Rates

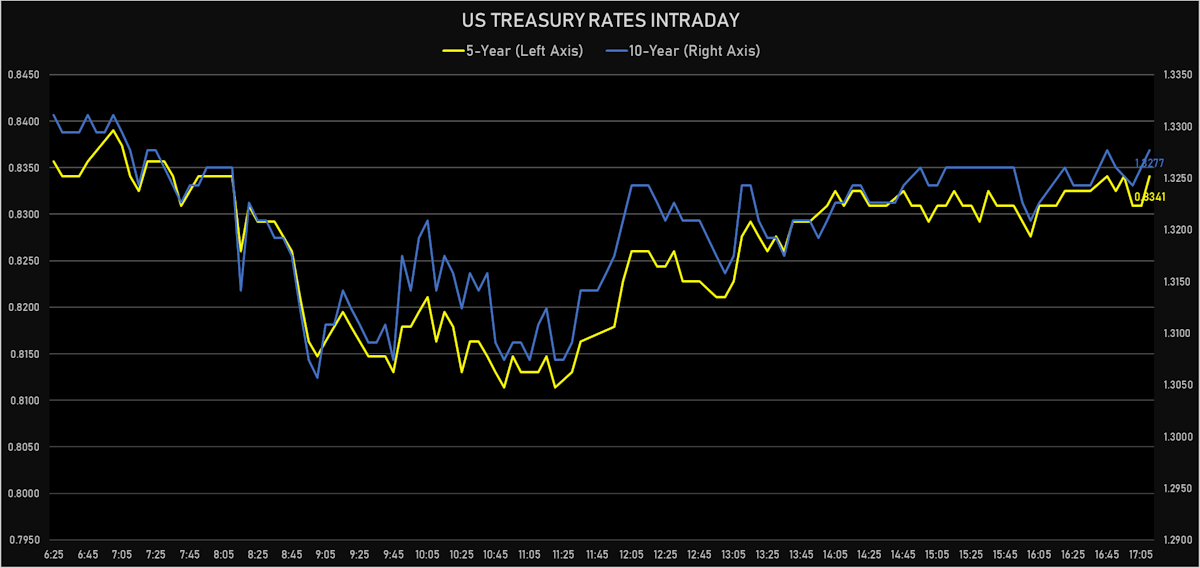

Modest Rise At The Longer End Of The Curve On Positive Housing Data

In our FOMC preview below, we highlight things to watch tomorrow when the Fed releases its updated economic projections and dot plot

Published ET

Expected rate hikes derived from the 3m USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.3bp today, now at 0.1284%

- The treasury yield curve steepened, with the 1s10s spread widening 1.5 bp, now at 126.0 bp (YTD change: +45.5bp)

- 1Y: 0.0680% (unchanged)

- 2Y: 0.2179% (up 0.2 bp)

- 5Y: 0.8341% (up 0.8 bp)

- 7Y: 1.1273% (up 1.2 bp)

- 10Y: 1.3277% (up 1.5 bp)

- 30Y: 1.8598% (up 1.1 bp)

