Rates

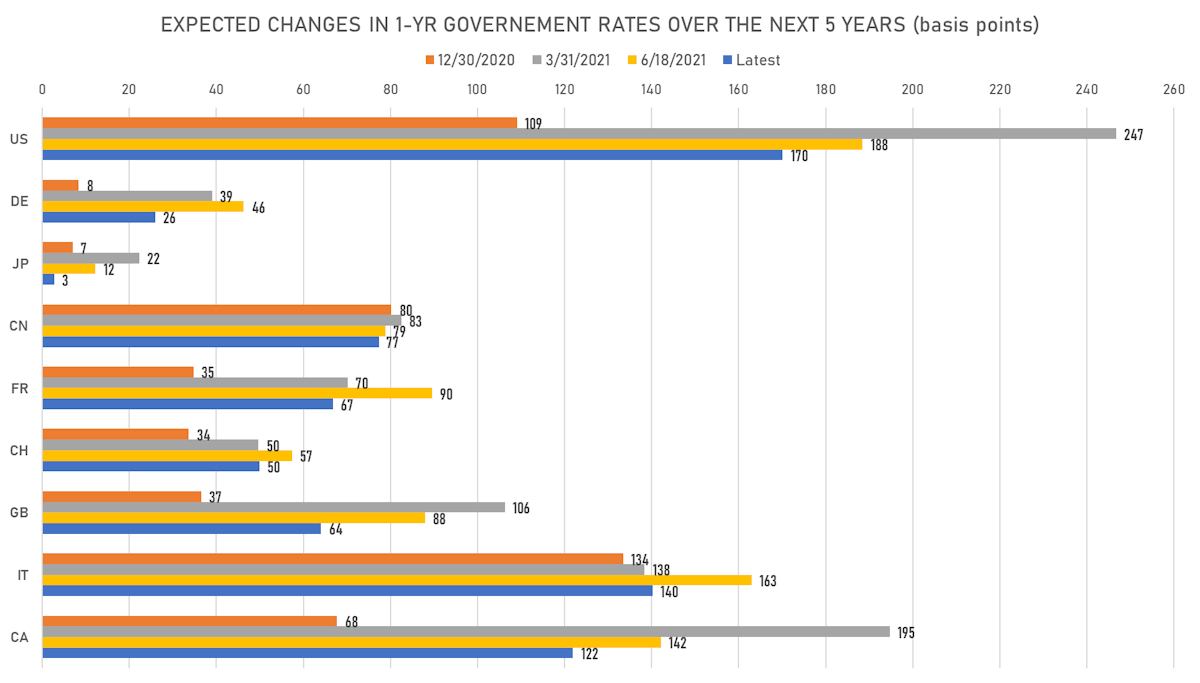

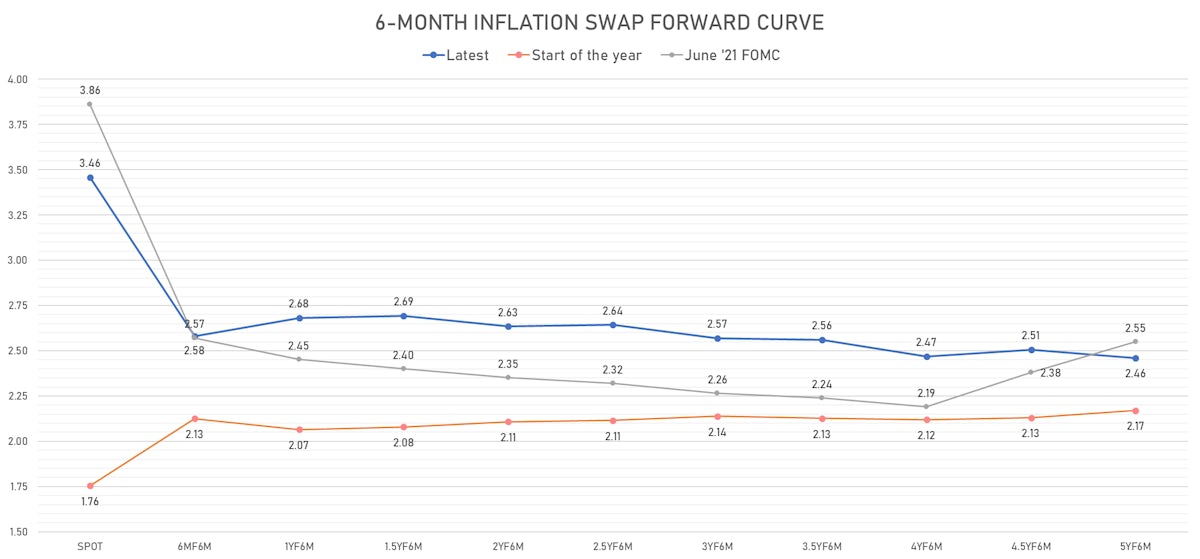

Nominal Rates Up On Higher Inflation Expectations While Real Rates Lag

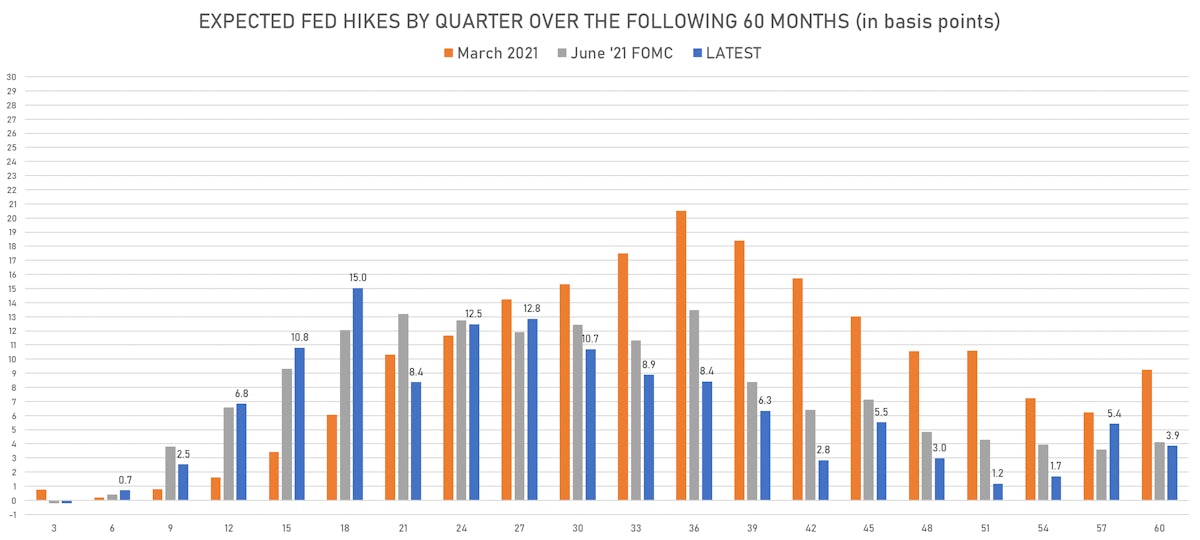

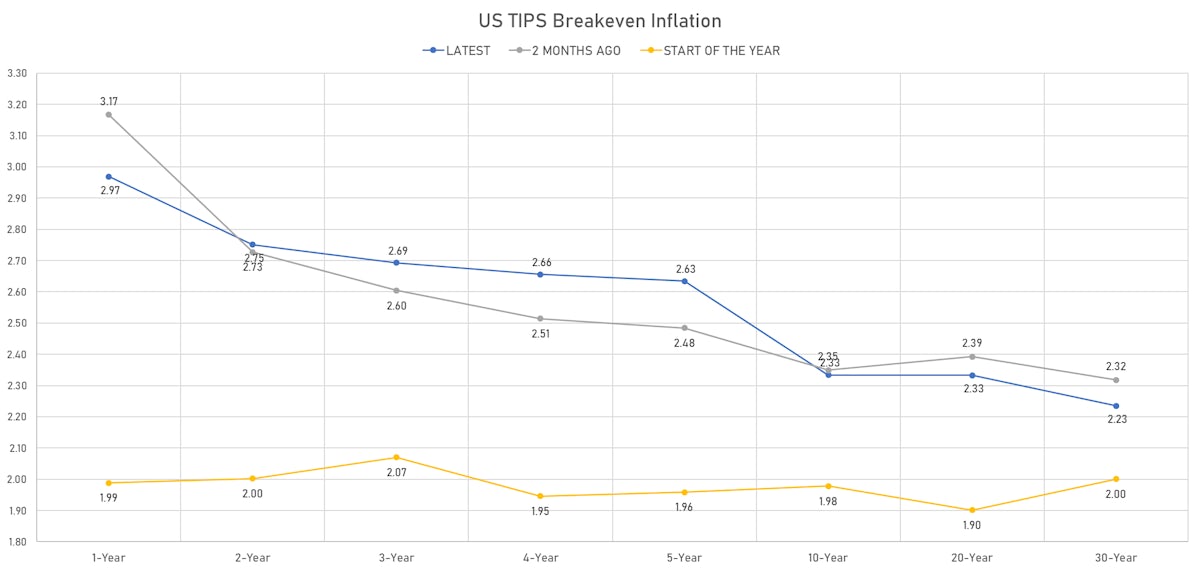

The inflation forward curve has been getting flatter, with medium-term expectations rising, which explains why markets have not materially changed rate hikes expectations despite recent macro data misses and a more dovish tone from Fed governors

Published ET

6-Month CPI Swap Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Money markets: 3-Month USD LIBOR +0.2bp today, now at 0.1238%

- The treasury yield curve steepened, with the 1s10s spread widening 5.0 bp, now at 128.6 bp (YTD change: +48.2bp)

- 1Y: 0.0630% (up 0.3 bp)

- 2Y: 0.2406% (up 1.6 bp)

- 5Y: 0.8243% (up 2.6 bp)

- 7Y: 1.1257% (up 4.5 bp)

- 10Y: 1.3491% (up 5.2 bp)

- 30Y: 1.9564% (up 4.2 bp)

- US treasury curve spreads: 2s5s at 58.4bp (up 1.0bp today), 5s10s at 52.5bp (up 2.6bp today), 10s30s at 60.8bp (down -1.1bp)

- Treasuries butterfly spreads: 2s5s10s at -6.3bp (up 1.6bp today), 5s10s30s at 8.3bp (down -3.7bp)

