US Rates Fall, Real Rates Fall Harder As Inflation Breakevens Rise

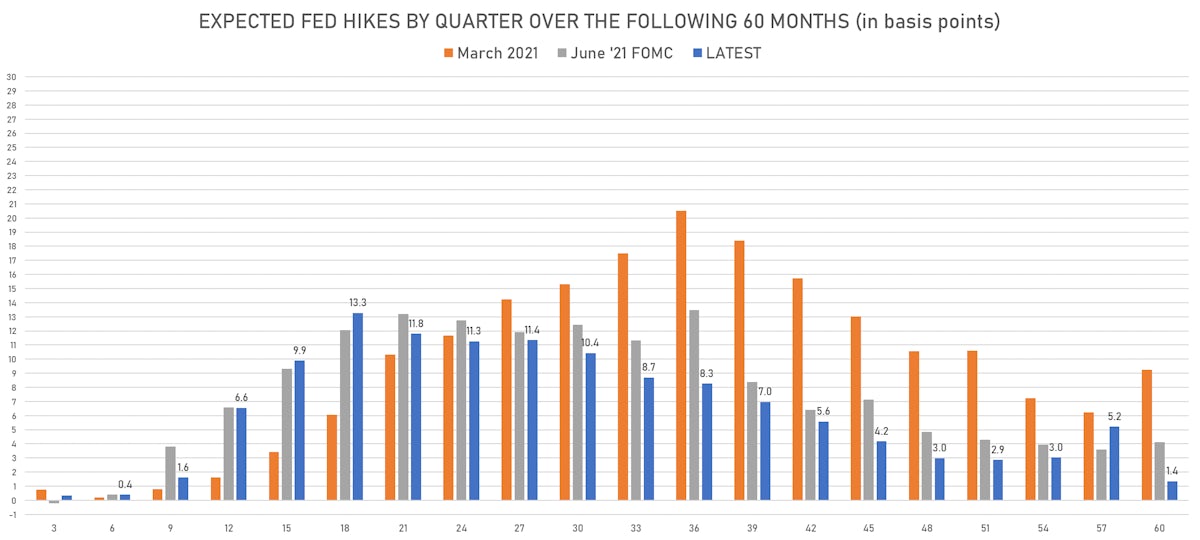

No surprises from Jackson Hole, as Powell doesn't commit to any path, confirms that the Fed is much less hawkish at the top than some of the vocal members heard this week

Published ET

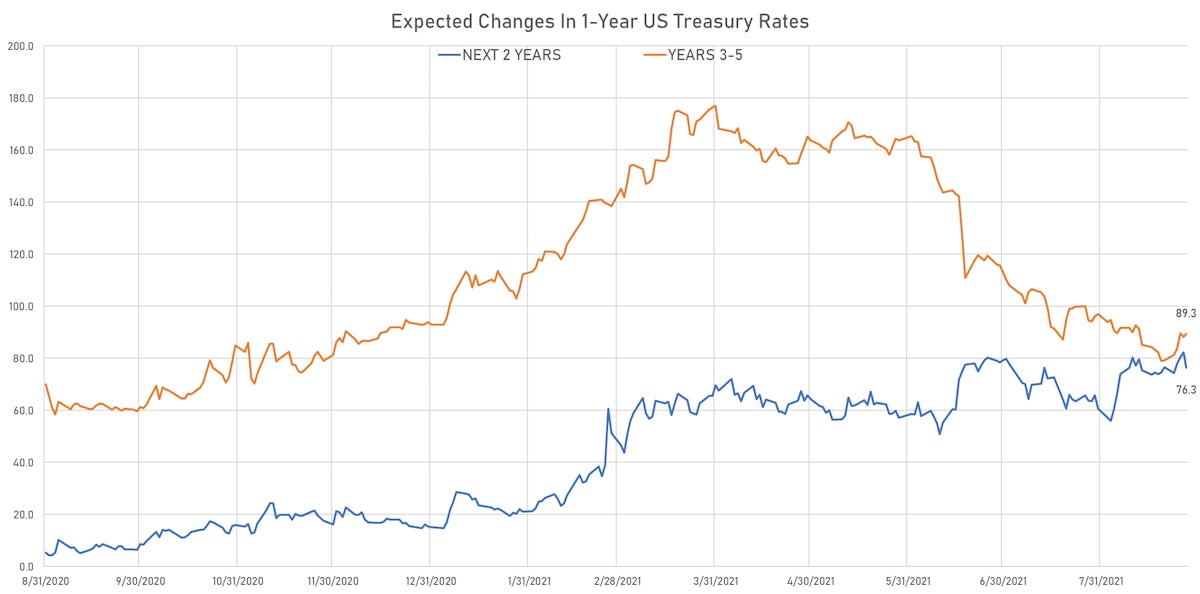

Rates Hikes Expectations Over The Next 3 Years Fell Today | Sources: ϕpost, Refinitiv data

