Rates

Very Little Movement In Rates With Decent T-Bills Auctions And Encouraging Manufacturing Data

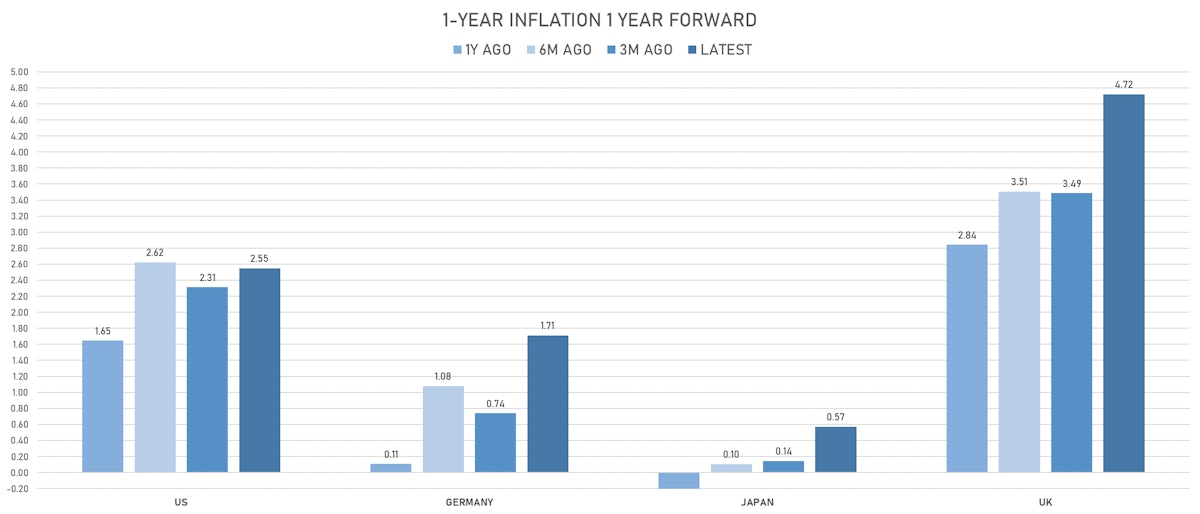

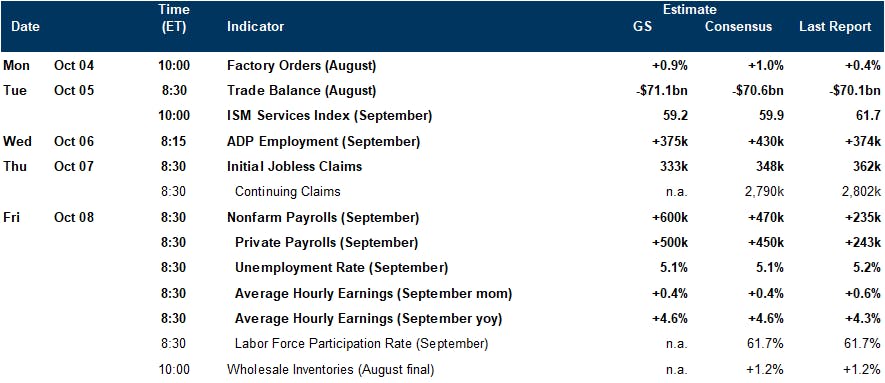

All eyes will be on jobs data later this week, most notably with the NFP report on Friday, which will also provide important indications on the inflationary pressures from wage growth

