Rates

Slight Rise In Rates, Mostly In The Belly Of The Curve, As Jackson Hole Gets Under Way

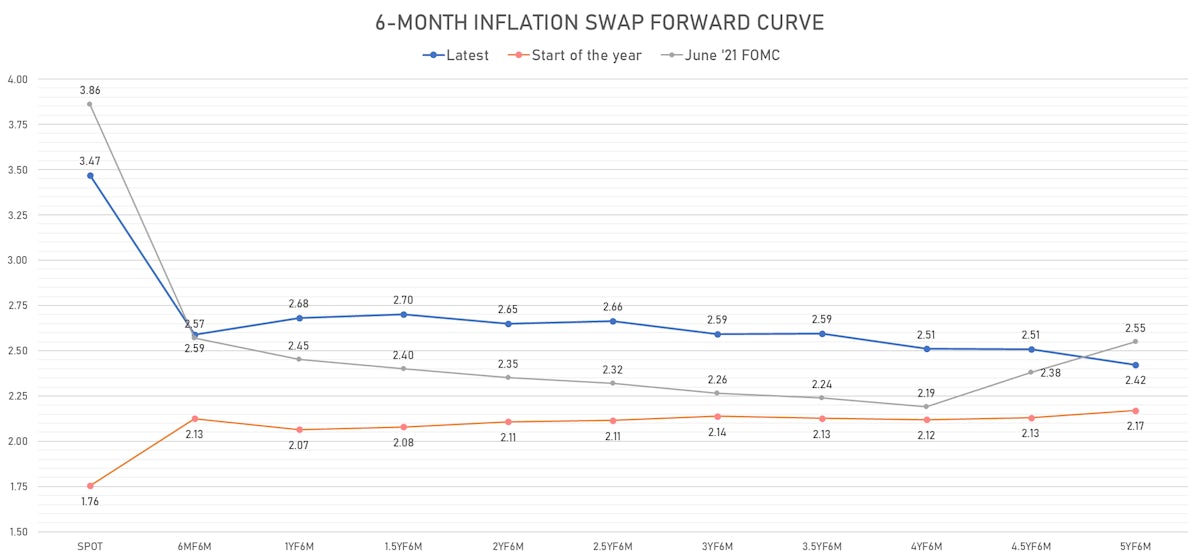

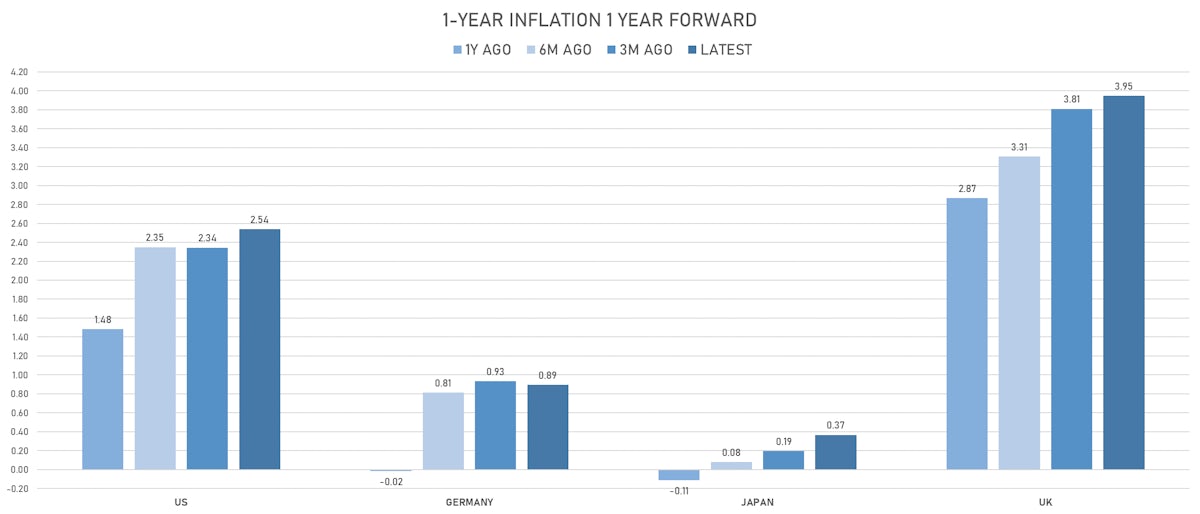

Hawkish comments from Fed governors brought forward the timing of possible rate hikes, which took short-term inflation breakevens down a little

