Rates

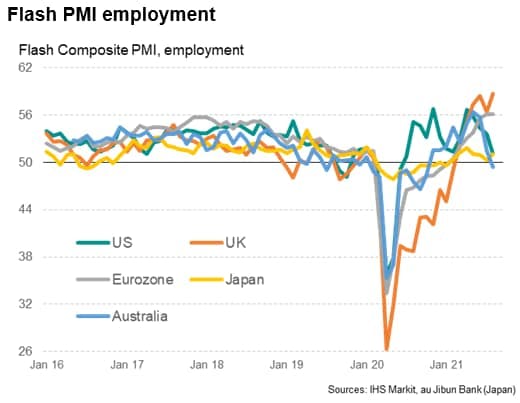

Flash PMIs Miss Estimates, Rates Drop Slightly And Inflation Breakevens Rise

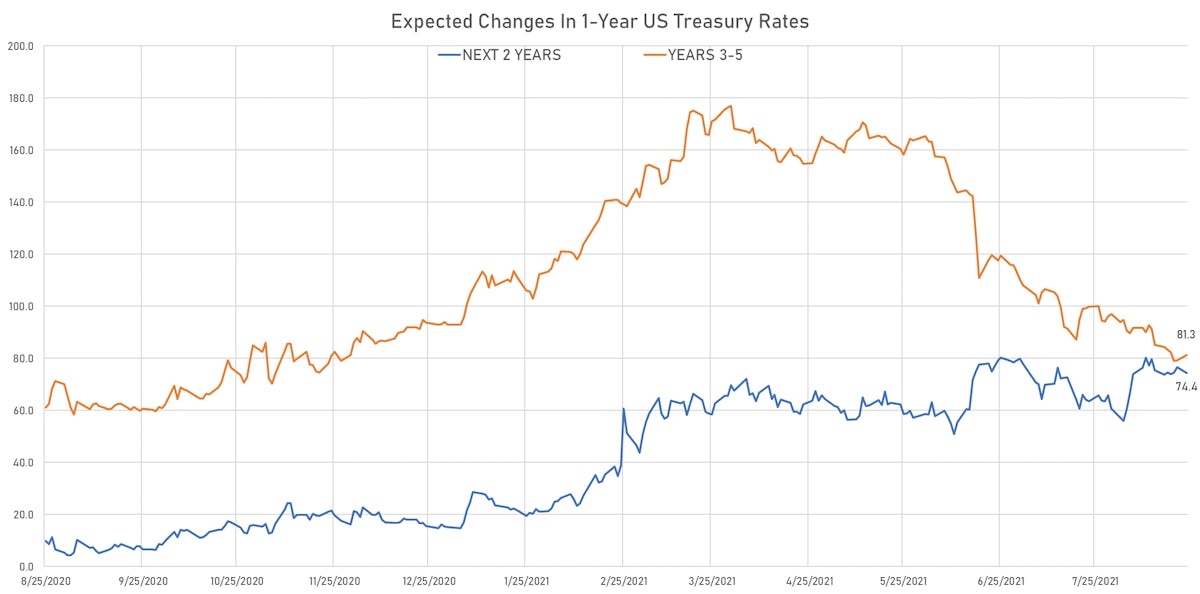

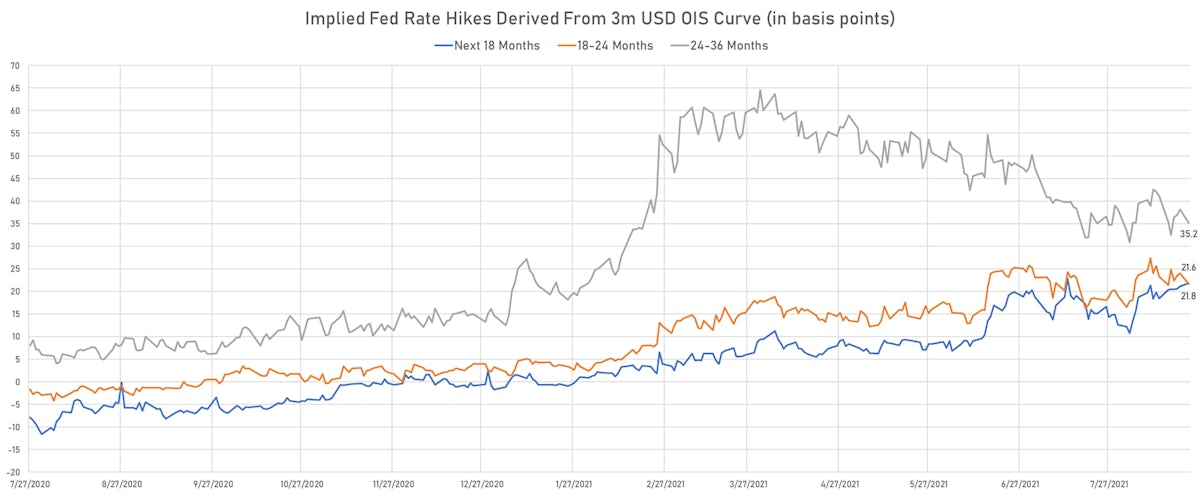

With the spread of the delta variant, the virtual Jackson Hole Symposium is now expected to tilt dovish, which could lead to a repricing of short rates and implied Fed hikes over the next 3 years

Published ET

