Rates

Rates Broadly Unchanged Today After Fed's FOMC Minutes

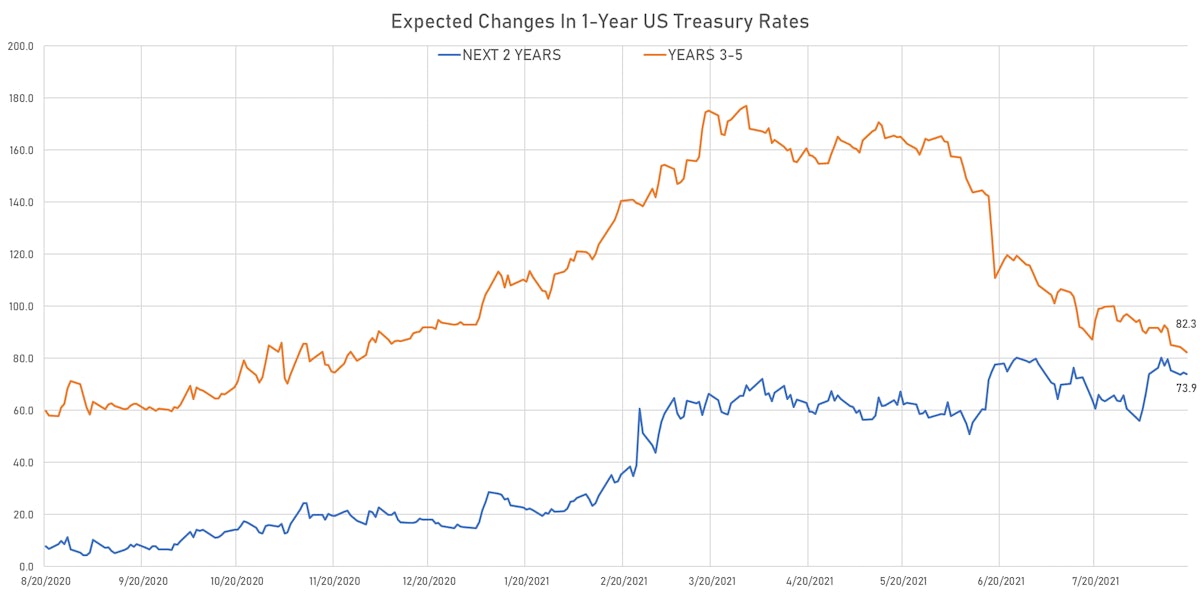

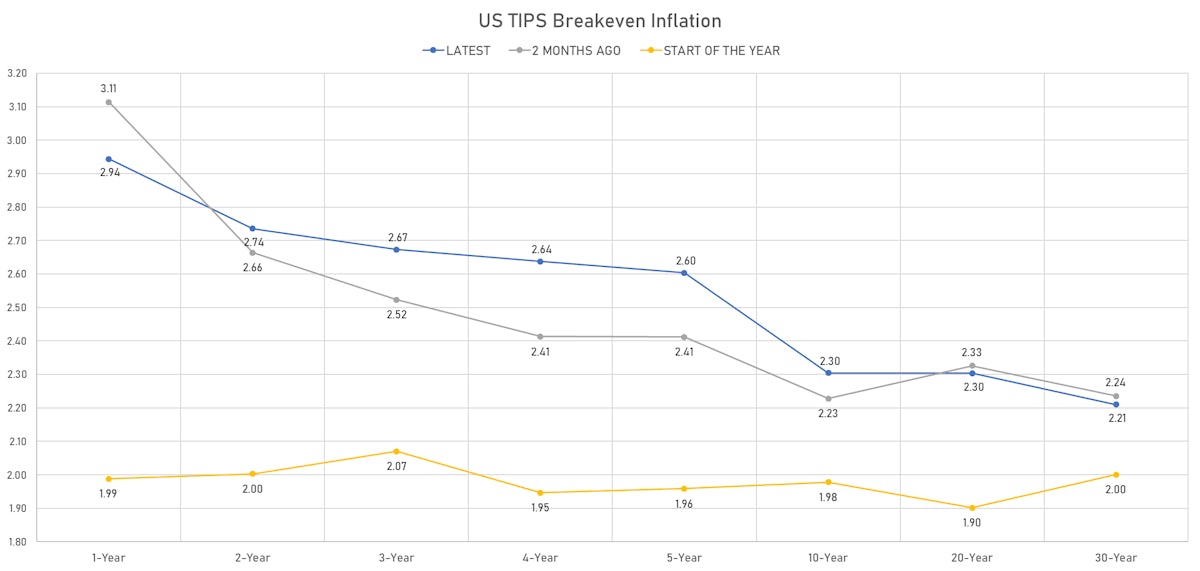

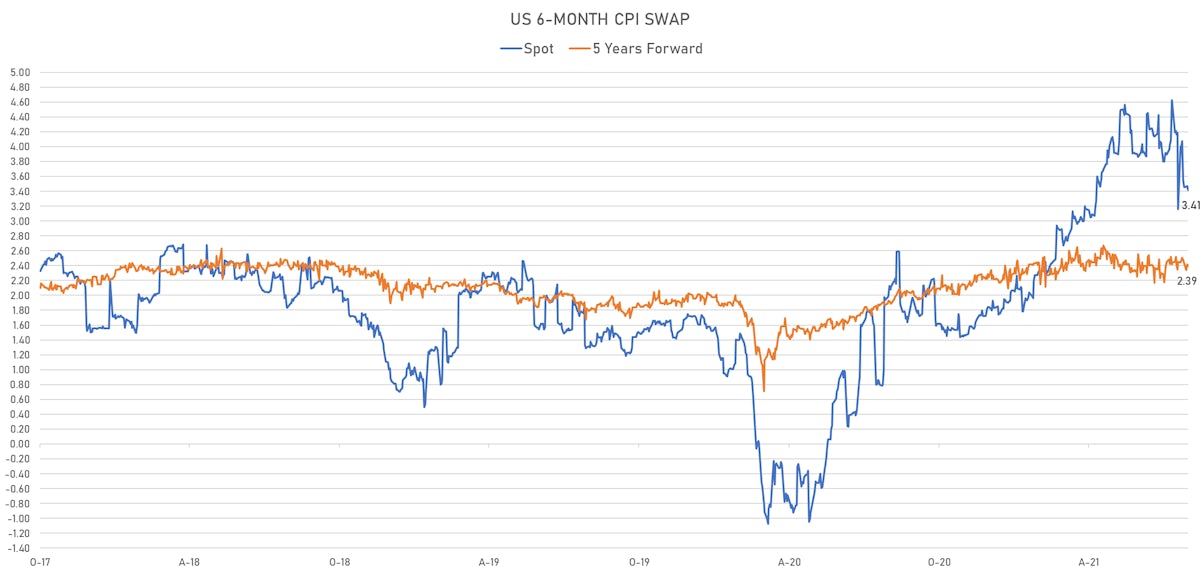

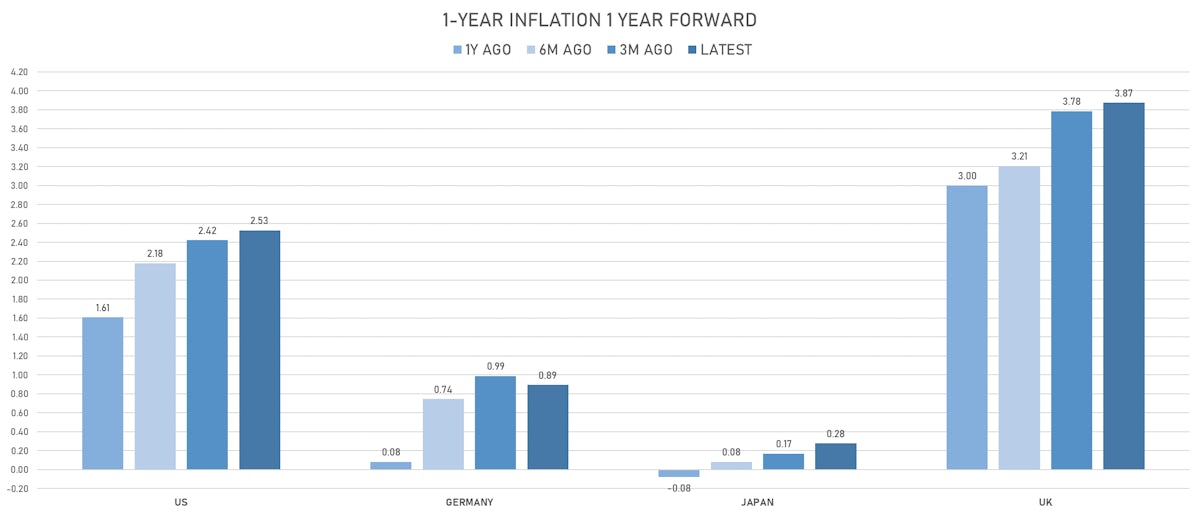