Published ET

Implied Hikes From 1-year US Treasury Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

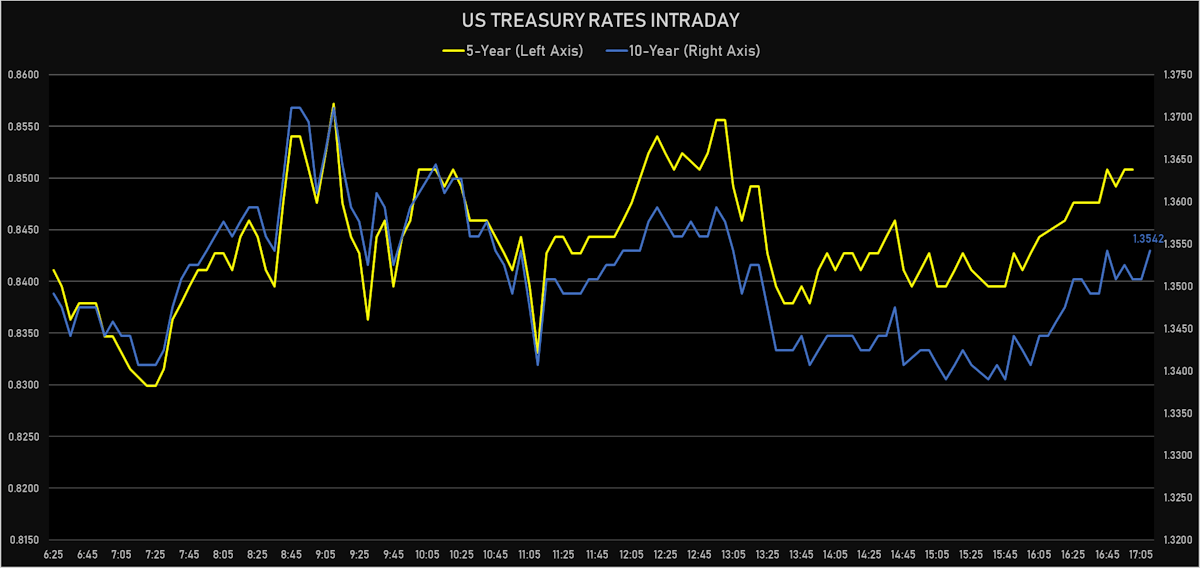

- 3-Month USD LIBOR -0.3bp today, now at 0.1208%

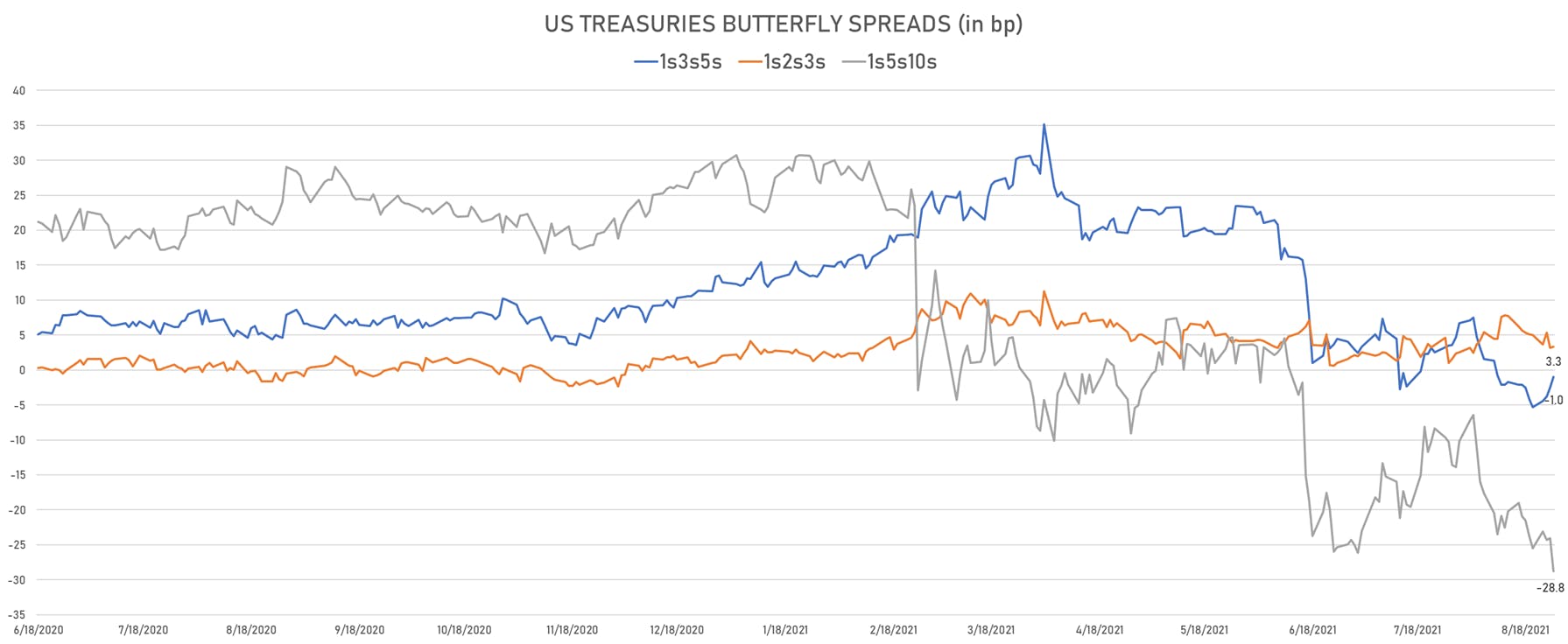

- The treasury yield curve steepened, with the 1s10s spread widening 0.5 bp, now at 128.8 bp (YTD change: +48.4bp)

- 1Y: 0.0660% (unchanged)

- 2Y: 0.2426% (up 0.2 bp)

- 5Y: 0.8508% (up 2.7 bp)

- 7Y: 1.1352% (up 1.0 bp)

- 10Y: 1.3542% (up 0.5 bp)

- 30Y: 1.9496% (down 0.7 bp)

