Rates

US Yield Curve Steepens With A Continued Emphasis On the Belly, 1s5s10s Treasury Butterfly Drops Further

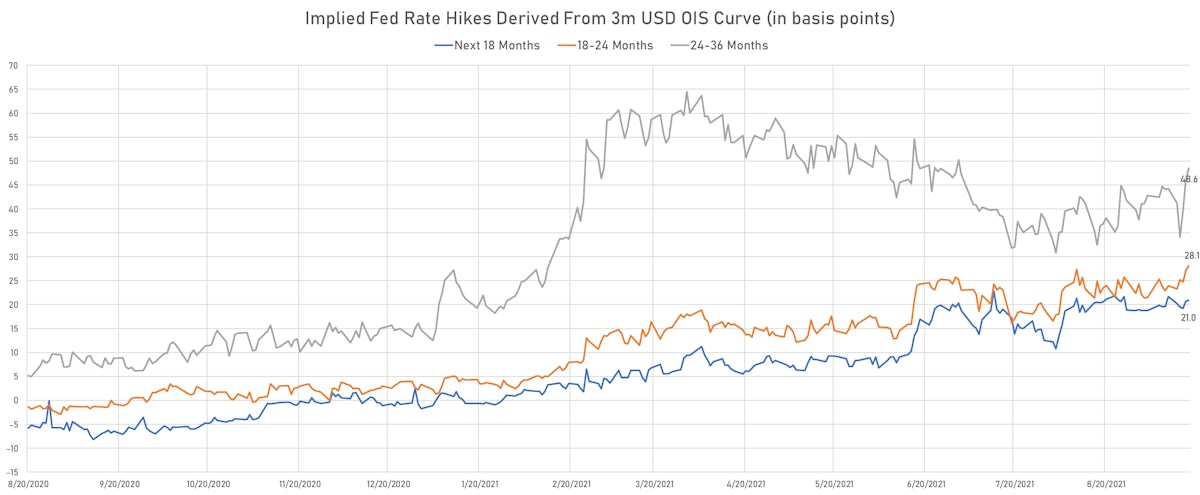

The market currently prices in just about 4 rate hikes over the next 3 years, leaving itself exposed to a bearish surprise when the Fed releases its 2024 dot plot for the first time next week

