Rates

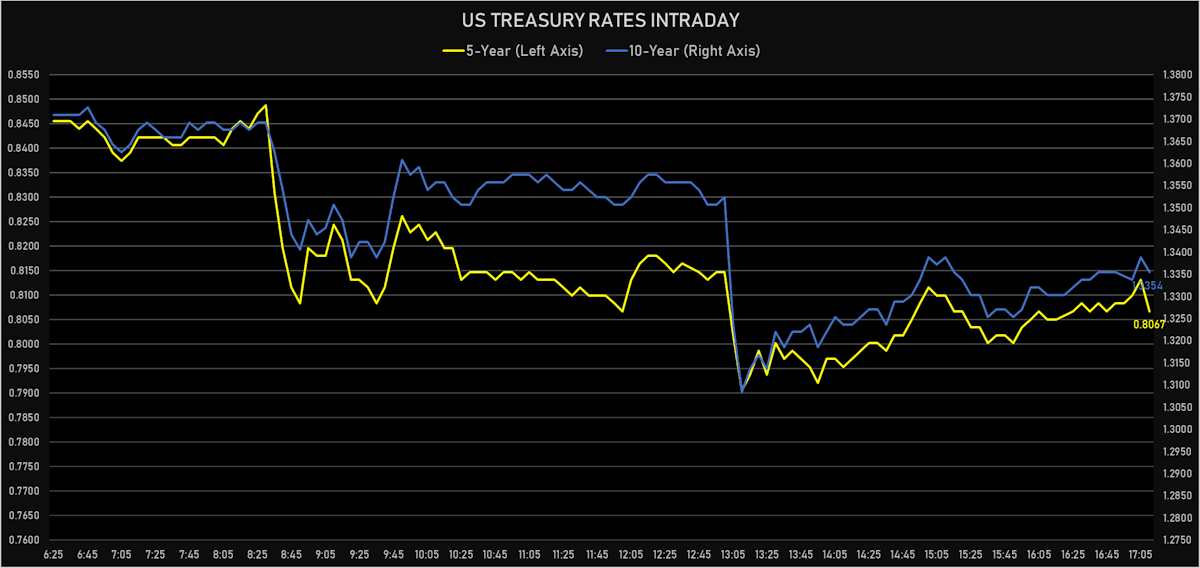

Slight Drop In US Rates As Core CPI Comes In Below Market Expectations

CPI data remains noisy, but there is a stabilization in used auto prices, while supply shortages will likely continue to drive strong inflation till the end of the year; market pricing points to a less transitory inflation than previously thought

Published ET

1-Year Forward Short-Term Inflation In The US, Germany, Japan, UK | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.2bp today, now at 0.1213%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.9 bp, now at 125.9 bp (YTD change: +45.5bp)

- 1Y: 0.0760% (unchanged)

- 2Y: 0.2206% (down 1.8 bp)

- 5Y: 0.8067% (down 2.3 bp)

- 7Y: 1.1145% (down 1.6 bp)

- 10Y: 1.3354% (down 1.9 bp)

- 30Y: 2.0014% (down)

