Rates

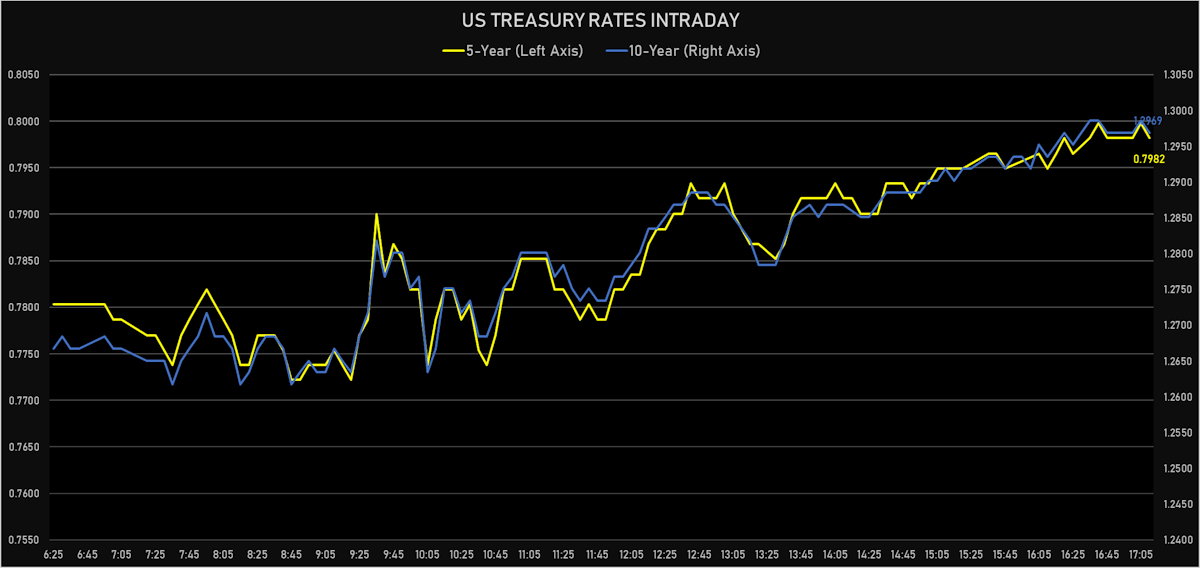

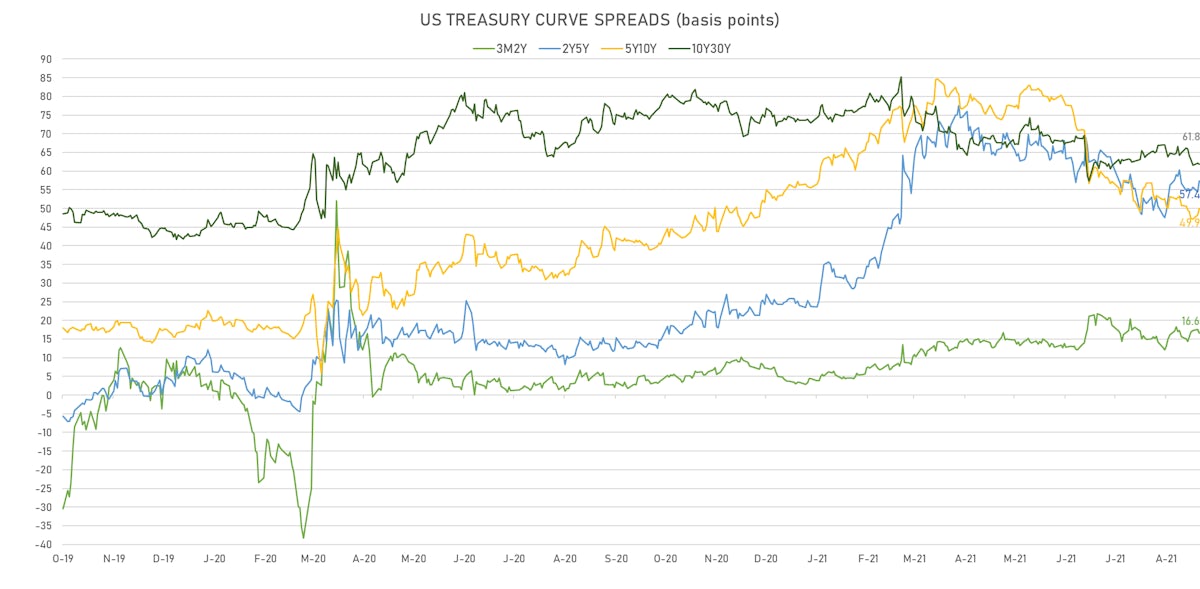

Modest Unwind Of The Flattening Trade In Treasuries, With Rates Rising From The Belly Out

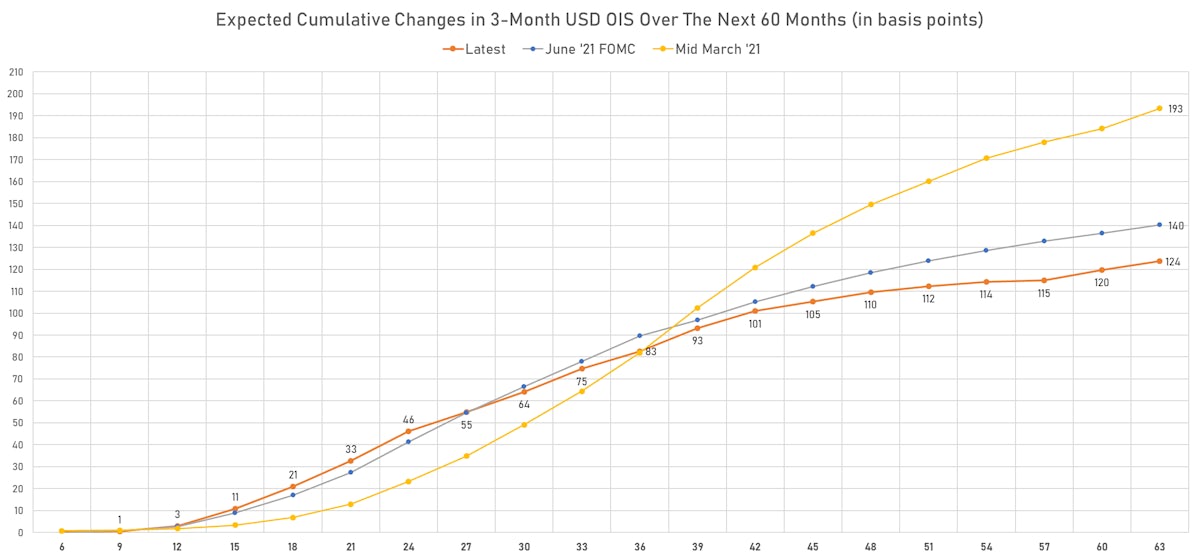

With the current macro uncertainty, the Fed is unlikely to be specific about tapering this week in Jackson Hole; market expectations are still for an official announcement in November / December, and a start in early 2022

