Rates

Short Rates Edge Higher, Long Rates Inch Down On Mixed Macro Data

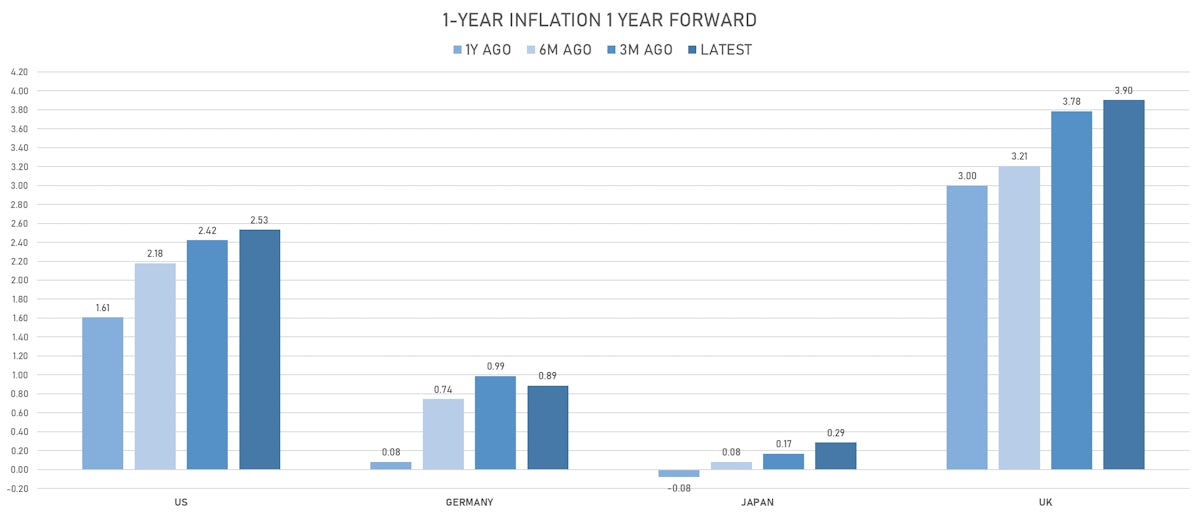

As the inflation forward curve shifts higher and price pressures appear less transitory, some Fed staffers now publicly express the view that a higher inflation target of 3% would be desirable

Published ET

Implied Fed Hikes Over The Next 2 Years Derived From The 3-month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

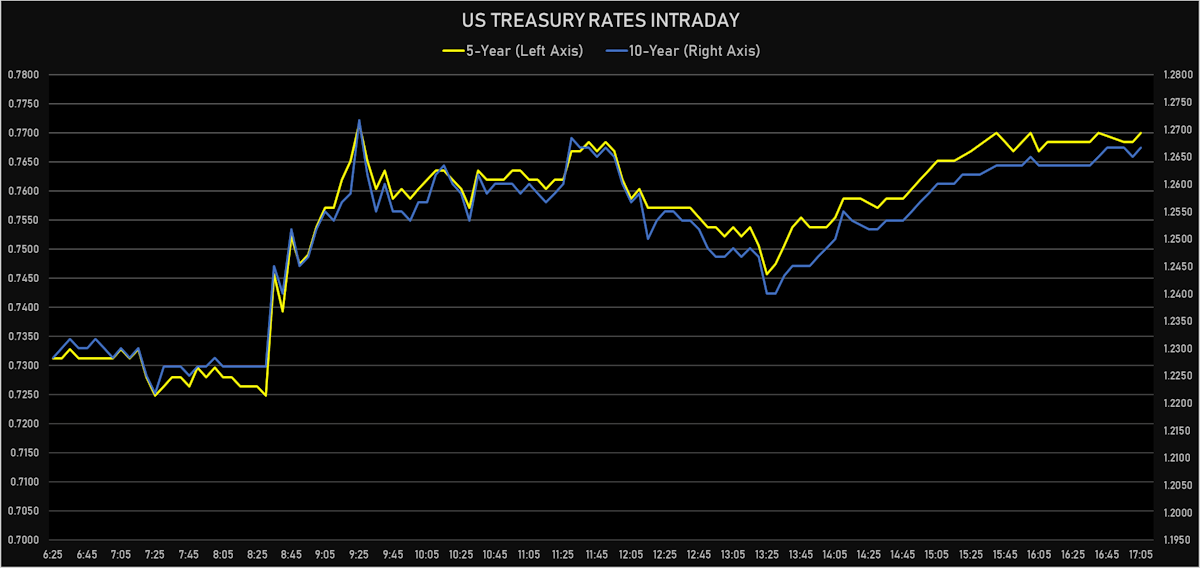

- 3-Month USD LIBOR +0.3bp today, now at 0.1273%

- The treasury yield curve steepened, with the 1s10s spread widening 0.1 bp, now at 119.3 bp (YTD change: +38.8bp)

