Rates

Delayed Reaction To The FOMC Leads To Dramatic Repricing Of The Yield Curve

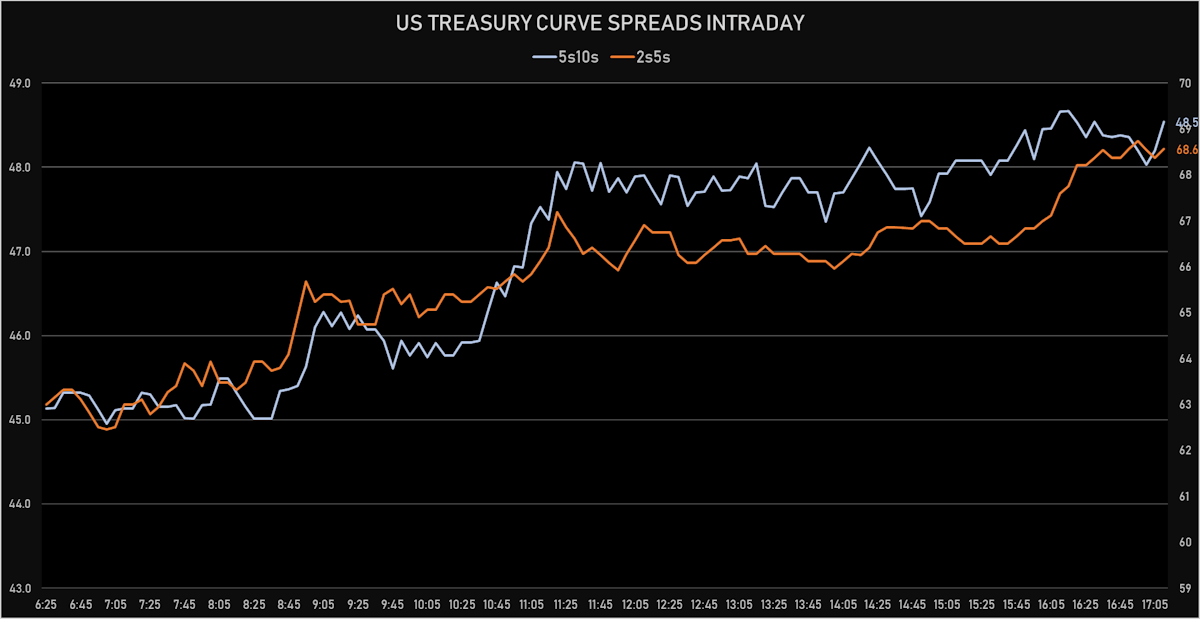

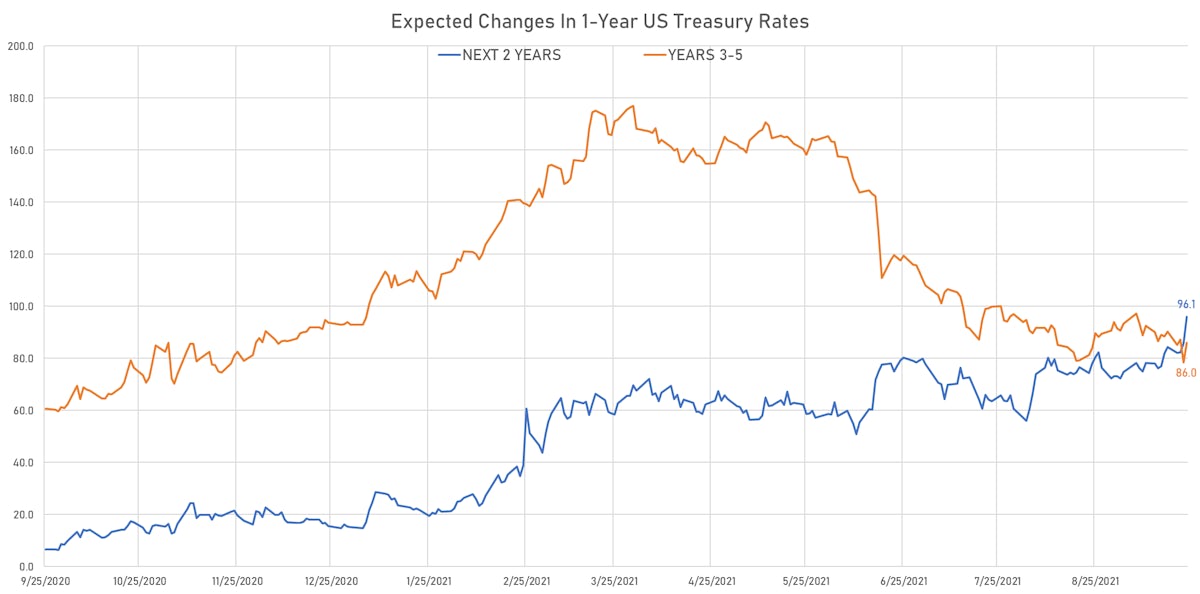

The 1s5s Treasury spread rose 9.5bp, while the 5s10s rose only 3.6bp: the market is still pricing in a shallow, front-loaded period of rates normalization, with very few Fed hikes after 4 years and a low terminal rate

Published ET

Implied Fed Hikes Derived From The 3m USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.3bp today, now at 0.1323%

