Rates

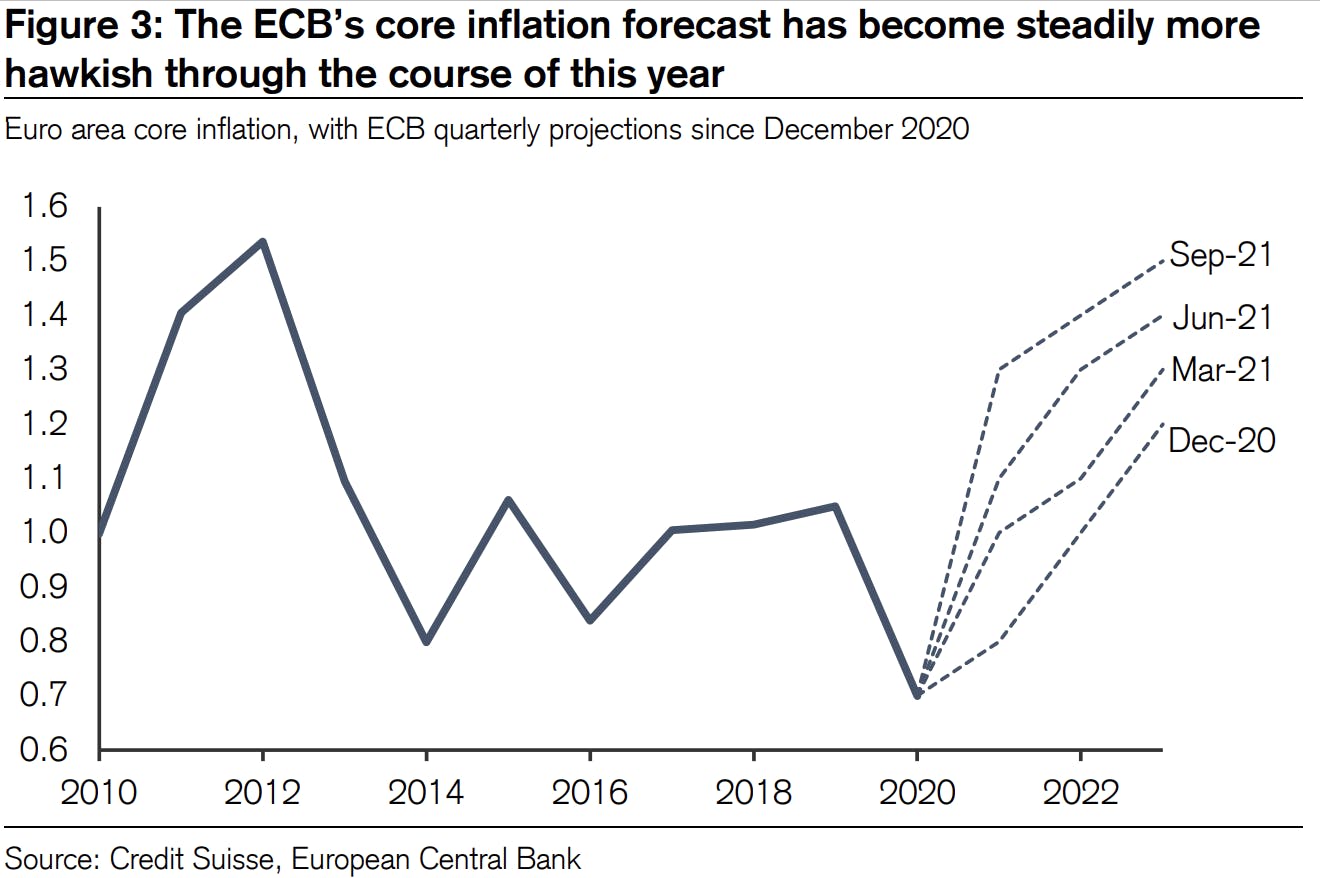

No Surprise From The ECB, As Growing Eurozone Inflation Expectations Ignored For Now

European rates dropped despite the slowed pace of QE, as Lagarde put a dovish reading on the earlier announcement, ironically paraphrasing Thatcher while spinning faster than a whirling dervish

