Rates

US Rates Rise From The Belly Out On Positive ISM Non-manufacturing Data

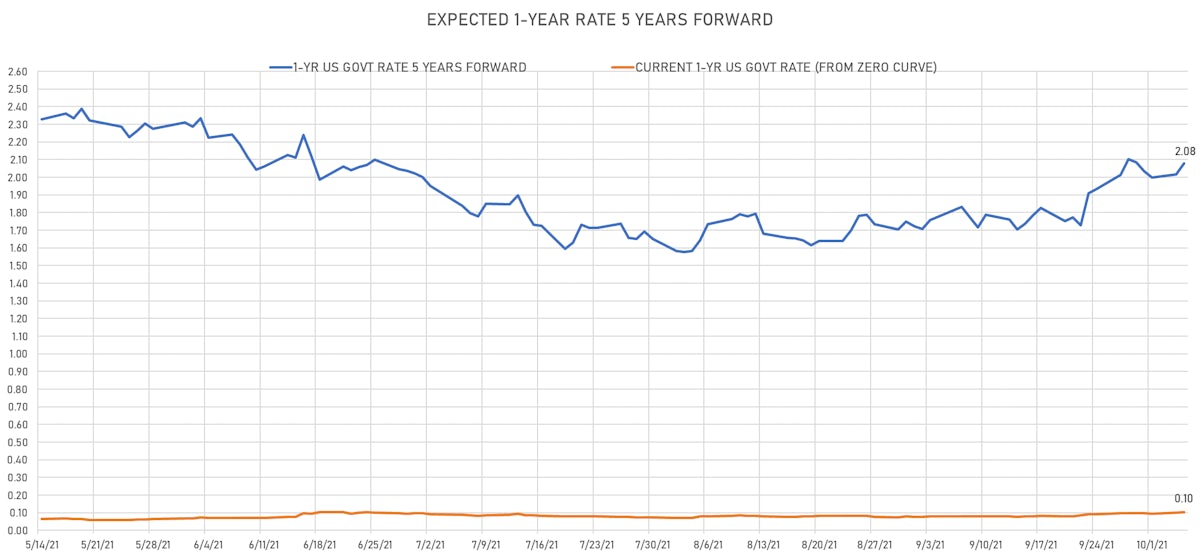

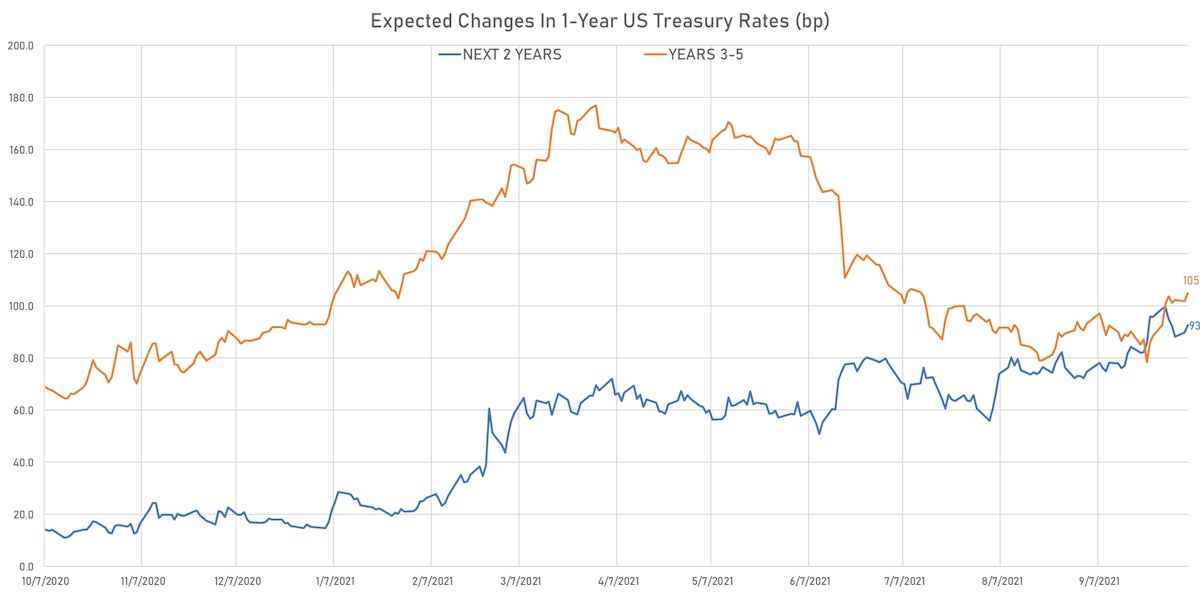

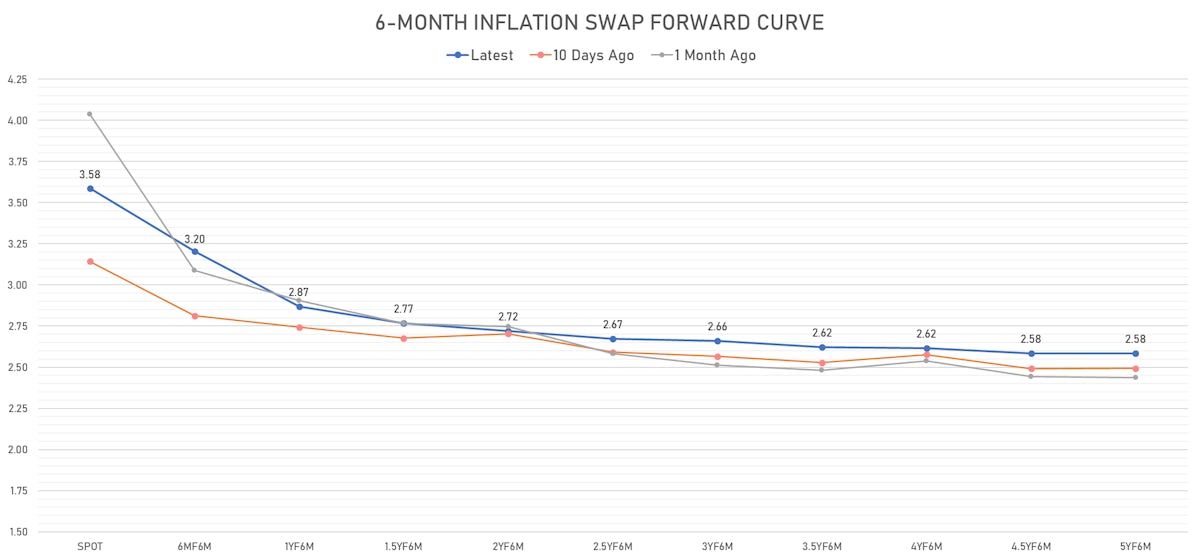