Published ET

US Treasuries Butterfly Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

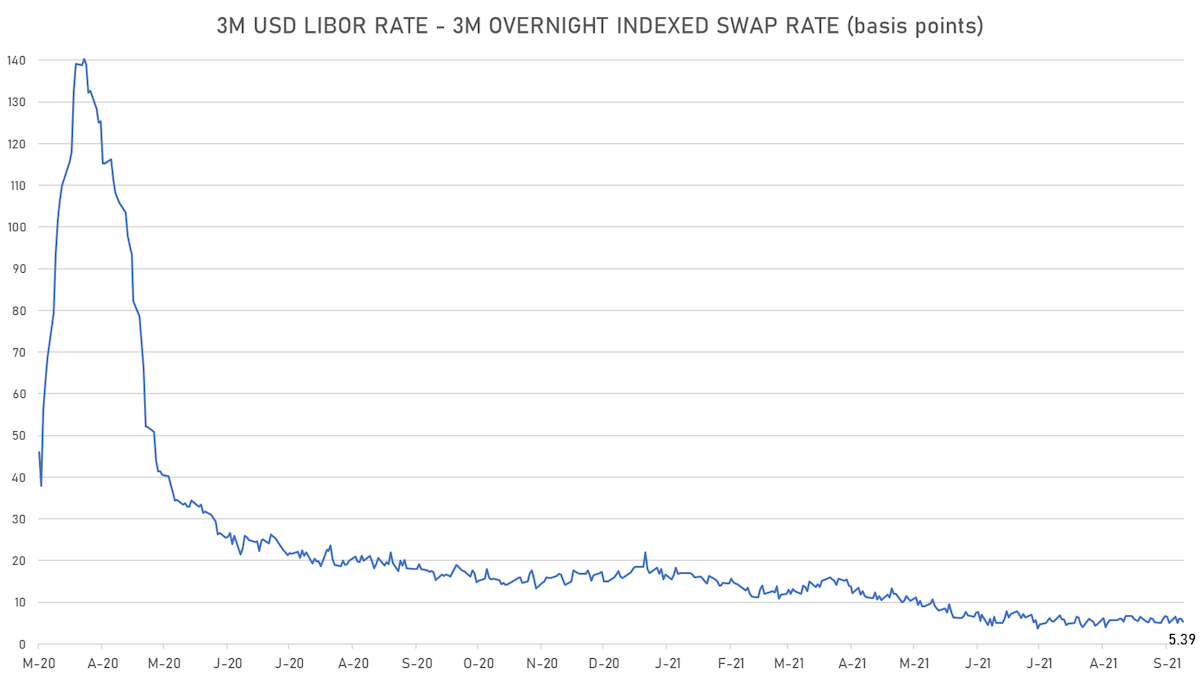

- 3-Month USD LIBOR +0.2bp today, now at 0.1239%

- The treasury yield curve steepened, with the 1s10s spread widening 2.7 bp, now at 129.2 bp (YTD change: +48.8bp)

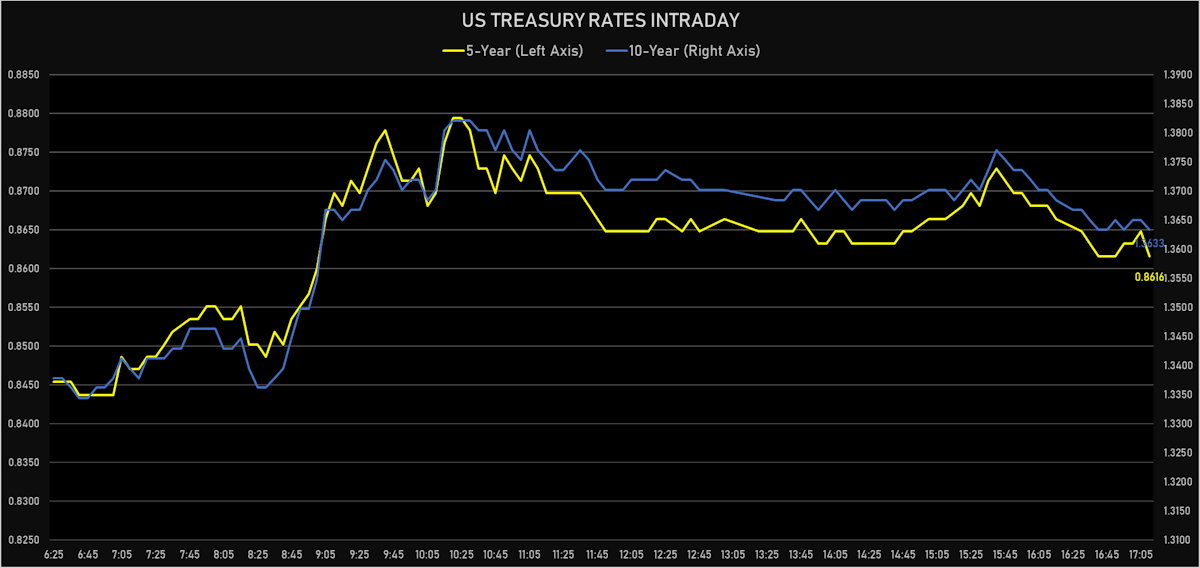

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2257% (up 0.4 bp)

- 5Y: 0.8616% (up 2.1 bp)

- 7Y: 1.1626% (up 2.8 bp)

- 10Y: 1.3633% (up 2.7 bp)

- 30Y: 1.9030% (up 2.2 bp)

