Rates

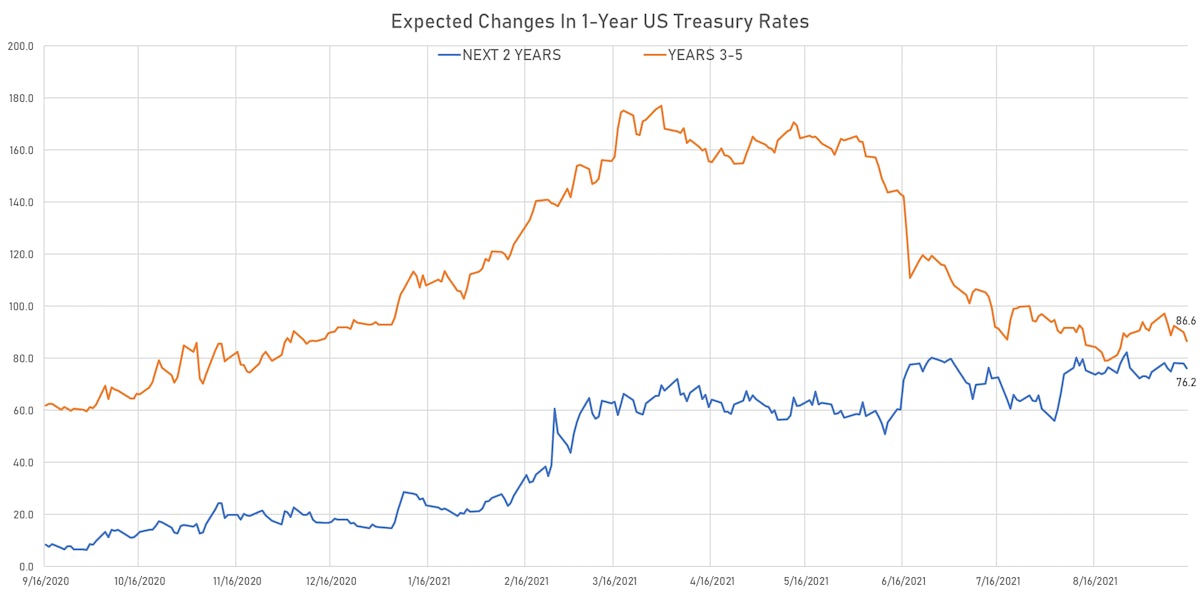

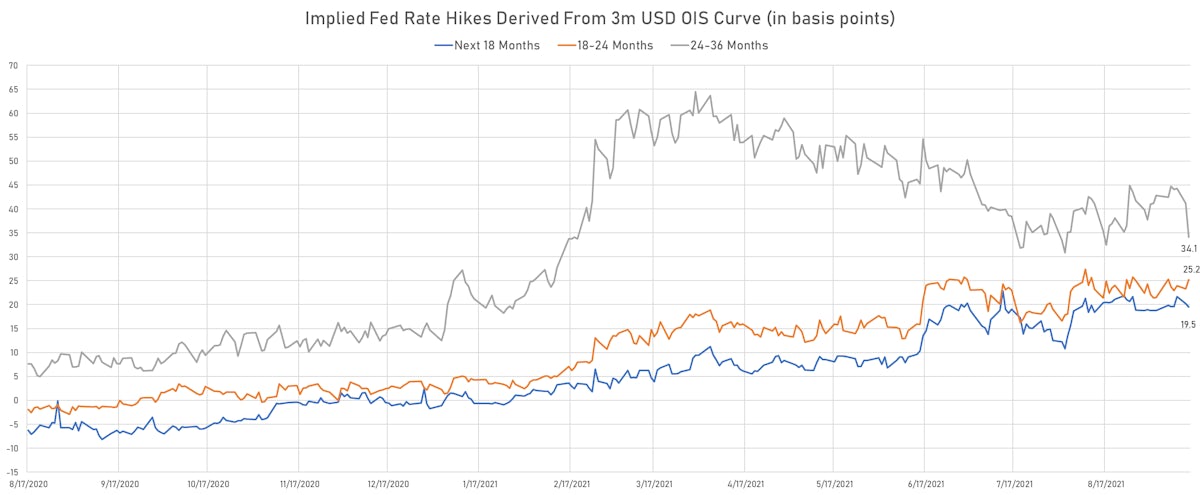

CPI Growth Slower Than Expected, Likelihood Of Fed Rate Hike Over The Next 18 Months Drops