Published ET

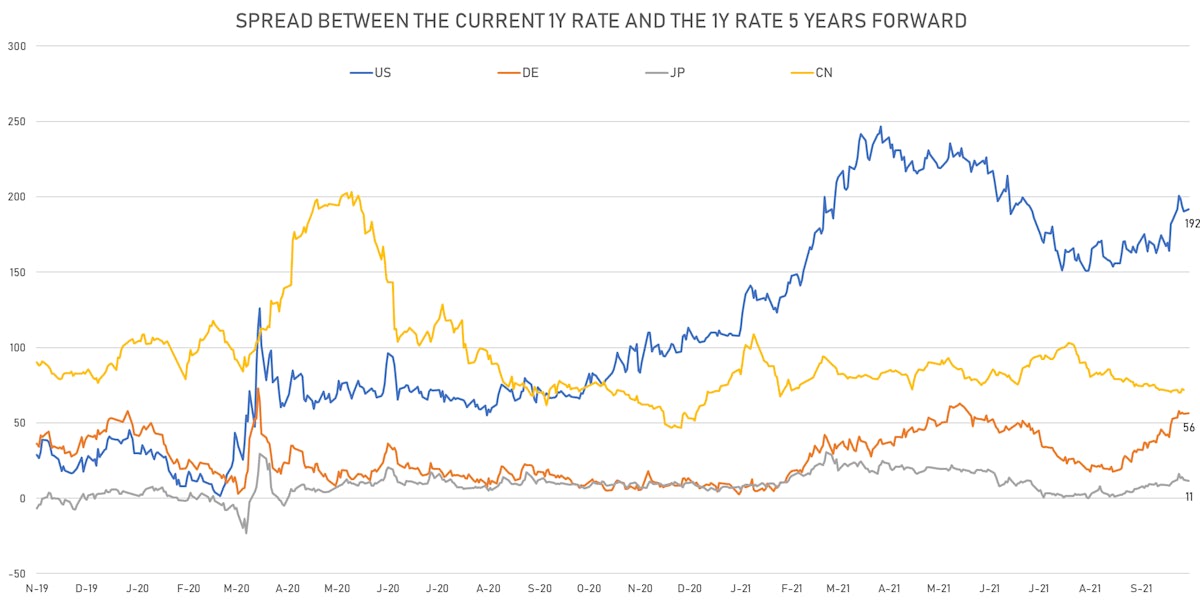

1Y US Treasury Spot Rate vs 5Y Forward Rate | Sources: ϕpost, Refinitiv data

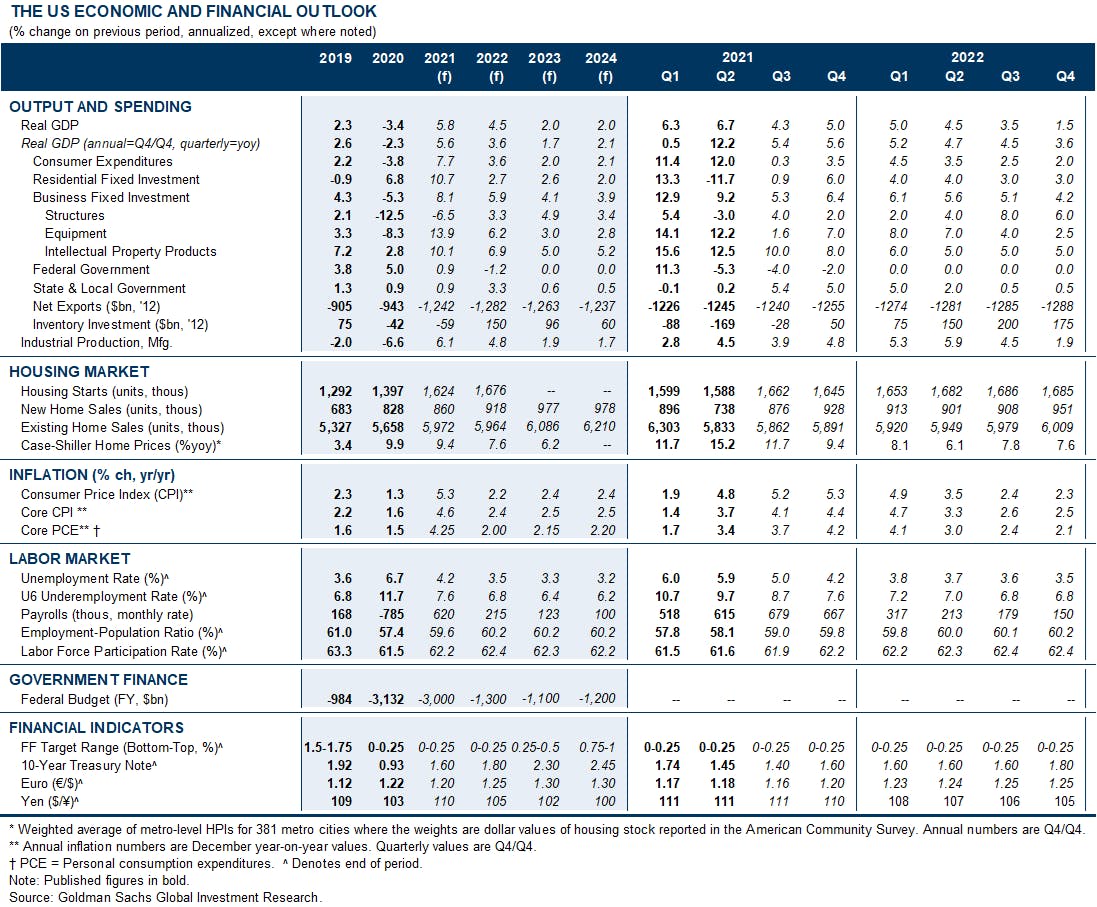

QUICK US SUMMARY