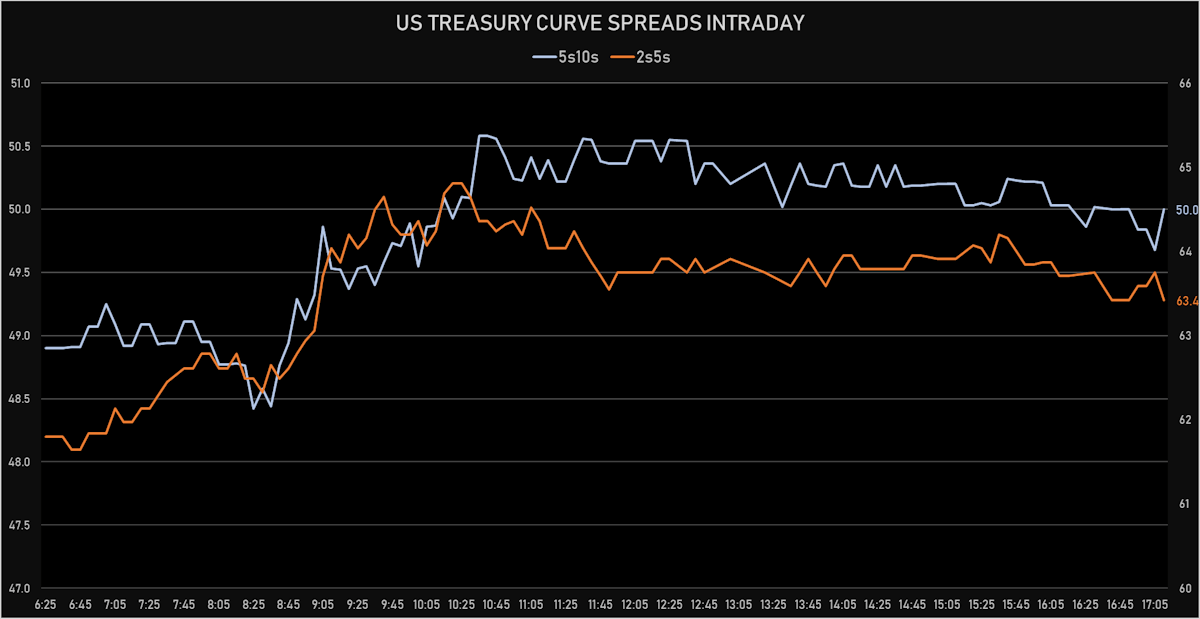

- US treasury curve spreads: 2s5s at 63.6bp (up 1.7bp today), 5s10s at 50.2bp (up 0.6bp today), 10s30s at 54.0bp (down -0.6bp)

- Treasuries butterfly spreads: 2s5s10s at -13.8bp (down -0.9bp), 5s10s30s at 3.2bp (down -0.9bp)

