Rates

TIPS Breakeven Inflation Expectations Rise, Yield Curve Steepens Slightly

Industrial production came in below consensus estimate, with weather events closing manufacturing facilities last month, but industrial capacity utilization edged higher

Published ET

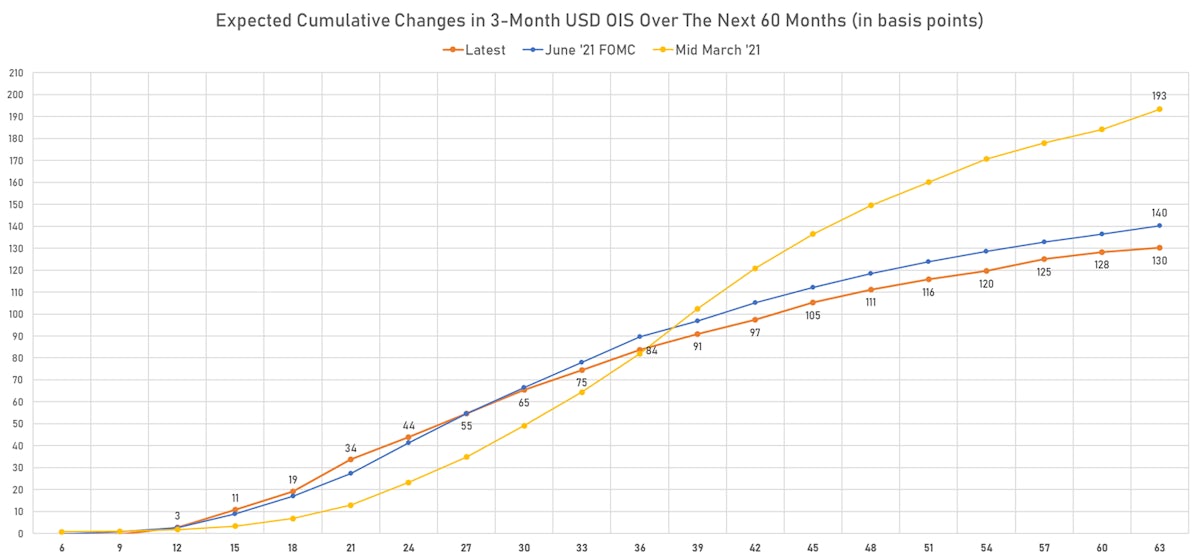

Implied Timing Of Hikes Derived From The 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.1200%