Published ET

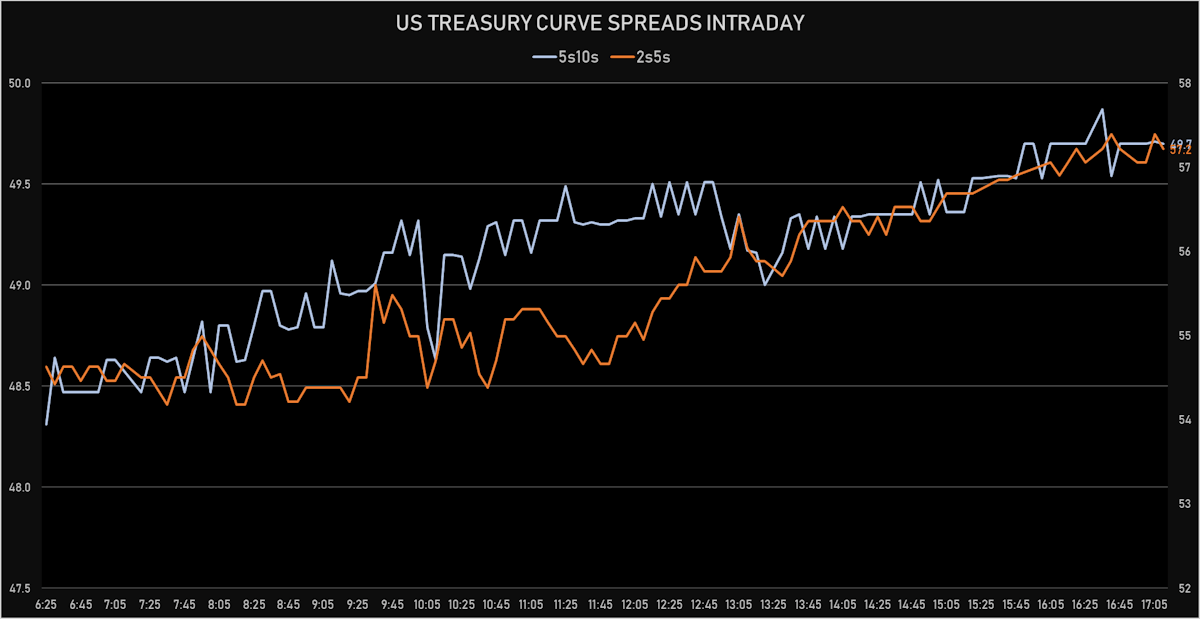

Spreads In The US Treasury Yield Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

