Rates

Weak Treasury Notes Auctions, With Further Steepening At The Front End Of The Curve

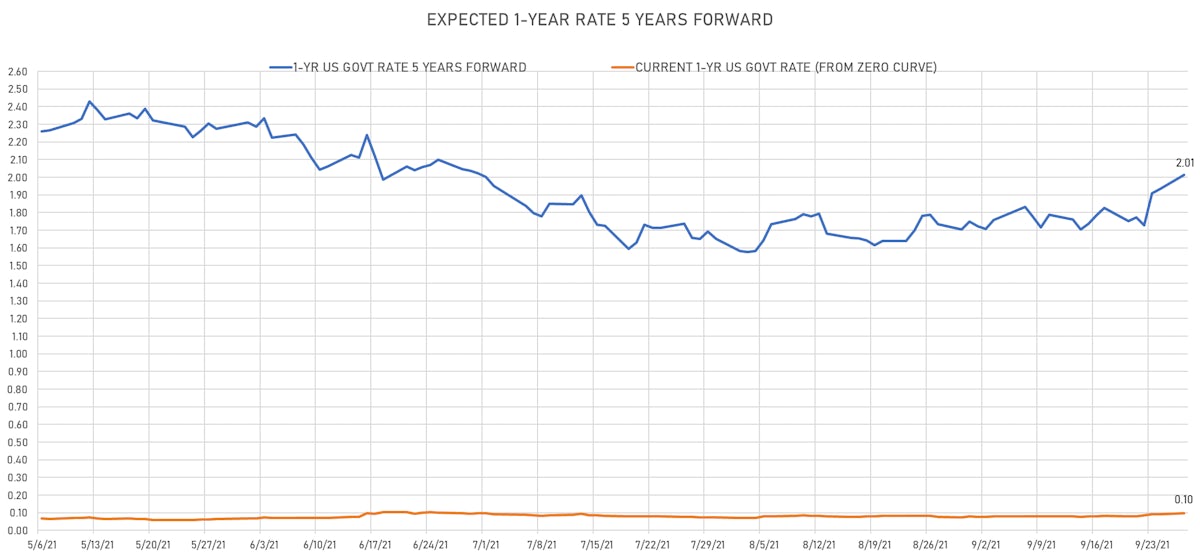

The 1-Year Treasury rate 5 years forward is up 27bp in the past week, and the 3-month Eurodollar-implied probability of a Fed hike by the end of 2022 is now at 80% (up from 60% last week)

Published ET

QUICK US SUMMARY

- 3-Month USD LIBOR -0.1bp today, now at 0.1318%

- The treasury yield curve steepened, with the 1s10s spread widening 3.8 bp, now at 141.2 bp (YTD change: +60.7bp)