- The treasury yield curve steepened, with the 1s10s spread widening 13.1 bp, now at 135.9 bp (YTD change: +55.5bp)

- 1Y: 0.0760% (unchanged)

- 2Y: 0.2608% (up 2.1 bp)

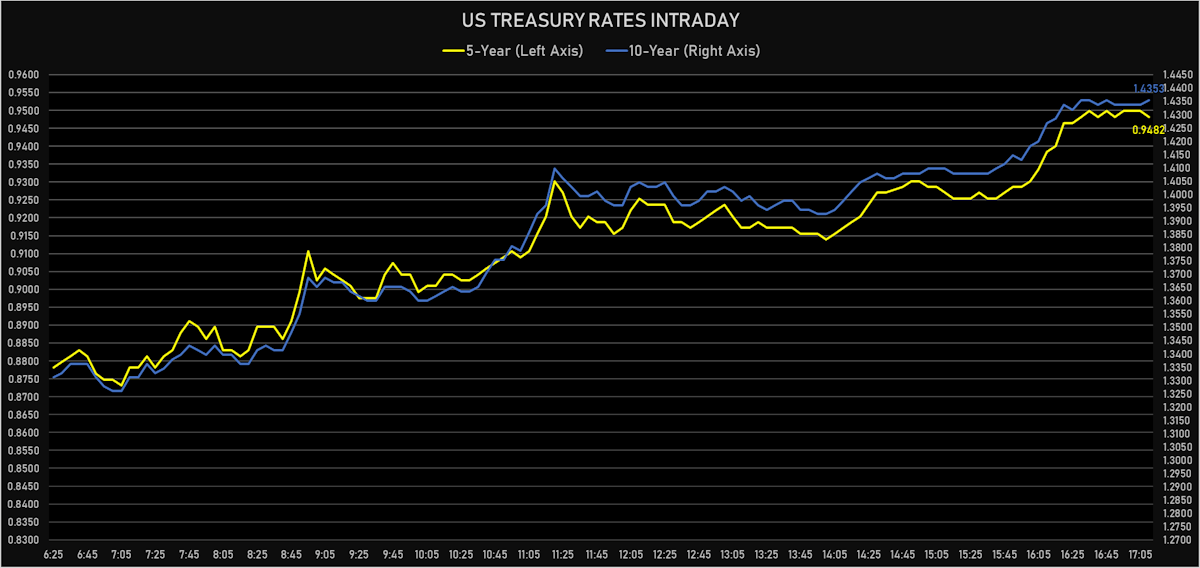

- 5Y: 0.9482% (up 9.5 bp)

- 7Y: 1.2429% (up 11.8 bp)

- 10Y: 1.4353% (up 13.1 bp)

- 30Y: 1.9460% (up 13.4 bp)

- US treasury curve spreads: 2s5s at 68.8bp (up 7.4bp today), 5s10s at 48.7bp (up 3.7bp today), 10s30s at 51.1bp (up 0.2bp today)