- 3-Month USD LIBOR -0.6bp today, now at 0.1266%

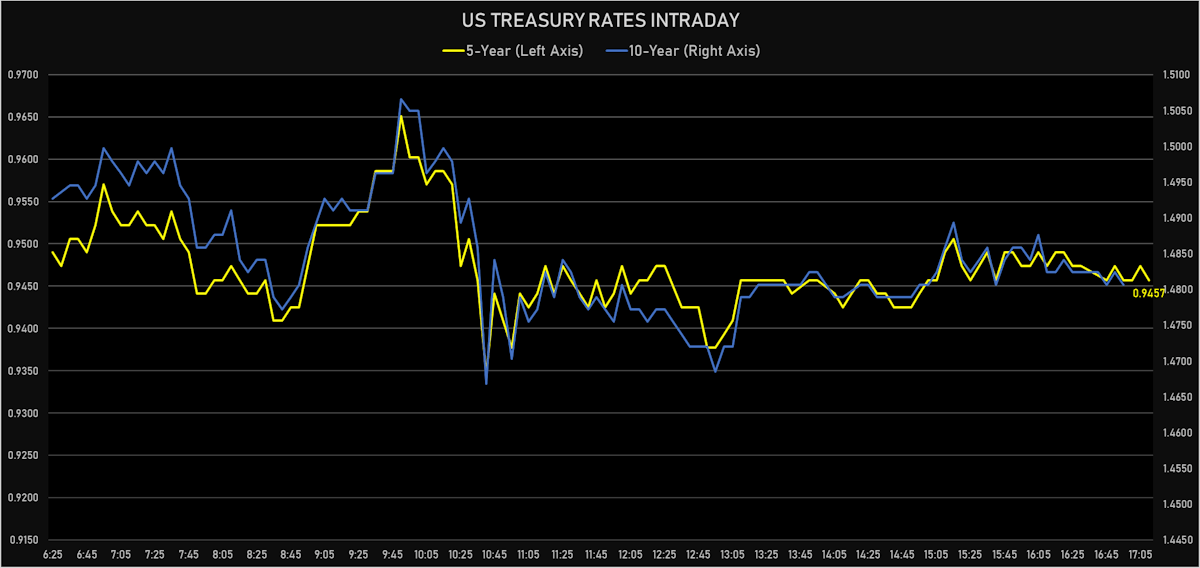

- The treasury yield curve steepened, with the 1s10s spread widening 1.6 bp, now at 140.2 bp (YTD change: +59.7bp)

