Rates

Duration Sell-Off Feels Overdone Considering Strong Economic Fundamentals, But Rates Will Likely Go Lower Before A Meaningful Rebound

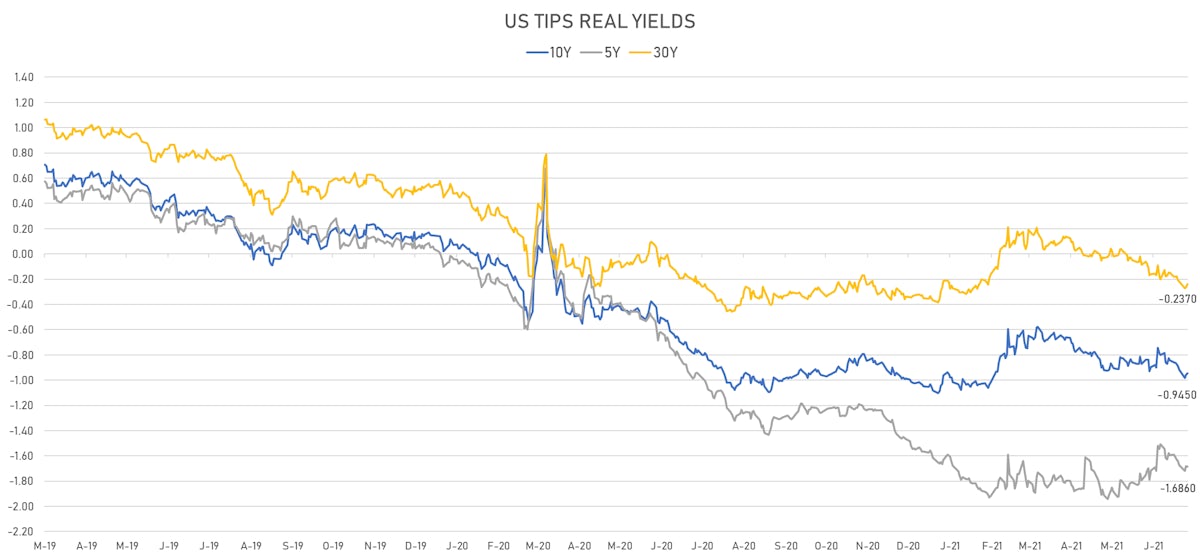

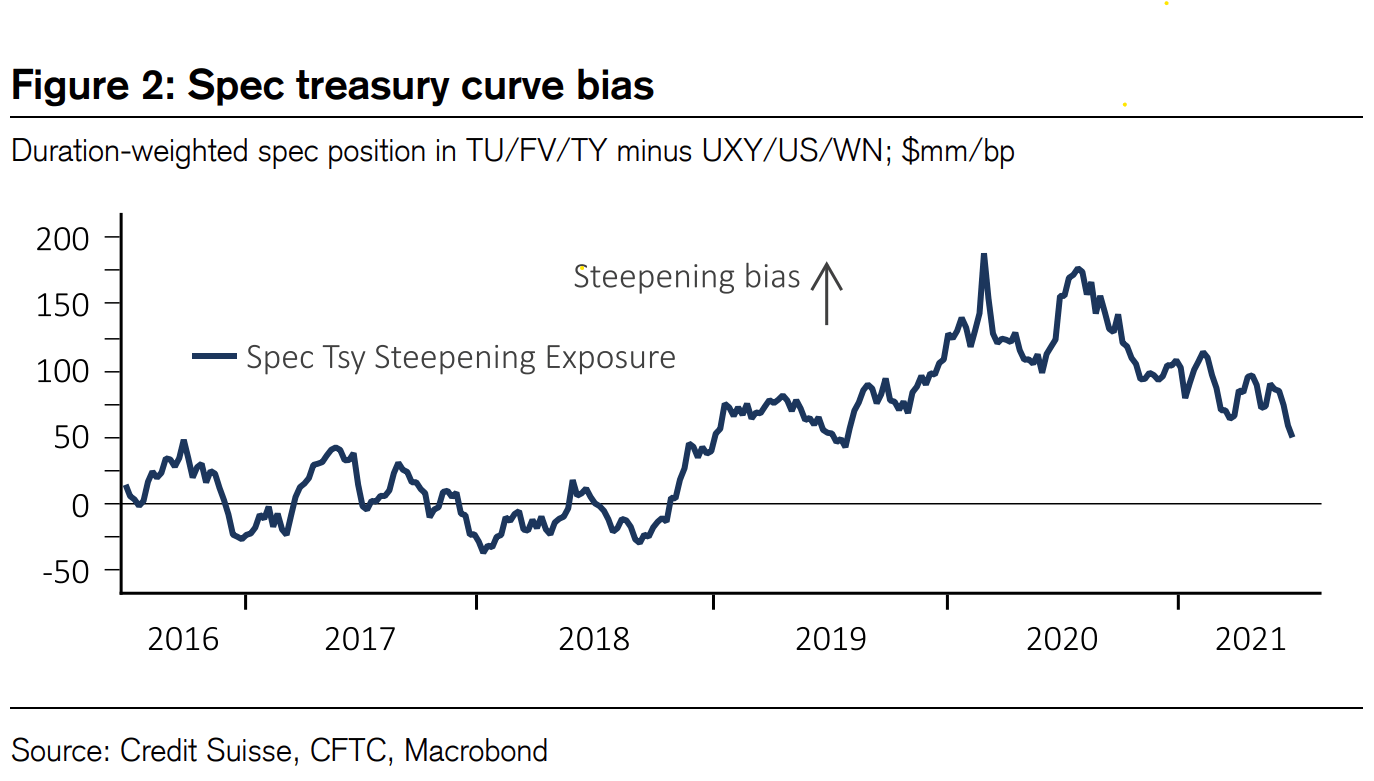

With inflation concerns receding and some weaker-than-expected macro releases, rates have been aggressively (arguably excessively) repriced to a lower growth environment