Rates

Slight Steepening Of The Yield Curve To End A Volatile Week For US Rates

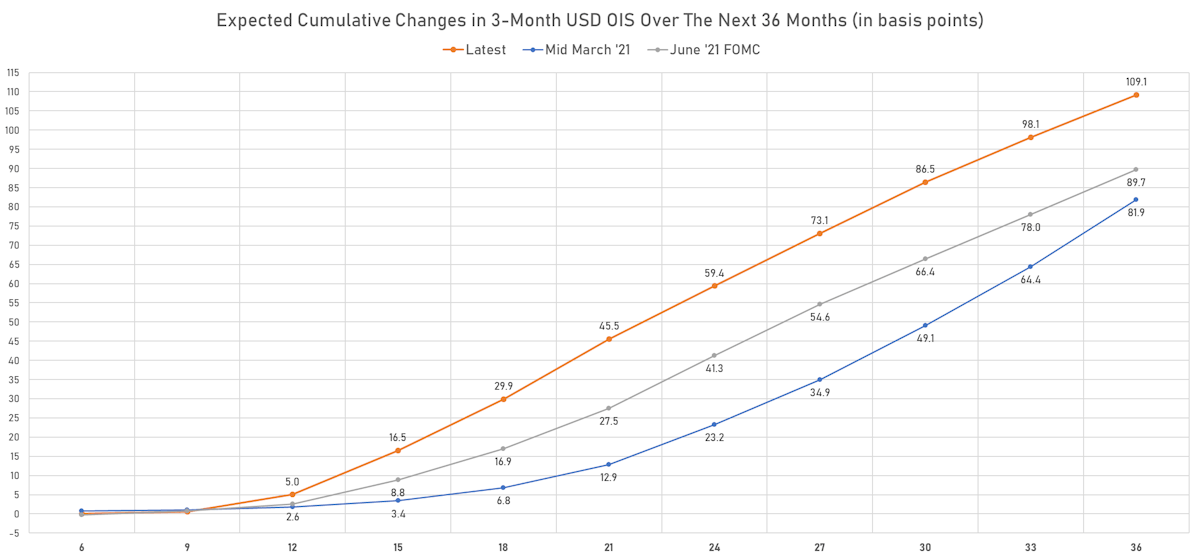

Eurodollar futures do not fully reflect the updated dot plot: unlike the Fed's modal forecast, EDs don't price in a full rate hike by the end of 2022, with the probability of that outcome now at 80% (up from 60% last week)

Published ET

Implied Fed Hikes Over The Next 3 Years, Derived From 3m USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged today, now at 0.1323%

- The treasury yield curve steepened, with the 1s10s spread widening 1.5 bp, now at 137.9 bp (YTD change: +57.4bp)

- 1Y: 0.0740% (up 0.3 bp)

- 2Y: 0.2715% (up 1.1 bp)