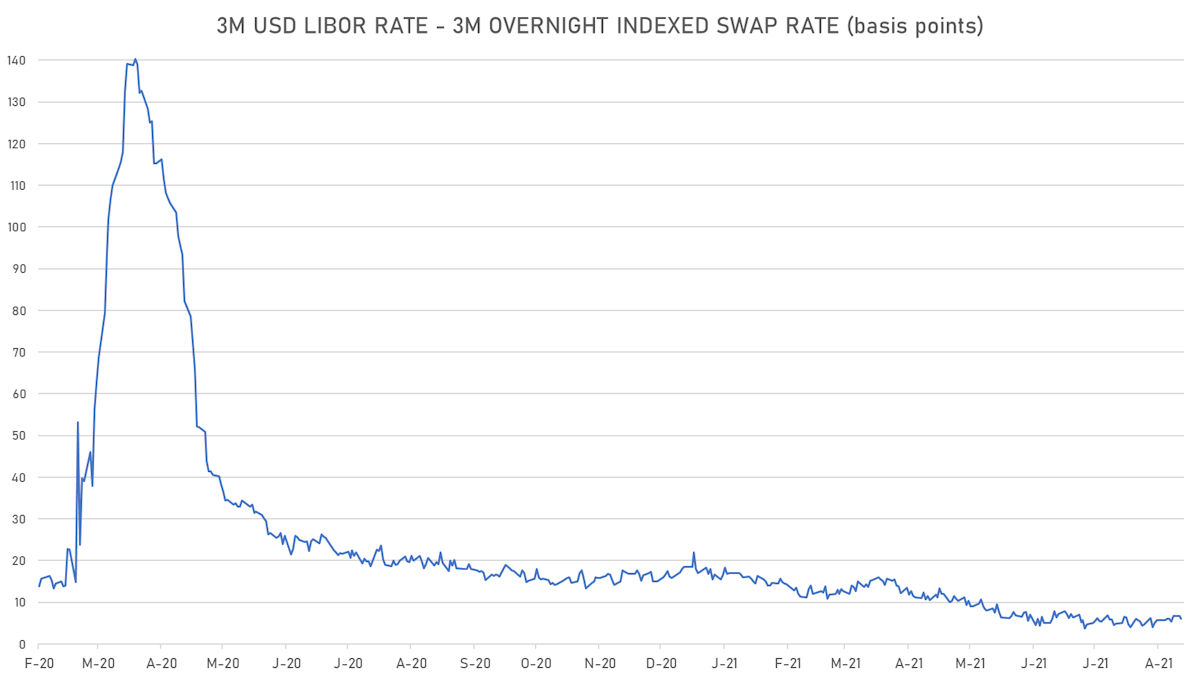

- 3-Month USD LIBOR down -0.7bp today, now at 0.1218%

- The treasury yield curve steepened, with the 1s10s spread widening 4.4 bp, now at 123.4 bp (YTD change: +42.9bp)

- 1Y: 0.0630% (unchanged)

- 2Y: 0.2243% (down 0.2 bp)

- 5Y: 0.7982% (up 2.8 bp)

- 7Y: 1.0809% (up 3.6 bp)

- 10Y: 1.2969% (up 4.4 bp)

- 30Y: 1.9147% (up 4.1 bp)

- US treasury curve spreads: 2s5s at 57.4bp (up 3.0bp today), 5s10s at 49.9bp (up 1.6bp today), 10s30s at 61.8bp (down -0.3bp)

- Treasuries butterfly spreads: 2s5s10s at -7.9bp (down -1.4bp), 5s10s30s at 12.0bp (down -1.1bp)

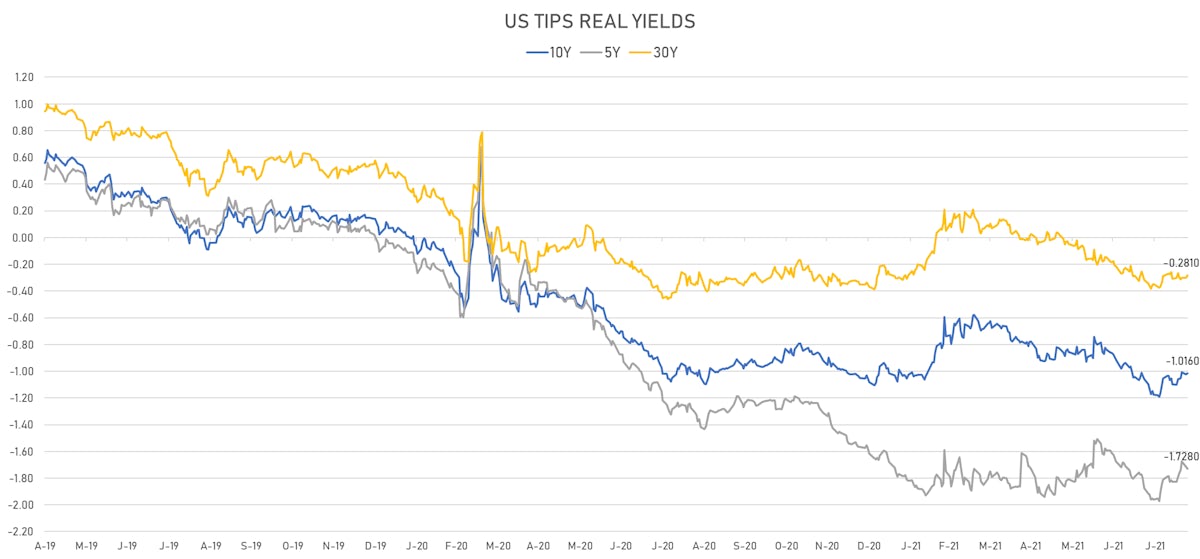

- US 5-Year TIPS Real Yield: -1.2 bp at -1.7280%; 10-Year TIPS Real Yield: +0.7 bp at -1.0160%; 30-Year TIPS Real Yield: +2.0 bp at -0.2810%

HEADLINES

- The $60 billion 2-year Treasury auction (91282CCU3) saw very strong demand and a 1.1 bp stop-trough: high yield of 0.242% (vs 0.253% when issued at the bid deadline and 0.213% at the previous auction in July), 2.65x bid-to-cover (2.47x in July and 2.53x 5-month average), competitive bids up at 81.2% (vs 74.1% in July and the 68.7% average), indirects took 60.54% (vs 52.8% last month and a 52.2% average), primary dealers were left with only 18.3% (vs 26.0% in July and 31.3% average).

