Rates

Rates Rise Ahead Of The Weekend In Quiet Session

US producer prices came in elevated but rates didn't move as the data was expected; the only (positive) surprise in the macro releases today was higher wholesale sales

Published ET

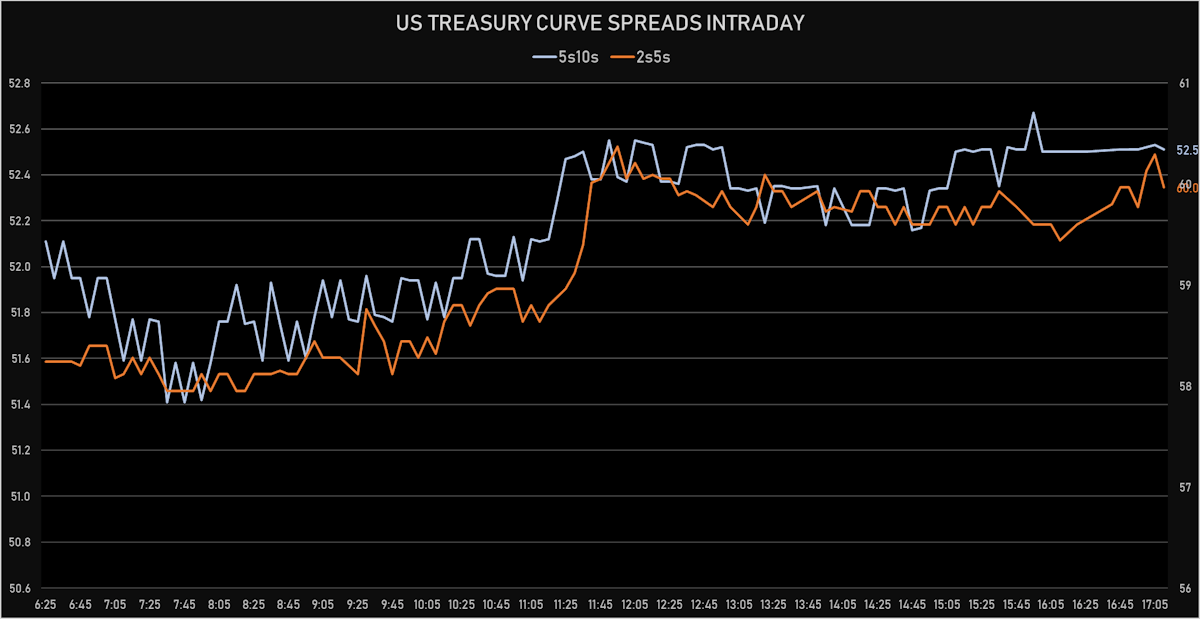

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.1158%

- The treasury yield curve steepened, with the 1s10s spread widening 4.6 bp, now at 126.9 bp (YTD change: +46.4bp)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2147% (unchanged)

