Rates

Rates Dropped, Then Rose On Huge NFP Miss As Market Priced A Possible Delay In Fed Policy

In the short-term, the curve could steepen further on a revived reflation trade, but most analysts believe the data will get better and the Fed is still on track for a taper announcement in November or December

Published ET

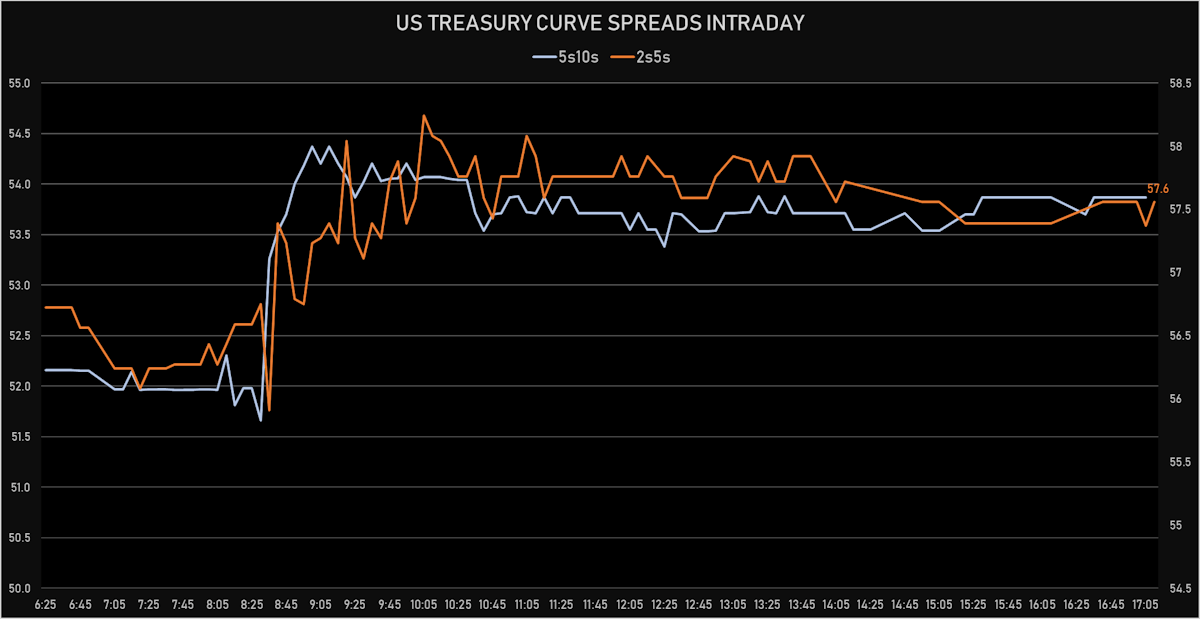

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

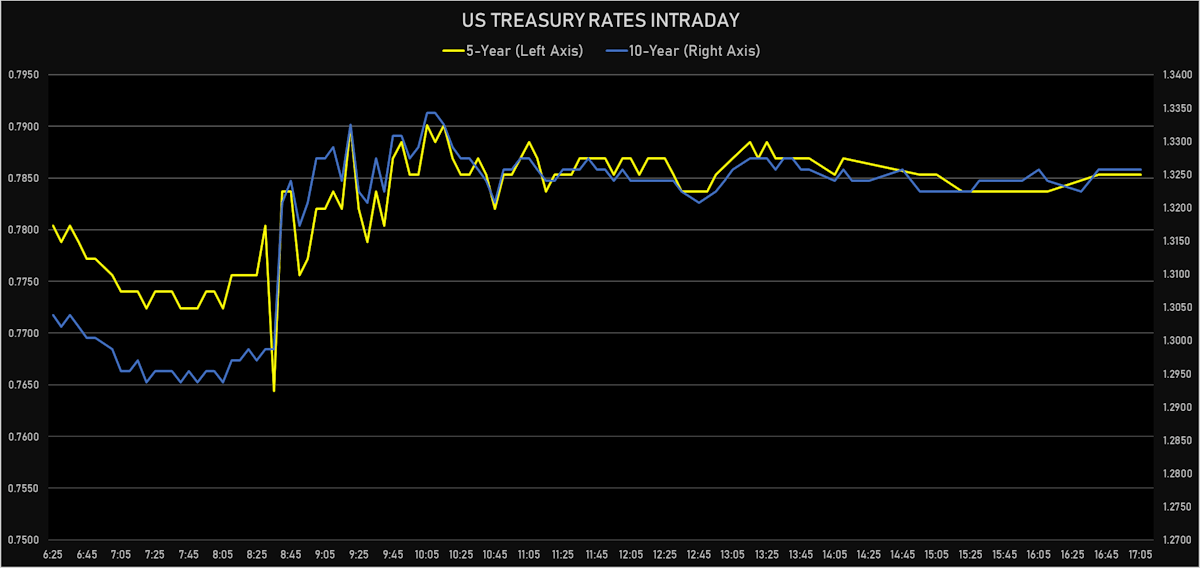

- 3-Month USD LIBOR -0.2bp today, now at 0.1155%

- The treasury yield curve steepened, with the 1s10s spread widening 3.8 bp, now at 126.0 bp (YTD change: +45.5bp)

- 1Y: 0.0660% (up 0.3 bp)

- 2Y: 0.2081% (down 0.2 bp)

- 5Y: 0.7853% (up 1.6 bp)

- 7Y: 1.0947% (up 2.7 bp)

- 10Y: 1.3257% (up 4.1 bp)

- 30Y: 1.9461% (up 4.8 bp)

- US treasury curve spreads: 2s5s at 57.7bp (up 1.9bp today), 5s10s at 54.0bp (up 2.4bp today), 10s30s at 62.1bp (up 0.7bp today)

