Rates

Slight Flattening Of The US Rates Curve As Market Awaits Private Payrolls Tomorrow

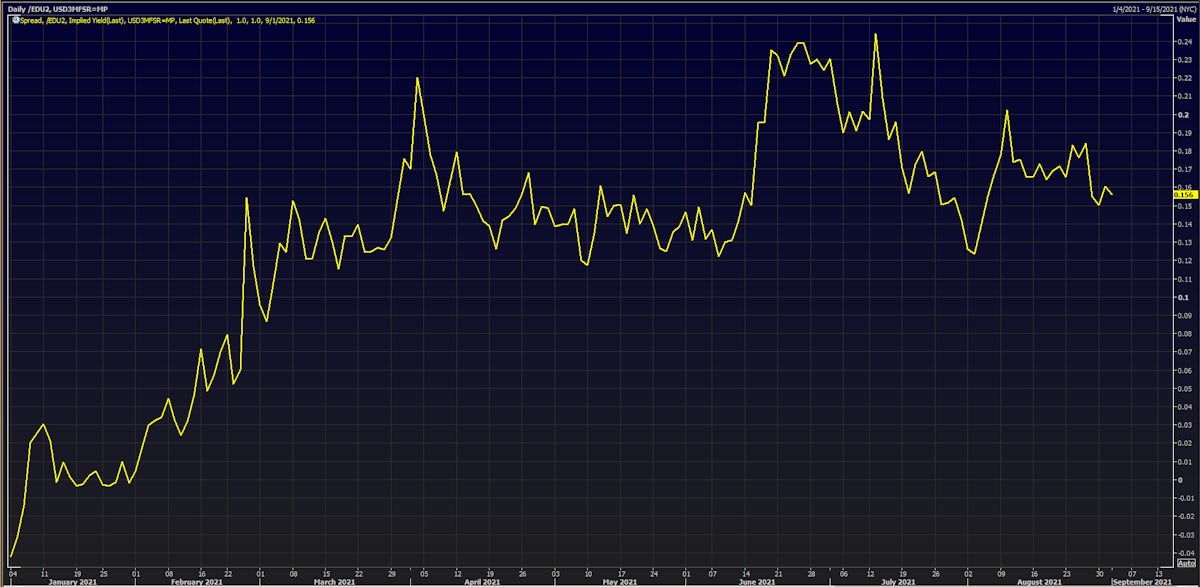

Despite the more dovish sentiment since Powell's Jackson Hole speech, Eurodollar futures still price in a 15bp increase by the end of 2022, a roughly 60% chance of a Fed hike

Published ET

Spread between a 3m Eurodollar future and current 3m USD LIBOR | Source: Refinitiv