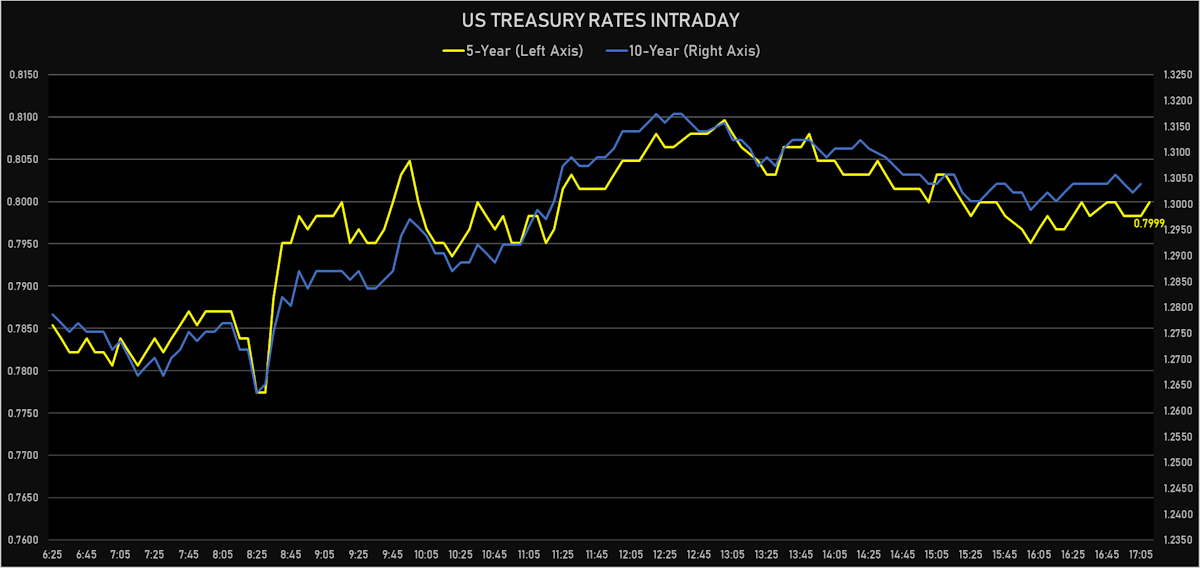

- The treasury yield curve steepened, with the 1s10s spread widening 2.3 bp, now at 123.3 bp (YTD change: +42.8bp)

- 1Y: 0.0710% (down 0.3 bp)

- 2Y: 0.2131% (up 0.4 bp)

- 5Y: 0.7999% (up 1.5 bp)

- 7Y: 1.0946% (up 1.9 bp)

- 10Y: 1.3039% (up 2.0 bp)

- 30Y: 1.8639% (up 0.5 bp)

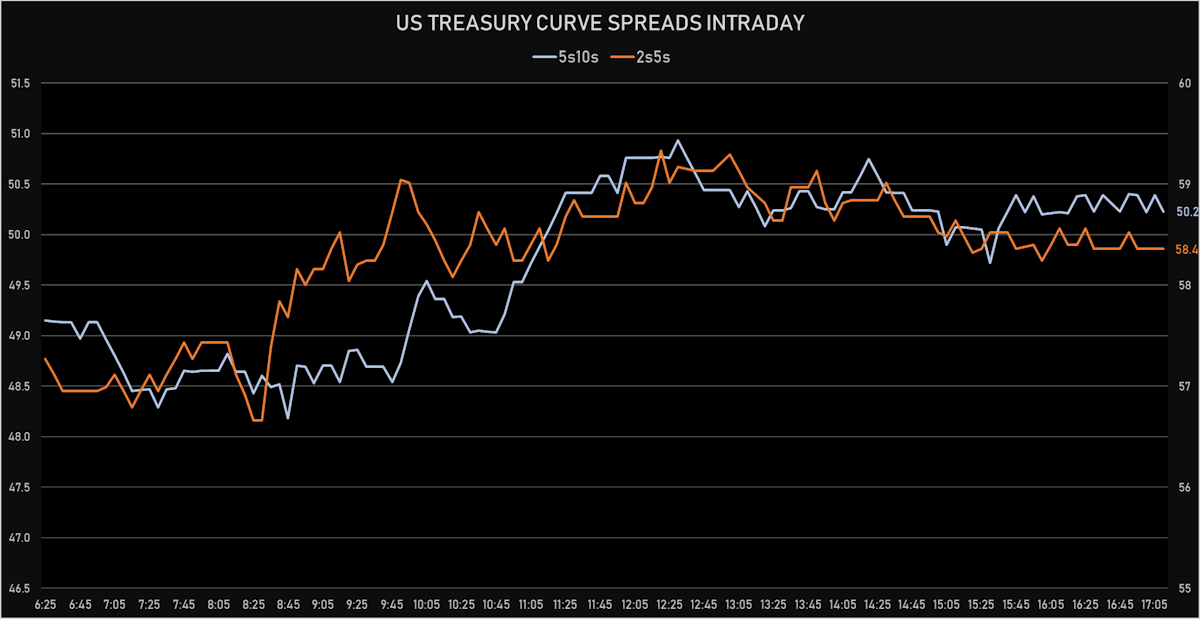

- US treasury curve spreads: 2s5s at 58.6bp (up 0.9bp today), 5s10s at 50.5bp (up 0.6bp today), 10s30s at 56.0bp (down -1.6bp)

