Rates

Rates Curve Steepens On Good US Macro Data, As Retail Sales Blow Out Estimates

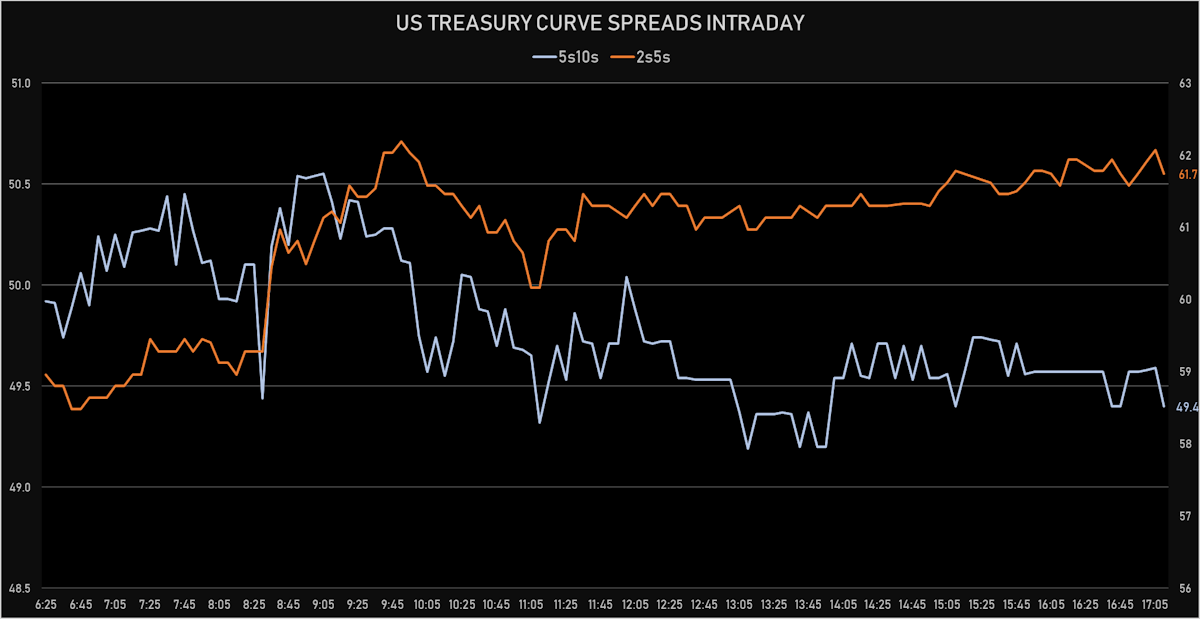

The belly of the curve is leading the rise in rates, with the 2s5s10s treasury butterfly spread closing at the lowest level in 3 years

Published ET

US Treasury 2s5s10s Butterfly Spread | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.1220%

- The treasury yield curve steepened, with the 1s10s spread widening 3.2 bp, now at 126.5 bp (YTD change: +46.1bp)

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2213% (up 0.8 bp)