Published ET

Spread Between Current 3m USD LIBOR and EDU2 Implied Yield | Source: Refinitiv

QUICK US SUMMARY

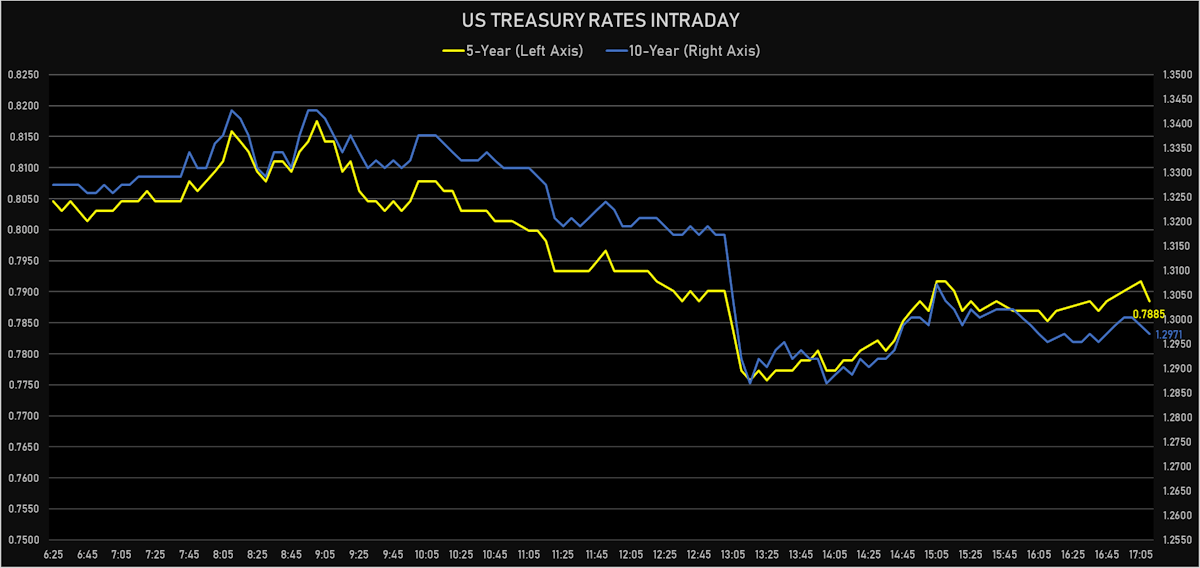

- US rates dropped after results of the strong 30Y auction were announced

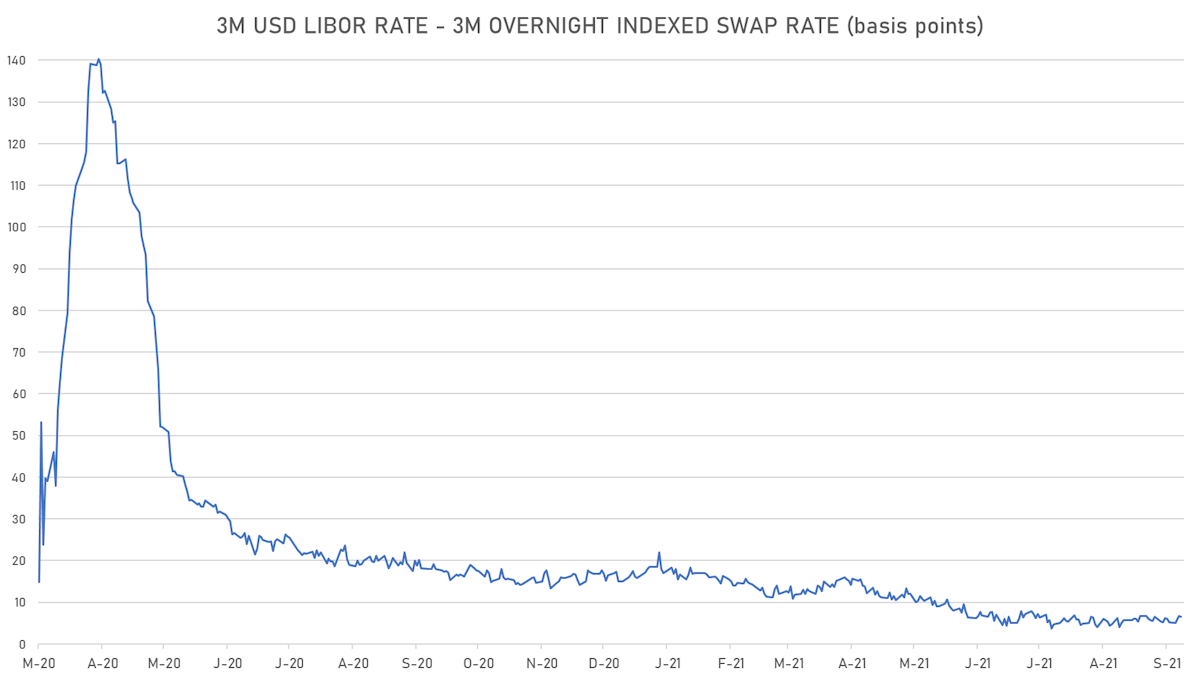

- 3-Month USD LIBOR -0.2bp today, now at 0.1141%

