Rates

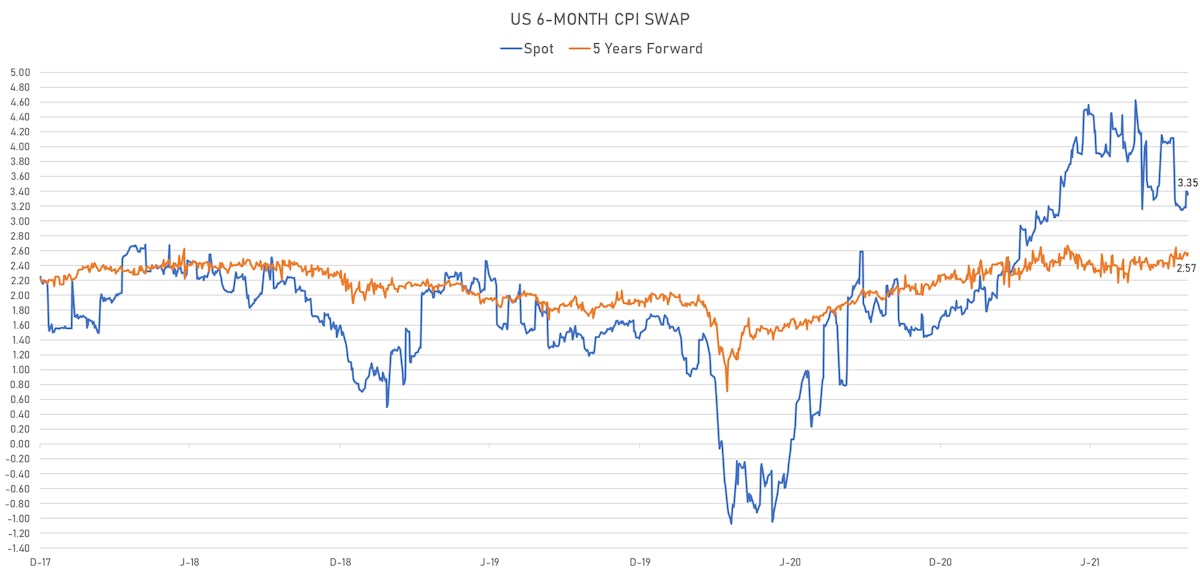

US Short-Term Inflation Expectations Rise After Core PCE Comes In Above Consensus