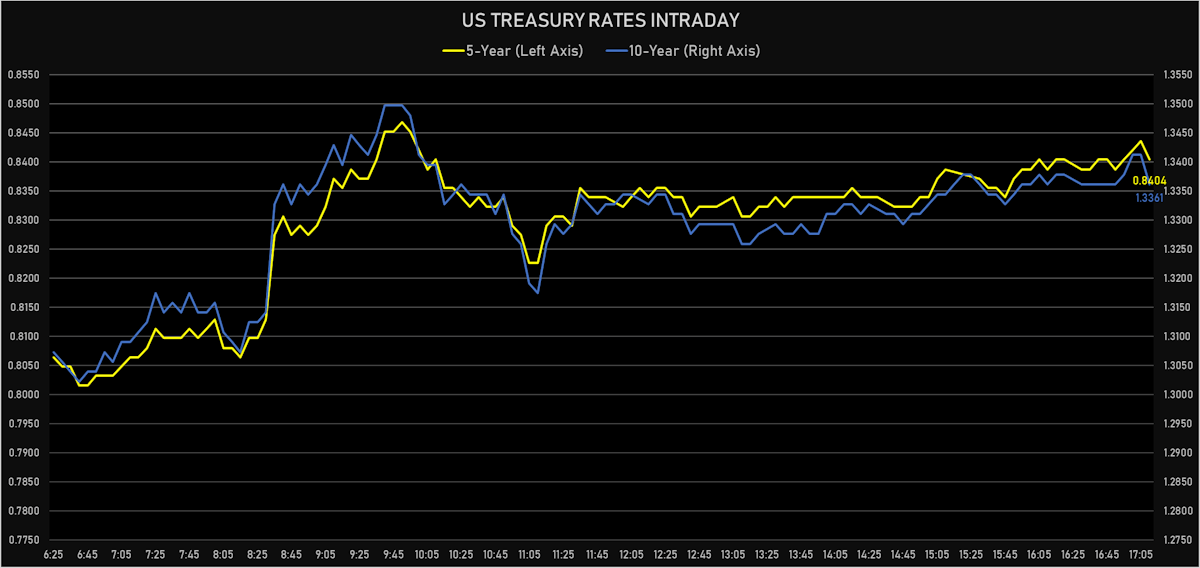

- 5Y: 0.8404% (up 4.1 bp)

- 7Y: 1.1344% (up 4.0 bp)

- 10Y: 1.3361% (up 3.2 bp)

- 30Y: 1.8807% (up 1.7 bp)

- US treasury curve spreads: 2s5s at 62.0bp (up 3.4bp today), 5s10s at 49.6bp (down -0.8bp), 10s30s at 54.5bp (down -1.5bp)

- Treasuries butterfly spreads: 2s5s10s at -12.9bp (down -4.3bp), 5s10s30s at 4.1bp (down -1.2bp)

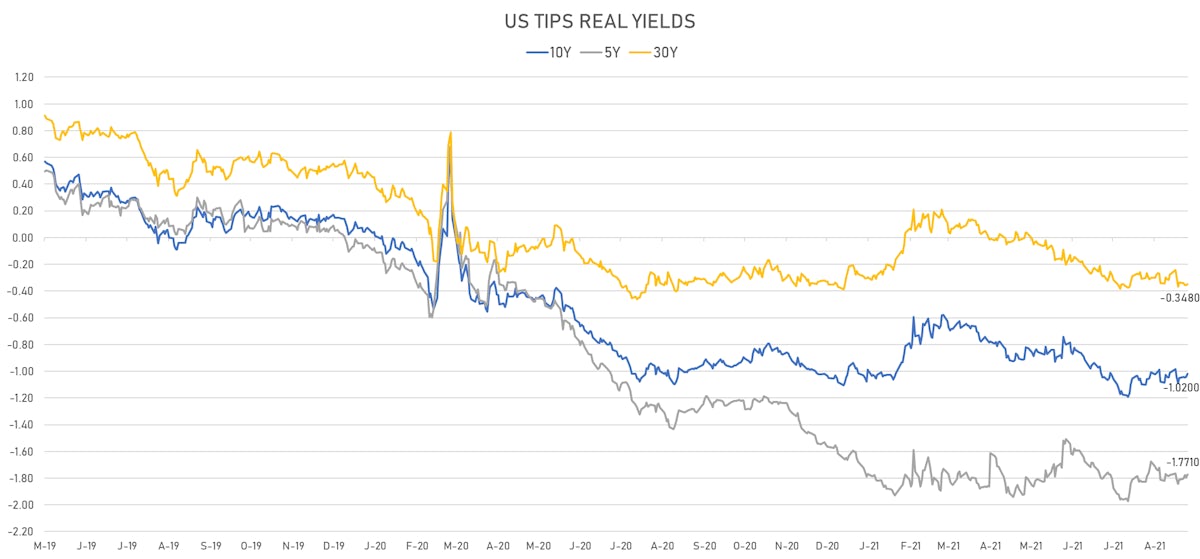

- US 5-Year TIPS Real Yield: +2.6 bp at -1.7710%; 10-Year TIPS Real Yield: +2.3 bp at -1.0200%; 30-Year TIPS Real Yield: +0.6 bp at -0.3480%