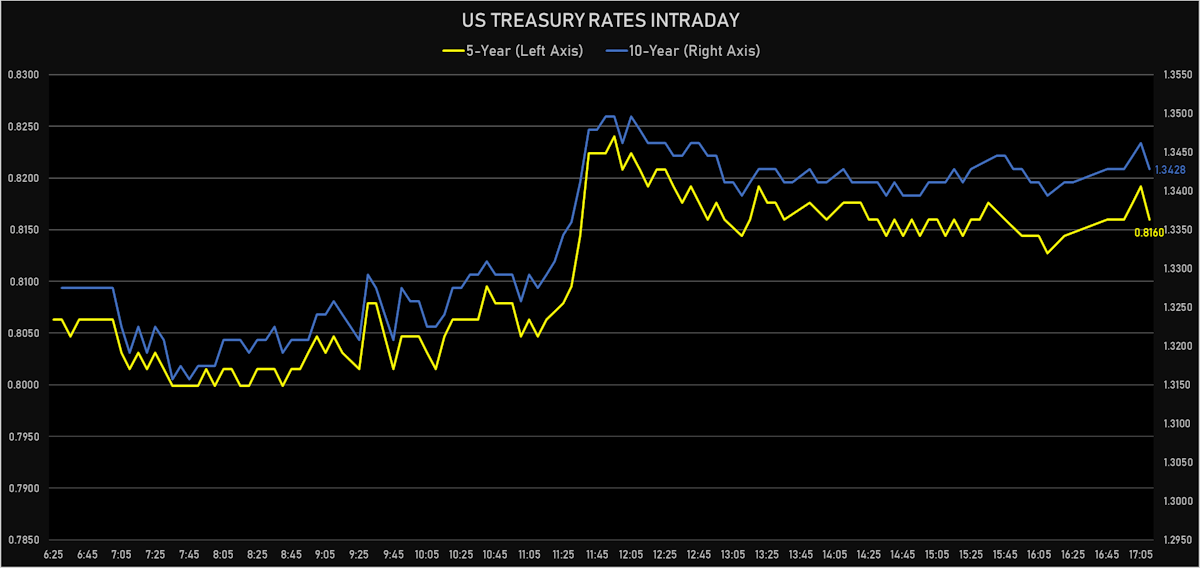

- 5Y: 0.8160% (up 2.8 bp)

- 7Y: 1.1226% (up 4.2 bp)

- 10Y: 1.3428% (up 4.6 bp)

- 30Y: 1.9344% (up 4.1 bp)

- US treasury curve spreads: 2s5s at 60.2bp (up 2.7bp today), 5s10s at 52.7bp (up 1.8bp today), 10s30s at 59.2bp (down -0.3bp)

- Treasuries butterfly spreads: 2s5s10s at -7.8bp (down -0.9bp), 5s10s30s at 6.2bp (down -2.5bp)

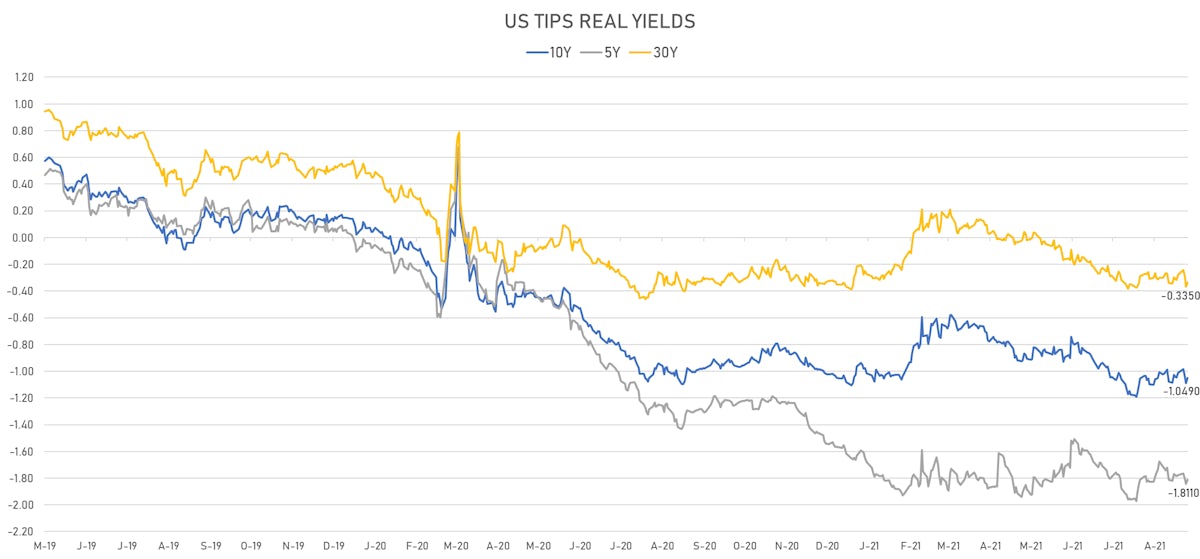

- US 5-Year TIPS Real Yield: +3.2 bp at -1.8110%; 10-Year TIPS Real Yield: +4.0 bp at -1.0490%; 30-Year TIPS Real Yield: +3.4 bp at -0.3350%

US MACRO RELEASES

- PPI ex Food/Energy/Trade MM, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.30 % (vs 0.90 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Aug 2021 (BLS, U.S Dep. Of Lab) at 6.30 % (vs 6.10 % prior)

- Producer Prices, Final demand less foods and energy, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 1.00 % prior), above consensus estimate of 0.50 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Aug 2021 (BLS, U.S Dep. Of Lab) at 6.70 % (vs 6.20 % prior), above consensus estimate of 6.60 %

- Producer Prices, Final demand, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.70 % (vs 1.00 % prior), above consensus estimate of 0.60 %

