Rates

FOMC Concludes With Taper Plans Set For 3 November Announcement

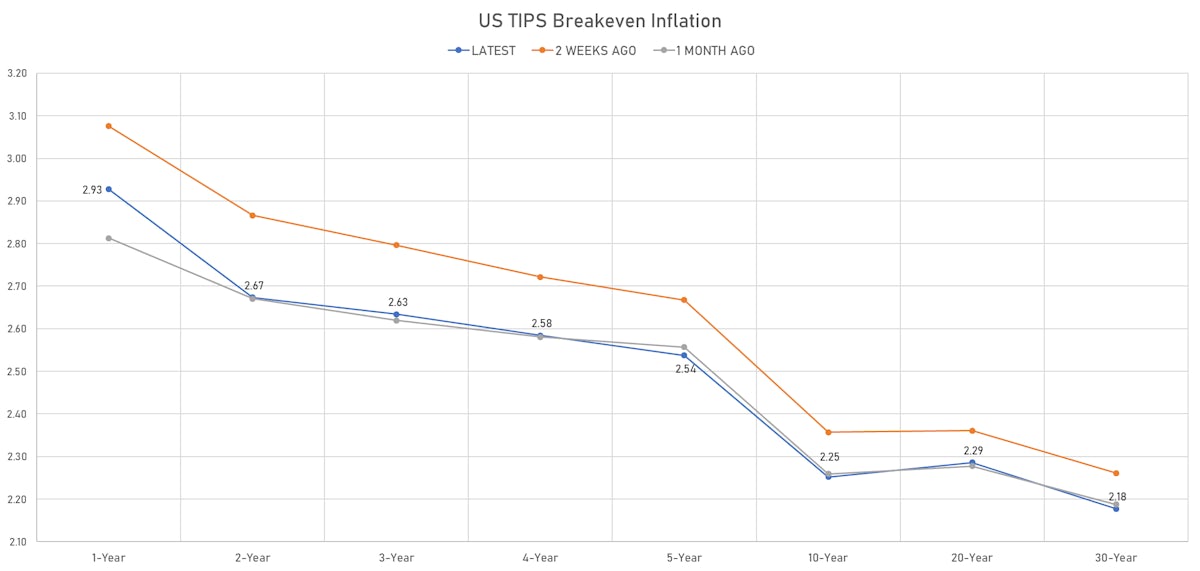

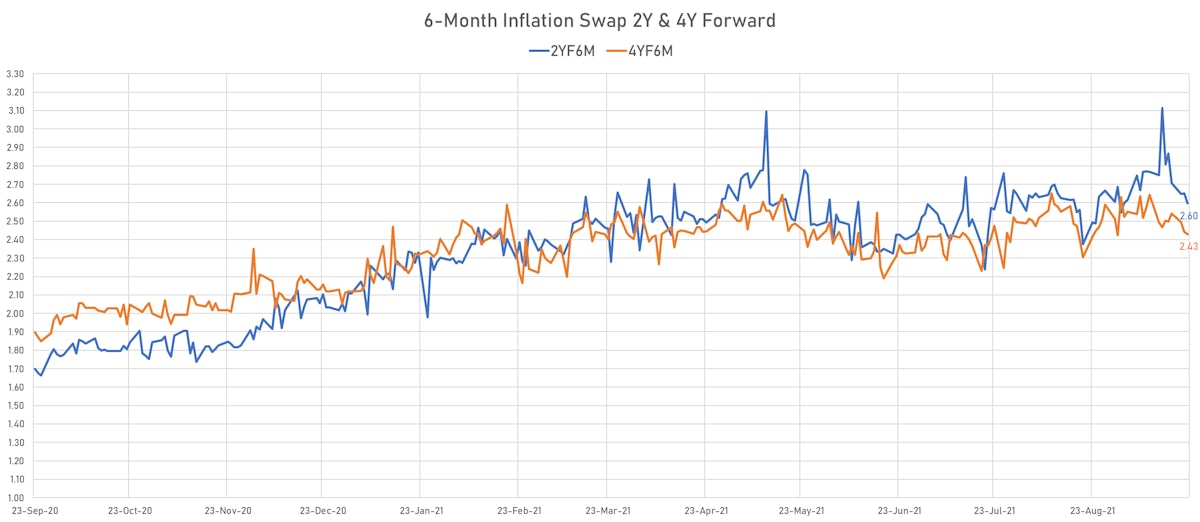

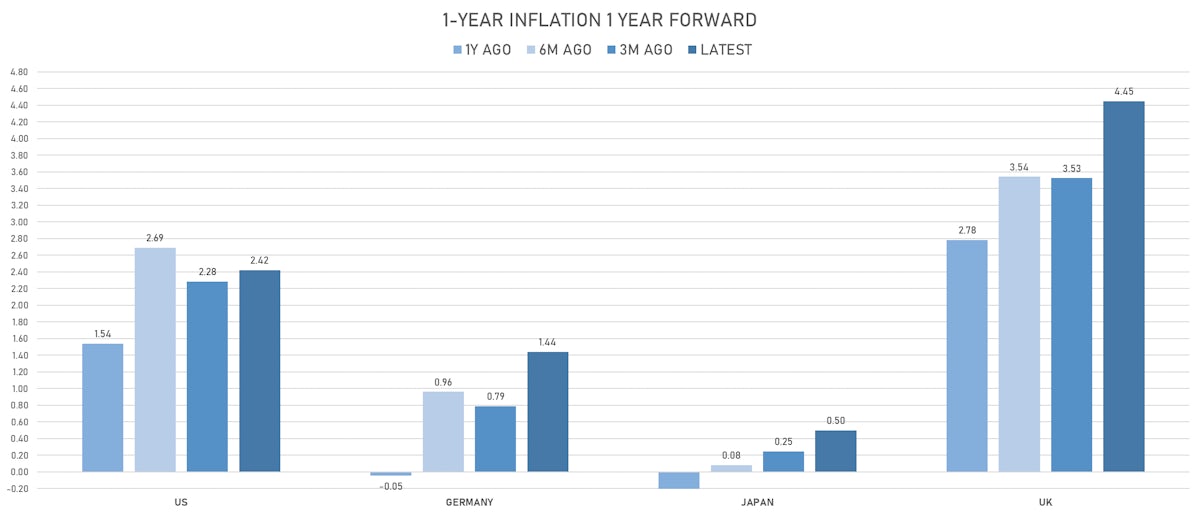

