Rates

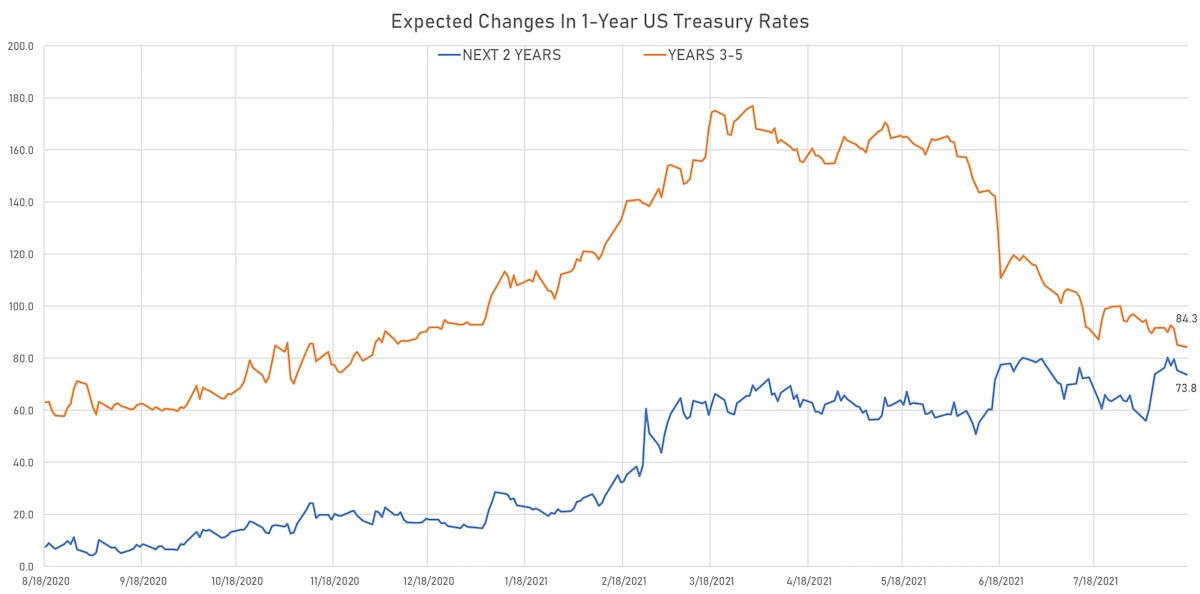

Slight Rise In 2Y Rates And Drop In Rates From The Belly Out Point To A Very Shallow Fed Hiking Cycle