- Producer Prices, Final demand, Change Y/Y for Aug 2021 (BLS, U.S Dep. Of Lab) at 8.30 % (vs 7.80 % prior), above consensus estimate of 8.20 %

- Wholesale Inventories, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.60 % (vs 0.60 % prior), in line with consensus estimate

- Wholesale Trade, Change P/P for Jul 2021 (U.S. Census Bureau) at 2.00 % (vs 2.00 % prior), above consensus estimate of 1.00 %

WEEKLY CFTC POSITIONING DATA

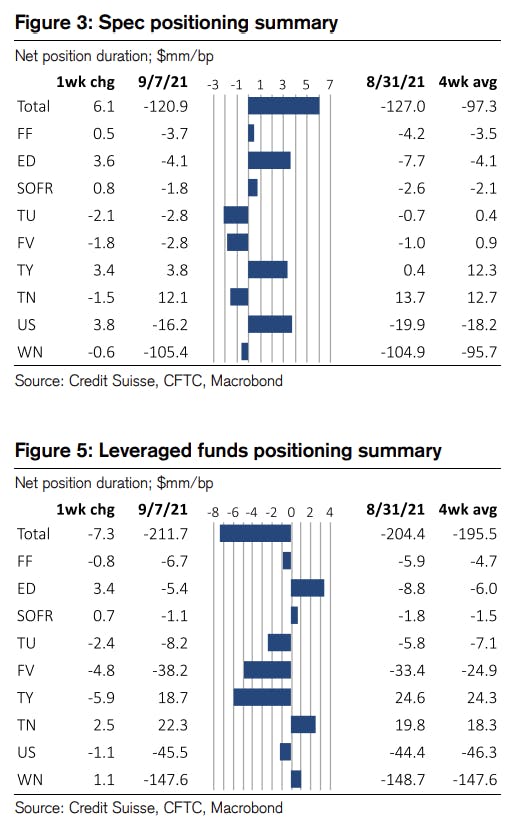

- Leveraged funds increased their net short duration, mostly at the longer end of the curve

- Specs reduced lightened their net short duration by about 5%, mainly through Eurodollars, 10s, 30s

US FORWARD RATES

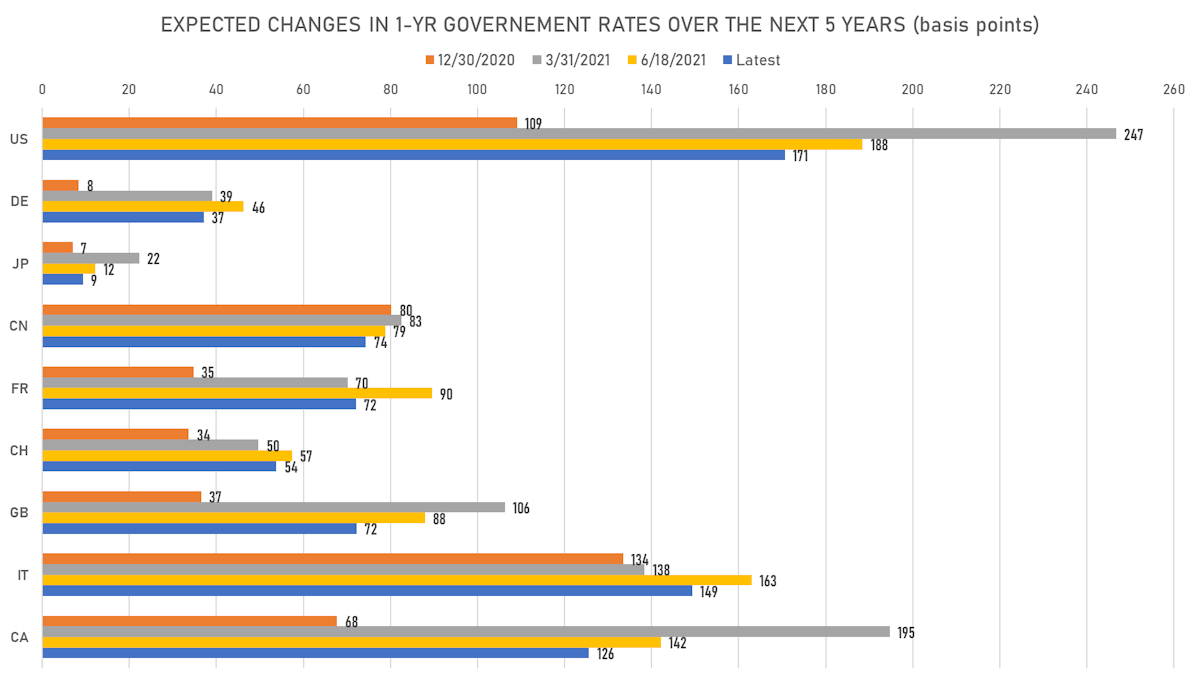

- US Treasury 1-year zero-coupon rate 5 years forward up 7.0 bp, now at 1.7871%, meaning that