- Treasuries butterfly spreads: 2s5s10s at -4.1bp (up 0.7bp today), 5s10s30s at 7.5bp (down -1.6bp)

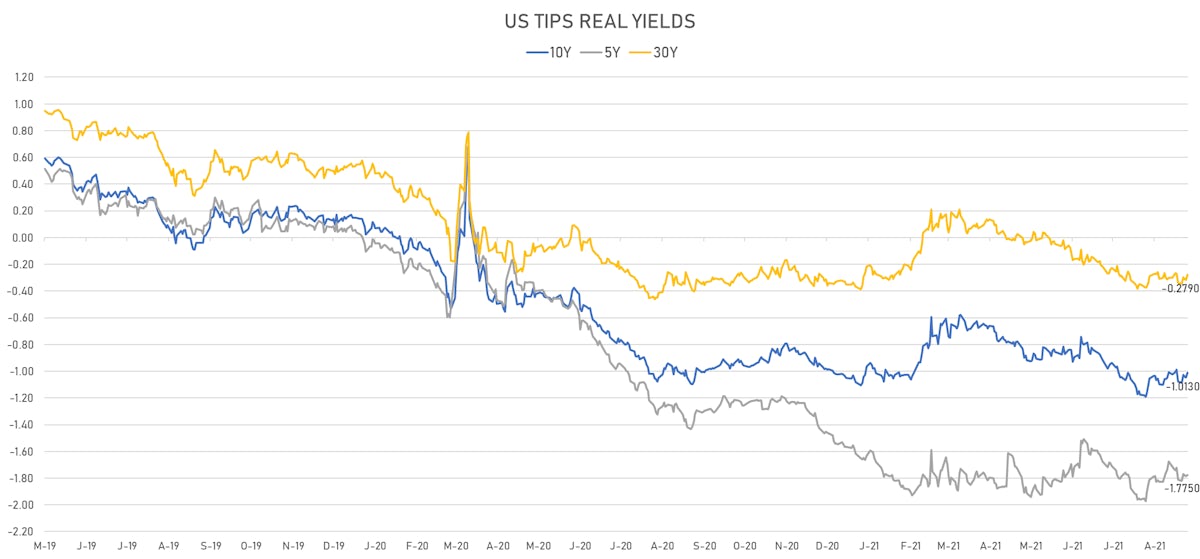

- US 5-Year TIPS Real Yield: +0.8 bp at -1.7750%; 10-Year TIPS Real Yield: +3.2 bp at -1.0130%; 30-Year TIPS Real Yield: +3.8 bp at -0.2790%

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for Aug 2021 (BLS, U.S Dep. Of Lab) at 4.30 % (vs 4.00 % prior), above consensus estimate of 4.00 %

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 0.40 % prior), above consensus estimate of 0.30 %

- Employment, Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for Aug 2021 (BLS, U.S Dep. Of Lab) at 37.00 k (vs 27.00 k prior), above consensus estimate of 25.00 k

- Employment, Nonfarm payroll, service-producing, government, Absolute change for Aug 2021 (BLS, U.S Dep. Of Lab) at -8.00 k (vs 240.00 k prior)