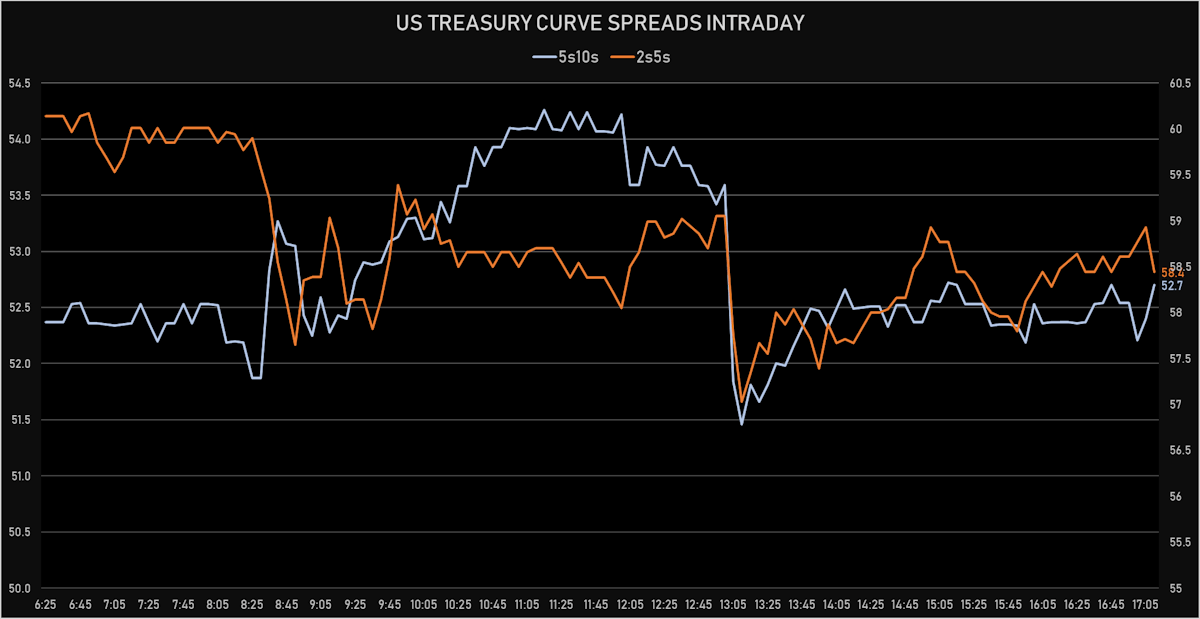

- US treasury curve spreads: 2s5s at 58.6bp (down -0.5bp), 5s10s at 52.9bp (up 0.4bp today), 10s30s at 66.7bp (up 1.9bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.1bp (up 0.9bp today), 5s10s30s at 13.9bp (up 1.8bp)

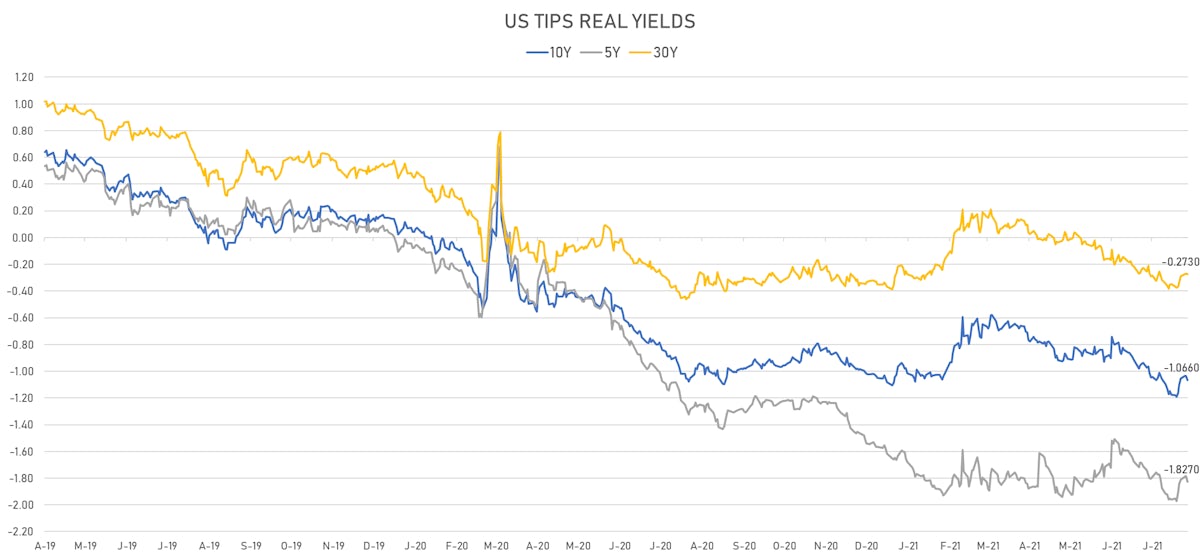

- US 5-Year TIPS Real Yield: -4.2 bp at -1.8270%; 10-Year TIPS Real Yield: -3.3 bp at -1.0660%; 30-Year TIPS Real Yield: -0.3 bp at -0.2730%