- Treasuries butterfly spreads: 2s5s10s at -8.7bp (down -0.5bp), 5s10s30s at 5.3bp (down -2.2bp)

- US 5-Year TIPS Real Yield: -1.9 bp at -1.7970%; 10-Year TIPS Real Yield: +0.3 bp at -1.0430%; 30-Year TIPS Real Yield: +0.2 bp at -0.3540%

US MACRO RELEASES

- Capacity Utilization, Total index, Change M/M for Aug 2021 (FED, U.S.) at 76.40 % (vs 76.10 % prior), in line with consensus estimate

- Export Prices, All commodities, Change P/P, Price Index for Aug 2021 (BLS, U.S Dep. Of Lab) at 0.40 % (vs 1.30 % prior), in line with consensus estimate

- Import Prices, All commodities, Change P/P, Price Index for Aug 2021 (BLS, U.S Dep. Of Lab) at -0.30 % (vs 0.30 % prior), below consensus estimate of 0.30 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 10 Sep (MBA, USA) at 0.30 % (vs -1.90 % prior)

- Mortgage applications, market composite index for W 10 Sep (MBA, USA) at 707.90 (vs 705.60 prior)

- Mortgage applications, market composite index, purchase for W 10 Sep (MBA, USA) at 277.90 (vs 258.40 prior)

- Mortgage applications, market composite index, refinancing for W 10 Sep (MBA, USA) at 3,185.60 (vs 3,292.10 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 10 Sep (MBA, USA) at 3.03 % (vs 3.03 % prior)

- New York Fed, General Business Condition for Sep 2021 (FED, NY) at 34.30 (vs 18.30 prior), above consensus estimate of 18.00

- Production, Change P/P for Aug 2021 (FED, U.S.) at 0.40 % (vs 0.90 % prior), in line with consensus estimate

- Production, Manufacturing, Total (SIC), Change P/P for Aug 2021 (FED, U.S.) at 0.20 % (vs 1.40 % prior), below consensus estimate of 0.40 %