- Employment, Nonfarm payroll, total private, Absolute change for Aug 2021 (BLS, U.S Dep. Of Lab) at 243.00 k (vs 703.00 k prior), below consensus estimate of 665.00 k

- Employment, Nonfarm payroll, total, Absolute change for Aug 2021 (BLS, U.S Dep. Of Lab) at 235.00 k (vs 943.00 k prior), below consensus estimate of 728.00 k

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Aug 2021 (BLS, U.S Dep. Of Lab) at 34.70 hrs (vs 34.80 hrs prior), below consensus estimate of 34.80 hrs

- ISM Non-manufacturing, Business activity for Aug 2021 (ISM, United States) at 60.10 (vs 67.00 prior), below consensus estimate of 62.80

- ISM Non-manufacturing, Employment for Aug 2021 (ISM, United States) at 53.70 (vs 53.80 prior)

- ISM Non-manufacturing, New orders for Aug 2021 (ISM, United States) at 63.20 (vs 63.70 prior)

- ISM Non-manufacturing, NMI/PMI for Aug 2021 (ISM, United States) at 61.70 (vs 64.10 prior), above consensus estimate of 61.50

- ISM Non-manufacturing, Prices for Aug 2021 (ISM, United States) at 75.40 (vs 82.30 prior)

- Labor Force Partic for Aug 2021 (BLS, U.S Dep. Of Lab) at 61.70 % (vs 61.70 % prior)

- PMI, Composite, Output, Final for Aug 2021 (Markit Economics) at 55.40 (vs 55.40 prior)

- PMI, Services Sector, Business Activity, Final for Aug 2021 (Markit Economics) at 55.10 (vs 55.20 prior)

- Unemployment, Rate for Aug 2021 (BLS, U.S Dep. Of Lab) at 5.20 % (vs 5.40 % prior), in line with consensus estimate

- Unemployment, Rate, Special (U-6) for Aug 2021 (BLS, U.S Dep. Of Lab) at 8.80 % (vs 9.20 % prior)