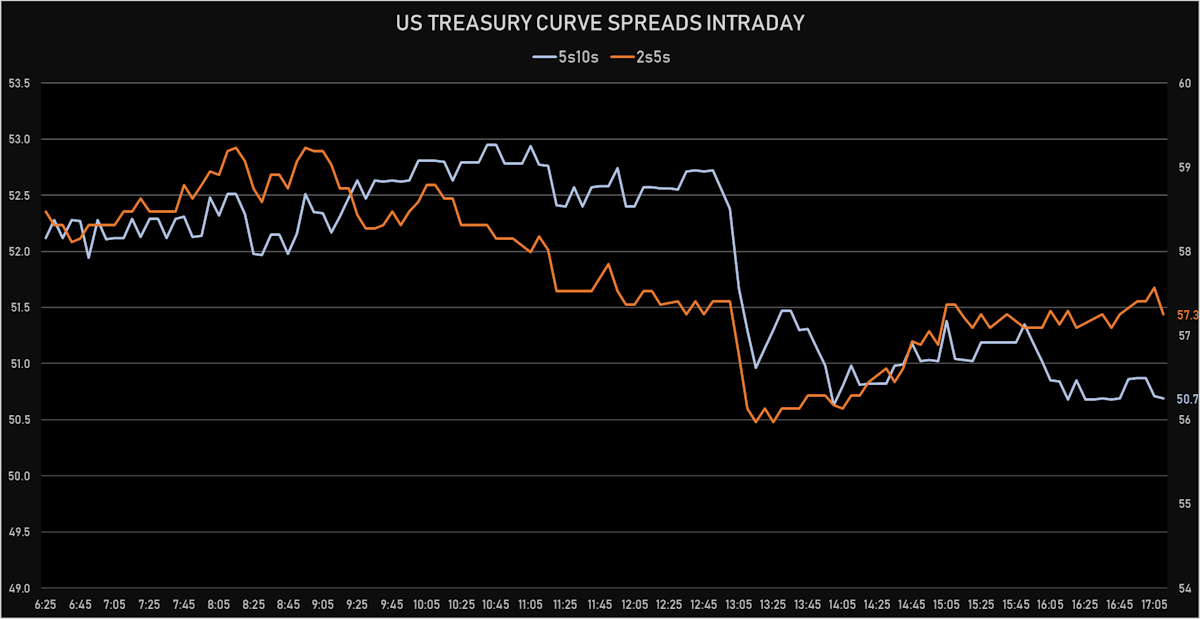

- The treasury yield curve flattened, with the 1s10s spread tightening -3.9 bp, now at 122.3 bp (YTD change: +41.9bp)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2144% (down 0.4 bp)

- 5Y: 0.7885% (down 1.8 bp)

- 7Y: 1.0807% (down 3.0 bp)

- 10Y: 1.2971% (down 3.9 bp)

- 30Y: 1.8929% (down 6.2 bp)