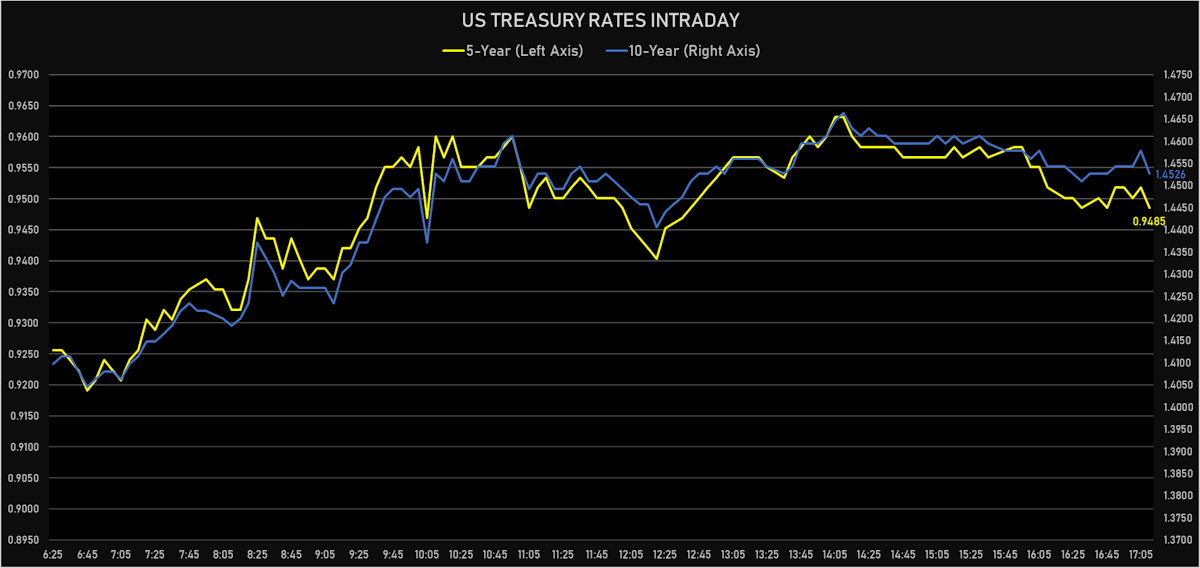

- 5Y: 0.9485% (unchanged)

- 7Y: 1.2525% (up 1.0 bp)

- 10Y: 1.4526% (up 1.7 bp)

- 30Y: 1.9847% (up 3.9 bp)

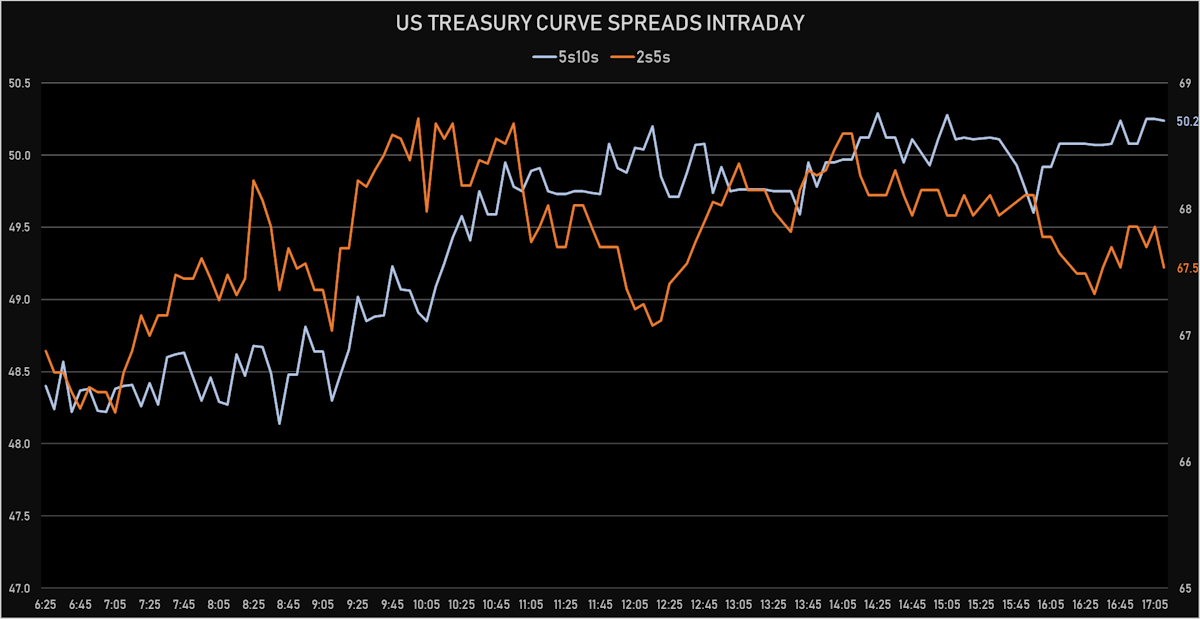

- US treasury curve spreads: 2s5s at 67.7bp (down -1.0bp), 5s10s at 50.4bp (up 1.7bp today), 10s30s at 53.3bp (up 2.1bp today)

- Treasuries butterfly spreads: 2s5s10s at -17.7bp (up 2.8bp today), 5s10s30s at 2.5bp (unchanged)

