Rates

US Rates Fall To Kick Off A Very Busy Week For Macro Events

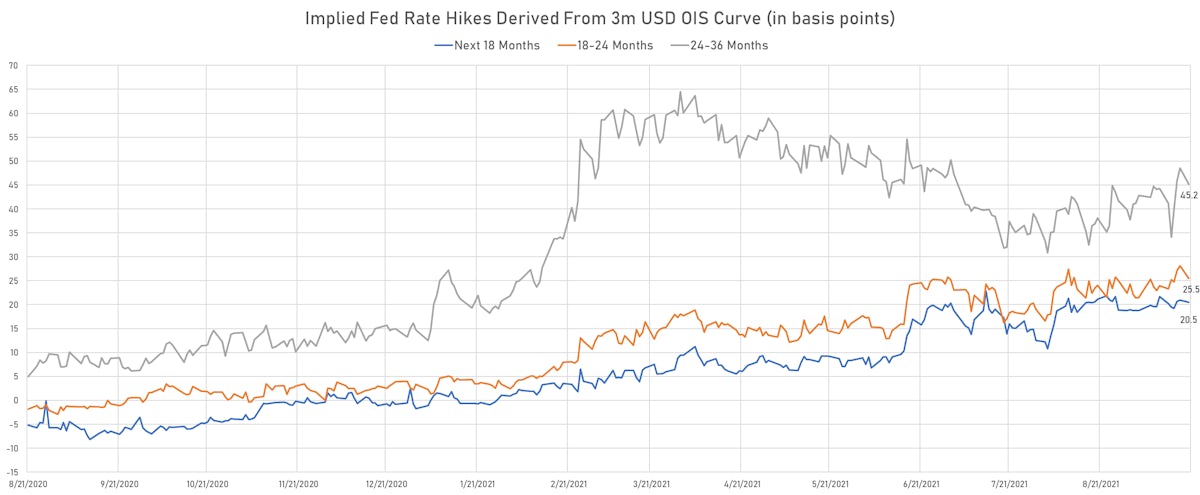

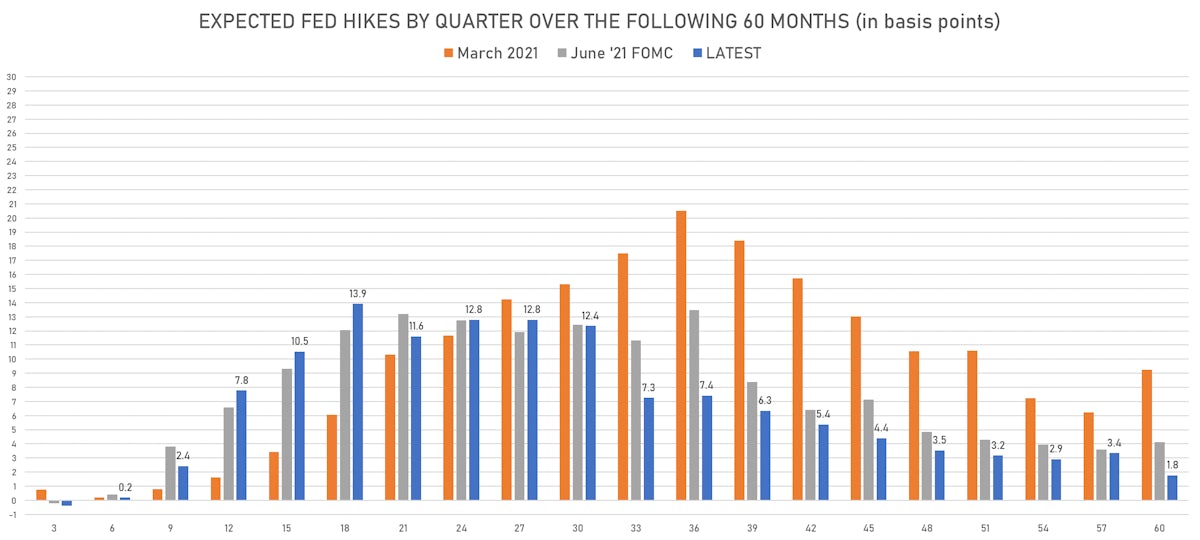

With Chinese markets closed for a couple days, the Evergrande story looks like a head fake ahead of FOMC risk that is skewed towards higher rates: currently markets price in fewer than 4 rate hikes over the next 3 years, which might look light when the Fed releases its updated dot plot