- Treasuries butterfly spreads: 2s5s10s at -20.4bp (down -3.8bp), 5s10s30s at 2.5bp (down -2.6bp)

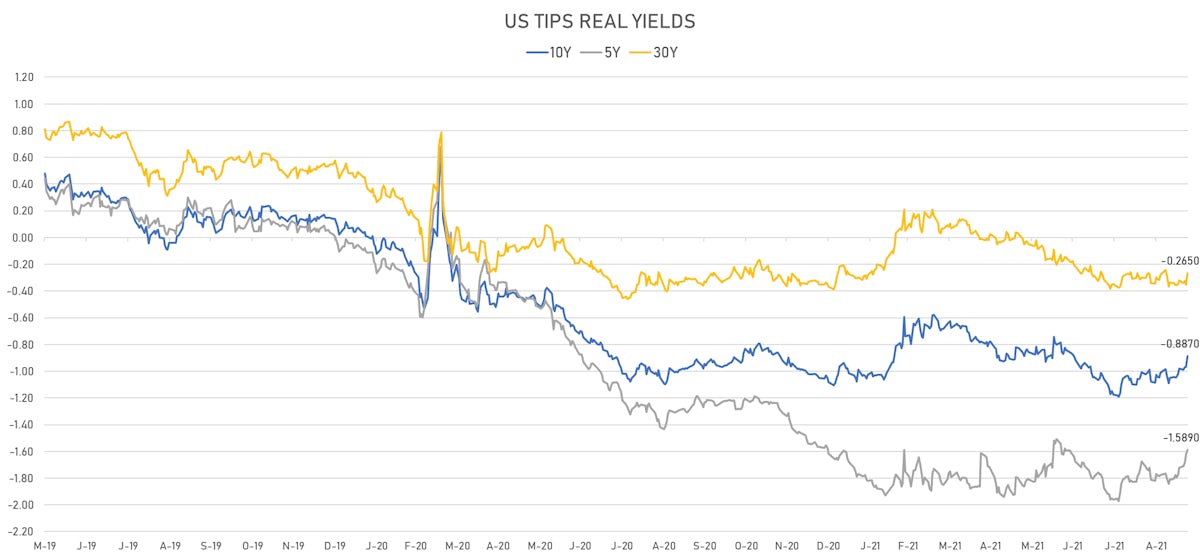

- US 5-Year TIPS Real Yield: +3.6 bp at -1.5890%; 10-Year TIPS Real Yield: +8.1 bp at -0.8870%; 30-Year TIPS Real Yield: +8.8 bp at -0.2650%

US MACRO RELEASES

- Chicago Fed CFMMI, National Activity Index for Aug 2021 (Fed Res, Chicago) at 0.29 (vs 0.53 prior)

- Jobless Claims, National, Continued for W 11 Sep (U.S. Dept. of Labor) at 2.85 Mln (vs 2.67 Mln prior), above consensus estimate of 2.65 Mln

- Jobless Claims, National, Initial for W 18 Sep (U.S. Dept. of Labor) at 351.00 k (vs 332.00 k prior), above consensus estimate of 320.00 k

- Jobless Claims, National, Initial, four week moving average for W 18 Sep (U.S. Dept. of Labor) at 335.75 k (vs 335.75 k prior)

- Kansas Fed, Current composite index for Sep 2021 (FED, Kansas) at 22.00 (vs 29.00 prior)

- Kansas Fed, Current production index for Sep 2021 (FED, Kansas) at 10.00 (vs 22.00 prior)

- Leading Index, Change P/P for Aug 2021 (The Conference Board) at 0.90 % (vs 0.90 % prior), above consensus estimate of 0.70 %

- PMI, Composite, Output, Flash for Sep 2021 (Markit Economics) at 54.50 (vs 55.40 prior)

- PMI, Manufacturing Sector, Total, Flash for Sep 2021 (Markit Economics) at 60.50 (vs 61.10 prior), below consensus estimate of 61.50

- PMI, Services Sector, Business Activity, Flash for Sep 2021 (Markit Economics) at 54.40 (vs 55.10 prior), below consensus estimate of 55.00