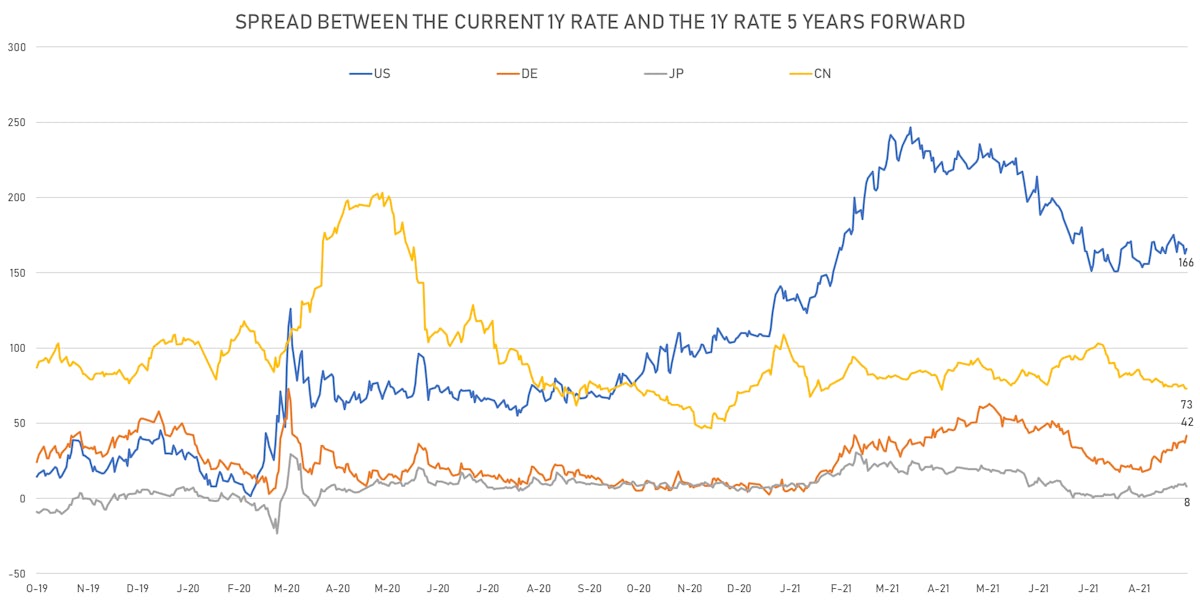

US FORWARD RATES

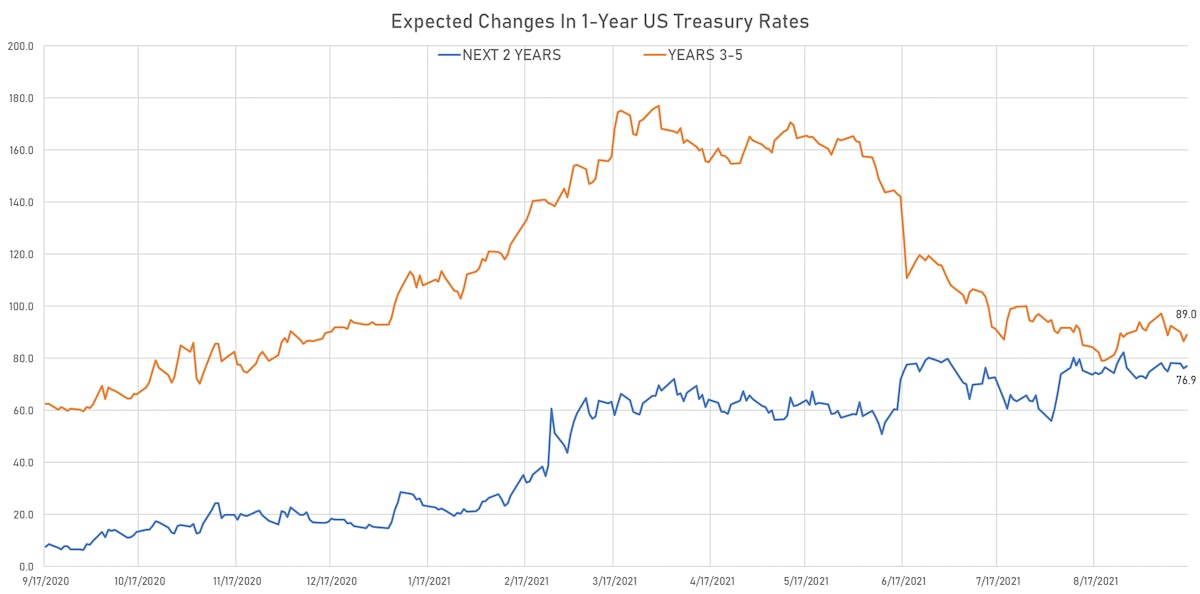

- US Treasury 1-year zero-coupon rate 5 years forward up 3.3 bp, now at 1.7383%

- 1-Year Treasury rates are now expected to increase by 166bp over the next 5 years (down from 250bp earlier this year)

- 3-month Eurodollar futures expected hike of 14.7 bp by the end of 2022 (meaning the market prices 58.8% chance of a 25bp hike by end of 2022)

