Rates

US Rates Curve Flattens Further With Delta Variant Putting The Recovery In Doubt

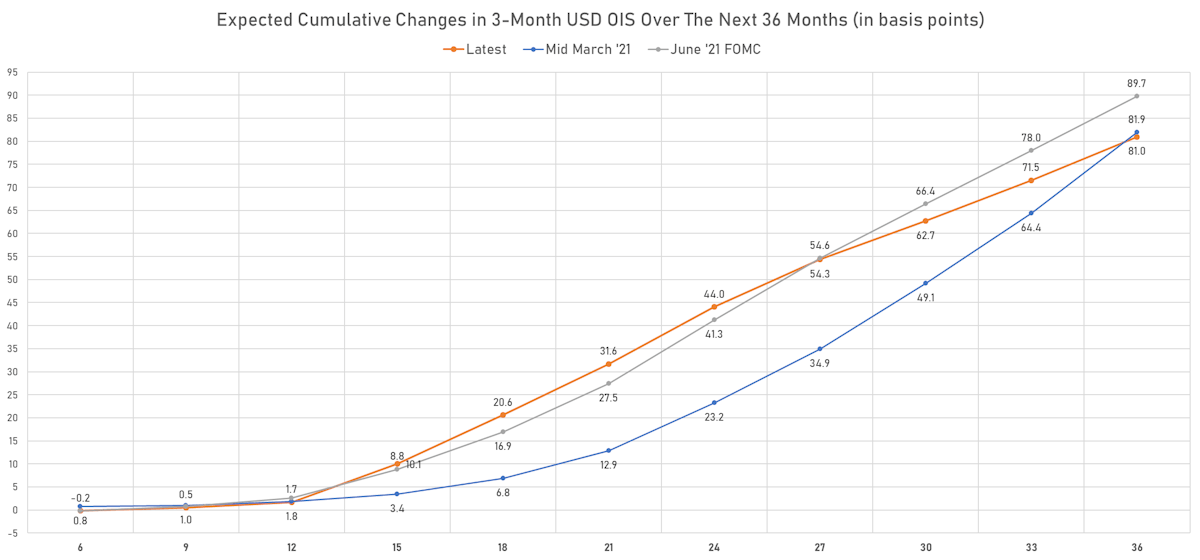

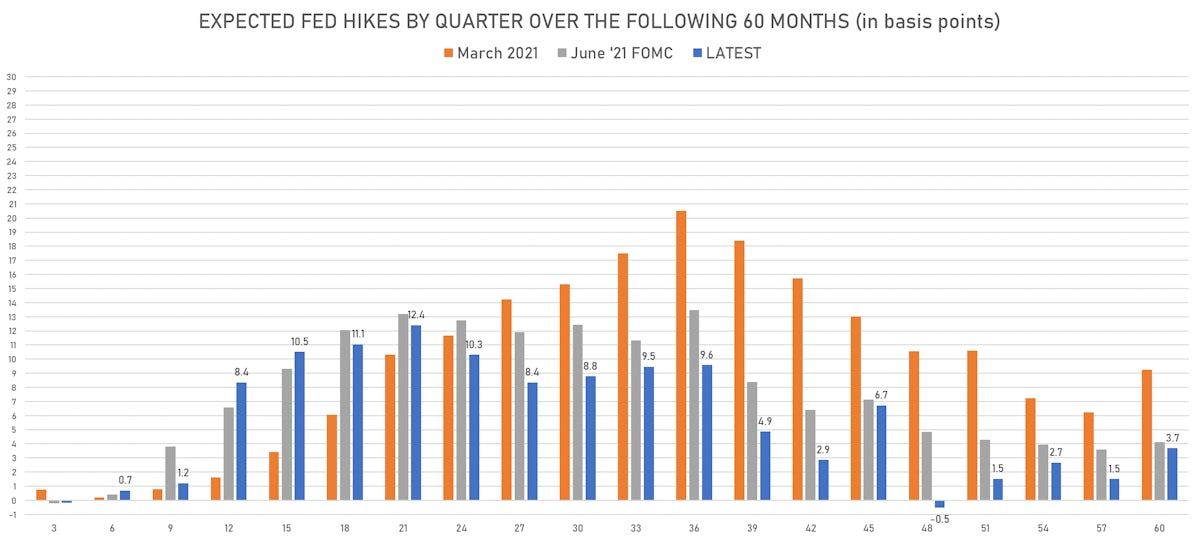

Inflationary pressures have pushed up yields at the front end of the curve, while concerns about growth have caused a significant repricing of forward rate hikes