US MACRO RELEASES

- Building Permits for Jul 2021 (U.S. Census Bureau) at 1.63 Mln (vs 1.64 Mln prior)

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 21 Aug (Redbook Research) at 16.6% (vs 15.00 % prior)

- New Home Sales for Jul 2021 (U.S. Census Bureau) at 0.71 Mln (vs 0.68 Mln prior), above consensus estimate of 0.70 Mln

- New Home Sales, Change P/P for Jul 2021 (U.S. Census Bureau) at 1.00 % (vs -6.60 % prior)

- Richmond Fed Manufacturing, Manufacturing Index for Aug 2021 (FED, Richmond) at 9.00 (vs 27.00 prior)

- Richmond Fed Manufacturing, Shipments, current conditions for Aug 2021 (FED, Richmond) at 6.00 (vs 21.00 prior)

- Richmond Fed Services, Revenues for Aug 2021 (FED, Richmond) at 15.00 (vs 19.00 prior)

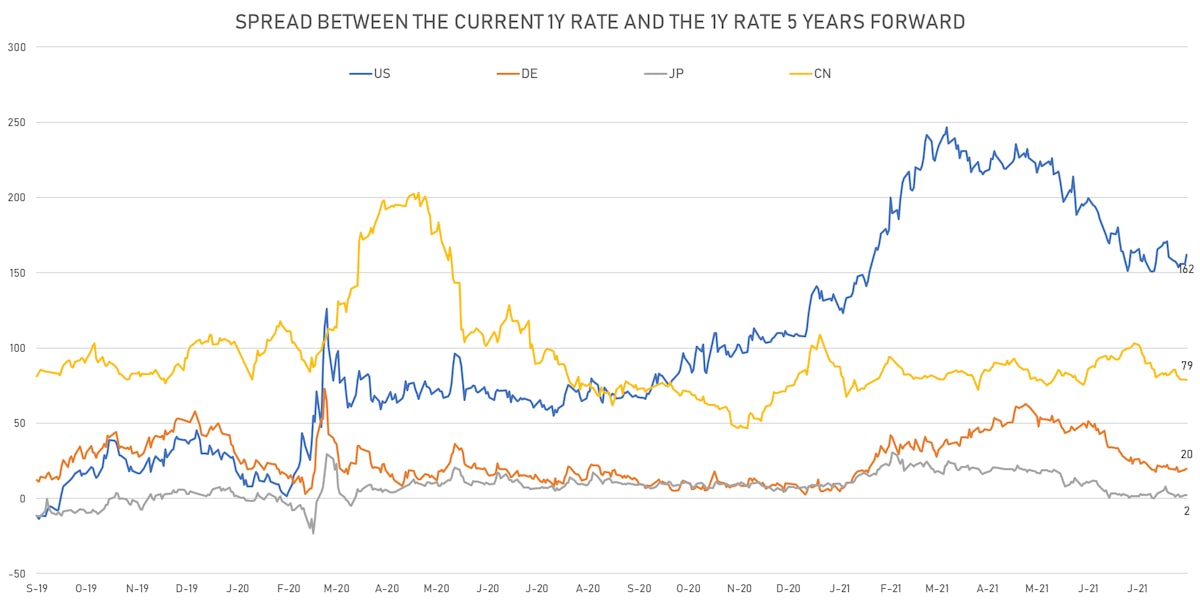

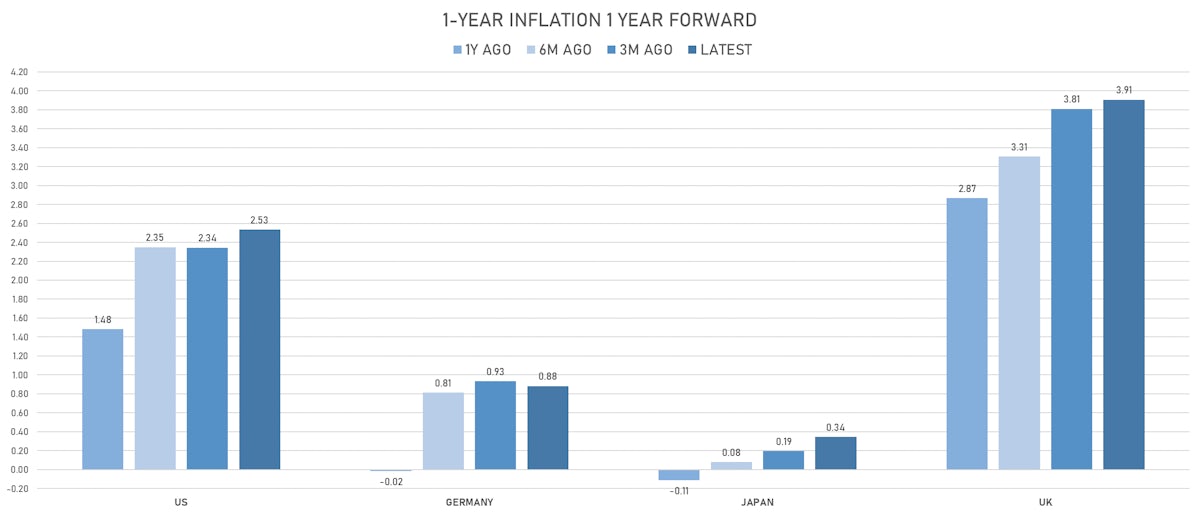

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 6.1 bp, now at 1.7002%

- 1-Year Treasury rates are now expected to increase by 161.8 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 17.7 bp by the end of 2022 (meaning the market prices 70.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 21.0 bp of rate hikes over the next 18 months (equivalent to 0.84 rate hike) and 82.7 bp over the next 3 years (equivalent to 3.31 rate hikes)