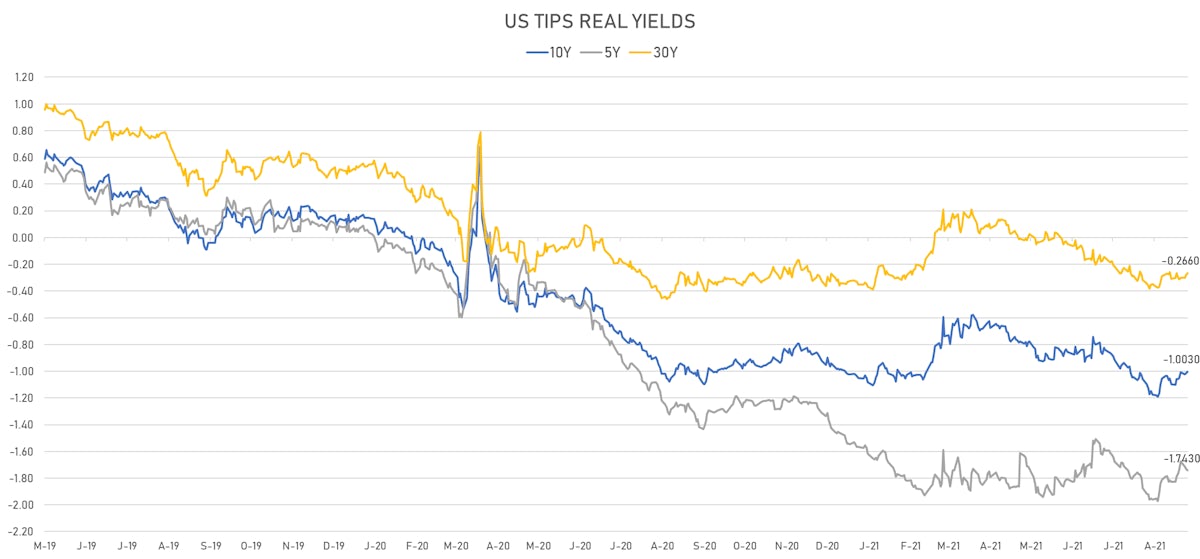

- US 5-Year TIPS Real Yield: -1.5 bp at -1.7430%; 10-Year TIPS Real Yield: +1.3 bp at -1.0030%; 30-Year TIPS Real Yield: +1.5 bp at -0.2660%

HEADLINES

- US$ 61bn 5-year note auction (91282CCW9) went OK with average demand: high yield of 0.831% (0.3bp tail vs 0.828% when issued), non-dealer bidding at 80.2% (vs. 75.8% last month and 75.9% average), bid-to-cover at 2.35x (vs. 5-month average of 2.38x), indirects at 62.70% (vs. 59.21% average), direct bidders at 17.54% (vs. 17.75% last month and 16.97% 5m average), primary dealers at 19.77% (vs 23.82% 5m average)

US MACRO RELEASES

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Jul 2021 (U.S. Census Bureau) at -1.20 % (vs 1.10 % prior)

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.70 % (vs 0.50 % prior), above consensus estimate of 0.50 %

- Manufacturers New Orders, Durable goods total, Change P/P for Jul 2021 (U.S. Census Bureau) at -0.10 % (vs 0.90 % prior), above consensus estimate of -0.30 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 20 Aug (MBA, USA) at 1.60 % (vs -3.90 % prior)

- Mortgage applications, market composite index for W 20 Aug (MBA, USA) at 737.10 (vs 725.40 prior)

- Mortgage applications, market composite index, purchase for W 20 Aug (MBA, USA) at 257.50 (vs 249.90 prior)

- Mortgage applications, market composite index, refinancing for W 20 Aug (MBA, USA) at 3,520.70 (vs 3,490.20 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 20 Aug (MBA, USA) at 3.03 % (vs 3.06 % prior)