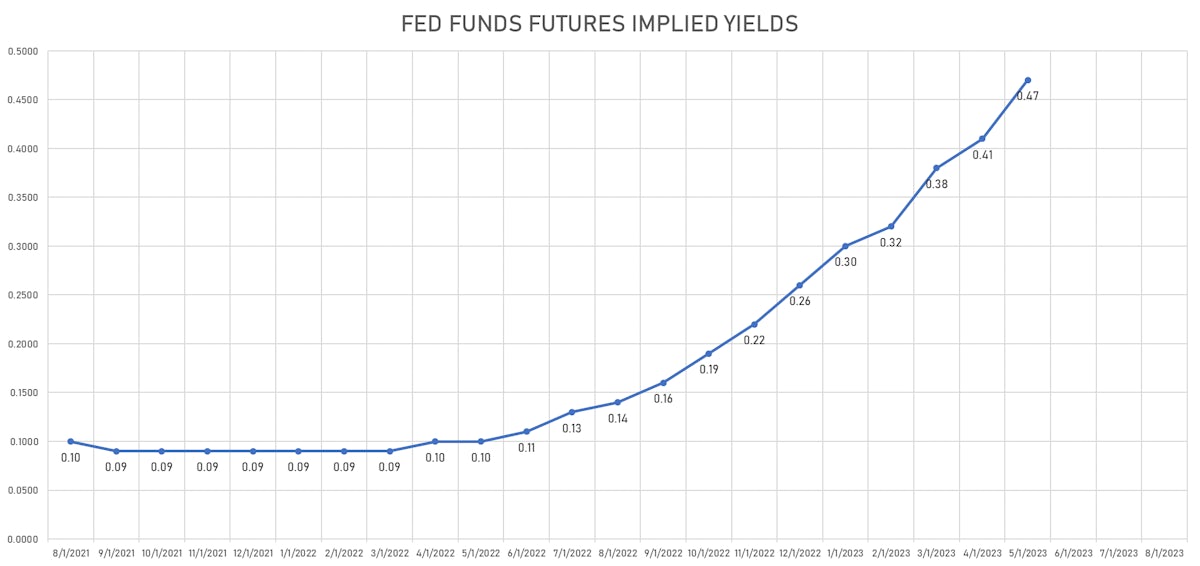

The risk of a Fed policy error rose today, with Fed presidents stating their preference for a faster-than-expected wind-down of asset purchases; that was reflected in money markets, with the timing of hikes brought forward but the magnitude over the next 5 years edging down

Published ET

Implied Rate Hikes Derived From The 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

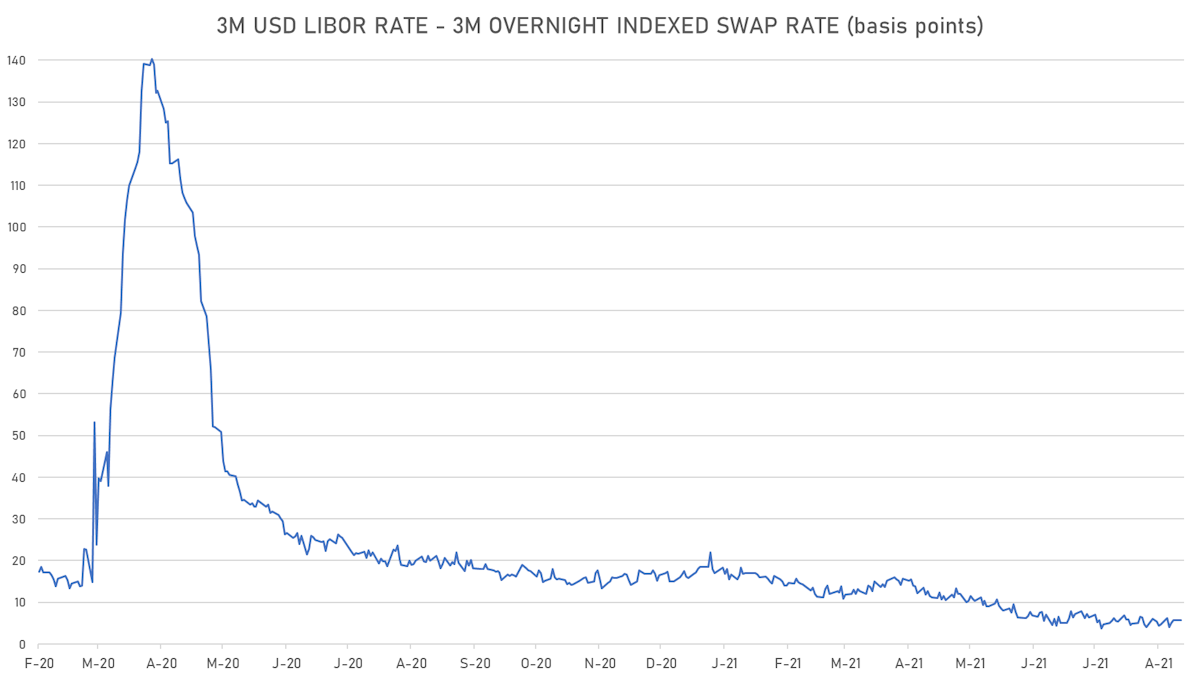

- 3-Month USD LIBOR unchanged at 0.1245%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.5 bp, now at 119.4 bp (YTD change: +39.0bp)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2132% (up 0.4 bp)