JACKSON HOLE WRAP-UP

Nothing new from Powell's speech but it's worth summarizing the key messages:

- Strong reinforcement of the distinction between asset purchases and the Fed funds rate policy: tapering is not a signal that rate hikes are coming

- It is not clear yet whether inflation is anything but transitory, a pushback against some of the more hawkish Fed governors

- The data will determine if / when interest rates need to raised, with greater gains needed on the jobs front before rate normalization

Sell-side economists still see a formal tapering announcement at the November FOMC as the most likely scenario: David Mericle at GS for example sees probabilities unchanged (45% at the November FOMC, 35% in December, 30% in early 2022).

Data over the next few weeks will be critical as markets await the Fed's updated economic projections / dot plot, which will be released after the September 21-22 FOMC.

US MARKET SUMMARY

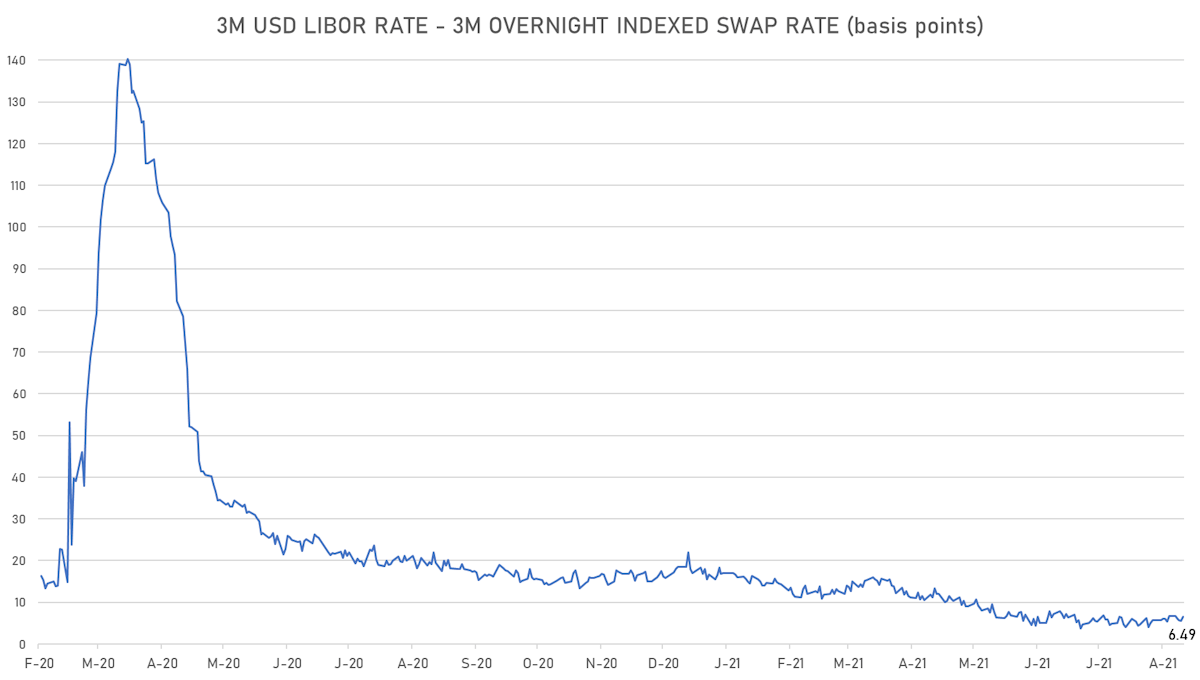

- 3-Month USD LIBOR -0.1bp today, now at 0.1199%

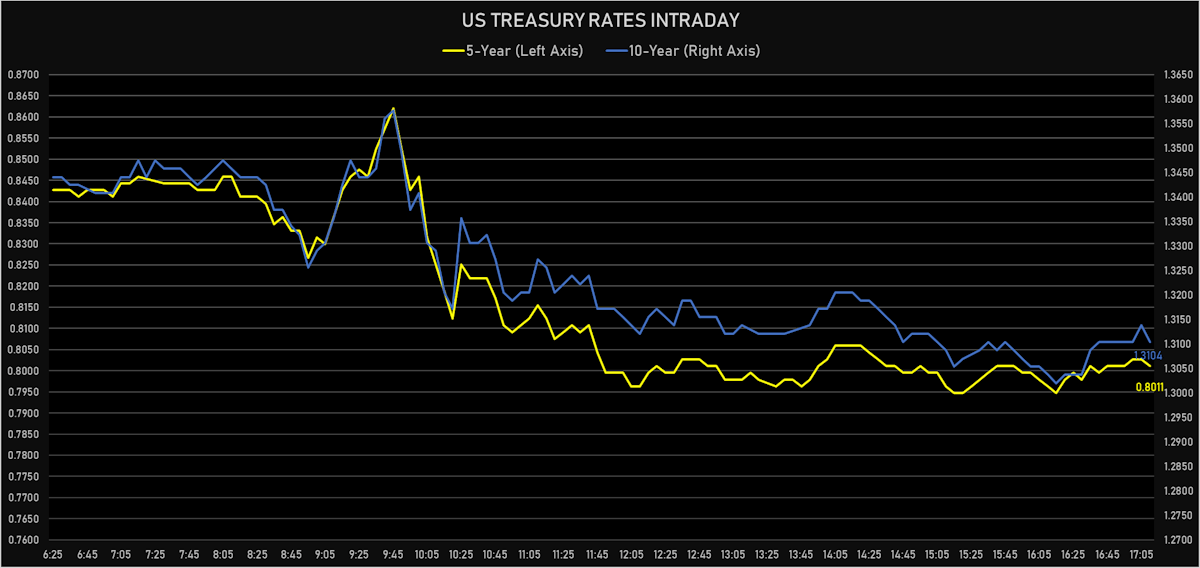

- The treasury yield curve flattened, with the 1s10s spread tightening -4.4 bp, now at 124.4 bp (YTD change: +44.0bp)

- 1Y: 0.0660% (unchanged 0.0 bp)

- 2Y: 0.2190% (down 2.4 bp)

- 5Y: 0.8011% (down 5.0 bp)

- 7Y: 1.0971% (down 3.8 bp)

- 10Y: 1.3104% (down 4.4 bp)

- 30Y: 1.9208% (down 2.9 bp)

