Rates

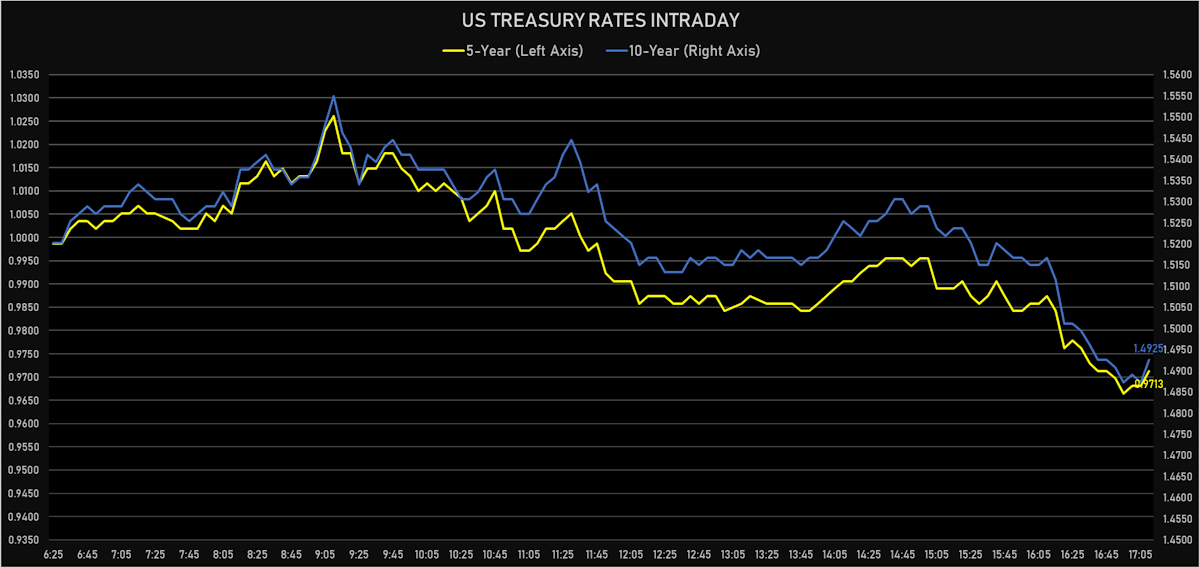

More Consolidation Across The Rates Complex, With 10Y Treasury Yields Dropping Back Under 1.50%