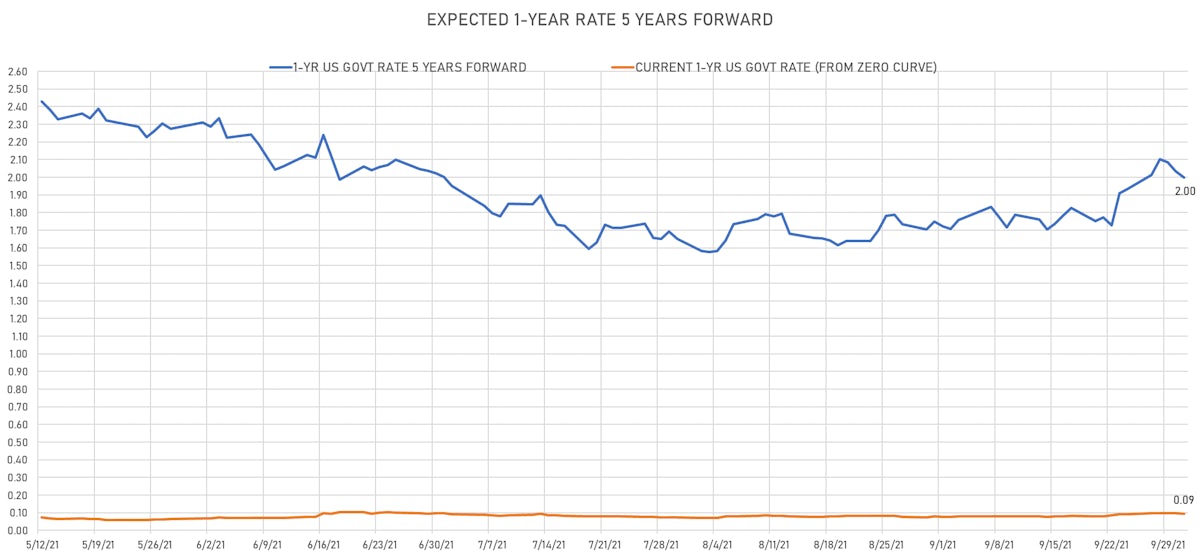

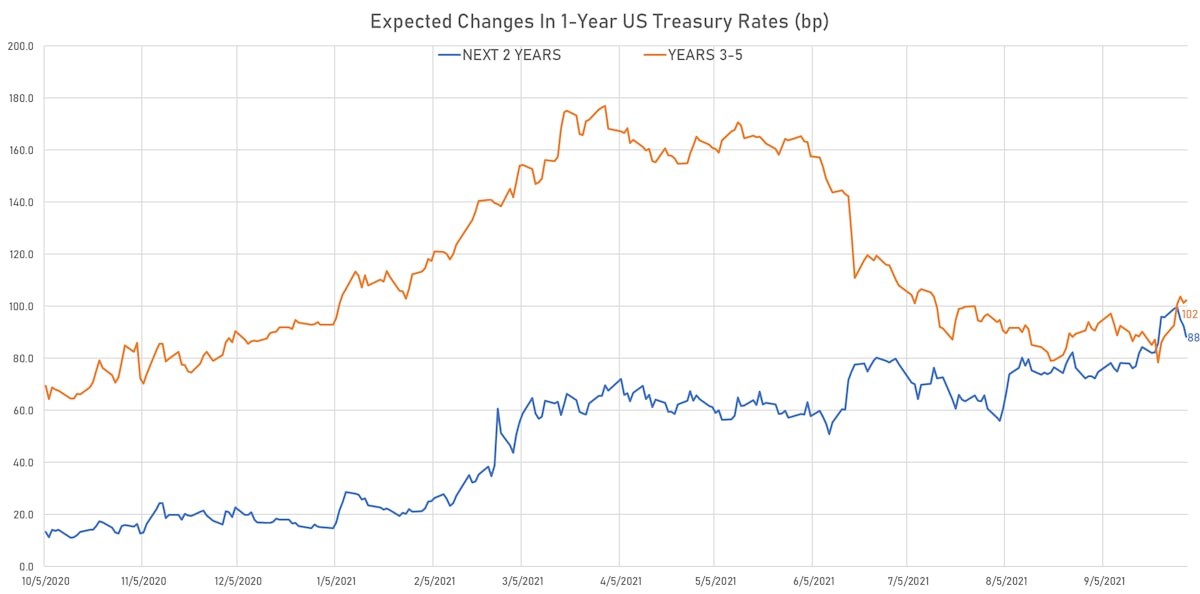

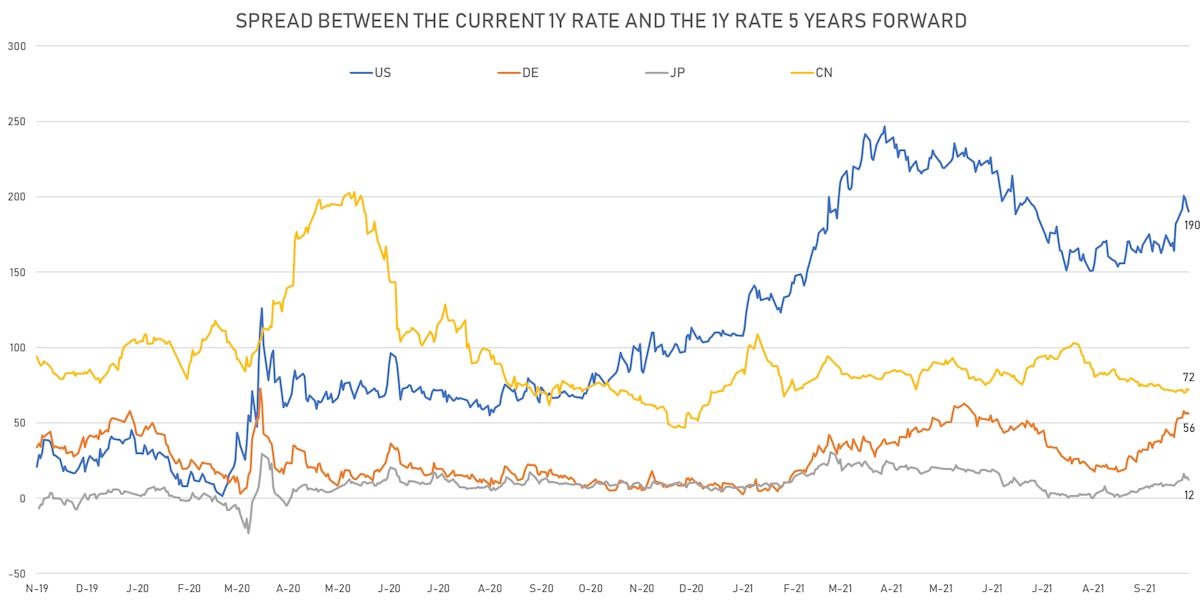

The yield curve flattens, with expected rate hikes over the next 5 years falling about 10bp since the beginning of the week despite higher inflation

Published ET

US TIPS Breakeven Inflation Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.3bp today, now at 0.1331%