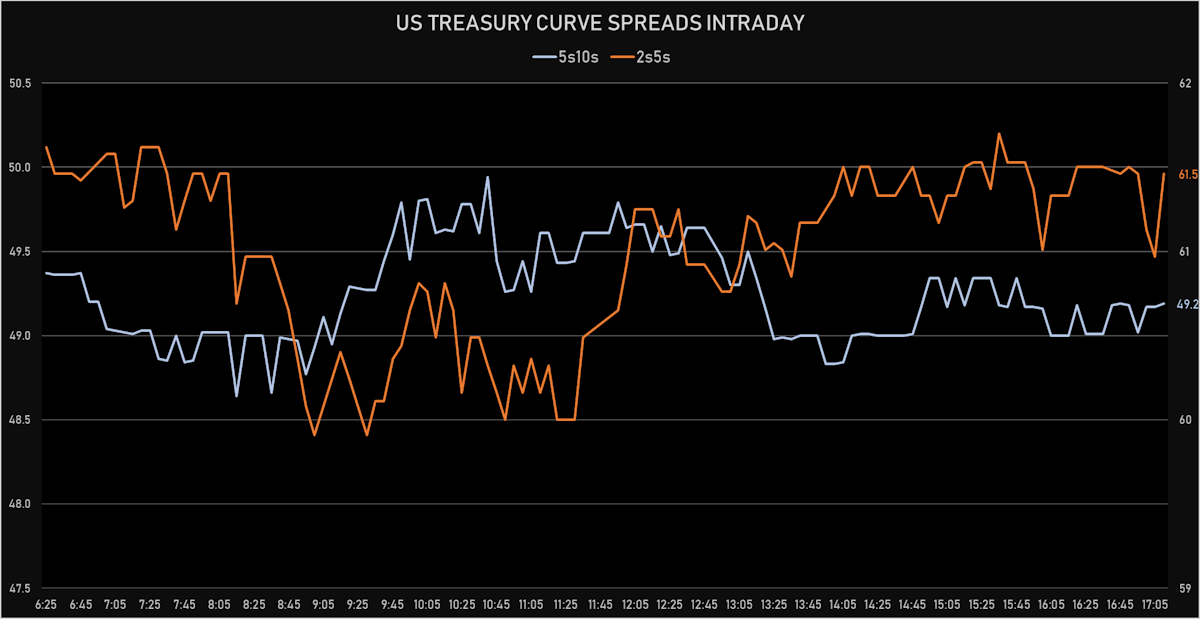

- US treasury curve spreads: 2s5s at 61.6bp (up 0.8bp today), 5s10s at 49.4bp (up 0.7bp today), 10s30s at 53.3bp (down -0.3bp)

- Treasuries butterfly spreads: 2s5s10s at -12.6bp (up 0.1bp today), 5s10s30s at 3.7bp (down -1.1bp)

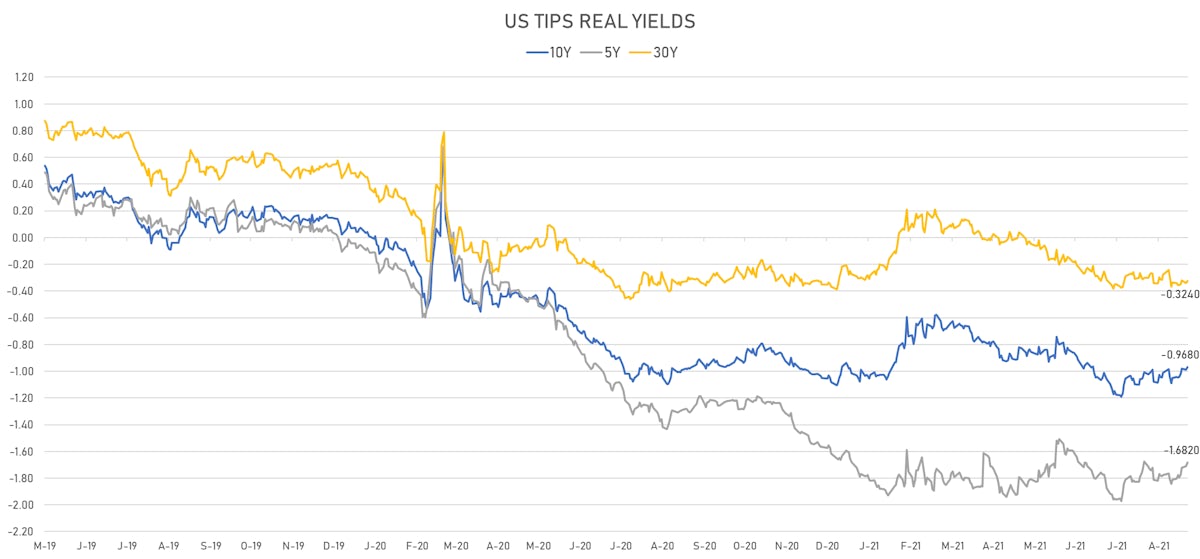

- US 5-Year TIPS Real Yield: +2.7 bp at -1.6820%; 10-Year TIPS Real Yield: +2.2 bp at -0.9680%; 30-Year TIPS Real Yield: +1.8 bp at -0.3240%