QUICK US SUMMARY

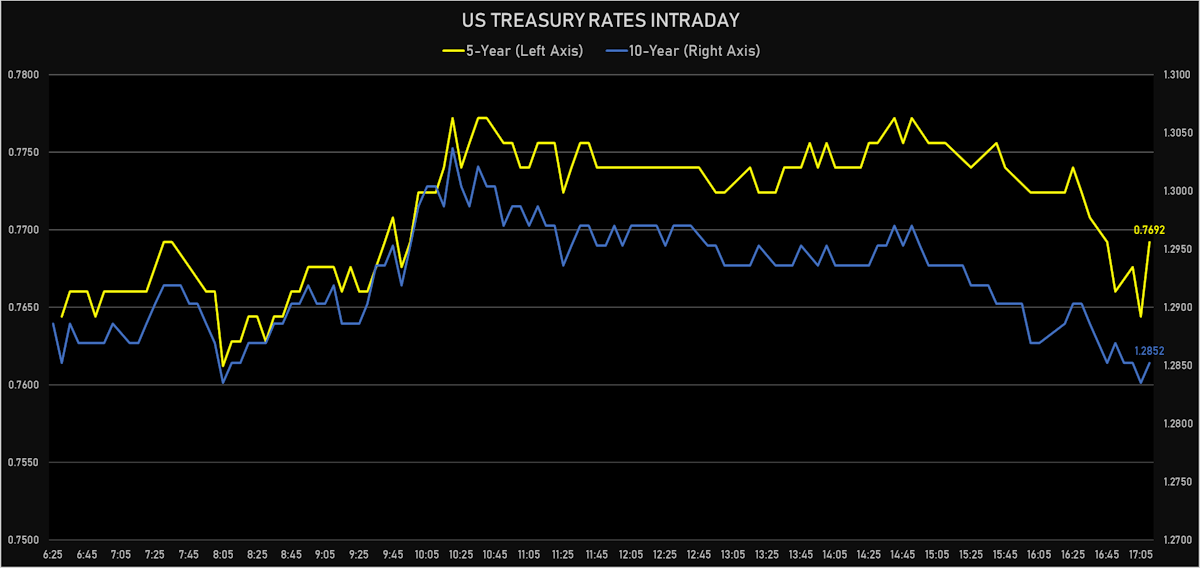

- 3-Month USD LIBOR -0.1bp today, now at 0.1176%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.1 bp, now at 121.7 bp (YTD change: +41.3bp)

- 1Y: 0.0680% (down 0.3 bp)

- 2Y: 0.2096% (down 0.2 bp)

- 5Y: 0.7692% (down 0.6 bp)

- 7Y: 1.0680% (down 0.9 bp)

- 10Y: 1.2852% (down 1.4 bp)

- 30Y: 1.8984% (down 1.6 bp)

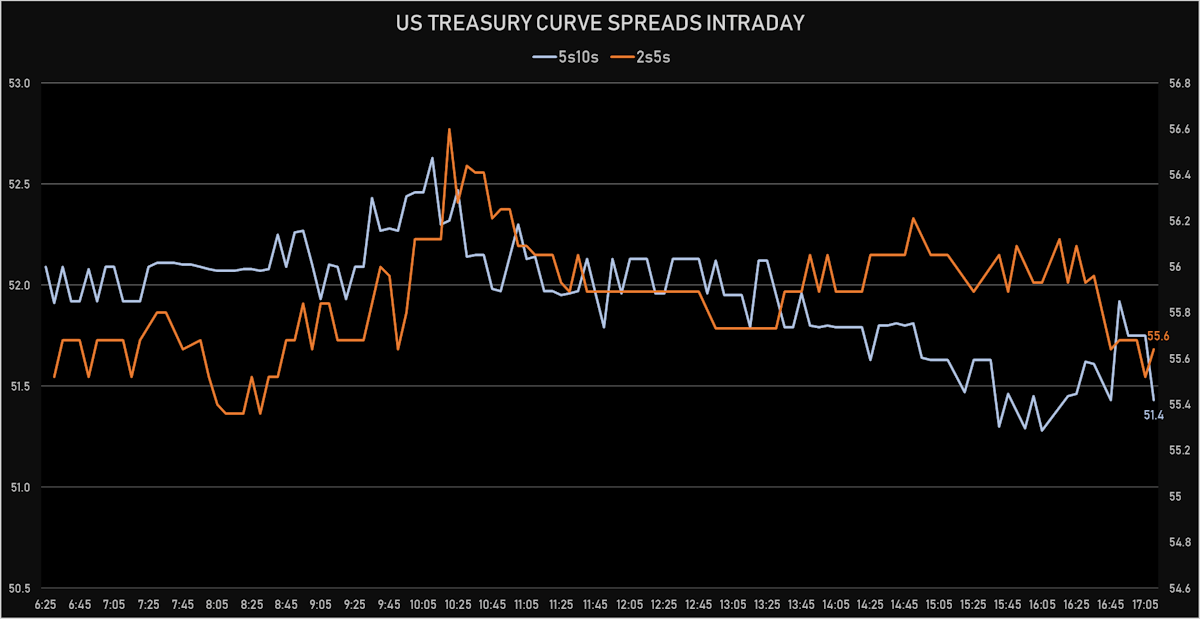

- US treasury curve spreads: 2s5s at 55.9bp (down -0.6bp), 5s10s at 51.7bp (down -0.7bp), 10s30s at 61.3bp (down -0.3bp)