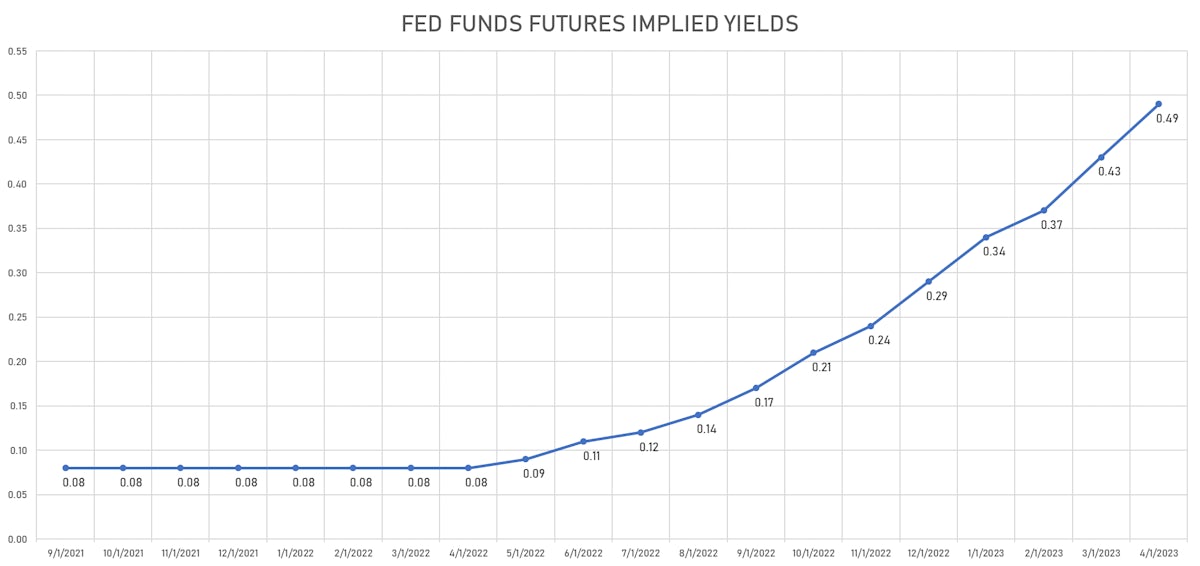

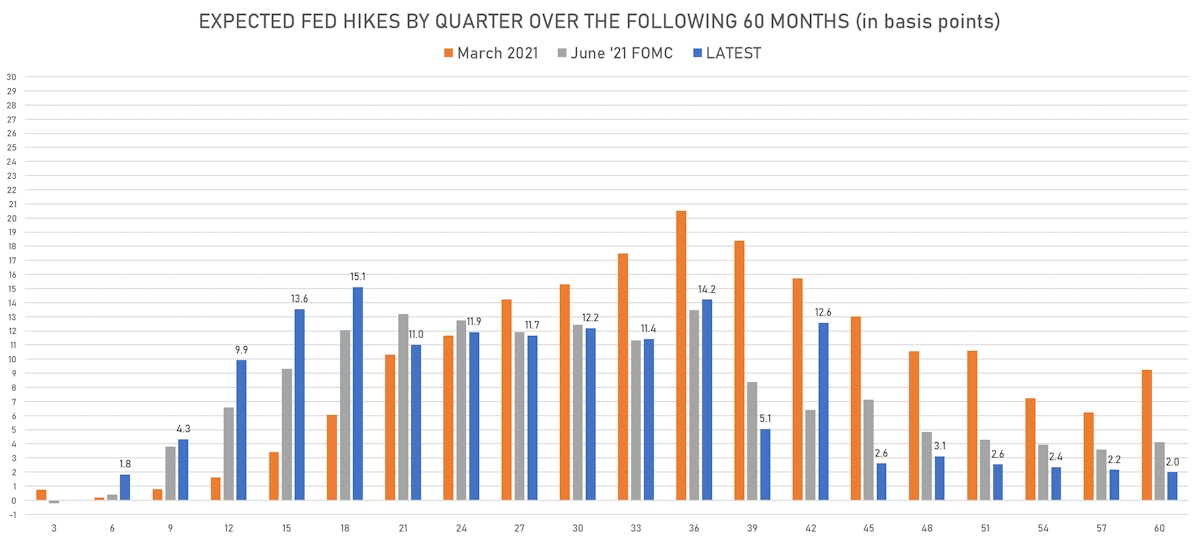

Market-implied probabilities of Fed liftoff by the end of 2022 dropped back a little, although Atlanta Fed's Bostic confirmed he sees first rate hike in H2 2022, with three additional hikes in 2023