US FORWARD RATES

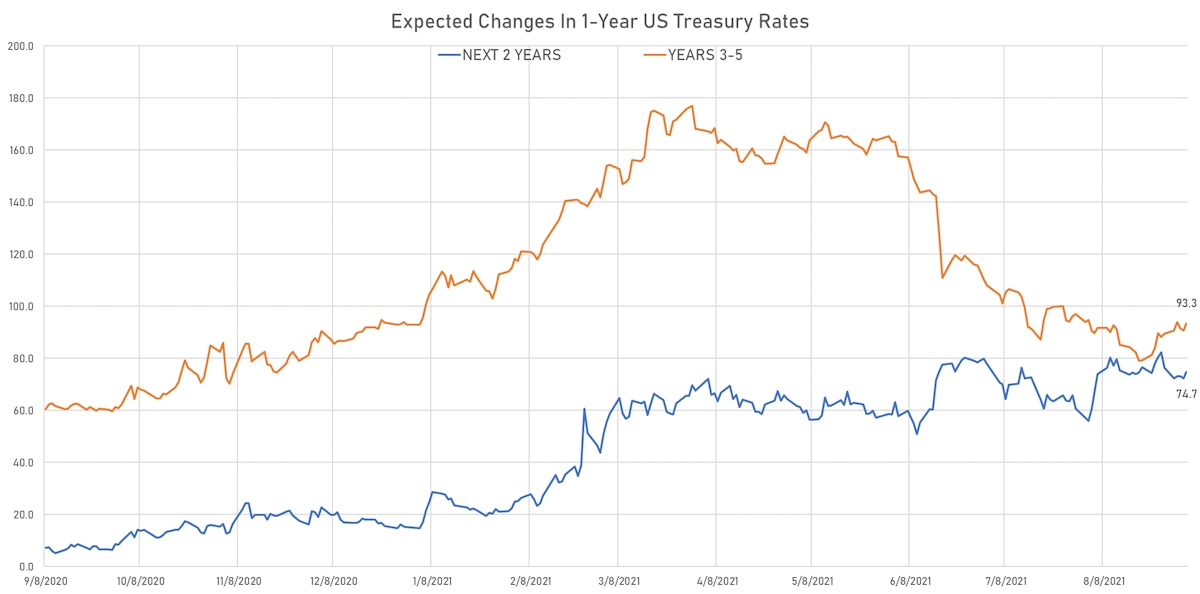

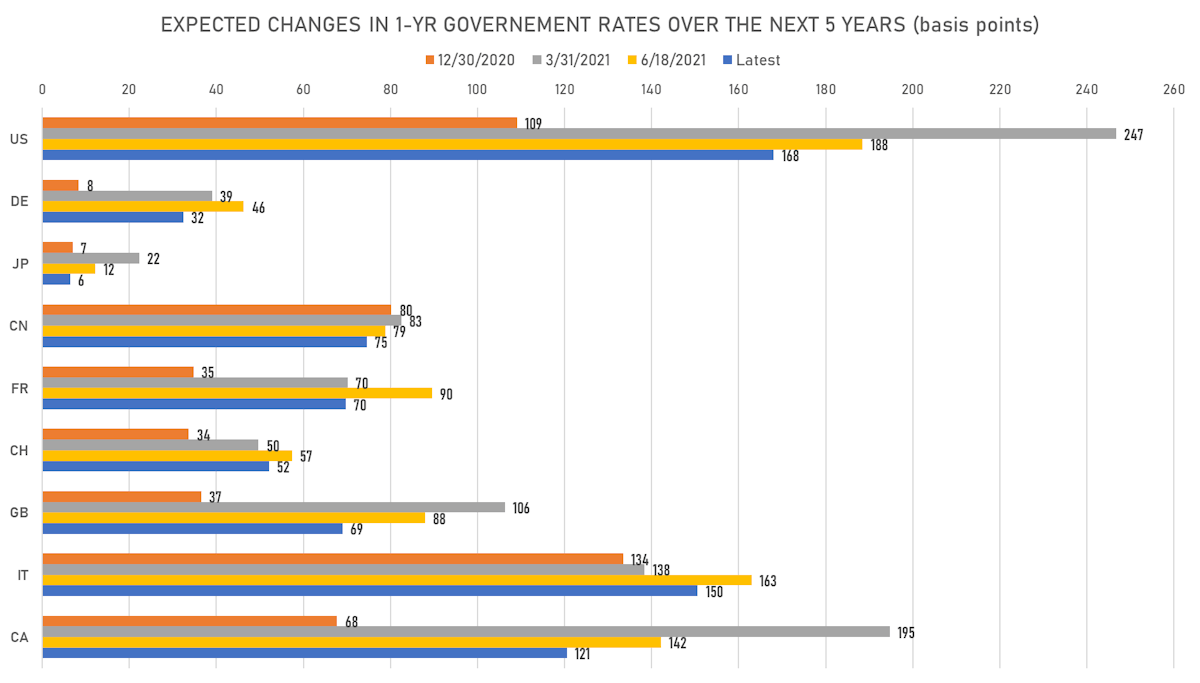

- US Treasury 1-year zero-coupon rate 5 years forward up 5.2 bp, now at 1.7589%

- 1-Year Treasury rates are now expected to increase by 168.0 bp over the next 5 years