RESULTS OF $14 BN 10Y TIPS AUCTION

- Good stats with end users grabbing 87.3% of the offering

- High yield at -0.939%, a stop-through vs -0.92% when issued at the bid deadline

- $35.7 bn in bids, 2.55x cover (vs. 2.50 in July and 2.44x average)

- Indirects took in 71.5% of the offering (vs 70.1% prior and 67.0% average)

- Direct bidders at 15.8% (vs 15.5% prior and 15.8% average)

- Dealers at 12.7% (vs 14.3% prior and 17.3% average)

US FORWARD RATES

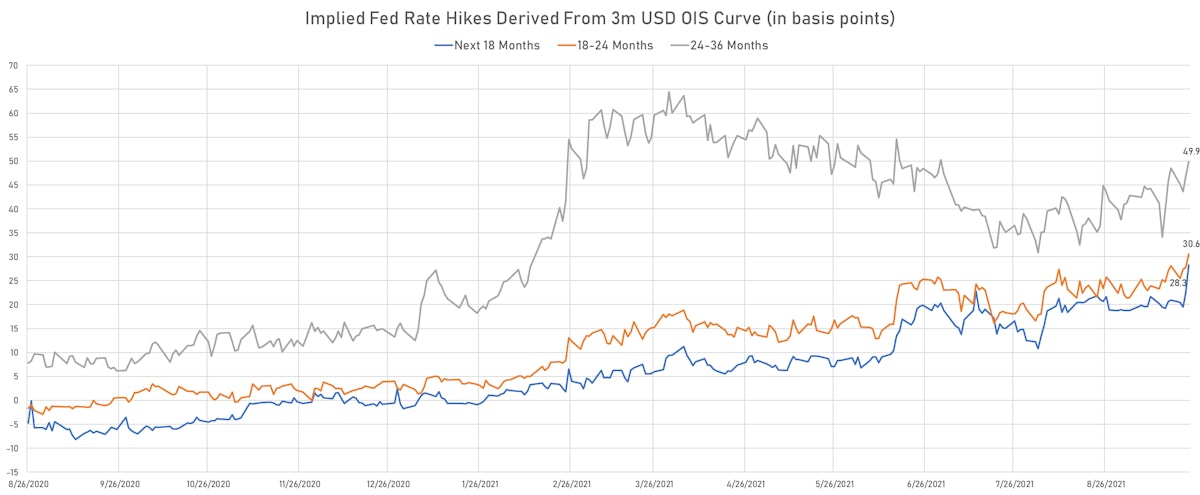

- 3-month Eurodollar futures (EDU2) expected hike of 18.7 bp by the end of 2022 (meaning the market prices 74.8% chance of a 25bp hike by end of 2022), and the spread between EDU2 and EDU3 shows the market expects almost 3 hikes in 2023

- 1-month USD LIBOR FRAs imply 25.6 bp hike by the end of 2022 (interpolation of 14X15 and 15X16), meaning that FRAs price in 1.0 full hike

- The 3-month Eurodollar zero curve prices in 21.3 bp of rate hikes over the next 15 months (equivalent to 0.85 rate hike) and 132.0 bp over the next 3 years (equivalent to 5.28 rate hikes)

- The 3-month USD OIS forward curve prices in 108.8 bp over the next 3 years (equivalent to 4.35 rate hikes)