- 1Y: 0.0740% (down 0.3 bp)

- 2Y: 0.2173% (up 0.4 bp)

- 5Y: 0.7700% (up 0.8 bp)

- 7Y: 1.0490% (up 0.2 bp)

- 10Y: 1.2667% (down 0.2 bp)

- 30Y: 1.9257% (down 0.5 bp)

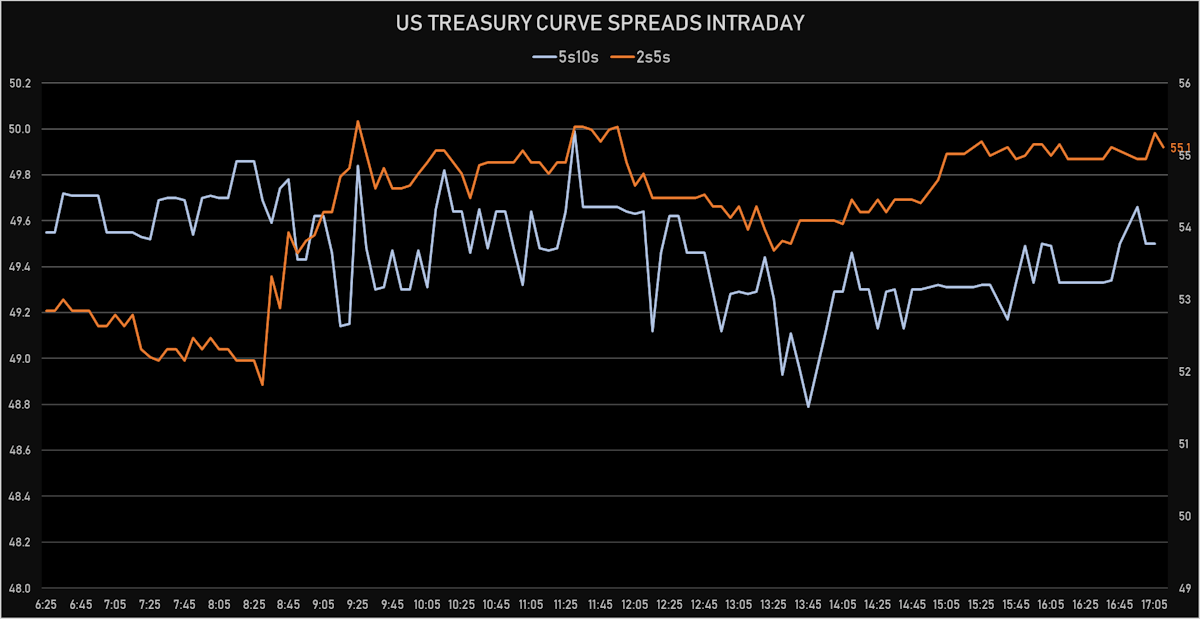

- US treasury curve spreads: 2s5s at 55.3bp (up 0.4bp today), 5s10s at 49.7bp (down -0.8bp), 10s30s at 65.9bp (down -0.3bp)

- Treasuries butterfly spreads: 2s5s10s at -6.0bp (down -1.2bp), 5s10s30s at 15.5bp (up 0.3bp)

- US 5-Year TIPS Real Yield: +3.8 bp at -1.7880%; 10-Year TIPS Real Yield: +4.3 bp at -1.0590%; 30-Year TIPS Real Yield: +3.5 bp at -0.2670%