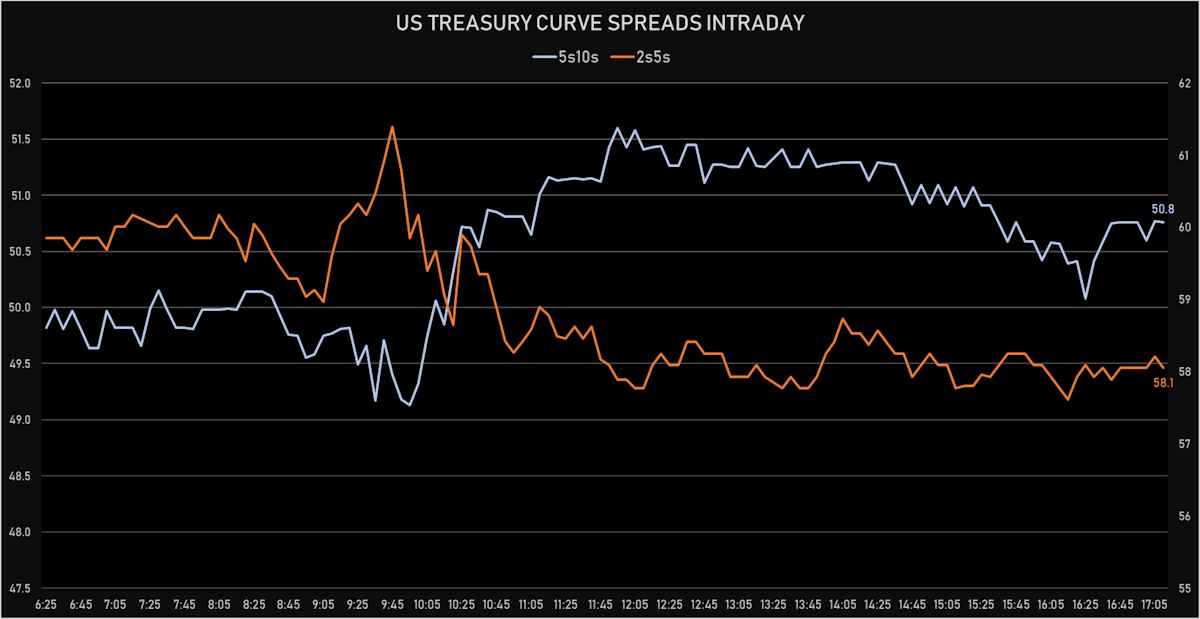

- US treasury curve spreads: 2s5s at 58.2bp (down -2.6bp), 5s10s at 50.9bp (up 0.6bp today), 10s30s at 61.1bp (up 1.4bp today)

- Treasuries butterfly spreads: 2s5s10s at -7.7bp (up 3.2bp today), 5s10s30s at 9.8bp (up 0.4bp)

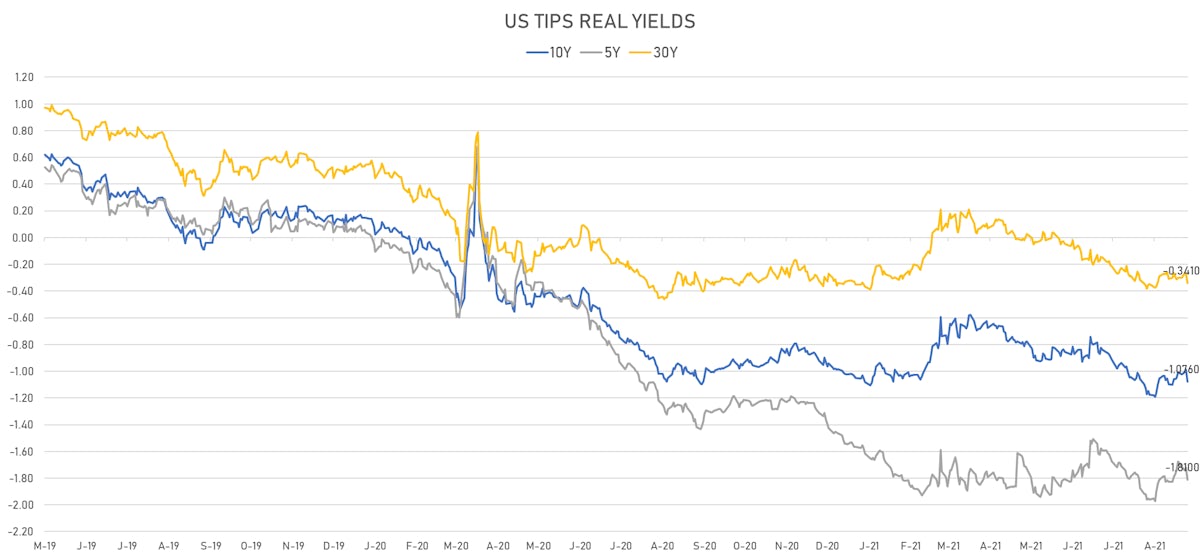

- US 5-Year TIPS Real Yield: -8.7 bp at -1.8100%; 10-Year TIPS Real Yield: -8.6 bp at -1.0760%; 30-Year TIPS Real Yield: -7.1 bp at -0.3410%