HEADLINES

- The US$ 41 bn 10-Year auction today (91282CCS8) was exceptionally strong: high

yield of 1.340% (stopped through vs. 1.372% when issued), bid-to-cover at 2.65x (vs. five-auction average of 2.43x), indirect bids at 77.25% (vs. five-auction average of 61.16%), primary dealer get 9.63% (vs five-auction average of 20.77%) - Fed's Barkin, Evans both expressed a need to see more labor market improvement before tapering decision (no timetable yet)

- Some Treasury bill yields starting to reflect concerns Congress will wait until last minute to deal with debt ceiling (Reuters)

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for Jul 2021 (BLS, U.S Dep. Of Lab) at 5.40 %, above consensus estimate of 5.30 %

- CPI, All items less food and energy for Jul 2021 (BLS, U.S Dep. Of Lab) at 279.05

- CPI, All items less food and energy, Change P/P for Jul 2021 (BLS, U.S Dep. Of Lab) at 0.30 %, below consensus estimate of 0.40 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Jul 2021 (BLS, U.S Dep. Of Lab) at 4.30 %, in line with consensus estimate

- CPI, All items, Change P/P for Jul 2021 (BLS, U.S Dep. Of Lab) at 0.50 %, in line with consensus estimate

- CPI, All items, Price Index for Jul 2021 (BLS, U.S Dep. Of Lab) at 273.00 , in line with consensus estimate

- CPI, FRB Cleveland Median, 1 month, Change M/M for Jul 2021 (Fed Resrv, Cleveland) at 0.30 %

- Earnings, Average Weekly, Total Private, Change P/P for Jul 2021 (BLS, U.S Dep. Of Lab) at -0.10 %

- Federal Budget, Current Prices for Jul 2021 (Fiscal Service, USA) at -302.00 Bln USD, above consensus estimate of -307.00 Bln USD

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 06 Aug (MBA, USA) at 2.80 %

- Mortgage applications, market composite index for W 06 Aug (MBA, USA) at 754.80

- Mortgage applications, market composite index, purchase for W 06 Aug (MBA, USA) at 252.00

- Mortgage applications, market composite index, refinancing for W 06 Aug (MBA, USA) at 3,684.30

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 06 Aug (MBA, USA) at 2.99 %

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for Aug 2021 (Refinitiv/Ipsos) at 57.07