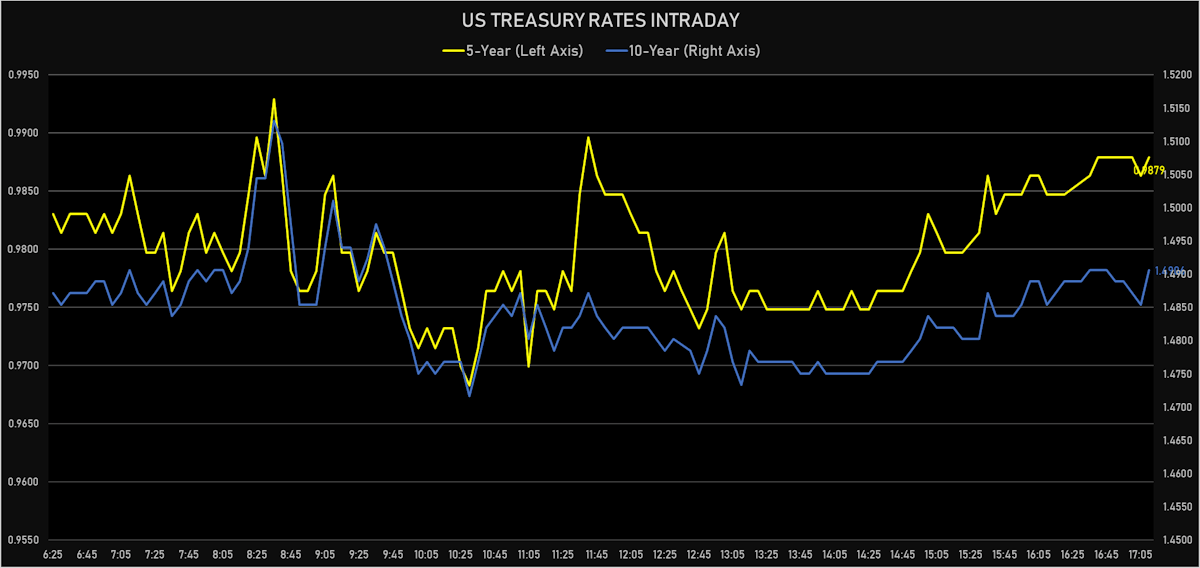

- 1Y: 0.0790% (unchanged)

- 2Y: 0.2799% (up 0.8 bp)

- 5Y: 0.9879% (up 3.9 bp)

- 7Y: 1.3002% (up 4.8 bp)

- 10Y: 1.4906% (up 3.8 bp)

- 30Y: 2.0014% (up 1.7 bp)

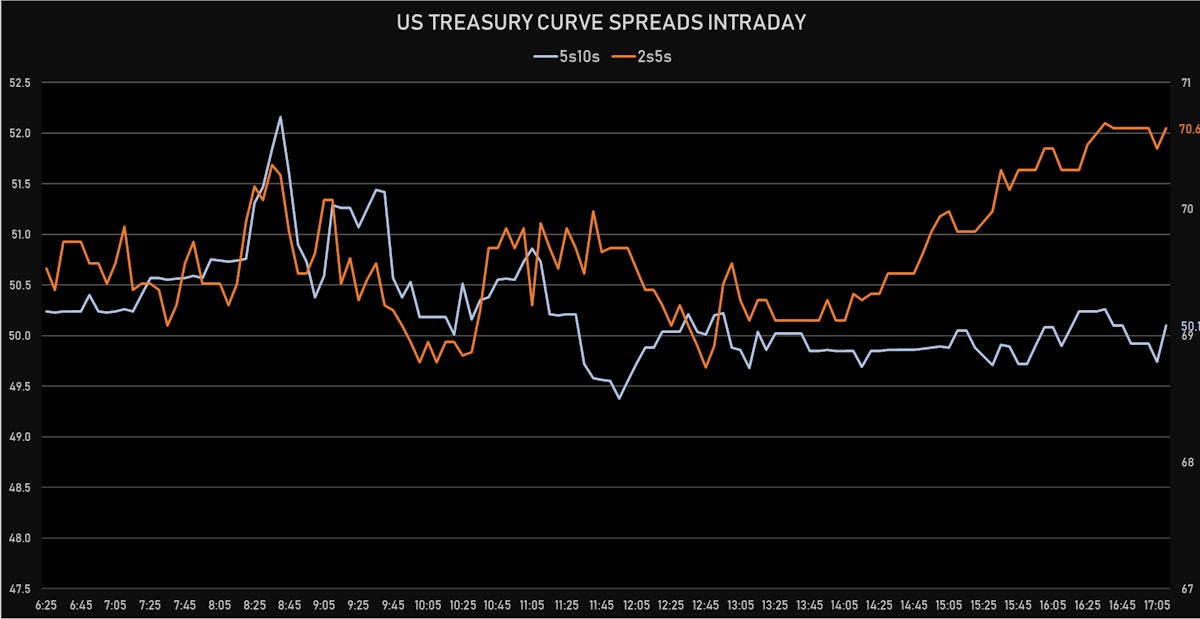

- US treasury curve spreads: 2s5s at 68.8bp (up 3.1bp today), 5s10s at 48.5bp (down -0.1bp), 10s30s at 51.2bp (down -2.2bp)