OUR COMMENT

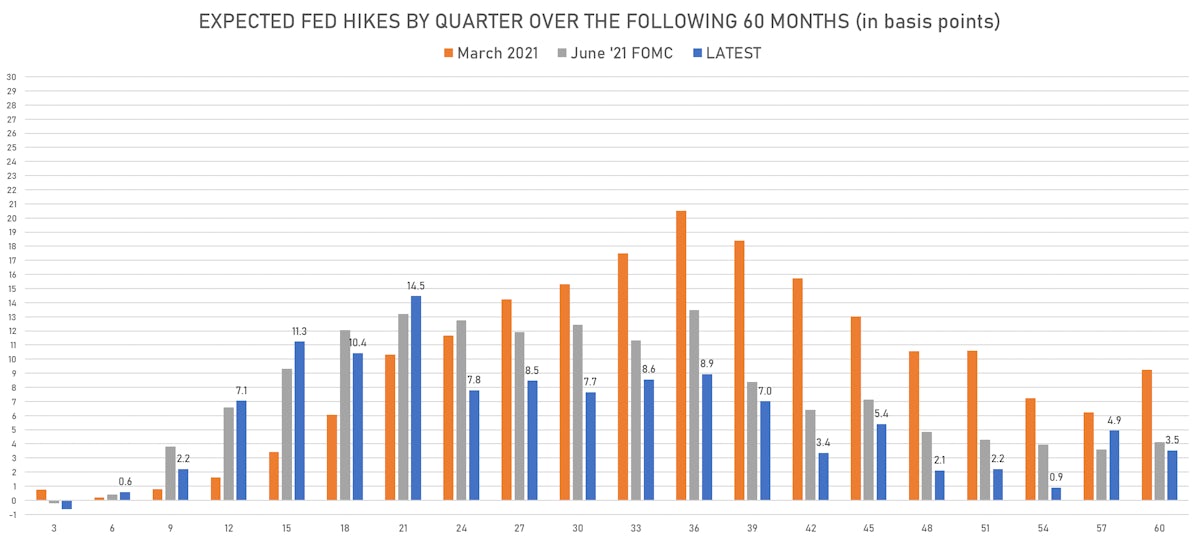

- The notion that the Fed should now change its target inflation to 3% seems a bit ad-hoc, but understandable in the current context, as meeting its dual mandate of price stability and growth will be difficult

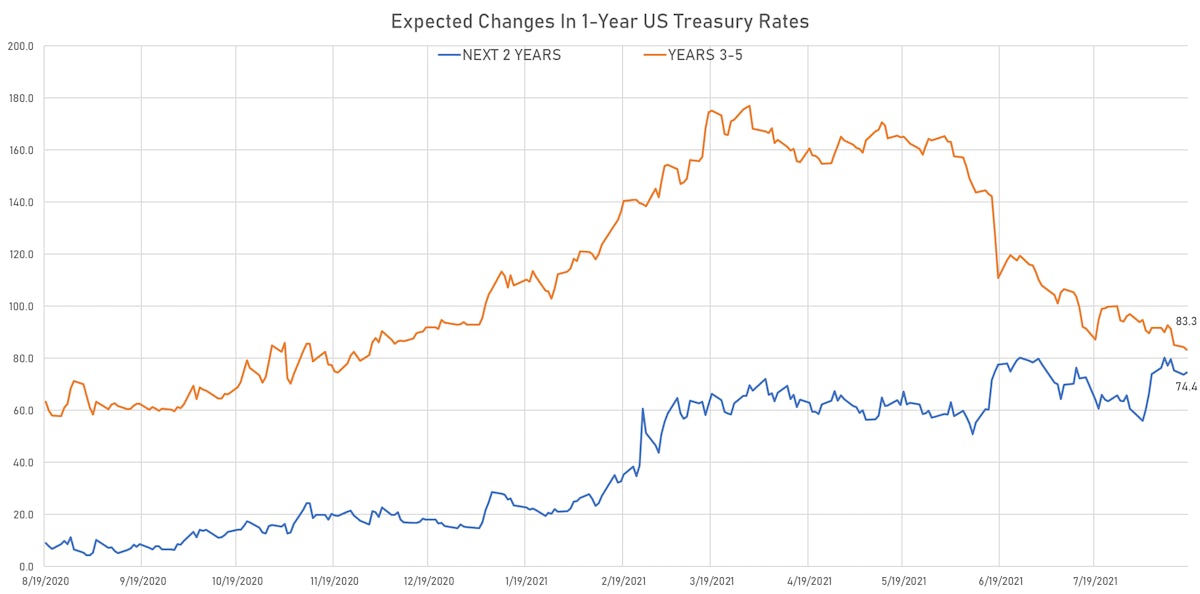

- Of course the Fed realizes that short-term rates have gone up as the inflation forward curve shifted higher