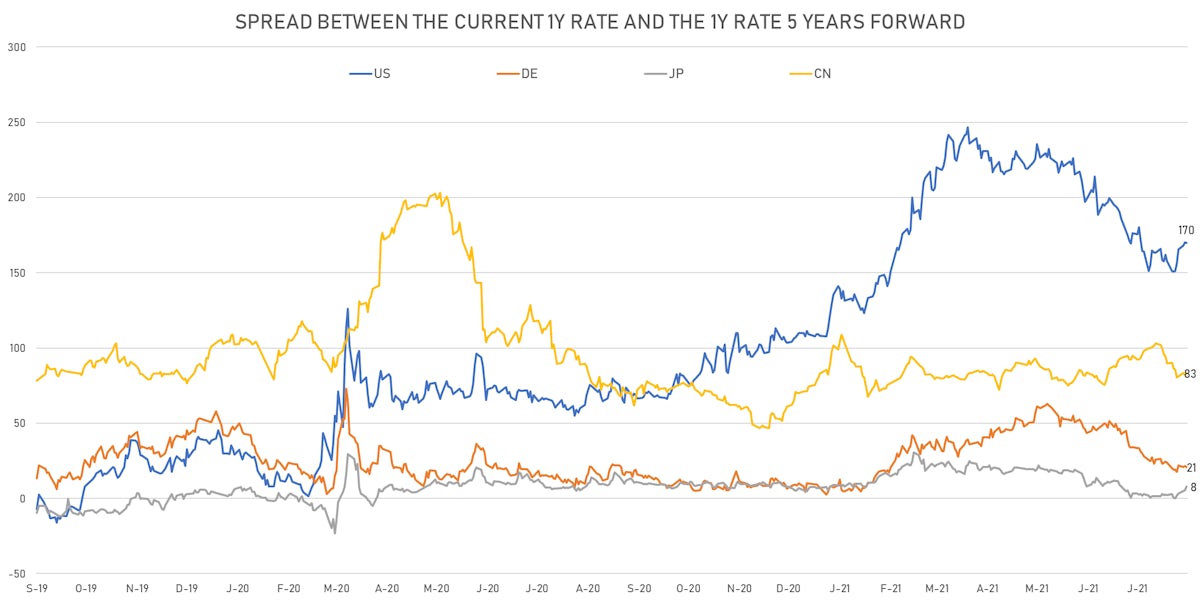

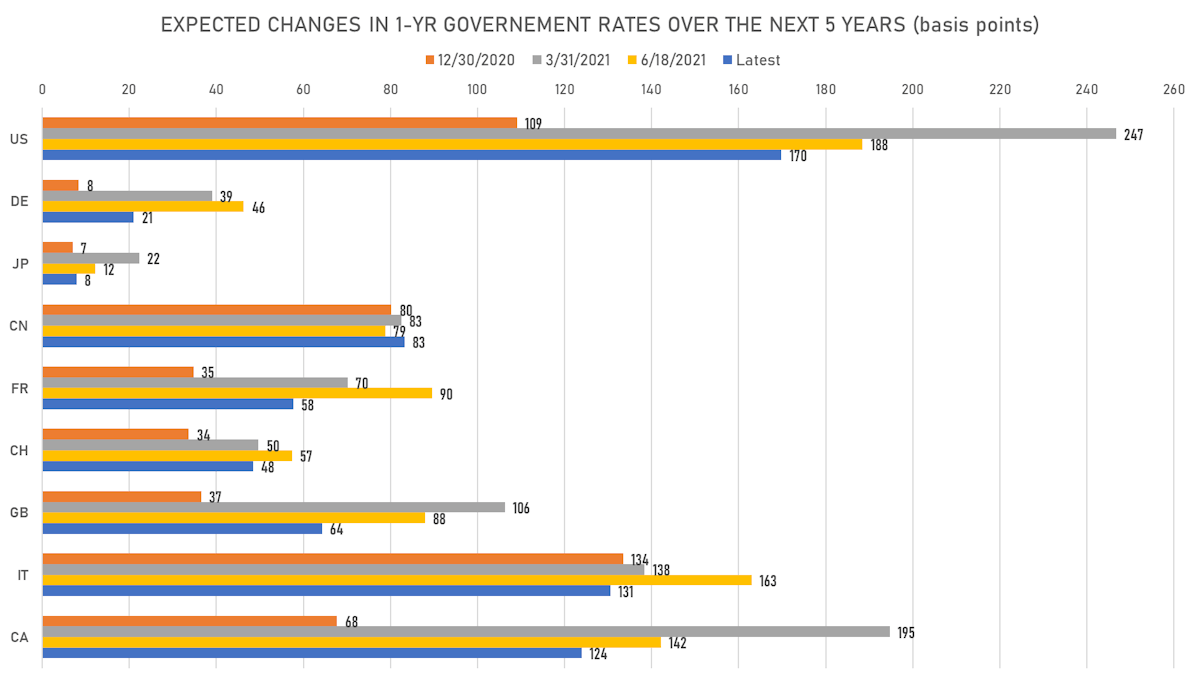

US FORWARD RATES

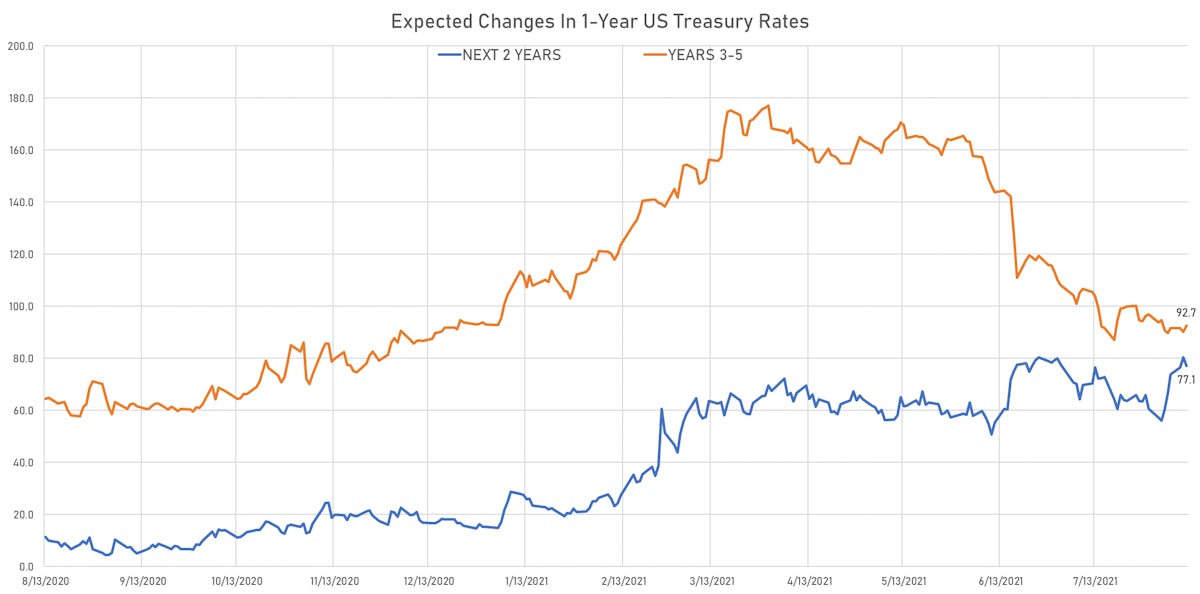

- US Treasury 1-year zero-coupon rate 5 years forward down 1.0 bp, now at 1.7801%

- 1-Year Treasury rates are now expected to increase by 169.8 bp over the next 5 years

