Rates

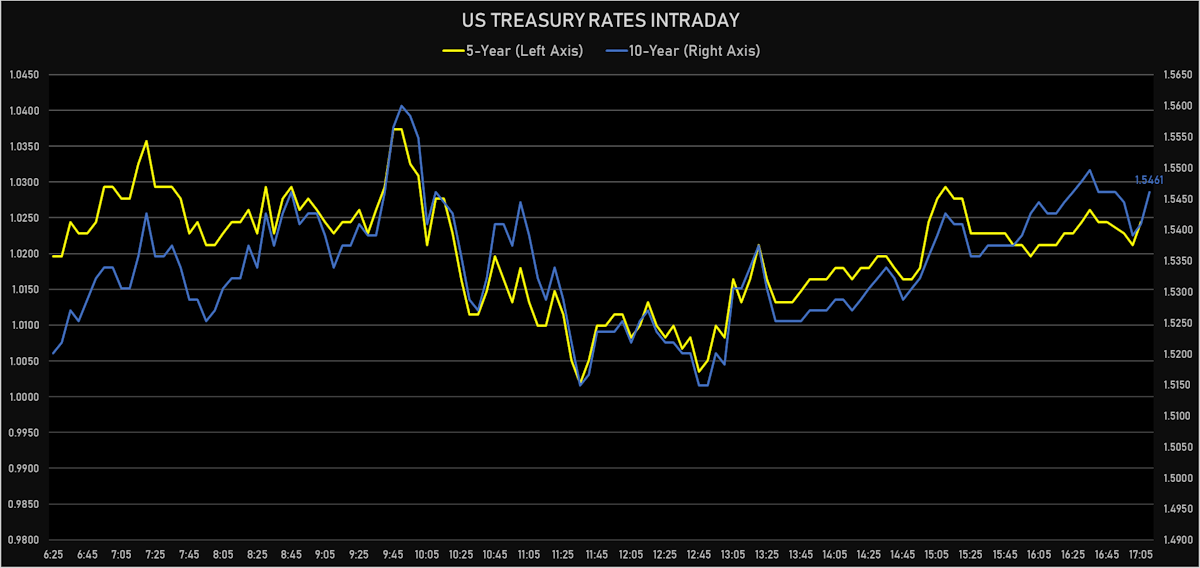

US Rates, Inflation Breakevens Rise As 5Y Treasury Yield Closes Above 1%

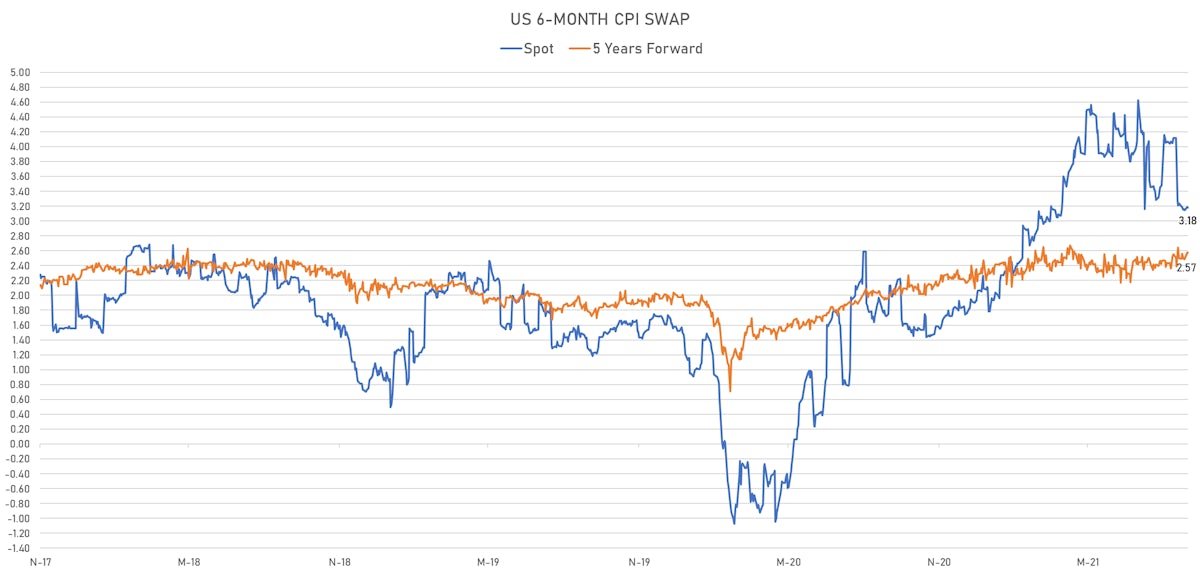

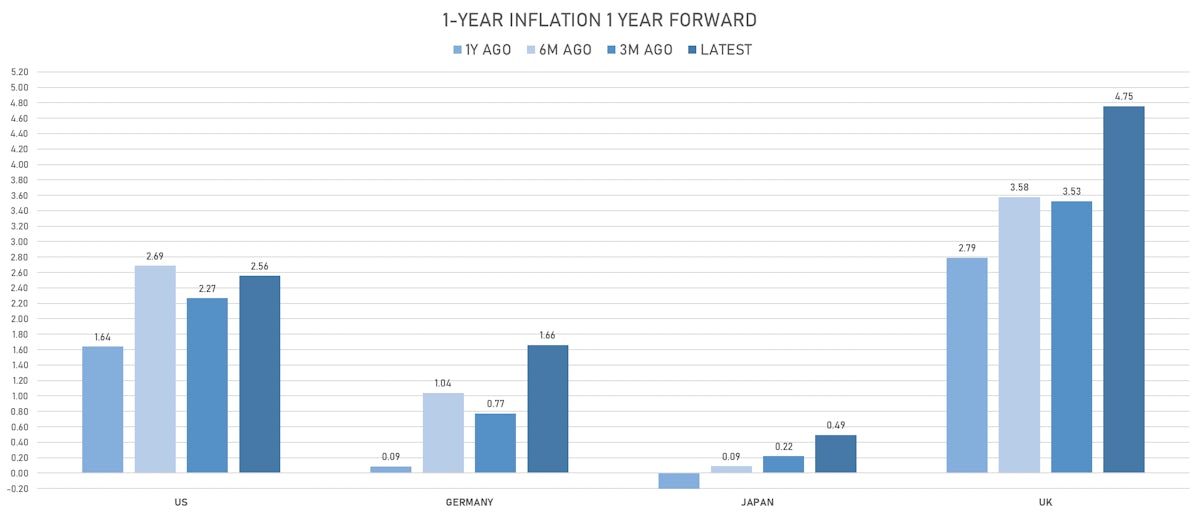

The inflation forward curve has been flattening: the spread between the 5Y and 1Y CPI zero coupon swaps has been getting less negative with concerns that inflation could prove stickier than initially anticipated

Published ET

5Y - 1Y Spread For TIPS Breakevens & CPI Swaps | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged at 0.1315%

- The treasury yield curve steepened, with the 1s10s spread widening 5.3 bp, now at 146.7 bp (YTD change: +66.3bp)

- 1Y: 0.0790% (up 0.3 bp)

- 2Y: 0.3049% (up 2.5 bp)

- 5Y: 1.0244% (up 3.7 bp)

- 7Y: 1.3408% (up 4.1 bp)

- 10Y: 1.5461% (up 5.6 bp)

- 30Y: 2.0960% (up 9.5 bp)