Implied Fed Rate Hikes Over The Next 3 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.1bp today, now at 0.1293%

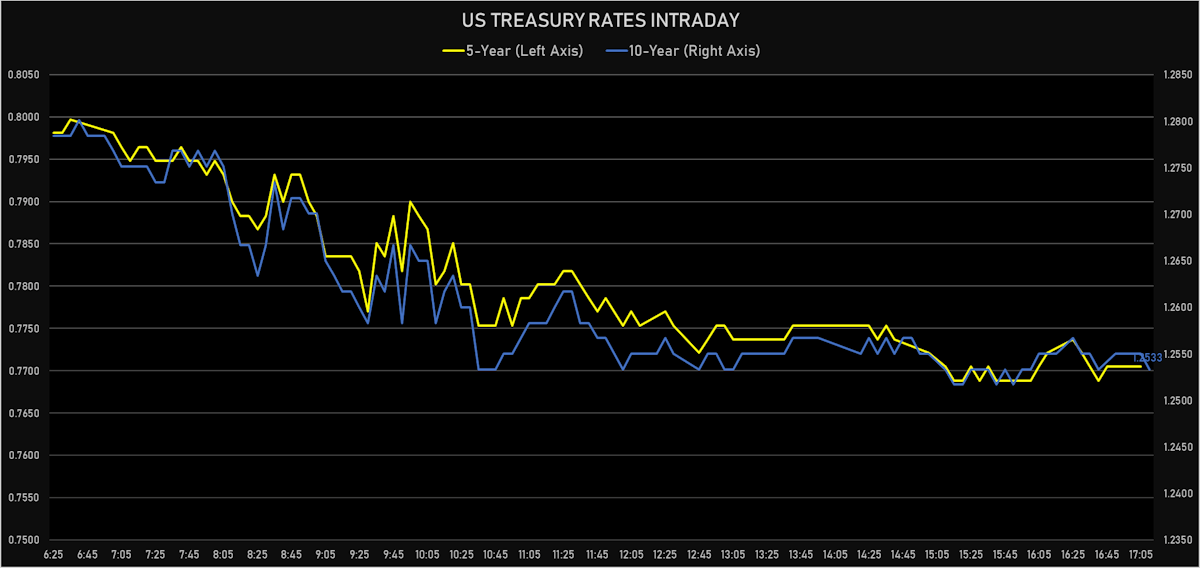

- The treasury yield curve flattened, with the 1s10s spread tightening -0.2 bp, now at 119.0 bp (YTD change: +38.6bp)

- 1Y: 0.0630% (unchanged)

- 2Y: 0.2262% (unchanged)

- 5Y: 0.7705% (down 1.3 bp)

- 7Y: 1.0445% (down 0.8 bp)

- 10Y: 1.2533% (down 0.2 bp)

- 30Y: 1.8742% (up 0.3 bp)

