Rates

US Rates Edge Up To End The Week, As The Curve Steepened Front To Belly, Flattened Further Out

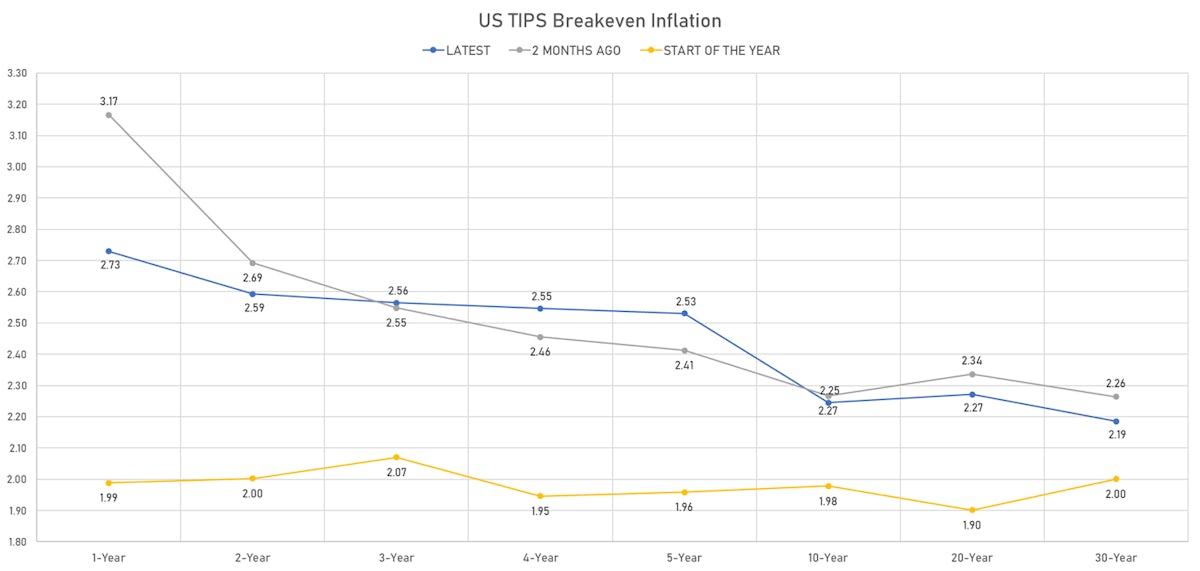

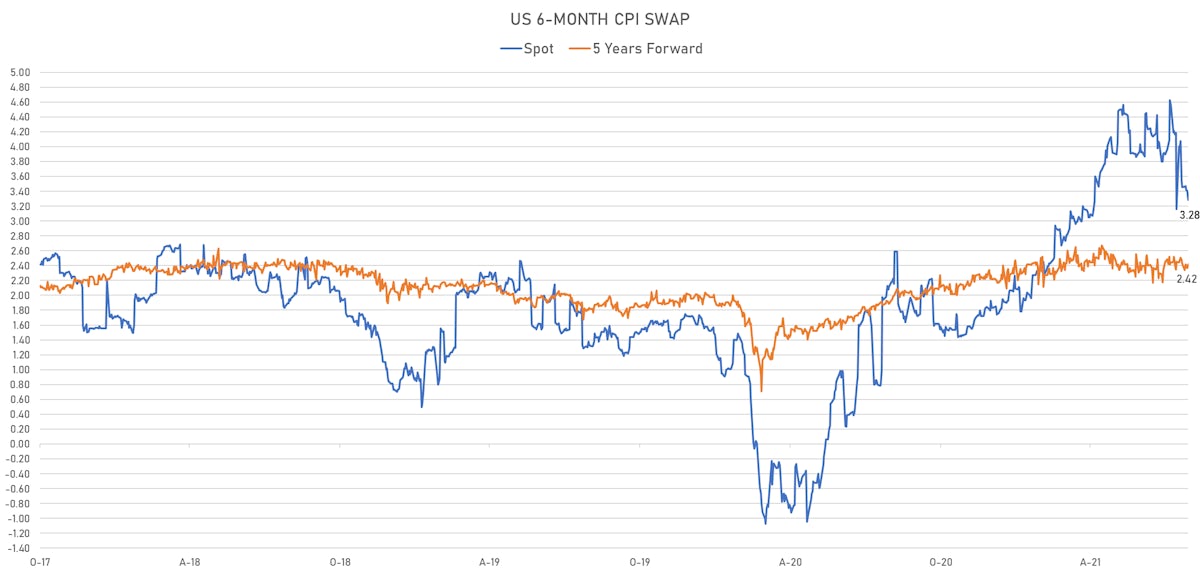

The inflation breakeven curve is also flatter, with the spread of the delta virus globally pushing down short-term inflation expectations

