Rates

Huge ADP Miss Spooks Rates, With Labor Market Seemingly Slowing In August

Sell-side analysts made downward revisions to their nonfarm payroll estimates, with Goldman now at +500k (for month-on-month seasonally adjusted data) and private payroll forecast at +350k, both down 100k from prior forecasts

Published ET

Rates Hikes Priced Into The 3-month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.1bp today, now at 0.1189%

- The treasury yield curve flattened, with the 1s10s spread tightening -0.6 bp, now at 123.1 bp (YTD change: +42.6bp)

- 1Y: 0.0680% (down 0.2 bp)

- 2Y: 0.2114% (unchanged)

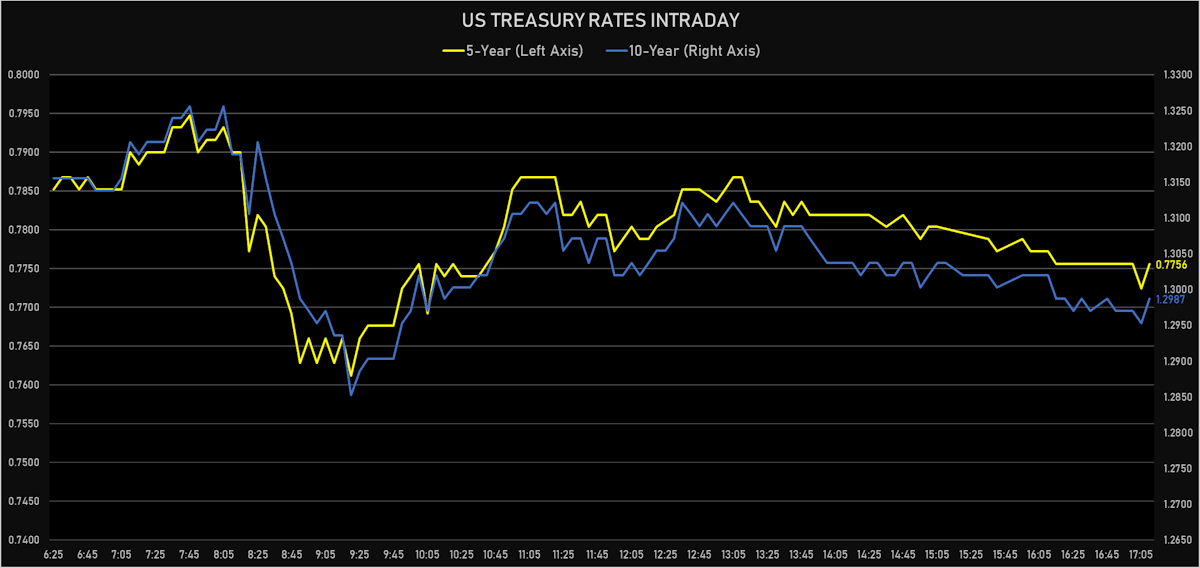

- 5Y: 0.7756% (unchanged)

- 7Y: 1.0773% (down 0.8 bp)

- 10Y: 1.2987% (down 0.8 bp)

- 30Y: 1.9147% (down 1.3 bp)