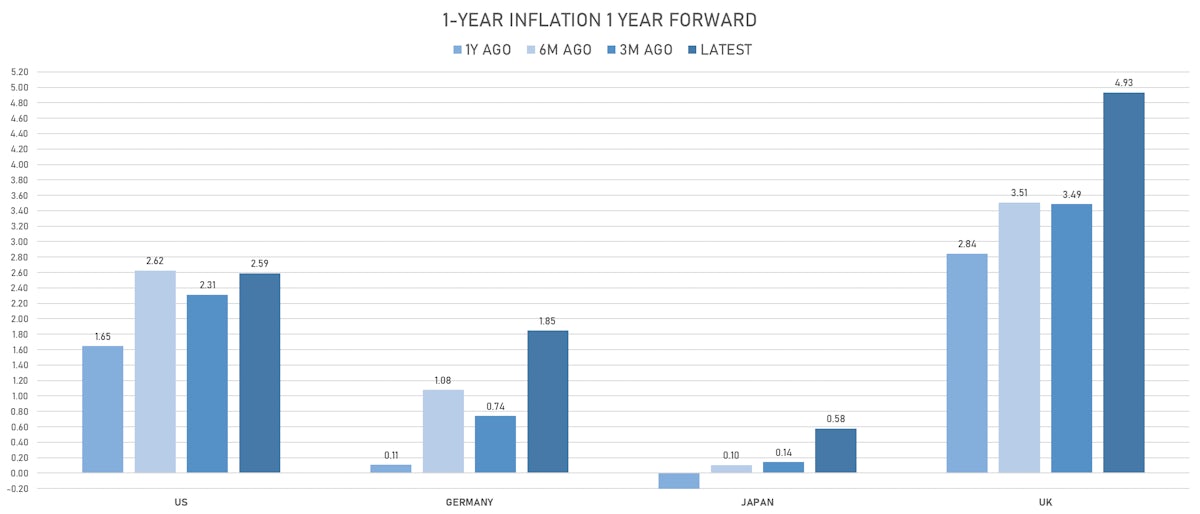

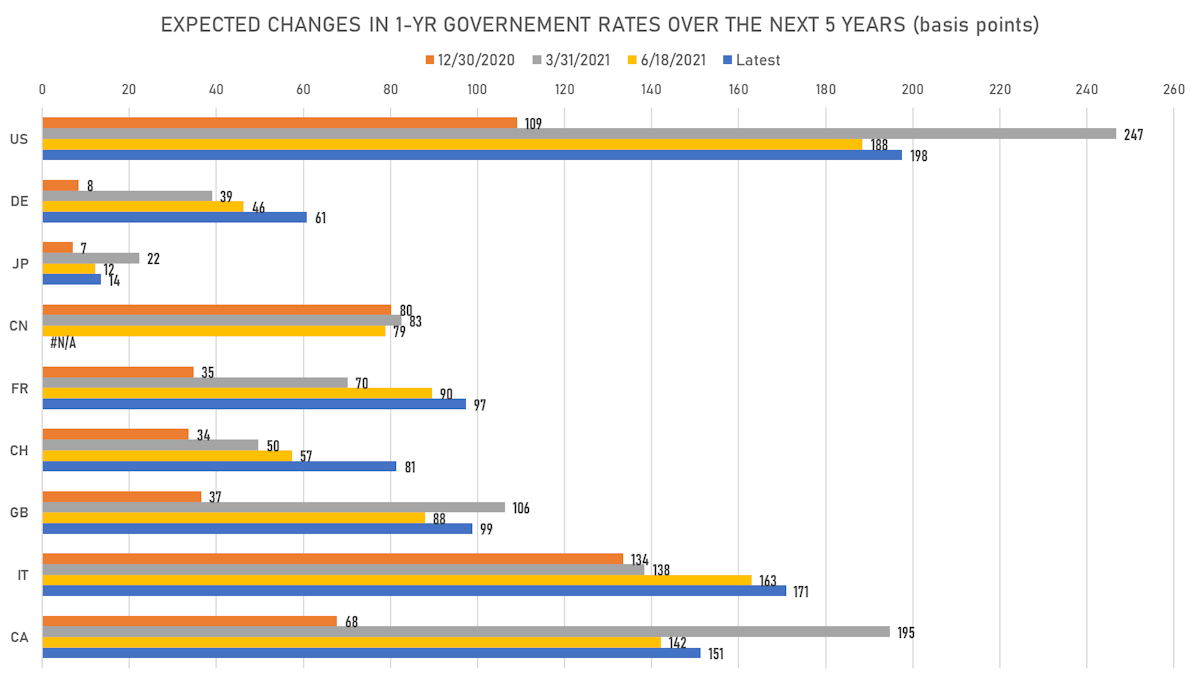

Since the September FOMC, 2 things have happened: 1) rate hikes expectations have risen in the next 3 years; 2) longer-term inflation expectations have settled above 2.50%. That tells you the market thinks the Fed will struggle to satisfy its dual mandate in the medium term