Published ET

6-Month CPI Swap Spot & 5 Years Forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

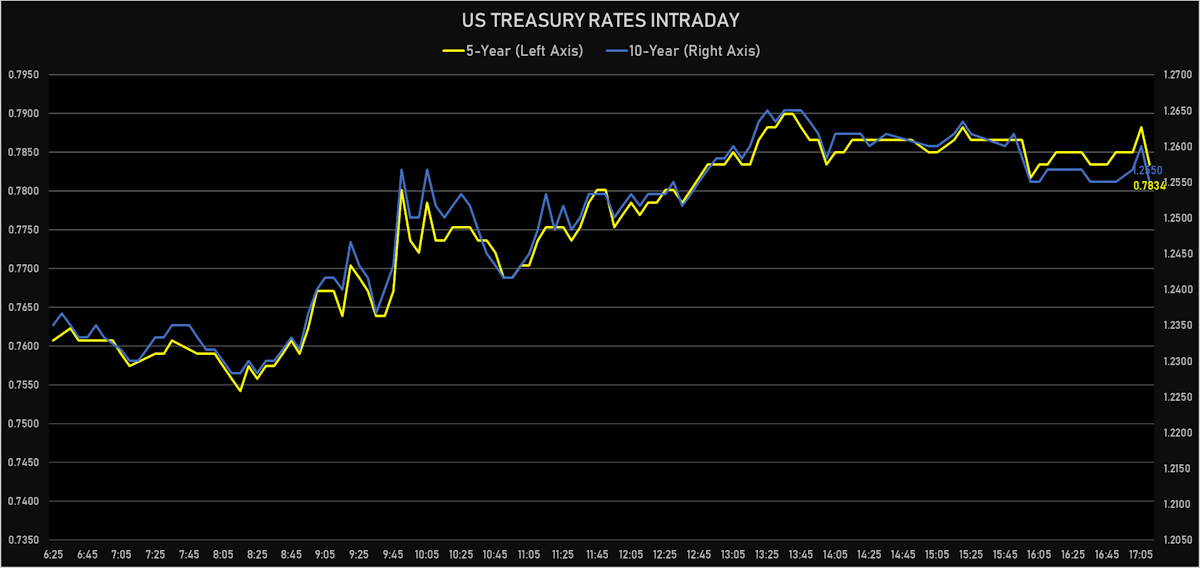

- 3-Month USD LIBOR -0.2bp today, now at 0.1284%

- The treasury yield curve steepened, with the 1s10s spread widening 1.2 bp, now at 118.9 bp (YTD change: +38.5bp)

- 1Y: 0.0660% (unchanged)

- 2Y: 0.2261% (up 0.5 bp)

- 5Y: 0.7834% (up 1.3 bp)

- 7Y: 1.0527% (up 1.7 bp)

- 10Y: 1.2550% (up 1.2 bp)

- 30Y: 1.8708% (down 0.3 bp)