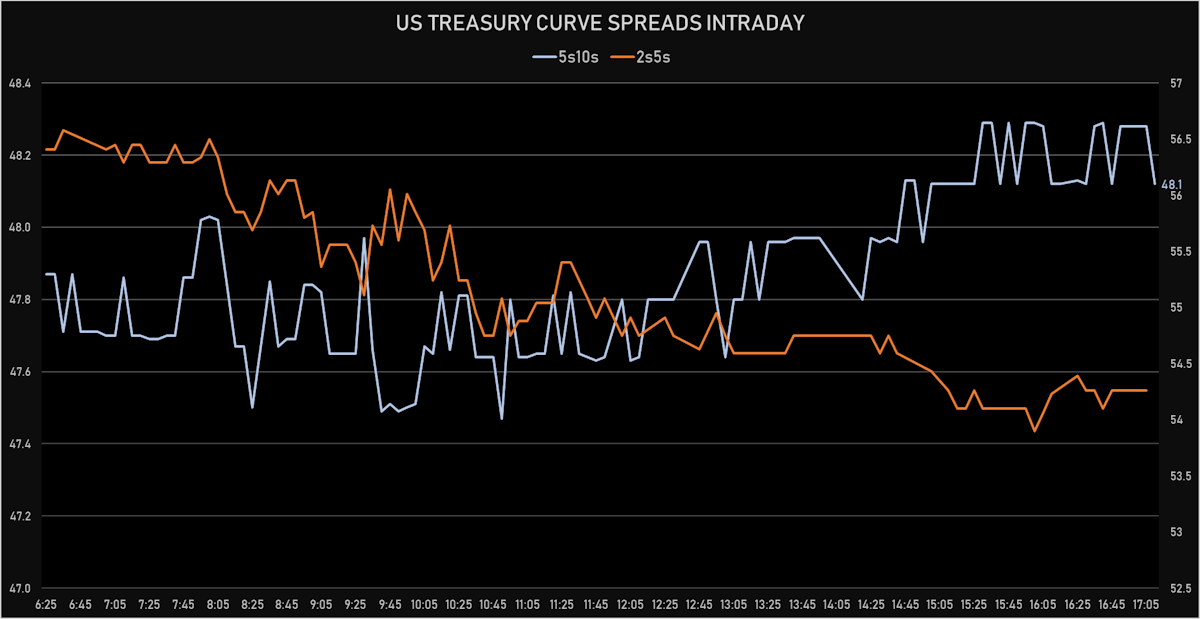

- US treasury curve spreads: 2s5s at 54.4bp (down -1.3bp), 5s10s at 48.3bp (up 1.1bp today), 10s30s at 62.1bp (up 0.6bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.5bp (up 2.4bp today), 5s10s30s at 13.1bp (down -0.6bp)