- The treasury yield curve flattened, with the 1s10s spread tightening -2.7 bp, now at 138.6 bp (YTD change: +58.2bp)

- 1Y: 0.0790% (unchanged)

- 2Y: 0.2657% (down 1.6 bp)

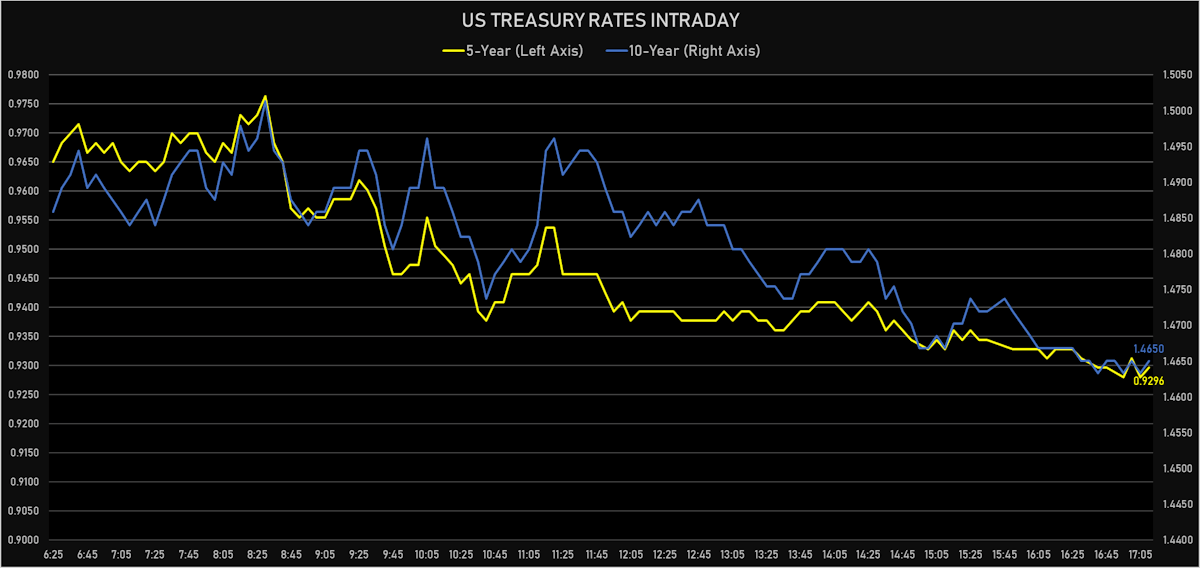

- 5Y: 0.9296% (down 4.2 bp)

- 7Y: 1.2570% (down 3.8 bp)

- 10Y: 1.4650% (down 2.7 bp)

- 30Y: 2.0329% (down 1.7 bp)