Real yields rose as inflation expectations dropped, with the inflation forward curve flattening further (longer-term inflation is less volatile)

Published ET

Implied Timing & Magnitude Of Fed Hikes Over The Next 3 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.4bp today, now at 0.1309%

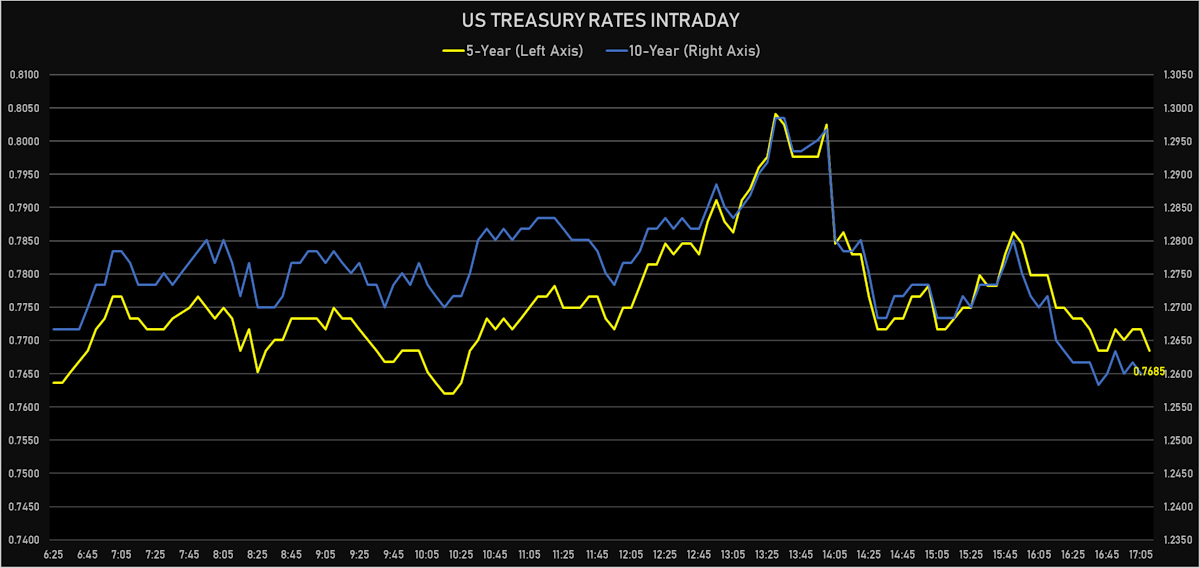

- The treasury yield curve flattened, with the 1s10s spread tightening -0.4 bp, now at 118.9 bp (YTD change: +38.5bp)

- 1Y: 0.0710% (down 0.2 bp)

- 2Y: 0.2175% (unchanged)

- 5Y: 0.7685% (down 0.2 bp)