- Treasuries butterfly spreads: 2s5s10s at -20.9bp (down -3.2bp), 5s10s30s at 0.3bp (down -2.2bp)

- US 5-Year TIPS Real Yield: -1.2 bp at -1.6120%; 10-Year TIPS Real Yield: 0.0 bp at -0.8780%; 30-Year TIPS Real Yield: -0.8 bp at -0.2490%

US MACRO RELEASES

- Dallas Fed, General Business Activity for Sep 2021 (Fed Reserve, Dallas) at 4.60 (vs 9.00 prior)

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Aug 2021 (U.S. Census Bureau) at 2.40 % (vs -1.10 % prior)

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.20 % (vs 0.80 % prior), below consensus estimate of 0.50 %

- Manufacturers New Orders, Durable goods total, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.80 % (vs -0.10 % prior), above consensus estimate of 0.70 %

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.50 % (vs 0.10 % prior), above consensus estimate of 0.40 %

$61bn 5-Year Note Auction

- Pretty poor auction results, with end-user demand down to 74.5% (vs 80.2% prior)

- High yield at 0.990% (vs 0.831% prior and 0.994% WI at the bid deadline)

- Direct bids at 20.2% (vs 17.5% prior and 16.2% average)

- Indirect bids at 54.3% (vs 62.7% prior and 59.5% average)

- Total bids at $114.3, bid-to-cover ratio at 2.37 (vs 2.35 prior and 2.37 average)

$60 bn 2-Year Note Auction

- Terrible results with end-user demand down to 67.0% (vs. 81.7% prior and 69.6% average), meaning that primary dealers had to pick up 33% of the offering

- High yield at 0.310% on Monday (0.8bp tail vs 0.302 WI at the bid deadline and 0.242% prior)

- $136.8 B in bids for a bid-to-cover ratio of 2.28 (vs. 2.65 prior and 2.53 average), the lowest level since December 2008

- Indirect bidders at 45.3% (vs. 60.5% prior and 52.4% average)

- Direct bidders at 21.7% (vs 21.2% prior and 17.1% average)