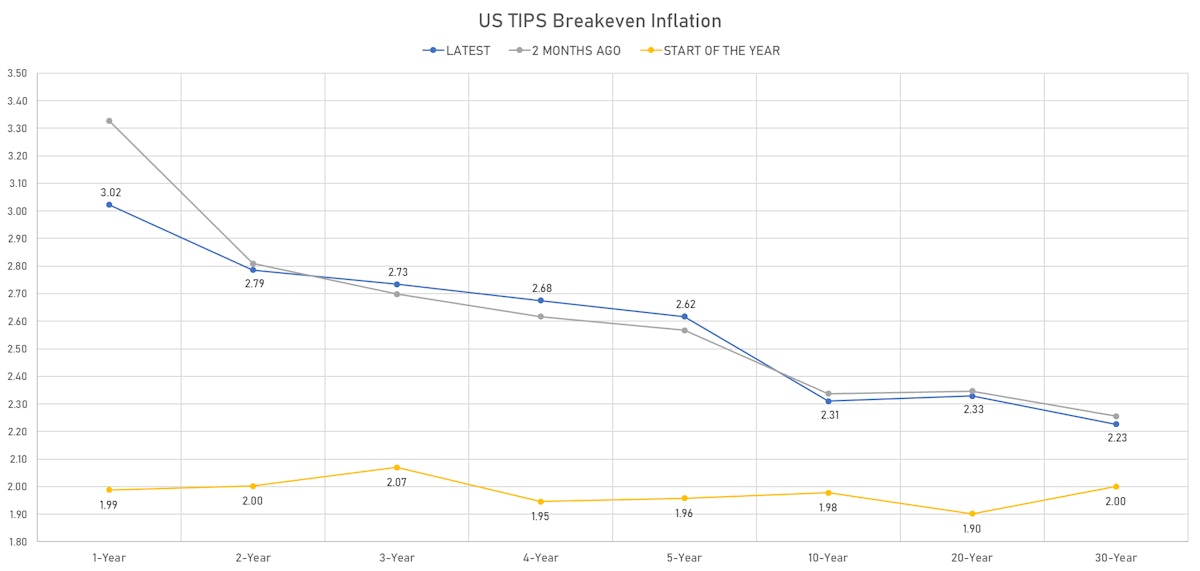

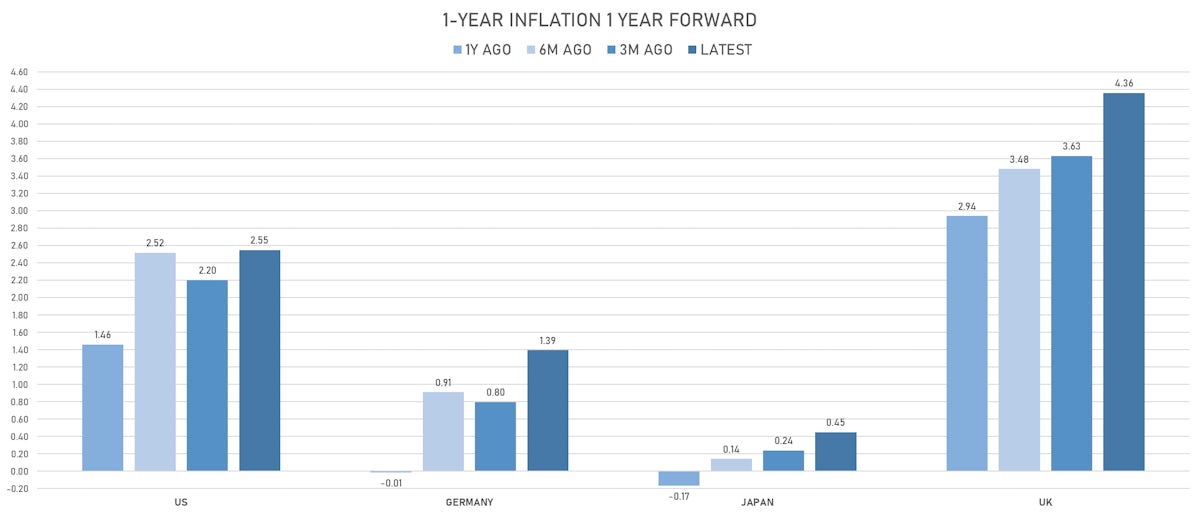

The TIPS breakeven inflation curve and Treasury yield curve both flattened, meaning that the lack of short-term rate hikes no longer leads to higher long rates, projecting a return to secular stagnation rather than stagflation