FOMC PREVIEW

- Tapering will not be announced tomorrow, but the Fed should set the stage for a November announcement, with enough flexibility to delay based on realized data between now and then

- Powell will reiterate that tapering the Fed's assets purchases is a separate matter from rates liftoff

- Focus will be on the updated economic projections, with inflation and growth the most important items for the market

- The labor market is still a long way from being normal and is not likely to move in the short term: we are currently about 6.8m jobs short of going back to the Employment / Population ratio we had before the pandemic, meaning that if the economy recovers and gains 500k jobs/month (which may be a stretch) it will take another 14 months to full recovery

- Watch out for a possible dot in '22: if the pace of taper is fast, it will be all done by the end of 1H2022, which opens the door to a possible rate hike by year end 2022

- Our first look at the 2024 dots will give insights into the path to normalization: if the Fed goes for a quarterly pace of 25 bp rate hikes (as in the previous round of policy tightening), rates by year end 2024 will be about 50bp higher than current market expectations

- The terminal rate will be an important view on what the Fed sees as normal: look for deviations of the median from 2.5% as a indicator of how positive / negative the Fed is about the post-pandemic growth prospects

US MACRO RELEASES TODAY

- Building Permits for Aug 2021 (U.S. Census Bureau) at 1.73 Mln (vs 1.63 Mln prior), above consensus estimate of 1.60 Mln

- Building Permits, Change P/P for Aug 2021 (U.S. Census Bureau) at 6.00 % (vs 2.30 % prior)

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 18 Sep (Redbook Research) at 17.10 % (vs 15.30 % prior)

- Current Account, Balance for Q2 2021 (BEA, US Dept. Of Com) at -190.30 Bln USD (vs -195.70 Bln USD prior), above consensus estimate of -191.00 Bln USD

- Housing Starts for Aug 2021 (U.S. Census Bureau) at 1.62 Mln (vs 1.53 Mln prior), above consensus estimate of 1.56 Mln

- Housing Starts, Change P/P for Aug 2021 (U.S. Census Bureau) at 3.90 % (vs -7.00 % prior)

- Atlanta Q3 Fed GDPNow 3.7% vs 3.6% prior to housing data release

US$ 24 BN 20-YEAR BOND AUCTION

- Excellent stats on this auction, with end-user demand at a record 83.1%

- High yield at 1.795% (vs. 1.797% when issued at the bid deadline and 1.850% prior in August)

- $56.6 bn in bids, bid-to-cover ratio at 2.36x (vs. 2.44x prior)

- Direct bids at 18.9% (vs 18.7% prior and 17.4% average)

- Indirect bids at 64.2% (vs 62.3% prior and 59.8% average)

- Dealers at 16.9%, a record low (vs 19% prior and 22.8% average)