US FORWARD RATES

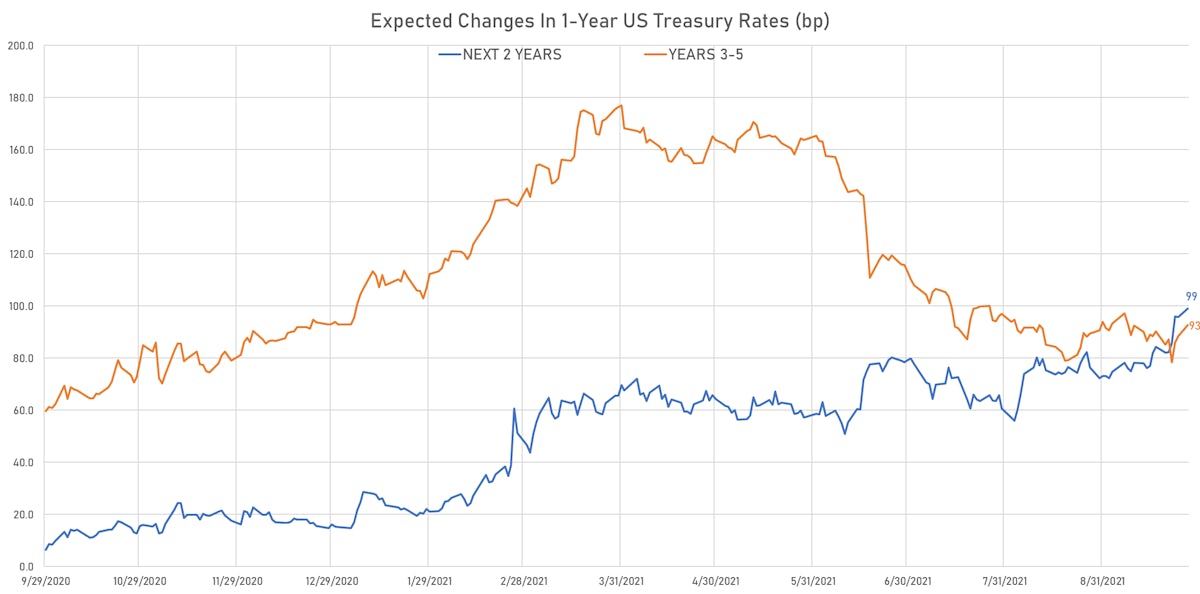

- 3-month Eurodollar future (EDU2) expected hike of 20.2 bp by the end of 2022 (meaning the market prices 80.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 17.6 bp of rate hikes over the next 15 months (equivalent to 0.70 rate hike) and 111.6 bp over the next 3 years (equivalent to 4.47 rate hikes)

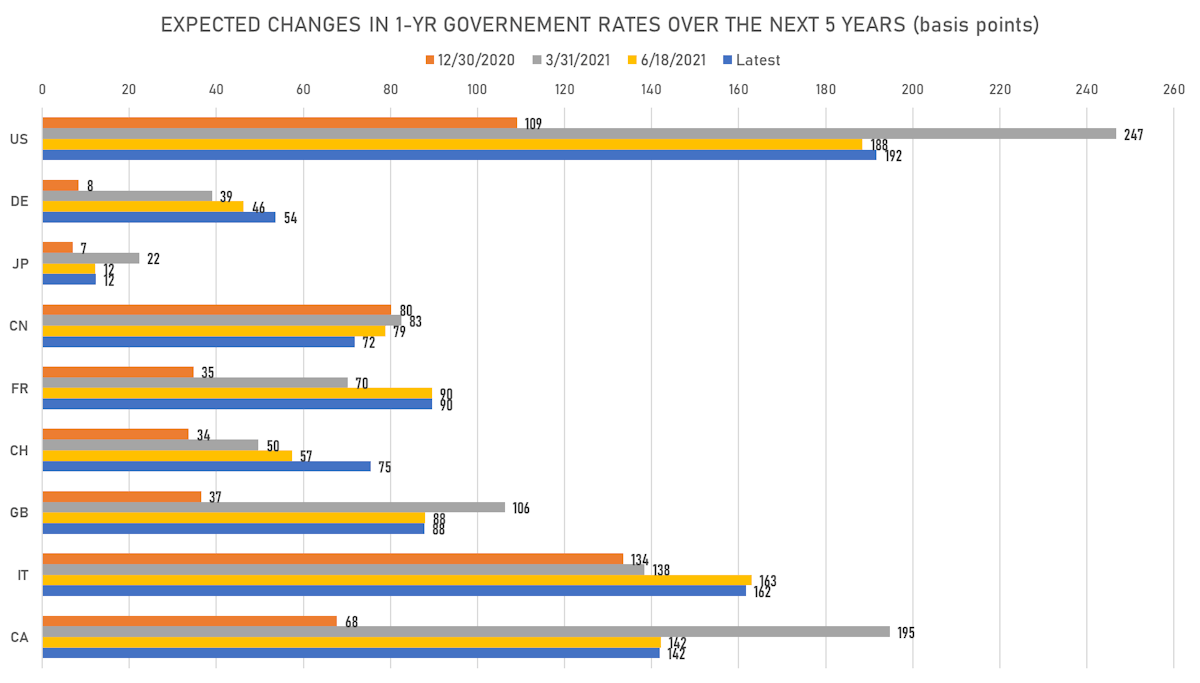

- 1-year US Treasury rate 5 years forward up 7.9 bp, now at 2.0138%, meaning that the 1-year Treasury rate is now expected to increase by 191.7 bp over the next 5 years (equivalent to 7.7 rate hikes)