Published ET

Implied Fed Hikes Derived From 1Y Treasury Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged at 0.1308%

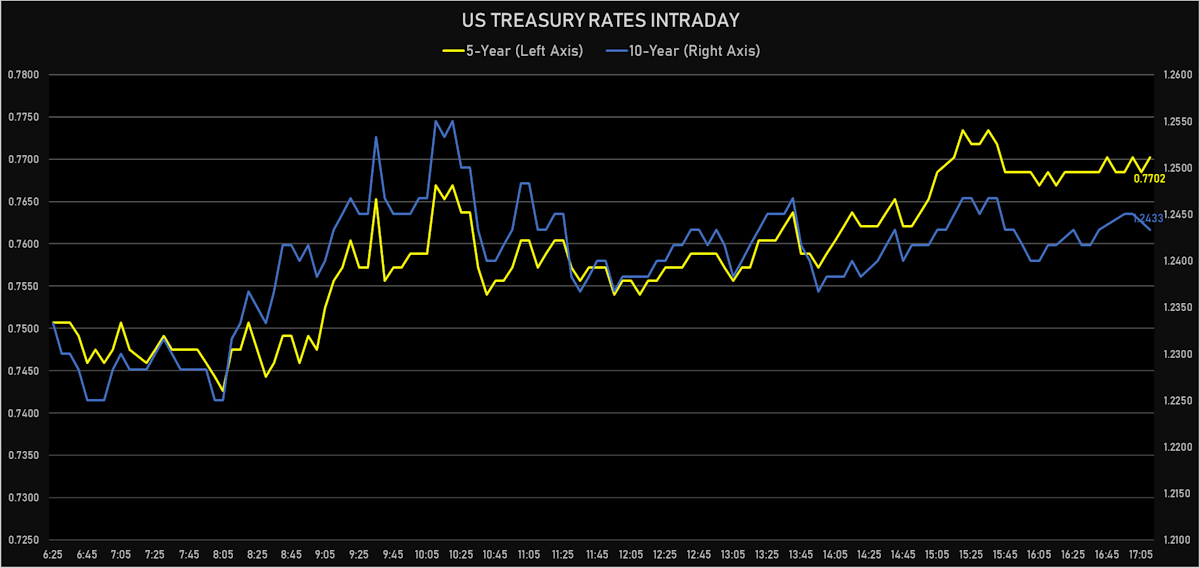

- The treasury yield curve flattened, with the 1s10s spread tightening -1.4 bp, now at 117.5 bp (YTD change: +37.1bp)

- 1Y: 0.0680% (down 0.3 bp)

- 2Y: 0.2216% (up 0.4 bp)

- 5Y: 0.7702% (up 0.2 bp)

- 7Y: 1.0362% (down 0.6 bp)

- 10Y: 1.2433% (down 1.7 bp)

- 30Y: 1.8736% (down 2.7 bp)