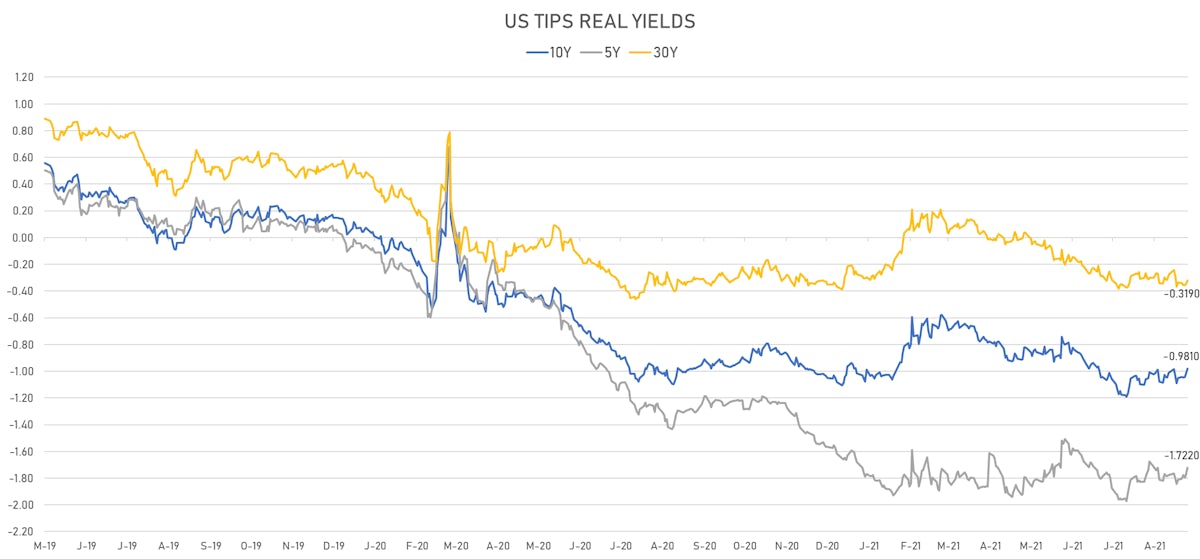

- US 5-Year TIPS Real Yield: +4.9 bp at -1.7220%; 10-Year TIPS Real Yield: +3.9 bp at -0.9810%; 30-Year TIPS Real Yield: +2.9 bp at -0.3190%

US MACRO RELEASES

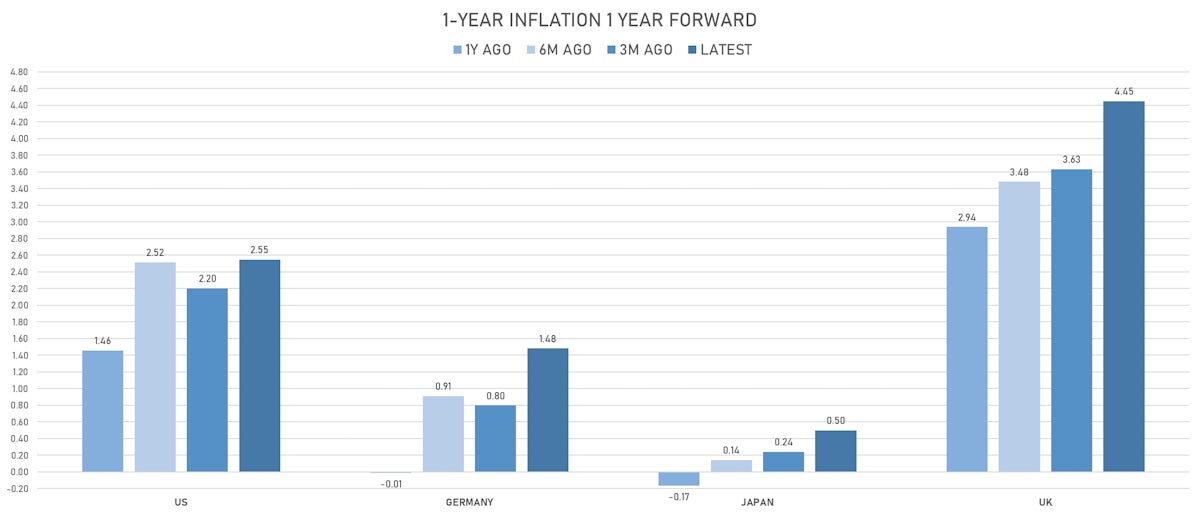

- 1 Year Inflation Expectations (median), preliminary for Sep 2021 (UMICH, Survey) at 4.70 % (vs 4.60 % prior)

- University of Michigan, Current Conditions Index-prelim, Volume Index for Sep 2021 (UMICH, Survey) at 77.10 (vs 78.50 prior)

- University of Michigan, Total-prelim, Change Y/Y for Sep 2021 (UMICH, Survey) at 2.90 % (vs 2.90 % prior)

- University of Michigan, Total-prelim, Volume Index for Sep 2021 (UMICH, Survey) at 67.10 (vs 65.10 prior)

- University of Michigan, Total-prelim, Volume Index for Sep 2021 (UMICH, Survey) at 71.00 (vs 70.30 prior), below consensus estimate of 72.00