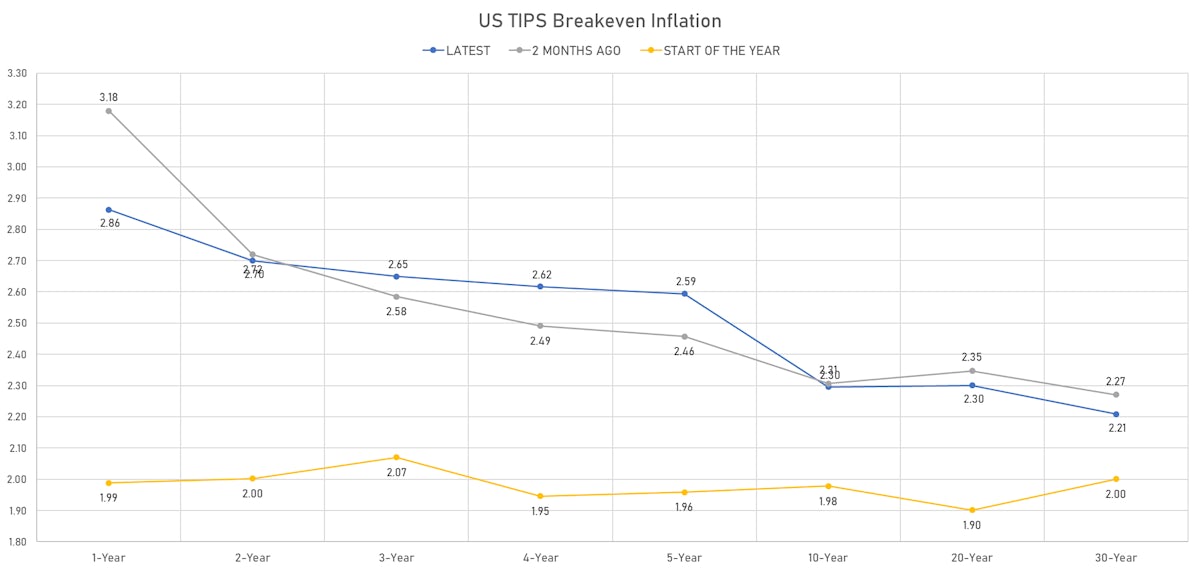

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.86% (up 5.0bp); 2Y at 2.70% (up 3.0bp); 5Y at 2.59% (up 3.7bp); 10Y at 2.30% (up 3.6bp); 30Y at 2.21% (up 2.0bp)

- 6-month spot US CPI swap up 3.9 bp to 3.357%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7280%, -1.2 bp today; 10Y at -1.0160%, +0.7 bp today; 30Y at -0.2810%, +2.0 bp today

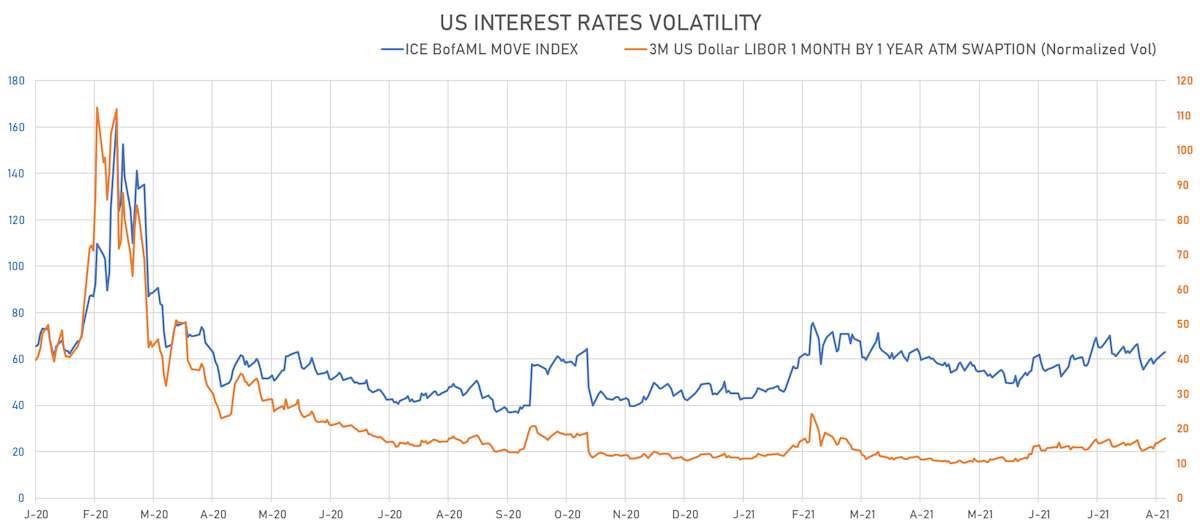

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.3% at 17.2%

- 3-Month LIBOR-OIS spread down -0.7 bp at 6.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.731% (up 0.3 bp); the German 1Y-10Y curve is 0.2 bp steeper at 19.0bp (YTD change: +3.0 bp)

- Japan 5Y: -0.119% (up 0.2 bp); the Japanese 1Y-10Y curve is 0.3 bp steeper at 14.7bp (YTD change: +1.1 bp)

- China 5Y: 2.698% (down -0.8 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 62.6bp (YTD change: +16.2 bp)

- Switzerland 5Y: -0.664% (up 0.1 bp); the Swiss 1Y-10Y curve is 6.4 bp flatter at 36.1bp (YTD change: +7.7 bp)