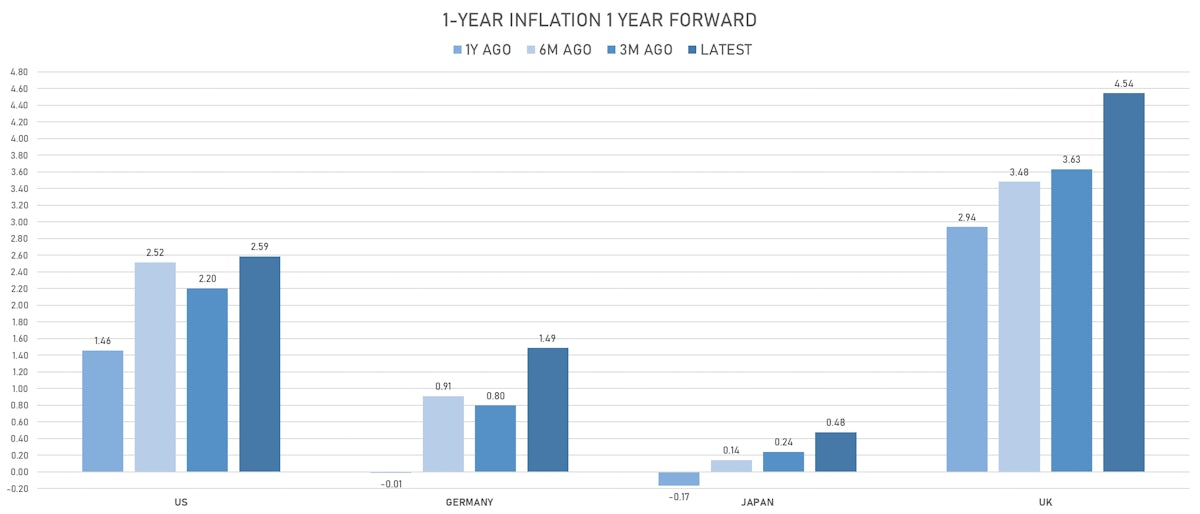

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.08% (up 5.2bp); 2Y at 2.83% (up 4.6bp); 5Y at 2.65% (up 3.4bp); 10Y at 2.33% (up 1.7bp); 30Y at 2.23% (up 0.3bp)

- US Real Rates: 5Y at -1.7970%, -1.9 bp today; 10Y at -1.0430%, +0.3 bp today; 30Y at -0.3540%, +0.2 bp today

