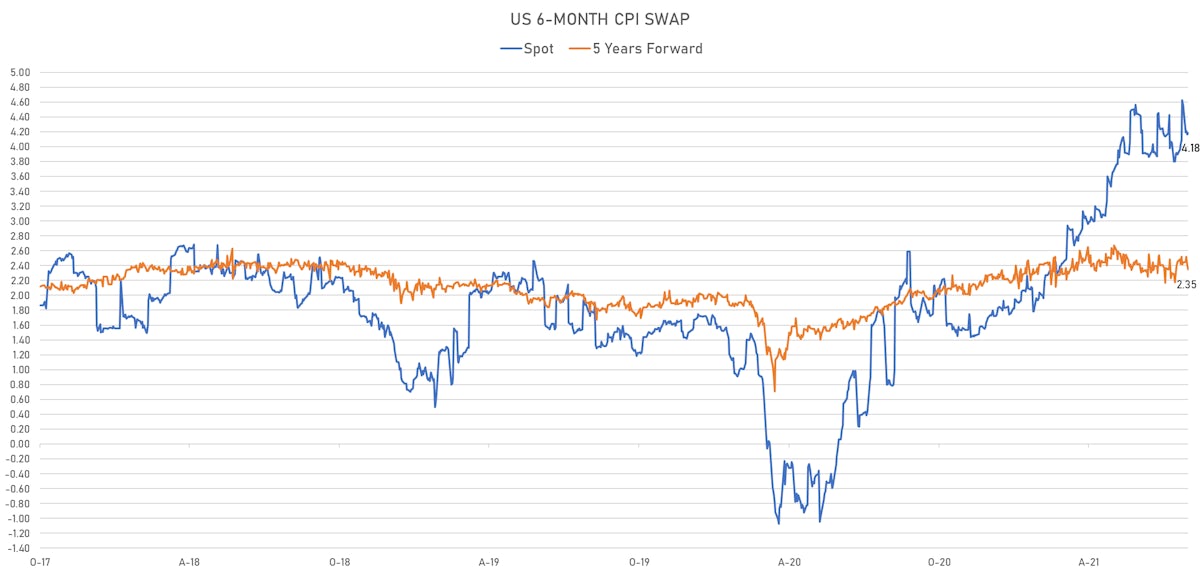

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.15% (down -3.1bp); 2Y at 2.81% (down -2.3bp); 5Y at 2.63% (down -1.8bp); 10Y at 2.33% (down -1.5bp); 30Y at 2.22% (down 0.0bp)

- 6-month spot US CPI swap up 2.2 bp to 4.183%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8430%, +6.3 bp today; 10Y at -1.1030%, +6.1 bp today; 30Y at -0.3370%, +3.0 bp today