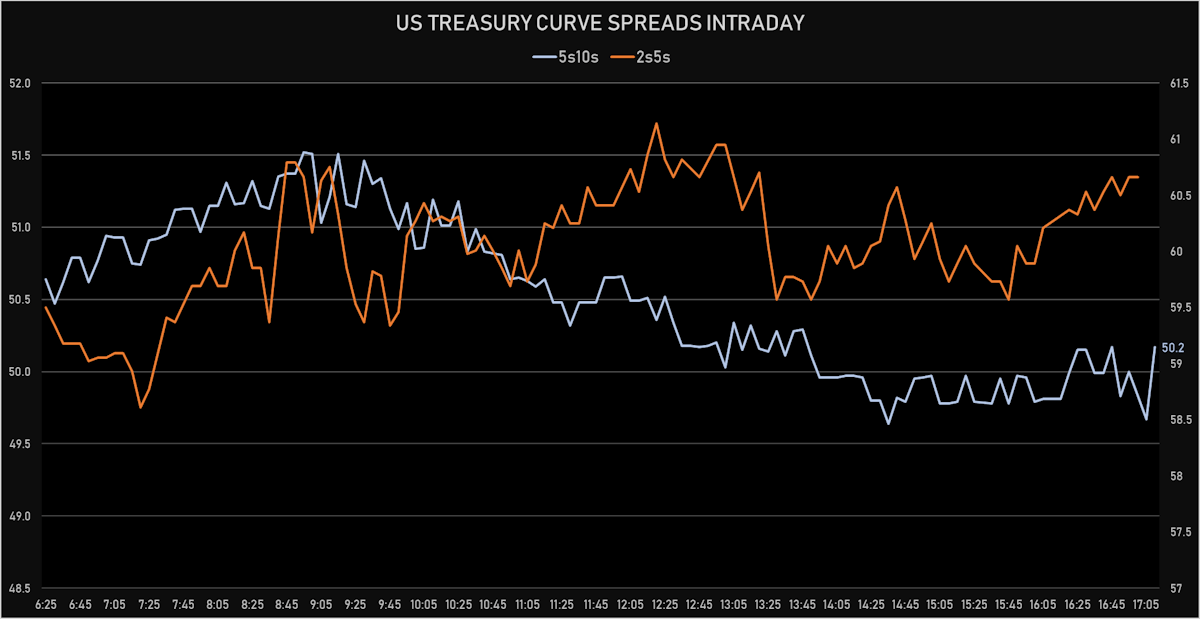

- US treasury curve spreads: 2s5s at 60.8bp (up 2.5bp today), 5s10s at 50.3bp (down -2.1bp), 10s30s at 59.6bp (down -1.2bp)

- Treasuries butterfly spreads: 2s5s10s at -10.9bp (down -4.6bp), 5s10s30s at 9.4bp (up 1.1bp)

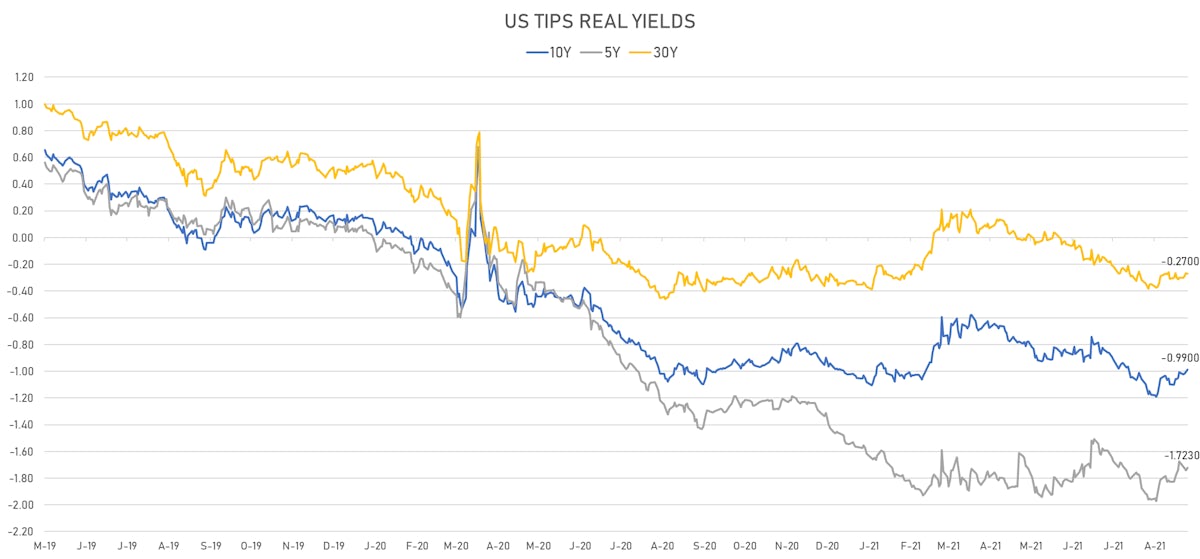

- US 5-Year TIPS Real Yield: +2.0 bp at -1.7230%; 10-Year TIPS Real Yield: +1.3 bp at -0.9900%; 30-Year TIPS Real Yield: -0.4 bp at -0.2700%

HEADLINES

- The US$ 62 bn 7-year note (91282CCV1) auction went OK considering the volatile market background: high yield at 1.155% (a 0.5bp tail vs. 1.150% when issued), bid-to-cover at 2.34x (vs. 2.23x in July and 2.31x five month average), indirects at 61.07 (vs. 58.37 in July and 58.45% 5-months average), directs at 18.86 (vs. 20.02% 5m average), primary dealers at 20.08% (vs. 22.18% in July and 21.53% 5m average)