- 7Y: 1.0420% (down 0.7 bp)

- 10Y: 1.2600% (down 0.7 bp)

- 30Y: 1.9005% (down 2.5 bp)

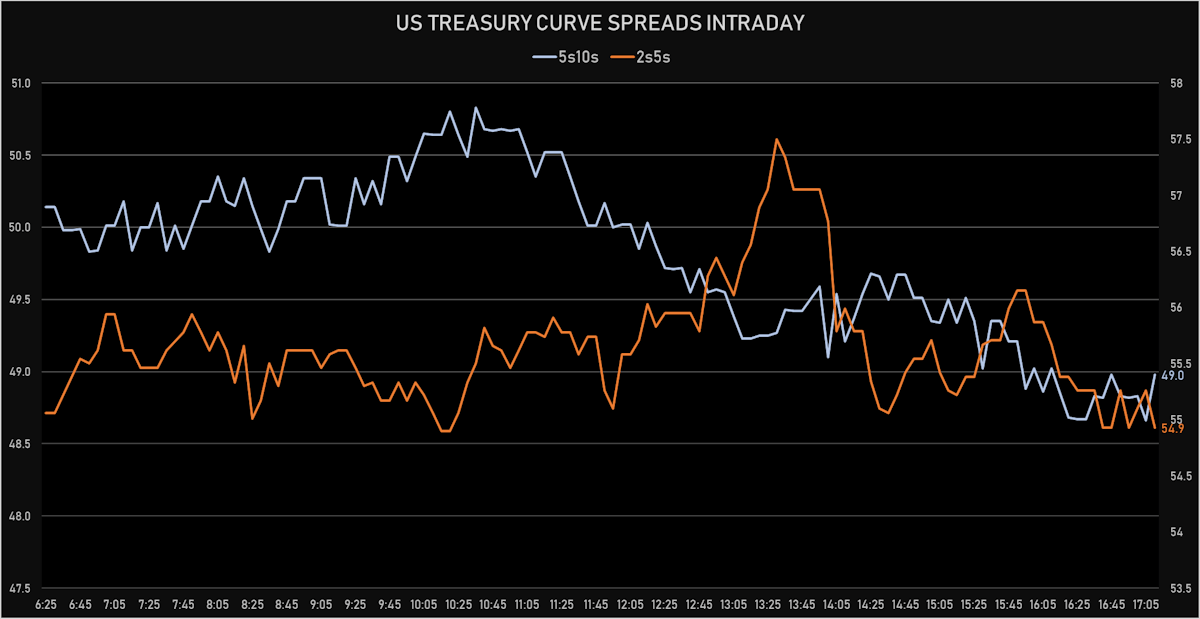

- US treasury curve spreads: 2s5s at 55.1bp (down -0.2bp), 5s10s at 49.2bp (down -0.5bp), 10s30s at 64.1bp (down -1.8bp)

- Treasuries butterfly spreads: 2s5s10s at -6.3bp (down -0.4bp), 5s10s30s at 14.4bp (down -1.1bp)