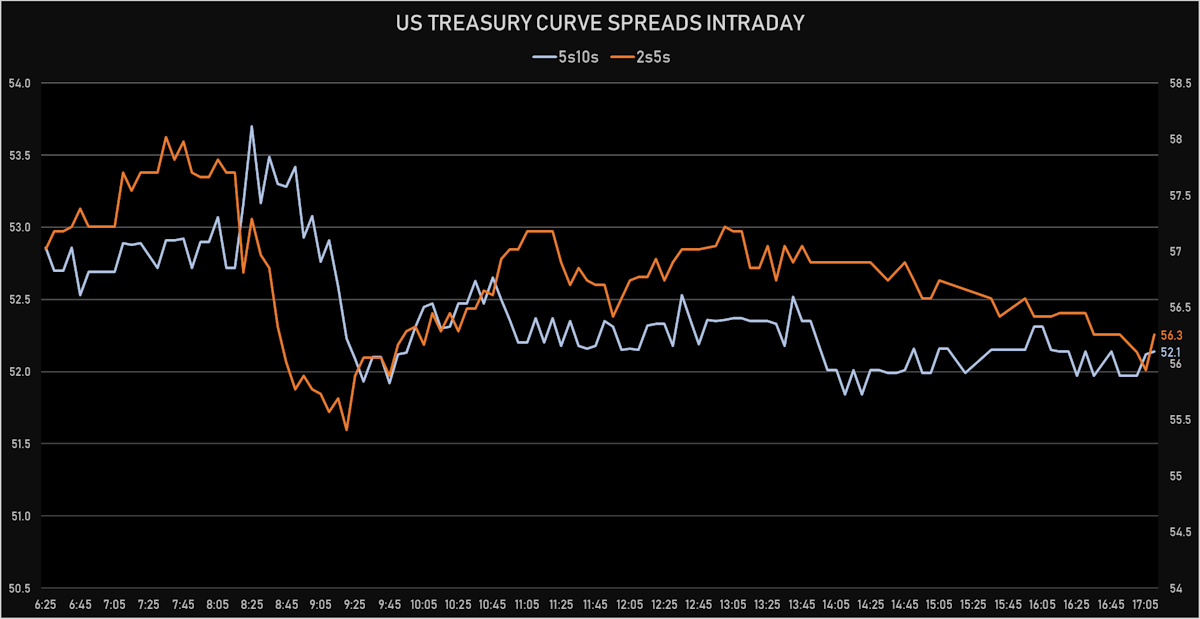

- US treasury curve spreads: 2s5s at 56.5bp (unchanged), 5s10s at 52.3bp (down -0.9bp), 10s30s at 61.6bp (down -0.5bp)

- Treasuries butterfly spreads: 2s5s10s at -4.7bp (down -1.0bp), 5s10s30s at 9.1bp (up 0.1bp)

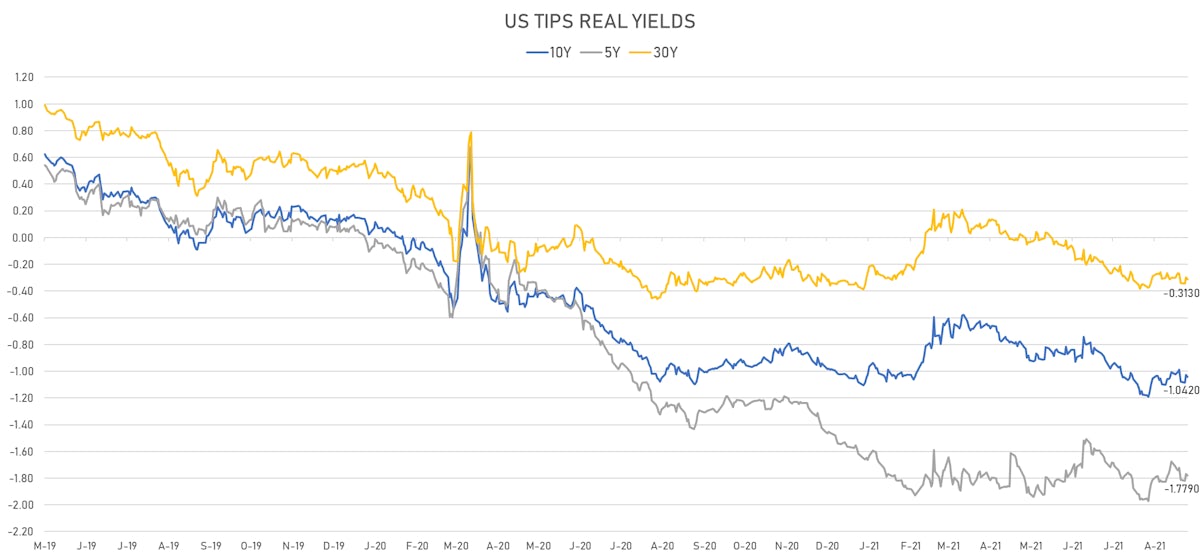

- US 5-Year TIPS Real Yield: -1.1 bp at -1.7790%; 10-Year TIPS Real Yield: -1.6 bp at -1.0420%; 30-Year TIPS Real Yield: -1.6 bp at -0.3130%