Published ET

1Y Treasury Rate 5 Years Forward Has Been Trading In A Tight Range Since July | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.1254%

- The treasury yield curve flattened, with the 1s10s spread tightening -5.1 bp, now at 124.1 bp (YTD change: +43.7bp)

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2158% (down 1.0 bp)

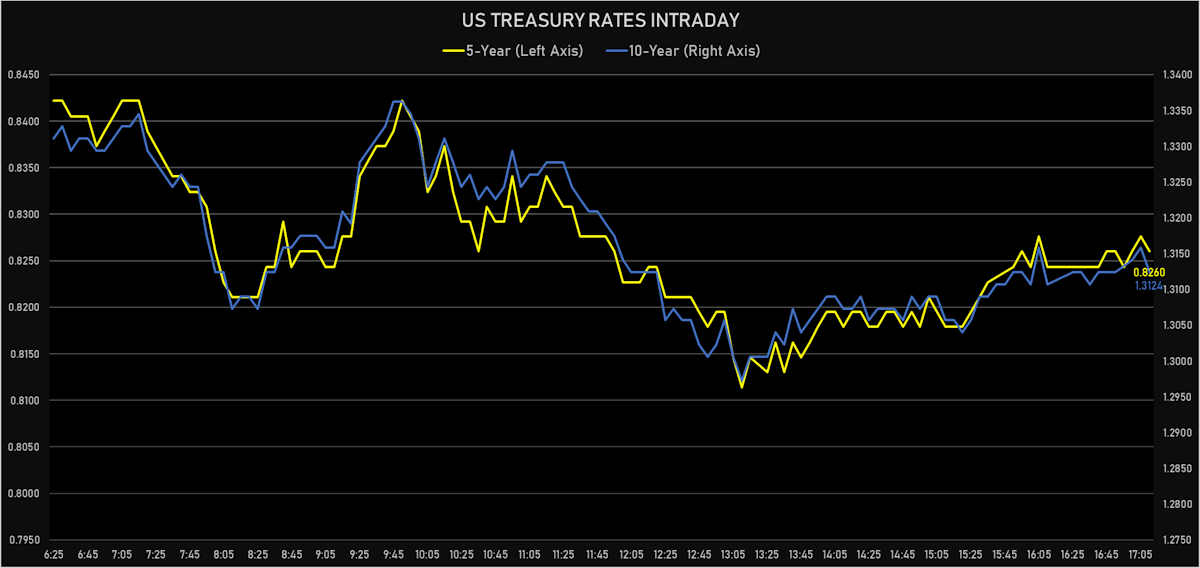

- 5Y: 0.8260% (down 3.6 bp)

- 7Y: 1.1156% (down 4.7 bp)

- 10Y: 1.3124% (down 5.1 bp)

- 30Y: 1.8484% (down 5.5 bp)