- Treasuries butterfly spreads: 2s5s10s at -4.7bp (down -0.1bp), 5s10s30s at 9.1bp (unchanged)

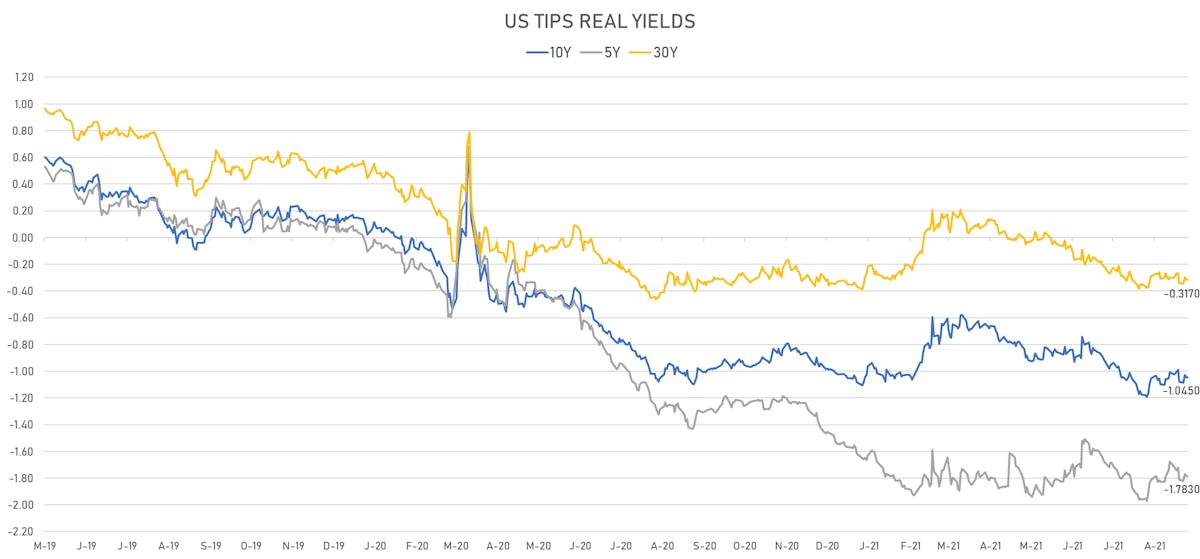

- US 5-Year TIPS Real Yield: -0.4 bp at -1.7830%; 10-Year TIPS Real Yield: -0.3 bp at -1.0450%; 30-Year TIPS Real Yield: -0.4 bp at -0.3170%

US MACRO RELEASES

- Jobless Claims, National, Continued for W 21 Aug (U.S. Dept. of Labor) at 2.75 Mln (vs 2.86 Mln prior), below consensus estimate of 2.78 Mln

- Jobless Claims, National, Initial for W 28 Aug (U.S. Dept. of Labor) at 340.00 k (vs 353.00 k prior), below consensus estimate of 345.00 k

- Jobless Claims, National, Initial, four week moving average for W 28 Aug (U.S. Dept. of Labor) at 355.00 k (vs 366.50 k prior)

- Labor Cost, Unit, business, nonfarm, Change P/P for Q2 2021 (BLS, U.S Dep. Of Lab) at 1.30 % (vs 1.00 % prior), above consensus estimate of 0.90 %

- Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Aug 2021 (Challenger) at 15.72 k (vs 18.94 k prior)

- Labor Productivity, Output per hour of all persons, nonfarm business for Q2 2021 (BLS, U.S Dep. Of Lab) at 2.10 % (vs 2.30 % prior), below consensus estimate of 2.40 %

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Jul 2021 (U.S. Census Bureau) at -1.10 % (vs -1.20 % prior)

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.80 % (vs 0.70 % prior)

- Manufacturers New Orders, Durable goods total, Change P/P for Jul 2021 (U.S. Census Bureau) at -0.10 % (vs -0.10 % prior)