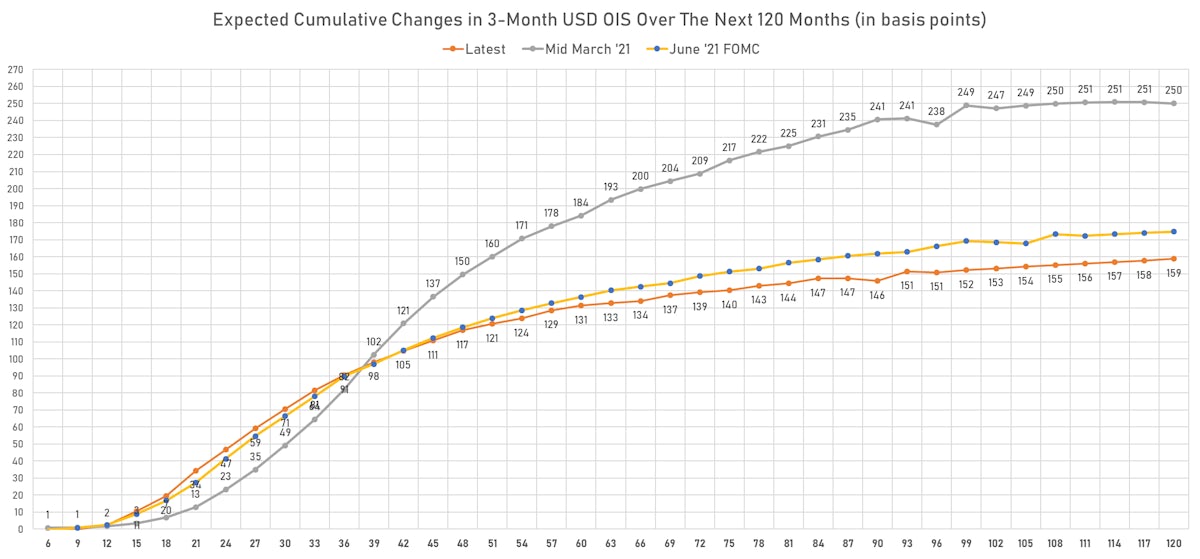

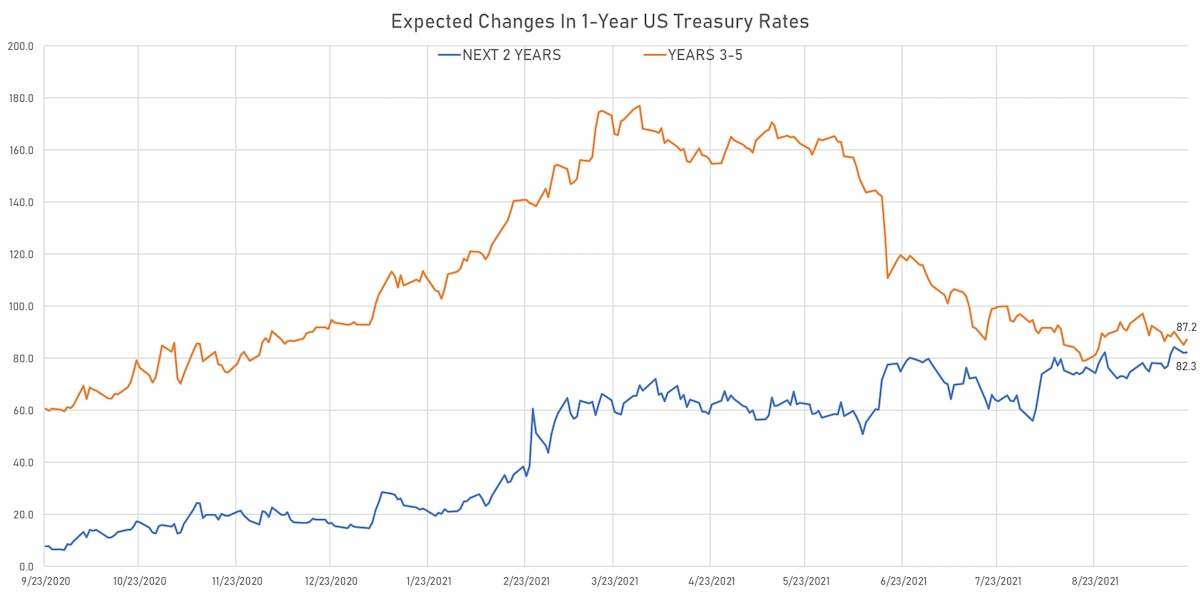

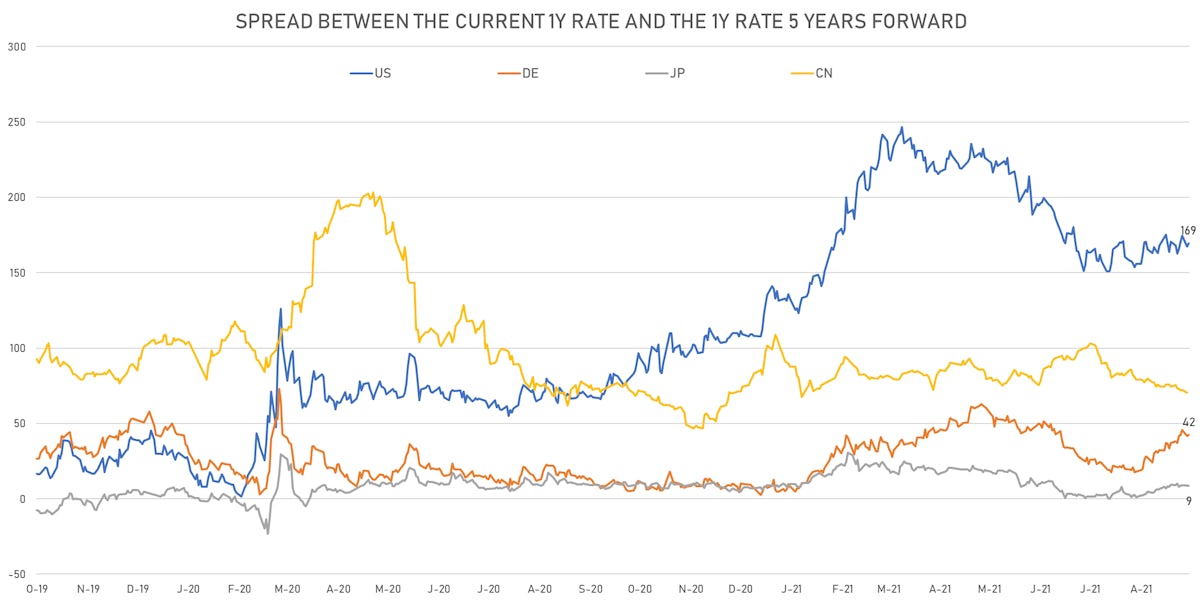

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 2.3 bp, now at 1.7739%, meaning that 1-Year Treasury rates are now expected to increase by 169.5 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 13.7 bp by the end of 2022 (meaning the market prices 54.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 90.5 bp over the next 3 years (equivalent to 3.62 rate hikes)