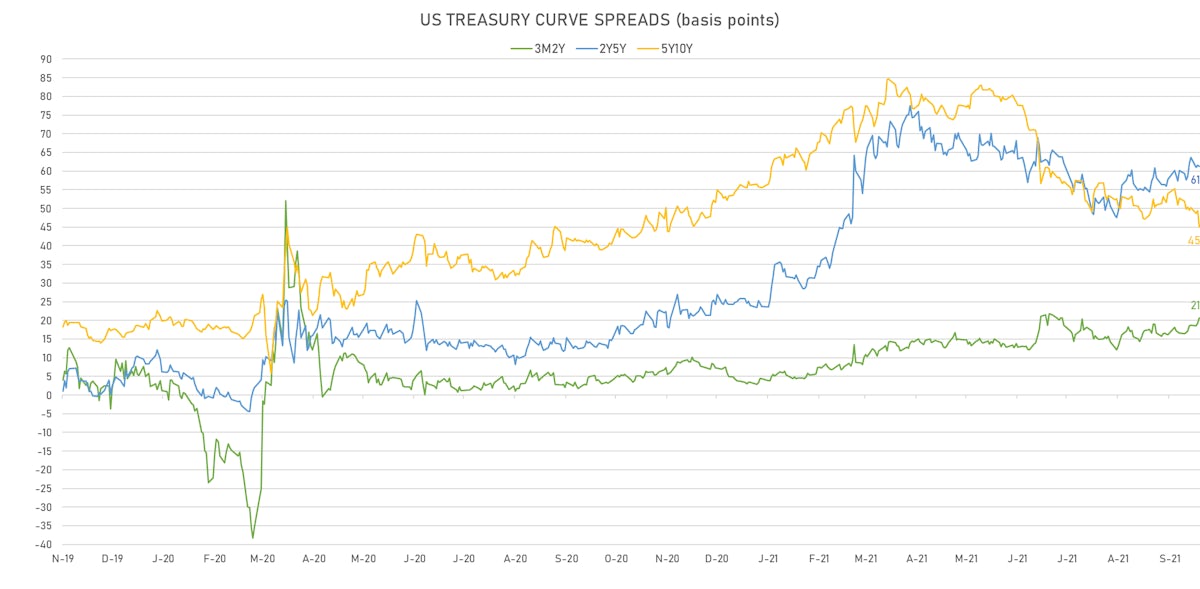

The short end of the yield curve steepened, the long end flattened, and inflation expectations dropped across the inflation forward curve