US INFLATION & REAL RATES

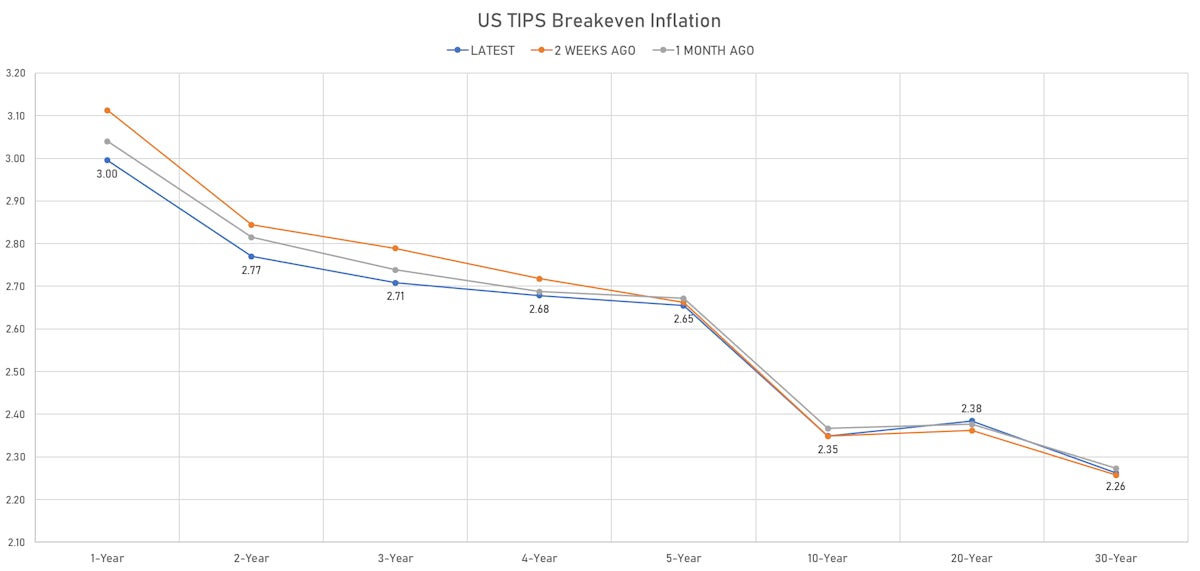

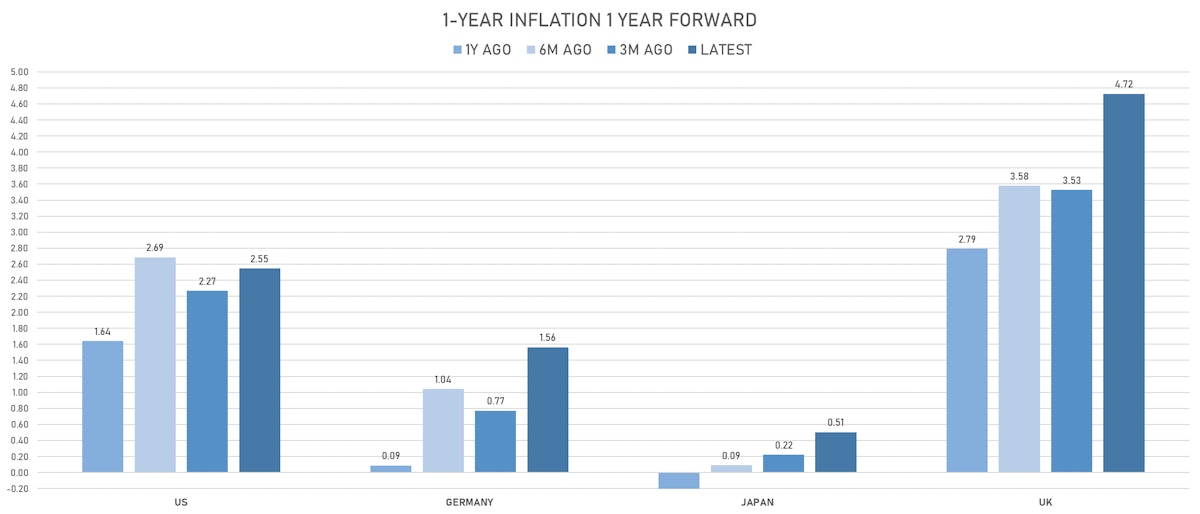

- TIPS 1Y breakeven inflation at 3.00% (up 5.9bp); 2Y at 2.77% (up 4.3bp); 5Y at 2.65% (up 5.0bp); 10Y at 2.35% (up 3.8bp); 30Y at 2.26% (up 2.5bp)