and a more dovish Fed; bearish specs have had to cover short duration positioning giving solid legs to the move lower in yields

Published ET

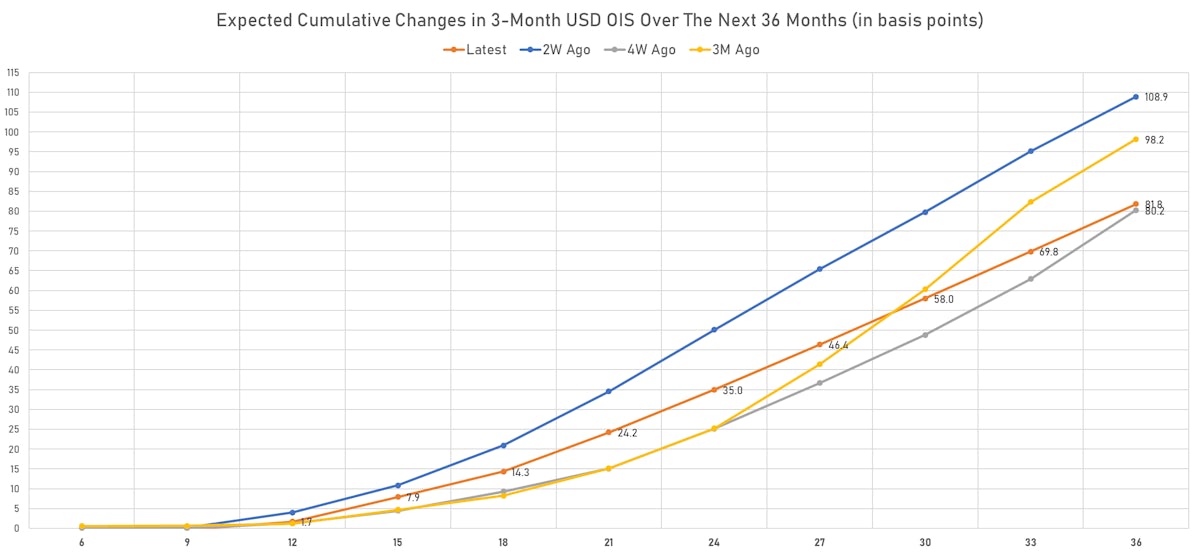

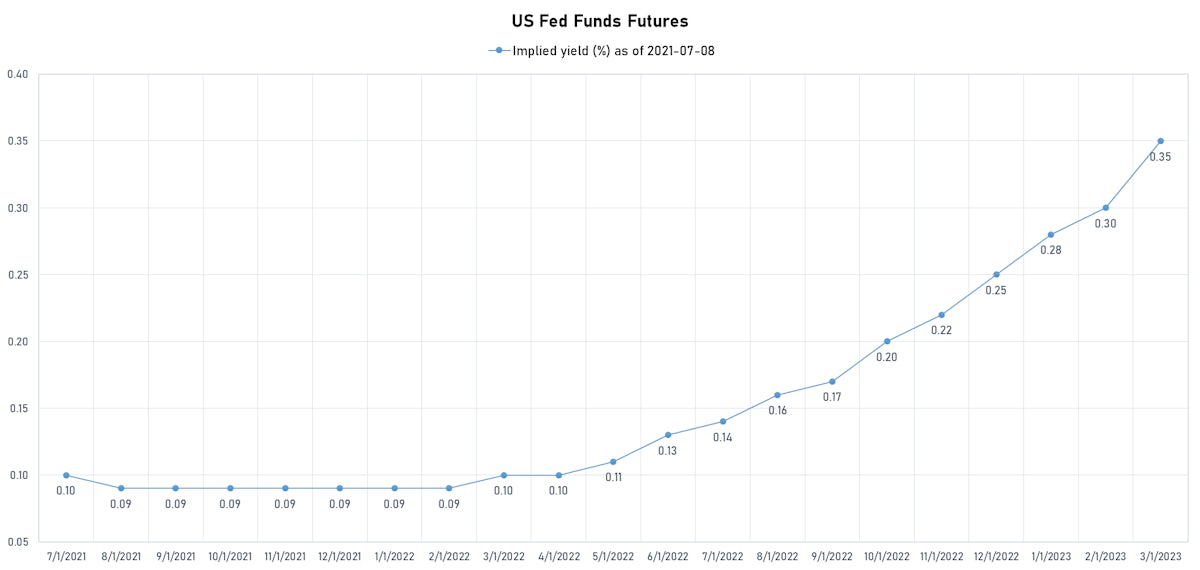

Implied rate hikes over the next 3 years are almost back to pre-FOMC levels, with a much lower terminal rate | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