Published ET

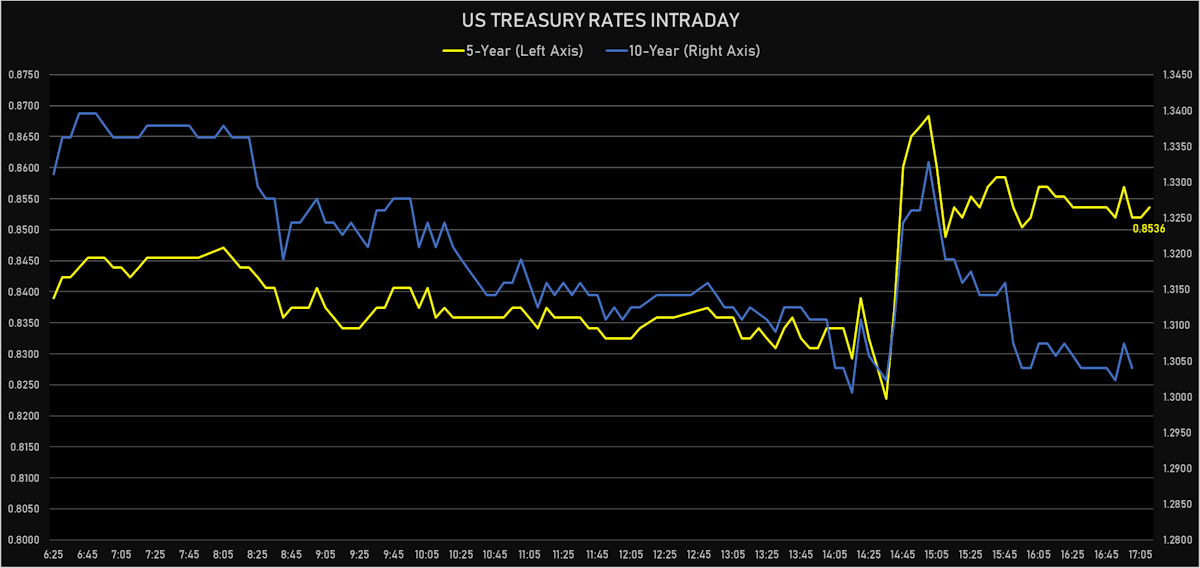

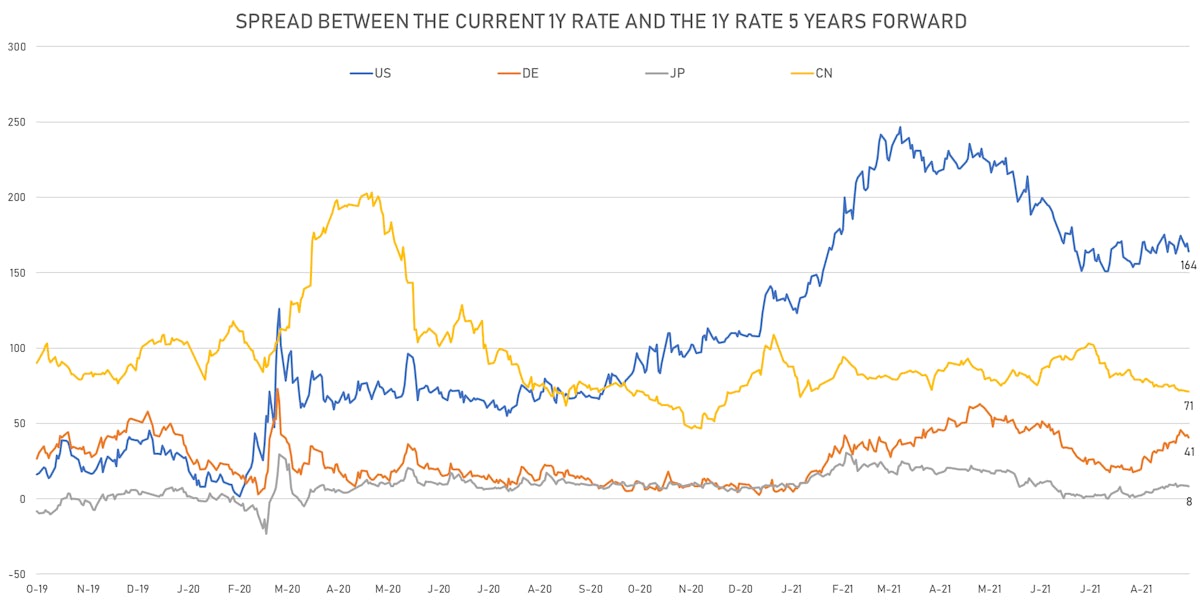

The front end of the US yield curve (3m to 2Y) is steeper, while the longer end (5Y to 10Y) is flatter | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.1bp today, now at 0.1293%

- The treasury yield curve flattened, with the 1s10s spread tightening -2.9 bp, now at 123.6 bp (YTD change: +43.2bp)

- 1Y: 0.0680% (up 0.5 bp)