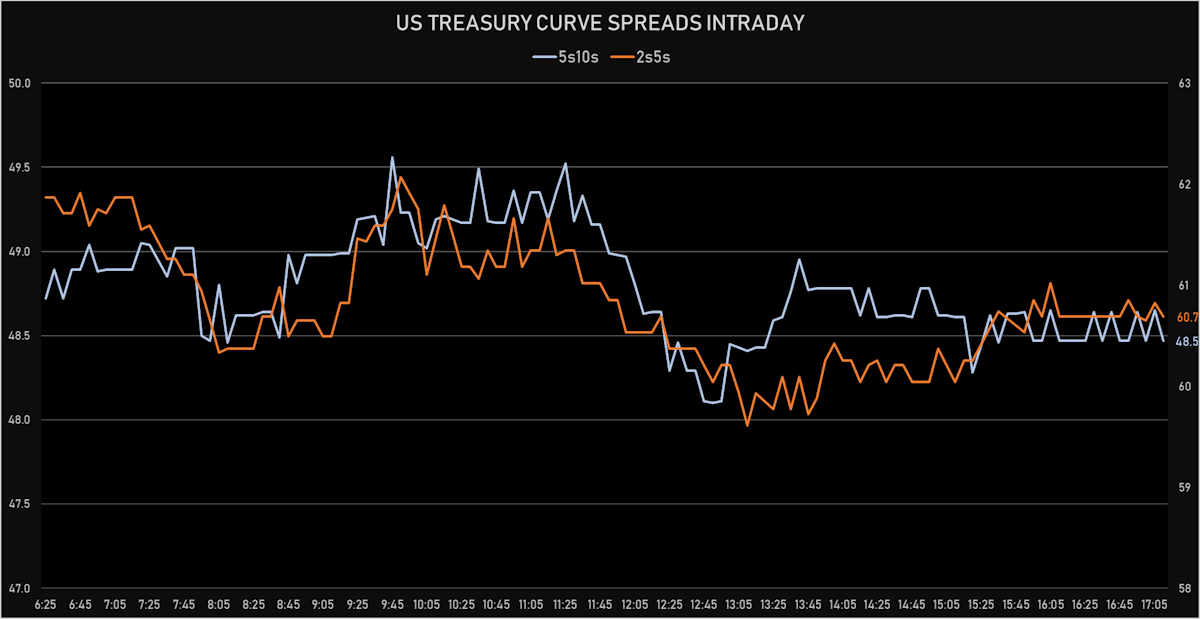

- US treasury curve spreads: 2s5s at 61.0bp (up 60.7bp today), 5s10s at 48.7bp (up 48.5bp today), 10s30s at 53.6bp (up 53.5bp today)

- Treasuries butterfly spreads: 2s5s10s at -12.8bp (up 1.0bp today), 5s10s30s at 4.8bp (up 1.6bp)