Published ET

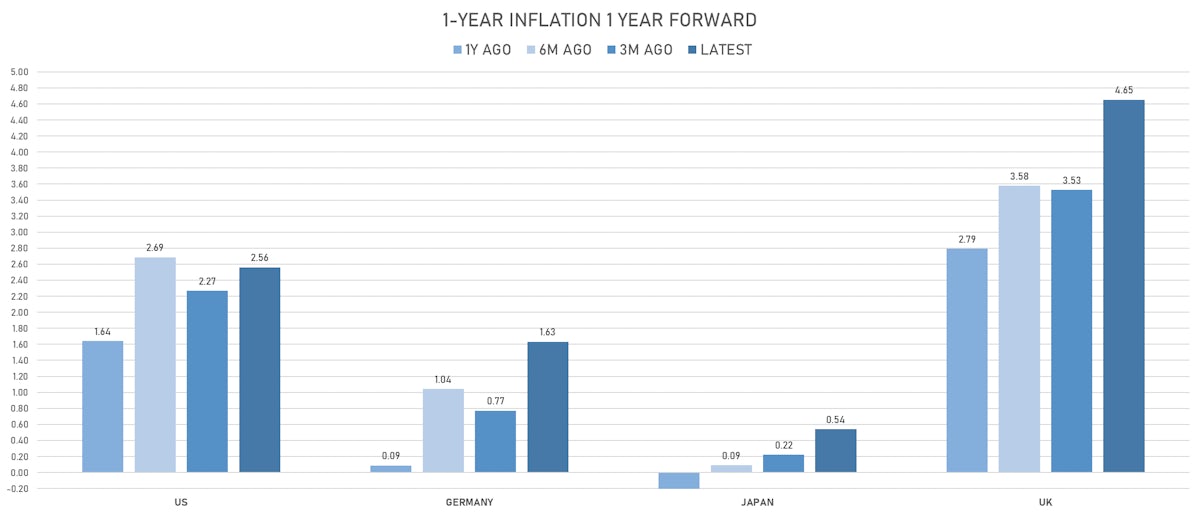

Market priced expectations of rate hikes by the end of 2022 (spreads between forward and spot rates) | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR -0.1bp today, now at 0.1301%

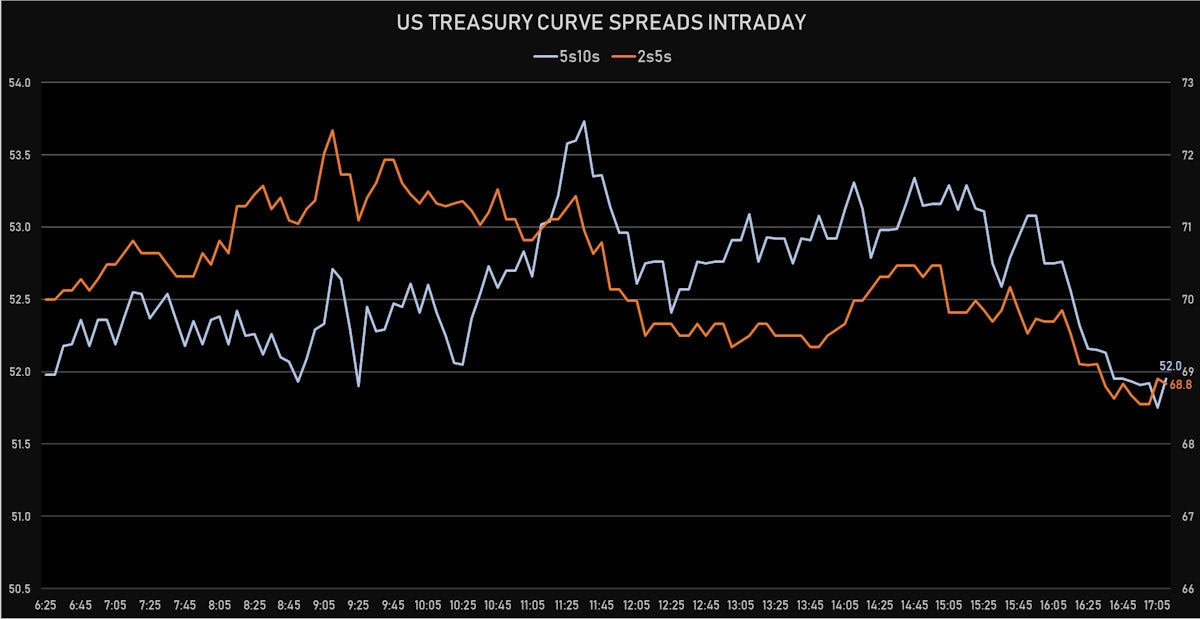

- The treasury yield curve flattened, with the 1s10s spread tightening -3.1 bp, now at 141.4 bp (YTD change: +60.9bp)