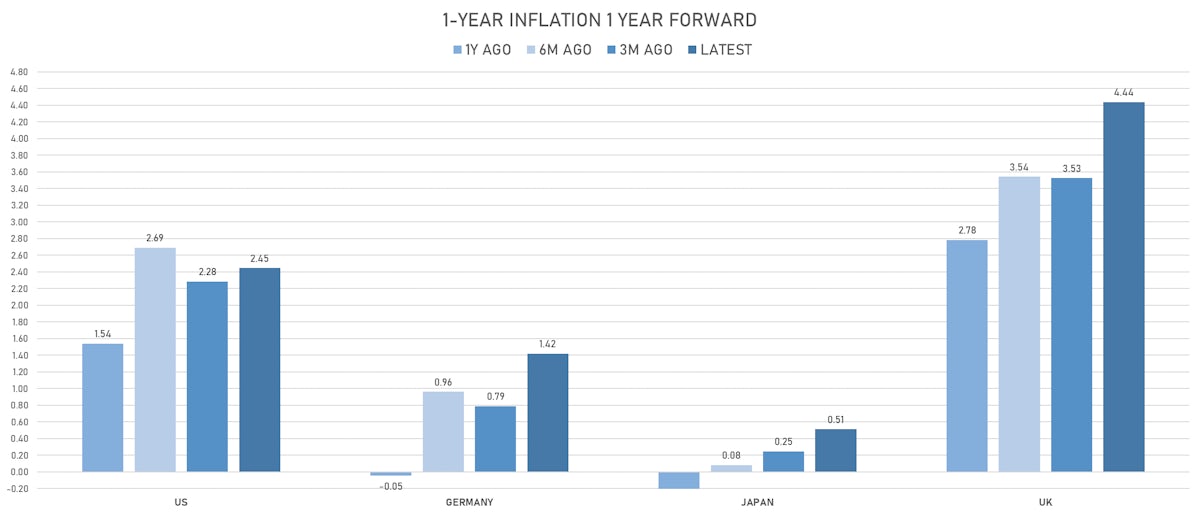

US INFLATION & REAL RATES

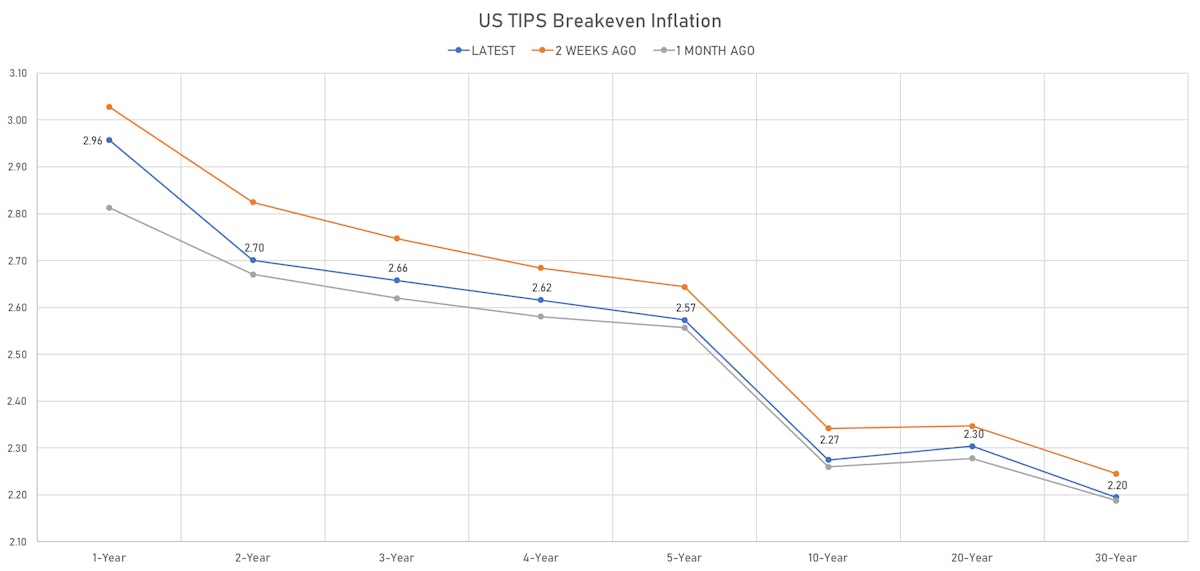

- TIPS 1Y breakeven inflation at 2.96% (down -0.9bp); 2Y at 2.70% (down -2.6bp); 5Y at 2.57% (down -1.9bp); 10Y at 2.27% (down -0.8bp); 30Y at 2.20% (down -0.6bp)

- 6-month spot US CPI swap down -0.4 bp to 3.190%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6820%, +2.7 bp today; 10Y at -0.9680%, +2.2 bp today; 30Y at -0.3240%, +1.8 bp today