Published ET

Implied Fed Hikes Derived From The 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.1180%

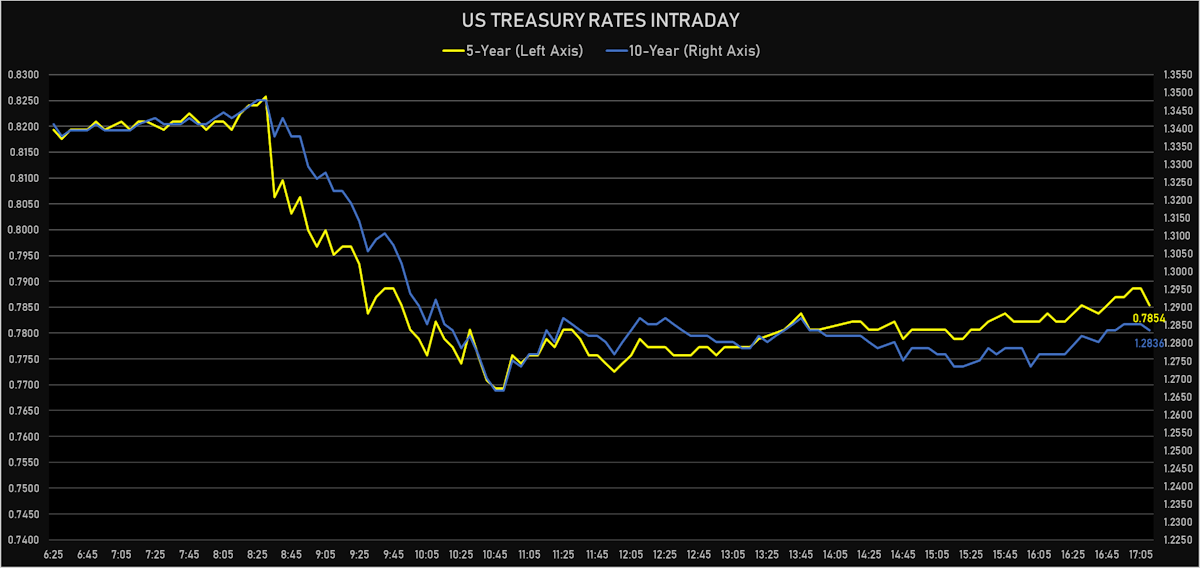

- The treasury yield curve flattened, with the 1s10s spread tightening -4.2 bp, now at 121.0 bp (YTD change: +40.5bp)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2090% (down 0.4 bp)

- 5Y: 0.7854% (down 2.1 bp)

- 7Y: 1.0759% (down 3.0 bp)

- 10Y: 1.2836% (down 4.2 bp)

- 30Y: 1.8585% (down 4.7 bp)