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.10 % (vs 0.00 % prior)

- Manufacturers New Orders, Total manufacturing excluding transportation, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.80 % (vs 1.40 % prior)

- Manufacturers New Orders, Total manufacturing, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.40 % (vs 1.50 % prior), above consensus estimate of 0.30 %

- Trade Balance, Total, Goods and services for Jul 2021 (U.S. Census Bureau) at -70.10 Bln USD (vs -75.70 Bln USD prior), above consensus estimate of -71.00 Bln USD

US FORWARD RATES

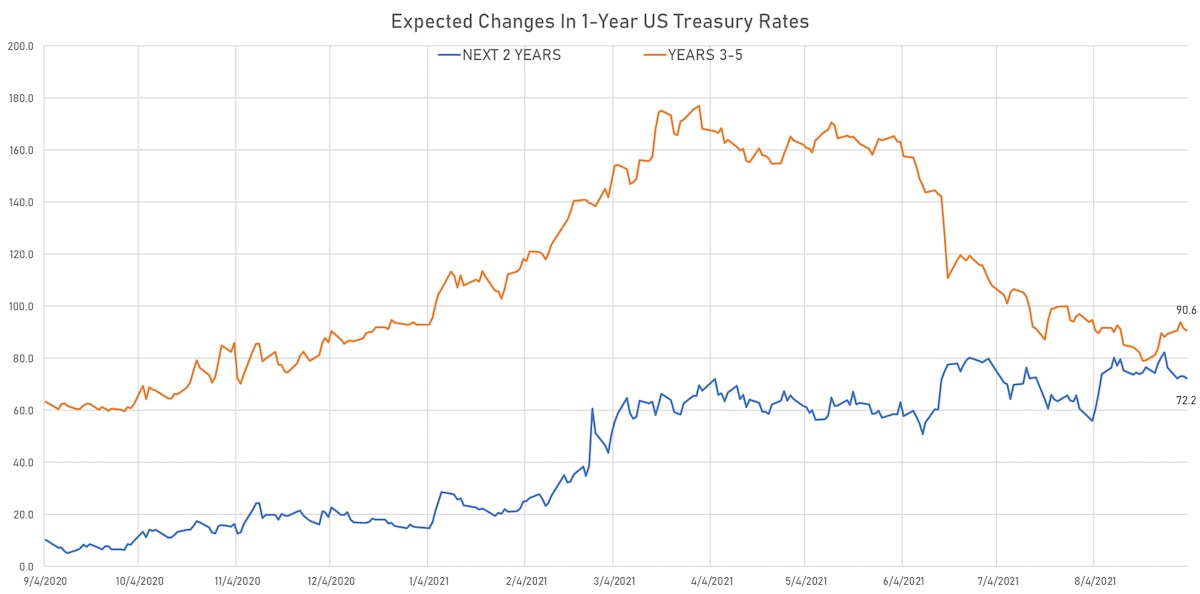

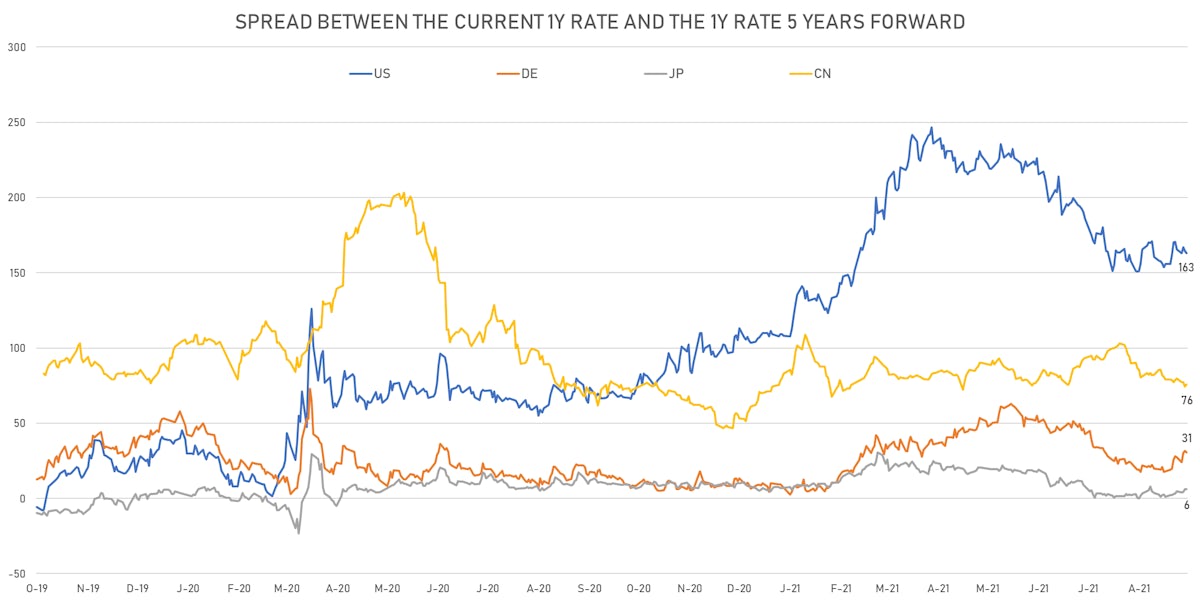

- US Treasury 1-year zero-coupon rate 5 years forward down 1.7 bp, now at 1.7069%

- 1-Year Treasury rates are now expected to increase by 162.9 bp over the next 5 years

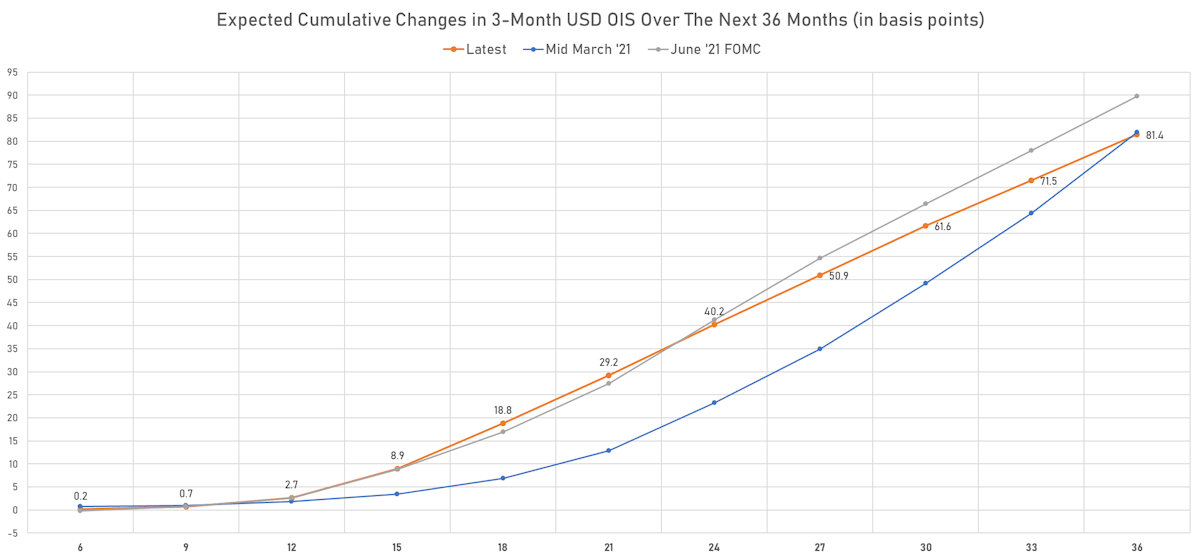

- 3-month Eurodollar futures expected hike of 15.2 bp by the end of 2022 (meaning the market prices 60.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 18.8 bp of rate hikes over the next 18 months (equivalent to 0.75 rate hike) and 81.4 bp over the next 3 years (equivalent to 3.26 rate hikes)