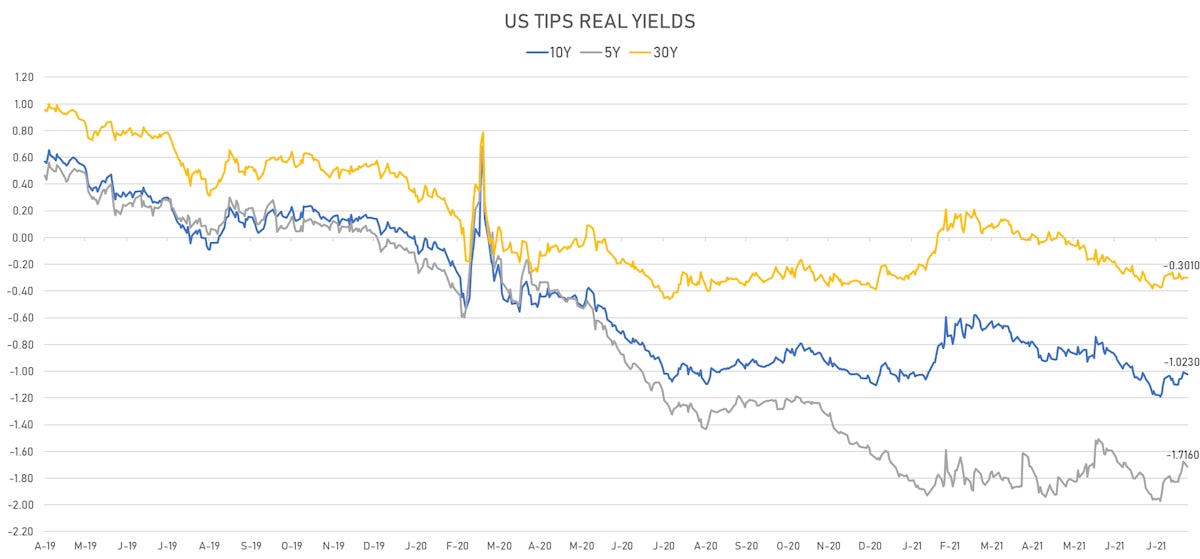

- US 5-Year TIPS Real Yield: -4.1 bp at -1.7160%; 10-Year TIPS Real Yield: -1.6 bp at -1.0230%; 30-Year TIPS Real Yield: +0.1 bp at -0.3010%

US MACRO RELEASES

- Chicago Fed CFMMI, National Activity Index for Jul 2021 (Fed Res, Chicago) at 0.53 (vs 0.09 prior)

- Existing-Home Sales, Single-Family and Condos, total for Jul 2021 (NAR, United States) at 5.99 Mln (vs 5.86 Mln prior), above consensus estimate of 5.83 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Jul 2021 (NAR, United States) at 2.00 % (vs 1.40 % prior)

- PMI, Composite, Output, Flash for Aug 2021 (Markit Economics) at 55.40 (vs 59.90 prior), below consensus estimate of 58.30

- PMI, Manufacturing Sector, Total, Flash for Aug 2021 (Markit Economics) at 61.20 (vs 63.40 prior), below consensus estimate of 62.50

- PMI, Services Sector, Business Activity, Flash for Aug 2021 (Markit Economics) at 55.20 (vs 59.90 prior), below consensus estimate of 59.50

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 0.2 bp, now at 1.6390%

- 1-Year Treasury rates are now expected to increase by 155.7 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 16.7 bp by the end of 2022 (meaning the market prices 66.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 21.8 bp of rate hikes over the next 18 months (equivalent to 0.87 rate hike) and 78.6 bp over the next 3 years (equivalent to 3.14 rate hikes)

US INFLATION & REAL RATES

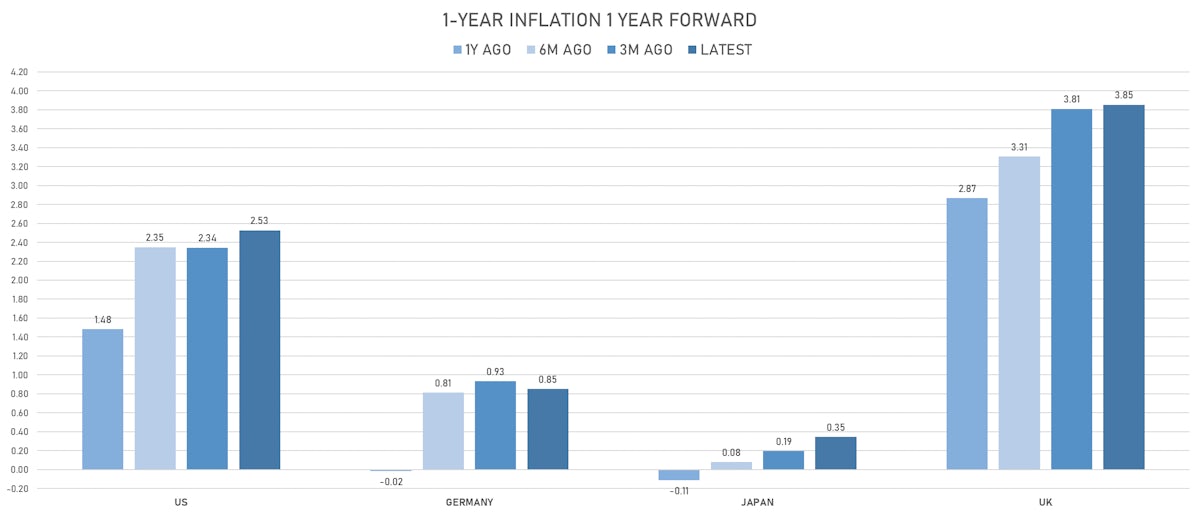

- TIPS 1Y breakeven inflation at 2.81% (up 8.3bp); 2Y at 2.67% (up 7.8bp); 5Y at 2.56% (up 2.6bp); 10Y at 2.26% (up 1.4bp); 30Y at 2.19% (up 0.2bp)