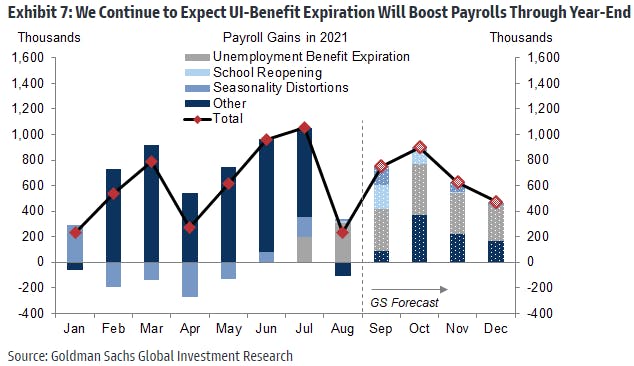

US MACRO RELEASES

- Jobless Claims, National, Continued for W 04 Sep (U.S. Dept. of Labor) at 2.67 Mln (vs 2.78 Mln prior), below consensus estimate of 2.79 Mln

- Jobless Claims, National, Initial for W 11 Sep (U.S. Dept. of Labor) at 332.00 k (vs 310.00 k prior), above consensus estimate of 330.00 k

- Jobless Claims, National, Initial, four week moving average for W 11 Sep (U.S. Dept. of Labor) at 335.75 k (vs 339.50 k prior)

- Net flows total, Current Prices for Jul 2021 (U.S. Dept. Treas.) at 126.00 Bln USD (vs 31.50 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Jul 2021 (U.S. Dept. Treas.) at -68.00 Bln USD (vs 75.80 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Jul 2021 (U.S. Dept. Treas.) at 2.00 Bln USD (vs 110.90 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Jul 2021 (U.S. Dept. Treas.) at 10.20 Bln USD (vs 10.90 Bln USD prior)

- Overall, Total business inventories, Change P/P for Jul 2021 (U.S. Census Bureau) at 0.50 % (vs 0.80 % prior), below consensus estimate of 0.50 %

- Philadelphia Fed, Future capital expenditures for Sep 2021 (FED, Philadelphia) at 23.60 (vs 33.70 prior)

- Philadelphia Fed, Future general business activity for Sep 2021 (FED, Philadelphia) at 20.00 (vs 33.70 prior)

- Philadelphia Fed, General business activity for Sep 2021 (FED, Philadelphia) at 30.70 (vs 19.40 prior), above consensus estimate of 18.80

- Philadelphia Fed, New orders for Sep 2021 (FED, Philadelphia) at 15.90 (vs 22.80 prior)

- Philadelphia Fed, Number of employees for Sep 2021 (FED, Philadelphia) at 26.30 (vs 32.60 prior)

- Philadelphia Fed, Prices paid for Sep 2021 (FED, Philadelphia) at 67.30 (vs 71.20 prior)

- Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for Aug 2021 (U.S. Census Bureau) at 2.50 % (vs -1.00 % prior), above consensus estimate of -0.10 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Aug 2021 (U.S. Census Bureau) at 2.00 % (vs -0.70 % prior)

- Retail Sales, Total including food services, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.70 % (vs -1.10 % prior), above consensus estimate of -0.80 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.80 % (vs -0.40 % prior), above consensus estimate of -0.10 %