- 1Y: 0.0790% (unchanged)

- 2Y: 0.2814% (down 1.2 bp)

- 5Y: 0.9713% (down 2.4 bp)

- 7Y: 1.2945% (down 3.3 bp)

- 10Y: 1.4925% (down 3.1 bp)

- 30Y: 2.0498% (down 1.9 bp)

- US treasury curve spreads: 2s5s at 69.0bp (down -1.2bp), 5s10s at 52.1bp (down -0.7bp), 10s30s at 55.8bp (up 1.3bp today)

- Treasuries butterfly spreads: 2s5s10s at -17.2bp (up 0.5bp today), 5s10s30s at 3.2bp (up 1.5bp)

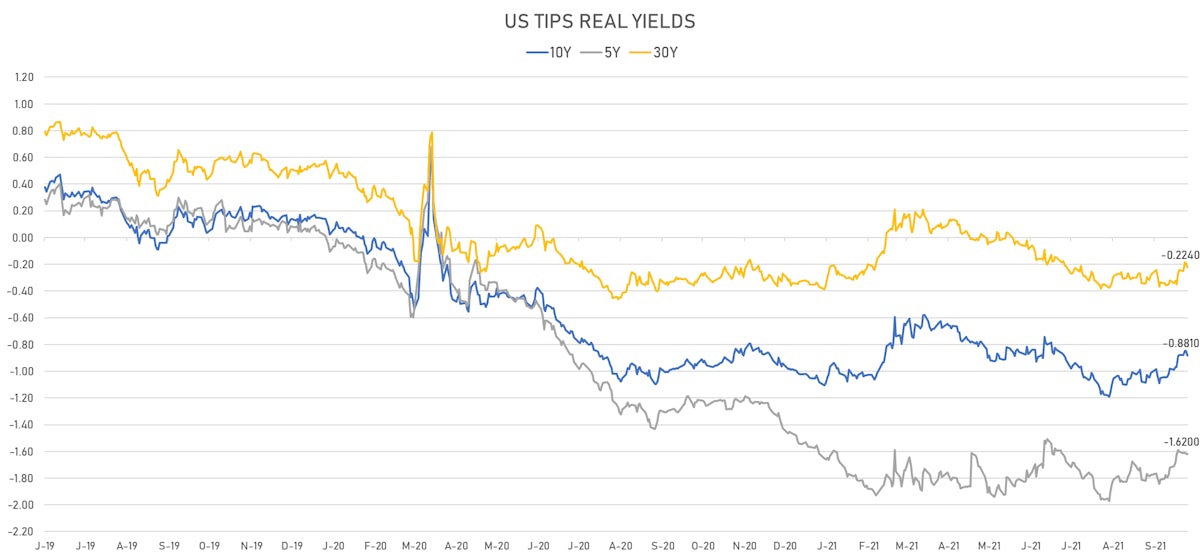

- US 5-Year TIPS Real Yield: -0.5 bp at -1.6200%; 10-Year TIPS Real Yield: -3.2 bp at -0.8810%; 30-Year TIPS Real Yield: -3.1 bp at -0.2240%

US MACRO RELEASES

- Personal Consumption Expenditure, Profits after tax total-final, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 12.00 % (vs 11.90 % prior)

- Total-final, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 8.10 % (vs 7.90 % prior)

- Implicit Price Deflator, GDP, Total-final, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.20 % (vs 6.20 % prior), above consensus estimate of 6.10 %

- Personal Consumption Expenditure, Total-final, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.50 % (vs 6.50 % prior)

- Personal Consumption Expenditure, Total-final, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.10 % (vs 6.10 % prior), in line with Reuters consensus

- Jobless Claims, National, Initial, four week moving average for W 25 Sep (U.S. Dept. of Labor) at 340.00 k (vs 335.75 k prior)