US FORWARD RATES

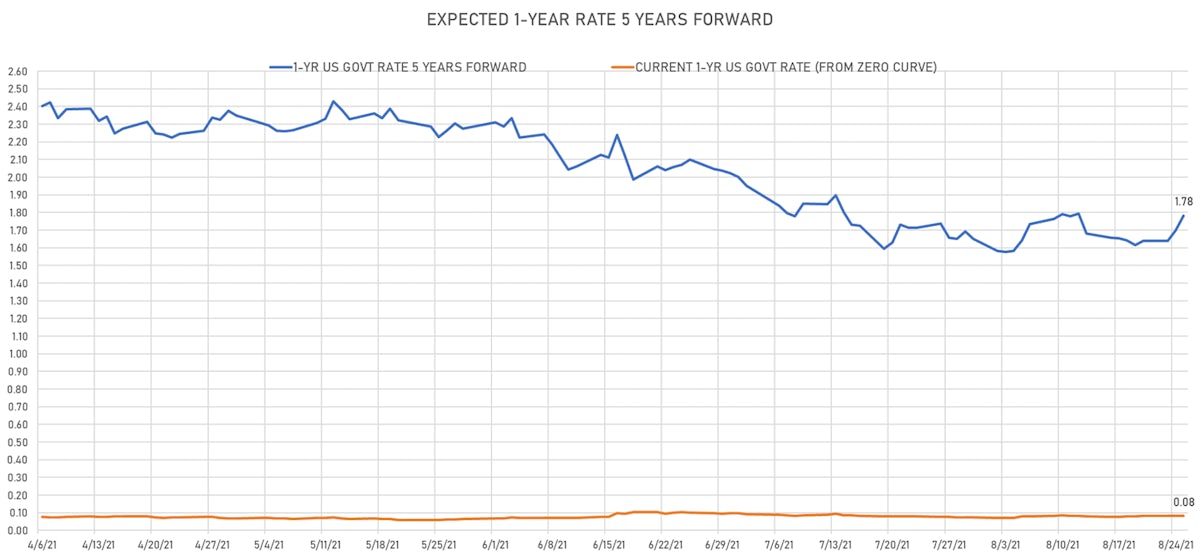

- US Treasury 1-year zero-coupon rate 5 years forward up 8.3 bp, now at 1.7831%

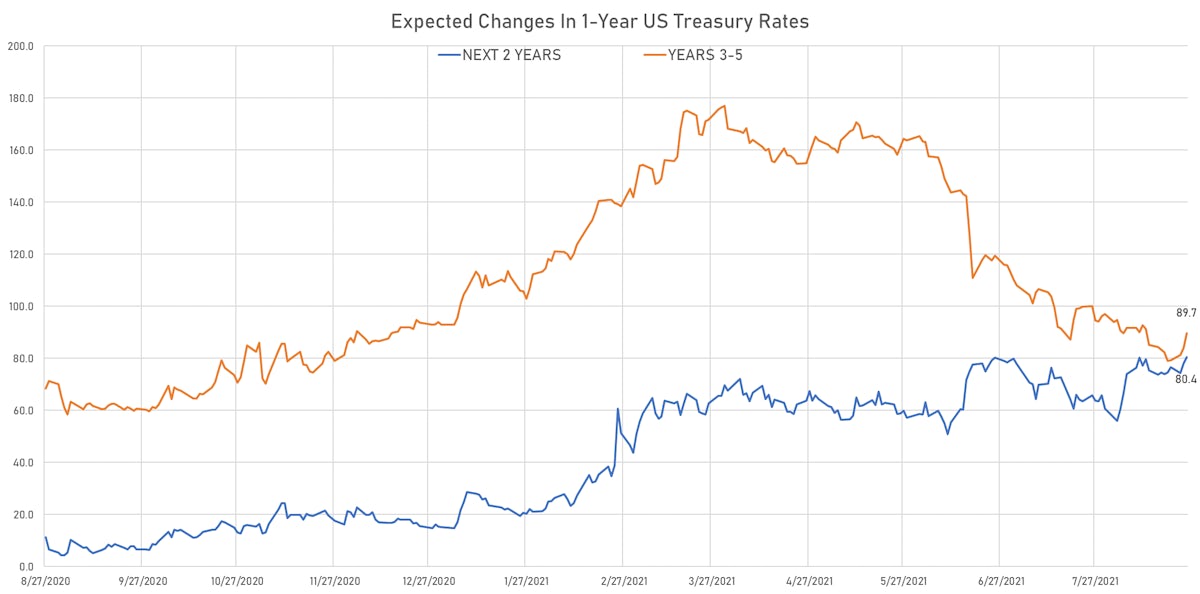

- 1-Year Treasury rates are now expected to increase by 170.1 bp over the next 5 years