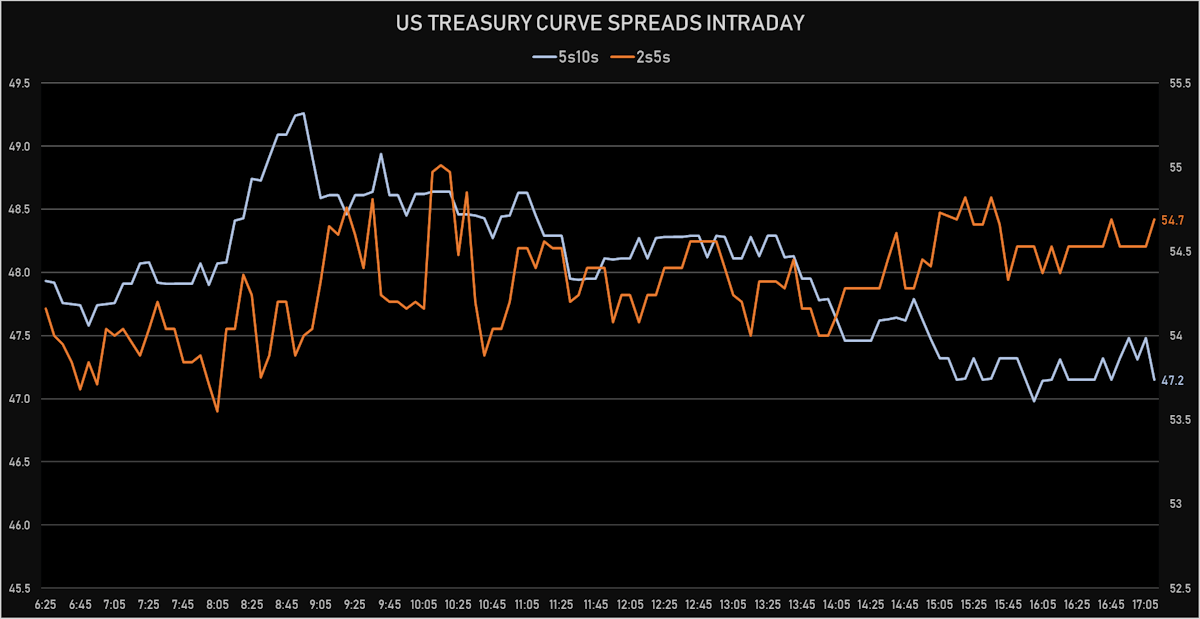

- US treasury curve spreads: 2s5s at 54.9bp (down -0.2bp), 5s10s at 47.3bp (down -1.8bp), 10s30s at 63.0bp (down -1.0bp)

- Treasuries butterfly spreads: 2s5s10s at -7.9bp (down -1.6bp), 5s10s30s at 14.9bp (up 0.5bp)