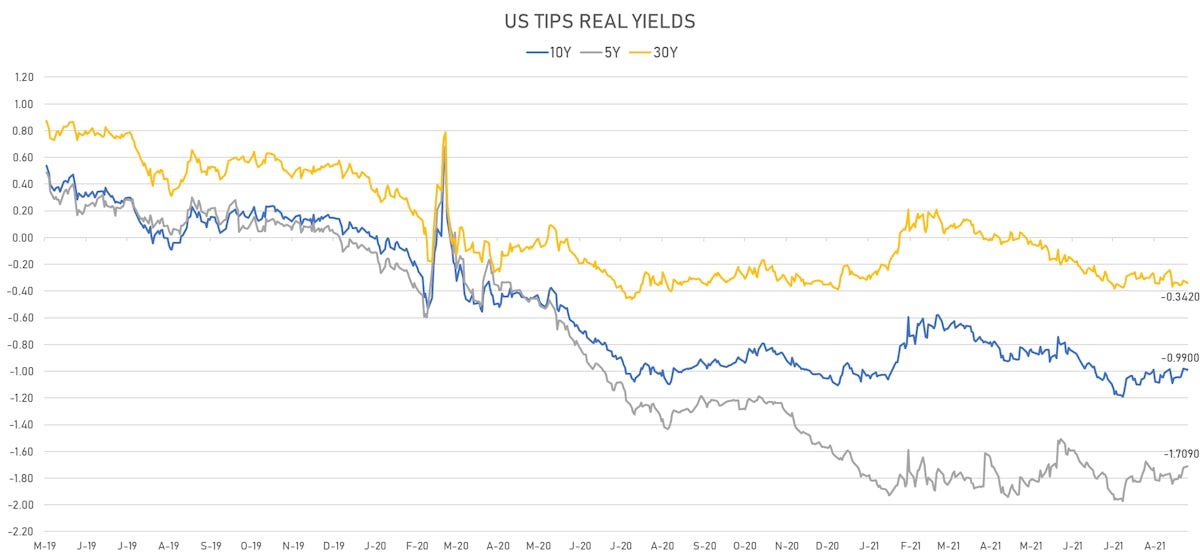

- US 5-Year TIPS Real Yield: +1.3 bp at -1.7090%; 10-Year TIPS Real Yield: -0.9 bp at -0.9900%; 30-Year TIPS Real Yield: -2.3 bp at -0.3420%

US MACRO RELEASES

- NAHB/Wells Fargo Housing Market Index for Sep 2021 (NAHB, United States) at 76.00 (vs 75.00 prior), above consensus estimate of 74.00

US FORWARD RATES

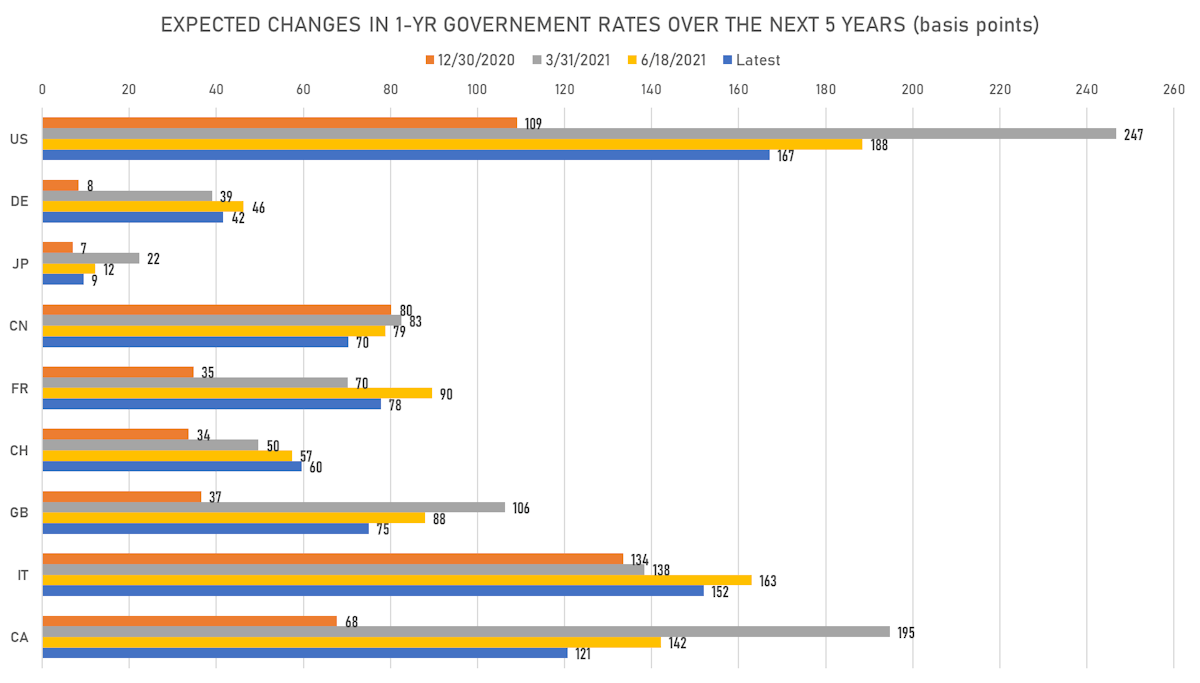

- US Treasury 1-year zero-coupon rate 5 years forward down 7.6 bp, now at 1.7514%, meaning that 1-Year Treasury rates are now expected to increase by 167.2 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 14.2 bp by the end of 2022 (meaning the market prices 56.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 91.3 bp over the next 3 years (equivalent to 3.65 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.97% (down -5.9bp); 2Y at 2.73% (down -6.0bp); 5Y at 2.59% (down -5.2bp); 10Y at 2.28% (down -4.1bp); 30Y at 2.20% (down -3.1bp)