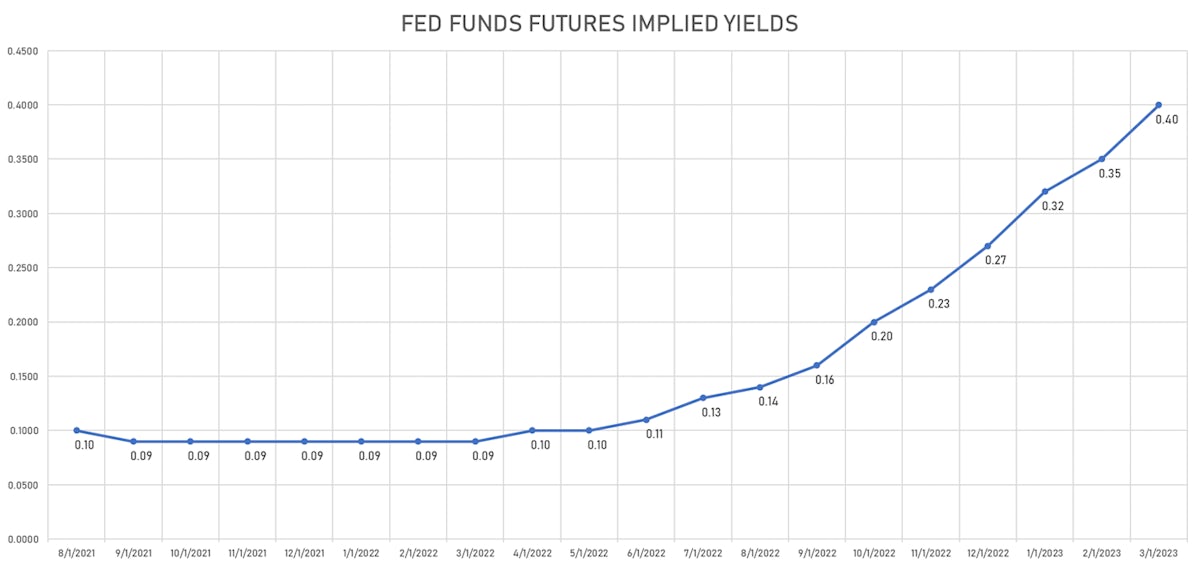

- 3-month Eurodollar futures expected hike of 17.0 bp by the end of 2022 (meaning the market prices 68.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 20.7 bp of rate hikes over the next 18 months (equivalent to 0.83 rate hike) and 89.0 bp over the next 3 years (equivalent to 3.56 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.97% (up 10.6bp); 2Y at 2.75% (up 5.1bp); 5Y at 2.63% (up 4.1bp); 10Y at 2.33% (up 3.8bp); 30Y at 2.23% (up 2.7bp)

- 6-month spot US CPI swap up 10.0 bp to 3.457%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7430%, -1.5 bp today; 10Y at -1.0030%, +1.3 bp today; 30Y at -0.2660%, +1.5 bp today