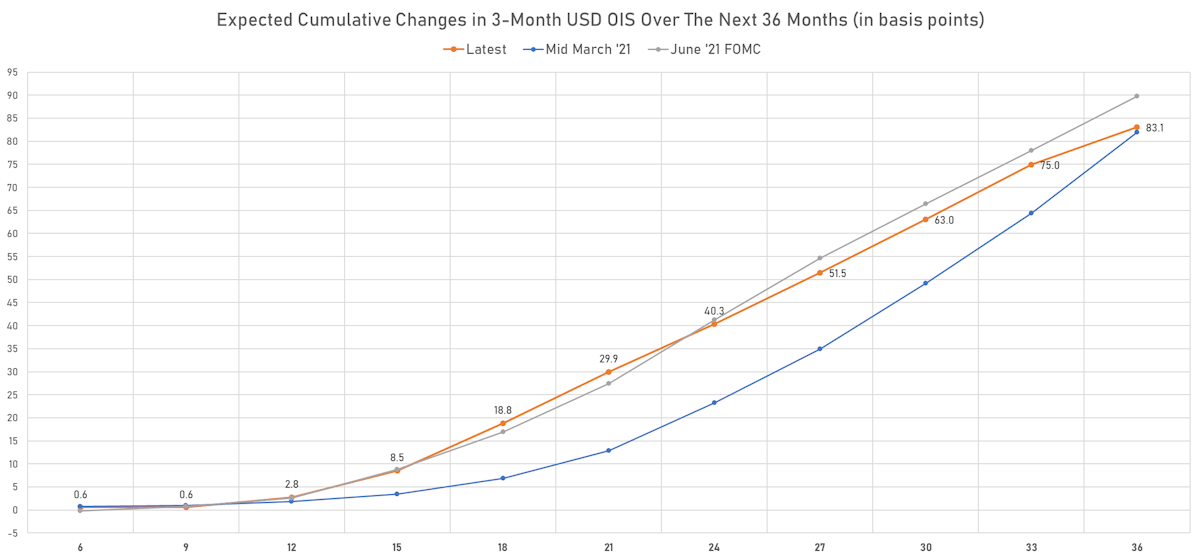

- 3-month Eurodollar futures expected hike of 15.2 bp by the end of 2022 (meaning the market prices 60.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 18.8 bp of rate hikes over the next 18 months (equivalent to 0.75 rate hike) and 83.1 bp over the next 3 years (equivalent to 3.32 rate hikes)

US INFLATION & REAL RATES

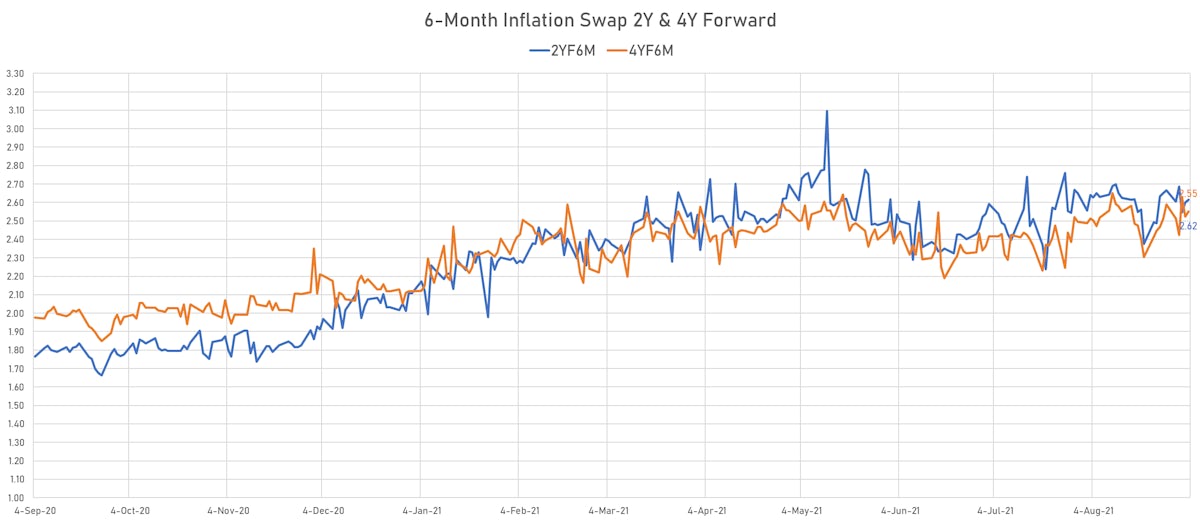

- TIPS 1Y breakeven inflation at 3.04% (down -2.3bp); 2Y at 2.82% (down -0.6bp); 5Y at 2.62% (up 0.8bp); 10Y at 2.32% (up 0.8bp); 30Y at 2.24% (up 1.1bp)

- 6-month spot US CPI swap up 0.8 bp to 4.066%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7750%, +0.8 bp today; 10Y at -1.0130%, +3.2 bp today; 30Y at -0.2790%, +3.8 bp today