US MACRO RELEASES

- ADP total nonfarm private employment (estimate), Absolute change for Aug 2021 (ADP - Automatic Data) at 374k (vs 330k prior), below consensus estimate of 613k

- Atlanta Fed Q3 GDPNow tracker 5.3% vs 5.1% prior after ISM Manufacturing and Construction Spending data

- Construction Spending, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.30 % (vs 0.10 % prior), above consensus estimate of 0.20 %

- ISM Manufacturing, Employment for Aug 2021 (ISM, United States) at 49.00 (vs 52.90 prior)

- ISM Manufacturing, New orders for Aug 2021 (ISM, United States) at 66.70 (vs 64.90 prior)

- ISM Manufacturing, PMI total for Aug 2021 (ISM, United States) at 59.90 (vs 59.50 prior), above consensus estimate of 58.60

- ISM Manufacturing, Prices for Aug 2021 (ISM, United States) at 79.40 (vs 85.70 prior), below consensus estimate of 83.80

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 27 Aug (MBA, USA) at -2.40 % (vs 1.60 % prior)

- Mortgage applications, market composite index for W 27 Aug (MBA, USA) at 719.40 (vs 737.10 prior)

- Mortgage applications, market composite index, purchase for W 27 Aug (MBA, USA) at 259.00 (vs 257.50 prior)

- Mortgage applications, market composite index, refinancing for W 27 Aug (MBA, USA) at 3,385.80 (vs 3,520.70 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 27 Aug (MBA, USA) at 3.03 % (vs 3.03 % prior)

- PMI, Manufacturing Sector, Total, Final for Aug 2021 (Markit Economics) at 61.10 (vs 61.20 prior)