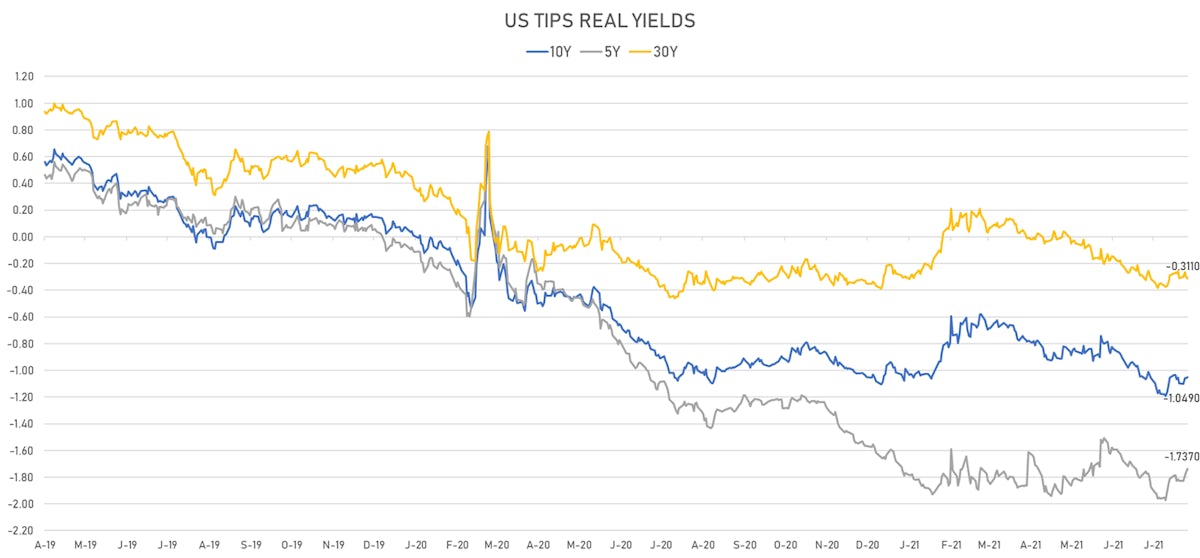

- US 5-Year TIPS Real Yield: +2.6 bp at -1.7370%; 10-Year TIPS Real Yield: +1.1 bp at -1.0490%; 30-Year TIPS Real Yield: -1.5 bp at -0.3110%

HEADLINES

- Crude oil and base metals fell sharply today, as markets priced in heightened risks on the demand side

- The US$8bn 30-year TIPS (912810SV1) auction went OK, with good pricing and average stats: high yield at -0.292% (stop-through vs. -0.287% when issued), 2.34x bid-to-cover ratio (vs. 2.31x prior and 2.45x average of the previous 12 auctions), indirects took in 74.89% (vs. 74.8% average), dealers 12.72% (vs. 18.7% average) and directs 12.38% (vs. 6.5% average)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 07 Aug (U.S. Dept. of Labor) at 2.82 Mln (vs 2.87 Mln prior), above consensus estimate of 2.80 Mln

- Jobless Claims, National, Initial for W 14 Aug (U.S. Dept. of Labor) at 348.00 k (vs 375.00 k prior), below consensus estimate of 363.00 k

- Jobless Claims, National, Initial, four week moving average for W 14 Aug (U.S. Dept. of Labor) at 377.75 k (vs 396.25 k prior)

- Leading Index, Change P/P for Jul 2021 (The Conference Board) at 0.90 % (vs 0.70 % prior), above consensus estimate of 0.80 %

- Philadelphia Fed, Future capital expenditures for Aug 2021 (FED, Philadelphia) at 33.70 (vs 41.20 prior)

- Philadelphia Fed, Future general business activity for Aug 2021 (FED, Philadelphia) at 33.70 (vs 48.60 prior)

- Philadelphia Fed, General business activity for Aug 2021 (FED, Philadelphia) at 19.40 (vs 21.90 prior), below consensus estimate of 23.00

- Philadelphia Fed, New orders for Aug 2021 (FED, Philadelphia) at 22.80 (vs 17.00 prior)

- Philadelphia Fed, Number of employees for Aug 2021 (FED, Philadelphia) at 32.60 (vs 29.20 prior)

- Philadelphia Fed, Prices paid for Aug 2021 (FED, Philadelphia) at 71.20 (vs 69.70 prior)