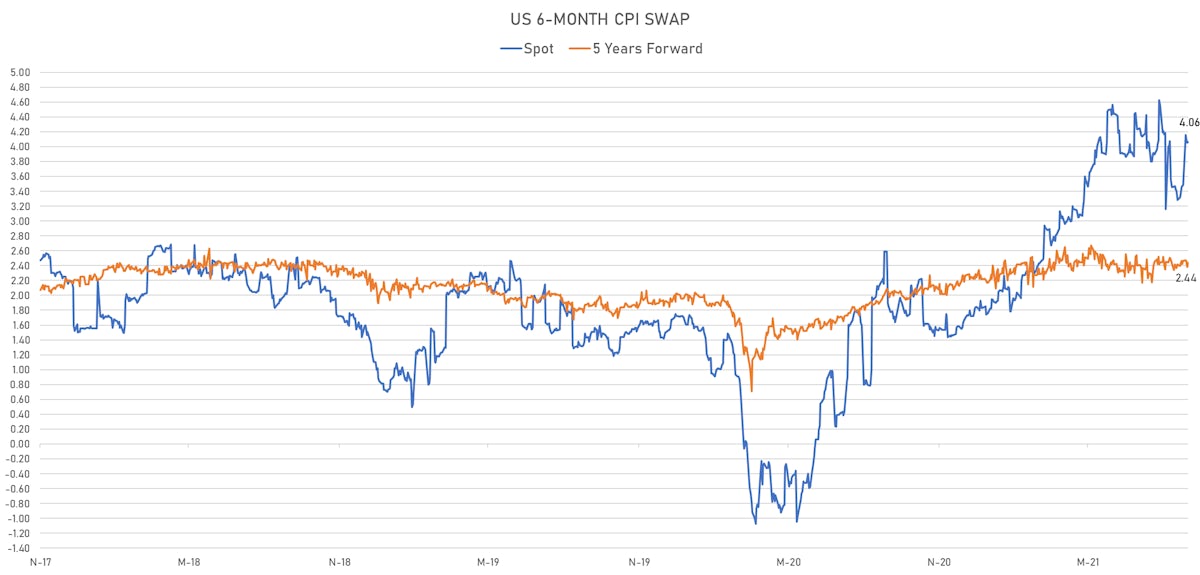

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.07% (up 8.2bp); 2Y at 2.83% (up 4.2bp); 5Y at 2.61% (down -0.4bp); 10Y at 2.31% (down -1.0bp); 30Y at 2.23% (down -1.2bp)

- 6-month spot US CPI swap up 0.4 bp to 4.058%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7830%, -0.4 bp today; 10Y at -1.0450%, -0.3 bp today; 30Y at -0.3170%, -0.4 bp today