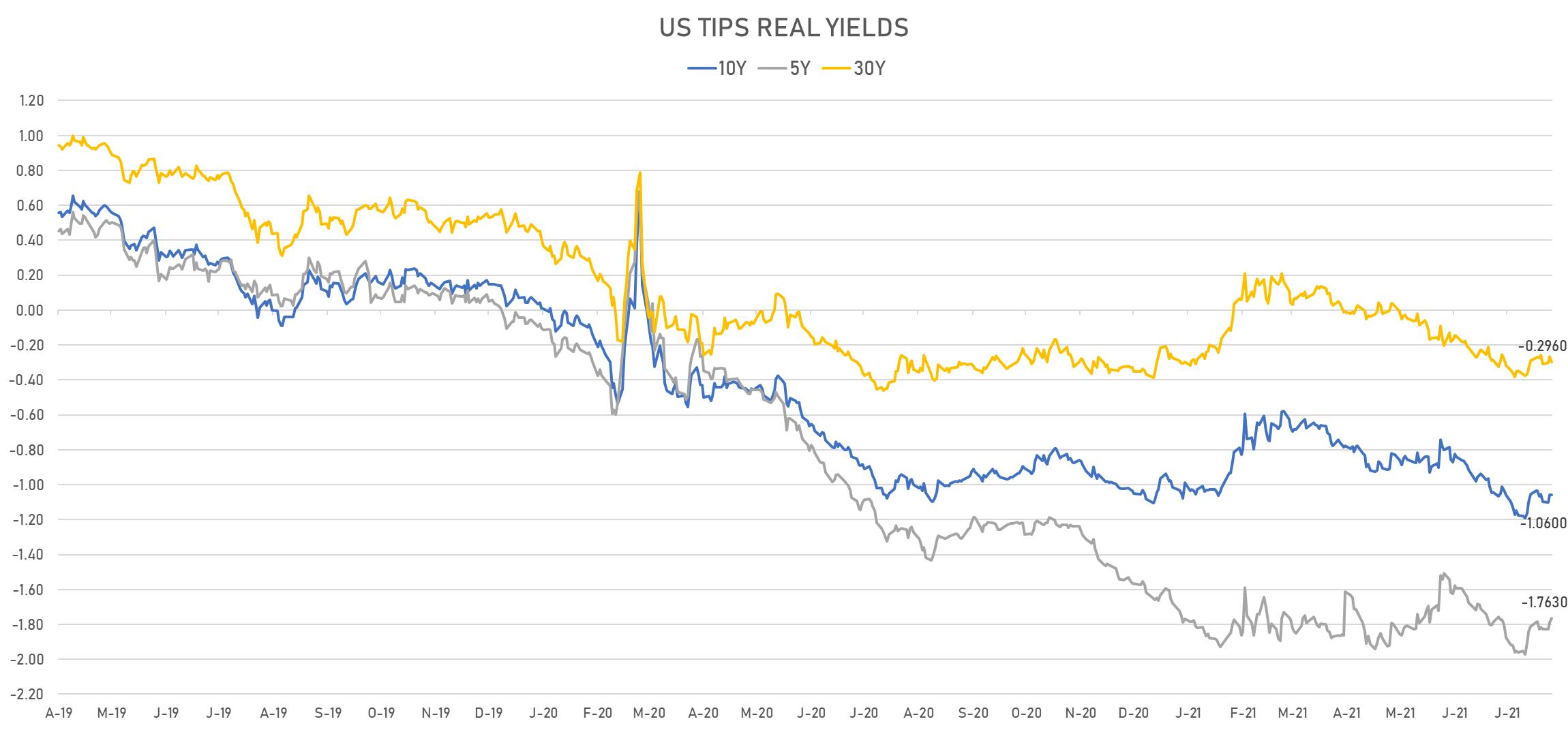

- US 5-Year TIPS Real Yield: +2.5 bp at -1.7630%; 10-Year TIPS Real Yield: -0.1 bp at -1.0600%; 30-Year TIPS Real Yield: -2.9 bp at -0.2960%