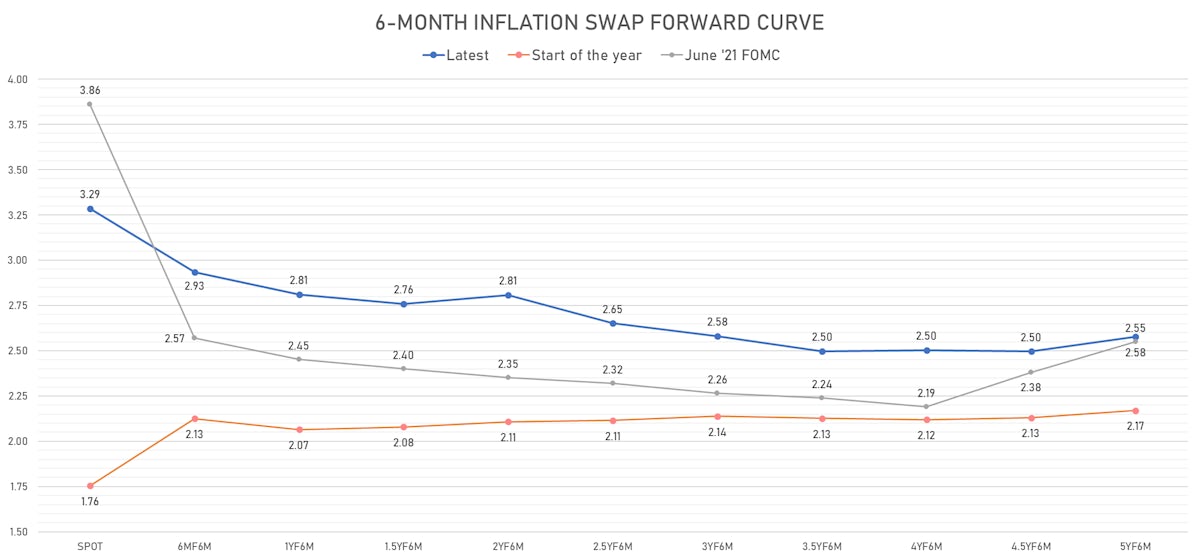

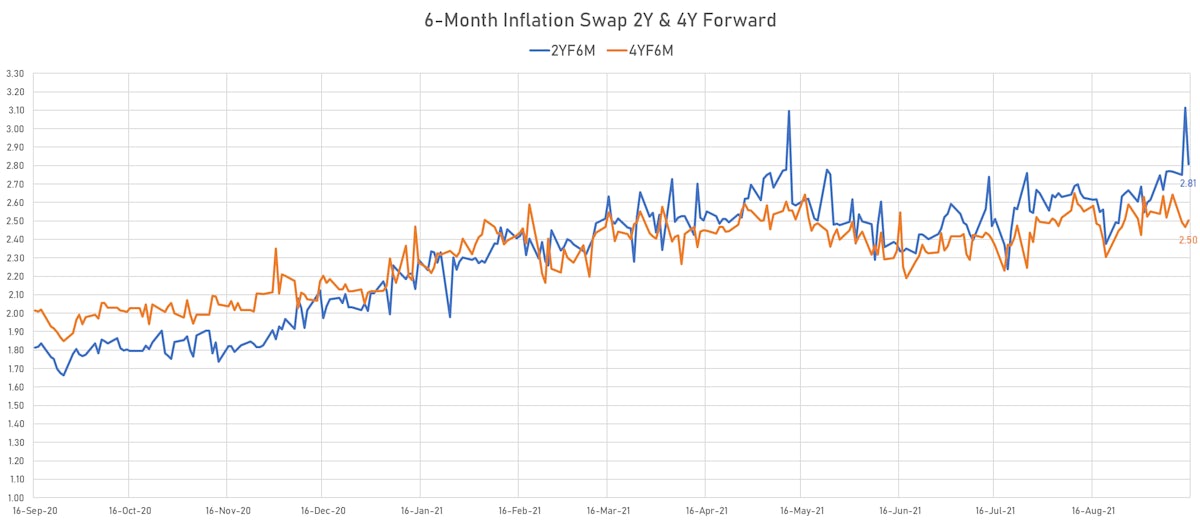

- The inflation swap curve is much flatter than it was back in June (see chart below), with longer-term expectations rising while they fell at the short end