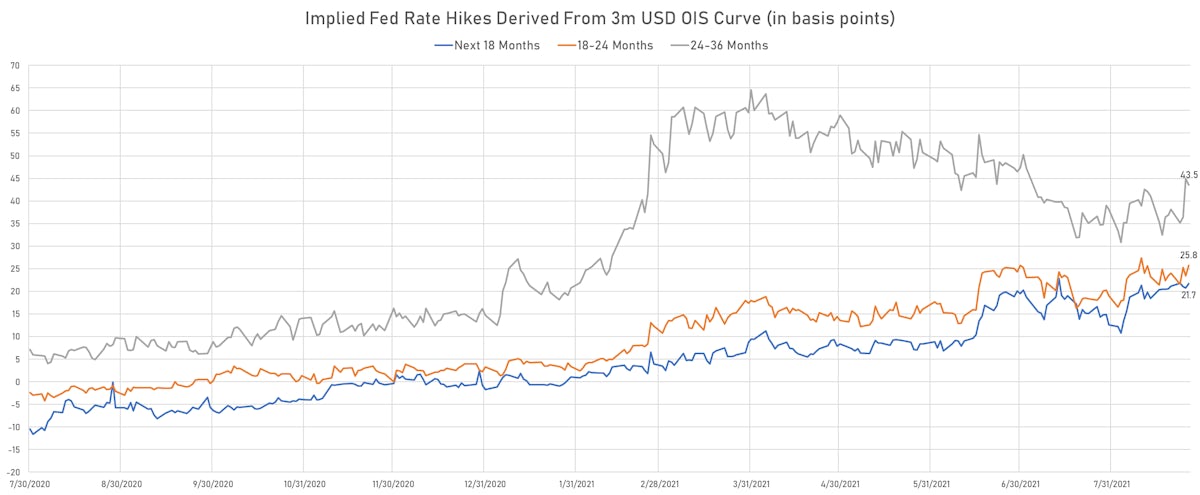

- Fed hawks Kaplan and Bullard said in TV interviews that they want taper to start soon and the process to be done in the first half of next year, in order to have the option to raise rates if needed (looking at inflation)

US MACRO RELEASES

- Corporate Profits, With IVA and CC Adj, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 9.70 % (vs 1.70 % prior)

- GDP, Total-2nd Estimate, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.60 % (vs 6.50 % prior), below consensus estimate of 6.70 %

- GDP Sales, Prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 7.90 % (vs 7.70 % prior)

- Implicit Price Deflator, GDP, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.20 % (vs 6.10 % prior), above consensus estimate of 6.00 %

- Jobless Claims, National, Continued for W 14 Aug (U.S. Dept. of Labor) at 2.86 Mln (vs 2.82 Mln prior), above consensus estimate of 2.79 Mln

- Jobless Claims, National, Initial for W 21 Aug (U.S. Dept. of Labor) at 353.00 k (vs 348.00 k prior), above consensus estimate of 350.00 k

- Jobless Claims, National, Initial, four week moving average for W 21 Aug (U.S. Dept. of Labor) at 366.50 k (vs 377.75 k prior)

- Kansas Fed, Current composite index for Aug 2021 (FED, Kansas) at 29.00 (vs 30.00 prior)

- Kansas Fed, Current production index for Aug 2021 (FED, Kansas) at 22.00 (vs 41.00 prior)

- Personal Consumption Expenditure, Profits after tax total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 11.90 % (vs 11.80 % prior)

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.10 % (vs 6.10 % prior), in line with consensus estimate

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.50 % (vs 6.40 % prior)