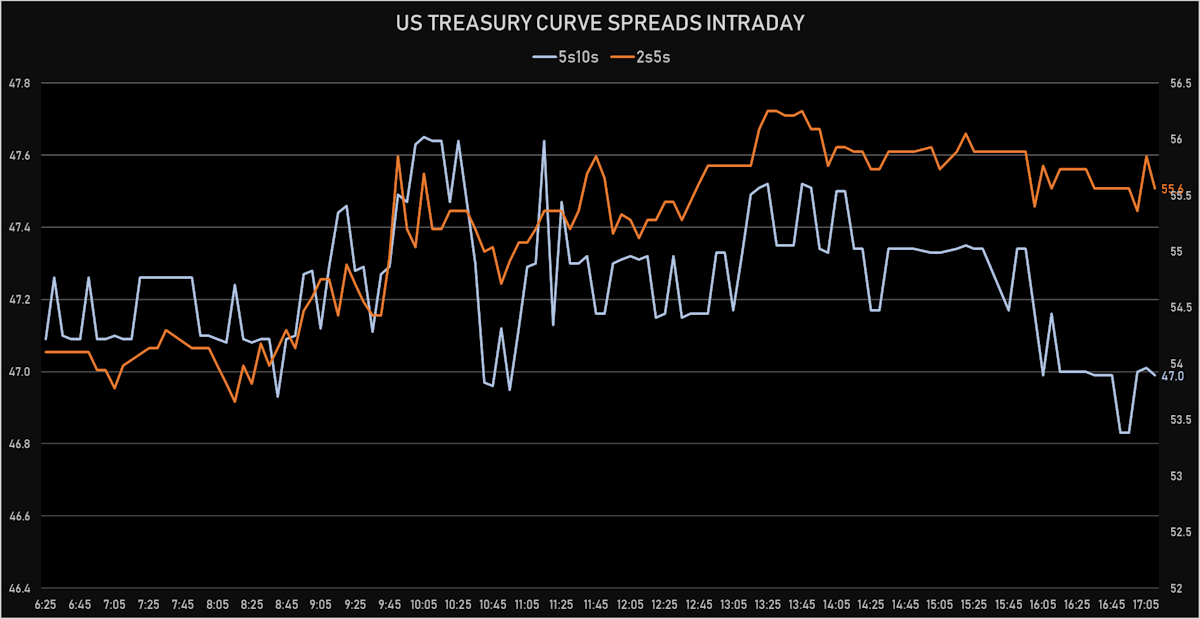

- US treasury curve spreads: 2s5s at 55.7bp (up 0.9bp today), 5s10s at 47.2bp (down -0.2bp), 10s30s at 61.6bp (down -1.4bp)

- Treasuries butterfly spreads: 2s5s10s at -8.9bp (down -1.0bp), 5s10s30s at 13.7bp (down -1.2bp)

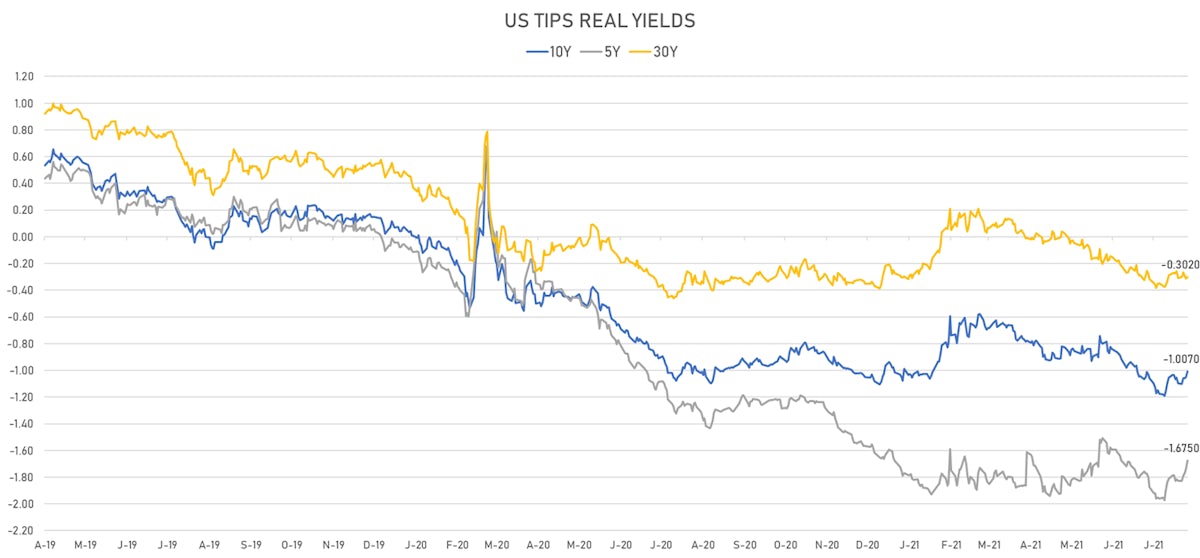

- US 5-Year TIPS Real Yield: +6.2 bp at -1.6750%; 10-Year TIPS Real Yield: +4.2 bp at -1.0070%; 30-Year TIPS Real Yield: +0.9 bp at -0.3020%

MACRO HEADLINES

- New York Fed Q3 GDP Nowcast was cut to 3.5% (from 3.8% prior) after retail sales, housing starts and Empire State releases this week

- Fed governors Kaplan and Kashkari are watching the impact of the delta variant carefully: both said in interviews today that they might have to postpone tapering asset purchases if the spread of the virus starts slowing down hiring or GDP growth