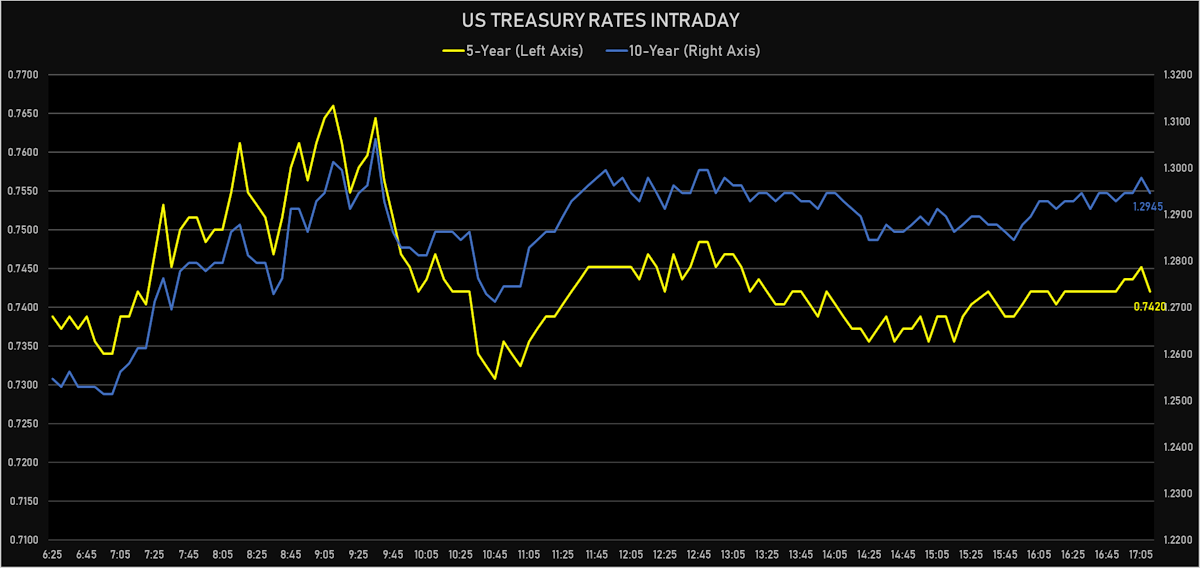

- Yield curve flattening, with the 1s10s Treasury spread tightening -2.6 bp today, now at 122.7 bp (YTD change: +42.2)

- 1Y: 0.0680% (down 0.3 bp)

- 2Y: 0.1963% (down 2.2 bp)

- 5Y: 0.7420% (down 4.3 bp)

- 7Y: 1.0613% (down 3.5 bp)

- 10Y: 1.2945% (down 2.8 bp)

- 30Y: 1.9253% (down 1.7 bp)

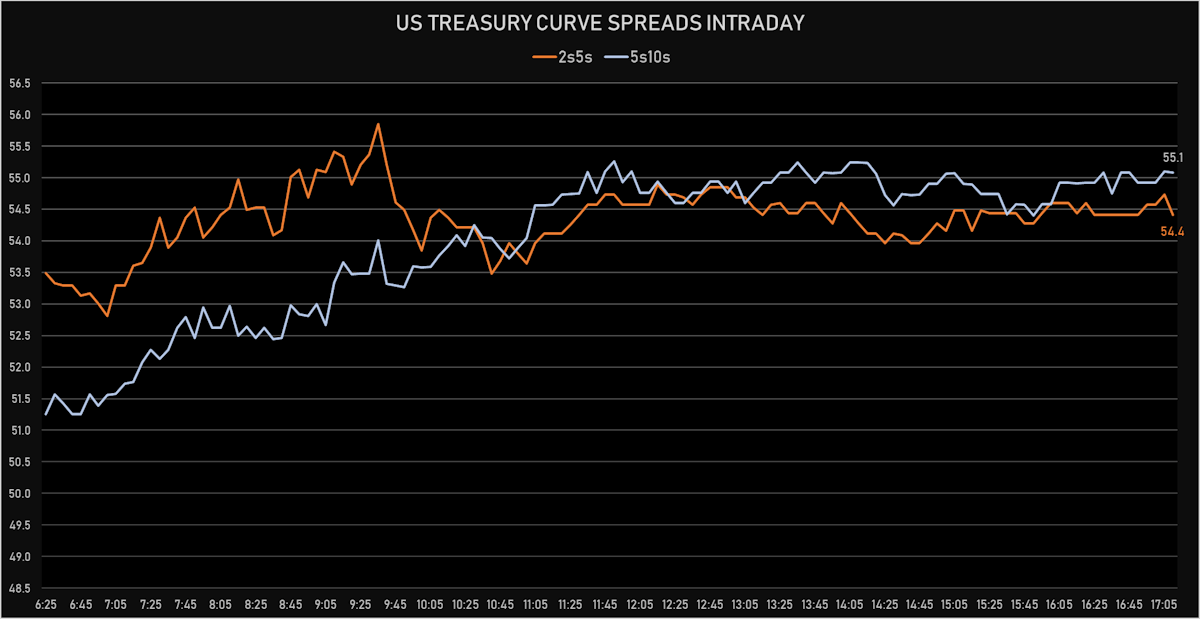

- US treasury curve spreads: 2s5s at 54.6bp (down -2.0bp today), 5s10s at 55.2bp (up 1.5bp today), 10s30s at 63.1bp (up 1.1bp today)