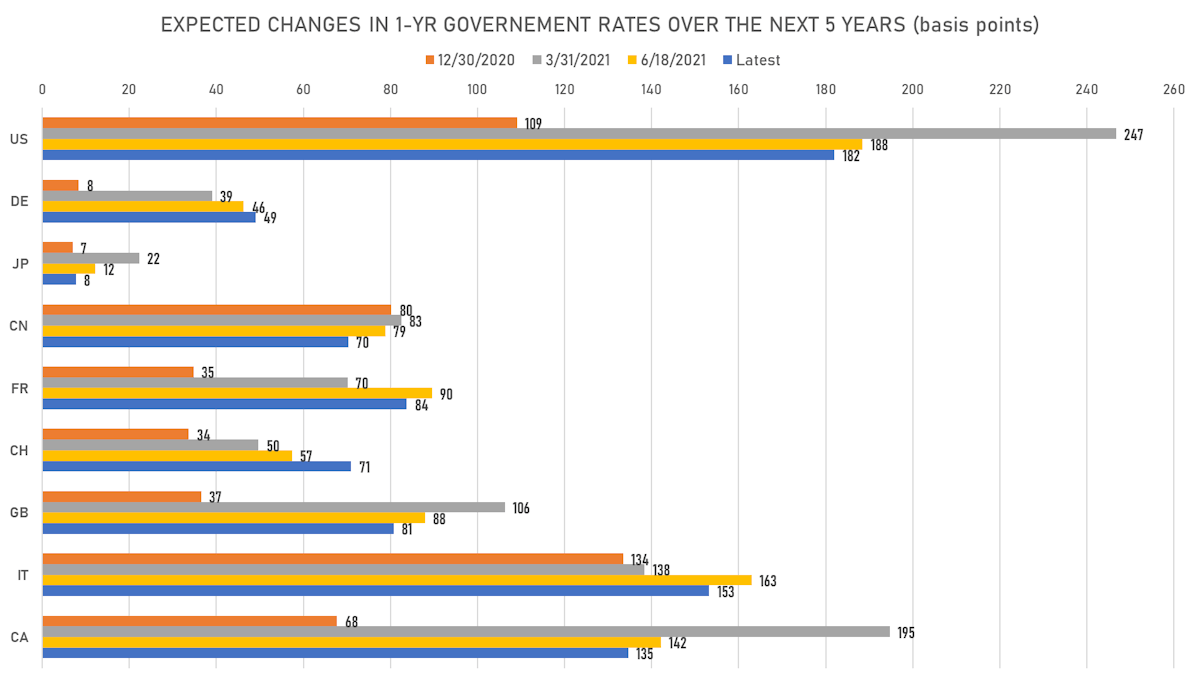

- 1-year US Treasury rate 5 years forward up 18.3 bp, now at 1.9106%, meaning that the 1-year Treasury rate is now expected to increase by 182.0 bp over the next 5 years (equivalent to 7.3 rate hikes)