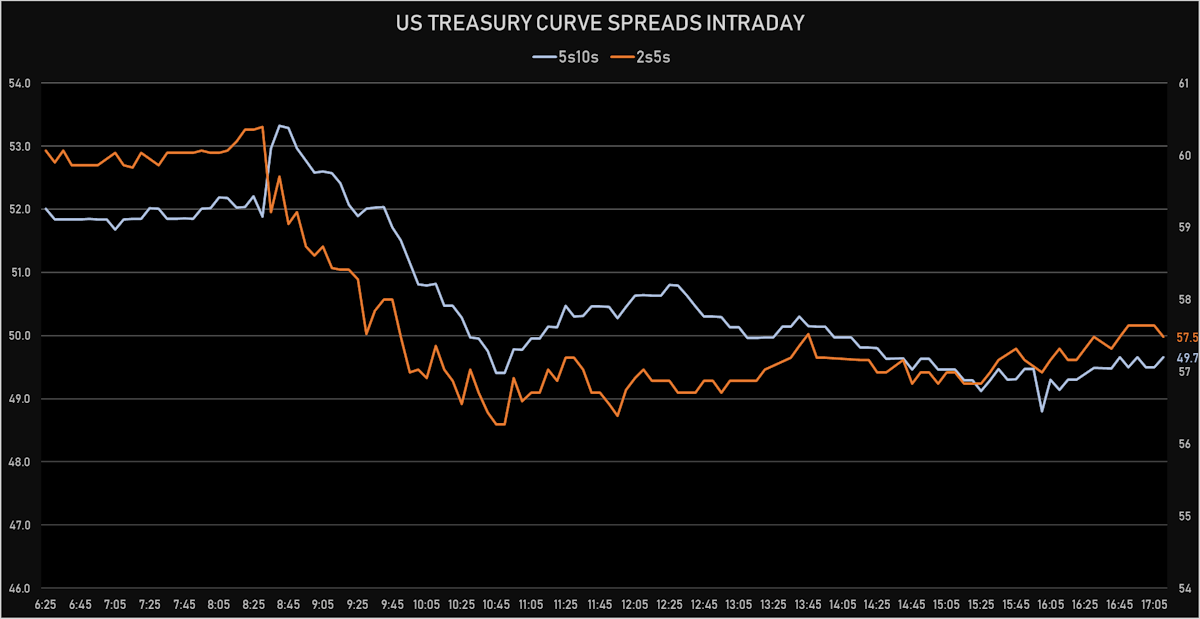

- US treasury curve spreads: 2s5s at 57.7bp (down -1.7bp), 5s10s at 49.8bp (down -2.1bp), 10s30s at 57.5bp (down -0.4bp)

- Treasuries butterfly spreads: 2s5s10s at -8.2bp (down -0.4bp), 5s10s30s at 7.5bp (up 2.2bp)

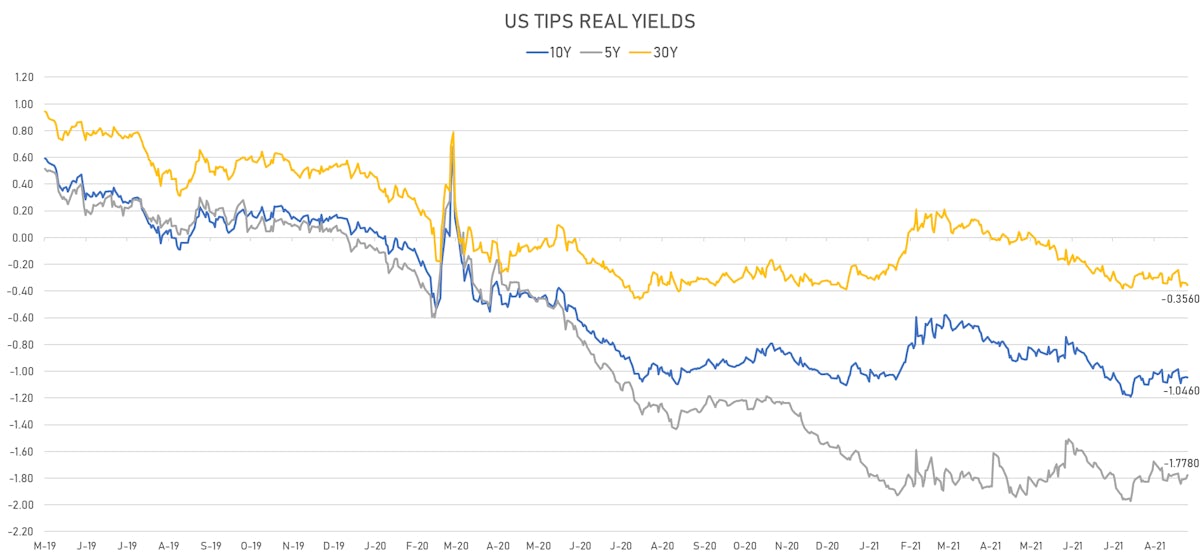

- US 5-Year TIPS Real Yield: +2.5 bp at -1.7780%; 10-Year TIPS Real Yield: -0.3 bp at -1.0460%; 30-Year TIPS Real Yield: -1.5 bp at -0.3560%