RATES VOLATILITY & LIQUIDITY

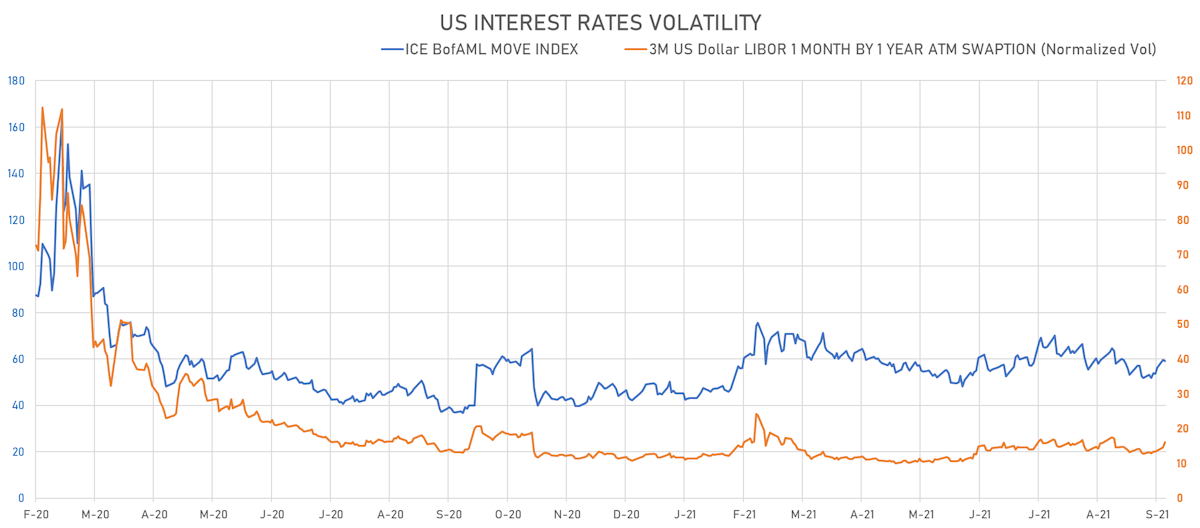

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.6% at 16.1%

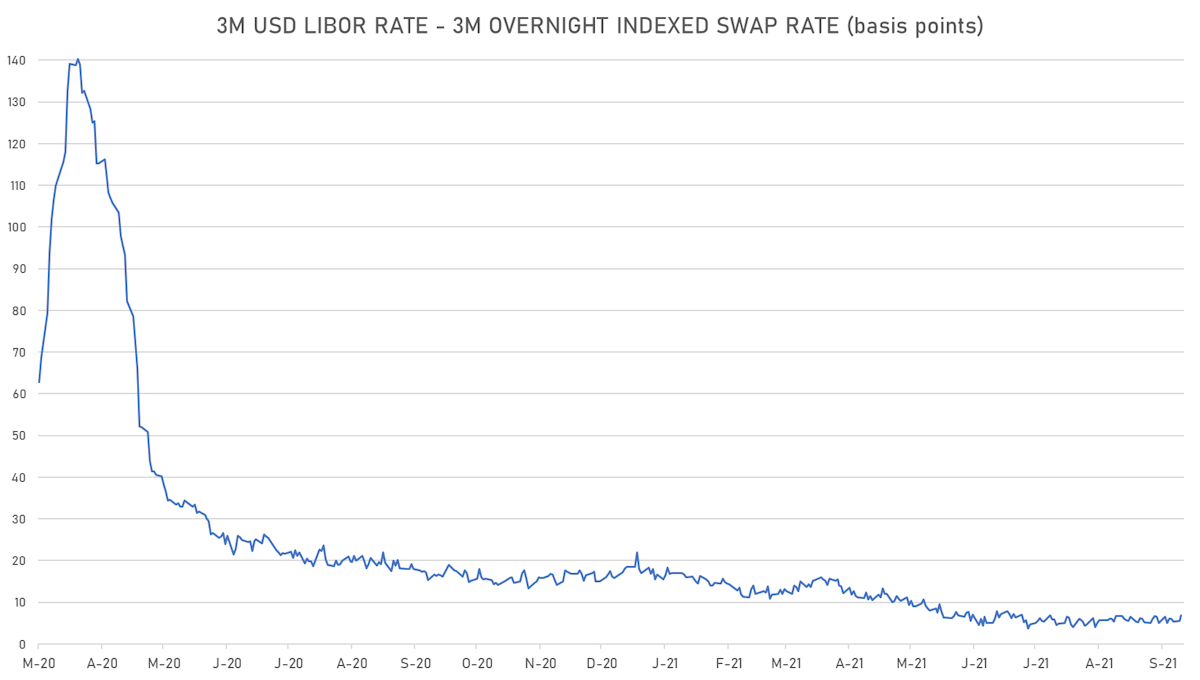

- 3-Month LIBOR-OIS spread up 1.3 bp at 6.8 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.633% (down -0.7 bp); the German 1Y-10Y curve is 0.5 bp flatter at 35.8bp (YTD change: +19.4 bp)

- Japan 5Y: -0.099% at 16.9bp (YTD change: +2.7 bp)

- China 5Y: 2.740% at 54.5bp (YTD change: -46.4 bp)

- Switzerland 5Y: -0.574% (down -1.1 bp); the Swiss 1Y-10Y curve is 3.1 bp flatter at 45.3bp (YTD change: +18.9 bp)