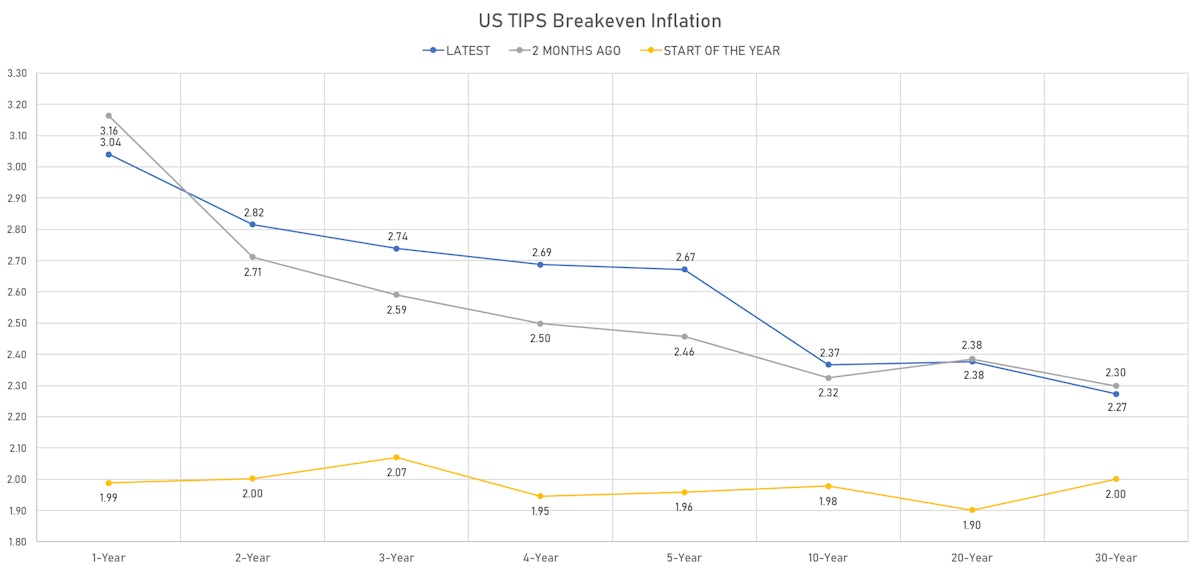

1-Year US TIPS breakeven inflation rose sharply after Powell speech

US MACRO RELEASES

- Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 1.10 % (vs 0.10 % prior), above consensus estimate of 0.20 %

- Personal Consumption Expenditure, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at -0.10 % (vs 0.50 % prior)

- Personal Consumption Expenditure, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 1.00 % prior), in line with consensus estimate

- Personal Consumption Expenditure, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 0.40 % (vs 0.50 % prior)

- Personal Consumption Expenditure, Change Y/Y for Jul 2021 (BEA, US Dept. Of Com) at 4.20 % (vs 4.00 % prior)

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Jul 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 0.40 % prior), in line with consensus estimate

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for Jul 2021 (BEA, US Dept. Of Com) at 3.60 % (vs 3.50 % prior), in line with consensus estimate

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Jul 2021 (Fed Resrv, Dallas) at 3.20 % (vs 2.30 % prior)

- Retail Inventories Advance, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.50 % (vs 0.50 % prior)

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Aug 2021 (UMICH, Survey) at 2.90 % (vs 3.00 % prior)

- 1 Year Inflation Expectations (median) for Aug 2021 (UMICH, Survey) at 4.60 % (vs 4.60 % prior)

- University of Michigan, Consumer Expectations Index, Volume Index for Aug 2021 (UMICH, Survey) at 65.10 (vs 65.20 prior)

- University of Michigan, Consumer Sentiment Index, Volume Index for Aug 2021 (UMICH, Survey) at 70.30 (vs 70.20 prior), below consensus estimate of 70.70

- University of Michigan, Current Conditions Index, Volume Index for Aug 2021 (UMICH, Survey) at 78.50 (vs 77.90 prior)

- US Adv Goods Trade Balance, Current Prices for Jul 2021 (U.S. Census Bureau) at -86.38 Bln USD (vs -92.05 Bln USD prior)

- Wholesale Inventories Advance, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.60 % (vs 1.10 % prior)