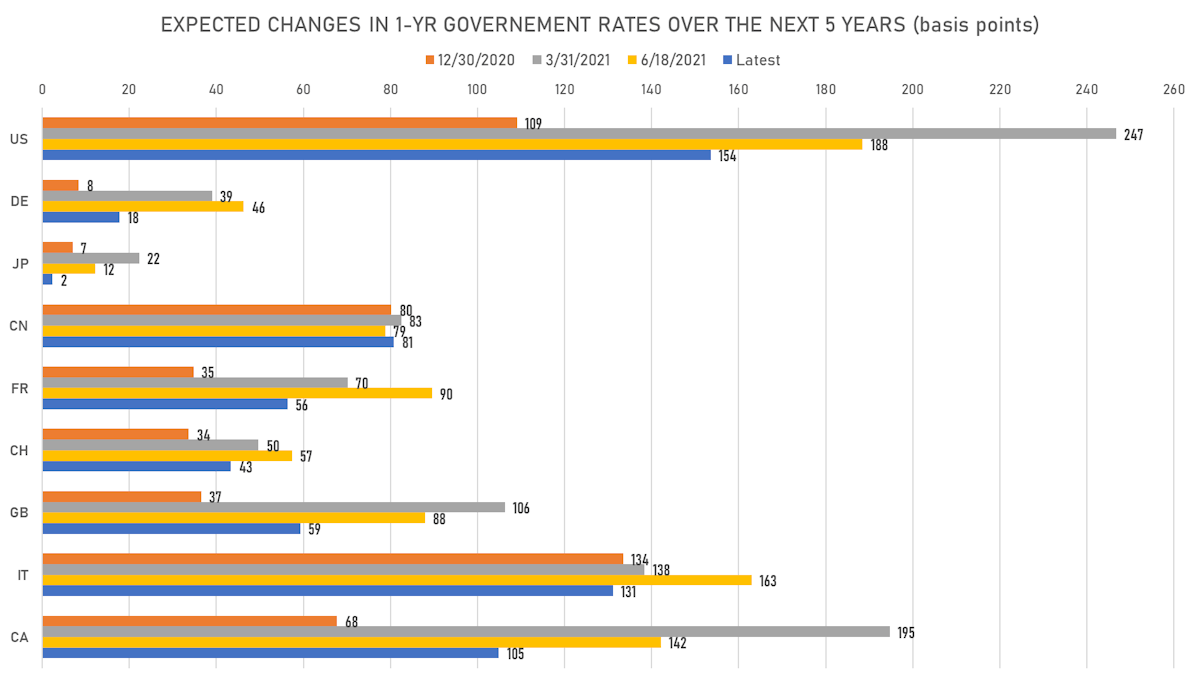

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 2.4 bp, now at 1.6170%

- 1-Year Treasury rates are now expected to increase by 153.7 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 16.8 bp by the end of 2022 (meaning the market prices 67.2% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 20.6 bp of rate hikes over the next 18 months (equivalent to 0.82 rate hike) and 81.0 bp over the next 3 years (equivalent to 3.24 rate hikes)

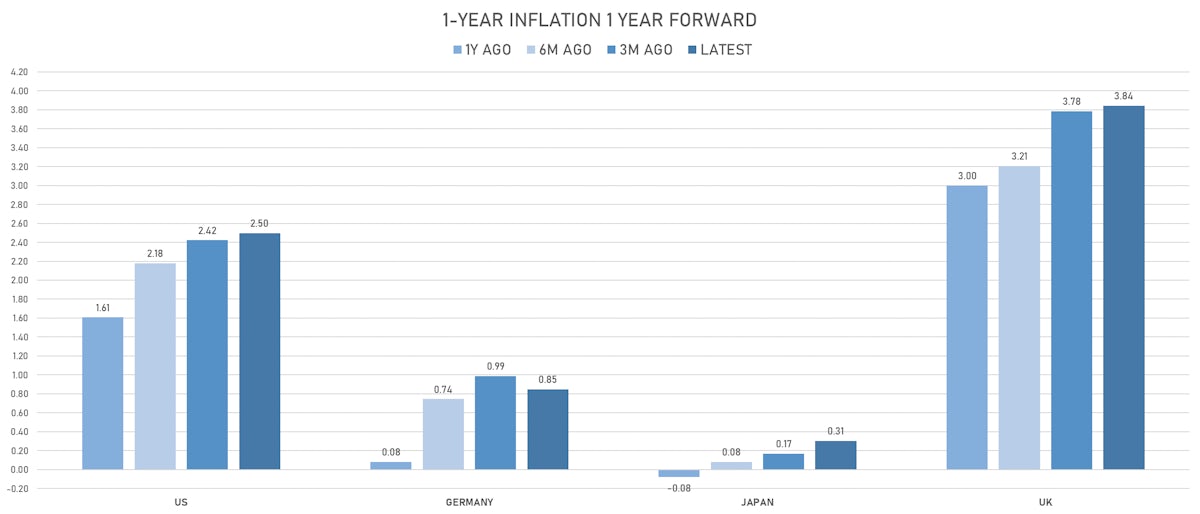

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.85% (down -9.4bp); 2Y at 2.67% (down -6.2bp); 5Y at 2.58% (down -2.7bp); 10Y at 2.28% (down -2.7bp); 30Y at 2.20% (down -1.2bp)