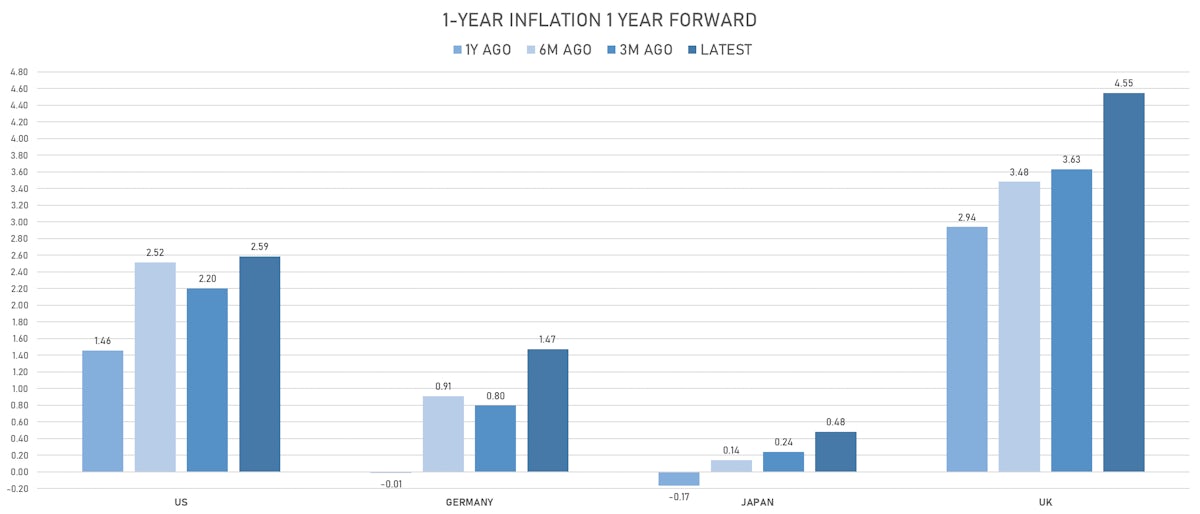

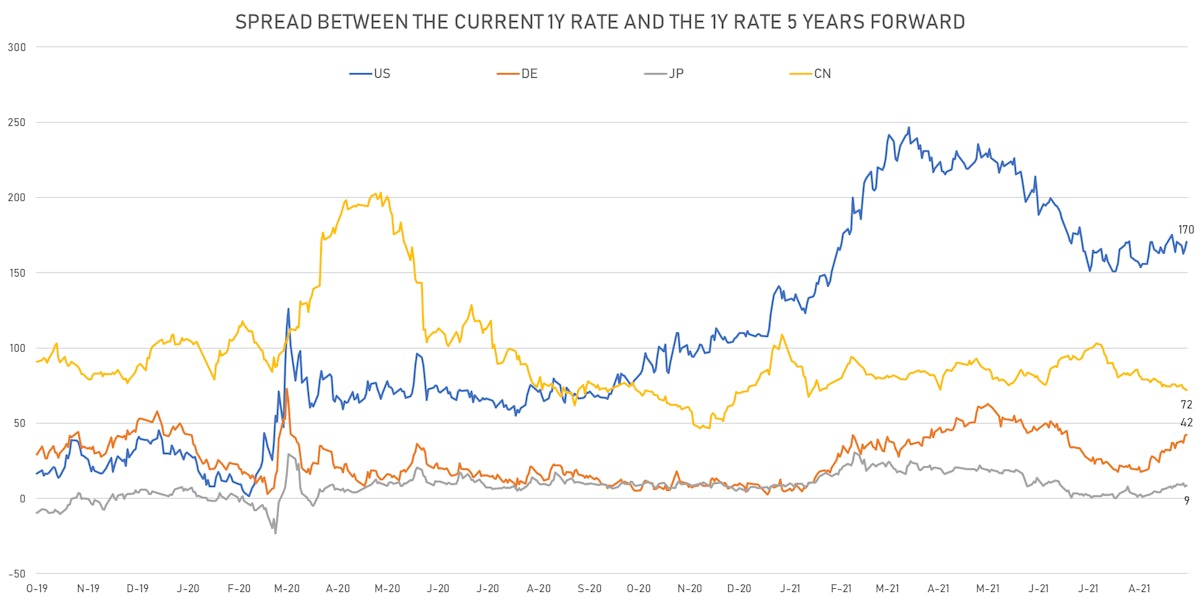

US FORWARD RATES

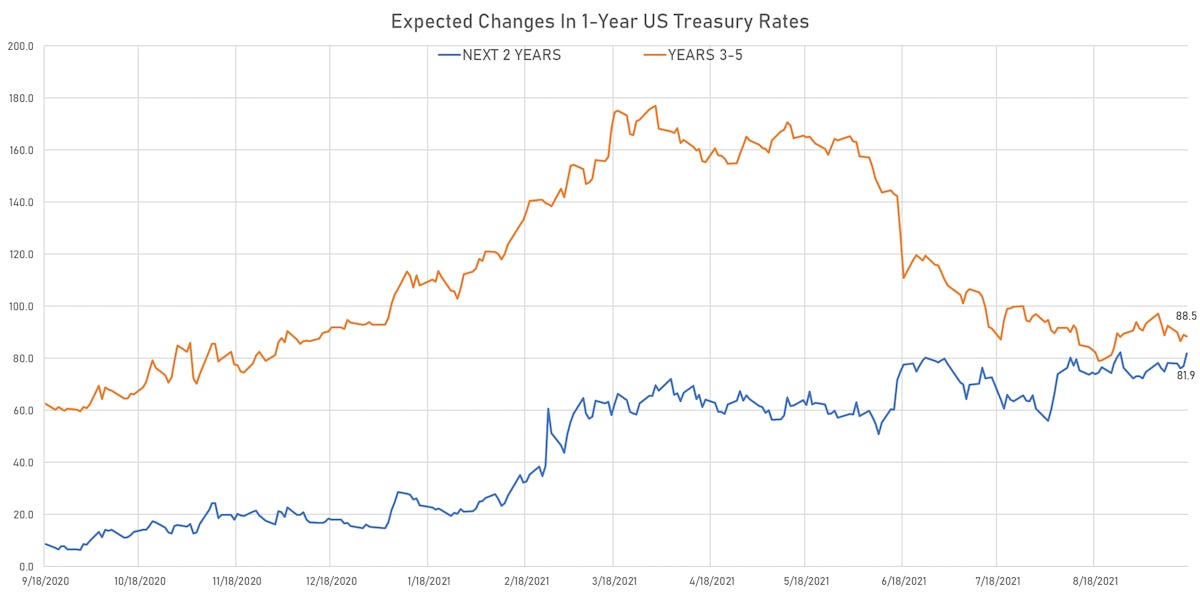

- US Treasury 1-year zero-coupon rate 5 years forward up 4.6 bp, now at 1.7844%