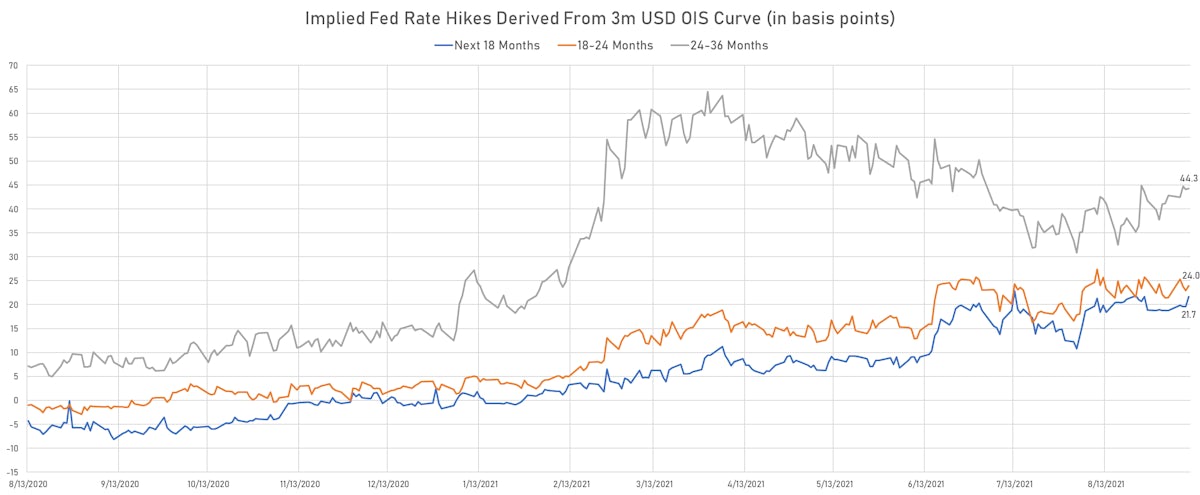

1-Year Treasury rates are now expected to increase by 170.7 bp over the next 5 years - 3-month Eurodollar futures expected hike of 16.2 bp by the end of 2022 (meaning the market prices 64.8% chance of a 25bp hike by end of 2022)

- The 3-month Eurodollar zero curve prices in 15.3 bp of rate hikes over the next 15 months (equivalent to 0.61 rate hike) and 112.0 bp over the next 3 years (equivalent to 4.48 rate hikes)