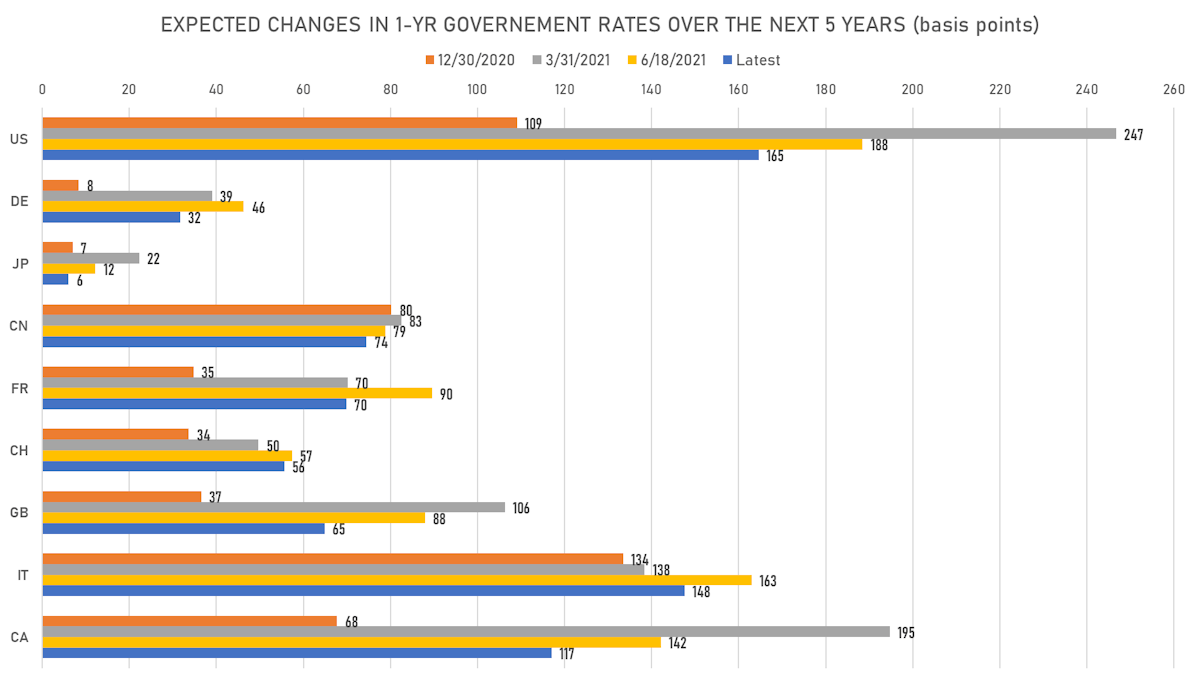

US FORWARD RATES

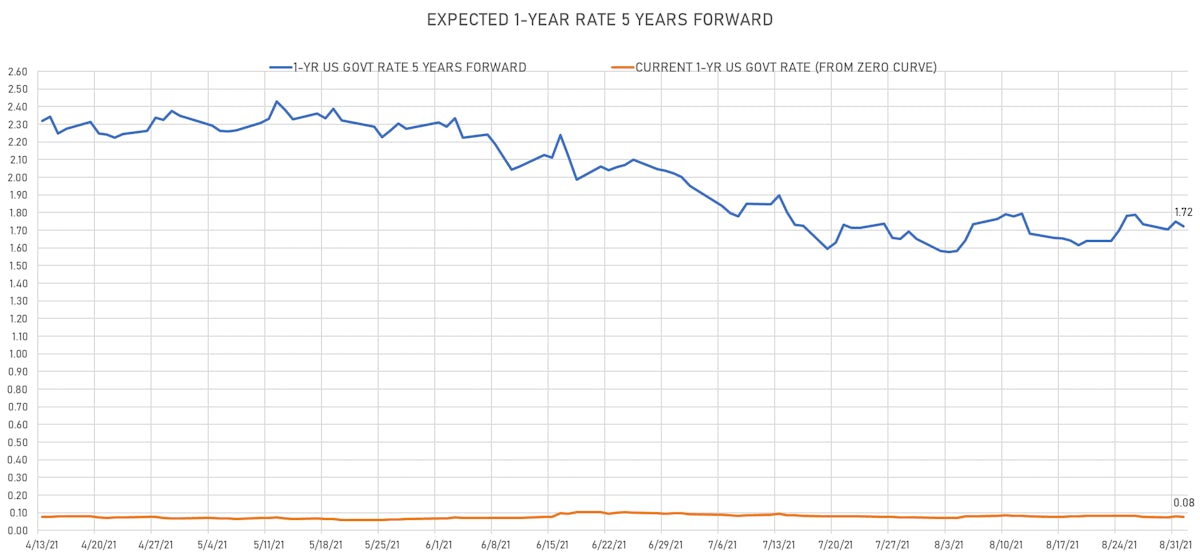

- US Treasury 1-year zero-coupon rate 5 years forward down 2.5 bp, now at 1.7238%