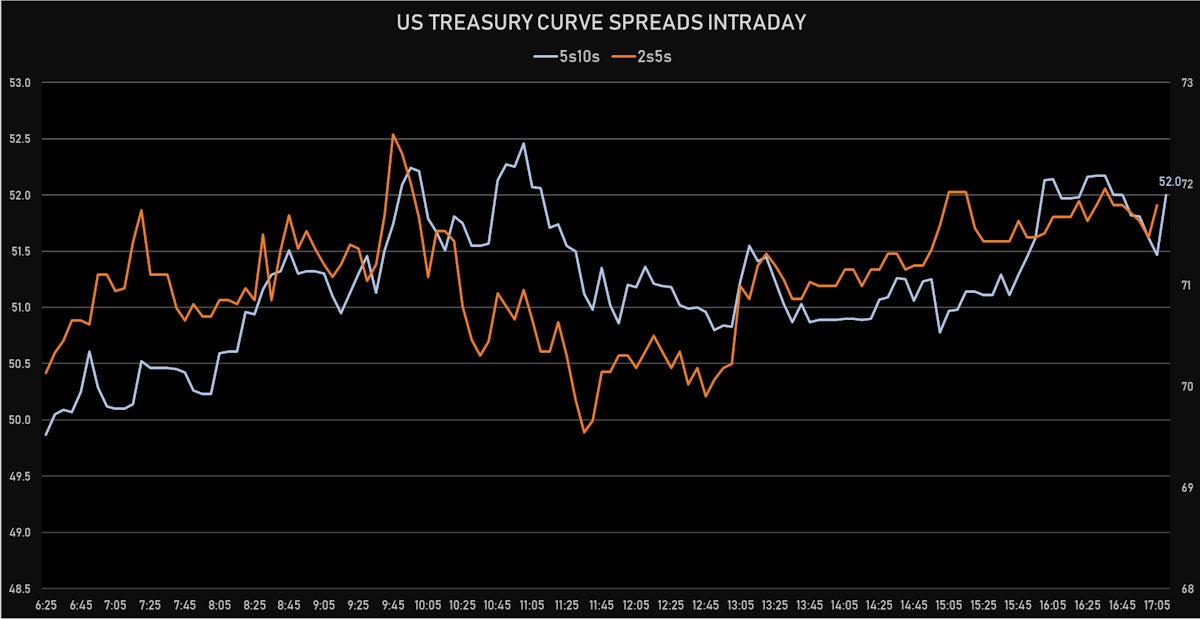

- US treasury curve spreads: 2s5s at 72.0bp (up 1.2bp today), 5s10s at 52.2bp (up 1.9bp today), 10s30s at 55.0bp (up 3.9bp today)

- Treasuries butterfly spreads: 2s5s10s at -20.2bp (up 0.8bp today), 5s10s30s at 2.5bp (up 2.2bp)

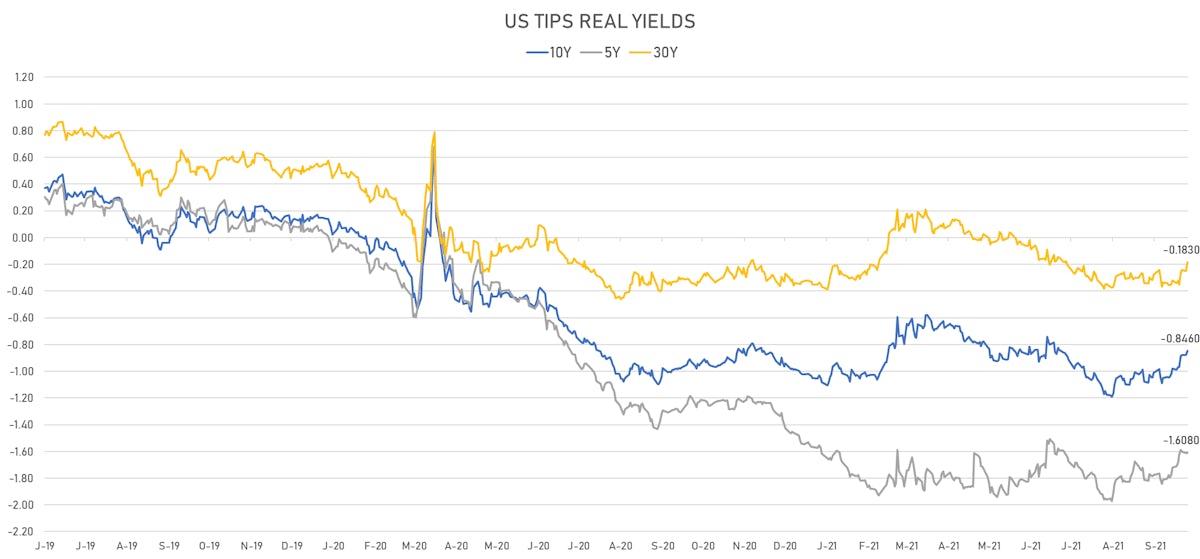

- US 5-Year TIPS Real Yield: +0.4 bp at -1.6080%; 10-Year TIPS Real Yield: +3.2 bp at -0.8460%; 30-Year TIPS Real Yield: +6.6 bp at -0.1830%