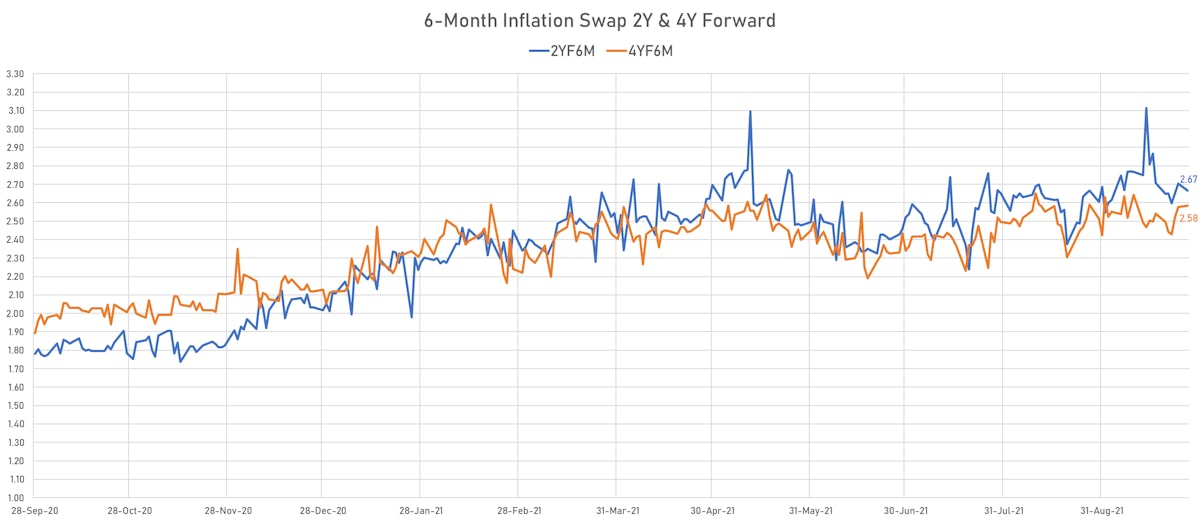

- 6-month spot US CPI swap up 4.3 bp to 3.187%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6120%, -1.2 bp today; 10Y at -0.8780%, 0.0 bp today; 30Y at -0.2490%, -0.8 bp today