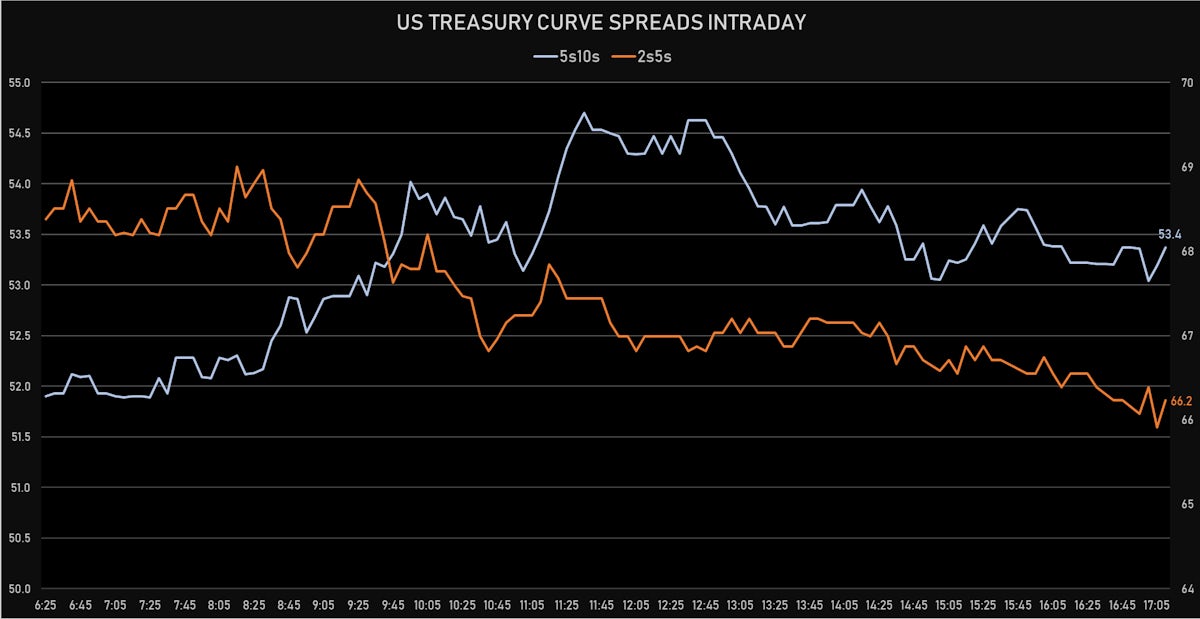

- US treasury curve spreads: 2s5s at 66.4bp (down -2.6bp), 5s10s at 53.5bp (up 1.4bp today), 10s30s at 56.8bp (up 1.0bp today)

- Treasuries butterfly spreads: 2s5s10s at -13.2bp (up 4.0bp today), 5s10s30s at 3.3bp (up 0.1bp)

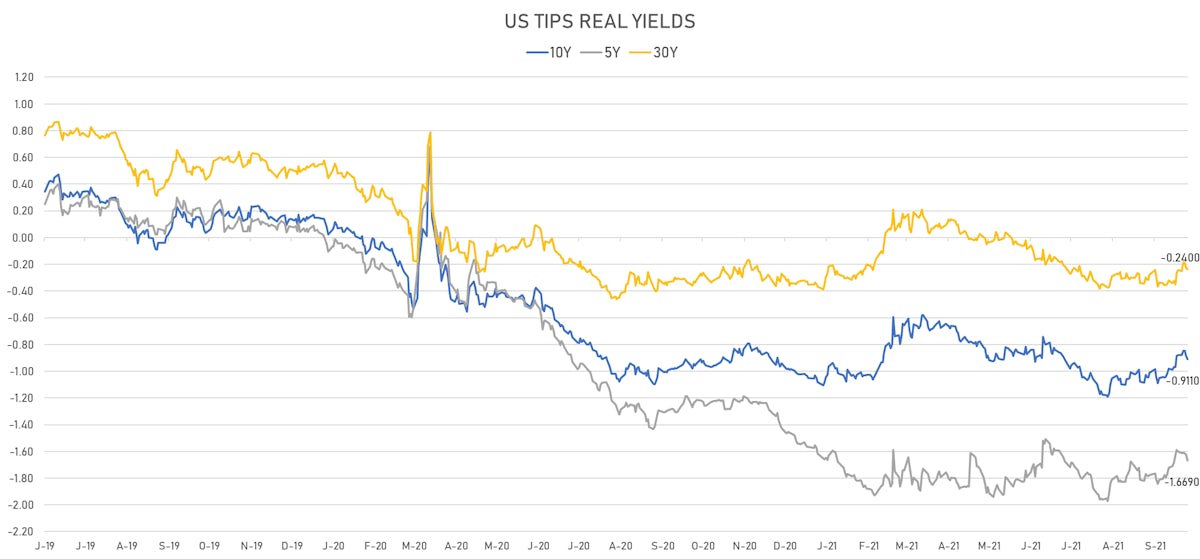

- US 5-Year TIPS Real Yield: -4.9 bp at -1.6690%; 10-Year TIPS Real Yield: -3.0 bp at -0.9110%; 30-Year TIPS Real Yield: -1.6 bp at -0.2400%