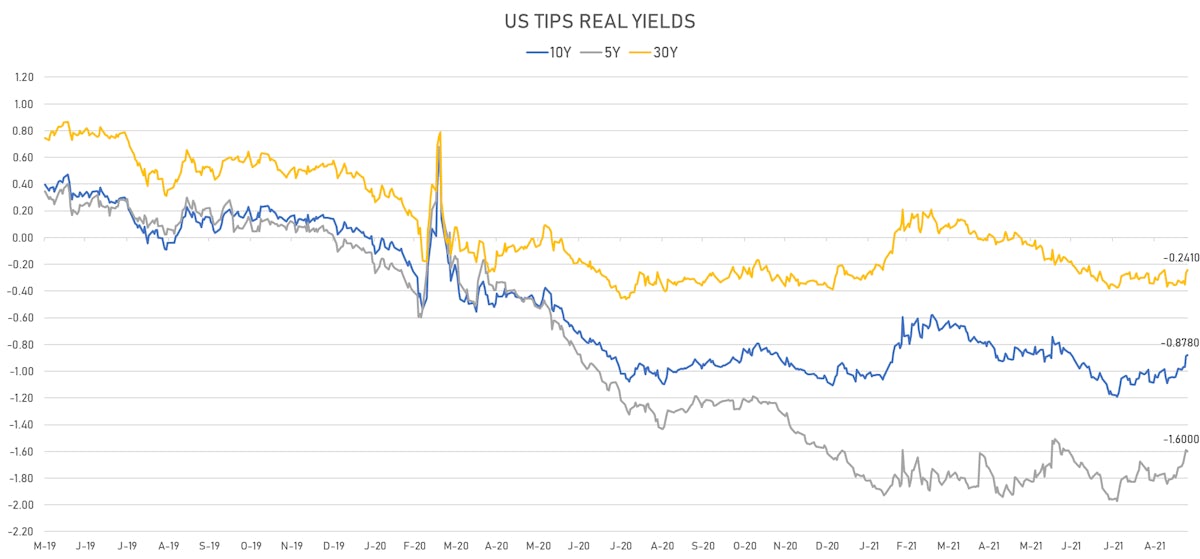

- US 5-Year TIPS Real Yield: -1.1 bp at -1.6000%; 10-Year TIPS Real Yield: +0.9 bp at -0.8780%; 30-Year TIPS Real Yield: +2.4 bp at -0.2410%

US MACRO RELEASES

- Building Permits for Aug 2021 (U.S. Census Bureau) at 1.72 Mln (vs 1.73 Mln prior)

- Building Permits, Change P/P for Aug 2021 (U.S. Census Bureau) at 5.60 % (vs 6.00 % prior)

- New Home Sales for Aug 2021 (U.S. Census Bureau) at 0.74 Mln (vs 0.71 Mln prior), above consensus estimate of 0.71 Mln

- New Home Sales, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.50 % (vs 1.00 % prior)

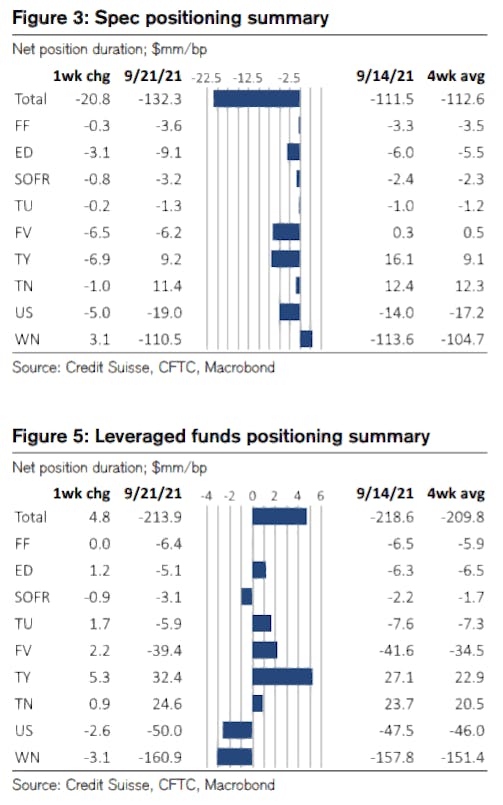

WEEKLY CFTC RATES POSITIONING UPDATE

- Leveraged funds decreased their net duration short, and notably increased their long positions in 10Y Treasury futures

- Specs increased their net short duration by selling futures throughout the curve

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 20.0 bp by the end of 2022 (meaning the market prices 80.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 109.1 bp over the next 3 years (equivalent to 4.37 rate hikes)

- The 3-month Eurodollar zero curve prices in 131.3 bp over the next 3 years (equivalent to 5.25 rate hikes)