- 1Y: 0.0790% (unchanged)

- 2Y: 0.2796% (up 1.4 bp)

- 5Y: 0.9457% (up 1.6 bp)

- 7Y: 1.2734% (up 1.6 bp)

- 10Y: 1.4806% (up 1.6 bp)

- 30Y: 2.0449% (up 1.2 bp)

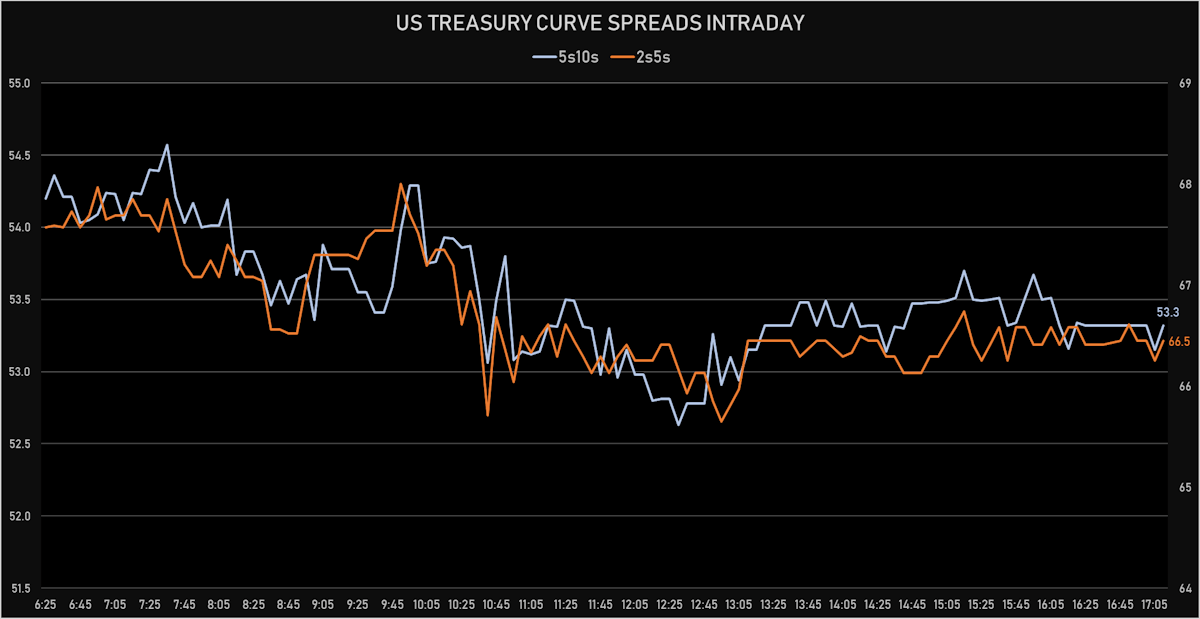

- US treasury curve spreads: 2s5s at 66.6bp (up 0.2bp today), 5s10s at 53.5bp (unchanged), 10s30s at 56.4bp (down -0.4bp)

- Treasuries butterfly spreads: 2s5s10s at -13.5bp (down -0.3bp), 5s10s30s at 2.7bp (down -0.6bp)