- 2Y: 0.2403% (up 2.2 bp)

- 5Y: 0.8536% (up 2.0 bp)

- 7Y: 1.1250% (down 0.2 bp)

- 10Y: 1.3040% (down 2.4 bp)

- 30Y: 1.8125% (down 4.7 bp)

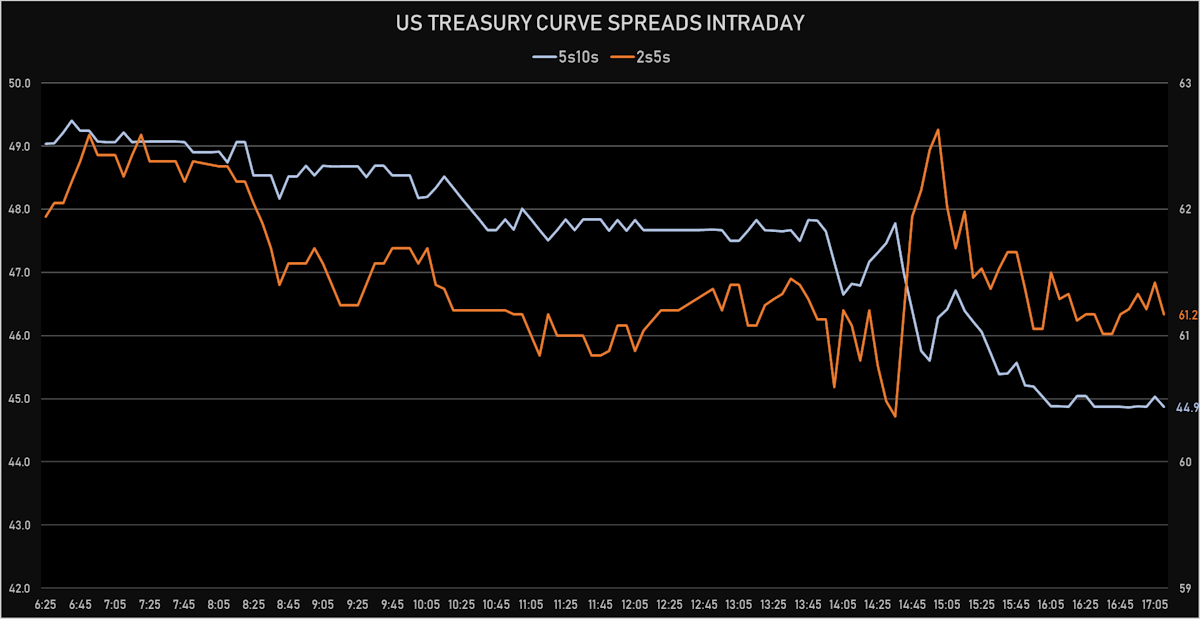

- US treasury curve spreads: 2s5s at 61.4bp (down -0.3bp), 5s10s at 45.0bp (down -4.3bp), 10s30s at 50.9bp (down -2.4bp)

- Treasuries butterfly spreads: 2s5s10s at -16.7bp (down -4.0bp), 5s10s30s at 5.1bp (up 1.4bp)