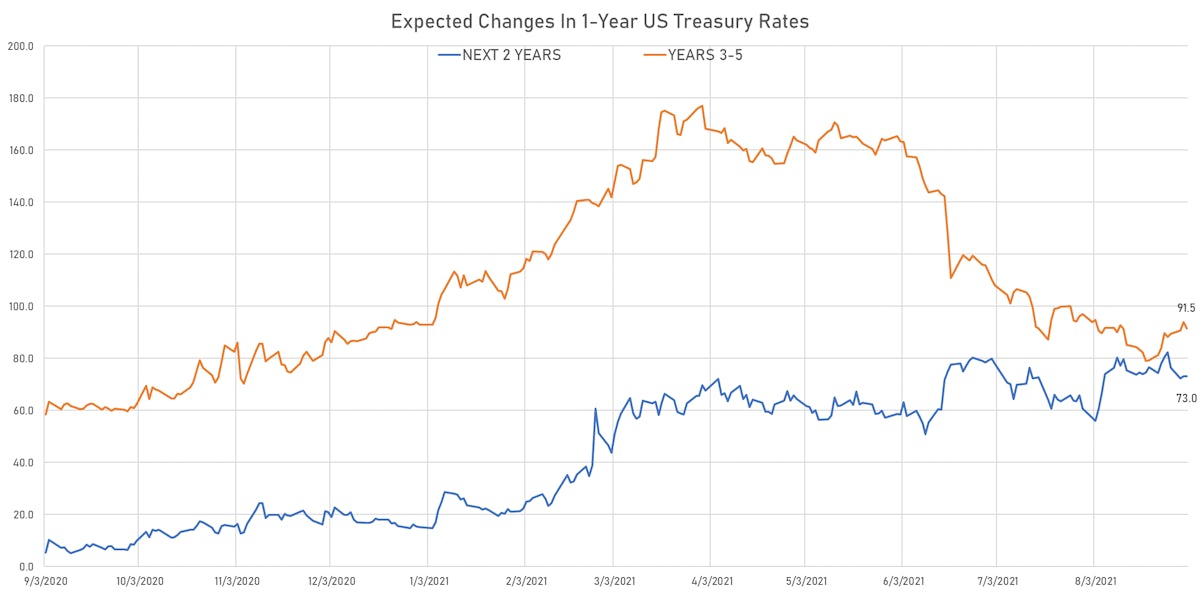

- 1-Year Treasury rates are now expected to increase by 164.6 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.5 bp by the end of 2022 (meaning the market prices 62.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 18.8 bp of rate hikes over the next 18 months (equivalent to 0.75 rate hike) and 81.9 bp over the next 3 years (equivalent to 3.28 rate hikes)