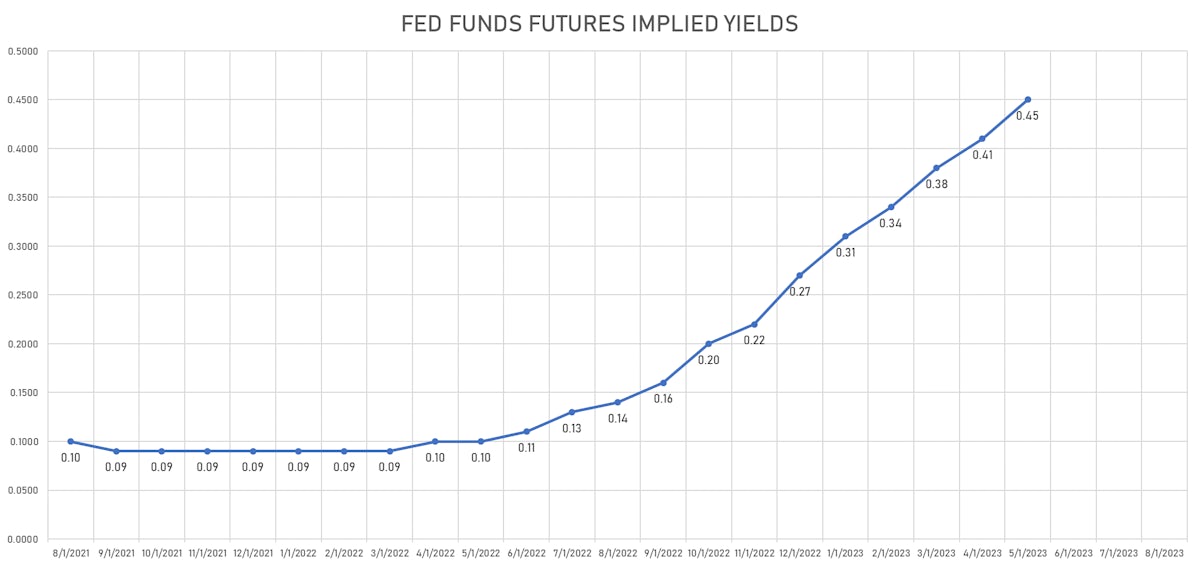

- 3-month Eurodollar futures expected hike of 17.0 bp by the end of 2022 (meaning the market prices 68.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 18.4 bp of rate hikes over the next 18 months (equivalent to 0.74 rate hike) and 85.0 bp over the next 3 years (equivalent to 3.40 rate hikes)