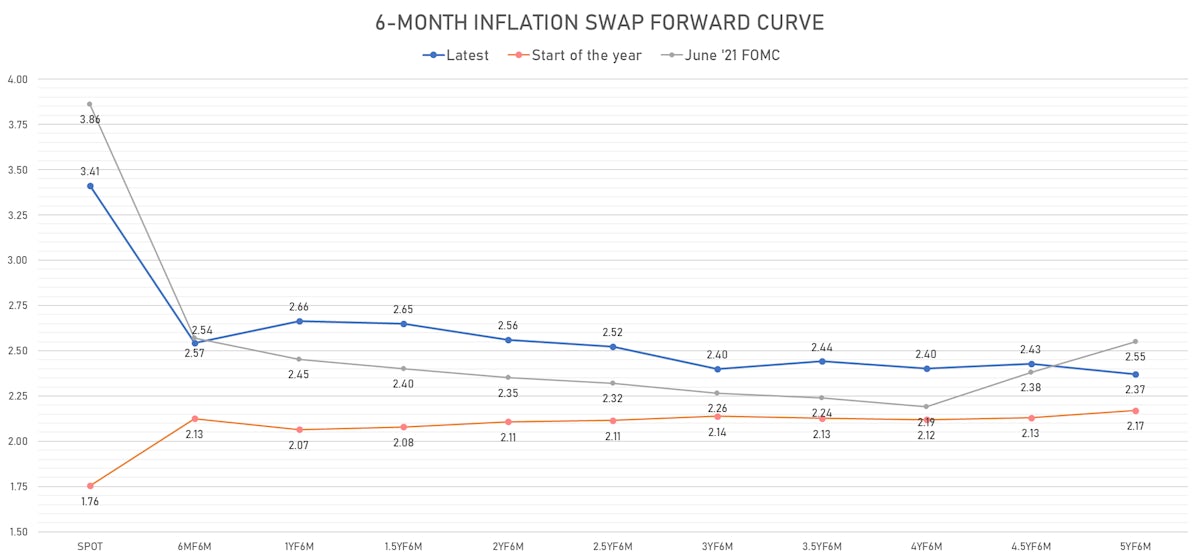

- 6-month spot US CPI swap down -0.2 bp to 3.410%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7370%, +2.6 bp today; 10Y at -1.0490%, +1.1 bp today; 30Y at -0.3110%, -1.5 bp today