- Kaplan still sees GDP at 6.5% this year, and PCE inflation rate to end the year in the 3.8%-3.9% range, with broadening price pressures in 2022

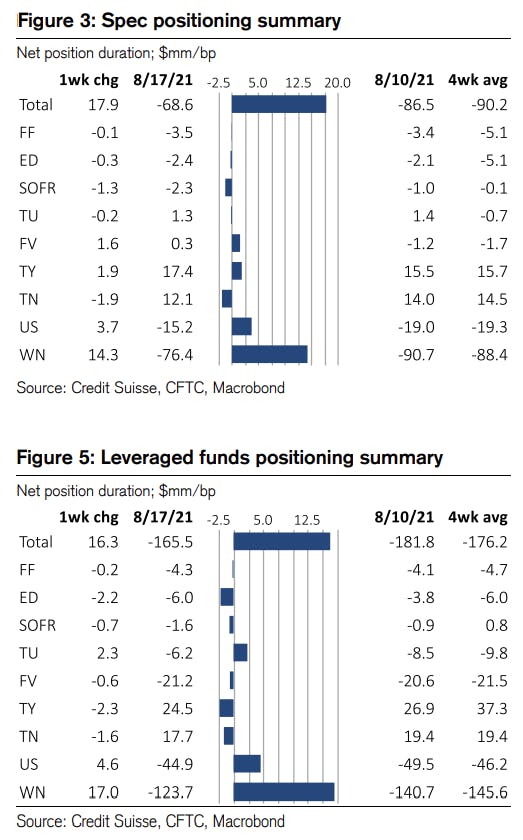

WEEKLY CFTC POSITIONING DATA SHOWS SIGNIFICANT SHORT DURATION COVERING

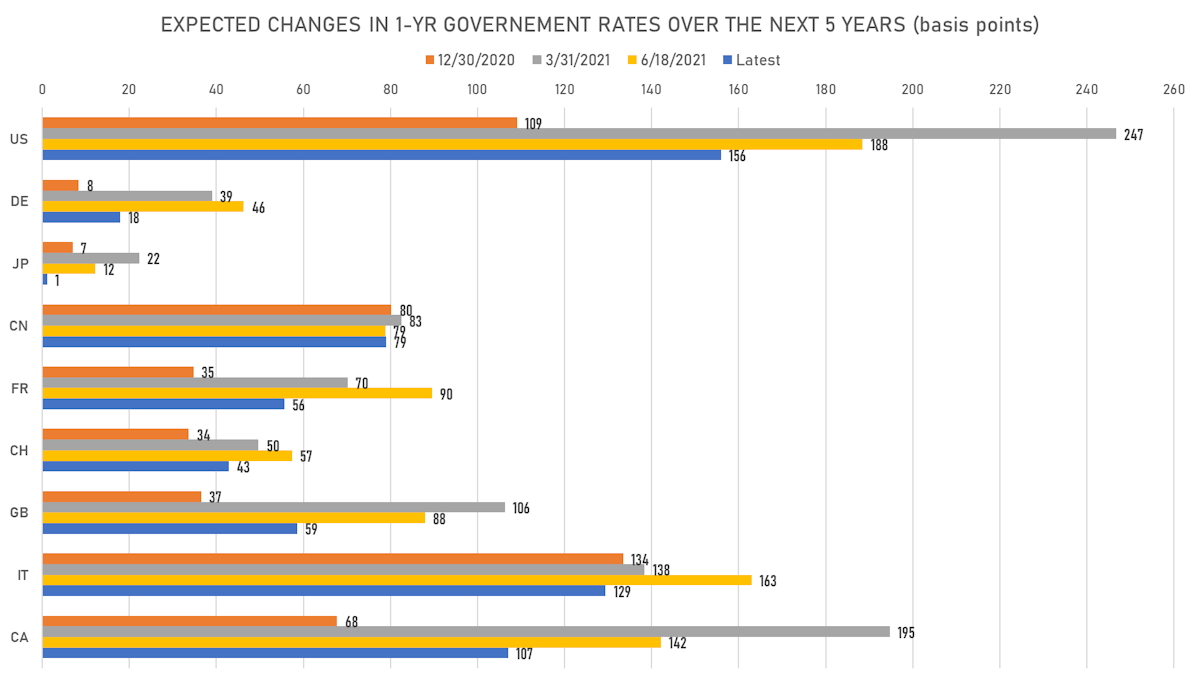

US FORWARD RATES