US MACRO RELEASES

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for Aug 2021 (BEA, US Dept. Of Com) at 3.60 % (vs 3.60 % prior), below Refinitiv consensus

- Personal Consumption Expenditure, Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.40 % (vs 0.40 % prior)

- Personal Consumption Expenditure, Change Y/Y for Aug 2021 (BEA, US Dept. Of Com) at 4.30 % (vs 4.20 % prior)

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 0.30 % prior), above consensus estimate of 0.20 %

- US Personal Income Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.20 % (vs 1.10 % prior), below consensus estimate of 0.30 %

- Personal Consumption Expenditure, Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.40 % (vs -0.10 % prior)

- Personal Consumption Expenditure, Change P/P for Aug 2021 (BEA, US Dept. Of Com) at 0.80 % (vs 0.30 % prior), above consensus estimate of 0.60 %

- PMI, Manufacturing Sector, Total, Final for Sep 2021 (Markit Economics) at 60.70 (vs 60.50 prior)

- University of Michigan, Current Conditions Index, Volume Index for Sep 2021 (UMICH, Survey) at 80.10 (vs 77.10 prior)

- University of Michigan, Consumer Sentiment Index, Volume Index for Sep 2021 (UMICH, Survey) at 72.80 (vs 71.00 prior), above consensus estimate of 71.00

- University of Michigan, Consumer Expectations Index, Volume Index for Sep 2021 (UMICH, Survey) at 68.10 (vs 67.10 prior)

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Sep 2021 (UMICH, Survey) at 3.00 % (vs 2.90 % prior)

- 1 Year Inflation Expectations (median) for Sep 2021 (UMICH, Survey) at 4.60 % (vs 4.70 % prior)

- ISM Manufacturing, PMI total for Sep 2021 (ISM, United States) at 61.10 (vs 59.90 prior), above consensus estimate of 59.60

- Construction Spending, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.00 % (vs 0.30 % prior), below consensus estimate of 0.30 %

- ISM Manufacturing, Prices for Sep 2021 (ISM, United States) at 81.20 (vs 79.40 prior), above consensus estimate of 78.50

- ISM Manufacturing, New orders for Sep 2021 (ISM, United States) at 66.70 (vs 66.70 prior)

- ISM Manufacturing, Employment for Sep 2021 (ISM, United States) at 50.20 (vs 49.00 prior)

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Aug 2021 (Fed Reserve, Dallas) at 2.80 % (vs 3.20 % prior)

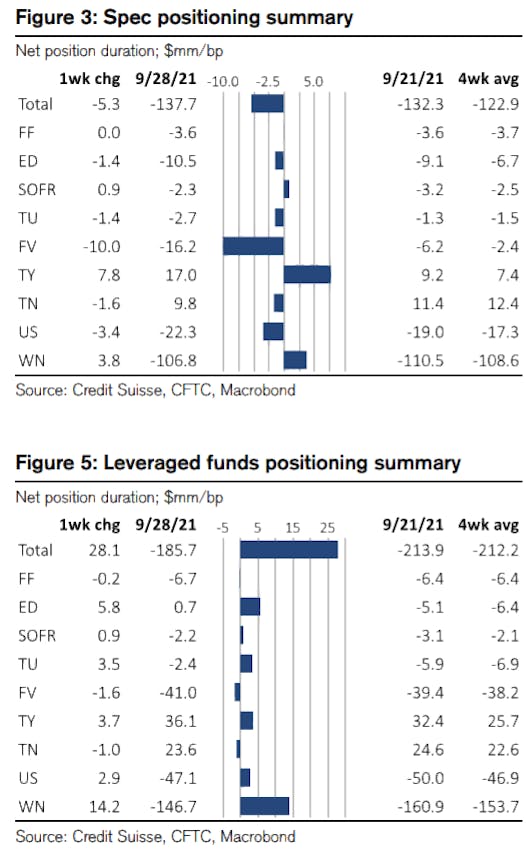

WEEKLY CFTC POSITIONING

- Leveraged funds covered a lot of duration shorts this week and were notable net buyers of duration at the long end of the curve