- US treasury curve spreads: 2s5s at 57.4bp (down -1.4bp), 5s10s at 50.9bp (down -2.1bp), 10s30s at 59.6bp (down -2.4bp)

- Treasuries butterfly spreads: 2s5s10s at -6.9bp (down -0.7bp), 5s10s30s at 8.7bp (unchanged)

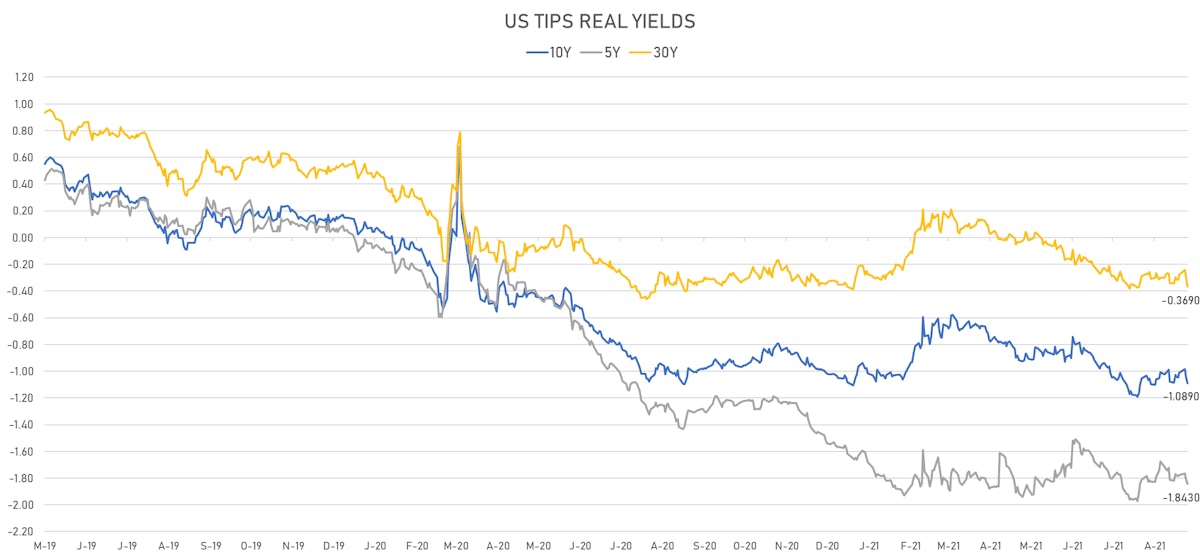

- US 5-Year TIPS Real Yield: -3.7 bp at -1.8430%; 10-Year TIPS Real Yield: -4.7 bp at -1.0890%; 30-Year TIPS Real Yield: -7.4 bp at -0.3690%

30-YEAR BOND AUCTION RESULTS

- Impressive stats for the $24 bn auction, with end-user demand at a record high 86.9% (vs 81.7% in August and 80.5% average)

- High yield at 1.910%, a 2 bp stop-though vs. 1.935% when issued at the bid deadline (-13bp vs prior auction)

- $59.7 in bids, 2.49x cover (vs. 2.21 prior)

- Indirect bids at 69.7% (vs, 60.7% prior and 62.4% average)

- Direct bids at 17.2% (vs. 21.0% prior and 18.1% average)

- Dealers picked up 13.1% (vs 18.3% prior and 19.5% average)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 28 Aug (U.S. Dept. of Labor) at 2.78 Mln (vs 2.75 Mln prior), above consensus estimate of 2.74 Mln

- Jobless Claims, National, Initial for W 04 Sep (U.S. Dept. of Labor) at 310.00 k (vs 340.00 k prior), below consensus estimate of 335.00 k

- Jobless Claims, National, Initial, four week moving average for W 04 Sep (U.S. Dept. of Labor) at 339.50 k (vs 355.00 k prior)