- And the market view on that is unambiguous: rate hikes to contain inflation will lead to an economic slowdown, which explains the recent fall in long rates

- We do not expect the Fed to change its inflation target in the near future (neither does the market), though we understand it would make their job easier

US MACRO RELEASES

- Capacity Utilization, Total index, Change M/M for Jul 2021 (FED, U.S.) at 76.10 %, above consensus estimate of 75.70 %

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 14 Aug (Redbook Research) at 15.00 %

- NAHB/Wells Fargo Housing Market Index for Aug 2021 (NAHB, United States) at 75.00, below consensus estimate of 80.00

- Overall, Total business inventories, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.80 %, in line with consensus estimate

- Production, Change P/P for Jul 2021 (FED, U.S.) at 0.90 %, above consensus estimate of 0.50 %

- Production, Manufacturing, Total (SIC), Change P/P for Jul 2021 (FED, U.S.) at 1.40 %, above consensus estimate of 0.60 %

- Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for Jul 2021 (U.S. Census Bureau) at -1.00 %, below consensus estimate of -0.10 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Jul 2021 (U.S. Census Bureau) at -0.70 %

- Retail Sales, Total including food services, Change P/P for Jul 2021 (U.S. Census Bureau) at -1.10 %, below consensus estimate of -0.30 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Jul 2021 (U.S. Census Bureau) at -0.40 %, below consensus estimate of 0.10 %

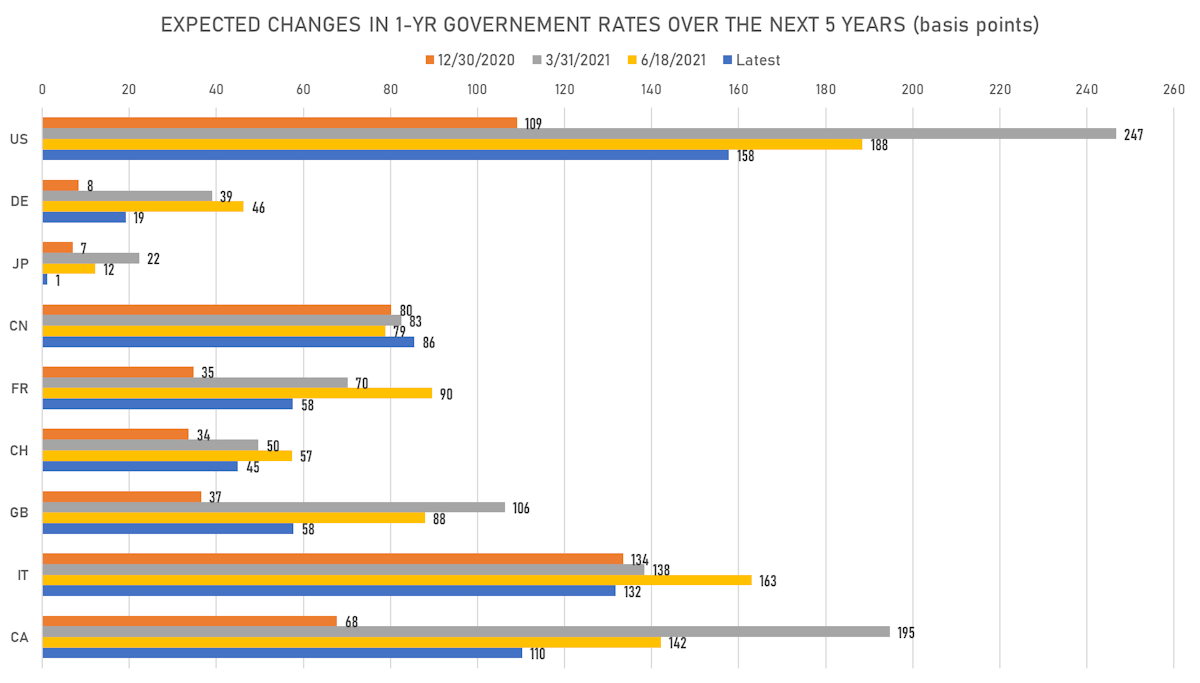

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 0.3 bp, now at 1.6555%

- 1-Year Treasury rates are now expected to increase by 157.8 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 17.3 bp by the end of 2022 (meaning the market prices 69.2% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 20.5 bp of rate hikes over the next 18 months (equivalent to 0.82 rate hike) and 77.9 bp over the next 3 years (equivalent to 3.12 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.00% (up 0.4bp); 2Y at 2.77% (down -0.7bp); 5Y at 2.62% (down -3.2bp); 10Y at 2.31% (down -4.4bp); 30Y at 2.21% (down -3.9bp)