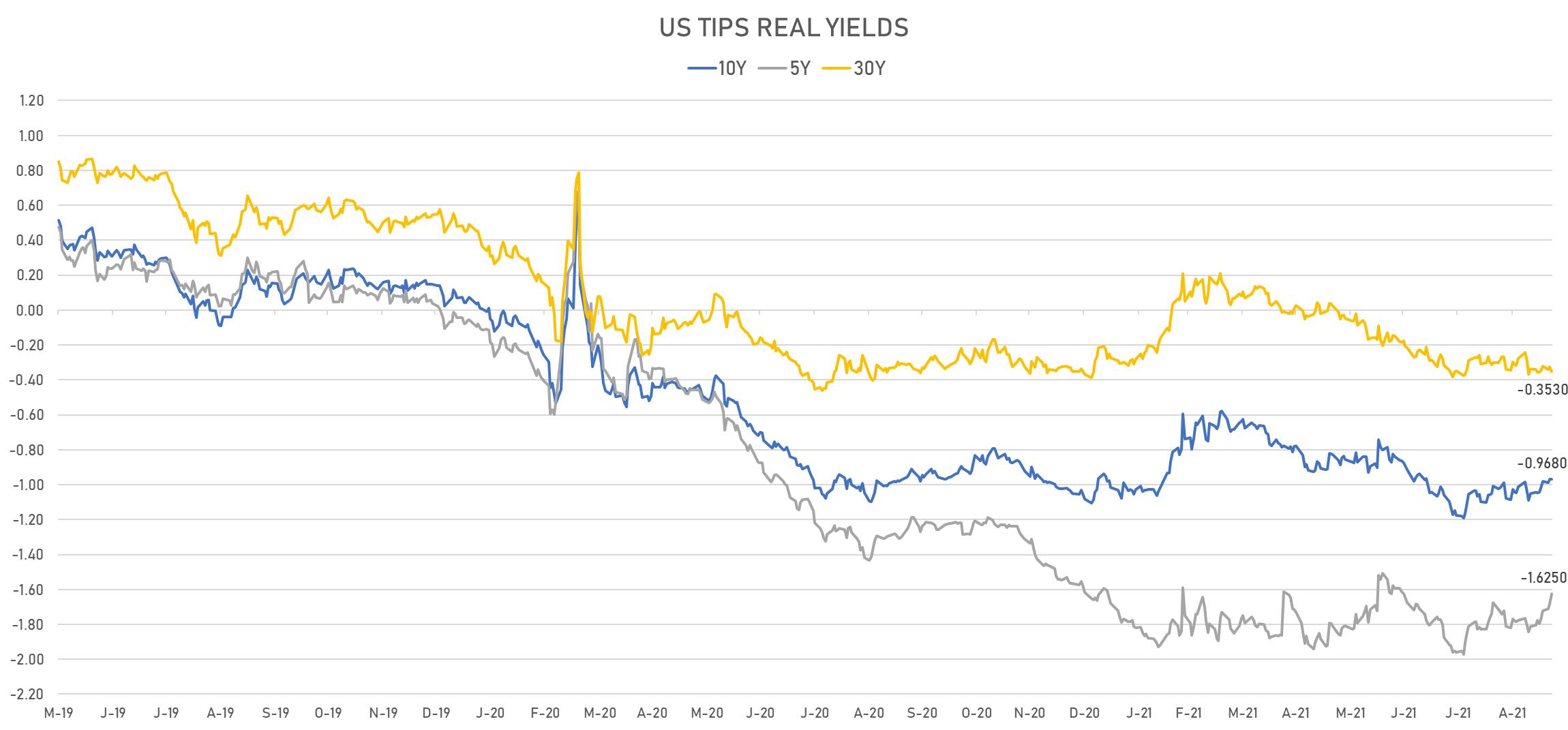

- US 5-Year TIPS Real Yield: +5.7 bp at -1.6250%; 10-Year TIPS Real Yield: unchanged at -0.9680%; 30-Year TIPS Real Yield: -2.9 bp at -0.3530%

FOMC WRAP-UP

- With Powell indicating that "substantial progress is all but met", the Fed is set announce the taper plan at the conclusion of its Fed FOMC on November 3rd

- The Fed's economic projections show higher core inflation forecasts to 3.7% (from 3%) in 2021, 2.3% (from 2.1%) in 2022, and 2.2% (from 2.1%) in 2023; growth forecast down to 5.8-6% for 2021 (from 6.8-7.3%), up to 3.4-4.5% in 2022 (from 2.8-3.8%), and 2.2-2.5% for 2023 (from 2-2.5%)