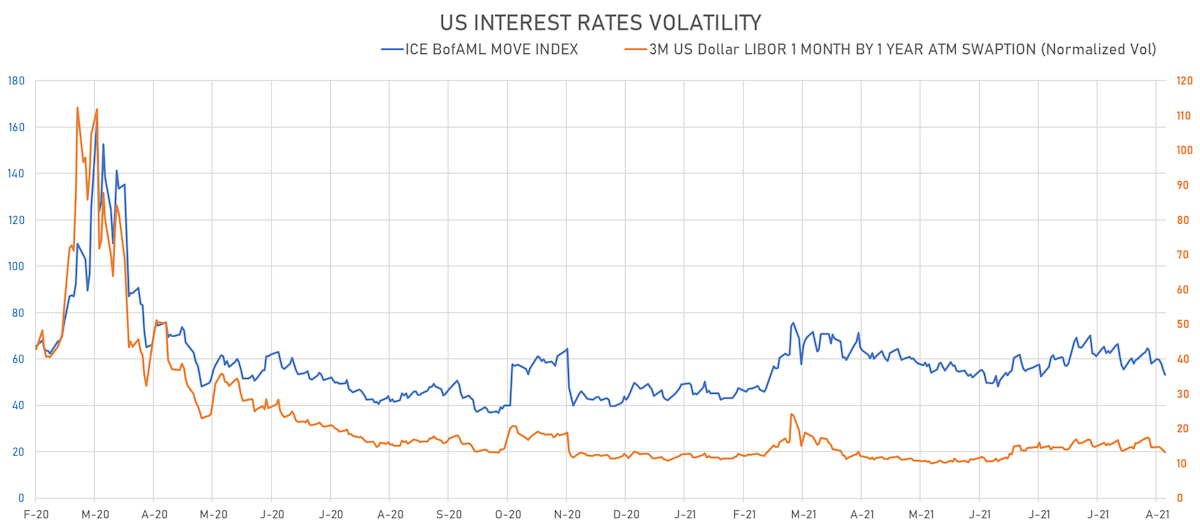

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.6% at 13.2%

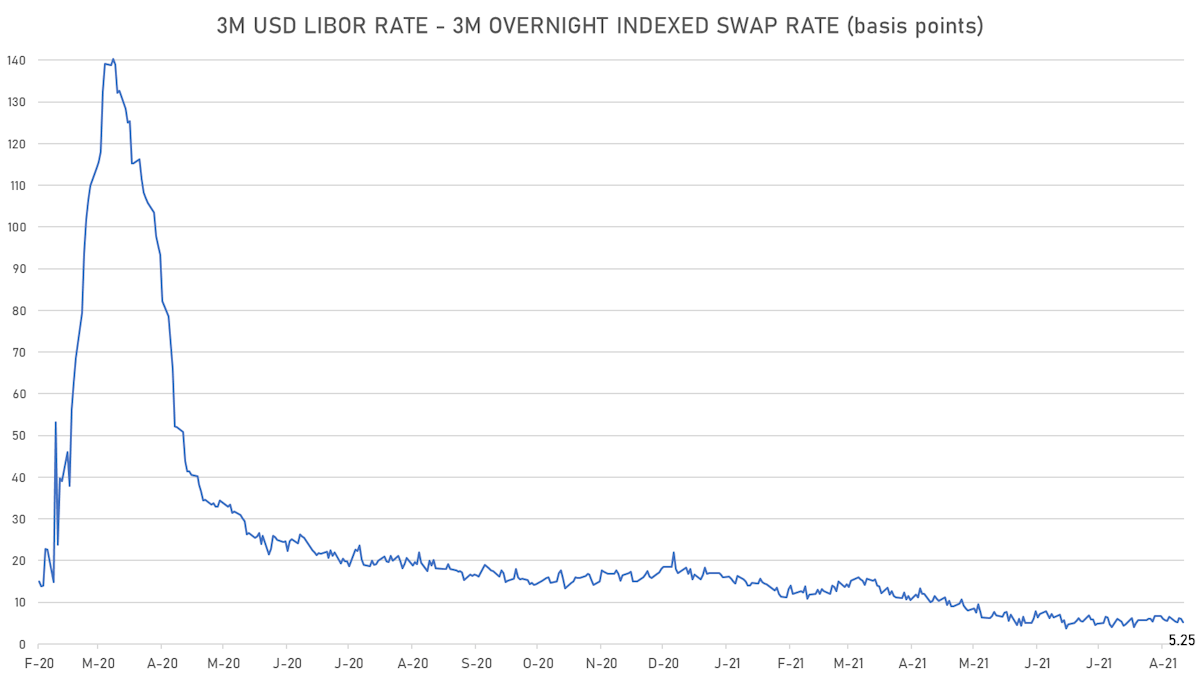

- 3-Month LIBOR-OIS spread down -0.8 bp at 5.3 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.671% (up 2.1 bp); the German 1Y-10Y curve is 2.5 bp steeper at 30.8bp (YTD change: +16.1 bp)

- Japan 5Y: -0.092% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 15.3bp (YTD change: +0.9 bp)

- China 5Y: 2.652% (up 1.1 bp); the Chinese 1Y-10Y curve is 0.5 bp flatter at 59.3bp (YTD change: +12.9 bp)

- Switzerland 5Y: -0.633% (up 0.7 bp); the Swiss 1Y-10Y curve is 4.4 bp flatter at 40.6bp (YTD change: +12.2 bp)