- 1-Year Treasury rates are now expected to increase by 170.4 bp over the next 5 years

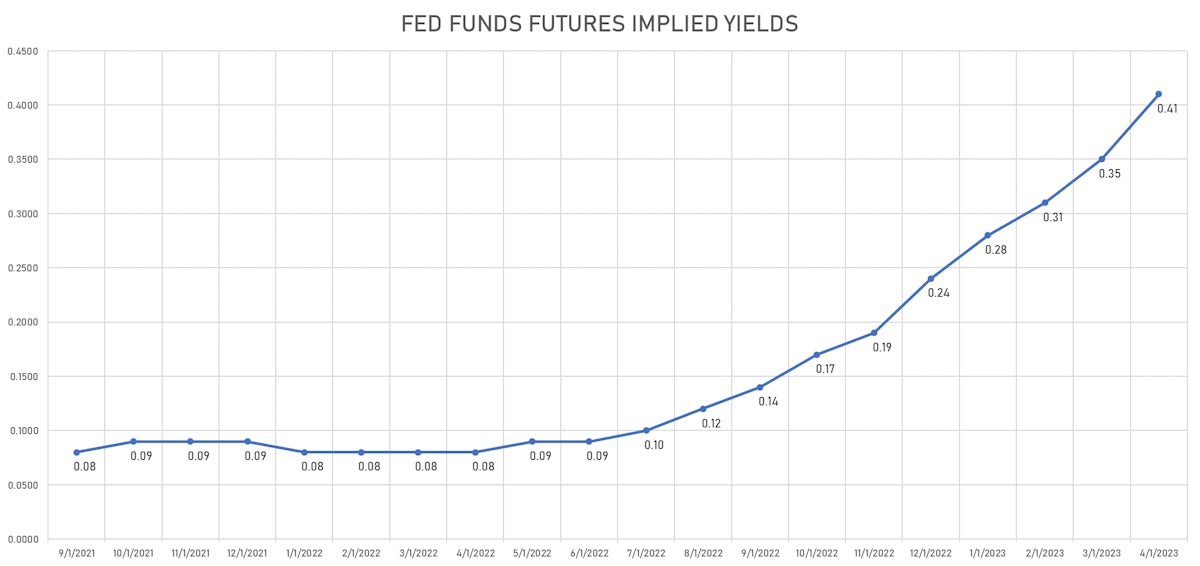

- 3-month Eurodollar futures expected hike of 14.7 bp by the end of 2022 (meaning the market prices 58.8% chance of a 25bp hike by end of 2022)