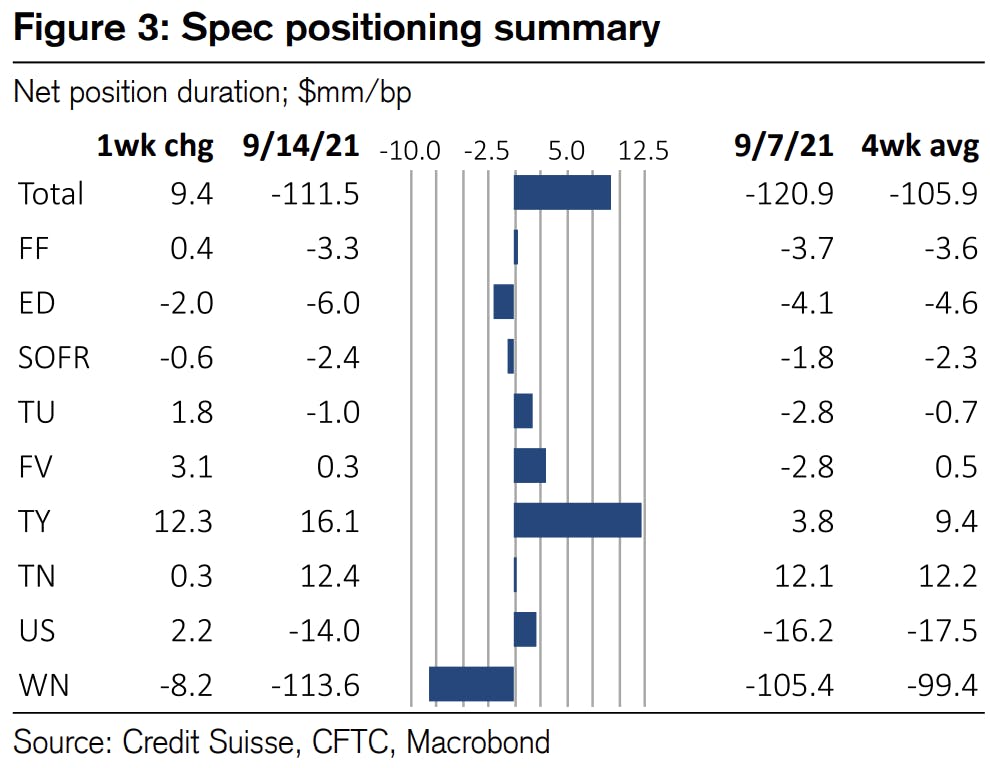

WEEKLY CFTC SPECULATIVE NET POSITIONING

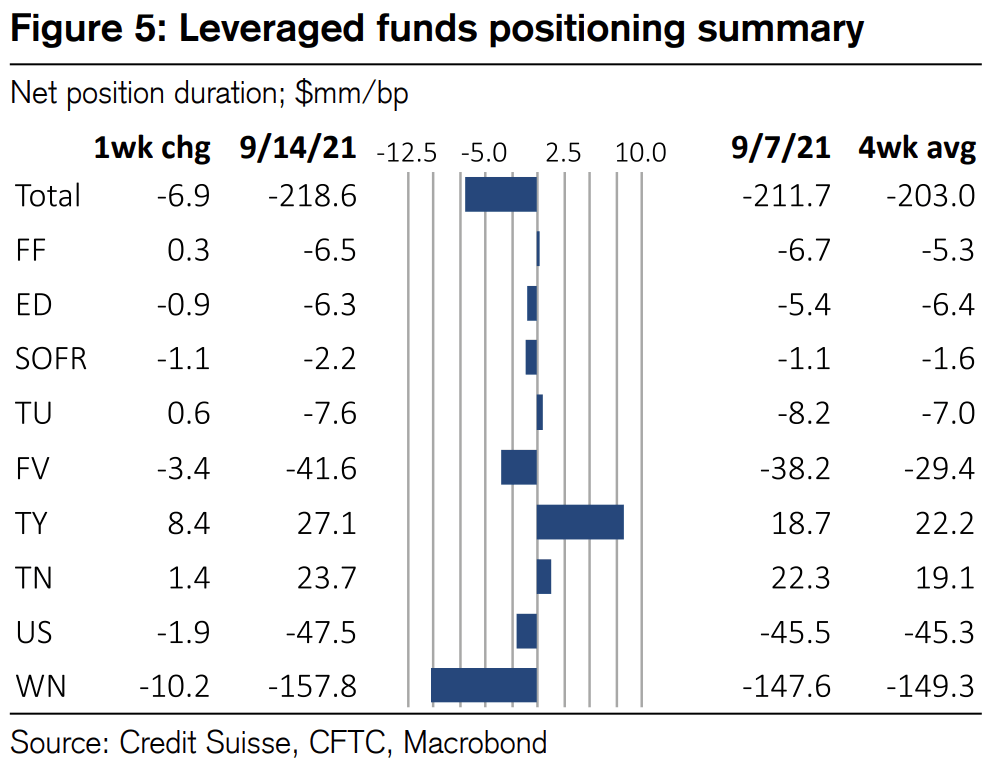

- Leveraged funds increased their net short duration, mainly in 5s and 30s

- Specs lowered their net short duration, mainly by buying 10s but then also shorted some more 30s