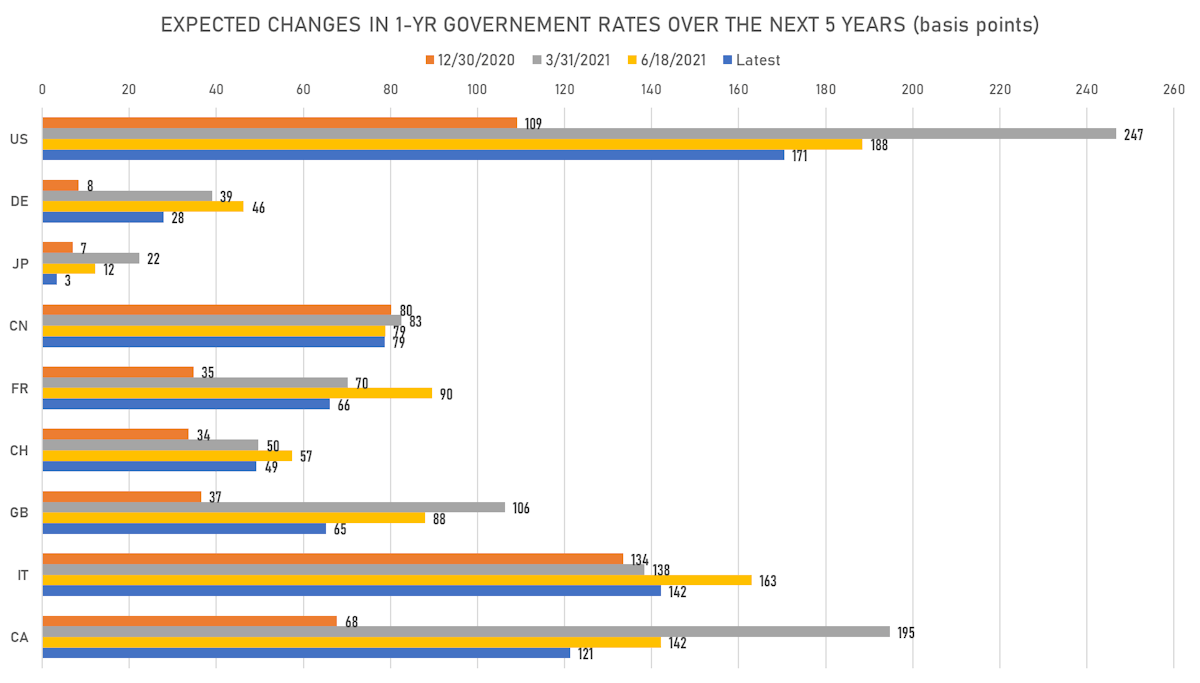

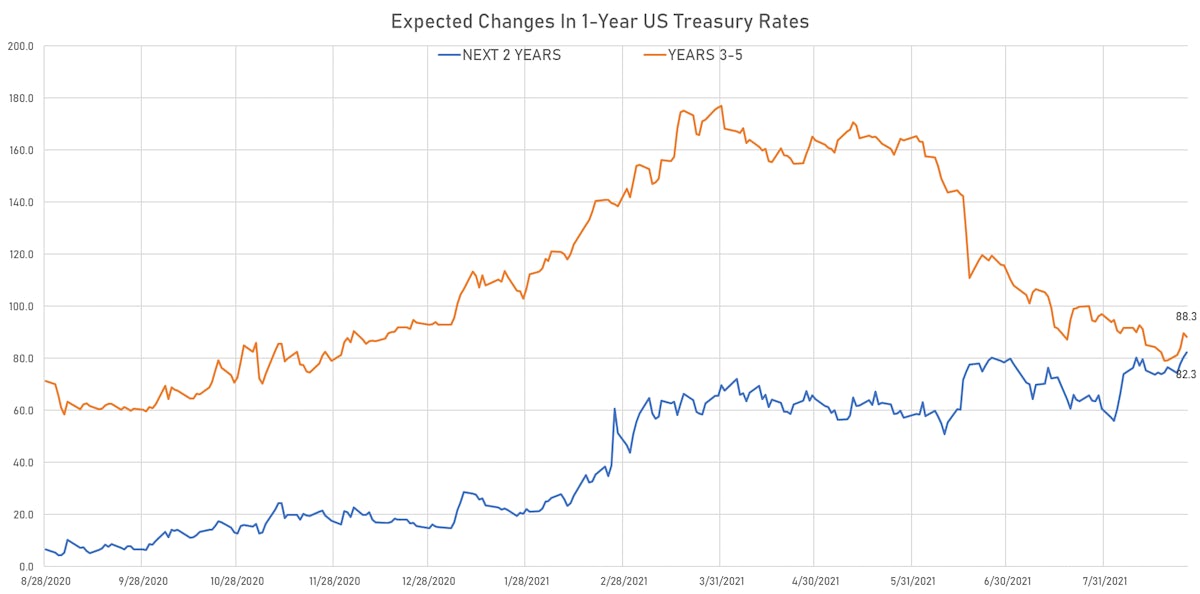

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 0.4 bp, now at 1.7871%

- 1-Year Treasury rates are now expected to increase by 170.6 bp over the next 5 years