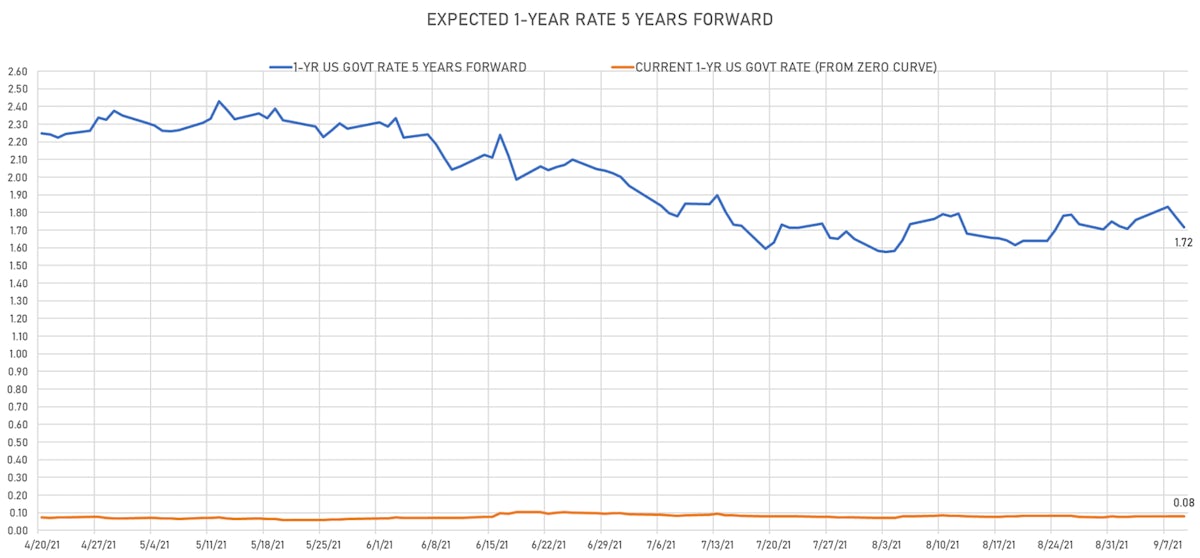

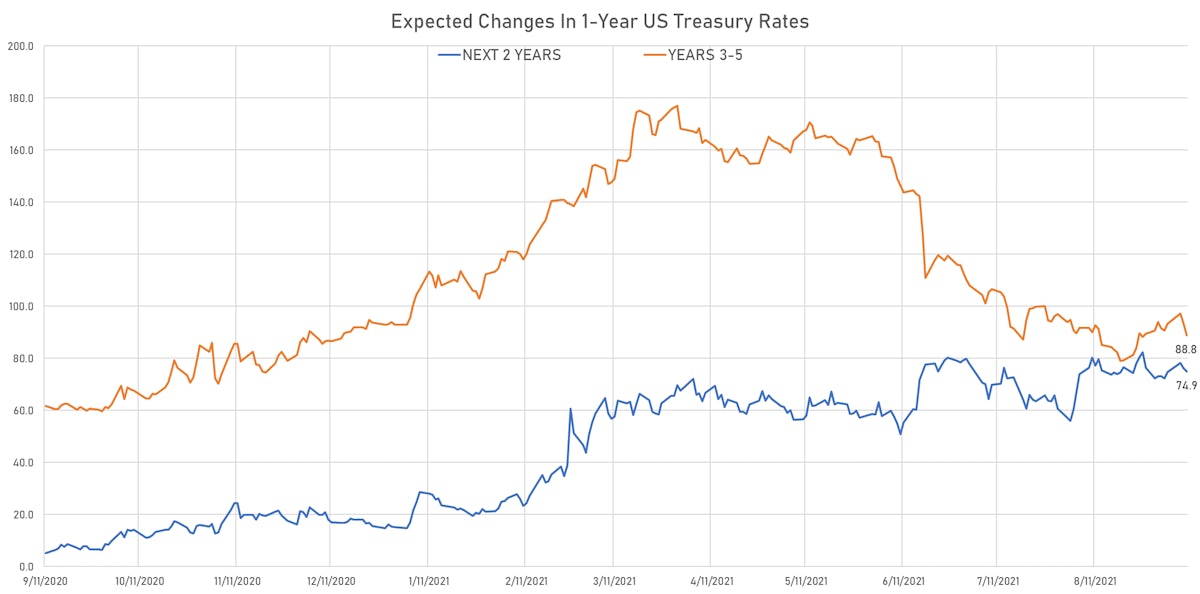

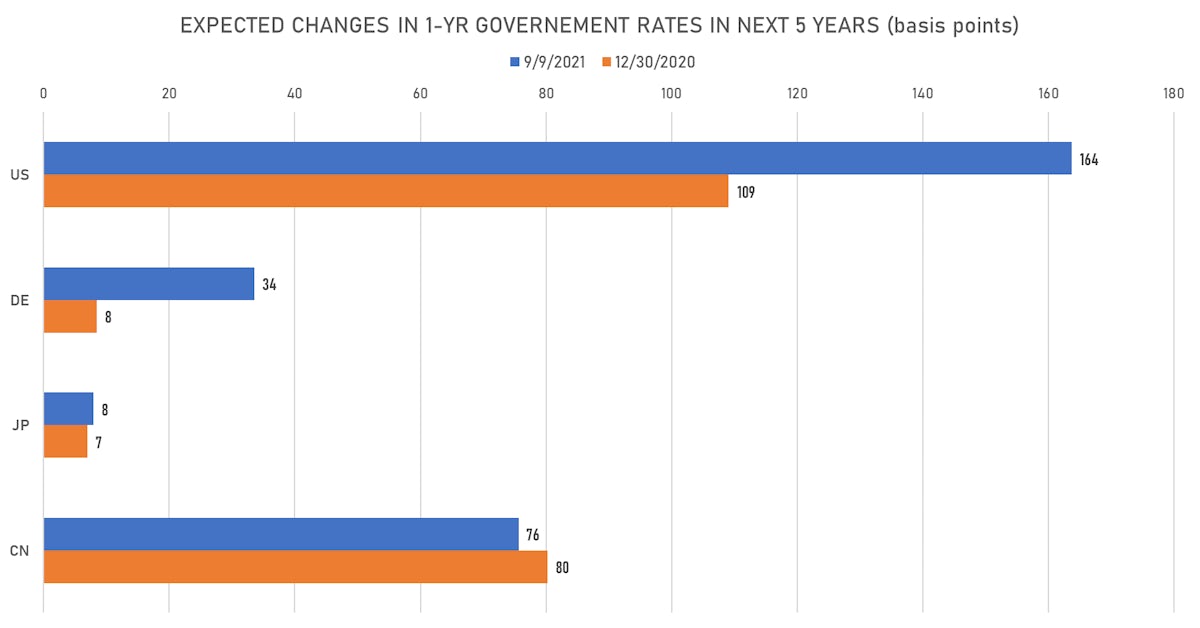

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 5.8 bp, now at 1.7173%, meaning 1-Year Treasury rates are now expected to increase by 163.7 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.5 bp by the end of 2022 (meaning the market prices 62.0% chance of a 25bp hike by end of 2022)