- Jobless Claims, National, Initial for W 25 Sep (U.S. Dept. of Labor) at 362.00 k (vs 351.00 k prior), above consensus estimate of 335.00 k

- Jobless Claims, National, Continued for W 18 Sep (U.S. Dept. of Labor) at 2.80 Mln (vs 2.85 Mln prior), in line with Reuters consensus

- GDP, Total-final (Unrevised), Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 6.70 % (vs 6.60 % prior), above consensus estimate of 6.60 %

- Corporate Profits, With IVA and CCAdj, Profits after tax total, Change P/P for Q2 2021 (BEA, US Dept. Of Com) at 10.50 % (vs 9.70 % prior)

- Chicago PMI, Total Business Barometer for Sep 2021 (MNI Indicators) at 64.70 (vs 66.80 prior), just below consensus estimate of 65.00

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 18.2 bp by the end of 2022 (meaning the market prices 72.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 103.1 bp over the next 3 years (equivalent to 4.12 rate hikes)

- The 3-month Eurodollar zero curve prices in 126.4 bp over the next 3 years (equivalent to 5.06 rate hikes)

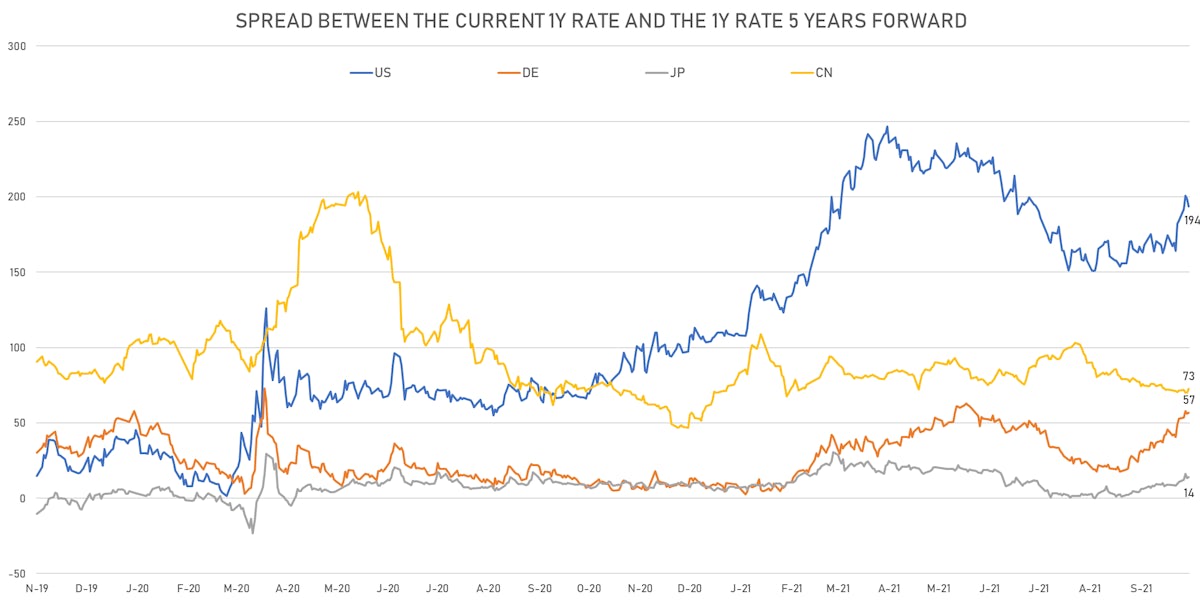

- 1-year US Treasury rate 5 years forward down 5.0 bp, now at 2.0347%, meaning that the 1-year Treasury rate is now expected to increase by 193.7 bp over the next 5 years (equivalent to 7.7 rate hikes), still 30bp higher than last week