- Specs increased their net short positioning in 5Y futures, while also increasing their net long 10Y positions (5s10s flattening)

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 16.7 bp by the end of 2022 (meaning the market prices 66.8% chance of a 25bp hike by end of 2022), down from 80% earlier this week

- The 3-month USD OIS forward curve prices in 99.6 bp over the next 3 years (equivalent to 3.98 rate hikes)

- The 3-month Eurodollar zero curve prices in 122.8 bp over the next 3 years (equivalent to 4.91 rate hikes)

- 1-year US Treasury rate 5 years forward down 3.7 bp, now at 1.9977%, meaning that the 1-year Treasury rate is now expected to increase by 190.4 bp over the next 5 years (equivalent to 7.6 rate hikes)

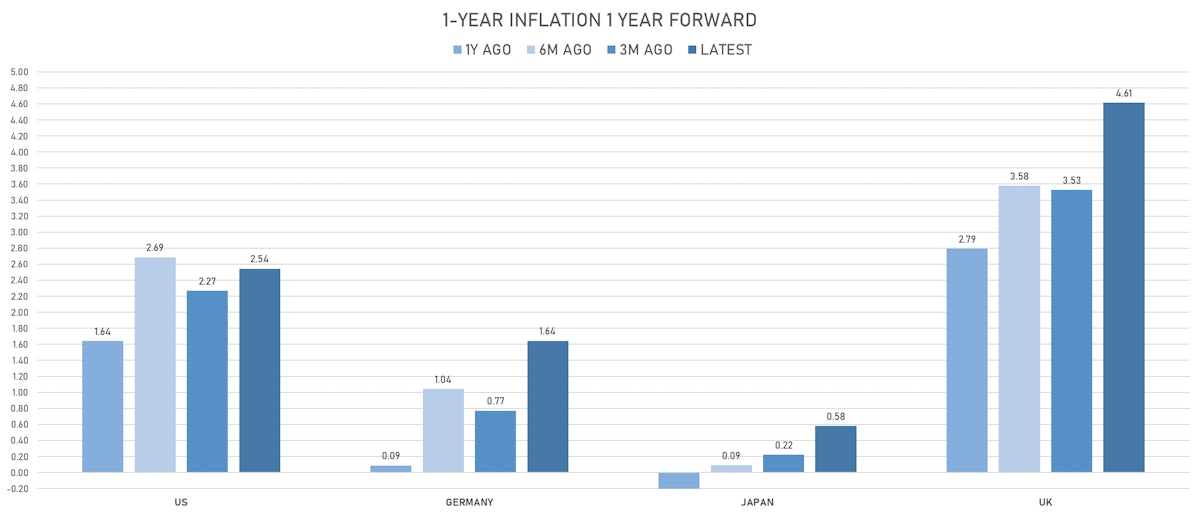

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.08% (up 6.8bp); 2Y at 2.81% (up 2.7bp); 5Y at 2.63% (down -0.6bp); 10Y at 2.36% (unchanged); 30Y at 2.28% unchanged)

- 6-month spot US CPI swap down -3.7 bp to 3.353%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6690%, -4.9 bp today; 10Y at -0.9110%, -3.0 bp today; 30Y at -0.2400%, -1.6 bp today