US INFLATION & REAL RATES

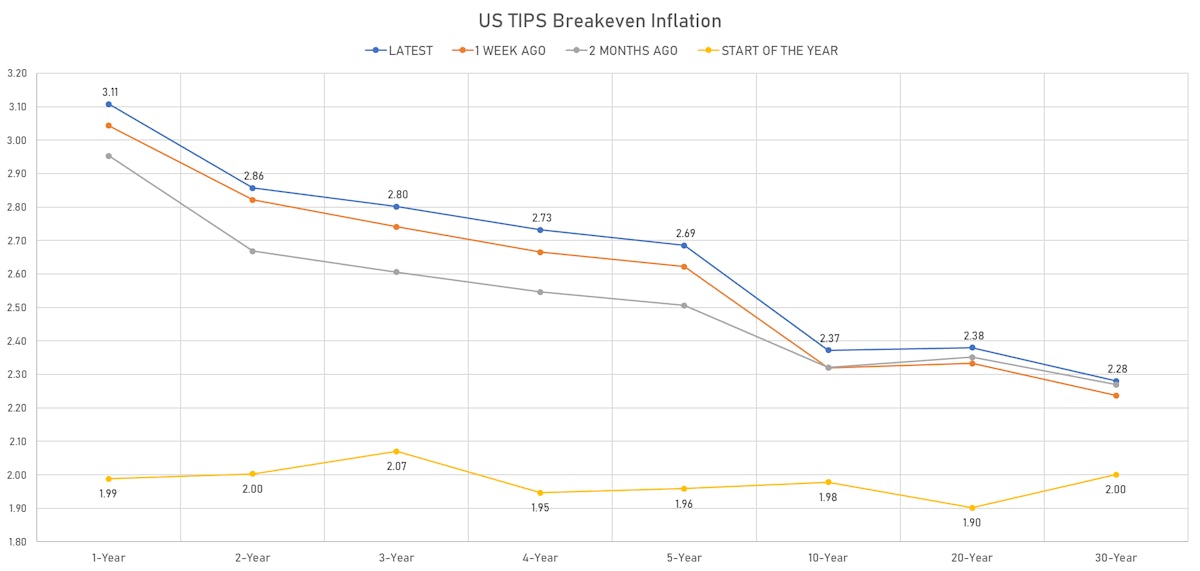

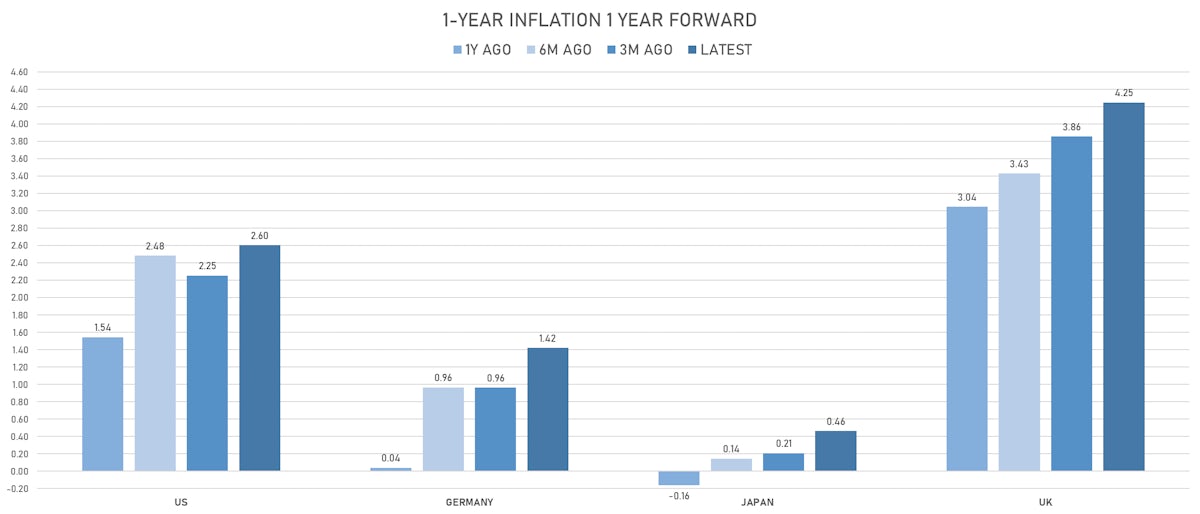

- TIPS 1Y breakeven inflation at 3.11% (up 2.8bp); 2Y at 2.86% (down -1.8bp); 5Y at 2.69% (down -0.3bp); 10Y at 2.37% (up 0.6bp); 30Y at 2.28% (up 0.8bp)

- 6-month spot US CPI swap up 7.0 bp to 4.116%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8110%, +3.2 bp today; 10Y at -1.0490%, +4.0 bp today; 30Y at -0.3350%, +3.4 bp today