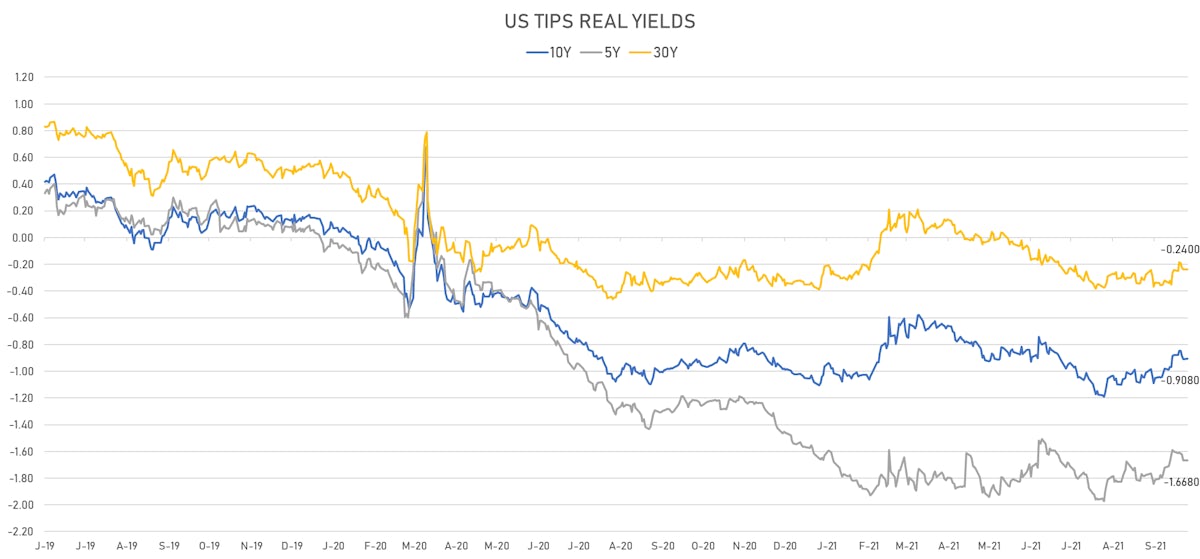

- US 5-Year TIPS Real Yield: +0.1 bp at -1.6680%; 10-Year TIPS Real Yield: +0.3 bp at -0.9080%; 30-Year TIPS Real Yield: unchanged at -0.2400%

US MACRO RELEASES

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.30 % (vs 0.20 % prior)

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.60 % (vs 0.50 % prior)

- Manufacturers New Orders, Total manufacturing excluding transportation, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.50 % (vs 0.80 % prior)

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Aug 2021 (U.S. Census Bureau) at 2.40 % (vs 2.40 % prior)

- Manufacturers New Orders, Durable goods total, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.80 % (vs 1.80 % prior)

- Manufacturers New Orders, Total manufacturing, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.20 % (vs 0.40 % prior), above consensus estimate of 1.00 %

US DATA TO COME LATER THIS WEEK

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 17.0 bp by the end of 2022 (meaning the market prices 68.0% chance of a 25bp hike by end of 2022)