US MACRO RELEASES

- Wholesale Inventories Advance, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.20 % (vs 0.60 % prior)

- US Adv Goods Trade Balance, Current Prices for Aug 2021 (U.S. Census Bureau) at -87.60 Bln USD (vs -86.82 Bln USD prior)

- Retail Inventories Advance, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.60 % (vs 0.50 % prior)

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 25 Sep (Redbook Research) at 16.50 % (vs 17.10 % prior)

- House Prices, S&P Case-Shiller, Composite-20, Change P/P for Jul 2021 (Standard & Poor's) at 1.50 % (vs 1.80 % prior), below consensus estimate of 1.70 %

- House Prices, S&P Case-Shiller, Composite-20, Change P/P, Price Index for Jul 2021 (Standard & Poor's) at 1.50 % (vs 2.00 % prior)

- House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Jul 2021 (Standard & Poor's) at 19.90 % (vs 19.10 % prior), below consensus estimate of 20.00 %

- House Prices, FHFA, USA (Purchase-Only), Change P/P for Jul 2021 (OFHEO, United States) at 1.40 % (vs 1.60 % prior)

- House Prices, FHFA, USA (Purchase-Only), Change Y/Y for Jul 2021 (OFHEO, United States) at 19.20 % (vs 18.80 % prior)

- House Prices, FHFA, USA (Purchase-Only) for Jul 2021 (OFHEO, United States) at 348.40 (vs 343.30 prior)

- Richmond Fed Services, Revenues for Sep 2021 (FED, Richmond) at -3.00 (vs 15.00 prior)

- Richmond Fed Manufacturing, Shipments, current conditions for Sep 2021 (FED, Richmond) at -1.00 (vs 6.00 prior)

- Conference Board, Consumer confidence for Sep 2021 (The Conference Board) at 109.30 (vs 113.80 prior), below consensus estimate of 114.50

- Richmond Fed Manufacturing, Manufacturing Index for Sep 2021 (FED, Richmond) at -3.00 (vs 9.00 prior)

- Dallas Fed, Revenue (Sales for TROS) for Sep 2021 (Fed Reserve, Dallas) at 14.50 (vs 16.50 prior)

- Dallas Fed, General Business Activity for Sep 2021 (Fed Reserve, Dallas) at 8.30 (vs 5.40 prior)

$62 Bn 7-Year Auction (91282CCY5)

- The auction priced poorly amid difficult market conditions for intermediate Treasuries, although end-user demand rose to 81.0% (vs 79.9% prior and 77.1% average)

- High yield: 1.332%, a 0.8bp tail vs. the when-issued at the bid deadline (vs 1.155% at prior auction)

- $139.2 B in bids, bid-to-cover at 2.24 (vs 2.34 prior and 2.30 average)

- Direct bids: 20.9% (vs 18.9% prior and 18.4% average)

- Indirect bids: 60.1% (vs 61.1% prior and 58.4% average)