- The Fed seems intent on finishing asset purchases by the end of 1H 2022, meaning that the pace of tapering should be $15bn per month (as opposed to $15bn per meeting)

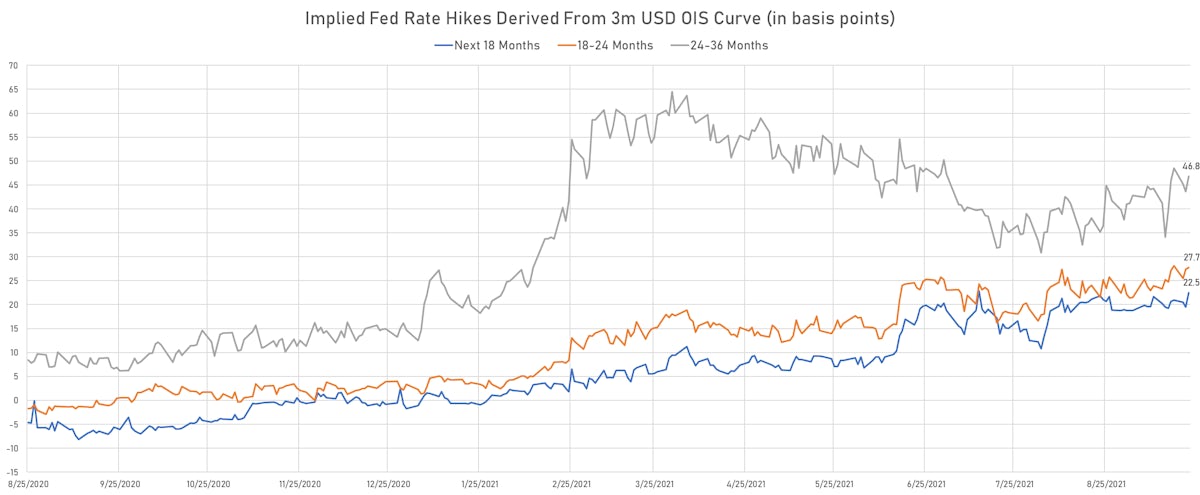

- This accelerated tapering pace will give the Fed freedom to start focusing on rates normalization, with the earliest possible rate hike in September 2022 (though liftoff is unlikely to be so soon)

- The revised dot plot is more hawkish, with a median of one full hike in 2022 and three hikes in 2023 (vs prior half a hike in 2022 and two hikes in 2023)