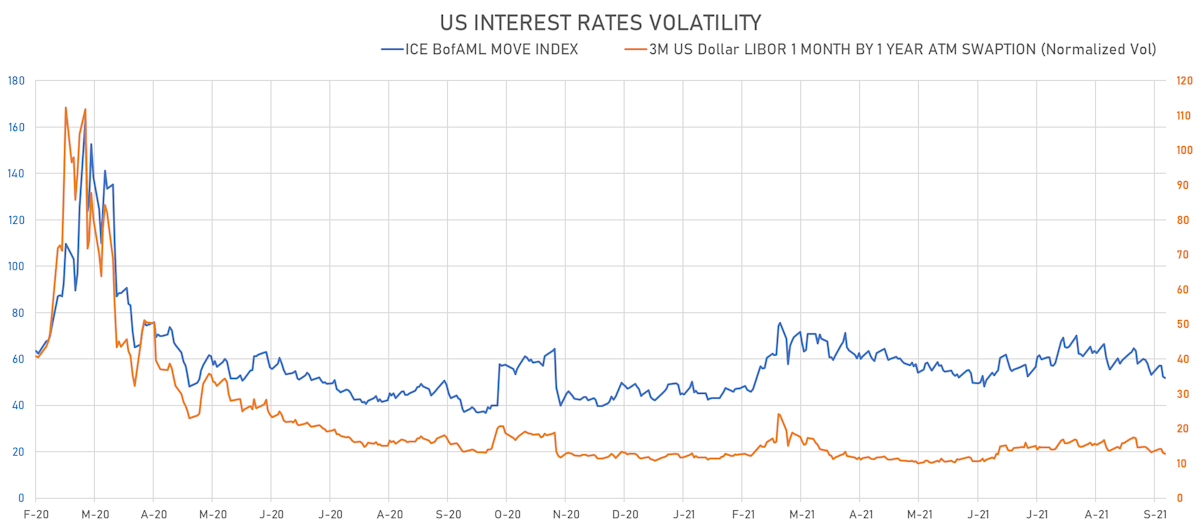

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 12.8%

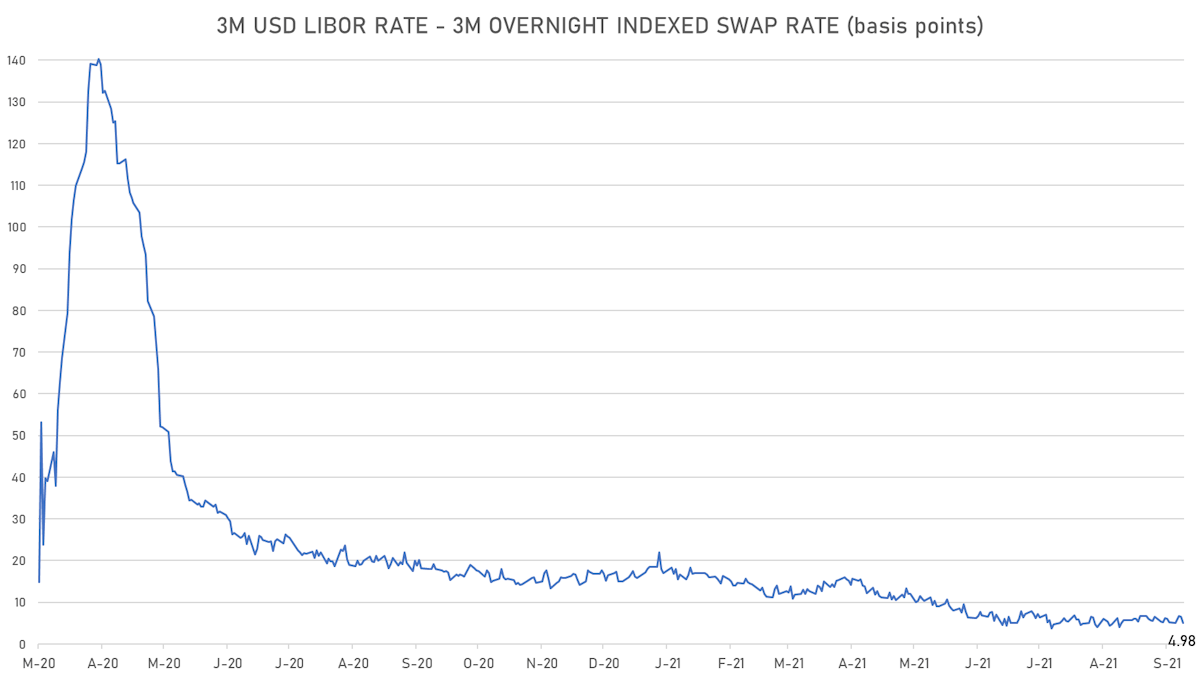

- 3-Month LIBOR-OIS spread down -1.5 bp at 5.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.635% (up 2.3 bp); the German 1Y-10Y curve is 2.8 bp steeper at 34.2bp (YTD change: +18.4 bp)

- Japan 5Y: -0.092% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.0 bp flatter at 15.4bp (YTD change: +0.9 bp)

- China 5Y: 2.708% (up 1.3 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 61.4bp (YTD change: +15.0 bp)

- Switzerland 5Y: -0.603% (up 0.6 bp); the Swiss 1Y-10Y curve is 0.8 bp steeper at 46.5bp (YTD change: +17.1 bp)