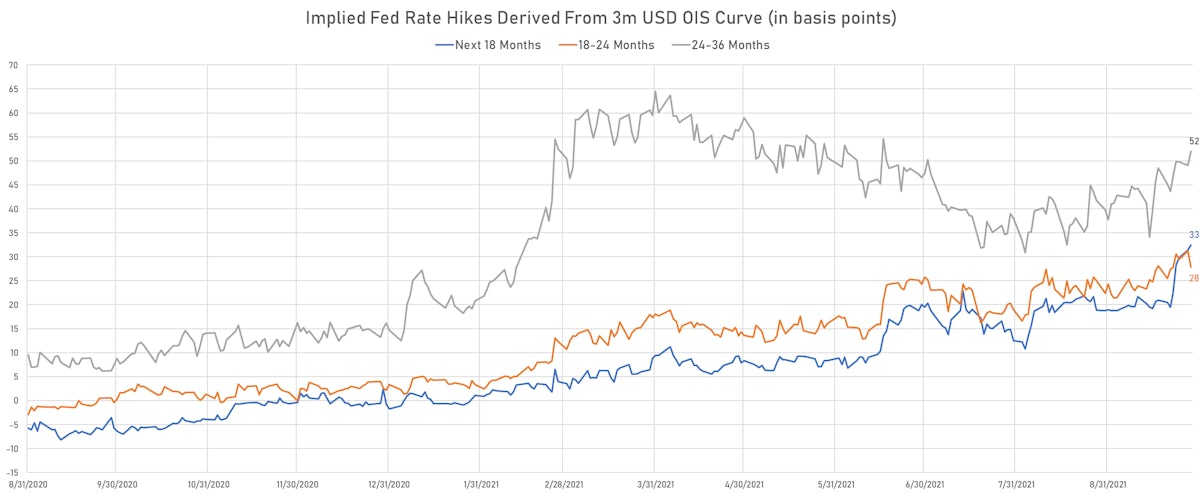

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 20.0 bp by the end of 2022 (meaning the market prices 80.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 112.4 bp over the next 3 years (equivalent to 4.50 rate hikes)

- The 3-month Eurodollar zero curve prices in 137.0 bp over the next 3 years (equivalent to 5.48 rate hikes)