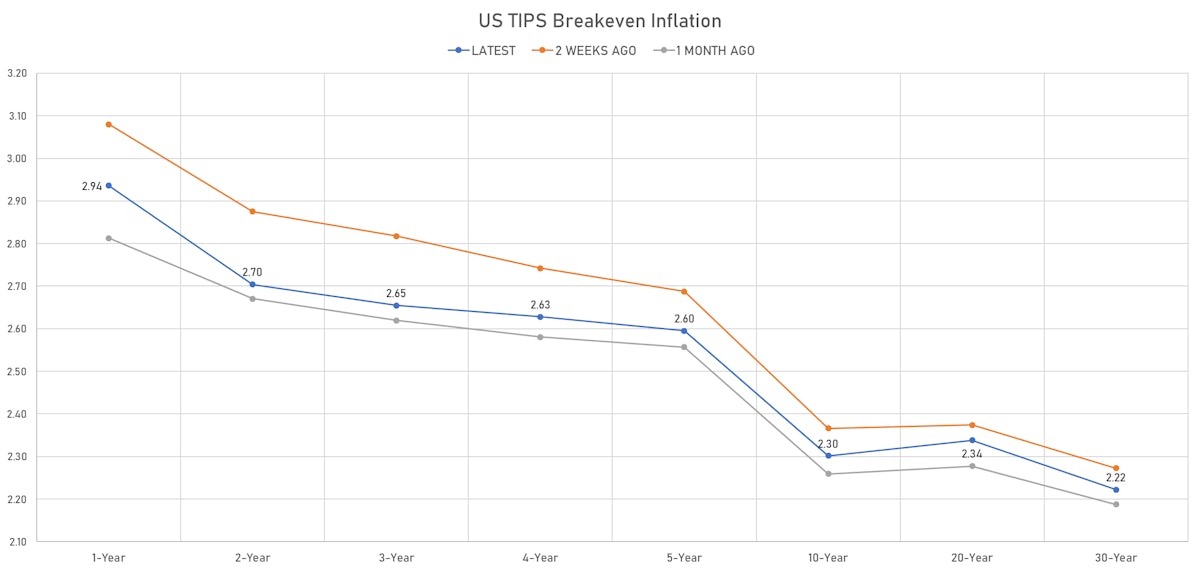

US INFLATION & REAL RATES

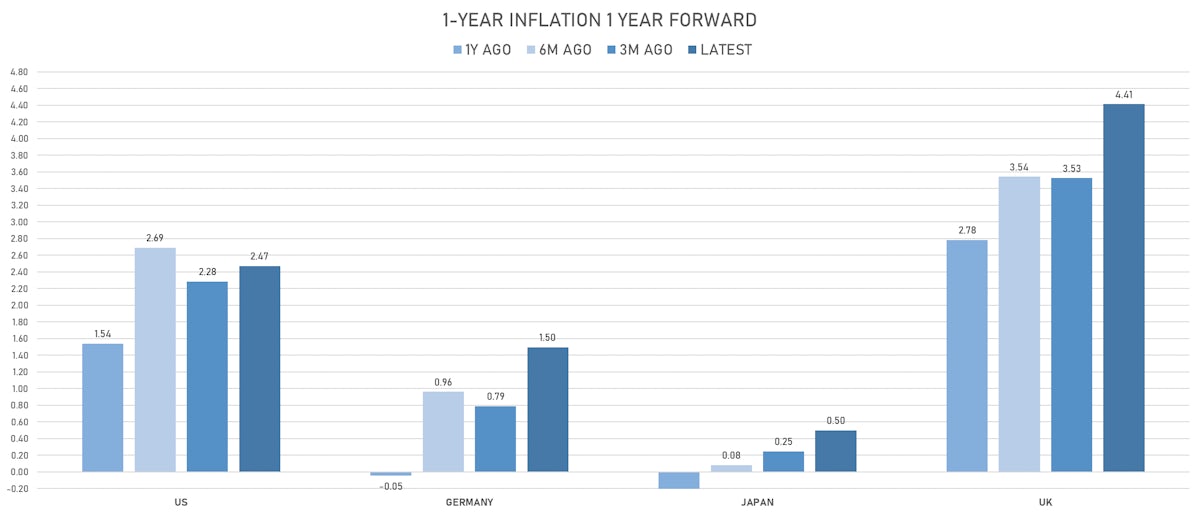

- TIPS 1Y breakeven inflation at 2.94% (up 0.9bp); 2Y at 2.70% (up 3.1bp); 5Y at 2.60% (up 5.8bp); 10Y at 2.30% (up 4.9bp); 30Y at 2.22% (up 4.5bp)

- 6-month spot US CPI swap up 0.6 bp to 3.159%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.5890%, +3.6 bp today; 10Y at -0.8870%, +8.1 bp today; 30Y at -0.2650%, +8.8 bp today