- Treasuries butterfly spreads: 2s5s10s at 0.3bp (up 3.6bp today), 5s10s30s at 8.2bp (unchanged)

US MACRO RELEASES

- Consumer credit, total, Absolute change for May 2021 (FED, U.S.) at 35.28 Bln USD, above consensus estimate of 18.40 Bln USD

- Jobless Claims, National, Continued for W 26 Jun (U.S. Dept. of Labor) at 3.34 Mln, in line with consensus estimate

- Jobless Claims, National, Initial for W 03 Jul (U.S. Dept. of Labor) at 373.00 k, above consensus estimate of 350.00 k

- Jobless Claims, National, Initial, four week moving average for W 03 Jul (U.S. Dept. of Labor) at 394.50 k

Speculative positioning in rates as of last week; Credit Suisse estimates published on 2 July 2021, based on CFTC data

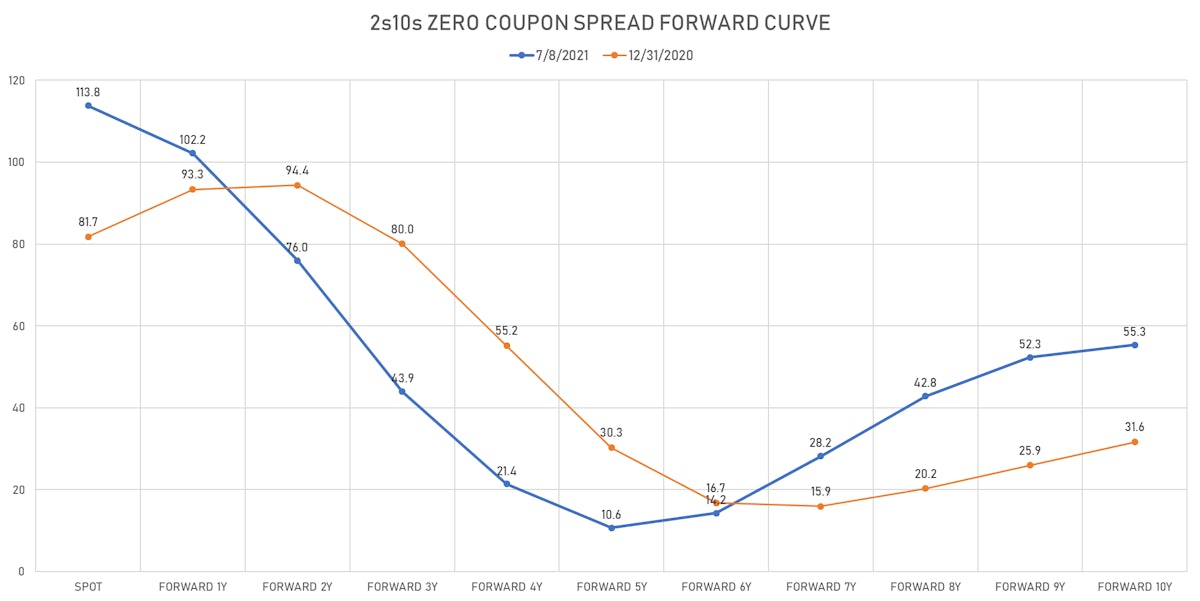

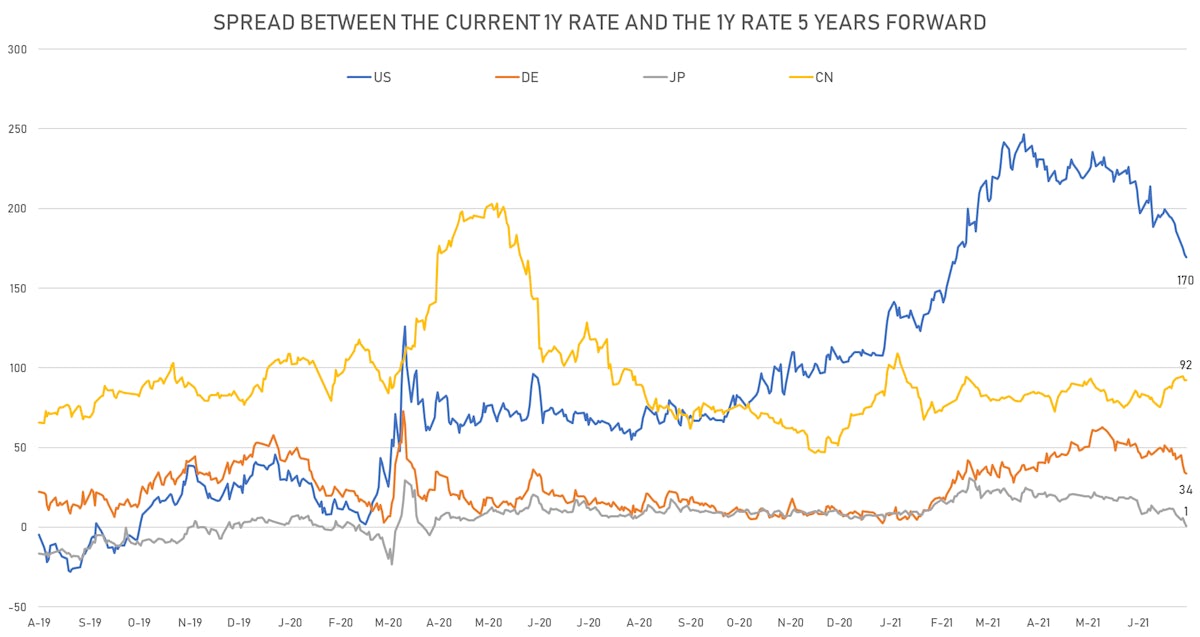

US FORWARD RATES

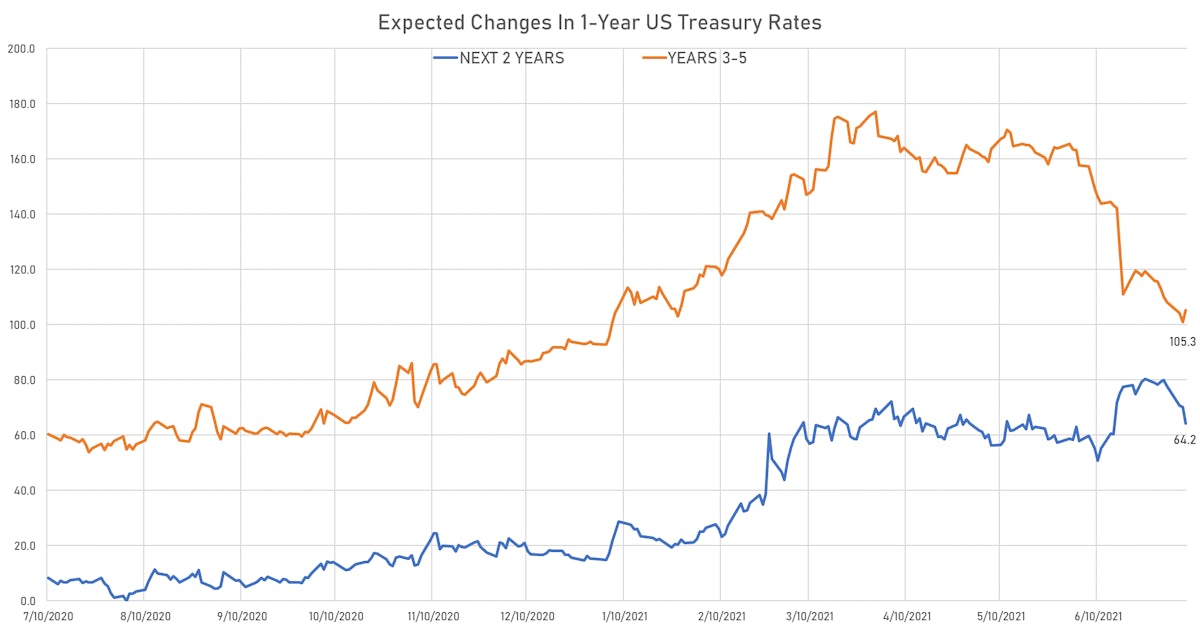

- 3-month USD Libor 5 years forward down 1.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 1.9 bp, now at 1.78%

- 1-Year Treasury rates are now expected to increase by 169.6 bp over the next 5 years (down from 250bp earlier this year)

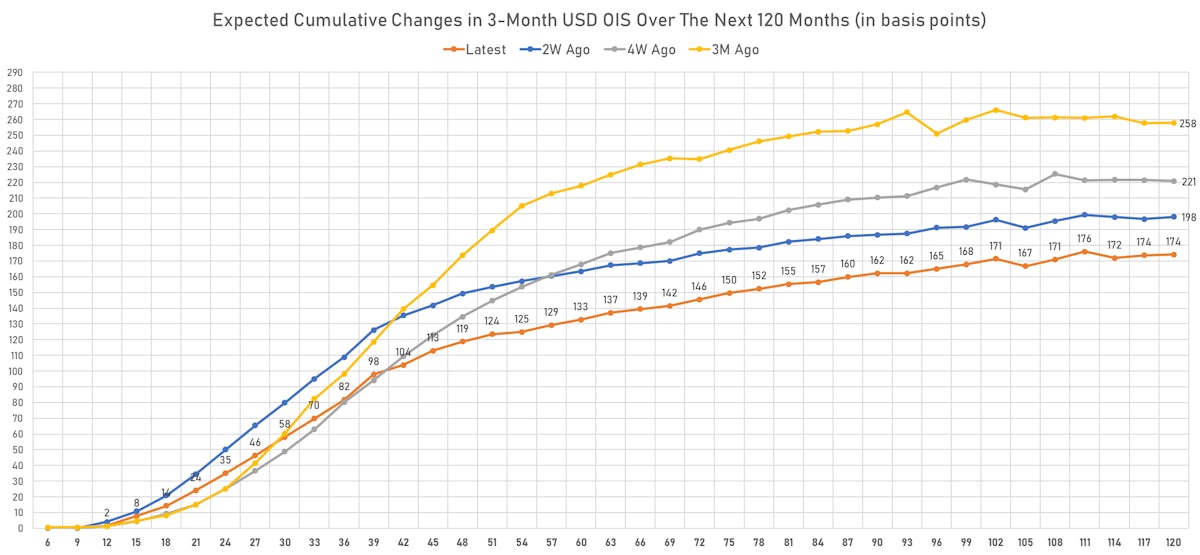

- The market currently expects the 3-month USD OIS rate to rise by 14.3 bp over the next 18 months (equivalent to 0.6 rate hike) and 81.8 bp over the next 3 years (equivalent to 3.3 rate hikes)