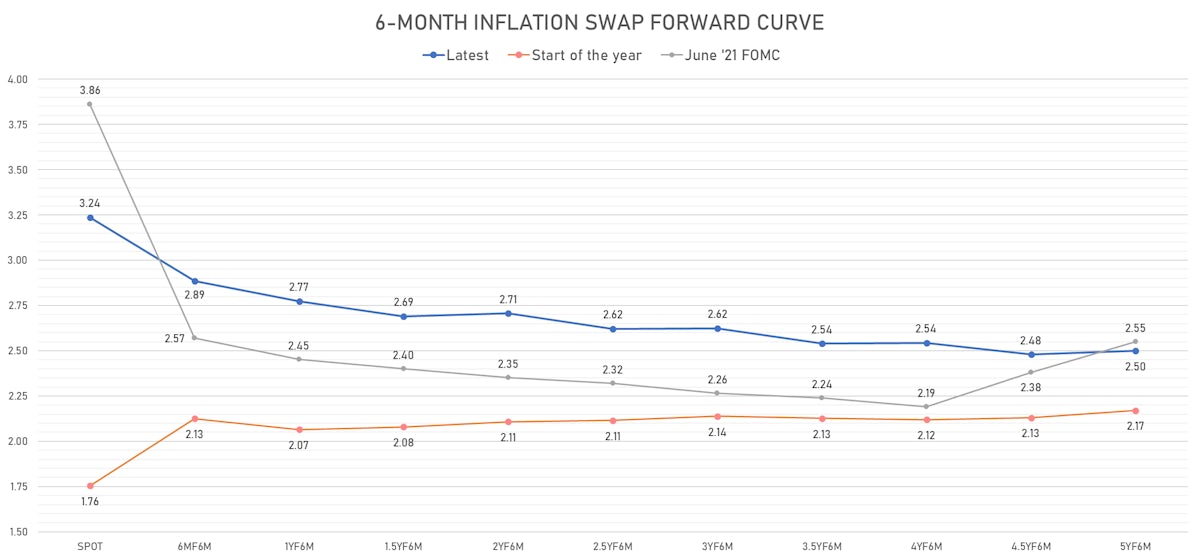

US FORWARD RATES

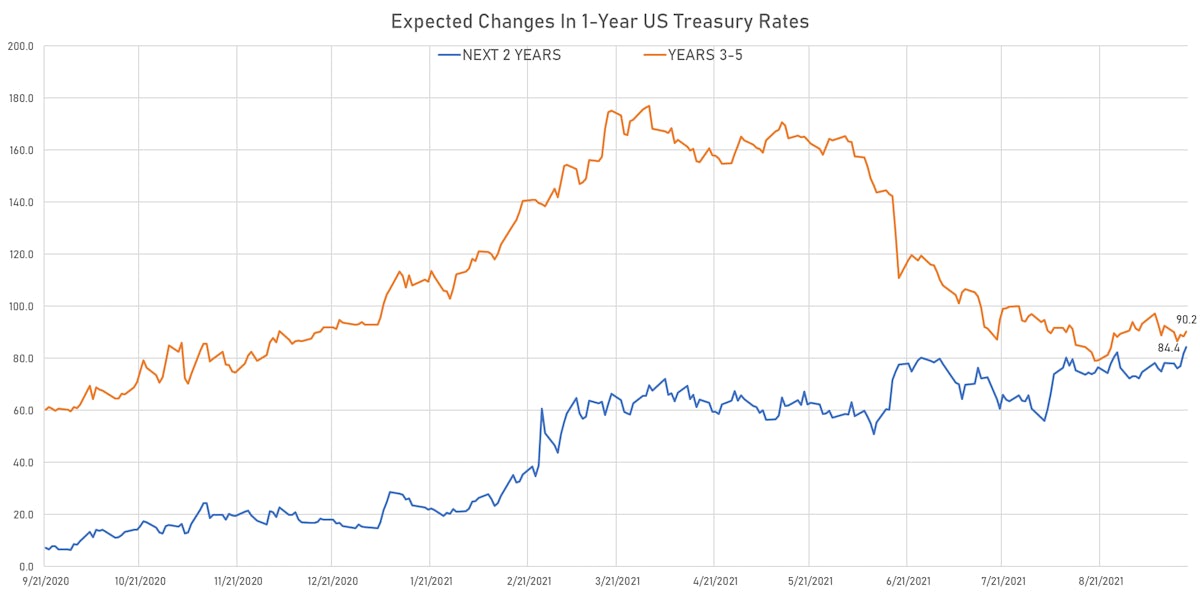

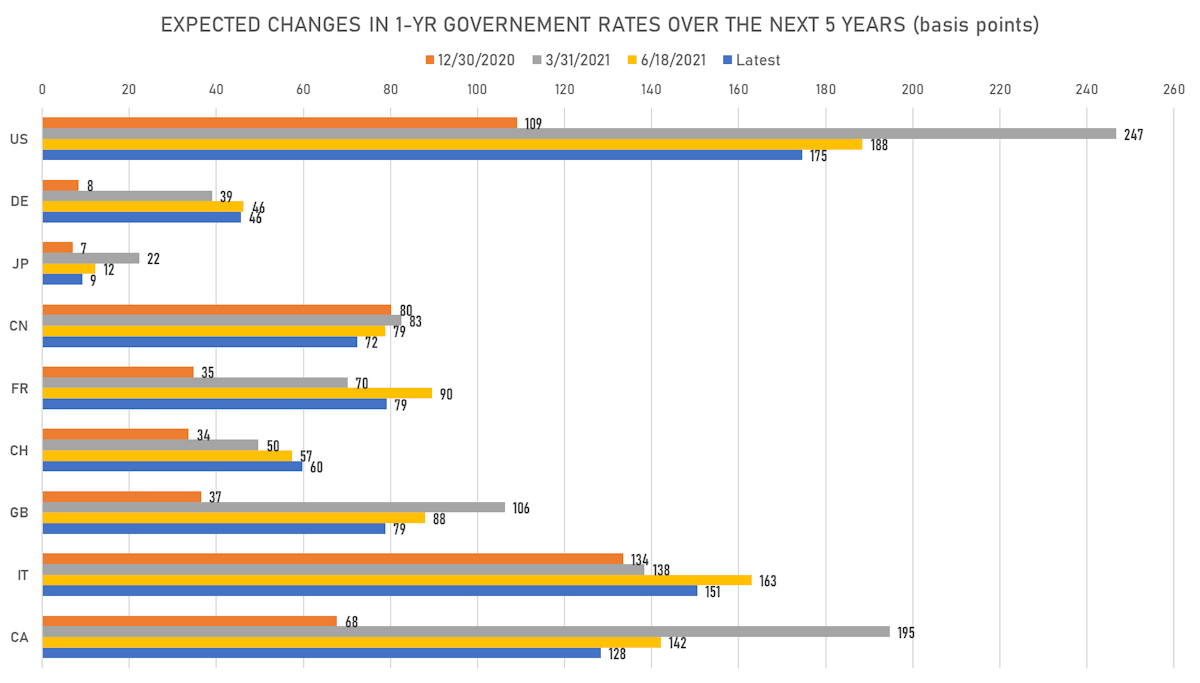

- US Treasury 1-year zero-coupon rate 5 years forward up 4.3 bp, now at 1.8275%: 1-Year Treasury rates are now expected to increase by 174.6 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.0 bp by the end of 2022 (meaning the market prices 60.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 97.7 bp over the next 3 years (equivalent to 3.91 