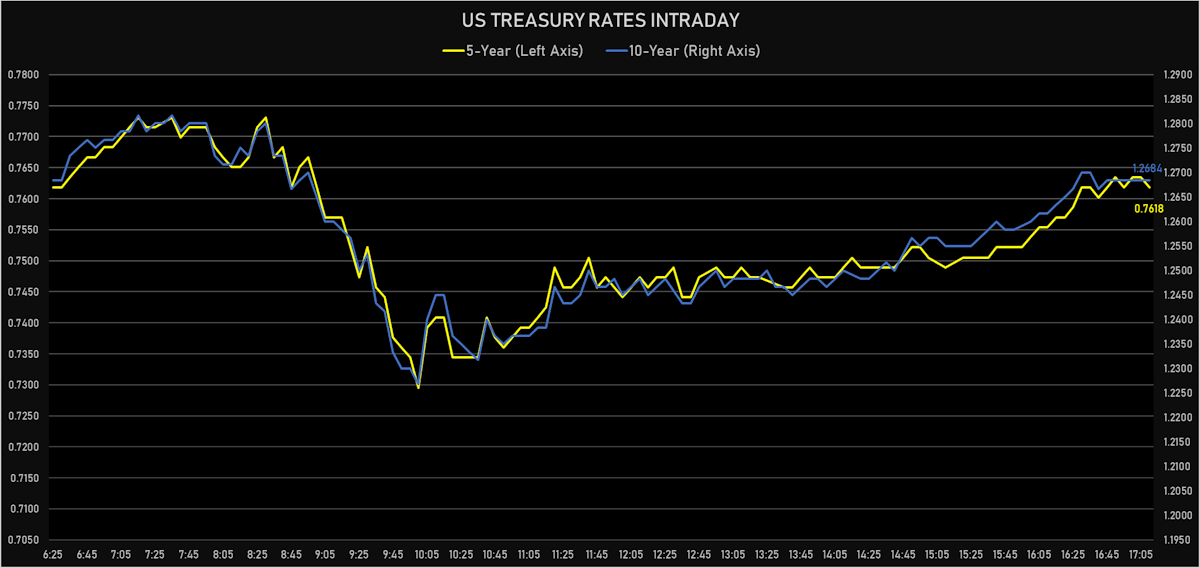

- 5Y: 0.7618% (down 1.5 bp)

- 7Y: 1.0467% (down 1.6 bp)

- 10Y: 1.2684% (down 1.5 bp)

- 30Y: 1.9304% (down 0.3 bp)

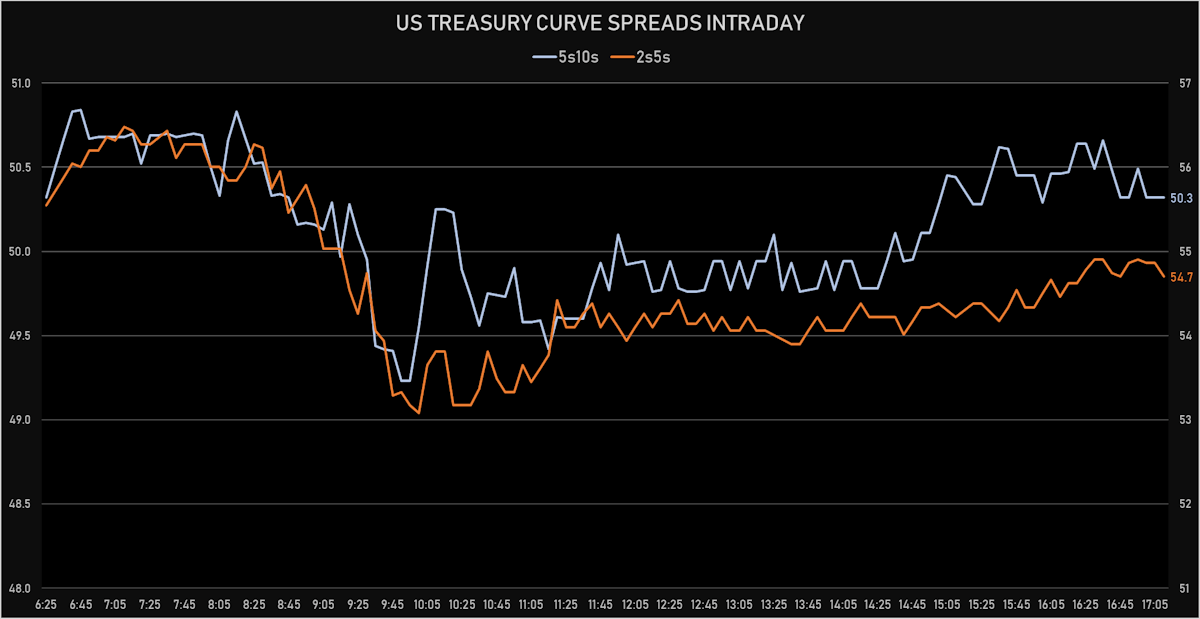

- US treasury curve spreads: 2s5s at 54.9bp (down -1.9bp), 5s10s at 50.6bp (down -0.2bp), 10s30s at 66.3bp (up 1.2bp today)