COMMENTARY ON CPI DATA

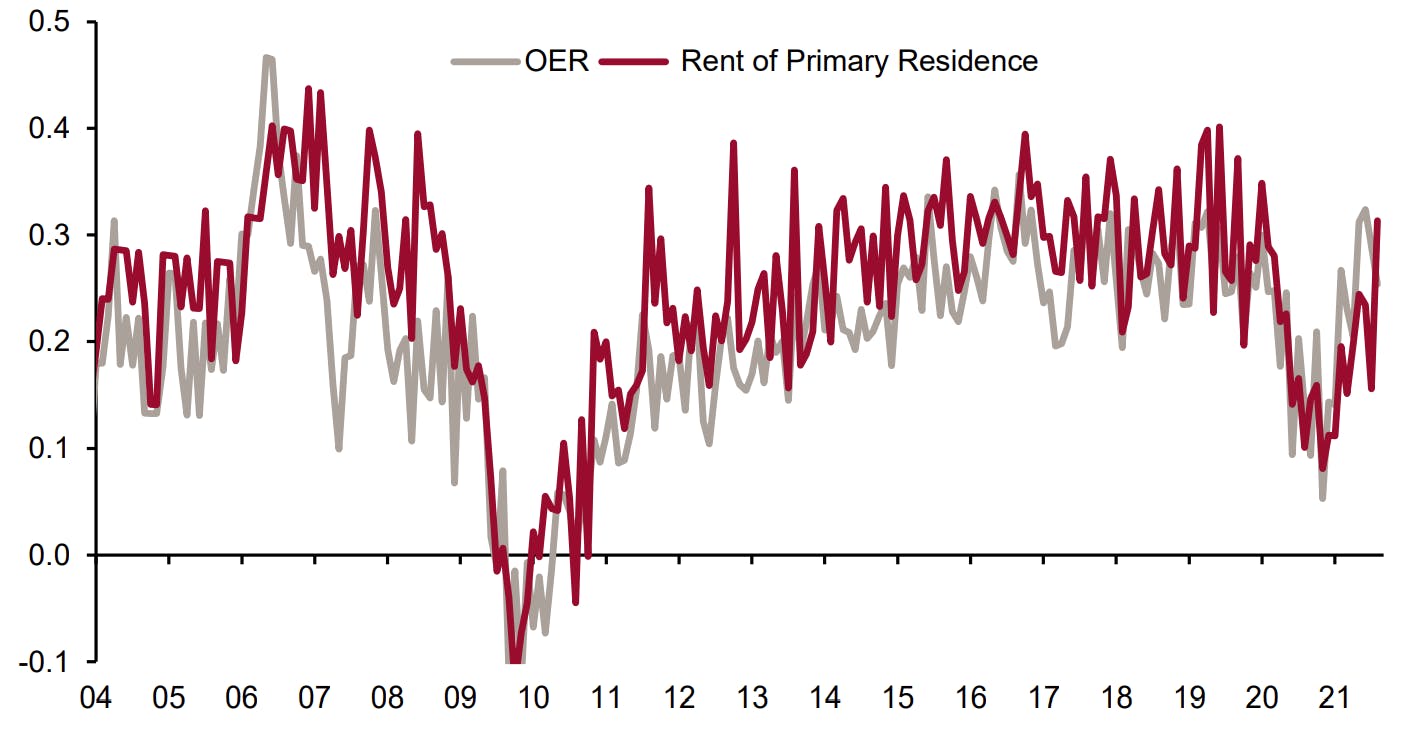

- Shelter inflation is the sticky category that is of most concern (see Credit Suisse commentary and chart below): "With a share of over 30% in CPI, shelter is the most important driver of the underlying inflation trend. Various rent price indicators have accelerated significantly this year. CPI rent measures adjust relatively slowly, but we expect price increases to show up in the data soon."