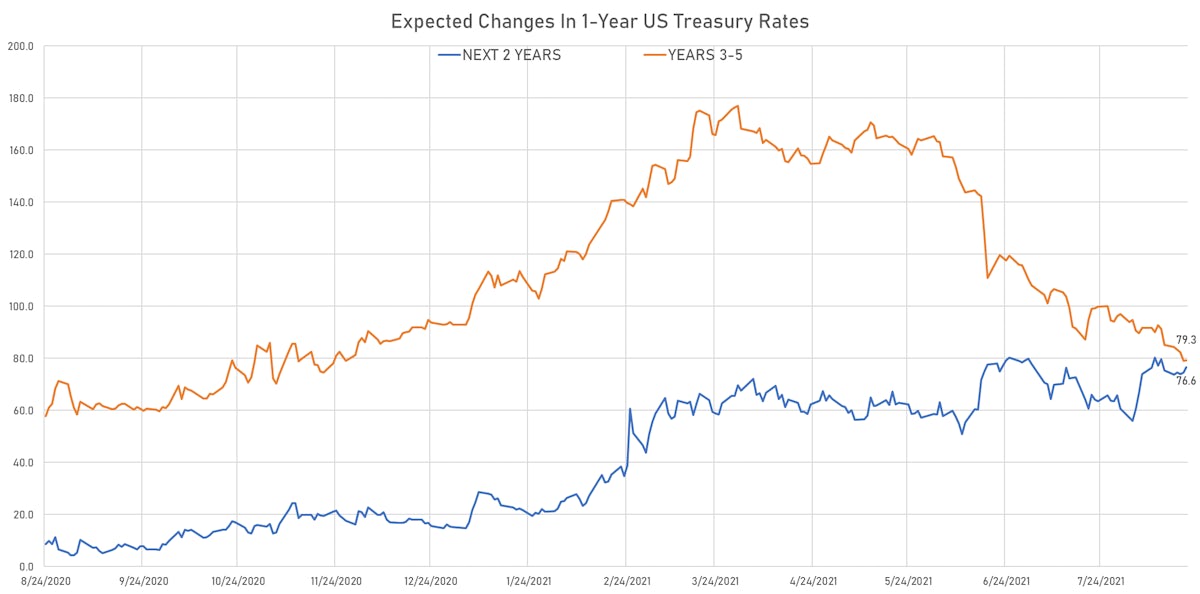

- US Treasury 1-year zero-coupon rate 5 years forward up 2.3 bp, now at 1.6405%

- 1-Year Treasury rates are now expected to increase by 155.9 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 17.0 bp by the end of 2022 (meaning the market prices 68.0% chance of a 25bp hike by end of 2022)