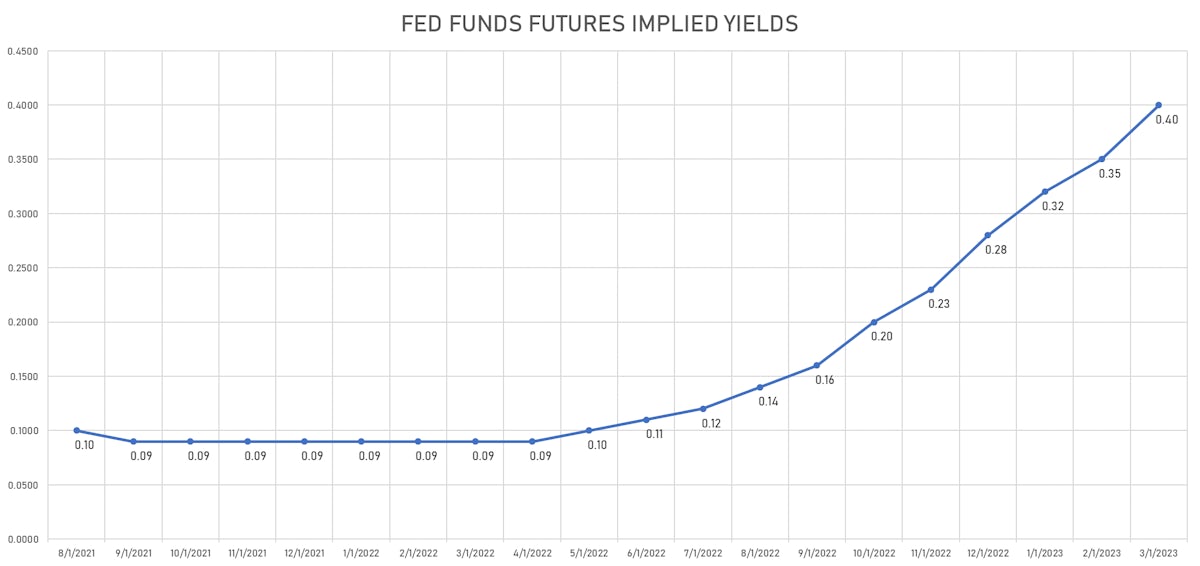

- 3-month Eurodollar futures expected hike of 17.7 bp by the end of 2022 (meaning the market prices 70.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 21.7 bp of rate hikes over the next 18 months (equivalent to 0.87 rate hike) and 91.0 bp over the next 3 years (equivalent to 3.64 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.95% (down -1.9bp); 2Y at 2.75% (down -0.6bp); 5Y at 2.63% (down -0.5bp); 10Y at 2.32% (down -0.9bp); 30Y at 2.23% (down -0.3bp)

- 6-month spot US CPI swap up 1.3 bp to 3.469%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7230%, +2.0 bp today; 10Y at -0.9900%, +1.3 bp today; 30Y at -0.2700%, -0.4 bp today