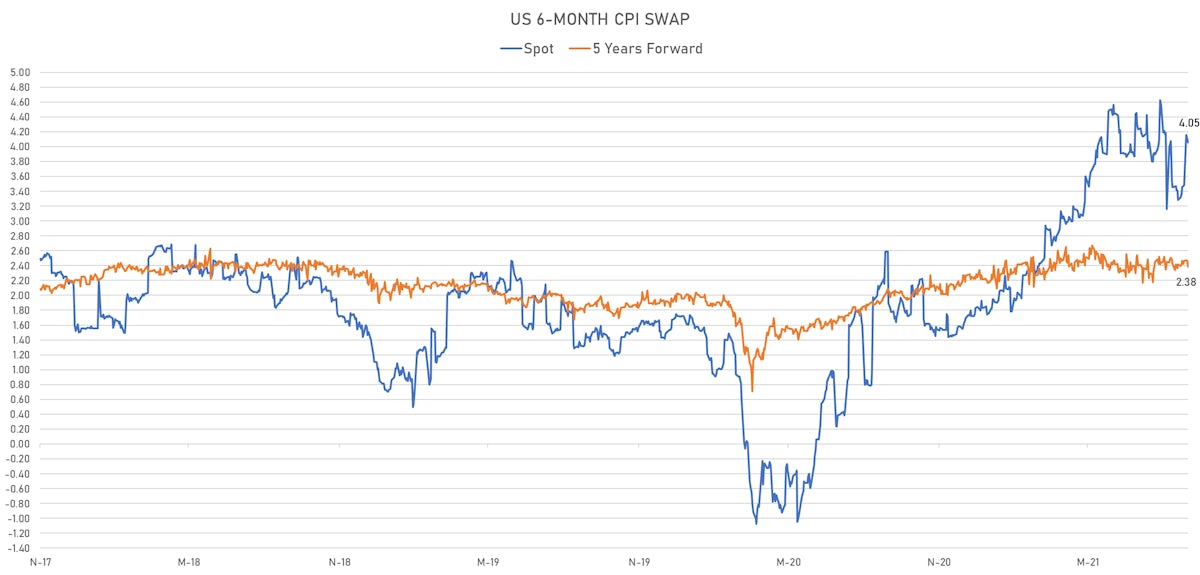

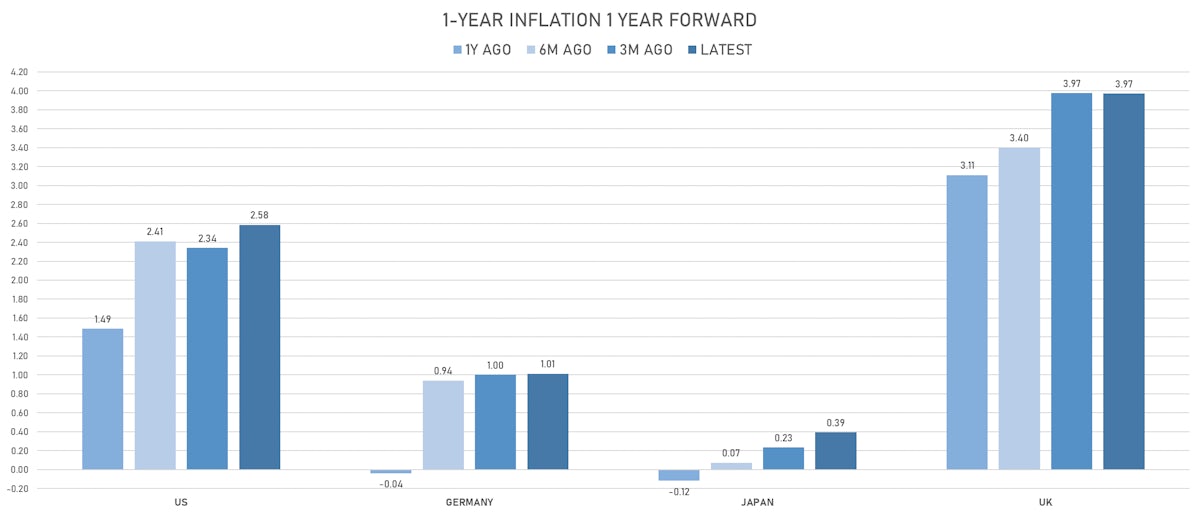

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.98% (up 0.5bp); 2Y at 2.79% (up 2.9bp); 5Y at 2.62% (up 0.8bp); 10Y at 2.32% (up 0.5bp); 30Y at 2.24% (up 0.3bp)

- 6-month spot US CPI swap down -4.6 bp to 4.054%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7790%, -1.1 bp today; 10Y at -1.0420%, -1.6 bp today; 30Y at -0.3130%, -1.6 bp today