- With that in mind, the good news is that tapering is still expected to start before the end of the year and getting the Fed out of the MBS market should help ease the rise in housing prices and rents (with a lag)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 11 Sep (Redbook Research) at 15.30 % (vs 16.50 % prior)

- CPI - All Urban Samples: All Items, Change Y/Y for Aug 2021 (BLS, U.S Dep. Of Lab) at 5.30 % (vs 5.40 % prior), in line with consensus estimate

CPI, All items less food and energy for Aug 2021 (BLS, U.S Dep. Of Lab) at 279.34 (vs 279.05 prior) - CPI, All items less food and energy, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.10 % (vs 0.30 % prior), below consensus estimate of 0.30 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Aug 2021 (BLS, U.S Dep. Of Lab) at 4.00 % (vs 4.30 % prior), below consensus estimate of 4.20 %

- CPI, All items, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.30 % (vs 0.50 % prior), below consensus estimate of 0.40 %

- CPI, All items, Price Index for Aug 2021 (BLS, U.S Dep. Of Lab) at 273.57 (vs 273.00 prior), below consensus estimate of 273.79

- CPI, FRB Cleveland Median, 1 month, Change M/M for Aug 2021 (Fed Reserve, Cleveland) at 0.30 % (vs 0.30 % prior)

- Earnings, Average Weekly, Total Private, Change P/P for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.30 % (vs -0.10 % prior)

- NFIB, Index of Small Business Optimism for Aug 2021 (NFIB, United States) at 100.10 (vs 99.70 prior)

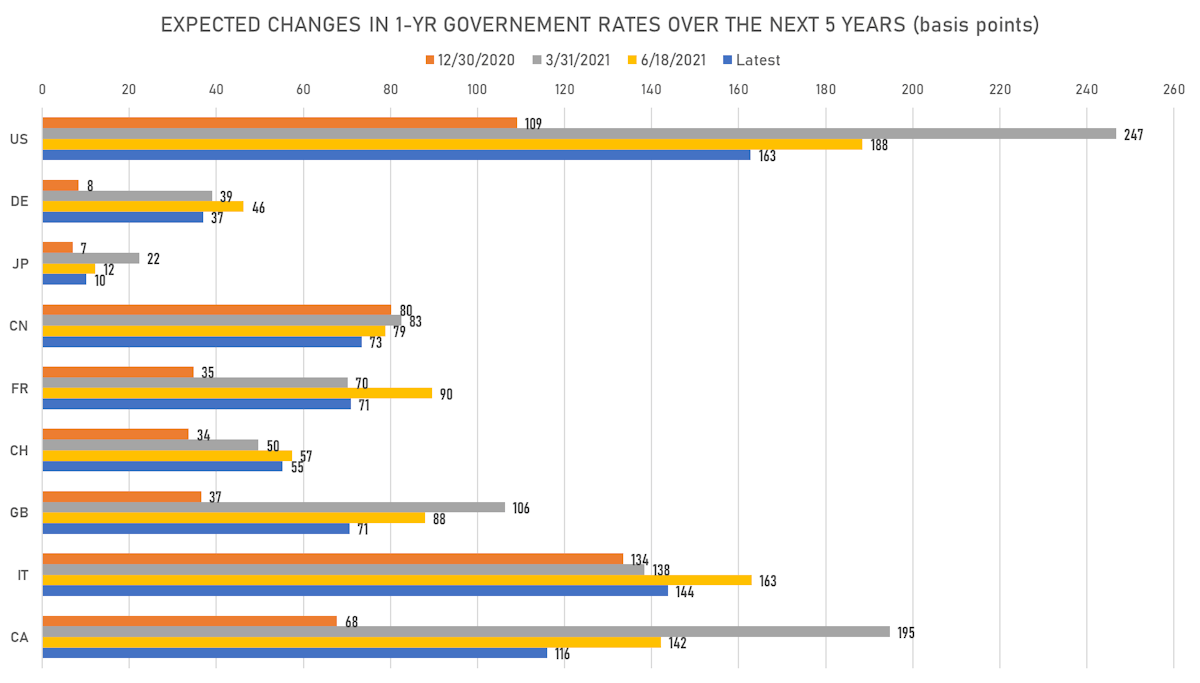

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 5.6 bp, now at 1.7055%

- 1-Year Treasury rates are now expected to increase by 162.7 bp over the next 5 years