RATES VOLATILITY & LIQUIDITY

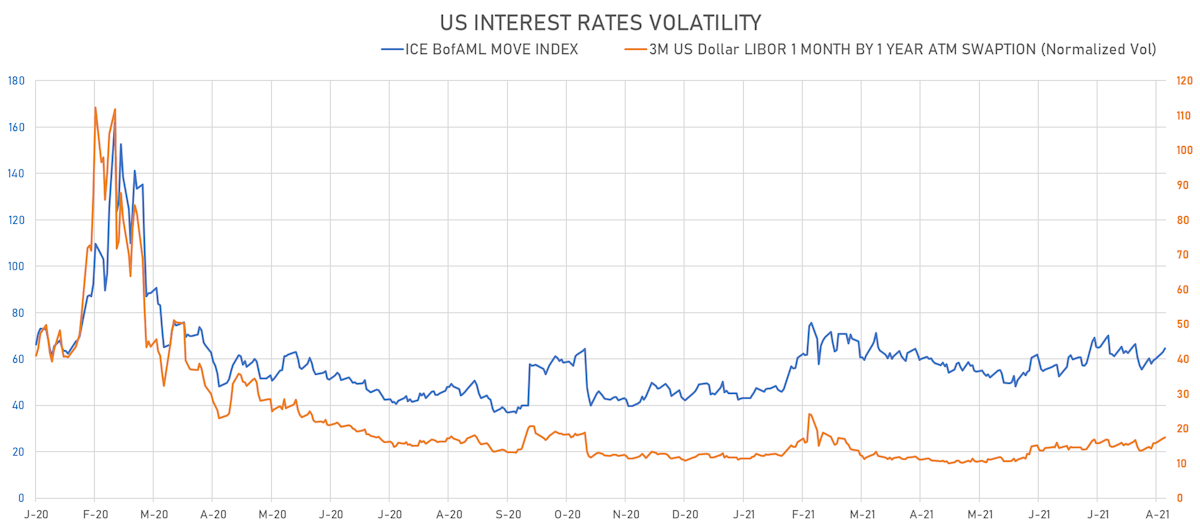

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.3% at 17.5%

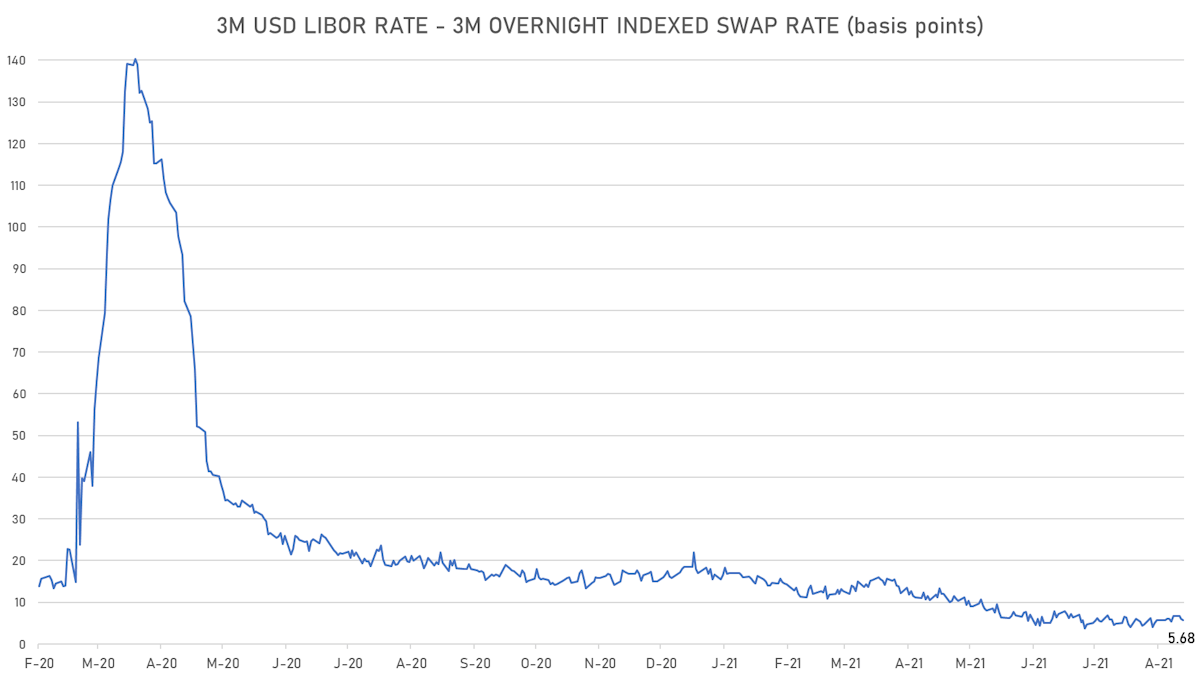

- 3-Month LIBOR-OIS spread down -0.3 bp at 5.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.702% (up 3.5 bp); the German 1Y-10Y curve is 6.1 bp steeper at 24.2bp (YTD change: +9.1 bp)

- Japan 5Y: -0.107% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.0 bp steeper at 14.8bp (YTD change: +1.1 bp)

- China 5Y: 2.689% (down -0.9 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 61.0bp (YTD change: +14.6 bp)

- Switzerland 5Y: -0.644% (up 2.0 bp); the Swiss 1Y-10Y curve is 3.2 bp steeper at 37.3bp (YTD change: +10.9 bp)