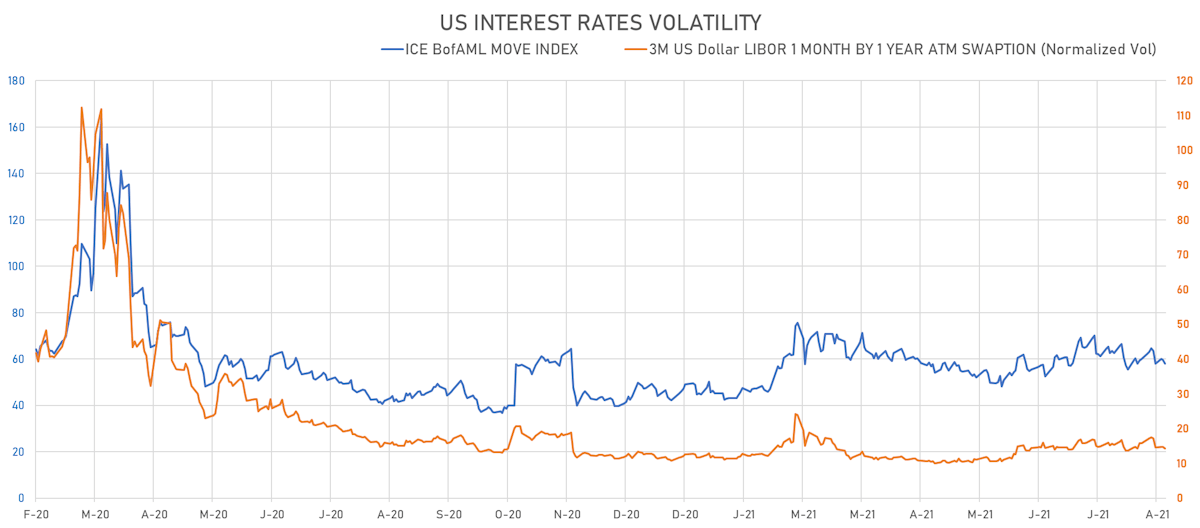

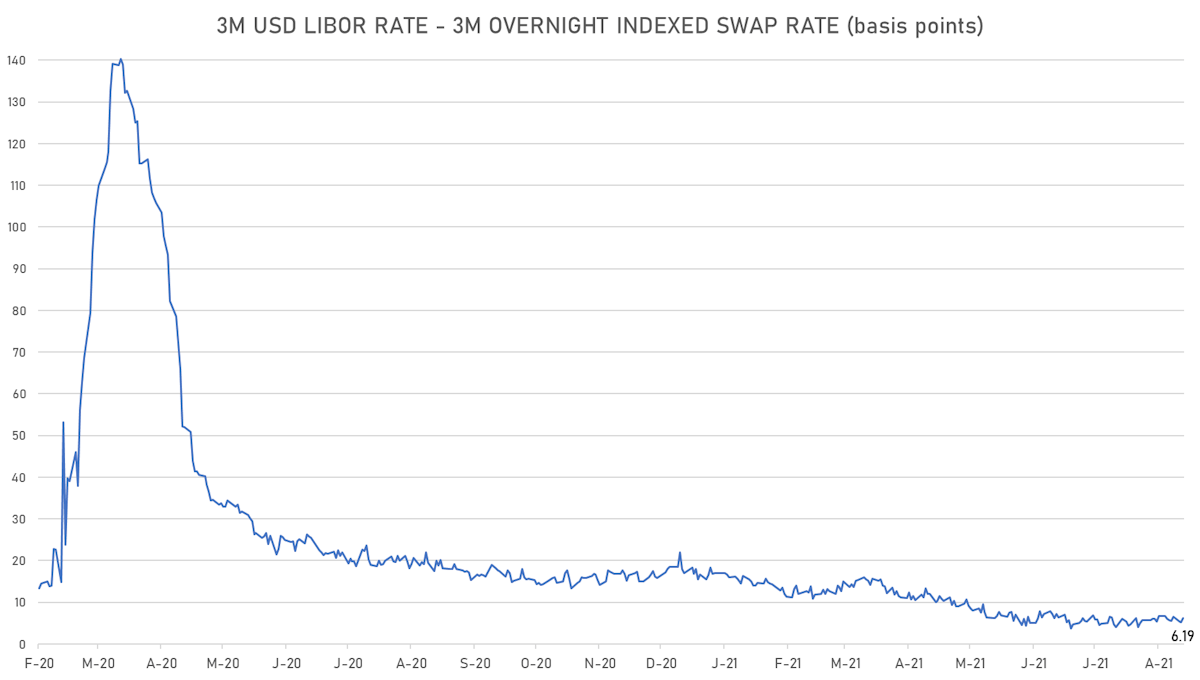

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.4% at 14.3%

- 3-Month LIBOR-OIS spread up 0.9 bp at 6.2 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.680% (down -0.3 bp); the German 1Y-10Y curve is 0.6 bp steeper at 29.7bp (YTD change: +14.6 bp)

- Japan 5Y: -0.110% (up 0.7 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 14.8bp (YTD change: +0.7 bp)

- China 5Y: 2.635% (down -3.7 bp); the Chinese 1Y-10Y curve is 0.8 bp flatter at 60.1bp (YTD change: +13.7 bp)

- Switzerland 5Y: -0.634% (down -0.9 bp); the Swiss 1Y-10Y curve is 2.2 bp steeper at 48.7bp (YTD change: +17.3 bp)