- The 3-month Eurodollar zero curve prices in 117.9 bp over the next 3 years (equivalent to 4.72 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.06% (down -1.5bp); 2Y at 2.82% (down -0.8bp); 5Y at 2.67% (up 1.6bp); 10Y at 2.34% (up 1.0bp); 30Y at 2.23% (up 0.5bp)

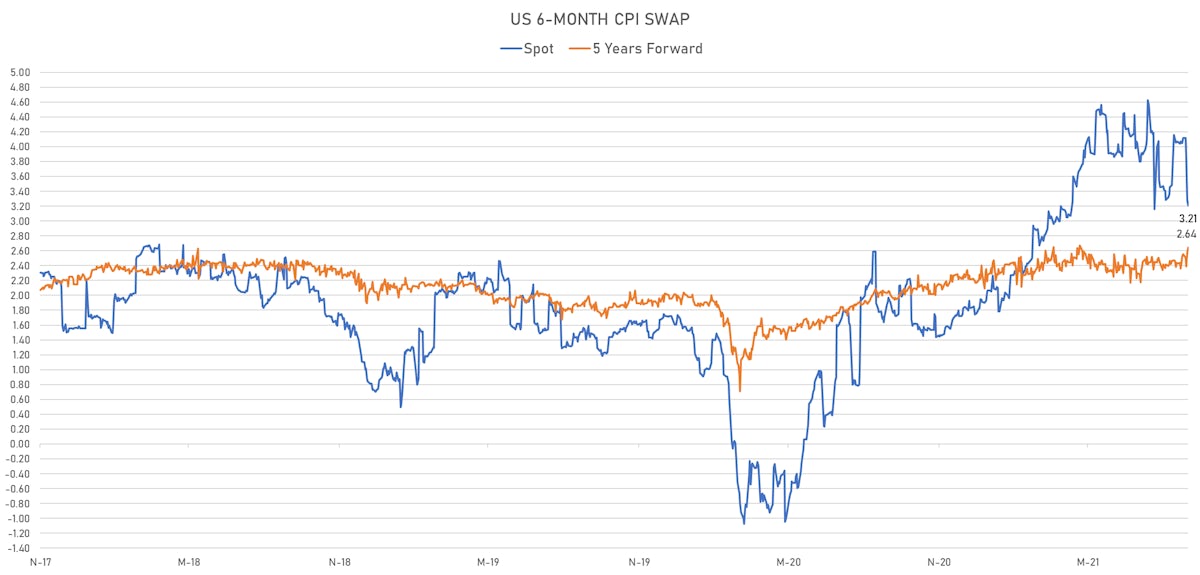

- 6-month spot US CPI swap down -7.6 bp to 3.209%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7710%, +2.6 bp today; 10Y at -1.0200%, +2.3 bp today; 30Y at -0.3480%, +0.6 bp today

