Rates

Big Miss In Michigan Consumer Sentiment Survey Brings Down Rates From The Belly Out

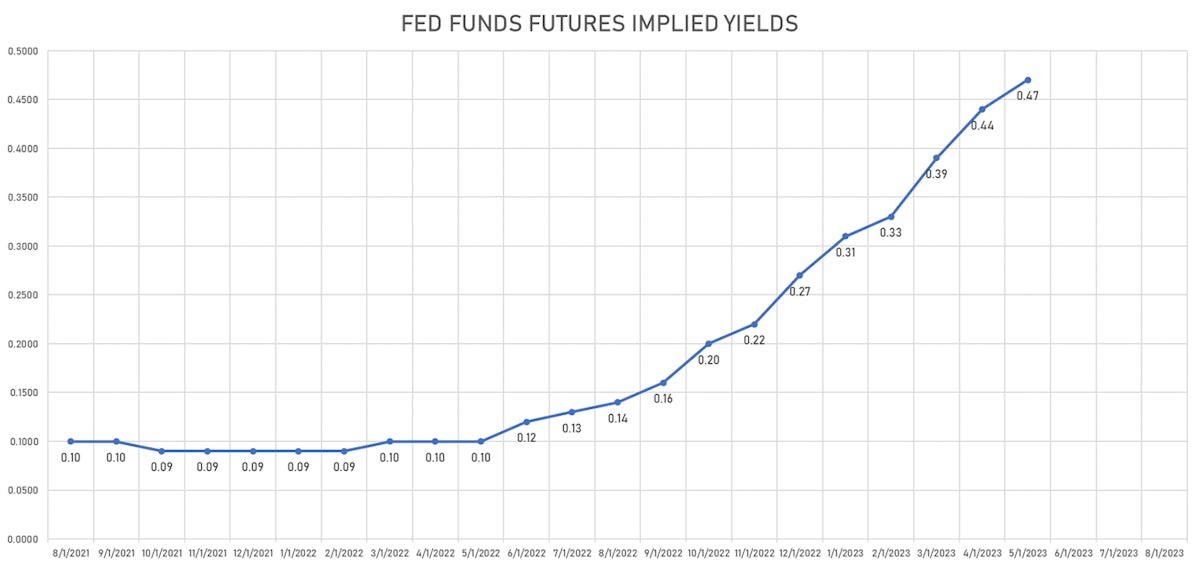

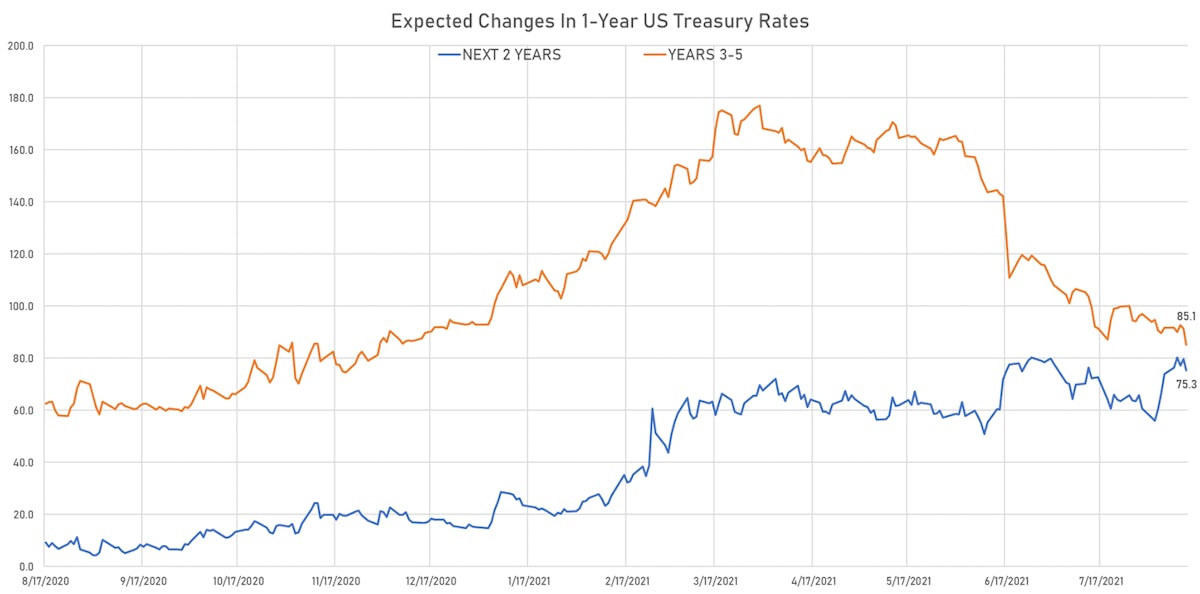

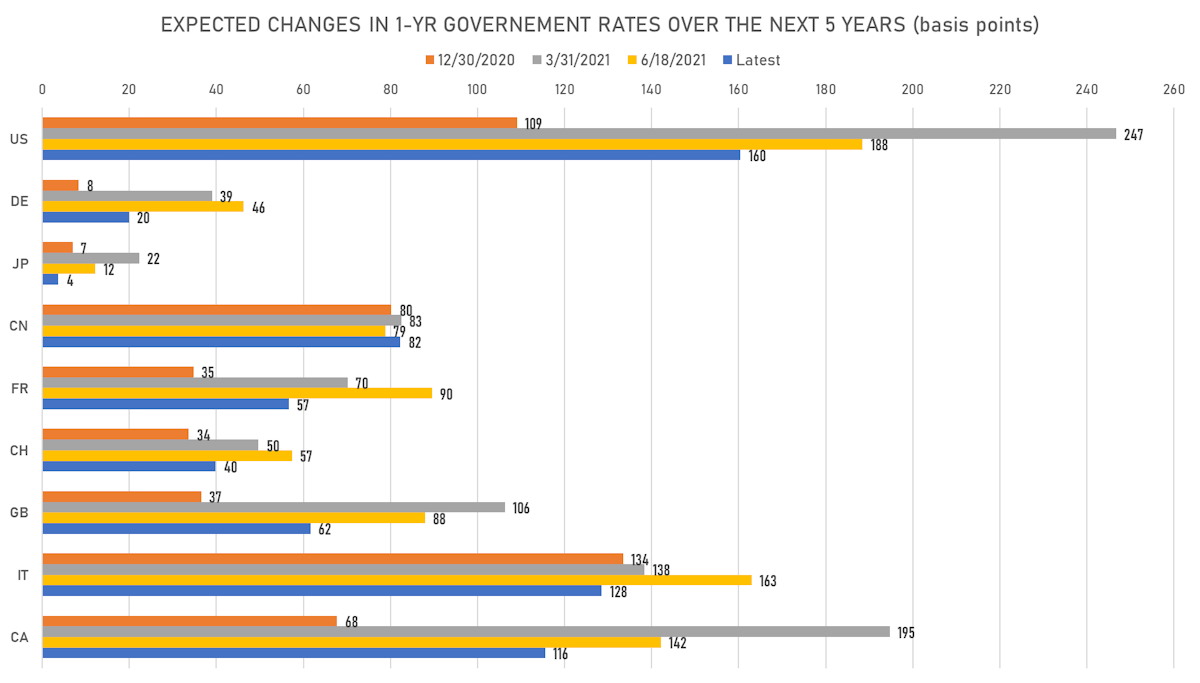

Growing public concern that the Delta variant could stall the growth rebound caused a repricing of potential rate hikes over the next 5 years, resulting in lighter / delayed expected Fed action

Published ET

Expected hikes derived from the 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.1bp today, now at 0.1243%