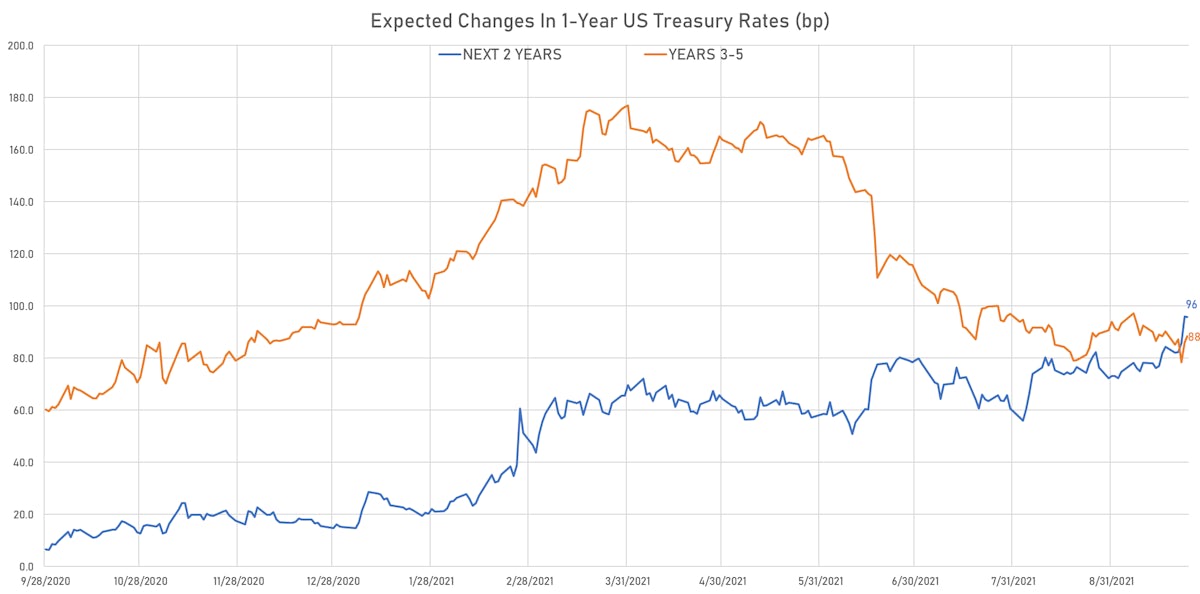

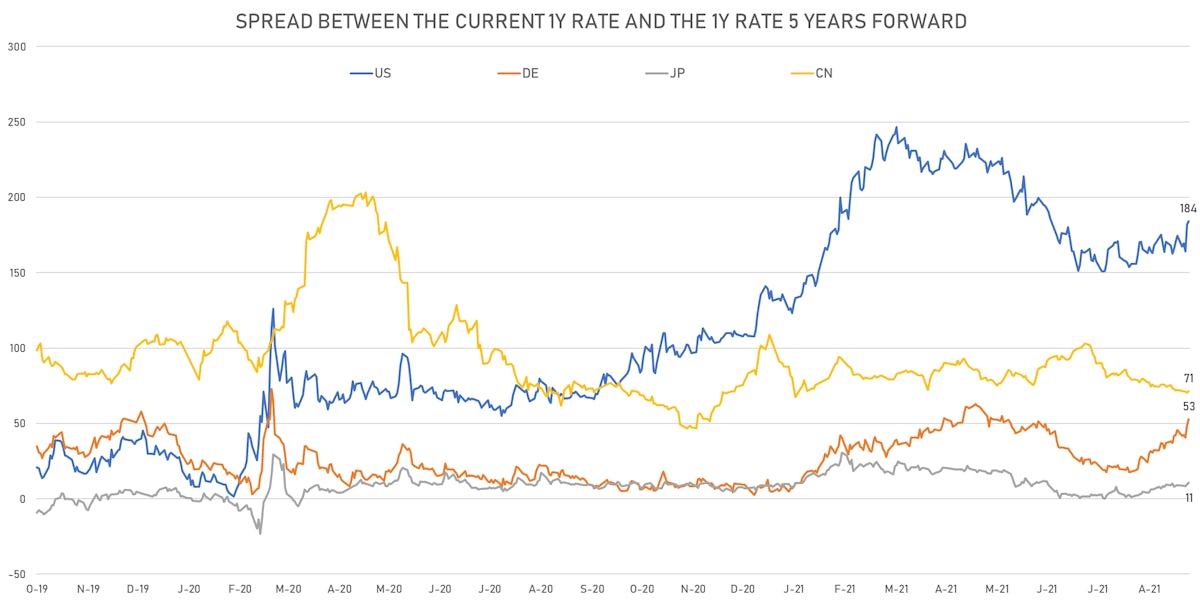

- 1-year US Treasury rate 5 years forward up 2.4 bp, now at 1.9348%, meaning that the 1-year Treasury rate is now expected to increase by 184.2 bp over the next 5 years (equivalent to 7.4 rate hikes), still a glacial pace of normalization