HEADLINES

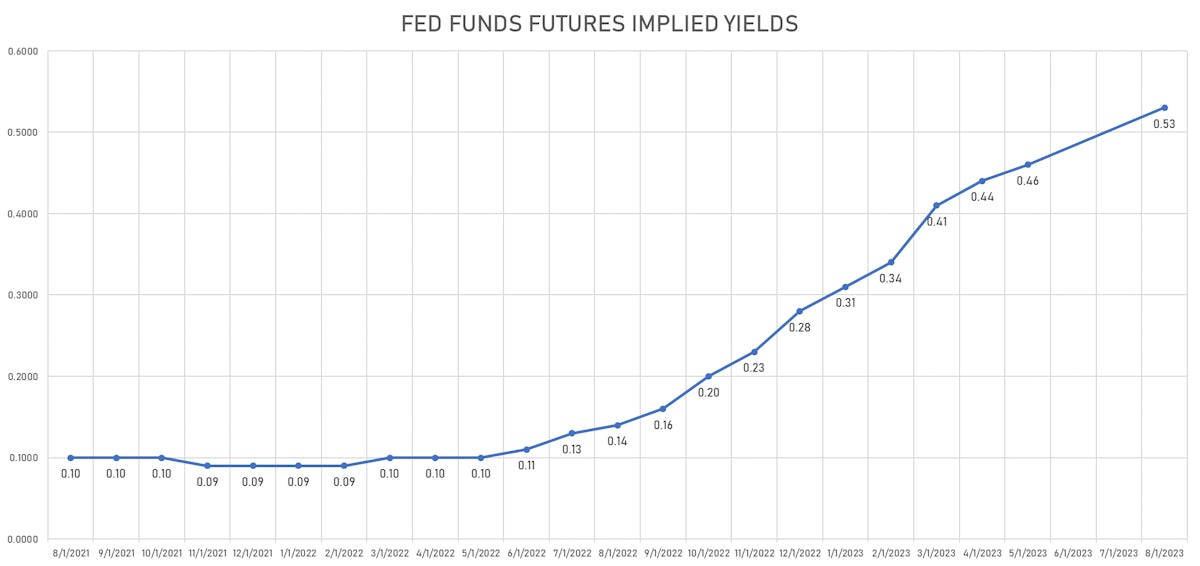

- A couple of interesting takeaways from the FOMC minutes: 1) the more hawkish members, who have been calling publicly for an "early and fast" tapering, are not representative of the majority view; 2) they favor a Q1 2022 start with a proportional tapering that would allow MBS and Treasuries to end at the same time. That means tapering should still be faster, leaving time for a possible rate hike in 2022.

- The US$ 27 bn 20-year auction results were solid, helped by a significant concession heading into auction time. High yield of 1.850%, right on the screws (vs 1.890% prior), direct bids at 18.7% (vs 18.9% prior), indirects at 62.3% (vs 60.2% prior), bid-to-cover ratio at 2.44x (vs 2.33x prior).

US MACRO RELEASES

- Building Permits for Jul 2021 (U.S. Census Bureau) at 1.64 Mln, above consensus estimate of 1.61 Mln

- Building Permits, Change P/P for Jul 2021 (U.S. Census Bureau) at 2.60 %

- Housing Starts for Jul 2021 (U.S. Census Bureau) at 1.53 Mln, below consensus estimate of 1.60 Mln

- Housing Starts, Change P/P for Jul 2021 (U.S. Census Bureau) at -7.00 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 13 Aug (MBA, USA) at -3.90 %

- Mortgage applications, market composite index for W 13 Aug (MBA, USA) at 725.40

- Mortgage applications, market composite index, purchase for W 13 Aug (MBA, USA) at 249.90

- Mortgage applications, market composite index, refinancing for W 13 Aug (MBA, USA) at 3490.20

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 13 Aug (MBA, USA) at 3.06 %