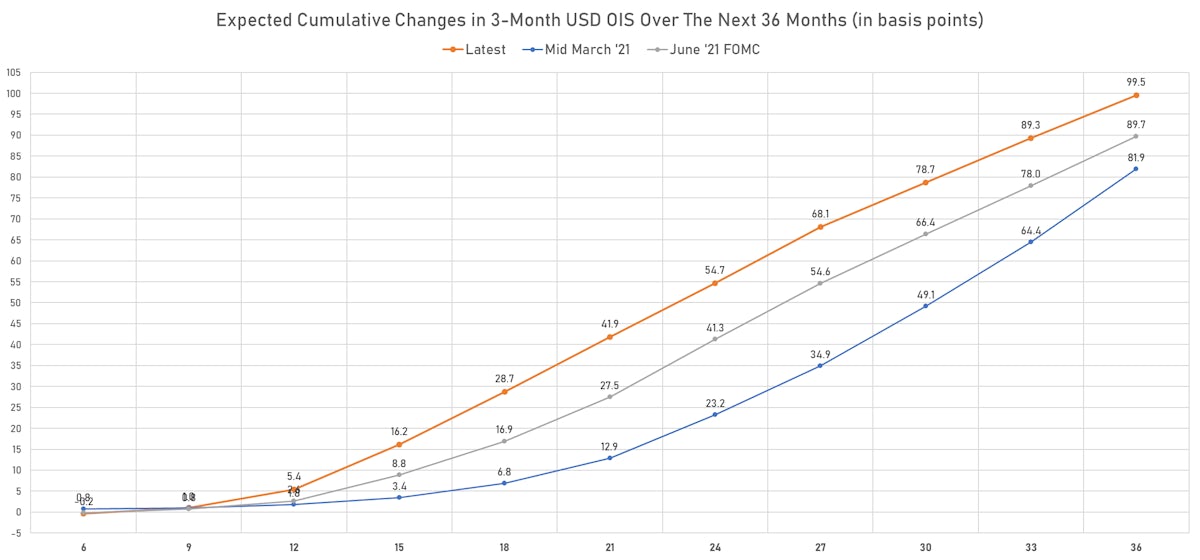

- The 3-month USD OIS forward curve prices in 99.5 bp over the next 3 years (equivalent to 3.98 rate hikes)

- The 3-month Eurodollar zero curve prices in 122.2 bp over the next 3 years (equivalent to 4.89 rate hikes)

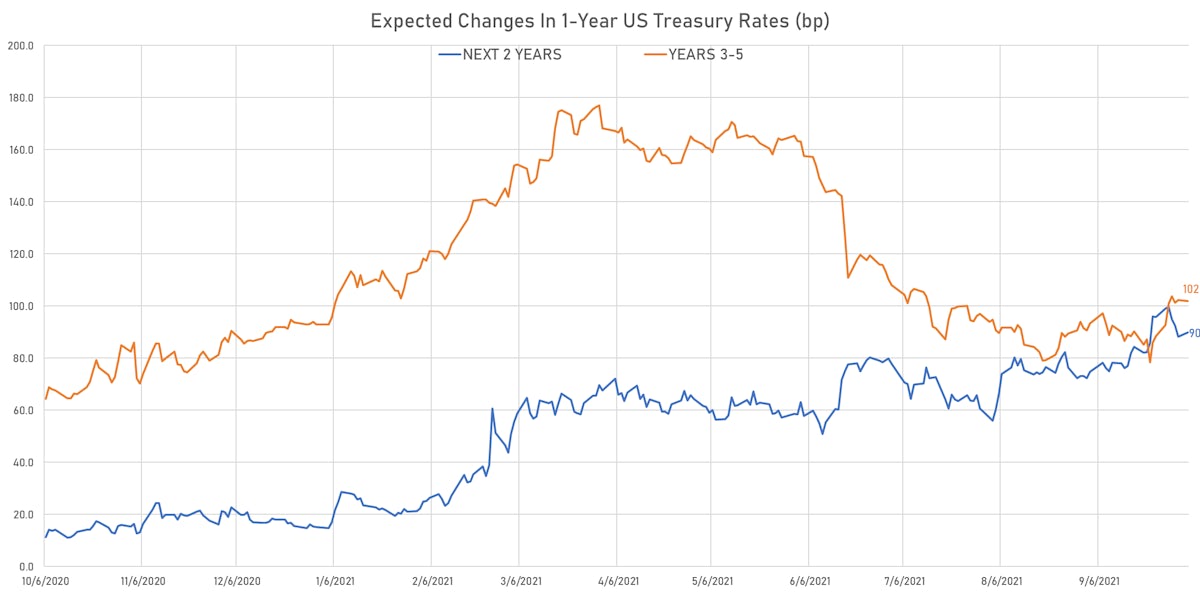

- 1-year US Treasury rate 5 years forward up 1.8 bp, now at 2.0153%, meaning that the 1-year Treasury rate is now expected to increase by 191.6 bp over the next 5 years (equivalent to 7.7 rate hikes)