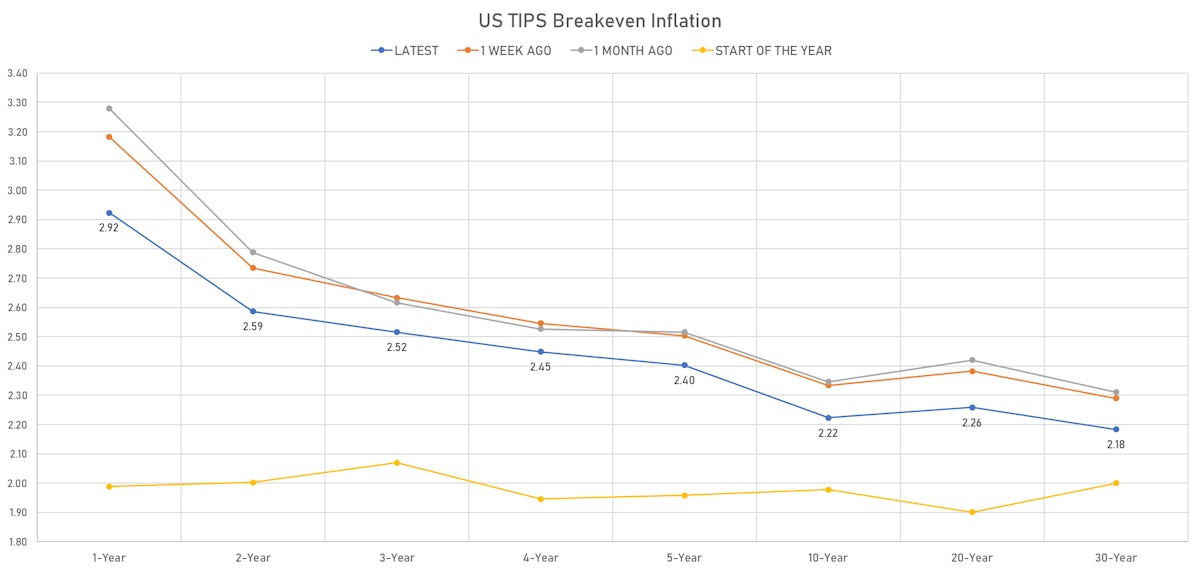

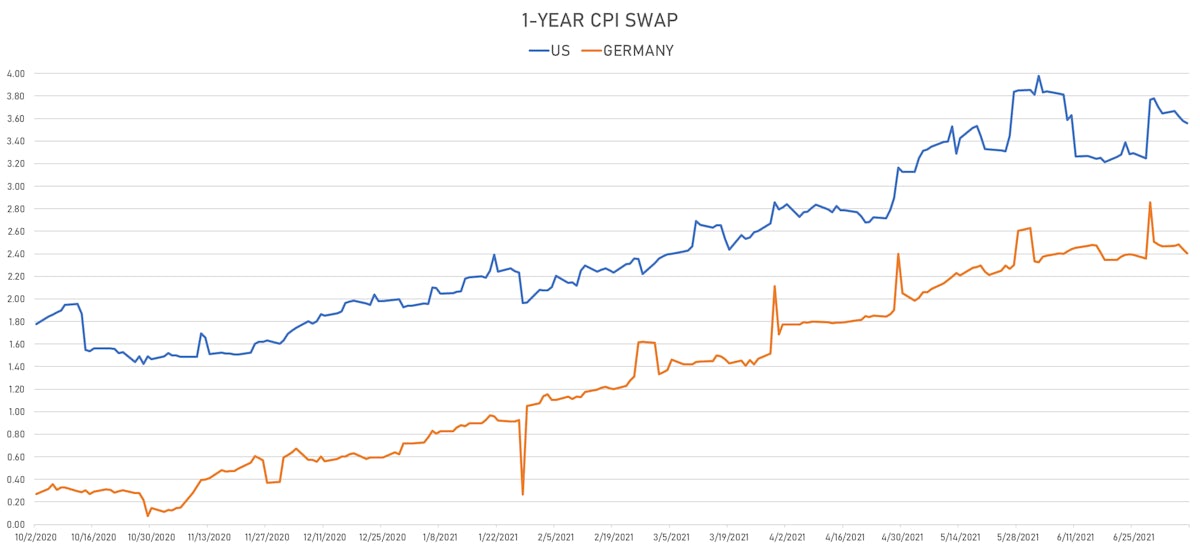

US INFLATION

- TIPS 1Y breakeven inflation at 2.92% (unchanged); 2Y at 2.59% (down -2.4bp); 5Y at 2.40% (down -3.8bp); 10Y at 2.22% (down -3.8bp); 30Y at 2.18% (down -4.1bp)