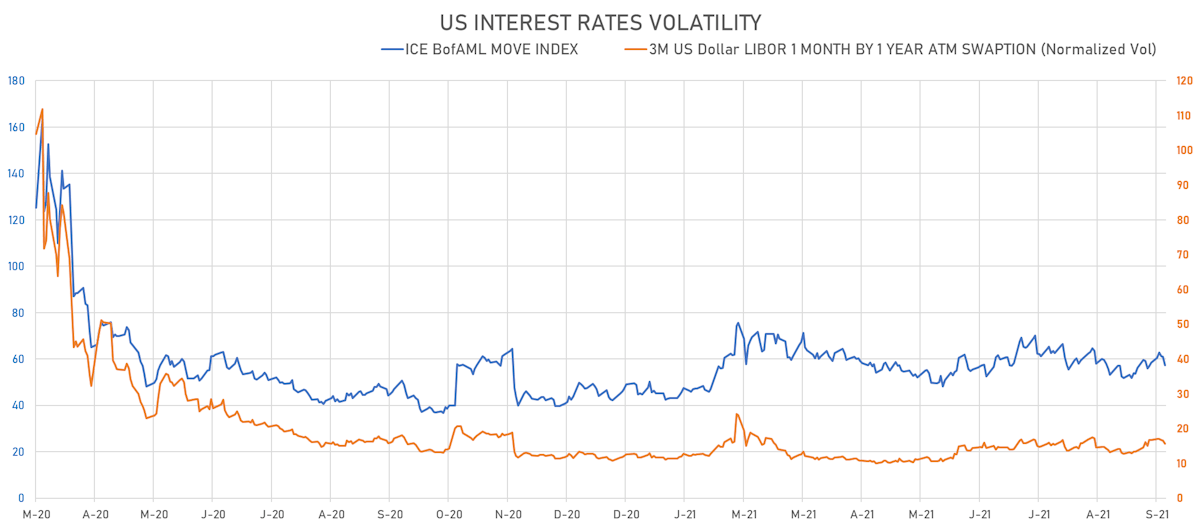

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.9% at 15.6%

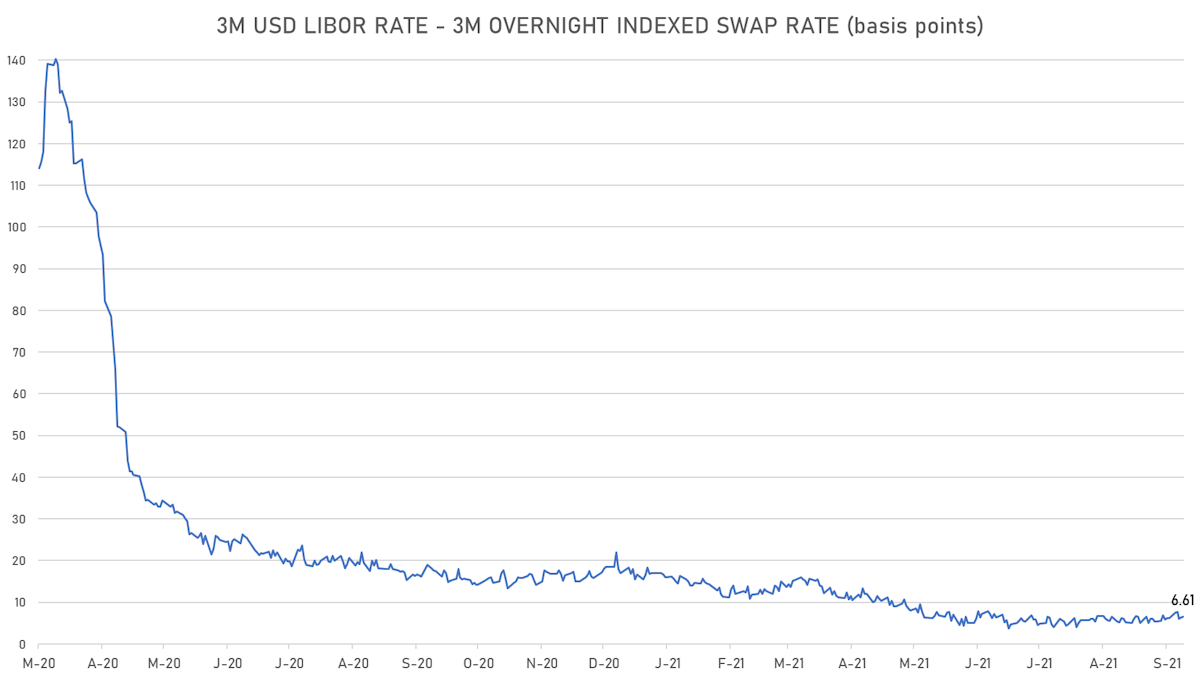

- 3-Month LIBOR-OIS spread up 0.2 bp at 6.6 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.589% (down -2.6 bp); the German 1Y-10Y curve is 2.6 bp flatter at 44.9bp (YTD change: +30.4 bp)

- Japan 5Y: -0.087% (down -1.1 bp); the Japanese 1Y-10Y curve is 1.0 bp flatter at 17.4bp (YTD change: +3.3 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.490% (up 0.1 bp); the Swiss 1Y-10Y curve is 6.9 bp flatter at 52.1bp (YTD change: +24.7 bp)