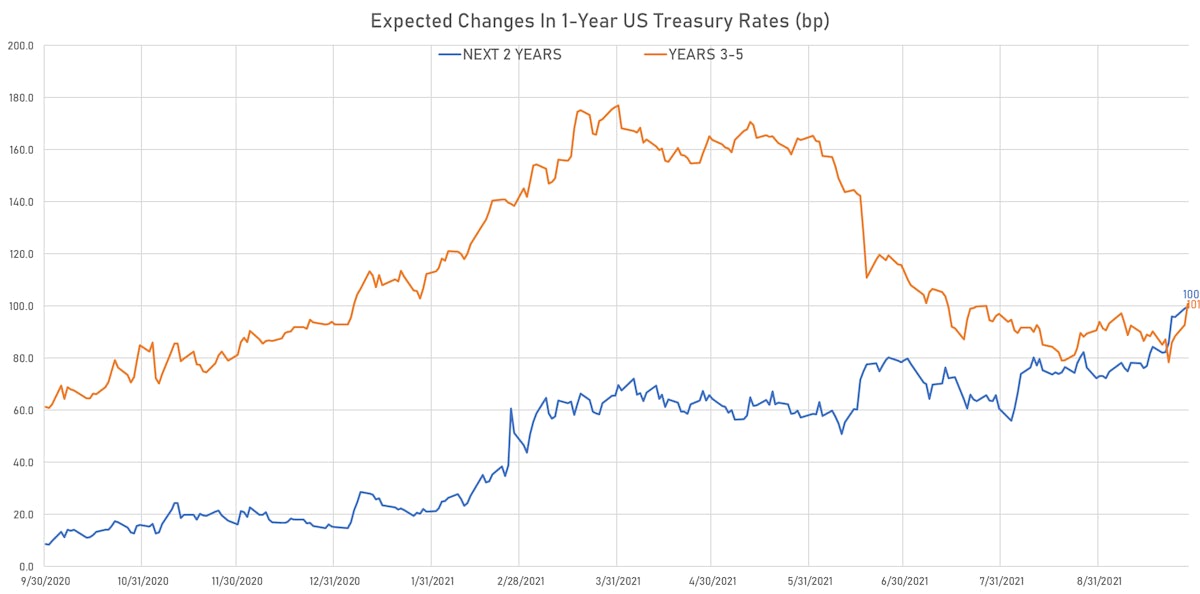

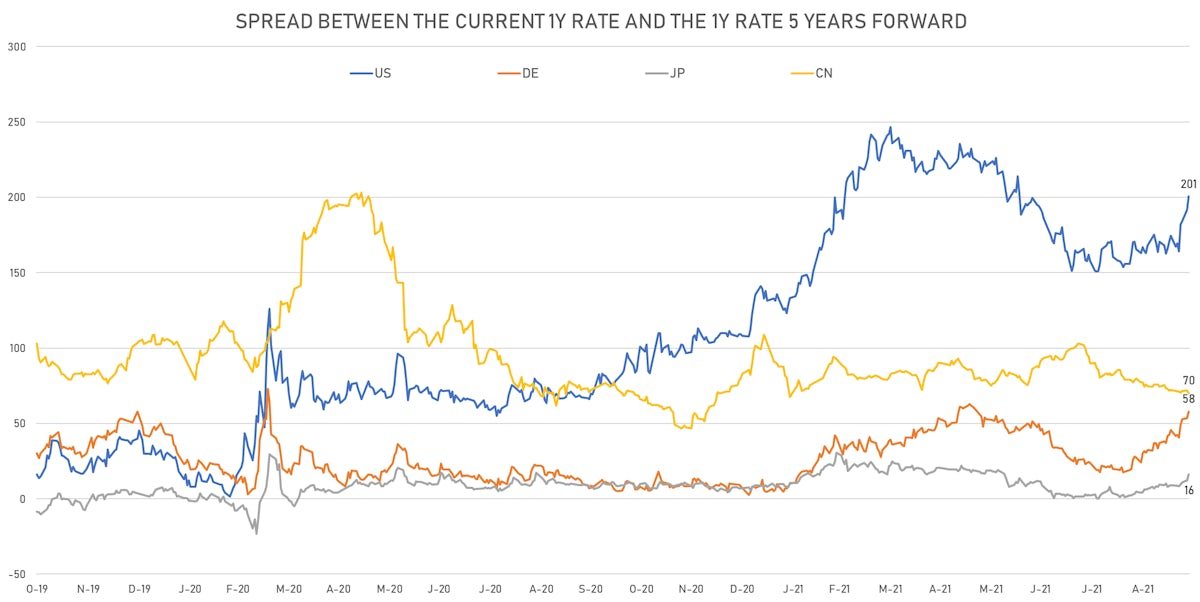

- 1-year US Treasury rate 5 years forward up 8.9 bp today (and up 37 bp since the latest FOMC), now at 2.1033%: the 1-year Treasury rate is now expected to increase by 200.5 bp over the next 5 years (equivalent to 8.0 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.01% (up 1.0bp); 2Y at 2.78% (up 1.3bp); 5Y at 2.67% (up 1.8bp); 10Y at 2.37% (up 2.4bp); 30Y at 2.29% (up 2.8bp)

- 6-month spot US CPI swap down -0.5 bp to 3.182%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6080%, +0.4 bp today; 10Y at -0.8460%, +3.2 bp today; 30Y at -0.1830%, +6.6 bp today