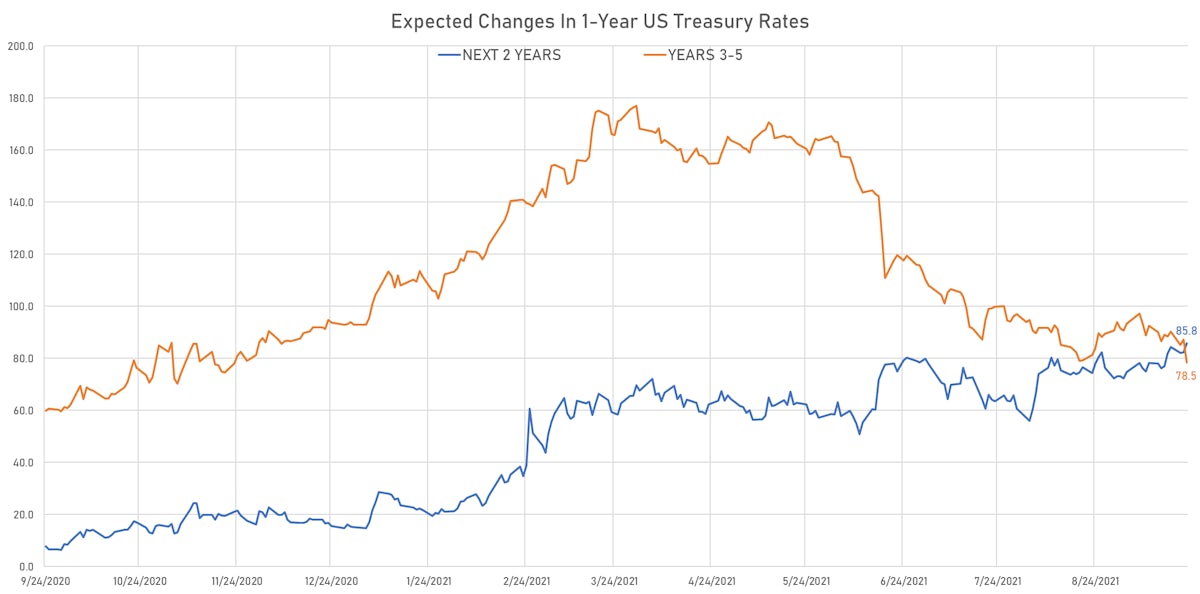

- In response, markets have priced in more rate hikes over the next 3 years, but fewer over the next 5 years, with a flatter yield curve: higher rates in the short term to kill any inflation overshoot, but a very shallow hiking cycle in order to avoid creating a recession in the process

US MACRO RELEASES

- Existing-Home Sales, Single-Family and Condos, total for Aug 2021 (NAR, United States) at 5.88 Mln (vs 5.99 Mln prior), below consensus estimate of 5.89 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Aug 2021 (NAR, United States) at -2.00 % (vs 2.00 % prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 17 Sep (MBA, USA) at 4.90 % (vs 0.30 % prior)

- Mortgage applications, market composite index for W 17 Sep (MBA, USA) at 742.70 (vs 707.90 prior)

- Mortgage applications, market composite index, purchase for W 17 Sep (MBA, USA) at 283.90 (vs 277.90 prior)

- Mortgage applications, market composite index, refinancing for W 17 Sep (MBA, USA) at 3,391.10 (vs 3,185.60 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 17 Sep (MBA, USA) at 3.03 % (vs 3.03 % prior)

- Policy Rates, Fed Funds Target Rate for 23 Sep (FOMC, U.S.) at 0.125 % (vs 0.13 % prior), in line with consensus estimate

- Policy Rates, Fed Interest On Excess Reserves for 23 Sep (FED, U.S.) at 0.15 % (vs 0.15 % prior)

US FORWARD RATES

- US 1-year Treasury rate 5 years forward down 4.7 bp, now at 1.7273%, with the 1-Year Treasury rate now expected to increase by 164.2 bp over the next 5 years

- 3-month Eurodollar futures EU2 shows expected hike of 16.7 bp by the end of 2022 (meaning the market prices in 66.8% chance of a 25bp hike by end of 2022)

- A linear interpolation of 1-Month USD LIBOR FRAs (14x15 and 15x16) shows 24bp by the end of 2022 (96% probability of a first hike in 2022)

- The 3-month USD OIS forward curve prices in 97.1 bp over the next 3 years (equivalent to 3.88 rate hikes)

- The 3-month Eurodollar zero curve prices in 120.3 bp over the next 3 years (equivalent to 4.81 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.93% (down -3.0bp); 2Y at 2.67% (down -2.8bp); 5Y at 2.54% (down -3.6bp); 10Y at 2.25% (down -2.2bp); 30Y at 2.18% (down -1.8bp)

- 6-month spot US CPI swap down -3.8 bp to 3.152%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6250%, +5.7 bp today; 10Y at -0.9680%, unchanged; 30Y at -0.3530%, -2.9 bp