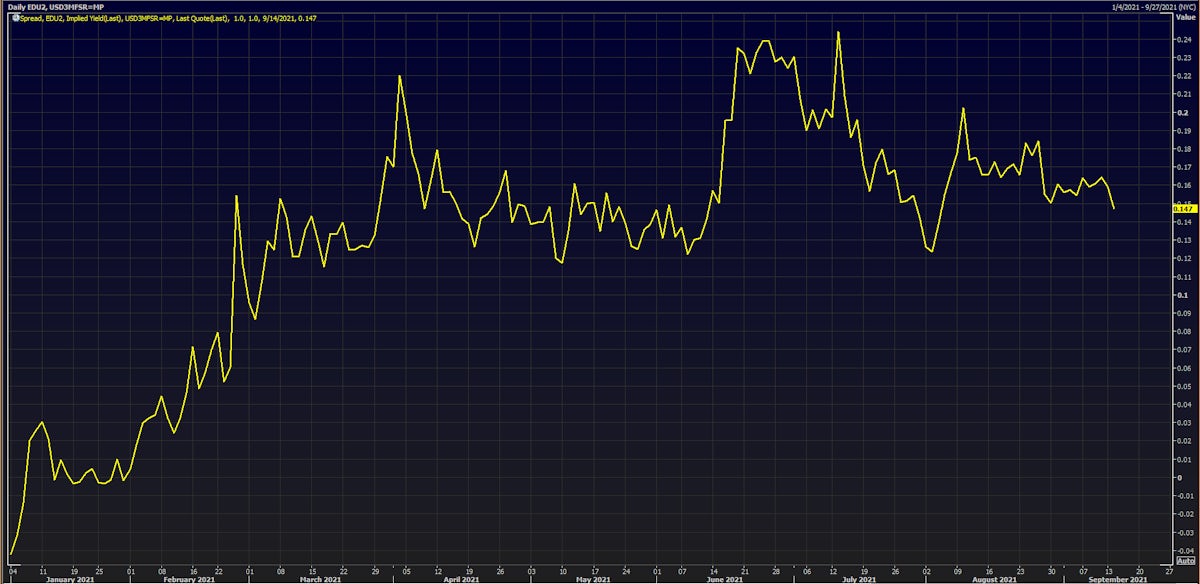

- 3-month Eurodollar futures expected hike of 14.2 bp by the end of 2022 (meaning the market prices 56.8% chance of a 25bp hike by end of 2022)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.02% (down -9.0bp); 2Y at 2.79% (down -5.8bp); 5Y at 2.62% (down -4.6bp); 10Y at 2.31% (down -3.9bp); 30Y at 2.23% (down -3.1bp)

- 6-month spot US CPI swap down -24.3 bp to 3.871%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7780%, +2.5 bp today; 10Y at -1.0460%, -0.3 bp today; 30Y at -0.3560%, -1.5 bp today