US INFLATION & REAL RATES

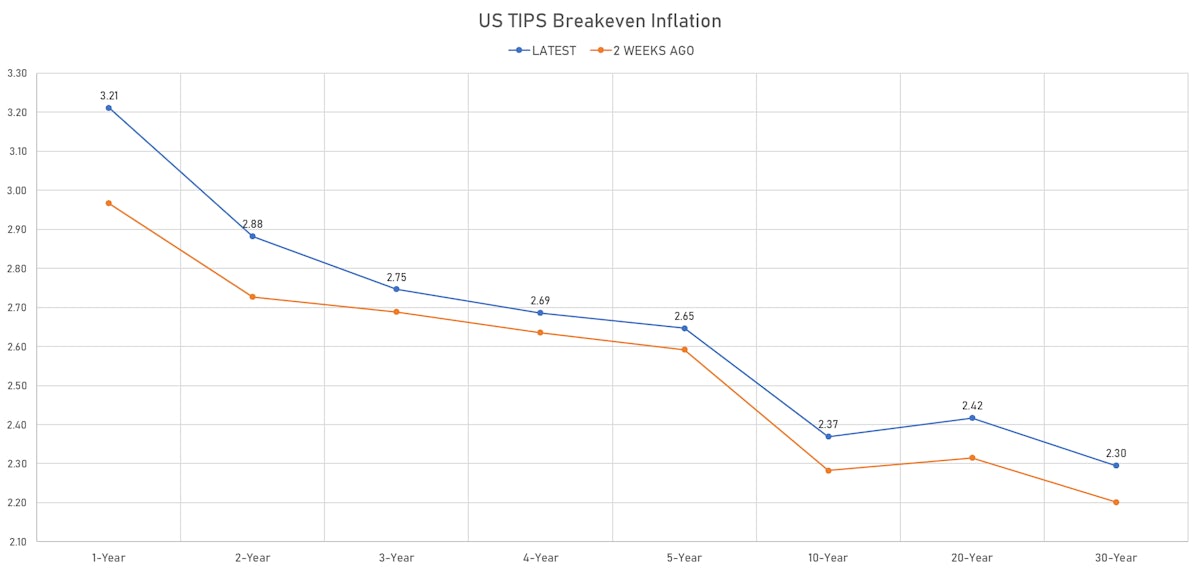

- TIPS 1Y breakeven inflation at 3.21% (up 13.6bp); 2Y at 2.88% (up 7.1bp); 5Y at 2.65% (up 2.0bp); 10Y at 2.37% (up 1.4bp); 30Y at 2.30% (up 1.1bp)

- 6-month spot US CPI swap up 14.8 bp to 3.501%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6680%, +0.1 bp today; 10Y at -0.9080%, +0.3 bp today; 30Y at -0.2400%, unchanged today