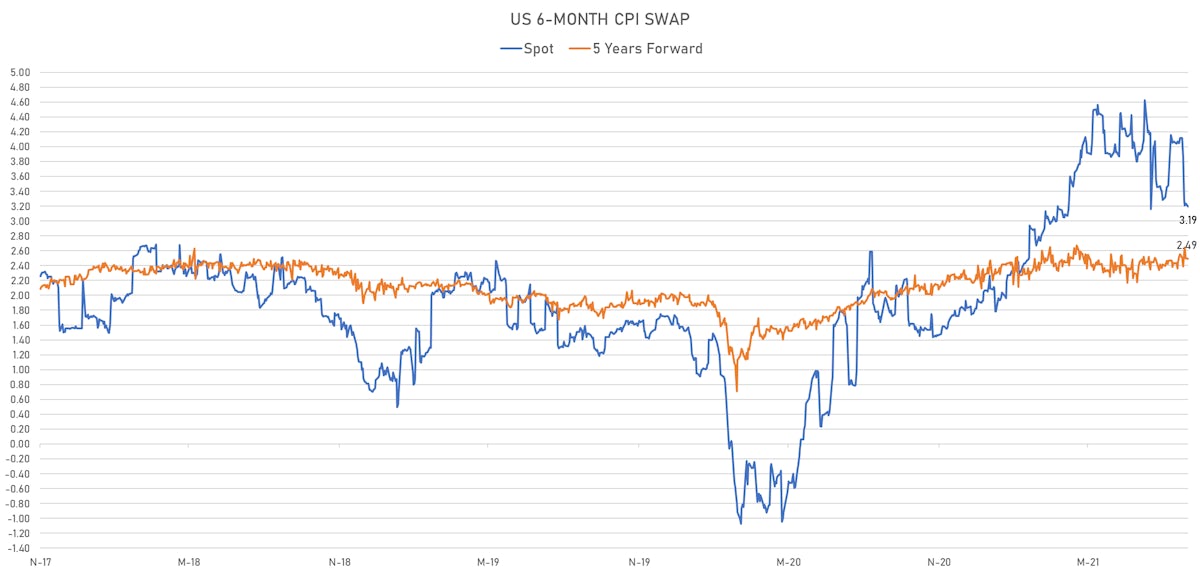

- 6-month spot US CPI swap down -4.3 bp to 3.194%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7090%, +1.3 bp today; 10Y at -0.9900%, -0.9 bp today; 30Y at -0.3420%, -2.3 bp today