- Treasuries butterfly spreads: 2s5s10s at -4.7bp (up 1.6bp today), 5s10s30s at 15.2bp (up 0.9bp)

- US 5-Year TIPS Real Yield: +0.2 bp at -1.8260%; 10-Year TIPS Real Yield: -0.5 bp at -1.1020%; 30-Year TIPS Real Yield: +0.5 bp at -0.3020%

RELEVANT HEADLINES

- Poor results in the Treasury’s $99 bn 3- and 6-month bills auctions: the $51bn 3-month tailed by 0.5bp (stopped at 0.070% vs 0.065% WI) and the $4bn 6-month bill stopped at 0.050% (right on the mark), with a 2.87 cover (much lower than the 3.38 5-auction average).

- According to the Wall Street Journal, Fed Presidents Bullard, Kaplan and Rosengren all want asset purchases to be done by the middle of 2022, allowing the Fed to possibly raise rates as early as 3Q 2022.

US MACRO RELEASES

- Net flows total, Current Prices for Jun 2021 (U.S. Dept. Treas.) at 31.5 Bln USD

- Net foreign acquisition of long-term securities, Current Prices for Jun 2021 (U.S. Dept. Treas.) at 75.8 Bln USD

- Net purchases (net long-term capital inflows), total, Current Prices for Jun 2021 (U.S. Dept. Treas.) at 110.9 Bln USD

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Jun 2021 (U.S. Dept. Treas.) at 10.9 Bln USD

- New York Fed, General Business Condition for Aug 2021 (FED, NY) at 18.30 , below consensus estimate of 29.0