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.03% (down -3.4bp); 2Y at 2.79% (down -3.7bp); 5Y at 2.64% (down -2.3bp); 10Y at 2.32% (down -1.3bp); 30Y at 2.23% (down -0.2bp)

- 6-month spot US CPI swap up 2.8 bp to 3.237%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7220%, +4.9 bp today; 10Y at -0.9810%, +3.9 bp today; 30Y at -0.3190%, +2.9 bp today

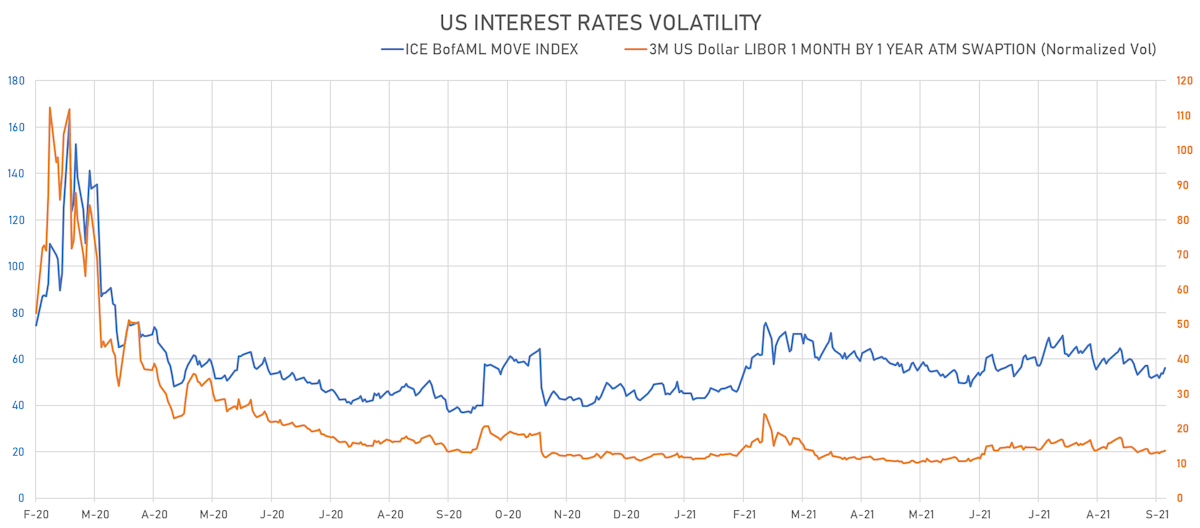

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.4% at 13.7%

- 3-Month LIBOR-OIS spread down -0.7 bp at 5.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.606% (up 1.7 bp); the German 1Y-10Y curve is 2.0 bp steeper at 38.8bp (YTD change: +23.4 bp)

- Japan 5Y: -0.085% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 18.0bp (YTD change: +2.2 bp)

- China 5Y: 2.724% (down -1.0 bp); the Chinese 1Y-10Y curve is 0.3 bp steeper at 56.8bp (YTD change: +10.4 bp)

- Switzerland 5Y: -0.570% (down -1.9 bp); the Swiss 1Y-10Y curve is 0.5 bp flatter at 50.4bp (YTD change: +24.0 bp)