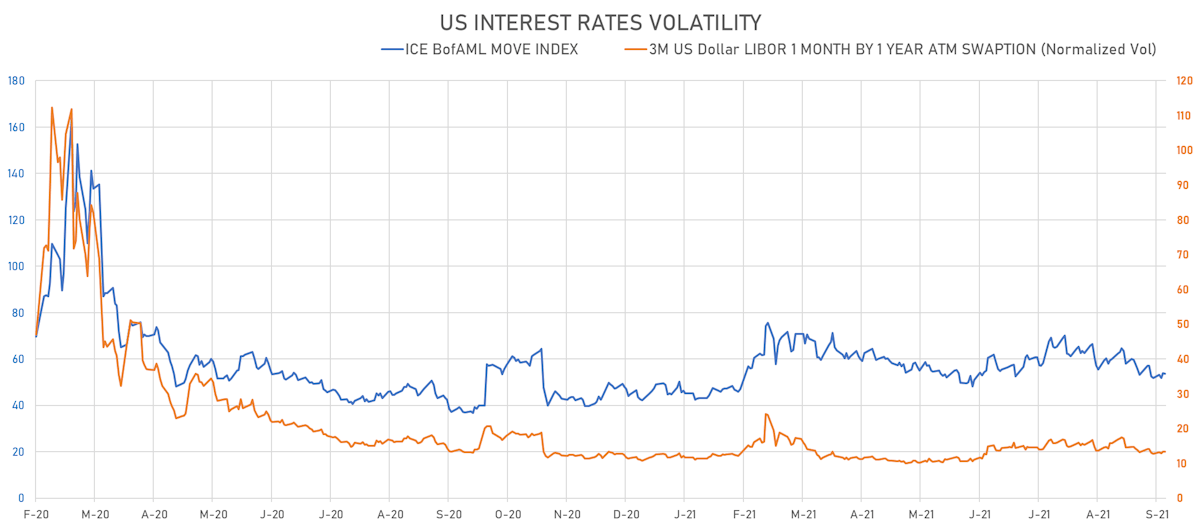

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 13.3%

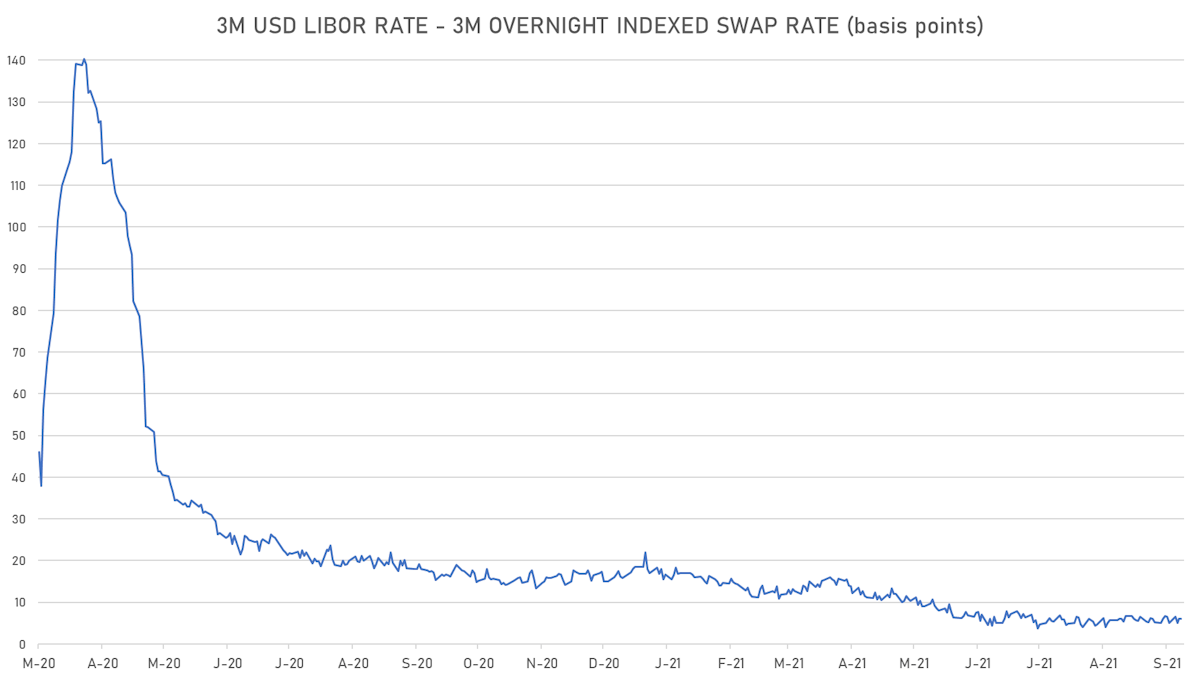

- 3-Month LIBOR-OIS spread up 0.1 bp at 6.1 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.608% (up 0.2 bp); the German 1Y-10Y curve is 0.0 bp steeper at 37.4bp (YTD change: +21.4 bp)

- Japan 5Y: -0.092% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.6 bp steeper at 15.9bp (YTD change: +1.4 bp)

- China 5Y: 2.734% (down -0.1 bp); the Chinese 1Y-10Y curve is 0.7 bp flatter at 56.5bp (YTD change: +10.1 bp)

- Switzerland 5Y: -0.549% (up 2.7 bp); the Swiss 1Y-10Y curve is 2.9 bp steeper at 50.4bp (YTD change: +24.5 bp)