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 1.4 bp, now at 1.6411%

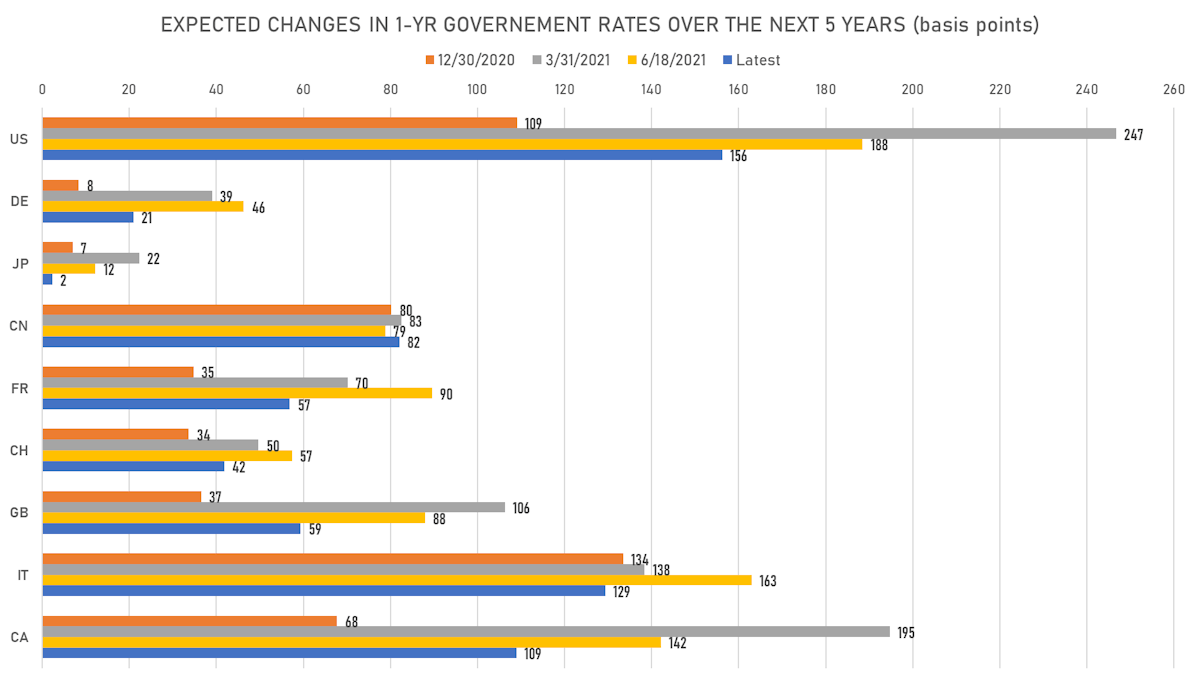

- 1-Year Treasury rates are now expected to increase by 156.2 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 16.8 bp by the end of 2022 (meaning the market prices 67.2% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 20.4 bp of rate hikes over the next 18 months (equivalent to 0.82 rate hike) and 79.3 bp over the next 3 years (equivalent to 3.17 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.94% (down -5.3bp); 2Y at 2.74% (down -3.0bp); 5Y at 2.60% (down -2.0bp); 10Y at 2.30% (down -0.6bp); 30Y at 2.21% (up 0.4bp)

- 6-month spot US CPI swap down -5.7 bp to 3.412%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7630%, +2.5 bp today; 10Y at -1.0600%, -0.1 bp today; 30Y at -0.2960%, -2.9 bp today