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 2.4 bp, now at 1.6585%

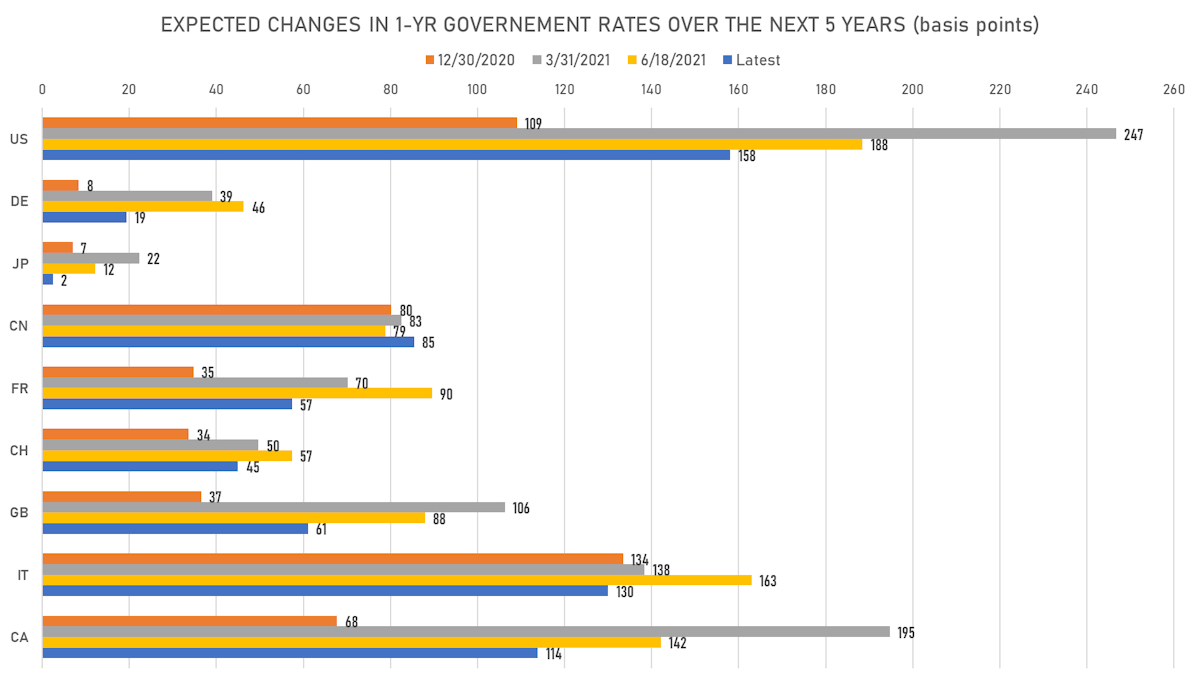

- 1-Year Treasury rates are now expected to increase by 158.0 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 16.5 bp by the end of 2022 (meaning the market prices 66.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 20.4 bp of rate hikes over the next 18 months (equivalent to 0.81 rate hike) and 77.1 bp over the next 3 years (equivalent to 3.08 rate hikes)

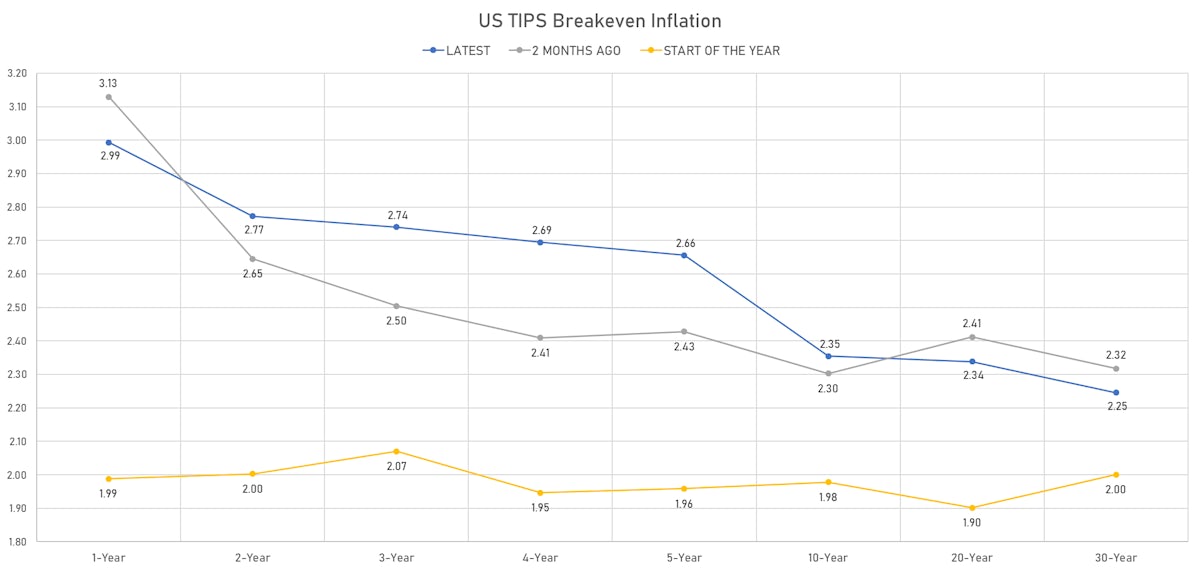

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.99% (down -3.5bp); 2Y at 2.77% (down -1.0bp); 5Y at 2.66% (down -1.4bp); 10Y at 2.35% (down -1.1bp); 30Y at 2.25% (down -0.6bp)

- 6-month spot US CPI swap up 0.5 bp to 3.462%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8260%, +0.2 bp today; 10Y at -1.1020%, -0.5 bp today; 30Y at -0.3020%, +0.5 bp today