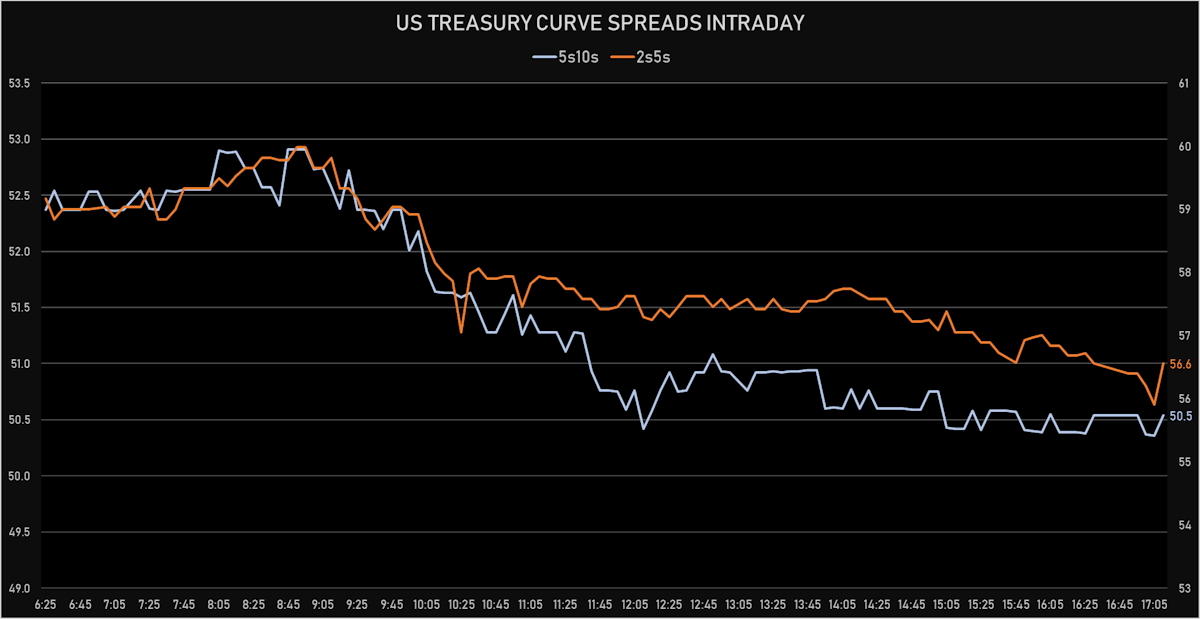

- The treasury yield curve flattened, with the 1s10s spread tightening -7.2 bp, now at 120.4 bp (YTD change: +40.0bp)

- 1Y: 0.0790% (down 0.5 bp)

- 2Y: 0.2091% (down 1.6 bp)