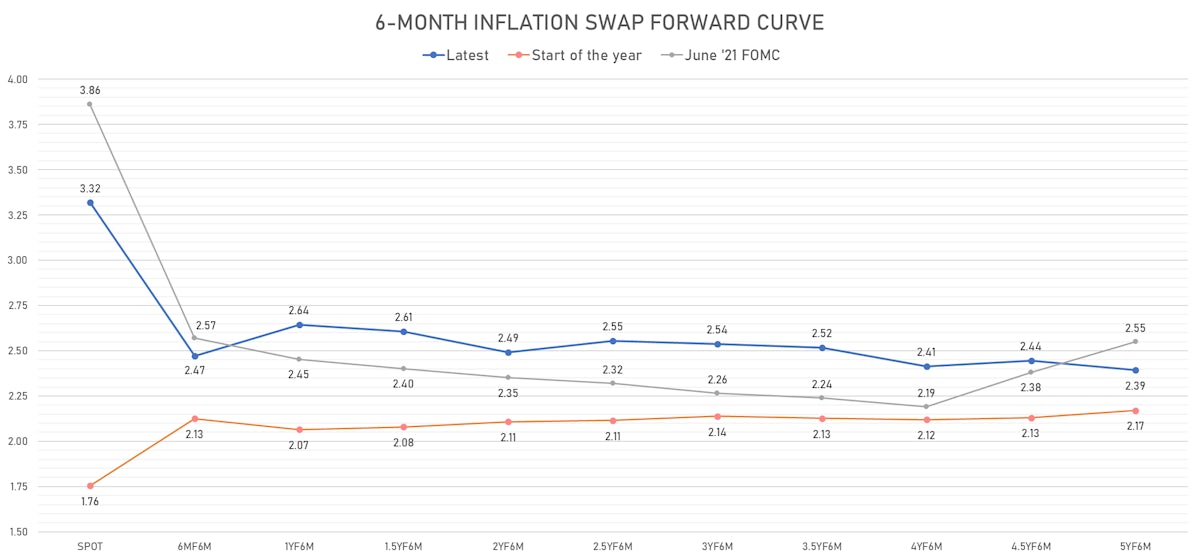

- 6-month spot US CPI swap up 3.7 bp to 3.318%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7160%, -4.1 bp today; 10Y at -1.0230%, -1.6 bp today; 30Y at -0.3010%, +0.1 bp today