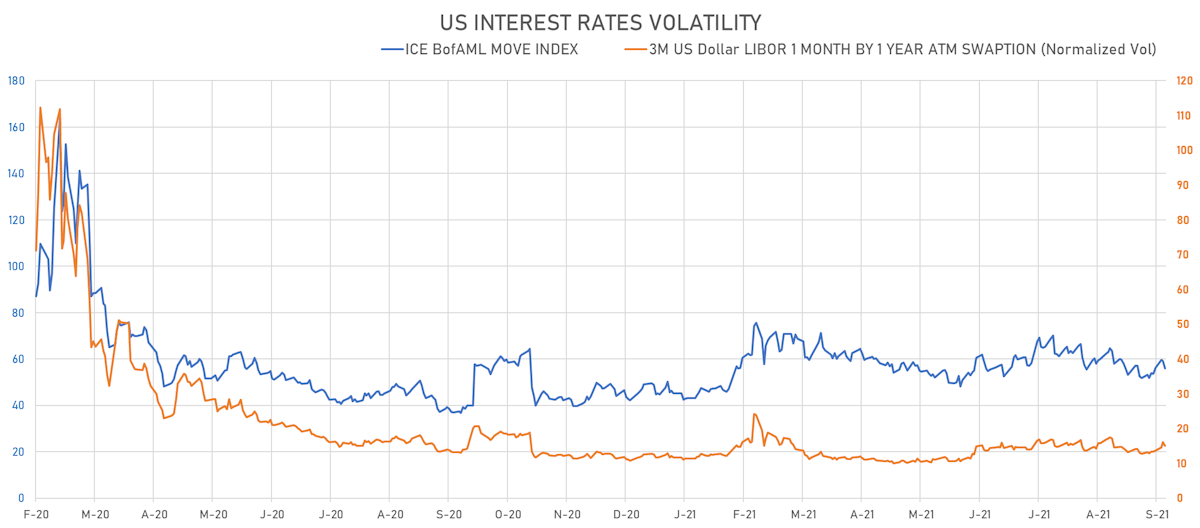

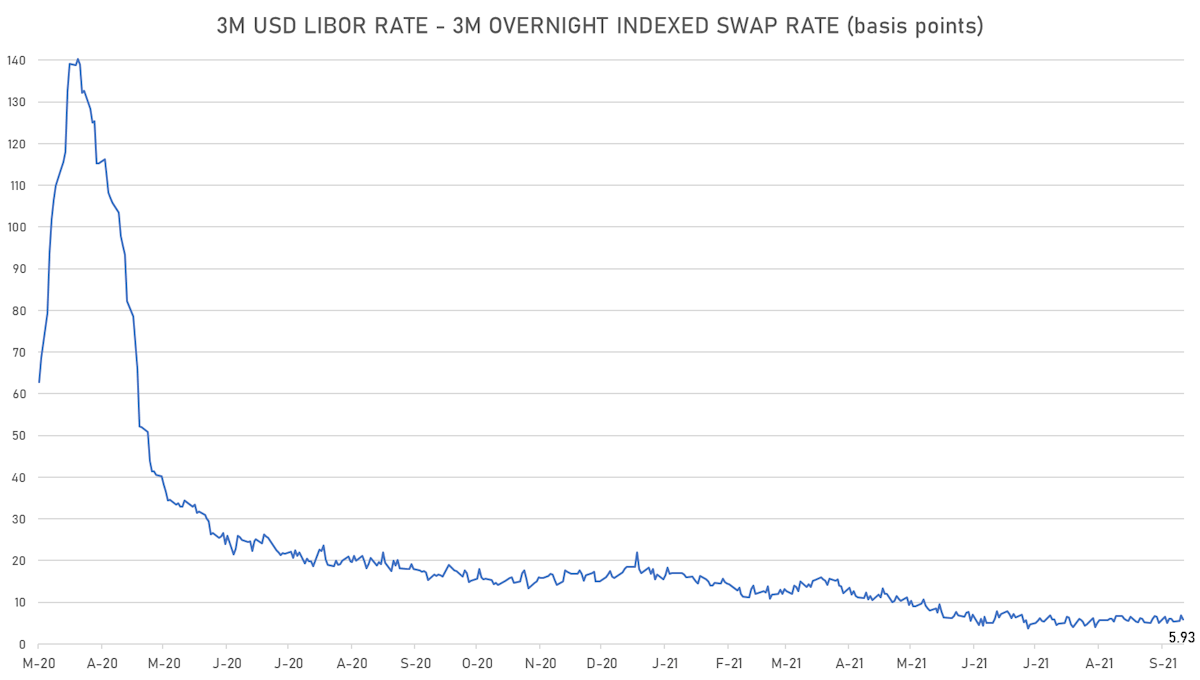

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.1% at 15.0%

- 3-Month LIBOR-OIS spread down -0.9 bp at 5.9 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.629% (up 0.7 bp); the German 1Y-10Y curve is 0.4 bp steeper at 35.1bp (YTD change: +19.8 bp)

- Japan 5Y: -0.105% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 16.0bp (YTD change: +2.2 bp)

- China 5Y: 2.689% at 54.5bp (YTD change: +8.1 bp)

- Switzerland 5Y: -0.567% (up 0.7 bp); the Swiss 1Y-10Y curve is 0.3 bp steeper at 44.6bp (YTD change: +19.2 bp)