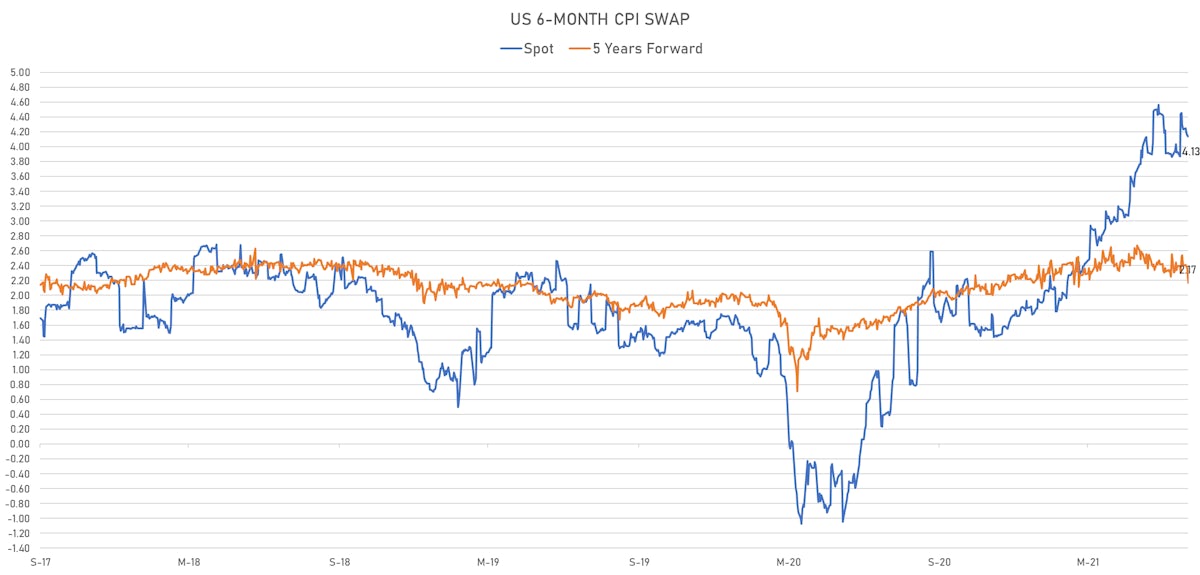

- 6-month spot US CPI swap down -1.5 bp to 4.134%, with a steepening of the forward curve