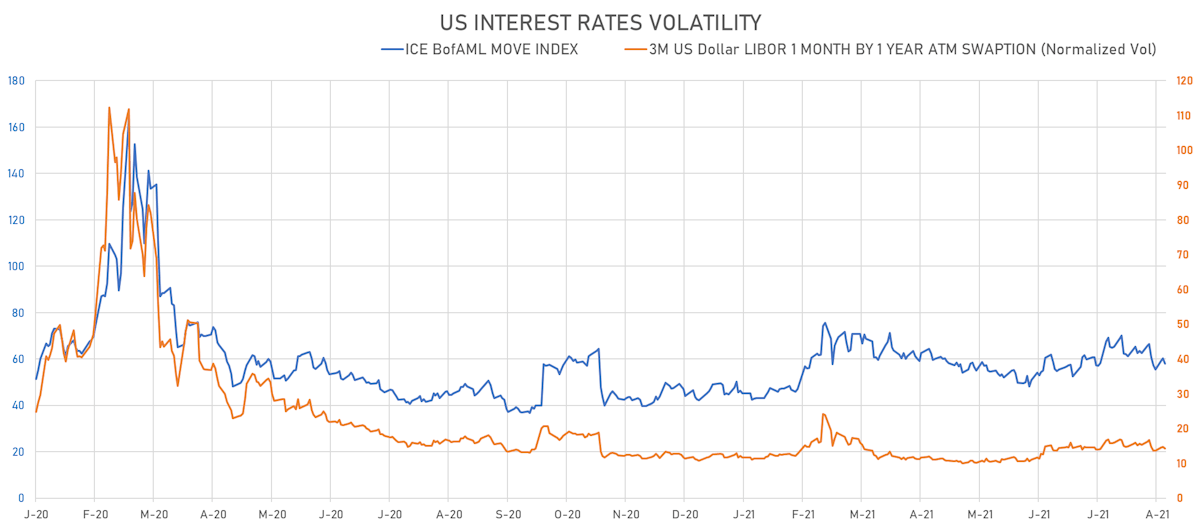

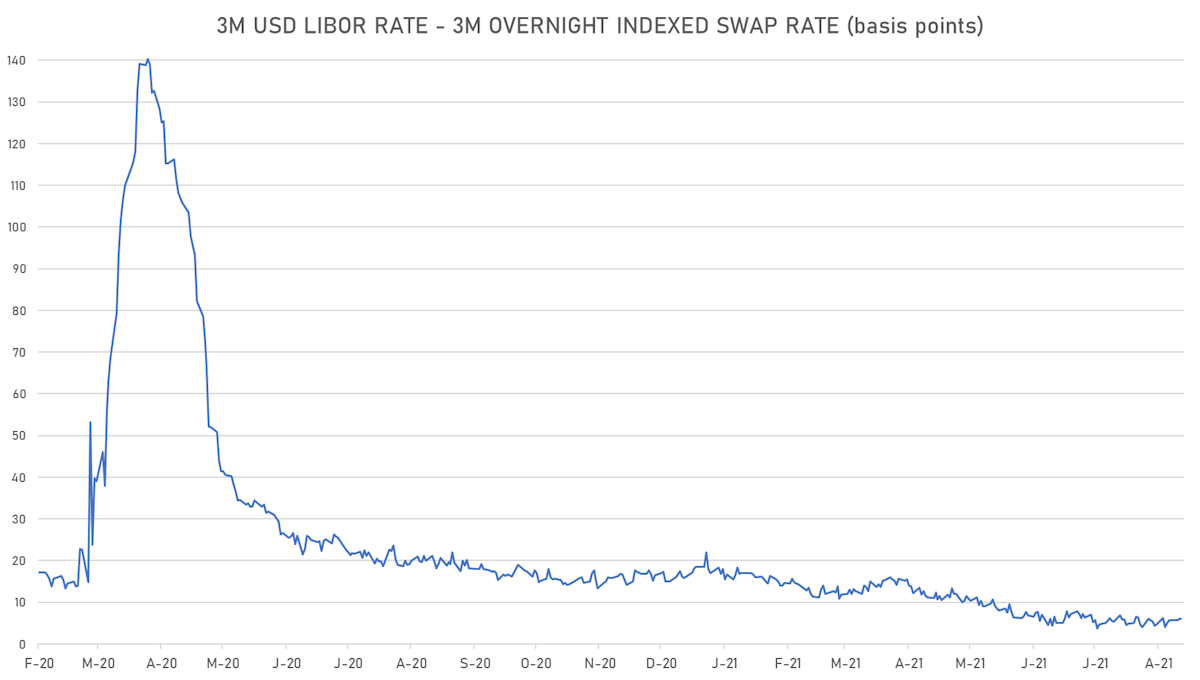

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.5% at 14.3%

- 3-Month LIBOR-OIS spread down 0.0 bp at 6.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.737% (down -1.3 bp); the German 1Y-10Y curve is 0.8 bp flatter at 18.9bp (YTD change: +3.5 bp)

- Japan 5Y: -0.122% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 14.8bp (YTD change: +1.2 bp)

- China 5Y: 2.683% (down -4.2 bp); the Chinese 1Y-10Y curve is 5.8 bp flatter at 65.7bp (YTD change: +19.3 bp)

- Switzerland 5Y: -0.673% (down -0.3 bp); the Swiss 1Y-10Y curve is 4.1 bp steeper at 41.6bp (YTD change: +11.2 bp)