US INFLATION & REAL RATES

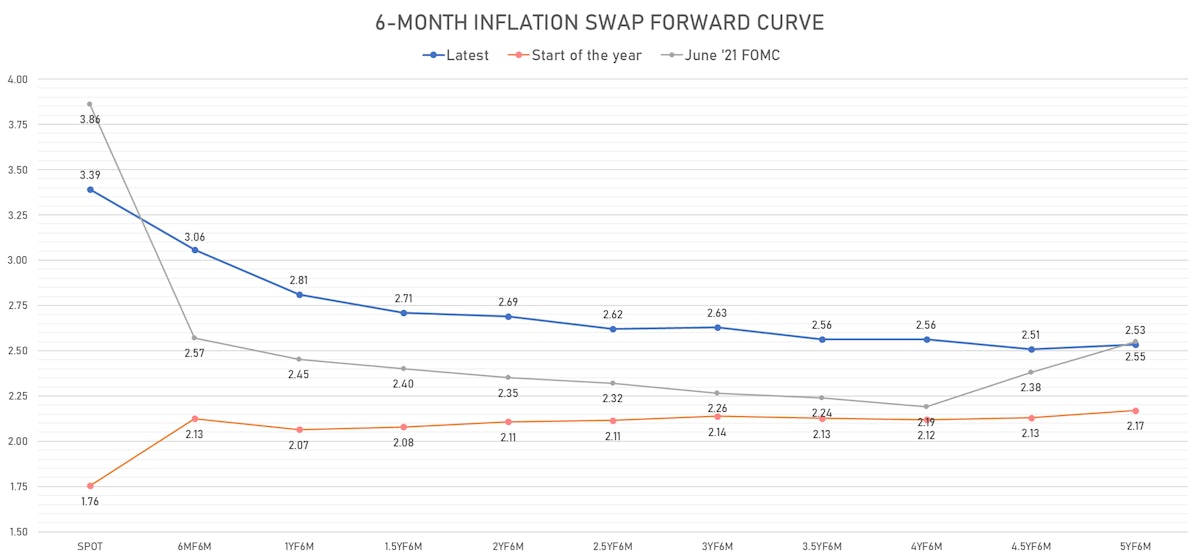

- TIPS 1Y breakeven inflation at 3.01% (down -1.4bp); 2Y at 2.78% (down -0.7bp); 5Y at 2.63% (down -1.8bp); 10Y at 2.36% (up 0.2bp); 30Y at 2.28% (up 1.1bp)

- 6-month spot US CPI swap down -0.9 bp to 3.391%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6200%, -0.5 bp today; 10Y at -0.8810%, -3.2 bp today; 30Y at -0.2240%, -3.1 bp today