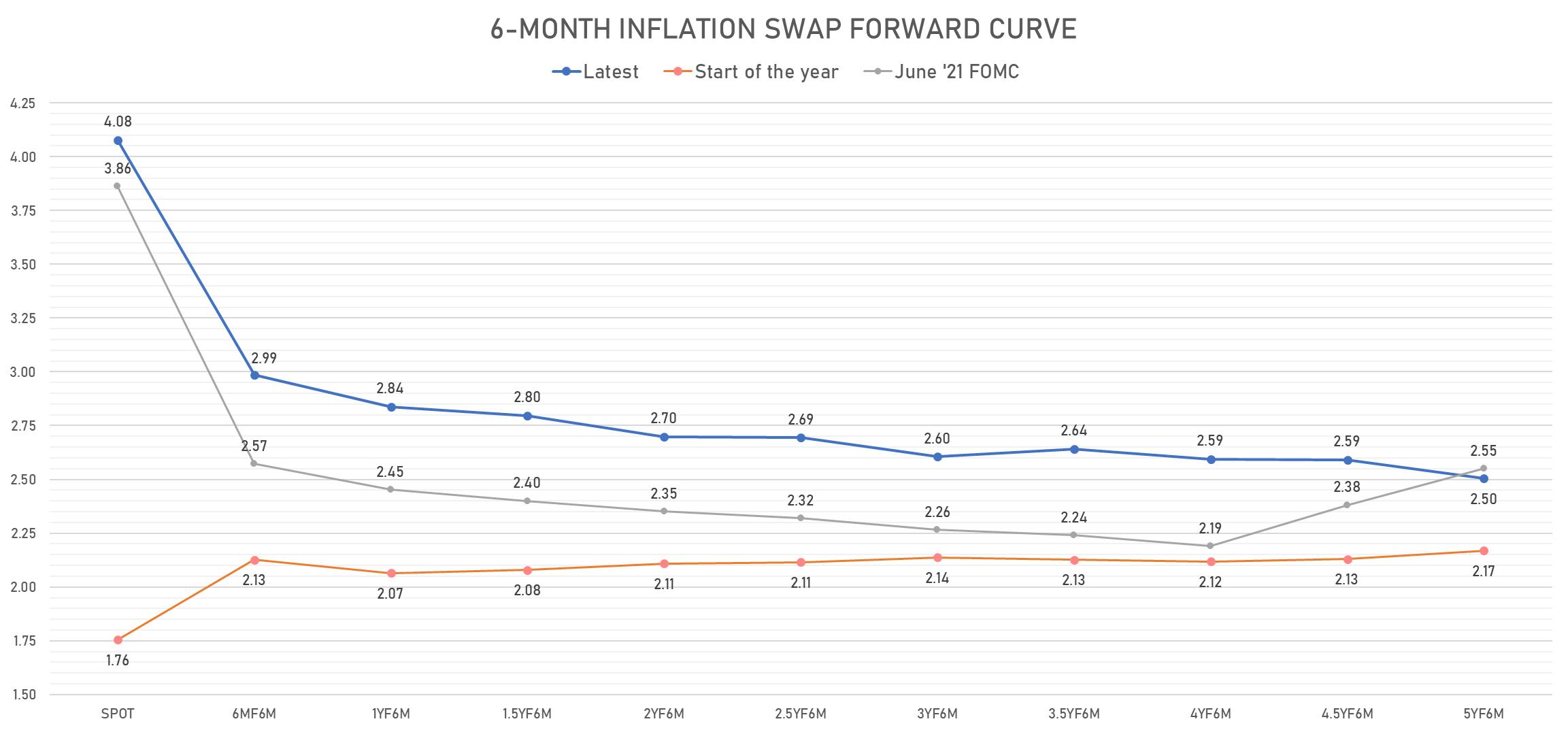

US INFLATION & REAL RATES

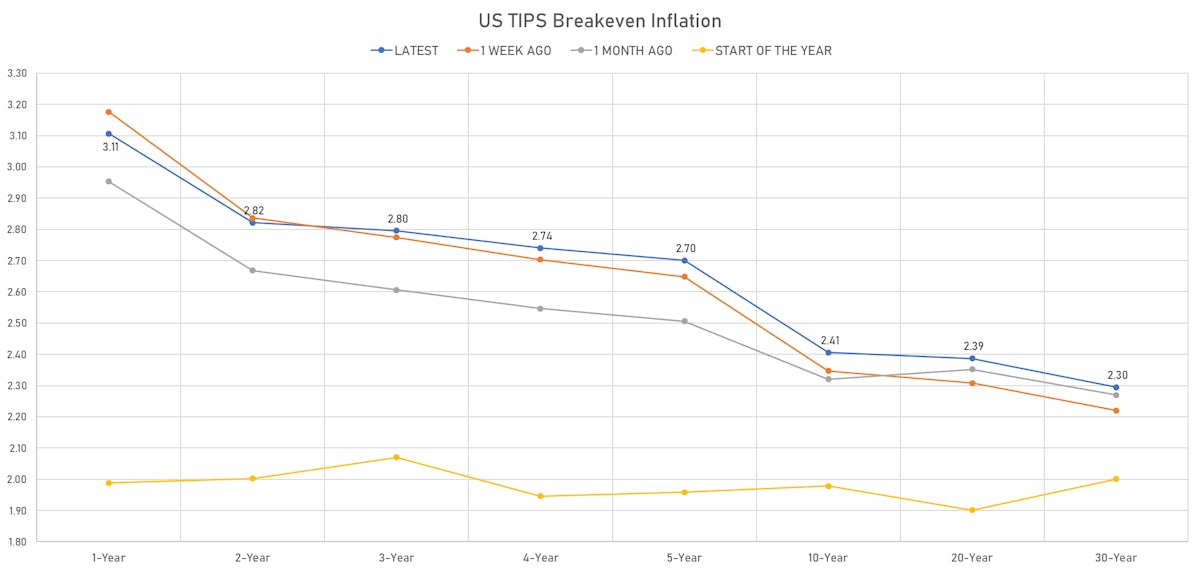

- TIPS 1Y breakeven inflation at 3.11% (up 3.1bp); 2Y at 2.82% (up 2.0bp); 5Y at 2.70% (up 2.1bp); 10Y at 2.41% (up 1.5bp); 30Y at 2.30% (up 0.3bp)

- 6-month spot US CPI swap up 5.5 bp to 4.076%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8270%, -4.2 bp today; 10Y at -1.0660%, -3.3 bp today; 30Y at -0.2730%, -0.3 bp today