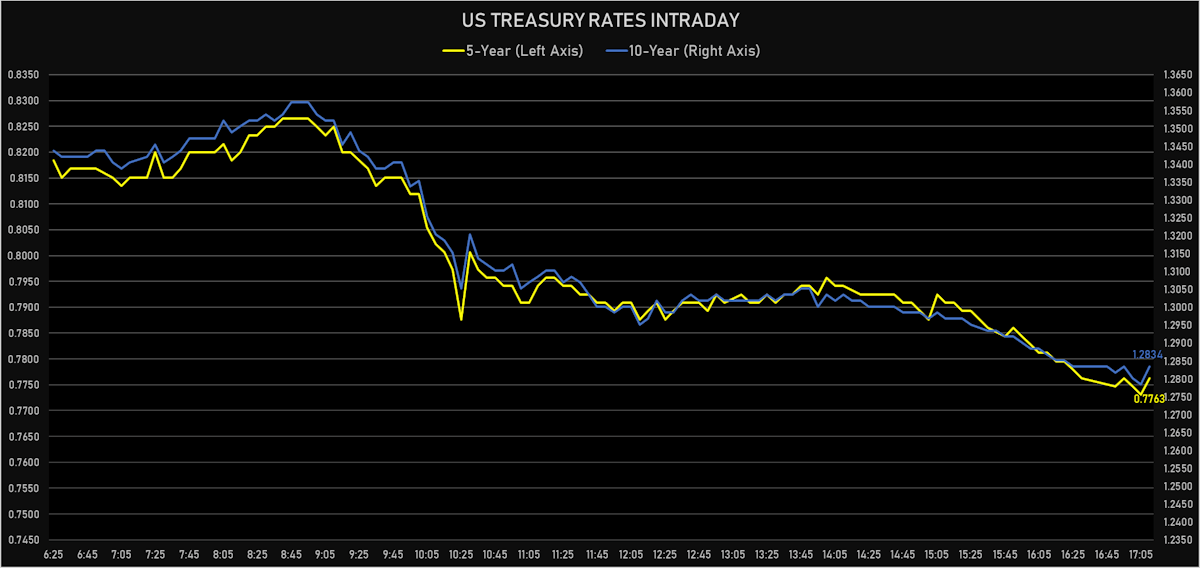

- 5Y: 0.7763% (down 5.2 bp)

- 7Y: 1.0631% (down 6.8 bp)

- 10Y: 1.2834% (down 7.7 bp)

- 30Y: 1.9332% (down 7.0 bp)

- US treasury curve spreads: 2s5s at 56.7bp (down -3.6bp), 5s10s at 50.7bp (down -2.6bp), 10s30s at 65.0bp (up 0.7bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.4bp (up 1.0bp today), 5s10s30s at 14.3bp (up 4.1bp)

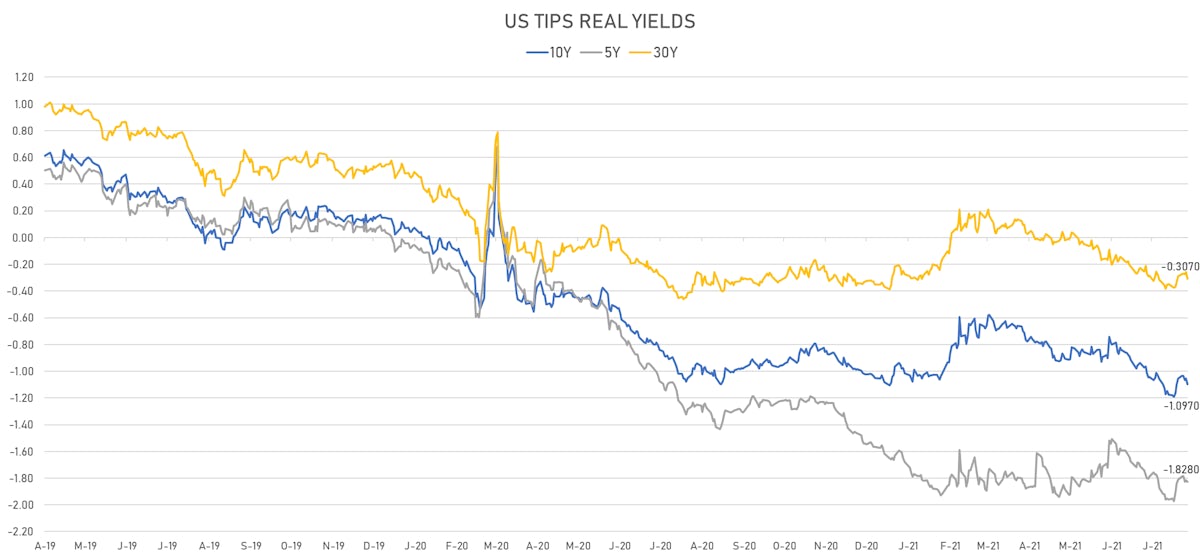

- US 5-Year TIPS Real Yield: -1.4 bp at -1.8280%; 10-Year TIPS Real Yield: -4.1 bp at -1.0970%; 30-Year TIPS Real Yield: -4.8 bp at -0.3070%

US MACRO RELEASES

- 1 Year Inflation Expectations (median), preliminary for Aug 2021 (UMICH, Survey) at 4.60 %