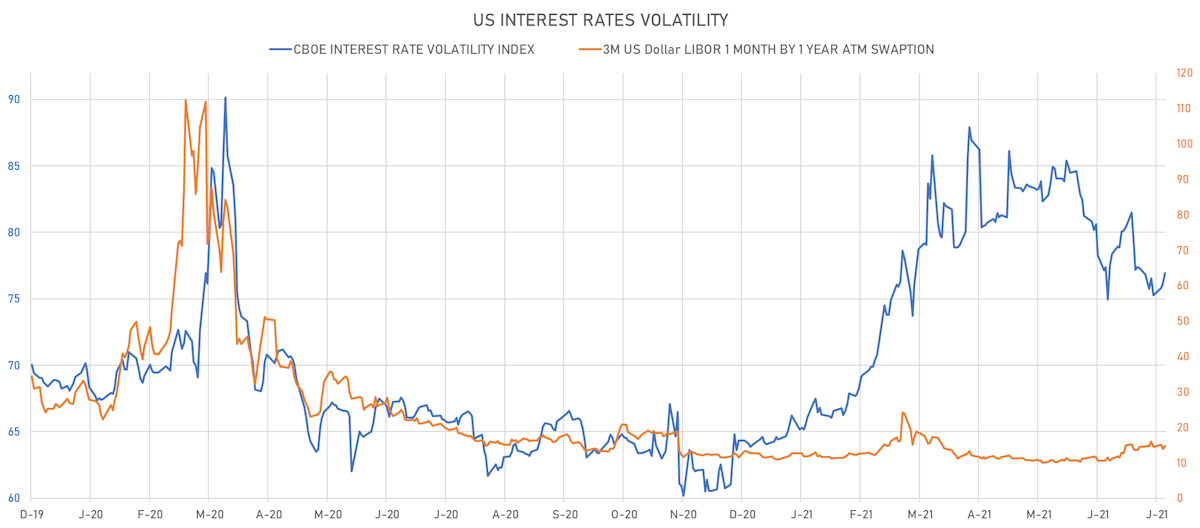

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 14.7%

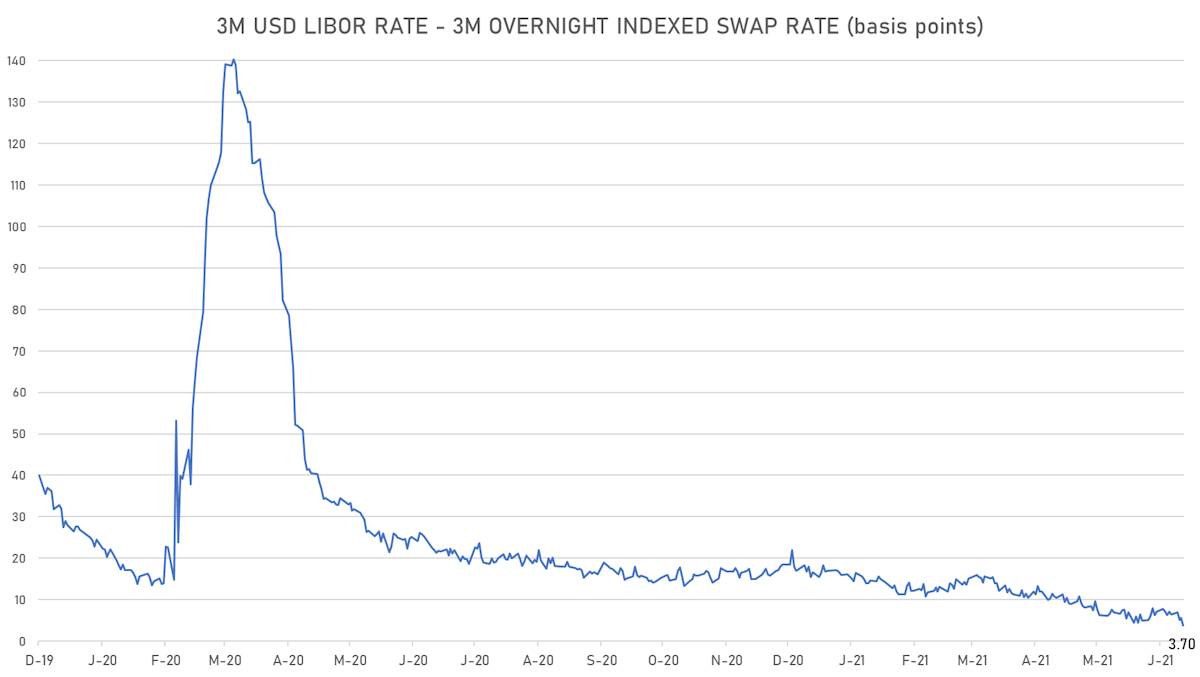

- 3-Month LIBOR-OIS spread down -2.0 bp at 3.7 bp (12-months range: 3.7-23.6 bp)

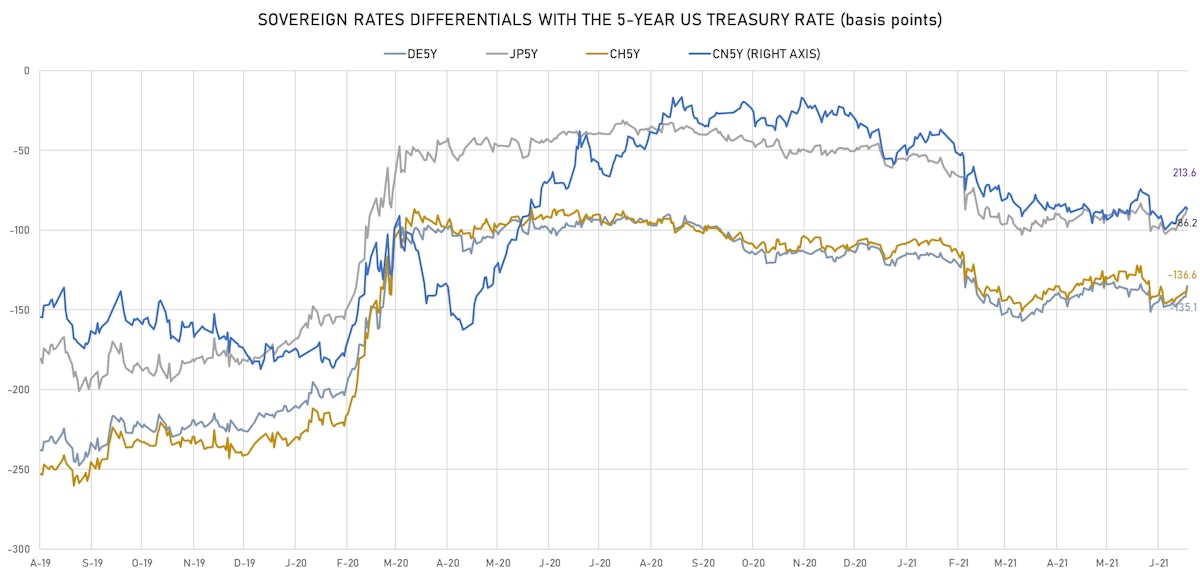

KEY INTERNATIONAL RATES

- Germany 5Y: -0.610% (up 2.3 bp); the German 1Y-10Y curve is 0.8 bp flatter at 36.1bp (YTD change: +21.0 bp)

- Japan 5Y: -0.112% (down -0.9 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 14.0bp (YTD change: -0.3 bp)

- China 5Y: 2.878% (down -5.3 bp); the Chinese 1Y-10Y curve is 5.8 bp steeper at 87.3bp (YTD change: +40.9 bp)

- Switzerland 5Y: -0.624% (down -2.0 bp); the Swiss 1Y-10Y curve is 0.8 bp steeper at 50.8bp (YTD change: +20.4 bp)