RATES VOLATILITY & LIQUIDITY

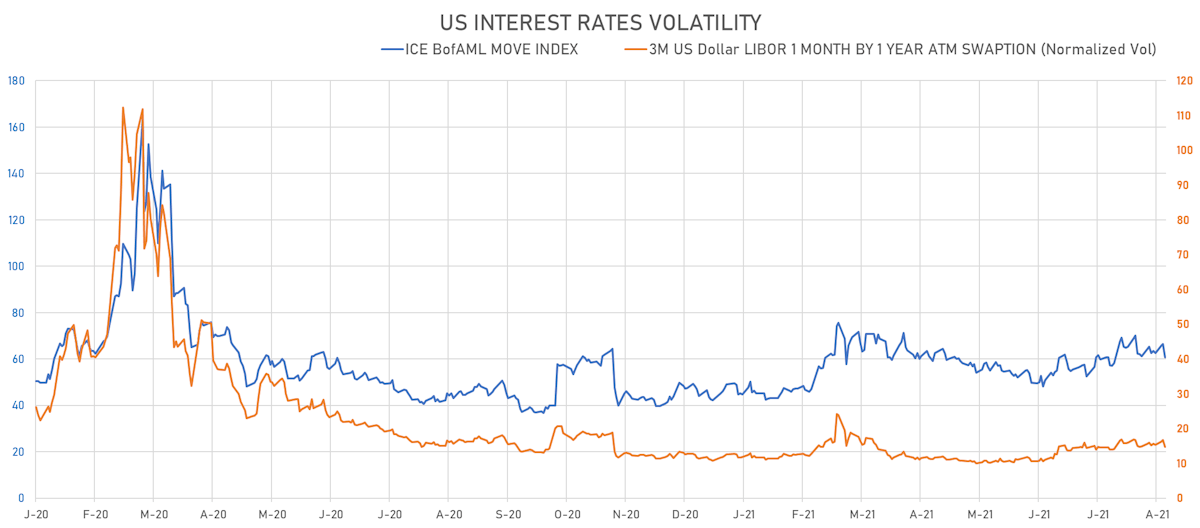

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.9% at 14.8%

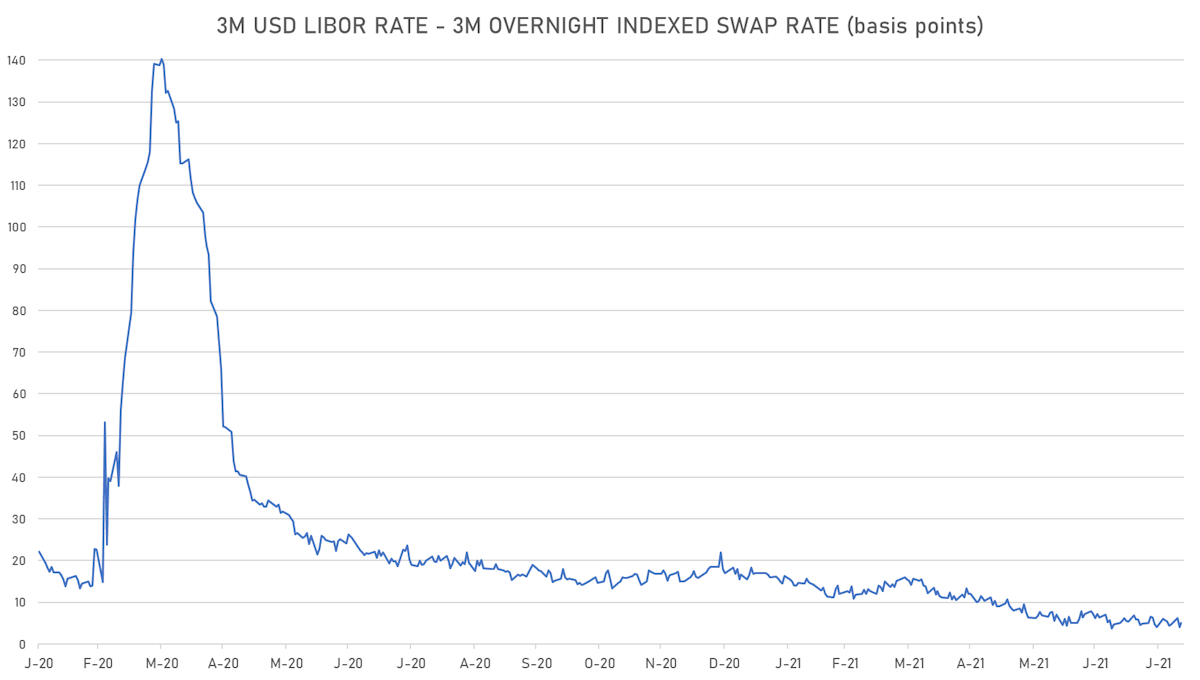

- 3-Month LIBOR-OIS spread up 1.0 bp at 5.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.730% (down -0.4 bp); the German 1Y-10Y curve is 0.2 bp flatter at 19.4bp (YTD change: +4.6 bp)

- Japan 5Y: -0.120% (up 0.5 bp); the Japanese 1Y-10Y curve is 1.3 bp steeper at 15.9bp (YTD change: +2.7 bp)

- China 5Y: 2.726% (up 1.3 bp); the Chinese 1Y-10Y curve is 2.1 bp steeper at 70.3bp (YTD change: +23.9 bp)

- Switzerland 5Y: -0.672% (up 1.8 bp); the Swiss 1Y-10Y curve is 2.1 bp steeper at 38.8bp (YTD change: +12.4 bp)