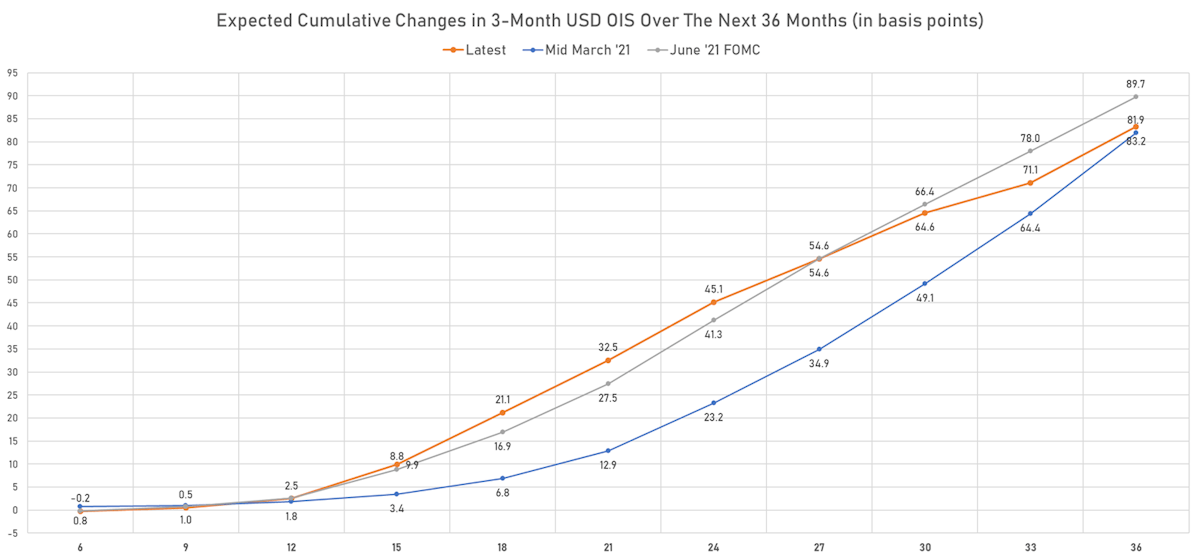

- The 3-month USD OIS forward curve prices in 21.1 bp of rate hikes over the next 18 months (equivalent to 0.85 rate hike) and 83.2 bp over the next 3 years (equivalent to 3.33 rate hikes)

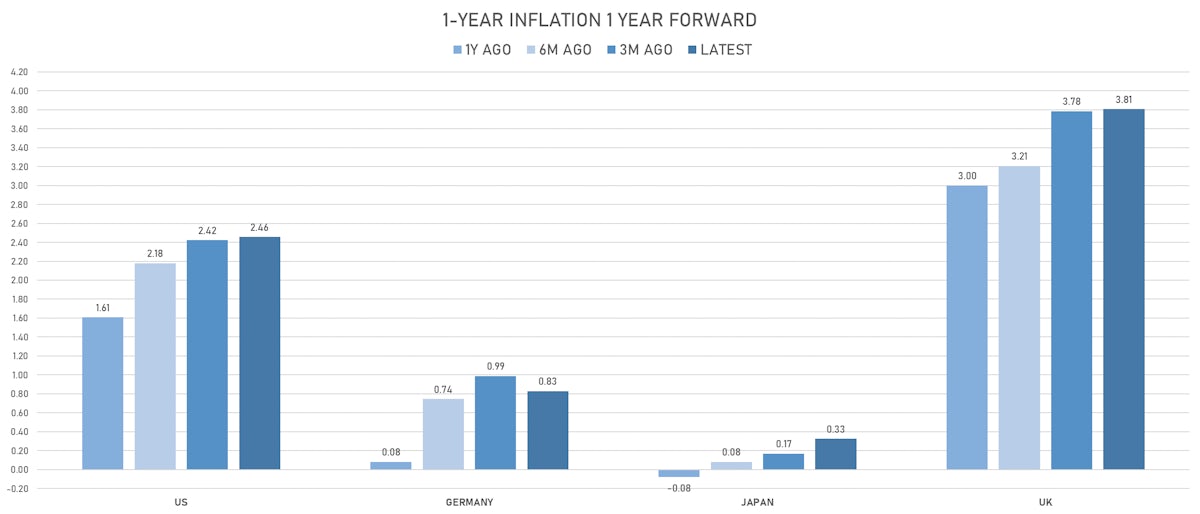

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.73% (down -12.0bp); 2Y at 2.59% (down -8.1bp); 5Y at 2.53% (down -4.7bp); 10Y at 2.25% (down -3.1bp); 30Y at 2.19% (down -1.2bp)

- 6-month spot US CPI swap down -13.0 bp to 3.281%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6750%, +6.2 bp today; 10Y at -1.0070%, +4.2 bp today; 30Y at -0.3020%, +0.9 bp today