RATES VOLATILITY & LIQUIDITY

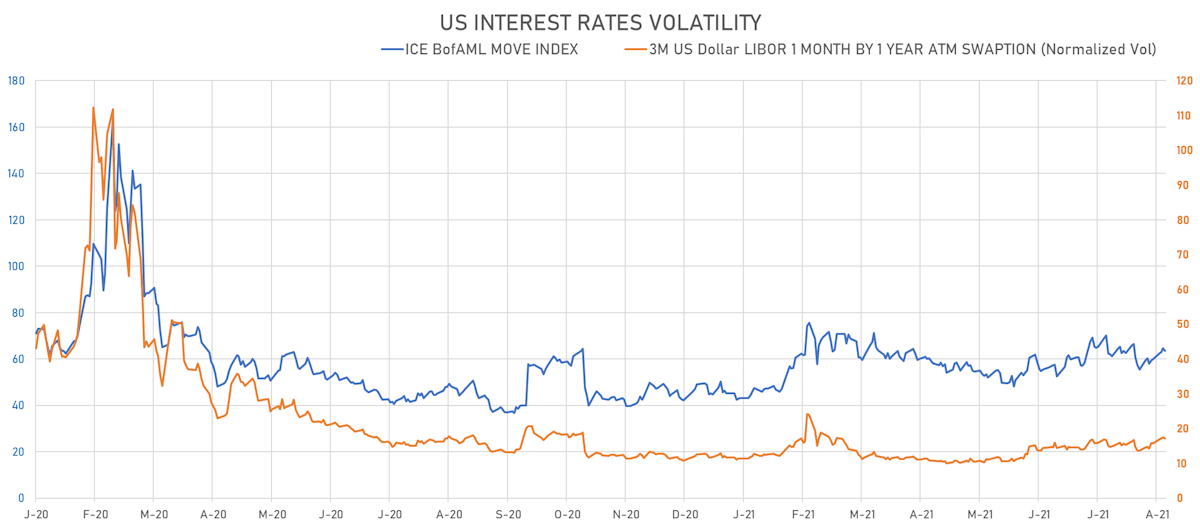

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.3% at 17.2%

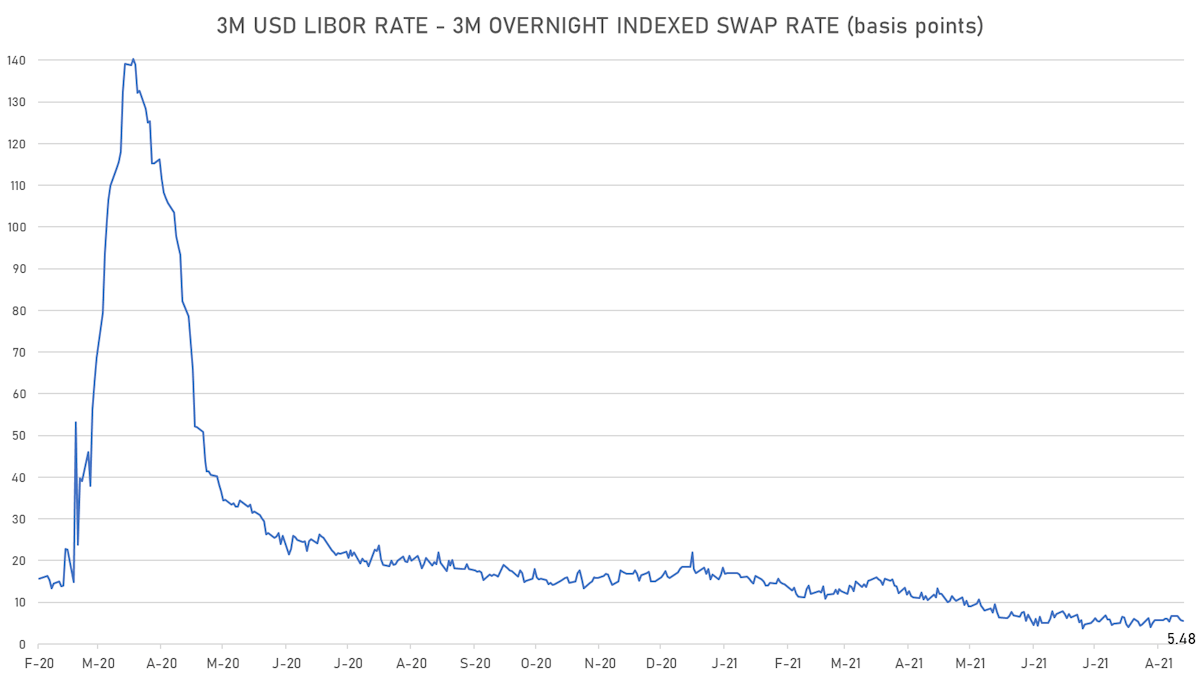

- 3-Month LIBOR-OIS spread down -0.2 bp at 5.5 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.697% (up 0.1 bp); the German 1Y-10Y curve is 0.2 bp steeper at 25.3bp (YTD change: +9.3 bp)

- Japan 5Y: -0.107% (unchanged); the Japanese 1Y-10Y curve is unchanged at 14.9bp (YTD change: +1.1 bp)

- China 5Y: 2.707% (up 1.8 bp); the Chinese 1Y-10Y curve is 0.6 bp flatter at 60.4bp (YTD change: +14.0 bp)

- Switzerland 5Y: -0.649% (down -0.5 bp); the Swiss 1Y-10Y curve is 1.0 bp flatter at 37.3bp (YTD change: +9.9 bp)