RATES VOLATILITY & LIQUIDITY

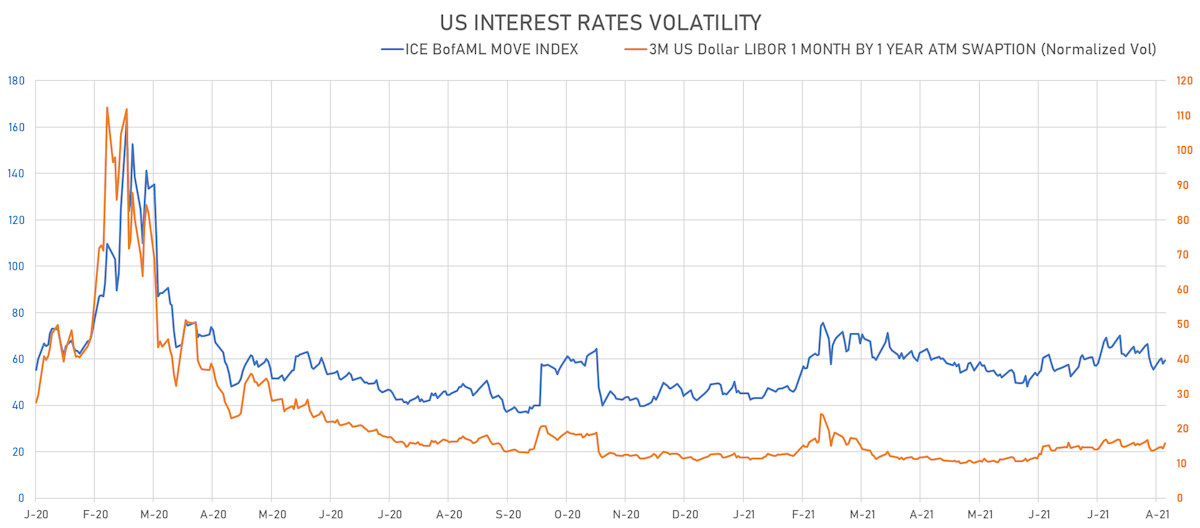

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.5% at 15.8%

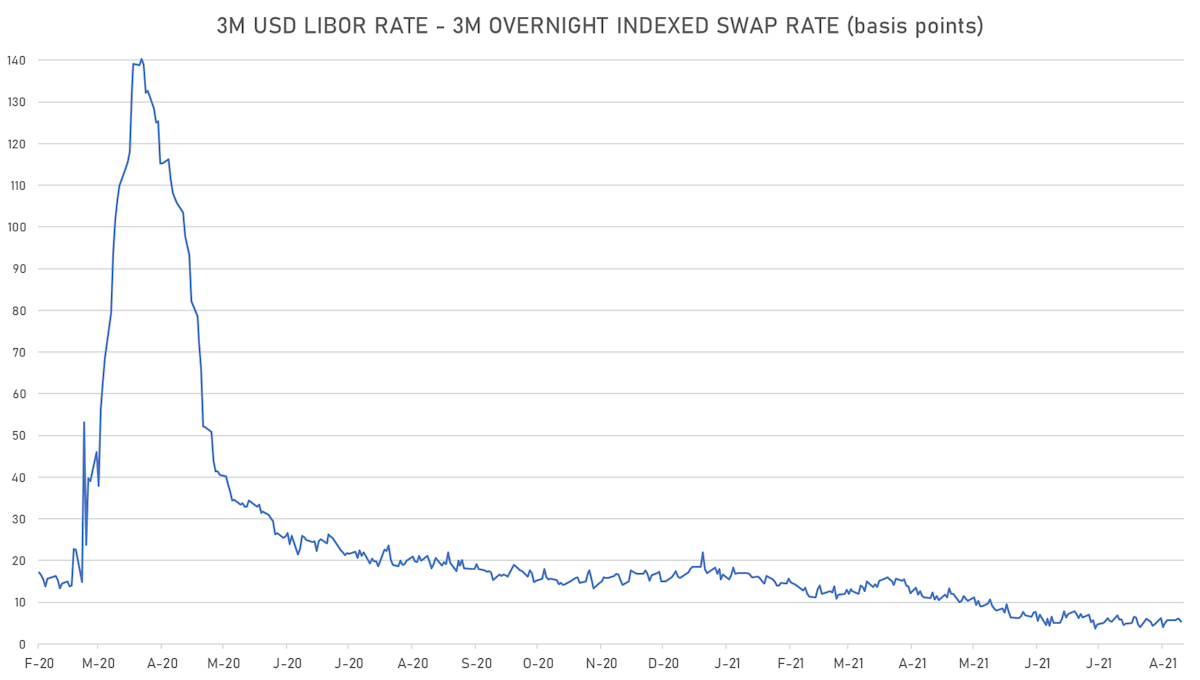

- 3-Month LIBOR-OIS spread down -0.6 bp at 5.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.739% (down -0.4 bp); the German 1Y-10Y curve is 1.3 bp flatter at 17.8bp (YTD change: +2.2 bp)

- Japan 5Y: -0.117% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.0 bp flatter at 14.9bp (YTD change: +1.2 bp)

- China 5Y: 2.684% (up 0.1 bp); the Chinese 1Y-10Y curve is 0.7 bp steeper at 66.4bp (YTD change: +20.0 bp)

- Switzerland 5Y: -0.665% (up 0.8 bp); the Swiss 1Y-10Y curve is 3.4 bp flatter at 34.2bp (YTD change: +7.8 bp)