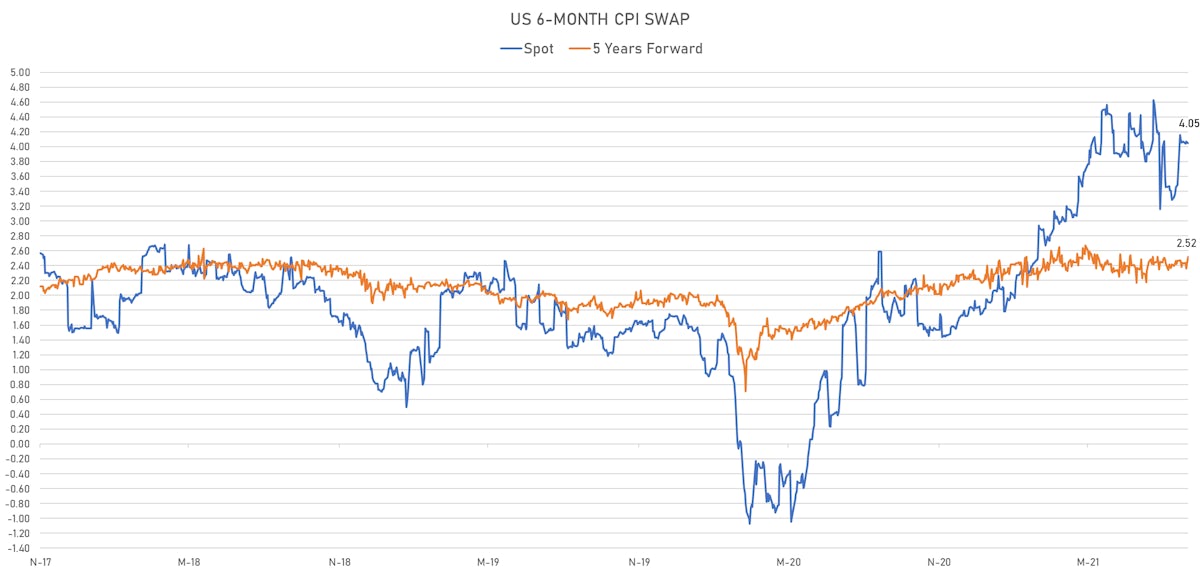

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.08% (up 0.4bp); 2Y at 2.88% (up 0.9bp); 5Y at 2.69% (up 2.0bp); 10Y at 2.37% (up 0.9bp); 30Y at 2.27% (up 1.2bp)

- 6-month spot US CPI swap down -0.9 bp to 4.046%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.8430%, -3.7 bp today; 10Y at -1.0890%, -4.7 bp today; 30Y at -0.3690%, -7.4 bp today

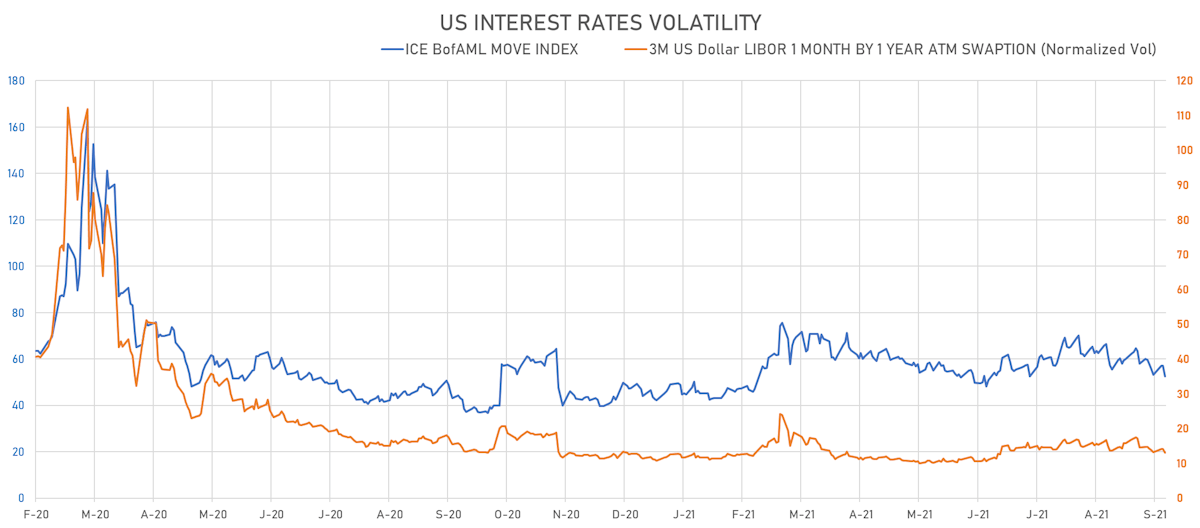

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.1% at 13.0%

- 3-Month LIBOR-OIS spread down -0.2 bp at 6.5 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.667% (down -3.1 bp); the German 1Y-10Y curve is 4.0 bp flatter at 30.4bp (YTD change: +15.6 bp)

- Japan 5Y: -0.101% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 14.8bp (YTD change: +0.9 bp)

- China 5Y: 2.695% (up 1.0 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 61.8bp (YTD change: +15.4 bp)

- Switzerland 5Y: -0.609% (down -0.1 bp); the Swiss 1Y-10Y curve is 4.9 bp flatter at 50.7bp (YTD change: +16.3 bp)