- 6-month spot US CPI swap up 0.7 bp to 3.469%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7880%, +3.8 bp today; 10Y at -1.0590%, +4.3 bp today; 30Y at -0.2670%, +3.5 bp today

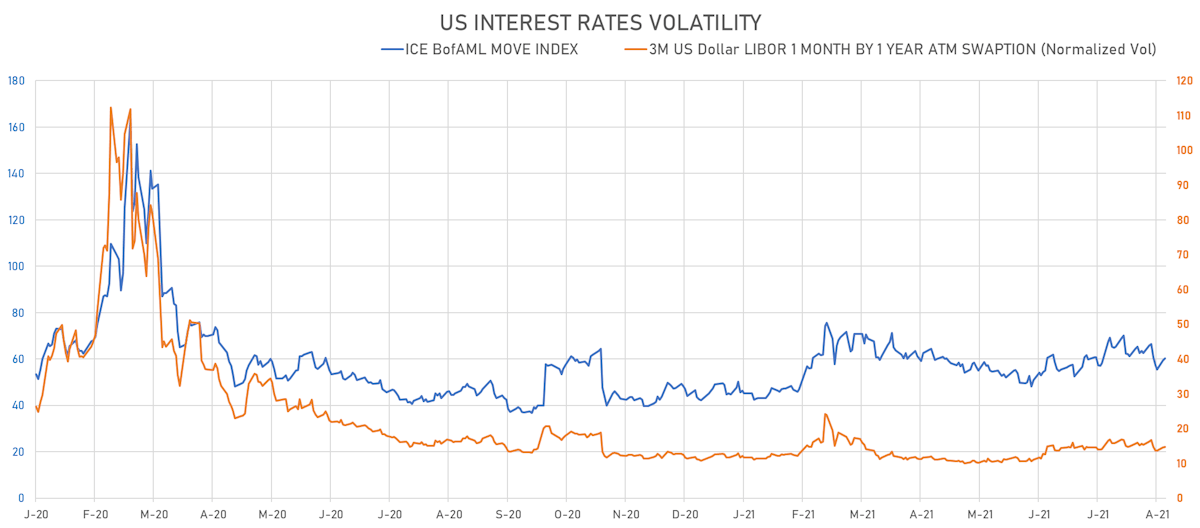

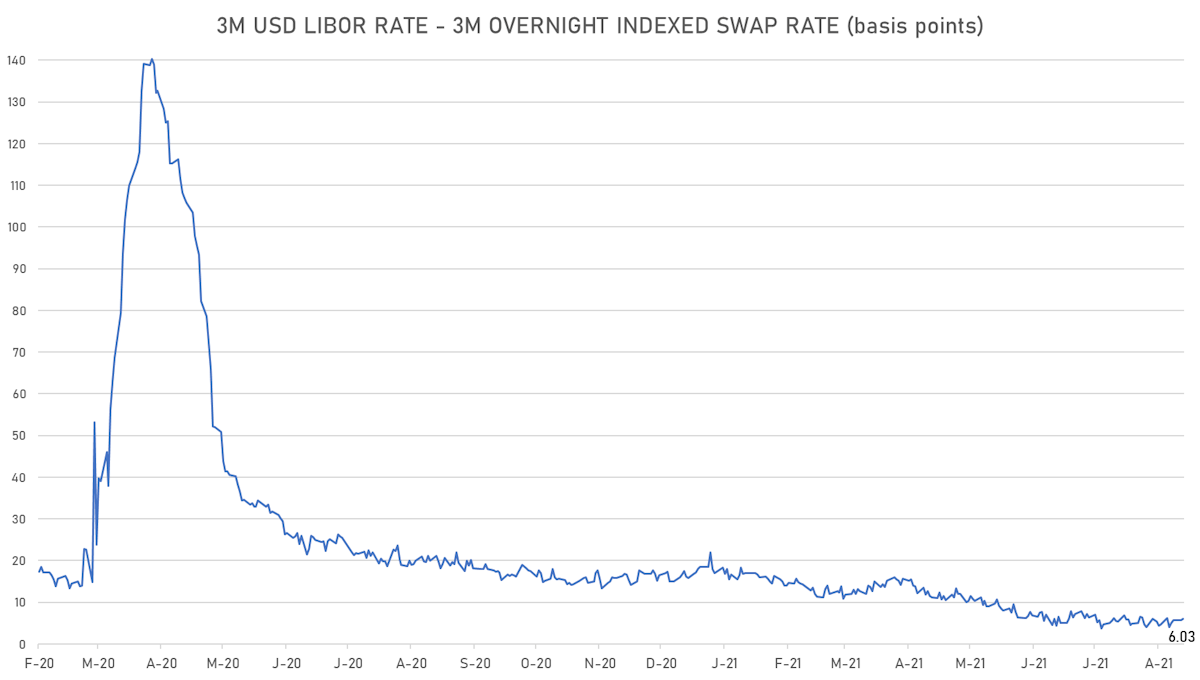

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.3% at 14.8%

- 3-Month LIBOR-OIS spread up 0.4 bp at 6.0 bp (12-months range: 3.7-22.0 bp)

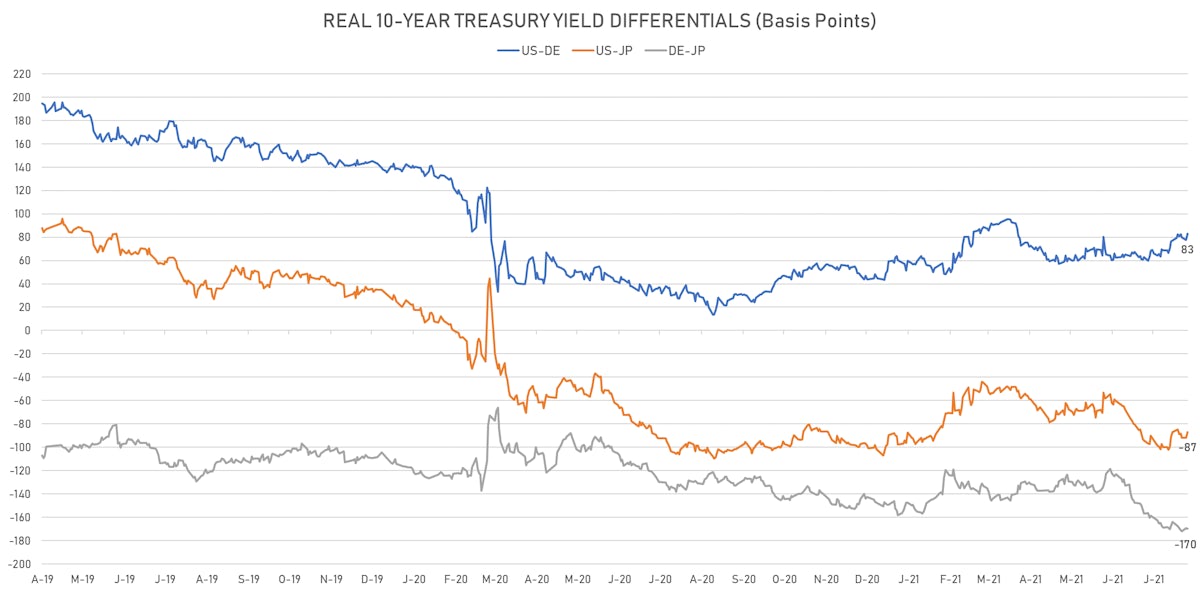

KEY INTERNATIONAL RATES

- Germany 5Y: -0.731% (up 0.1 bp); the German 1Y-10Y curve is 0.4 bp steeper at 18.9bp (YTD change: +4.3 bp)

- Japan 5Y: -0.129% (down -0.1 bp); the Japanese 1Y-10Y curve unchanged at 14.4bp (YTD change: +0.7 bp)

- China 5Y: 2.725% (down -0.9 bp); the Chinese 1Y-10Y curve is 2.3 bp steeper at 71.5bp (YTD change: +25.1 bp)

- Switzerland 5Y: -0.670% (up 0.5 bp); the Swiss 1Y-10Y curve is unchanged at 34.5bp (YTD change: +7.1 bp)