- Export Prices, All commodities, Change P/P, Price Index for Jul 2021 (BLS, U.S Dep. Of Lab) at 1.30 %, above consensus estimate of 0.80 %

- Import Prices, All commodities, Change P/P, Price Index for Jul 2021 (BLS, U.S Dep. Of Lab) at 0.30 %, below consensus estimate of 0.60 %

- University of Michigan, Current Conditions Index-prelim, Volume Index for Aug 2021 (UMICH, Survey) at 77.90

- University of Michigan, Total-prelim, Change Y/Y for Aug 2021 (UMICH, Survey) at 3.00 %

- University of Michigan, Total-prelim, Volume Index for Aug 2021 (UMICH, Survey) at 65.20

- University of Michigan, Total-prelim, Volume Index for Aug 2021 (UMICH, Survey) at 70.20, below consensus estimate of 81.20

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 11.0 bp, now at 1.6823%

- 1-Year Treasury rates are now expected to increase by 160.4 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 7.7 bp by the end of 2022 (meaning the market prices 30.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 18.4 bp of rate hikes over the next 18 months (equivalent to 0.74 rate hike) and 82.8 bp over the next 3 years (equivalent to 3.31 rate hikes)

US INFLATION & REAL RATES

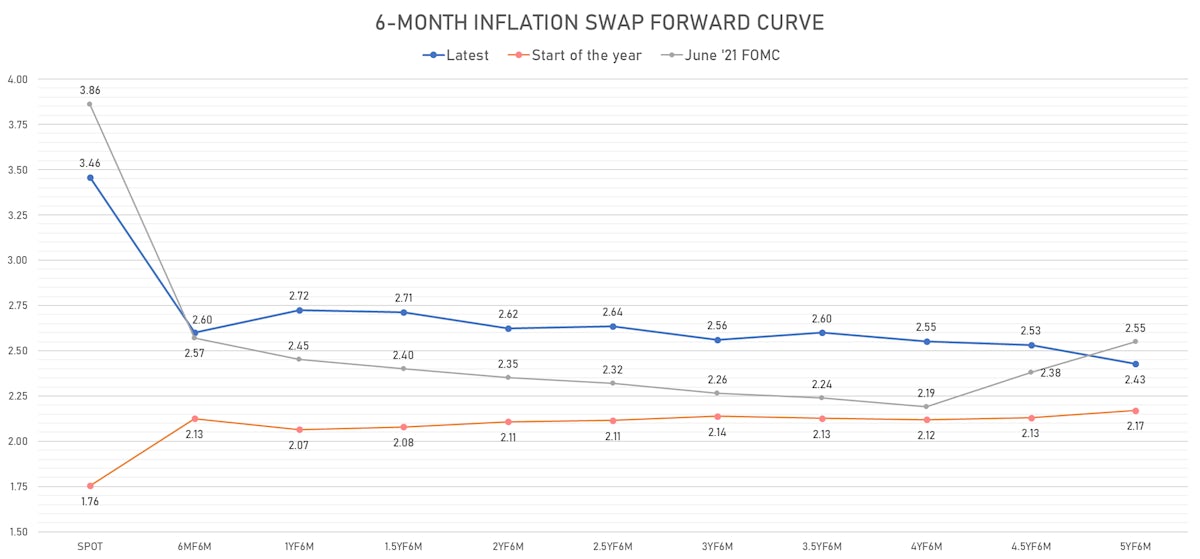

- TIPS 1Y breakeven inflation at 3.03% (down -5.0bp); 2Y at 2.78% (down -2.9bp); 5Y at 2.67% (down -3.7bp); 10Y at 2.37% (down -3.7bp); 30Y at 2.25% (down -3.1bp)

- 6-month spot US CPI swap down -9.2 bp to 3.458%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.8280%, -1.4 bp today; 10Y at -1.0970%, -4.1 bp today; 30Y at -0.3070%, -4.8 bp today