RATES VOLATILITY & LIQUIDITY

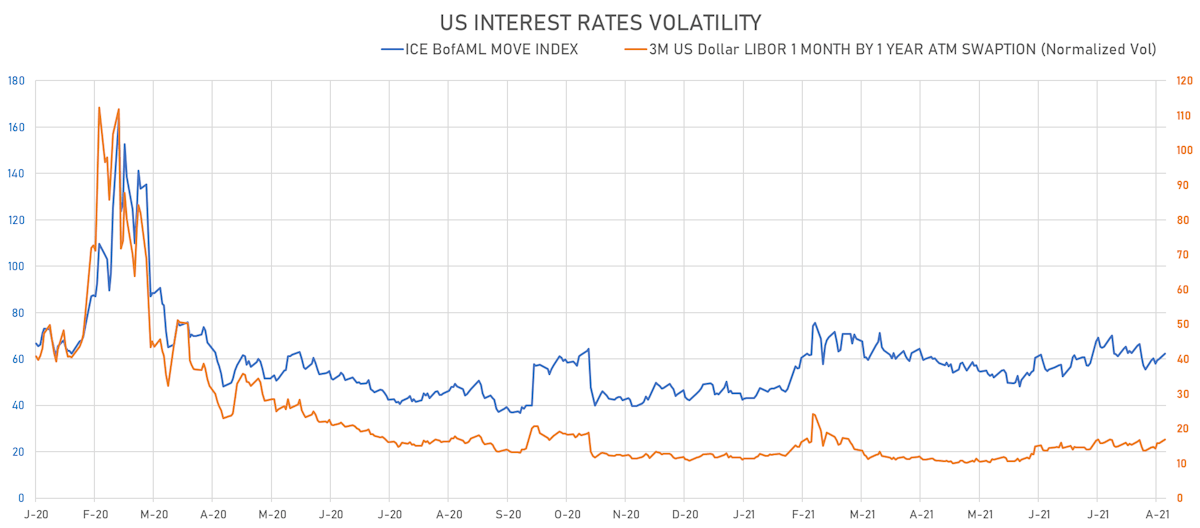

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.1% at 16.9%

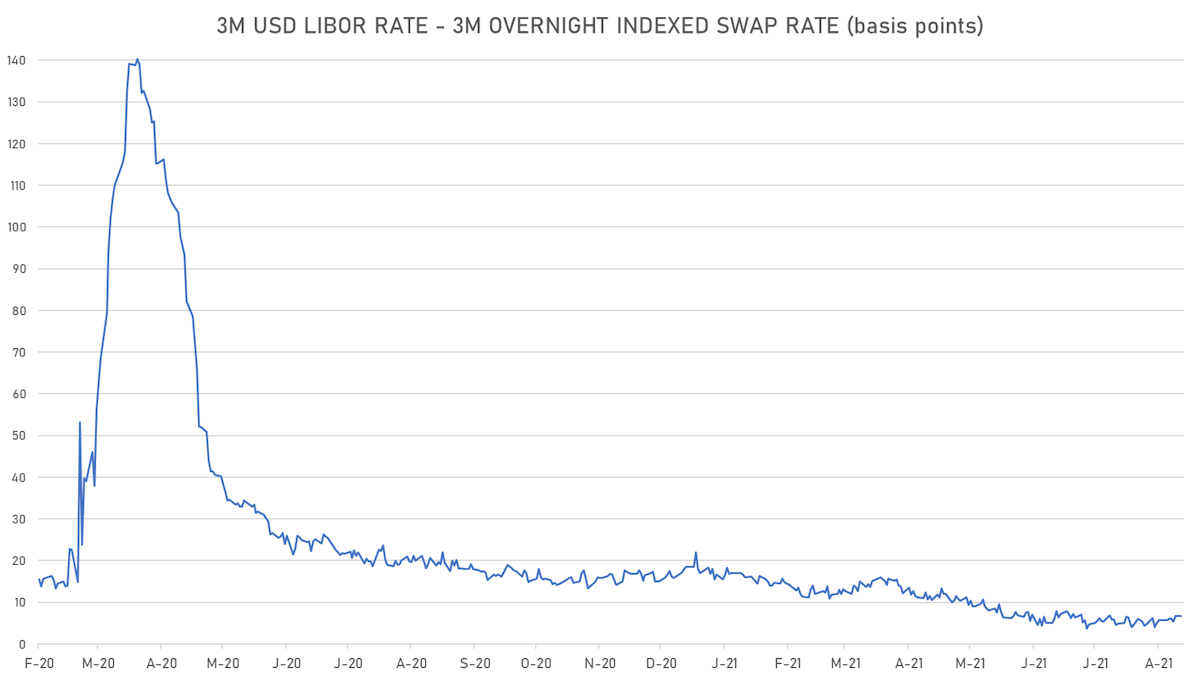

- 3-Month LIBOR-OIS spread up 0.1 bp at 6.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.743% (up 0.7 bp); the German 1Y-10Y curve is 1.0 bp steeper at 17.8bp (YTD change: +2.8 bp)

- Japan 5Y: -0.112% (up 0.8 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 14.9bp (YTD change: +0.8 bp)

- China 5Y: 2.706% (up 2.2 bp); the Chinese 1Y-10Y curve is 1.5 bp flatter at 62.5bp (YTD change: +16.1 bp)

- Switzerland 5Y: -0.661% (up 1.1 bp); the Swiss 1Y-10Y curve is 2.1 bp steeper at 40.5bp (YTD change: +14.1 bp)