RATES VOLATILITY & LIQUIDITY

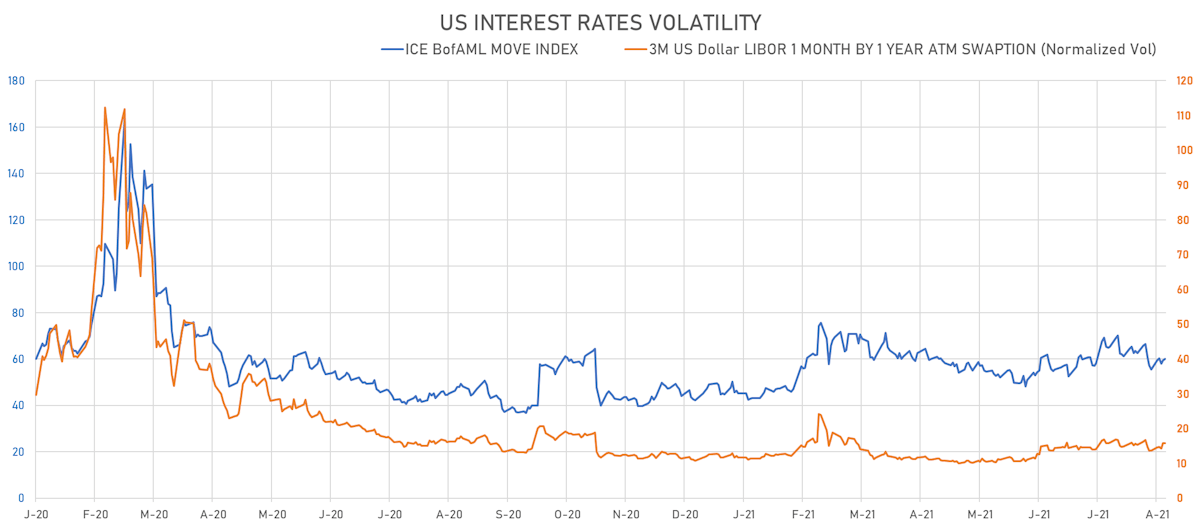

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down 0.0% at 15.8%

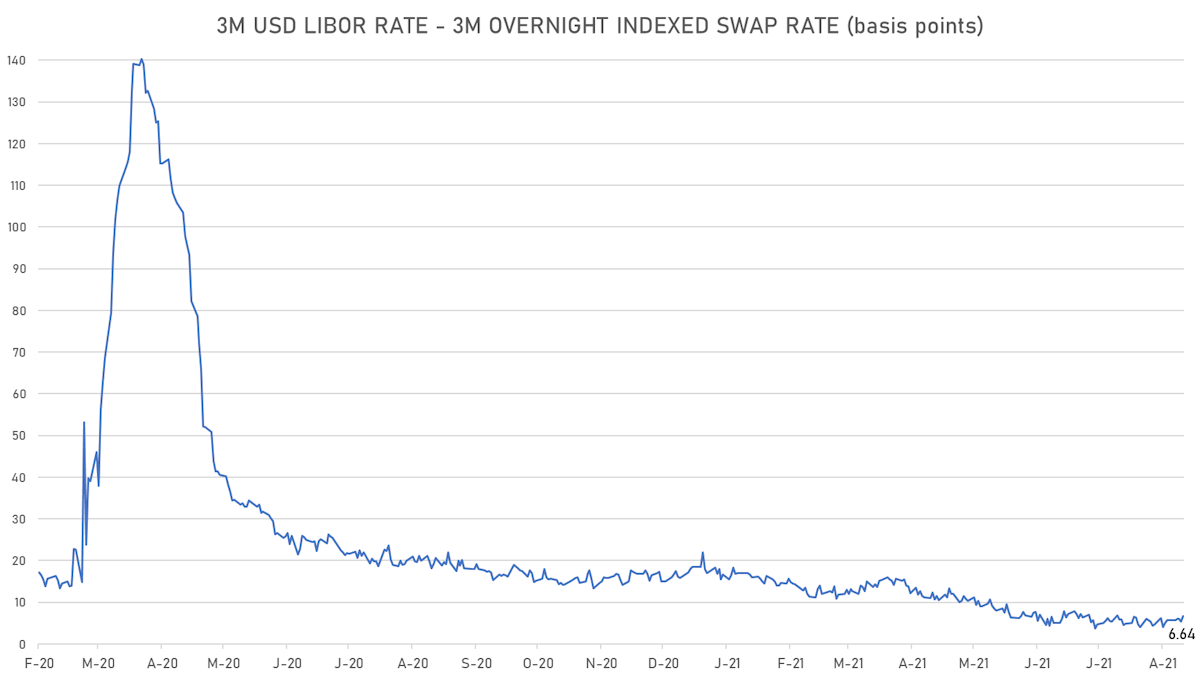

- 3-Month LIBOR-OIS spread up 1.3 bp at 6.6 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.745% (down -0.5 bp); the German 1Y-10Y curve is 0.4 bp flatter at 17.2bp (YTD change: +1.8 bp)

- Japan 5Y: -0.117% (unchanged); the Japanese 1Y-10Y curve is 0.5 bp flatter at 14.5bp (YTD change: +0.7 bp)

- China 5Y: 2.684% (unchanged); the Chinese 1Y-10Y curve is 2.4 bp flatter at 64.0bp (YTD change: +17.6 bp)

- Switzerland 5Y: -0.672% (down -1.1 bp); the Swiss 1Y-10Y curve is 4.2 bp steeper at 38.9bp (YTD change: +12.0 bp)