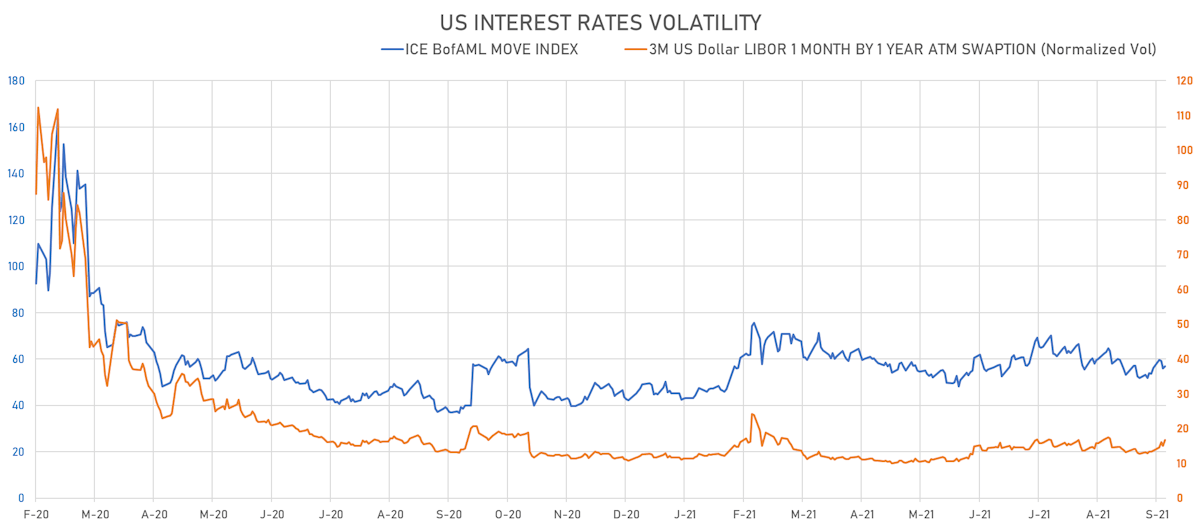

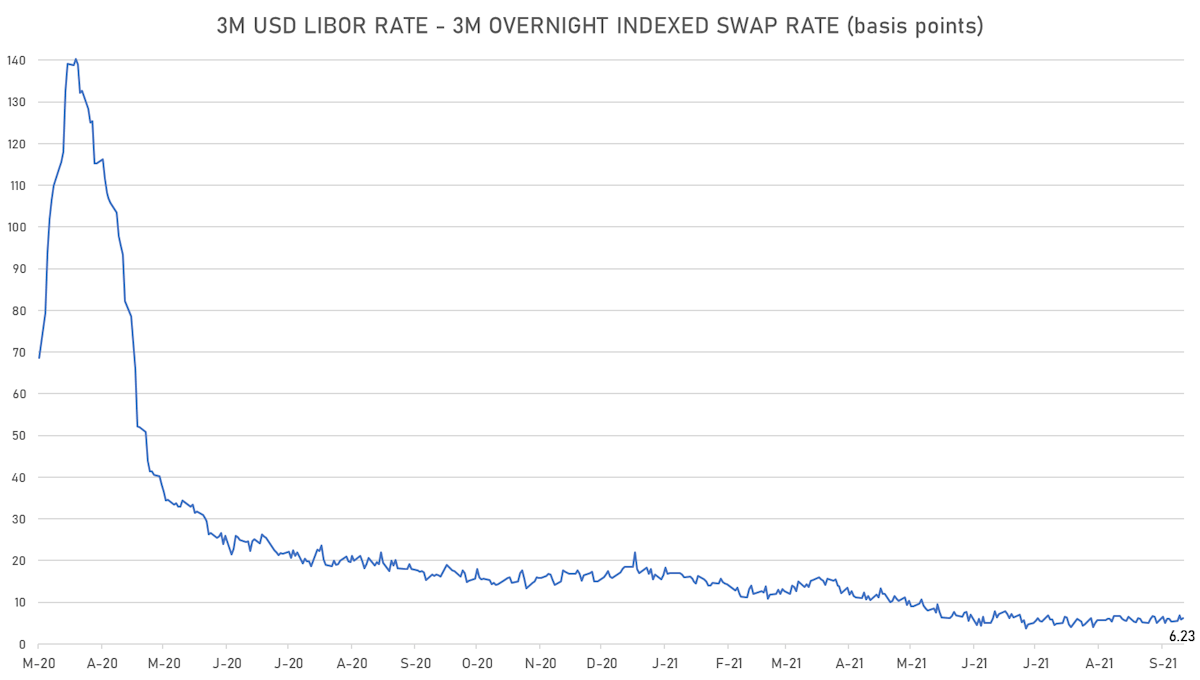

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.7% at 16.7%

- 3-Month LIBOR-OIS spread up 0.3 bp at 6.2 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.581% (up 5.0 bp); the German 1Y-10Y curve is 7.3 bp steeper at 42.5bp (YTD change: +27.1 bp)

- Japan 5Y: -0.105% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 16.0bp (YTD change: +2.2 bp)

- China 5Y: 2.692% (up 0.3 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 54.1bp (YTD change: +7.7 bp)

- Switzerland 5Y: -0.490% (up 4.7 bp); the Swiss 1Y-10Y curve is 3.9 bp steeper at 50.5bp (YTD change: +23.1 bp)