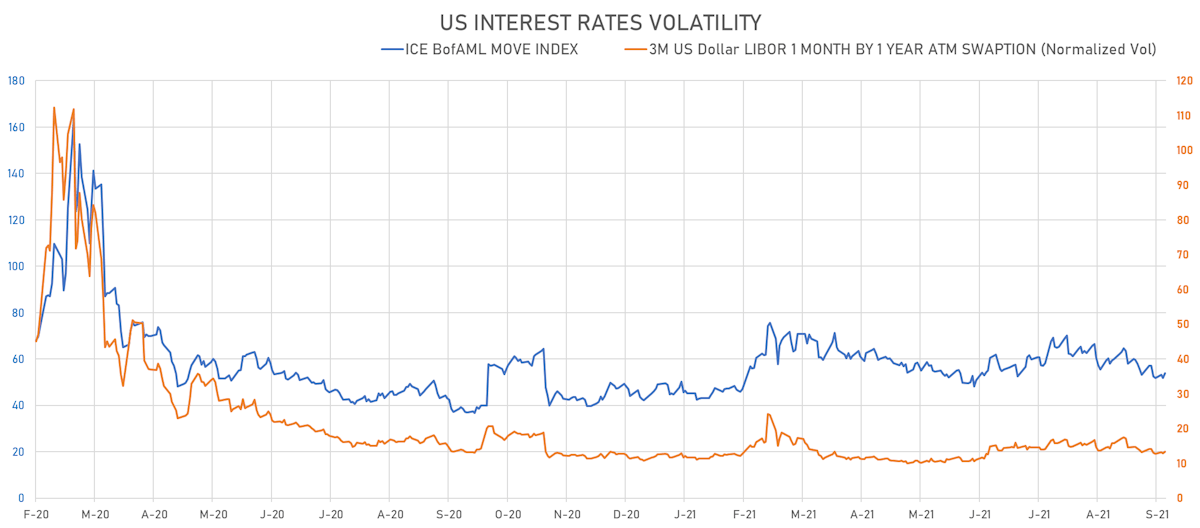

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.5% at 13.4%

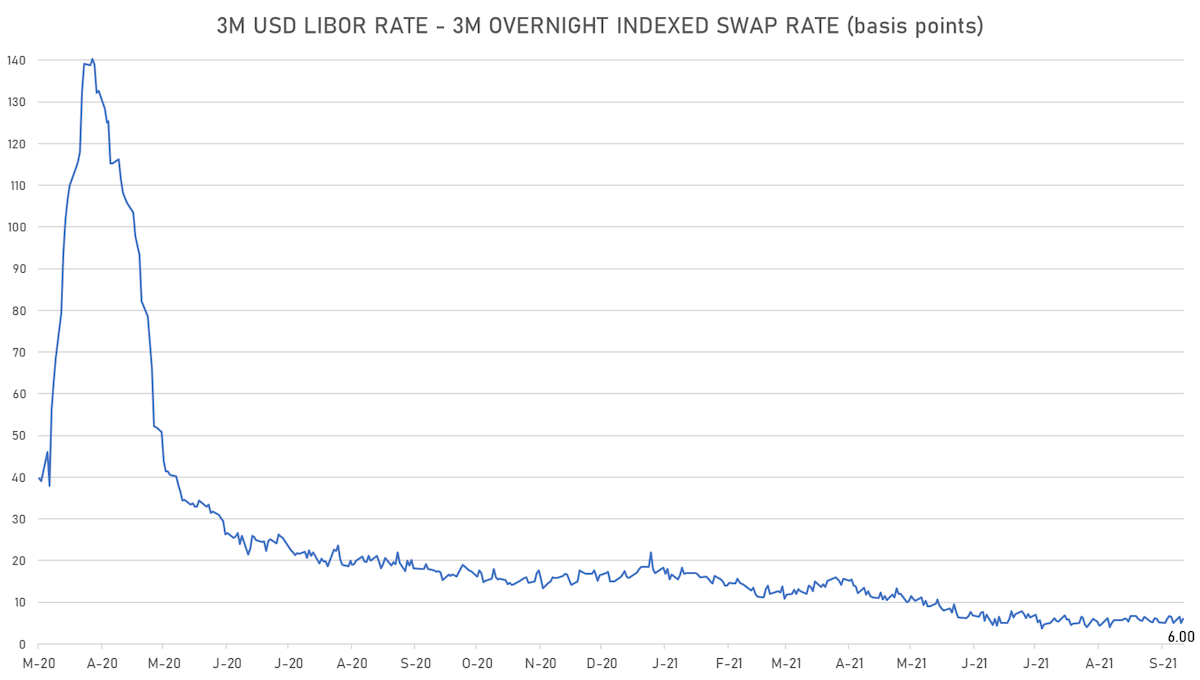

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.626% (up 1.7 bp); the German 1Y-10Y curve is 3.3 bp steeper at 36.5bp (YTD change: +21.4 bp)

- Japan 5Y: -0.104% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 14.8bp (YTD change: +0.8 bp)

- China 5Y: 2.735% (up 0.5 bp); the Chinese 1Y-10Y curve is unchanged at 57.2bp (YTD change: +10.8 bp)

- Switzerland 5Y: -0.578% (down -0.7 bp); the Swiss 1Y-10Y curve is 3.2 bp steeper at 45.0bp (YTD change: +21.6 bp)