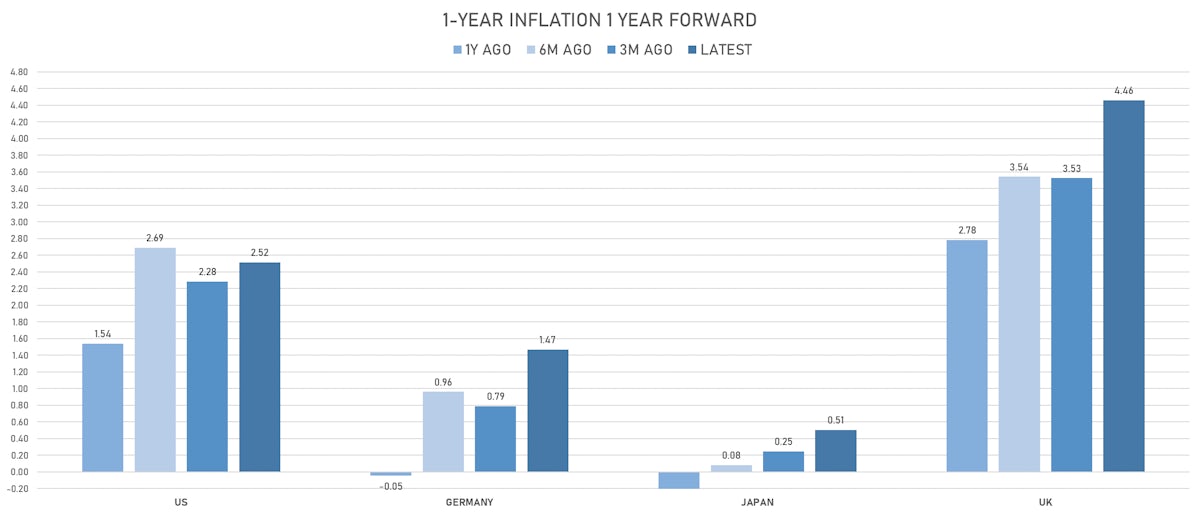

US INFLATION & REAL RATES

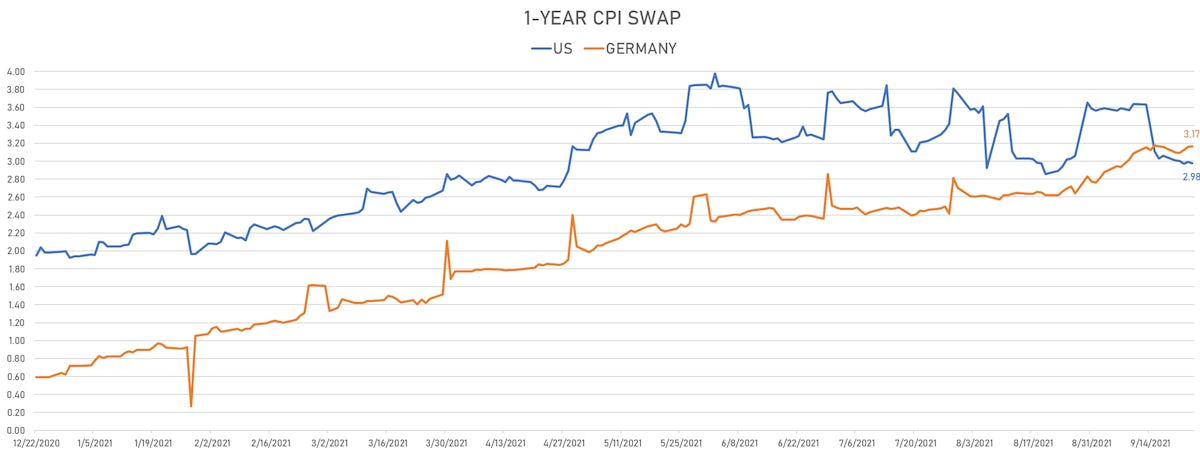

- TIPS 1Y breakeven inflation at 2.94% (unchanged); 2Y at 2.73% (up 2.3bp); 5Y at 2.61% (up 1.0bp); 10Y at 2.31% (up 0.9bp); 30Y at 2.24% (up 1.5bp)