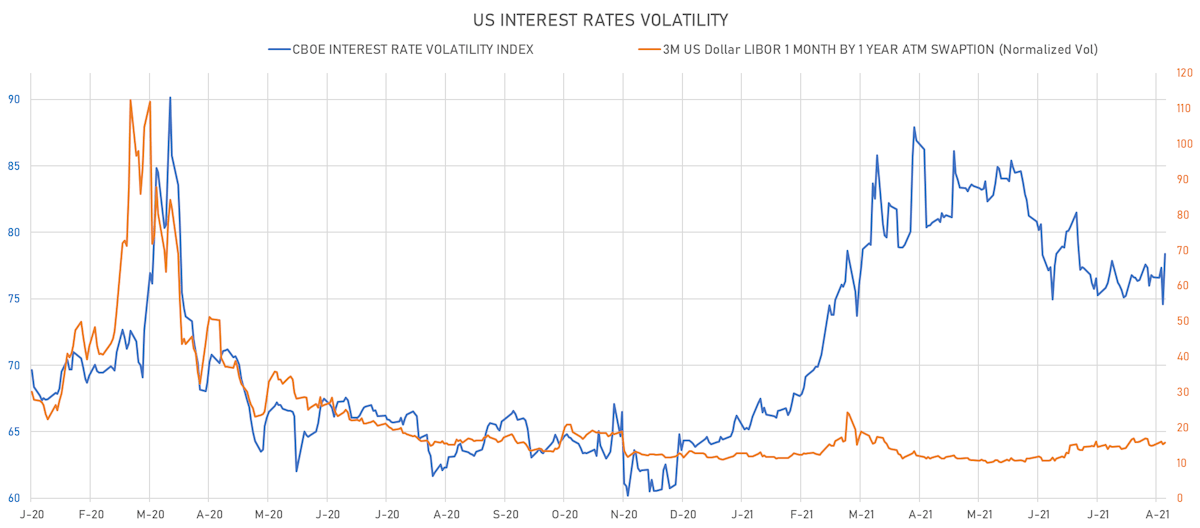

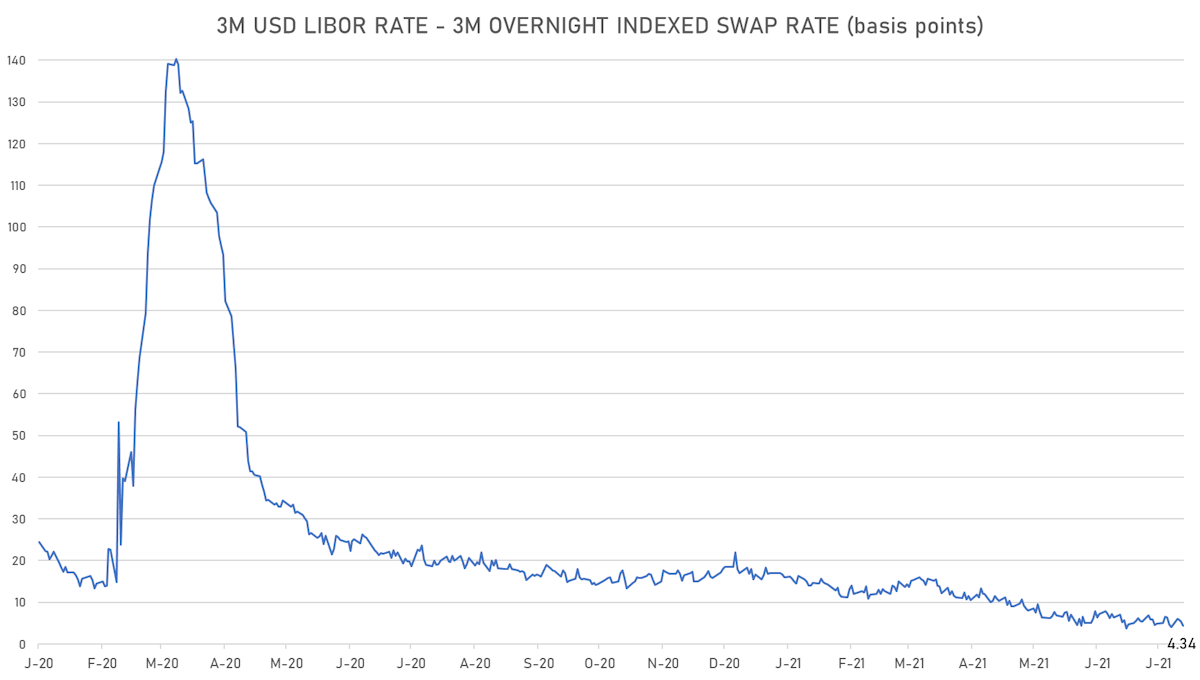

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.4% at 15.6%

- 3-Month LIBOR-OIS spread down -1.0 bp at 4.3 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.766% (up 0.3 bp); the German 1Y-10Y curve is 0.8 bp flatter at 14.7bp (YTD change: +0.4 bp)

- Japan 5Y: -0.132% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 13.7bp (YTD change: +0.2 bp)

- China 5Y: 2.653% (down -2.6 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 69.7bp (YTD change: +23.3 bp)

- Switzerland 5Y: -0.708% (unchanged 0.0 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 29.0bp (YTD change: +6.6 bp)