RATES VOLATILITY & LIQUIDITY

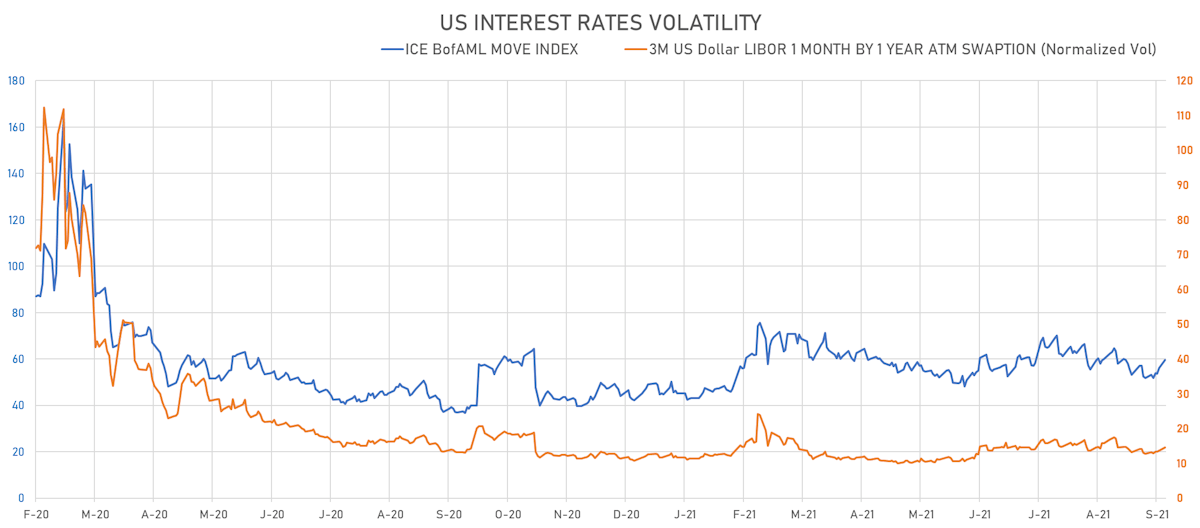

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 14.5%

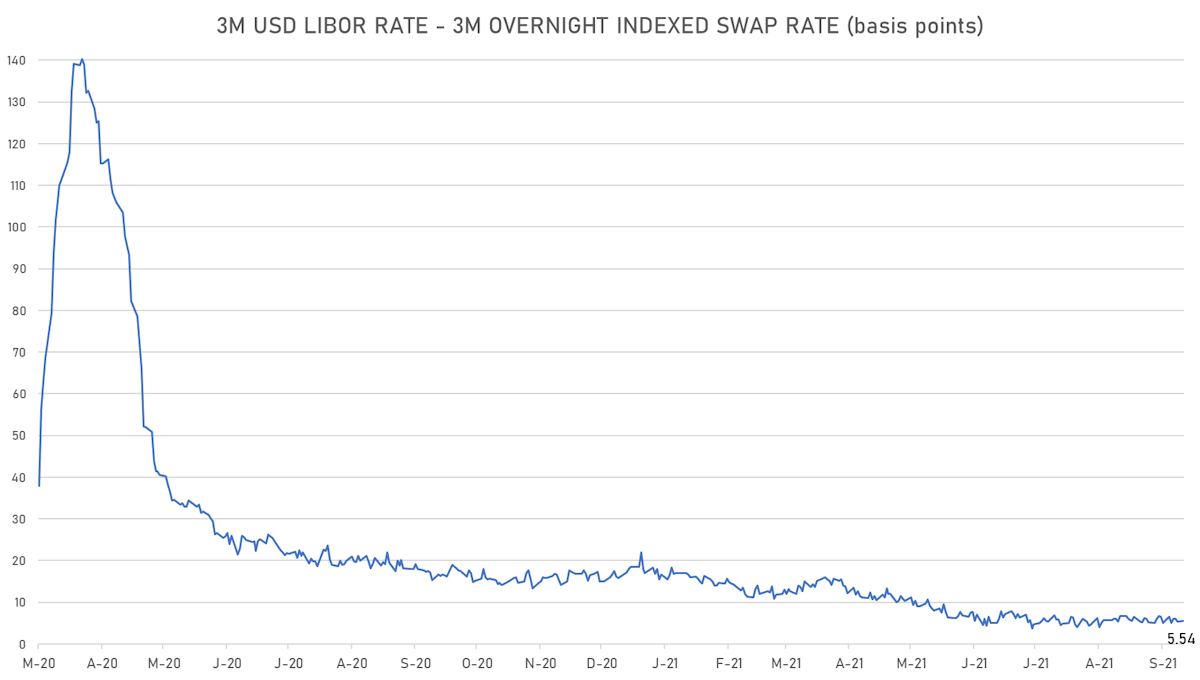

- 3-Month LIBOR-OIS spread up 0.2 bp at 5.5 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.638% (down -2.5 bp); the German 1Y-10Y curve is 3.5 bp flatter at 34.3bp (YTD change: +19.9 bp)

- Japan 5Y: -0.085% at 18.0bp (YTD change: -14.6 bp)

- Switzerland 5Y: -0.563% (up 0.7 bp); the Swiss 1Y-10Y curve is 2.0 bp flatter at 48.4bp (YTD change: +22.0 bp)