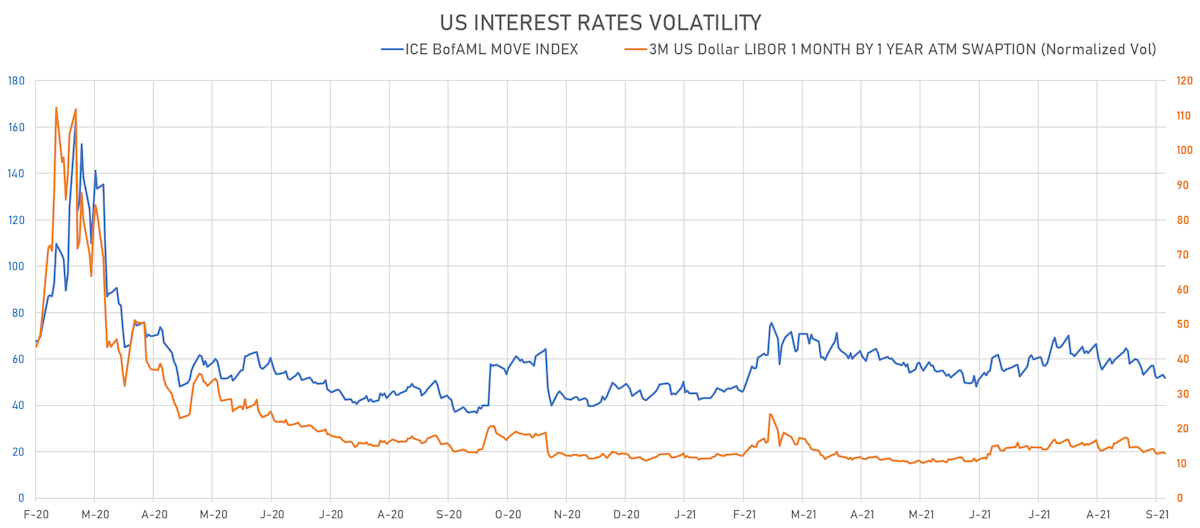

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.3% at 12.9%

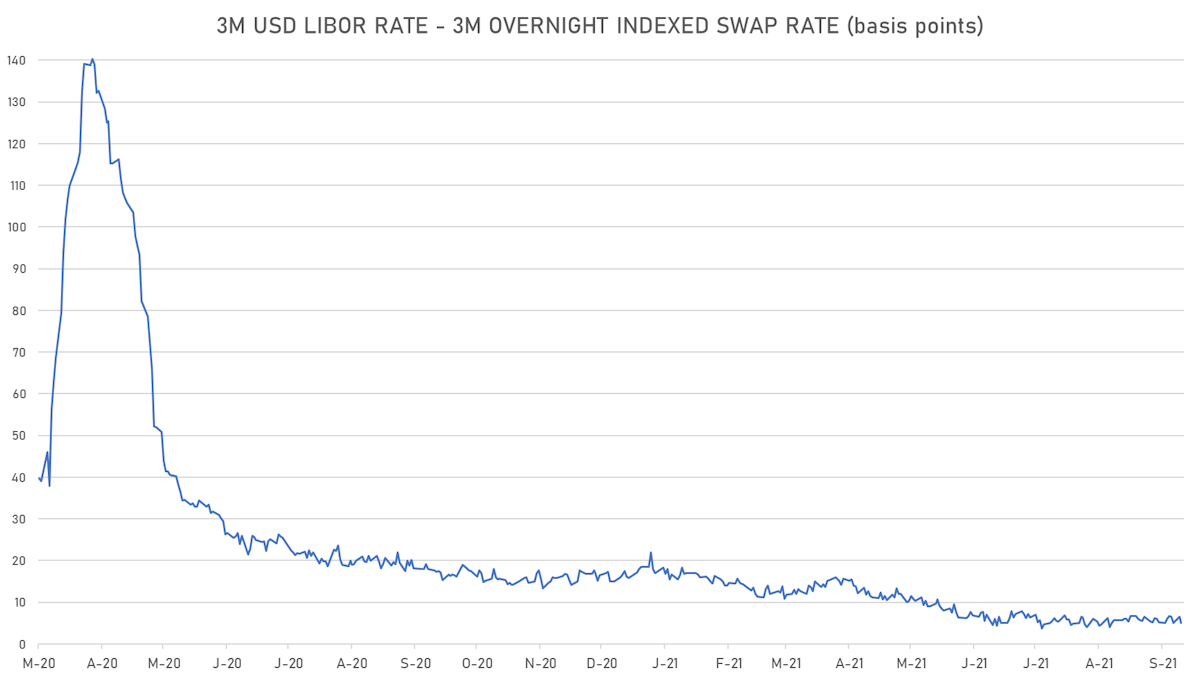

- 3-Month LIBOR-OIS spread down -1.5 bp at 5.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.645% (down -0.3 bp); the German 1Y-10Y curve is 0.5 bp flatter at 33.0bp (YTD change: +18.1 bp)

- Japan 5Y: -0.096% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 15.4bp (YTD change: +1.4 bp)

- China 5Y: 2.730% (up 1.5 bp); the Chinese 1Y-10Y curve is 4.6 bp flatter at 57.2bp (YTD change: +10.8 bp)

- Switzerland 5Y: -0.571% (up 0.3 bp); the Swiss 1Y-10Y curve is 0.1 bp steeper at 46.8bp (YTD change: +18.4 bp)