RATES VOLATILITY & LIQUIDITY

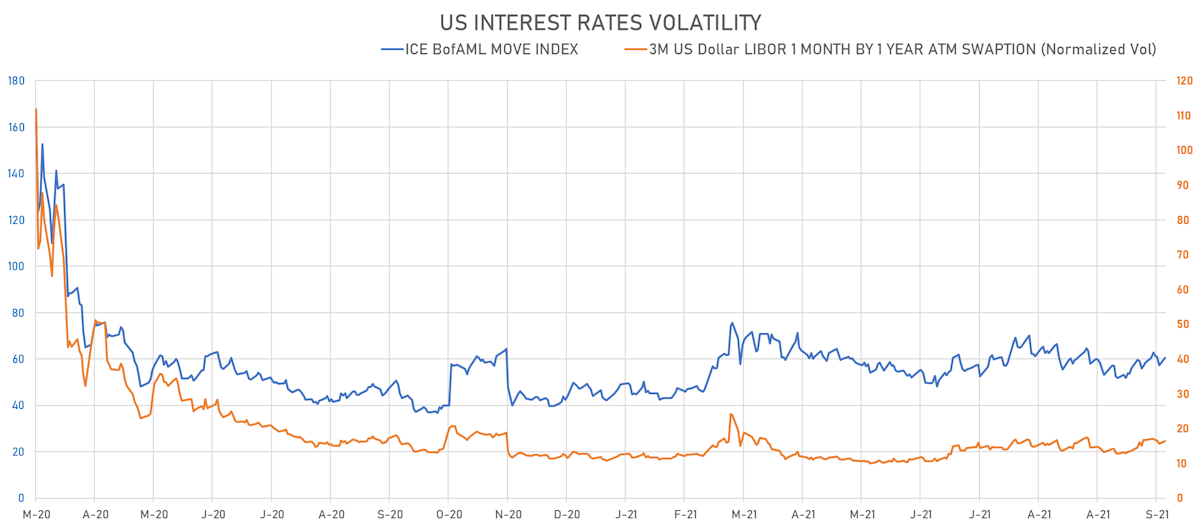

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 16.4%

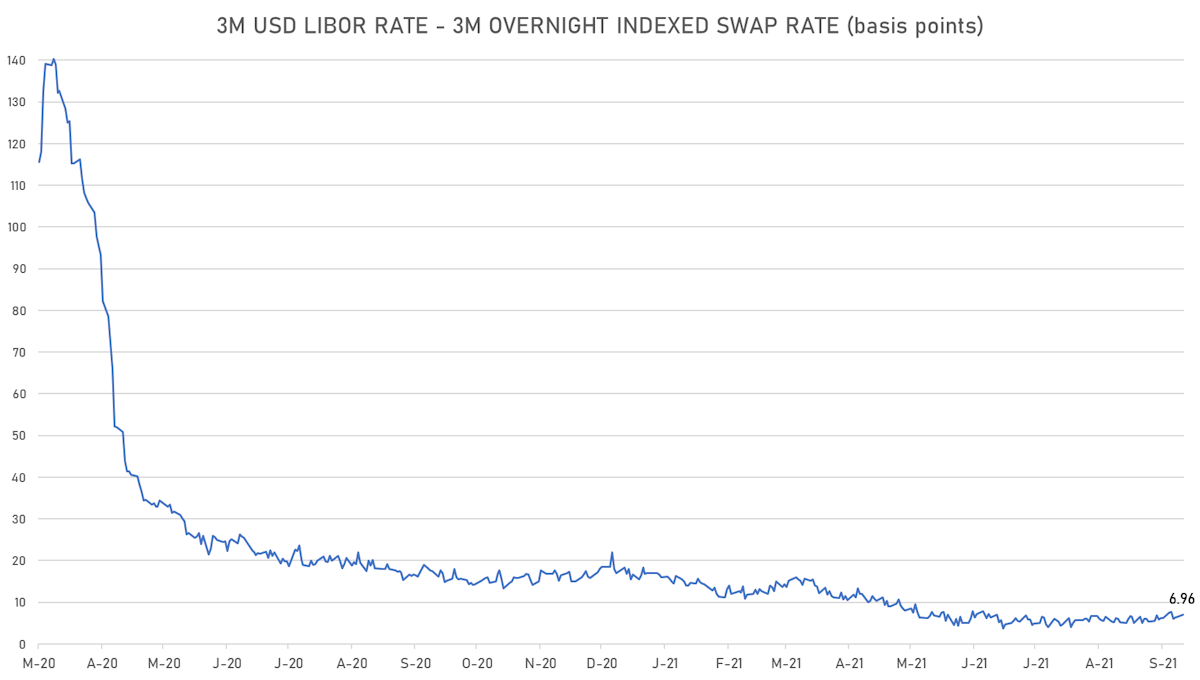

- 3-Month LIBOR-OIS spread up 0.4 bp at 7.0 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.575% (up 0.2 bp); the German 1Y-10Y curve is 0.1 bp steeper at 45.9bp (YTD change: +30.5 bp)

- Japan 5Y: -0.093% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 17.3bp (YTD change: +2.6 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.501% (down -1.1 bp); the Swiss 1Y-10Y curve is 3.7 bp steeper at 53.8bp (YTD change: +28.4 bp)