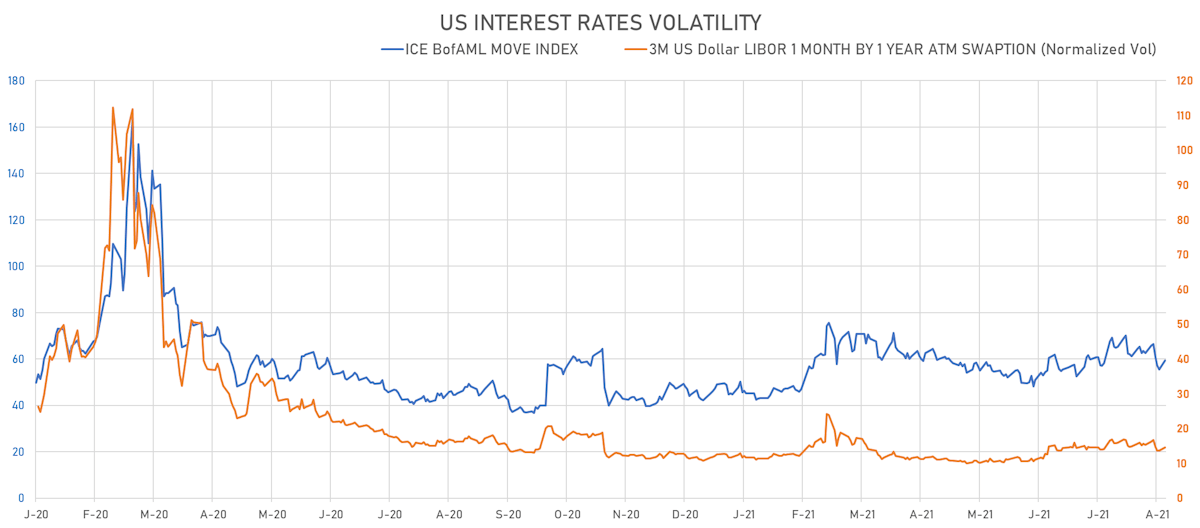

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 14.5%

- 3-Month LIBOR-OIS spread down -0.1 bp at 5.7 bp (12-months range: 3.7-22.0 bp)

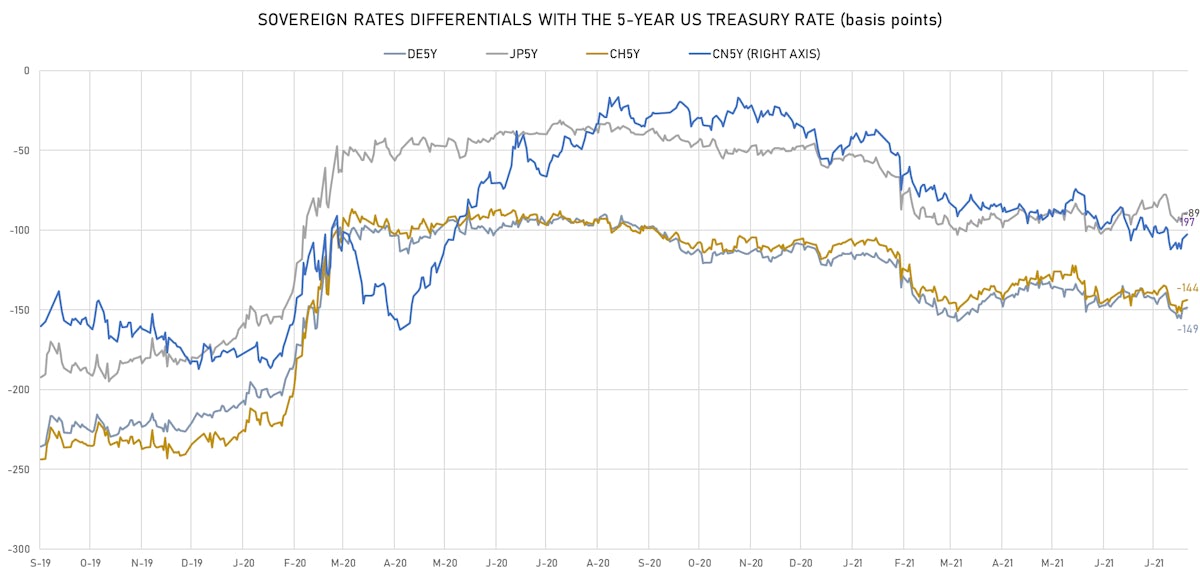

KEY INTERNATIONAL RATES

- Germany 5Y: -0.726% (down -0.5 bp); the German 1Y-10Y curve is unchanged at 19.2bp (YTD change: +3.9 bp)

- Japan 5Y: -0.117% (down -0.9 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 14.8bp (YTD change: +0.7 bp)

- China 5Y: 2.734% (up 1.4 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 69.2bp (YTD change: +22.8 bp)

- Switzerland 5Y: -0.675% (down -0.5 bp); the Swiss 1Y-10Y curve is 0.6 bp steeper at 38.5bp (YTD change: +7.1 bp)