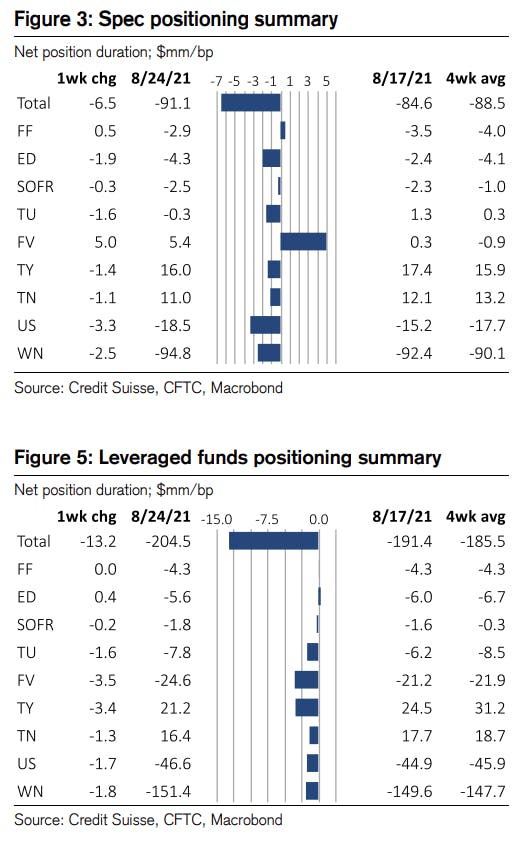

WEEKLY CFTC SPEC POSITIONING

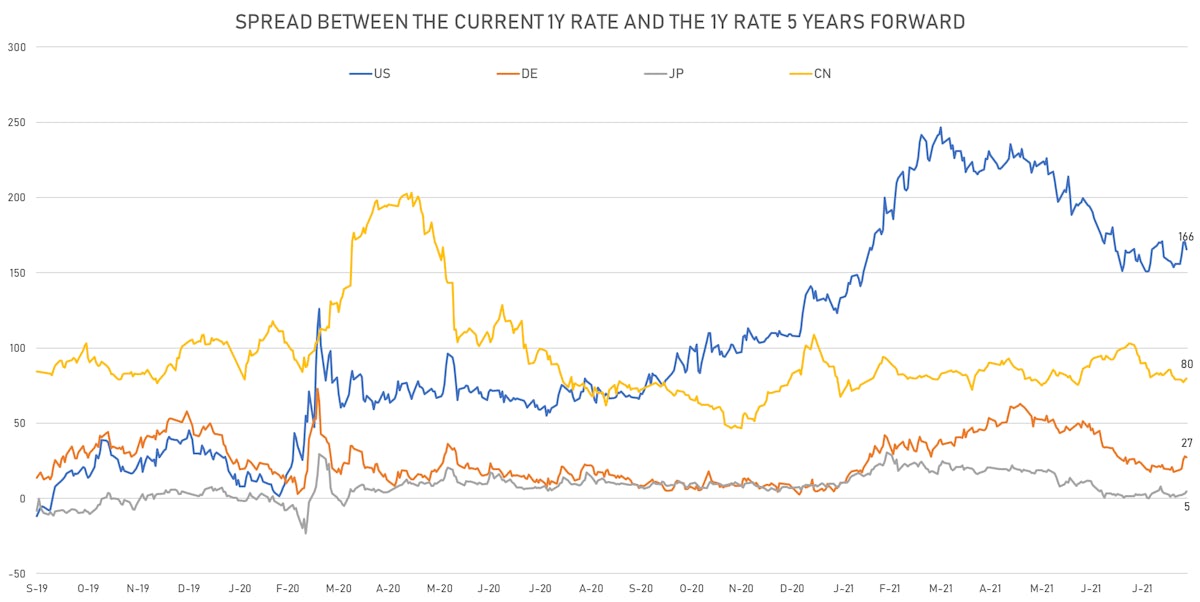

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 5.3 bp, now at 1.7345%

- 1-Year Treasury rates are now expected to increase by 165.6 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.0 bp by the end of 2022 (meaning the market prices 60.0% chance of a 25bp hike by end of 2022, down from close to 70% earlier this week)

- The 3-month USD OIS forward curve prices in 18.8 bp of rate hikes over the next 18 months (equivalent to 0.75 rate hike) and 85.6 bp over the next 3 years (equivalent to 3.42 rate hikes)