RATES VOLATILITY & LIQUIDITY

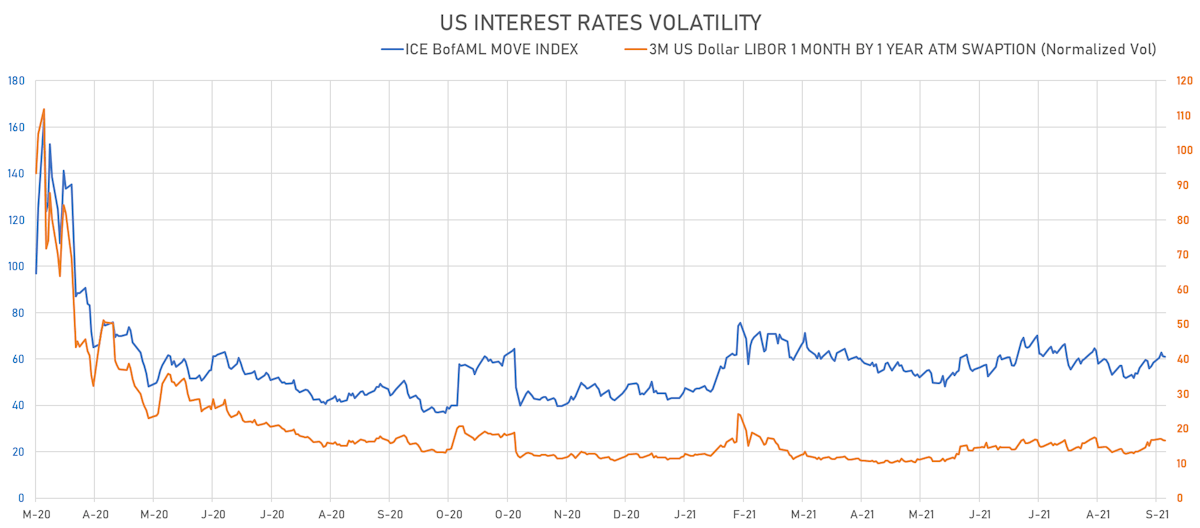

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 16.5%

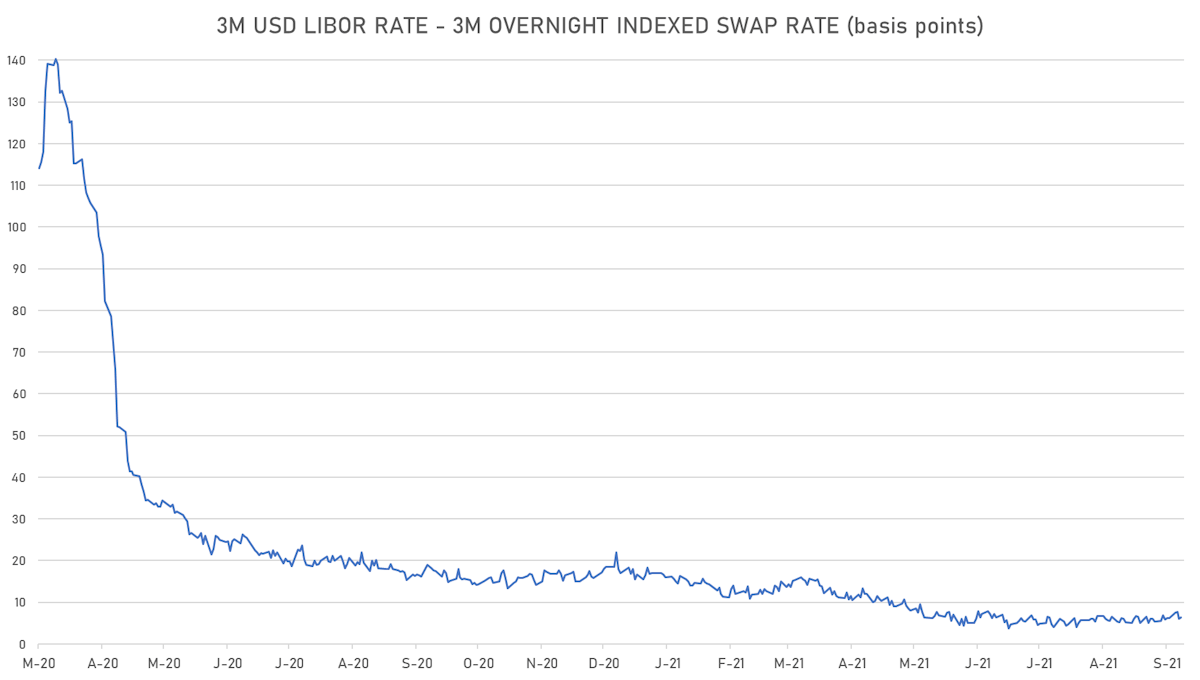

- 3-Month LIBOR-OIS spread up 0.3 bp at 6.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.562% (up 0.8 bp); the German 1Y-10Y curve is 2.3 bp steeper at 47.0bp (YTD change: +33.0 bp)

- Japan 5Y: -0.088% (up 0.1 bp); the Japanese 1Y-10Y curve is unchanged at 18.8bp (YTD change: +4.3 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.491% (up 3.1 bp); the Swiss 1Y-10Y curve is 5.9 bp steeper at 55.0bp (YTD change: +31.6 bp)