- 6-month spot US CPI swap down -1.5 bp to 3.144%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6000%, -1.1 bp today; 10Y at -0.8780%, +0.9 bp today; 30Y at -0.2410%, +2.4 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 16.7%

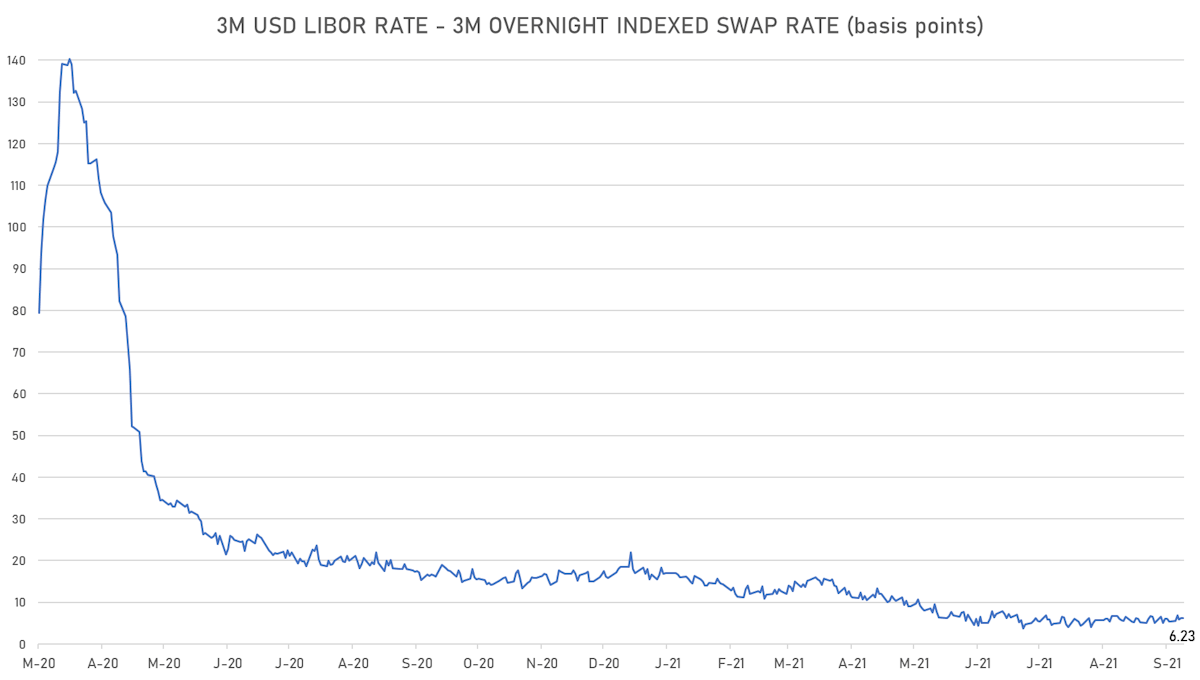

- 3-Month LIBOR-OIS spread down 0.0 bp at 6.2 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.566% (up 1.3 bp); the German 1Y-10Y curve is 2.0 bp steeper at 44.8bp (YTD change: +29.1 bp)

- Japan 5Y: -0.093% (up 1.0 bp); the Japanese 1Y-10Y curve is 1.1 bp steeper at 17.8bp (YTD change: +3.3 bp)

- China 5Y: 2.694% (up 0.2 bp); the Chinese 1Y-10Y curve is 0.1 bp flatter at 54.0bp (YTD change: +7.6 bp)

- Switzerland 5Y: -0.489% (up 3.1 bp); the Swiss 1Y-10Y curve is 3.2 bp steeper at 56.7bp (YTD change: +26.3 bp)