RATES VOLATILITY & LIQUIDITY

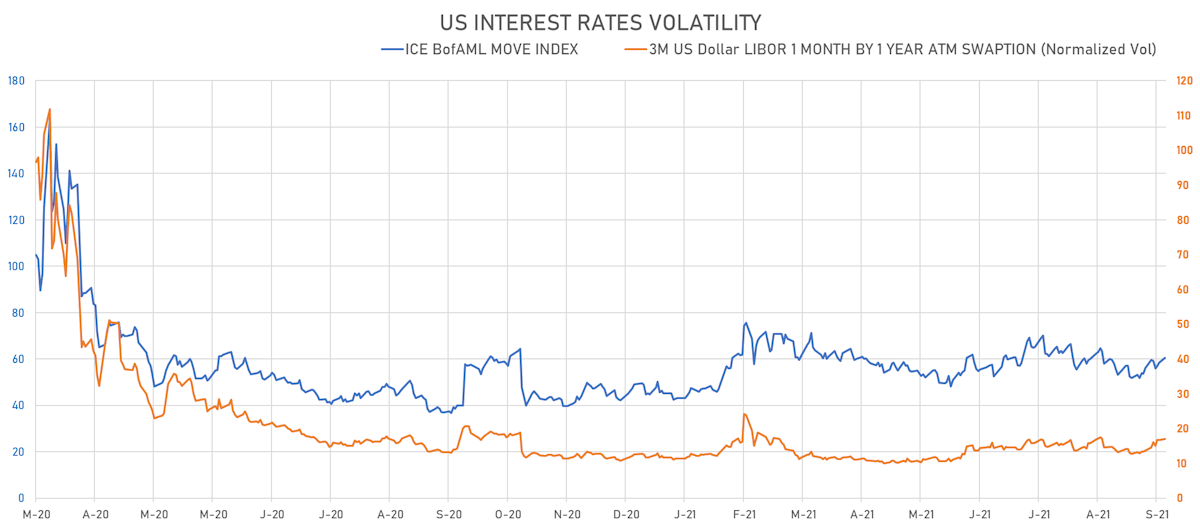

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.3% at 17.0%

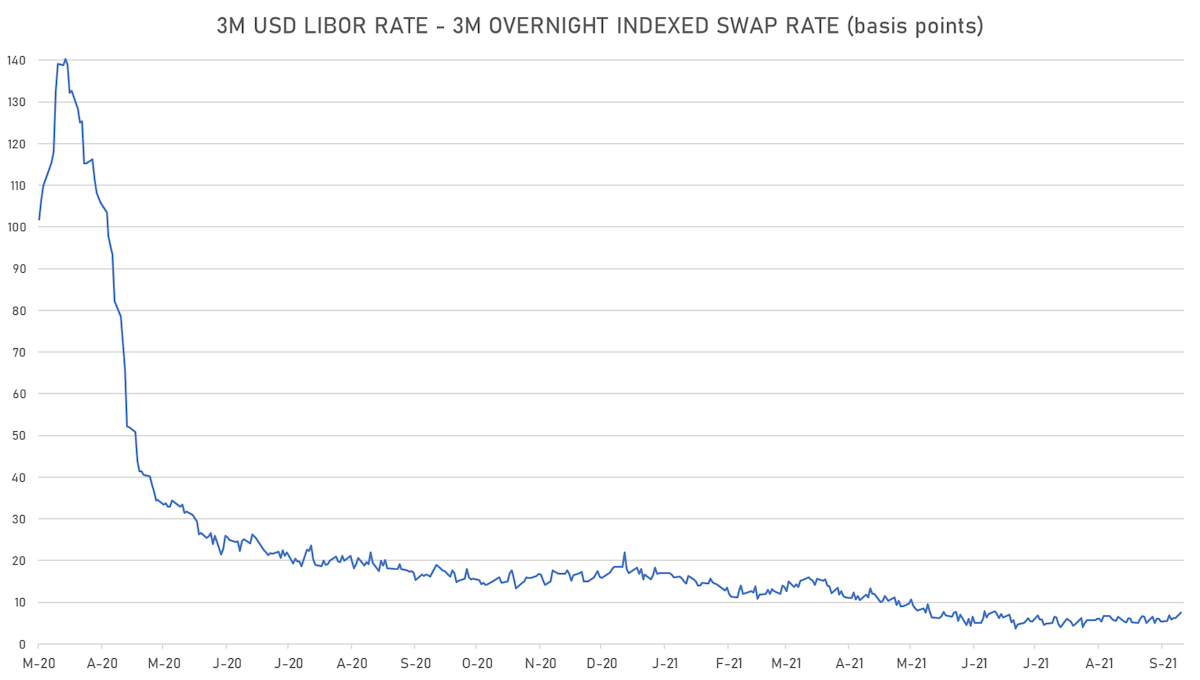

- 3-Month LIBOR-OIS spread up 1.4 bp at 7.6 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.563% (up 1.2 bp); the German 1Y-10Y curve is 1.0 bp steeper at 45.6bp (YTD change: +30.1 bp)

- Japan 5Y: -0.087% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 18.1bp (YTD change: +3.4 bp)

- China 5Y: 2.690% (down -1.0 bp); the Chinese 1Y-10Y curve is 0.3 bp steeper at 55.8bp (YTD change: +9.4 bp)

- Switzerland 5Y: -0.478% (up 1.1 bp); the Swiss 1Y-10Y curve is 13.5 bp steeper at 66.2bp (YTD change: +39.8 bp)