RATES VOLATILITY & LIQUIDITY

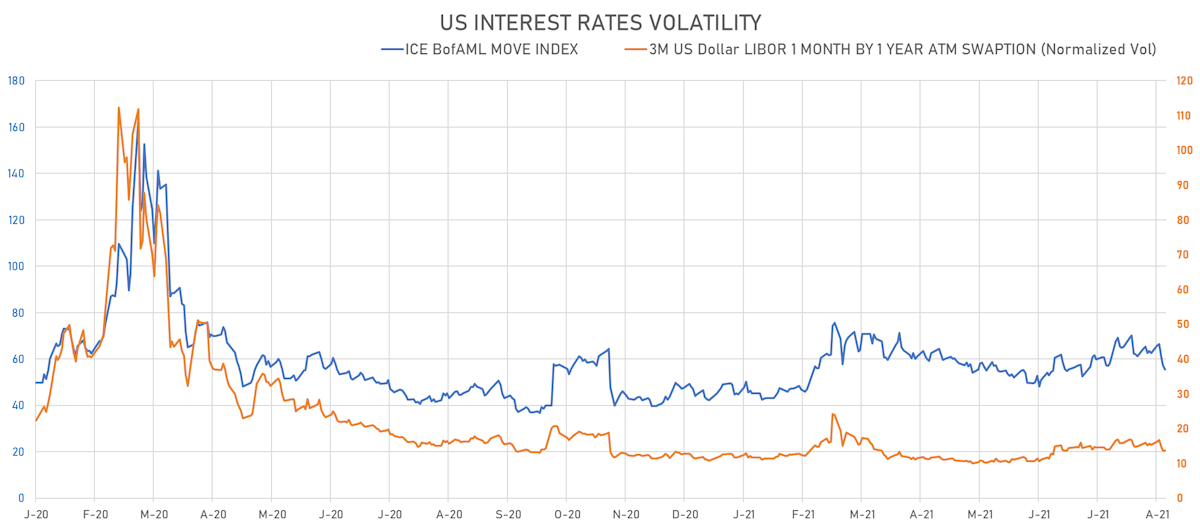

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.1% at 13.7%

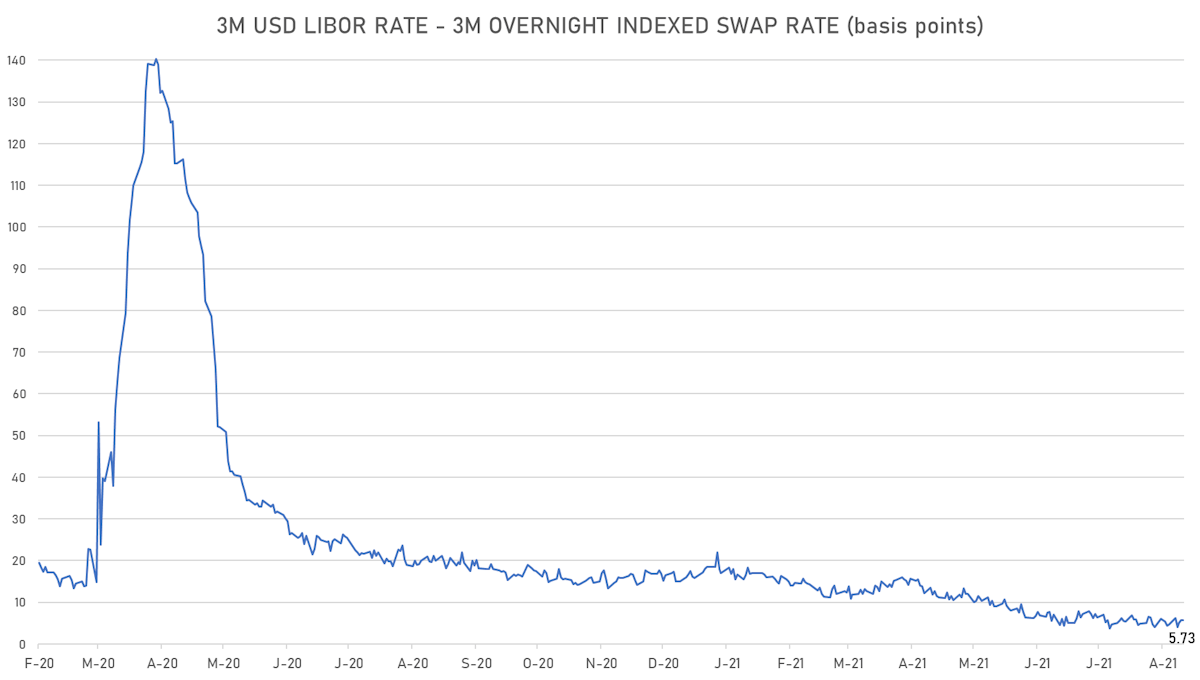

- 3-Month LIBOR-OIS spread down -0.1 bp at 5.7 bp (12-months range: 3.7-22.0 bp)

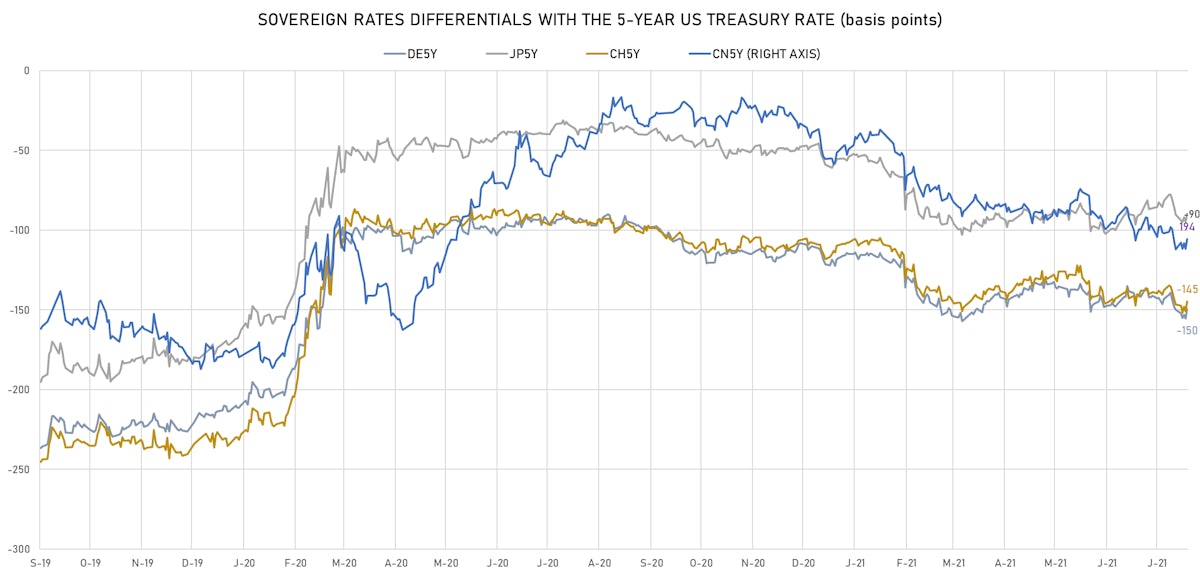

KEY INTERNATIONAL RATES

- Germany 5Y: -0.727% (up 0.5 bp); the German 1Y-10Y curve is 0.2 bp flatter at 18.4bp (YTD change: +3.9 bp)

- Japan 5Y: -0.120% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 14.6bp (YTD change: +1.6 bp)

- China 5Y: 2.720% (up 0.9 bp); the Chinese 1Y-10Y curve is 4.0 bp steeper at 69.5bp (YTD change: +23.1 bp)

- Switzerland 5Y: -0.670% (up 1.1 bp); the Swiss 1Y-10Y curve is 0.3 bp flatter at 39.9bp (YTD change: +6.5 bp)