RATES VOLATILITY & LIQUIDITY

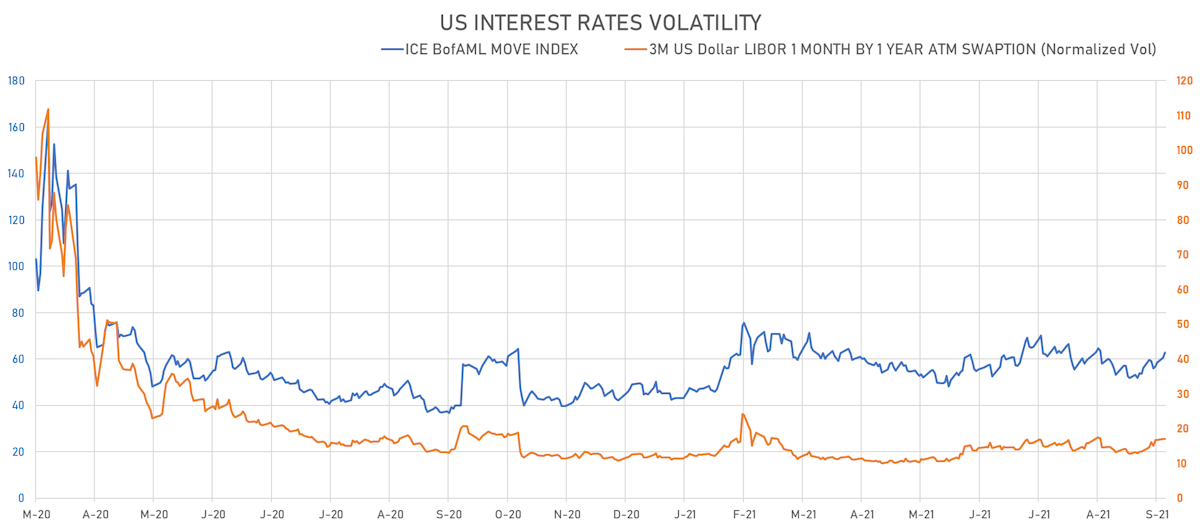

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 17.0%

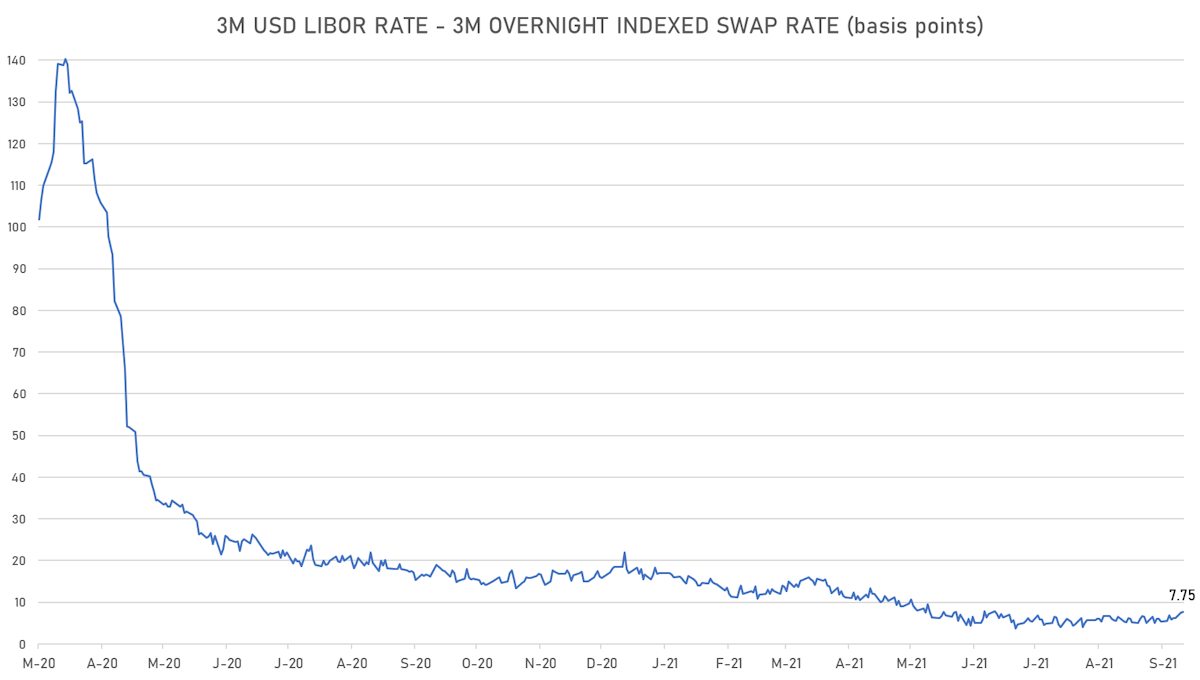

- 3-Month LIBOR-OIS spread up 0.2 bp at 7.8 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.544% (up 0.8 bp); the German 1Y-10Y curve is 3.2 bp flatter at 42.7bp (YTD change: +26.9 bp)

- Japan 5Y: -0.080% (up 0.6 bp); the Japanese 1Y-10Y curve is 1.7 bp steeper at 20.3bp (YTD change: +5.1 bp)

- China 5Y: 2.708% (up 1.8 bp); the Chinese 1Y-10Y curve is 1.9 bp flatter at 53.9bp (YTD change: +7.5 bp)

- Switzerland 5Y: -0.471% (down -1.1 bp); the Swiss 1Y-10Y curve is 11.2 bp flatter at 55.1bp (YTD change: +28.6 bp)