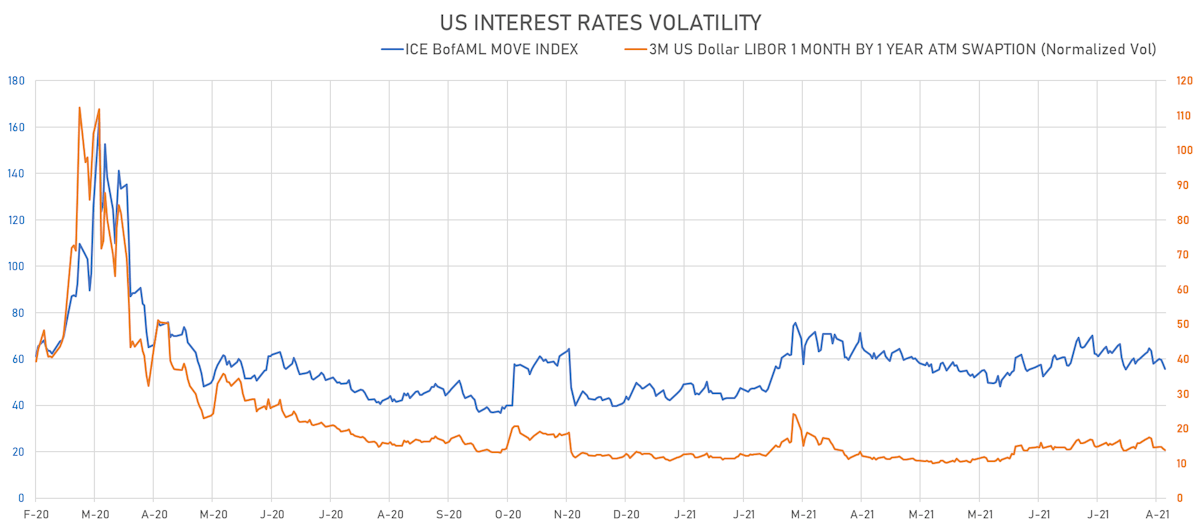

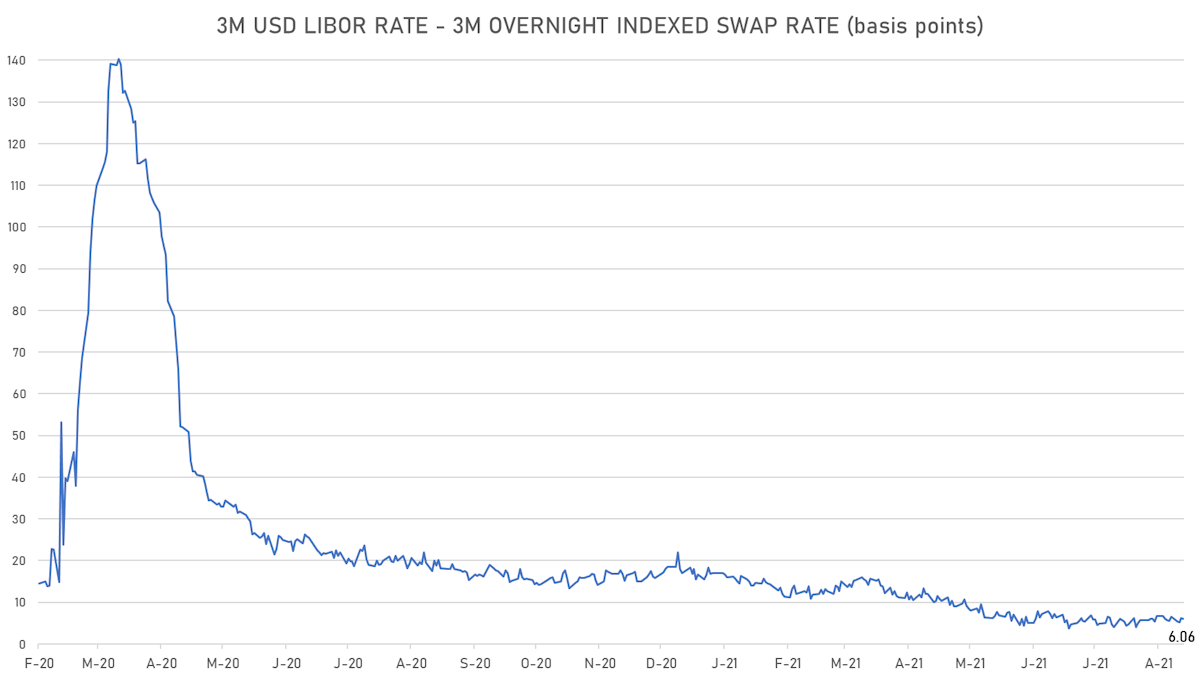

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.5% at 13.8%

- 3-Month LIBOR-OIS spread down -0.1 bp at 6.1 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.693% (down -1.2 bp); the German 1Y-10Y curve is 1.0 bp flatter at 28.7bp (YTD change: +13.6 bp)

- Japan 5Y: -0.097% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 15.4bp (YTD change: +0.4 bp)

- China 5Y: 2.641% (up 0.6 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 59.8bp (YTD change: +13.4 bp)

- Switzerland 5Y: -0.640% (down -0.6 bp); the Swiss 1Y-10Y curve is 0.7 bp flatter at 47.0bp (YTD change: +16.6 bp)