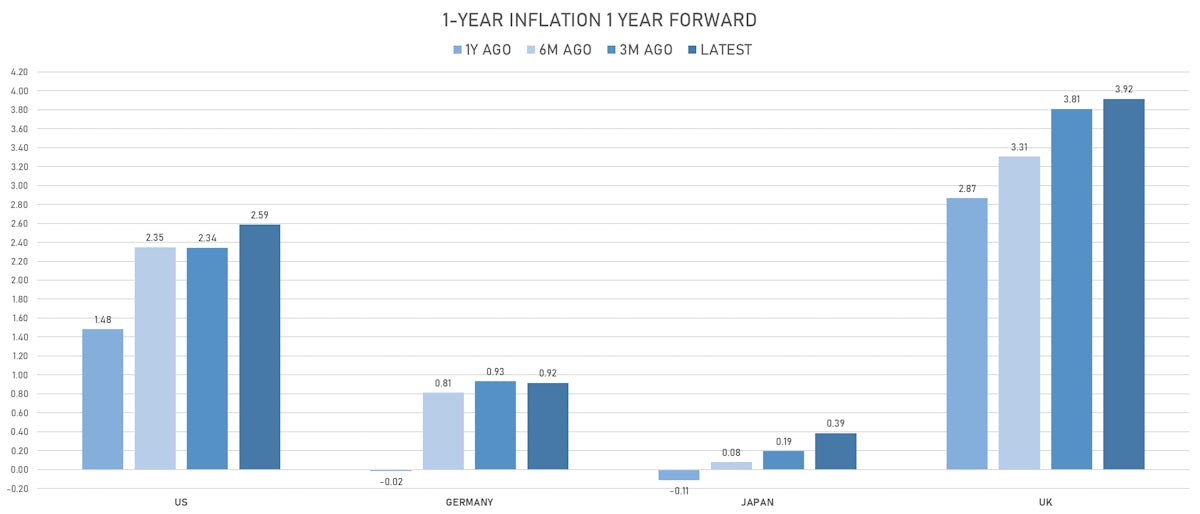

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.04% (up 9.0bp); 2Y at 2.82% (up 7.0bp); 5Y at 2.67% (up 4.2bp); 10Y at 2.37% (up 4.2bp); 30Y at 2.27% (up 4.2bp)

- 6-month spot US CPI swap up 1.0 bp to 3.479%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.8100%, -8.7 bp today; 10Y at -1.0760%, -8.6 bp today; 30Y at -0.3410%, -7.1 bp today

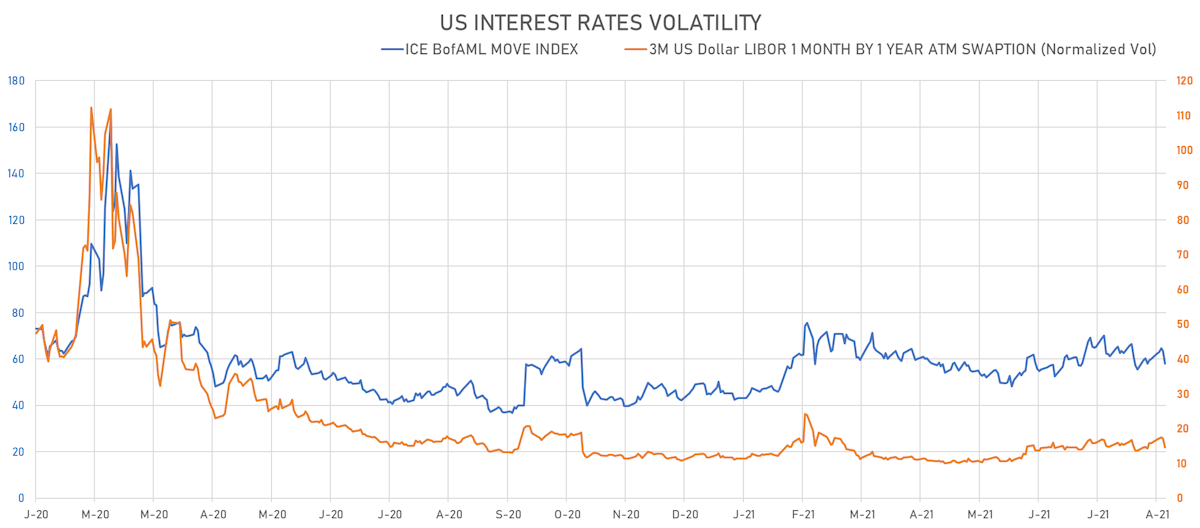

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.7% at 14.5%

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.5 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.708% (down -0.3 bp); the German 1Y-10Y curve is 0.4 bp flatter at 23.6bp (YTD change: +8.9 bp)

- Japan 5Y: -0.102% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 15.4bp (YTD change: +1.6 bp)

- China 5Y: 2.697% (down -1.0 bp); the Chinese 1Y-10Y curve is 2.8 bp steeper at 63.2bp (YTD change: +16.8 bp)

- Switzerland 5Y: -0.645% (up 0.4 bp); the Swiss 1Y-10Y curve is 4.9 bp steeper at 37.2bp (YTD change: +14.8 bp)