Published ET

QUICK US SUMMARY

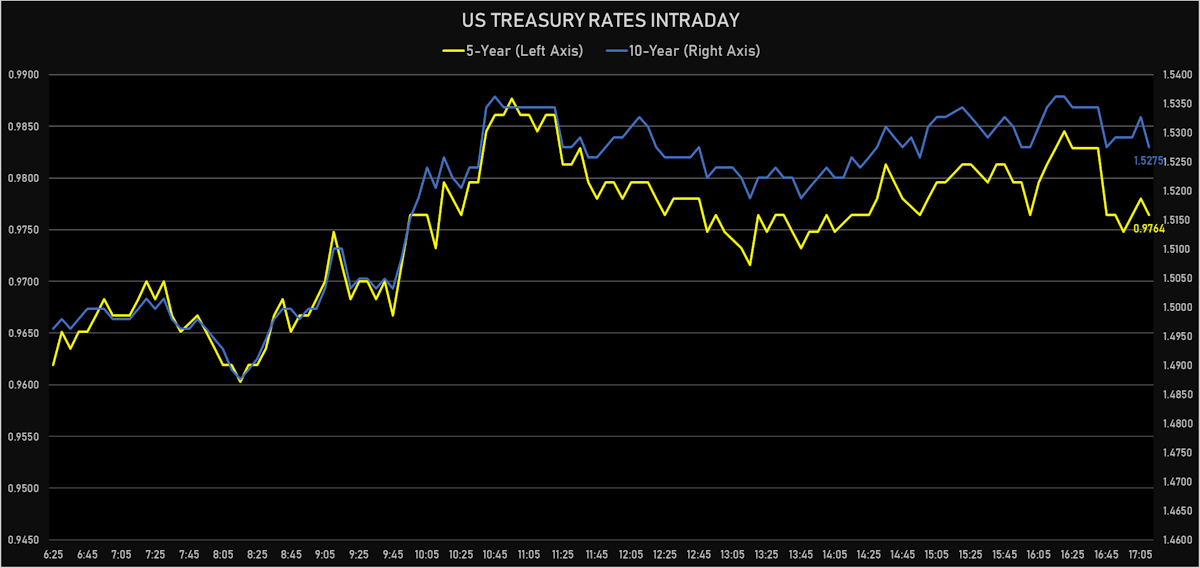

- 3-Month USD LIBOR -0.3bp today, now at 0.1240%

- The treasury yield curve steepened, with the 1s10s spread widening 4.4 bp, now at 144.9 bp (YTD change: +64.4bp)

- 1Y: 0.0790% (up 0.3 bp)

- 2Y: 0.2856% (up 0.6 bp)

- 5Y: 0.9764% (up 3.1 bp)

- 7Y: 1.3110% (up 3.8 bp)

- 10Y: 1.5275% (up 4.7 bp)

- 30Y: 2.0982% (up 5.3 bp)

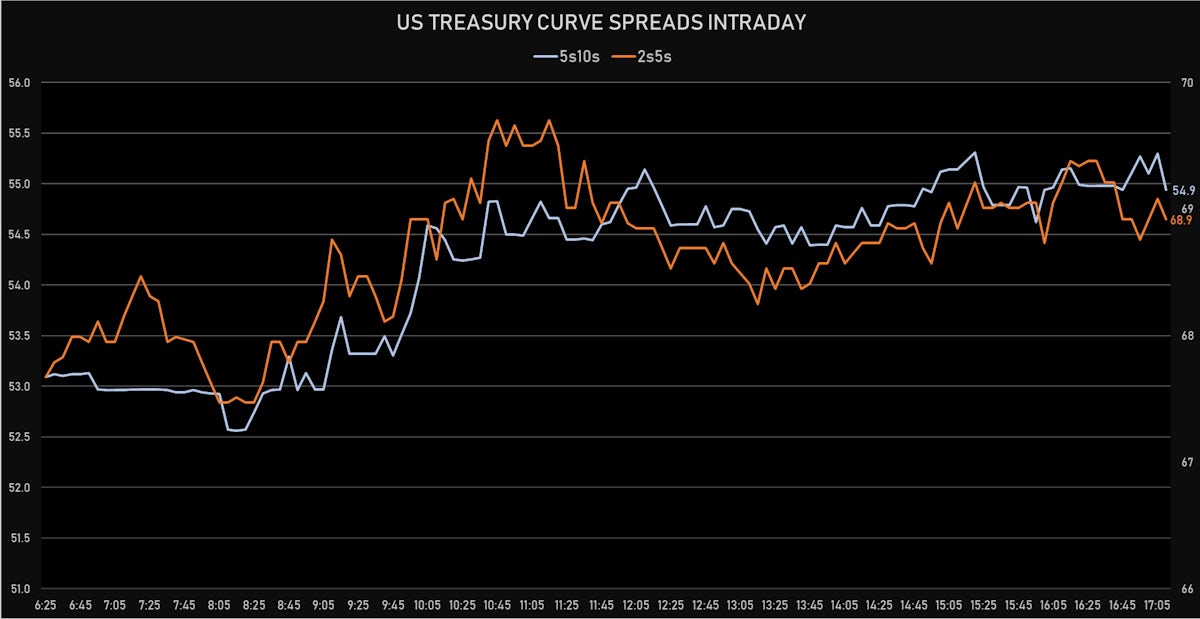

- US treasury curve spreads: 2s5s at 69.1bp (up 2.5bp today), 5s10s at 55.1bp (up 1.6bp today), 10s30s at 57.1bp (up 0.7bp today)

- Treasuries butterfly spreads: 1s5s10s at -35.4bp (down -1.2bp), 5s10s30s at 1.2bp (down -1.5bp)

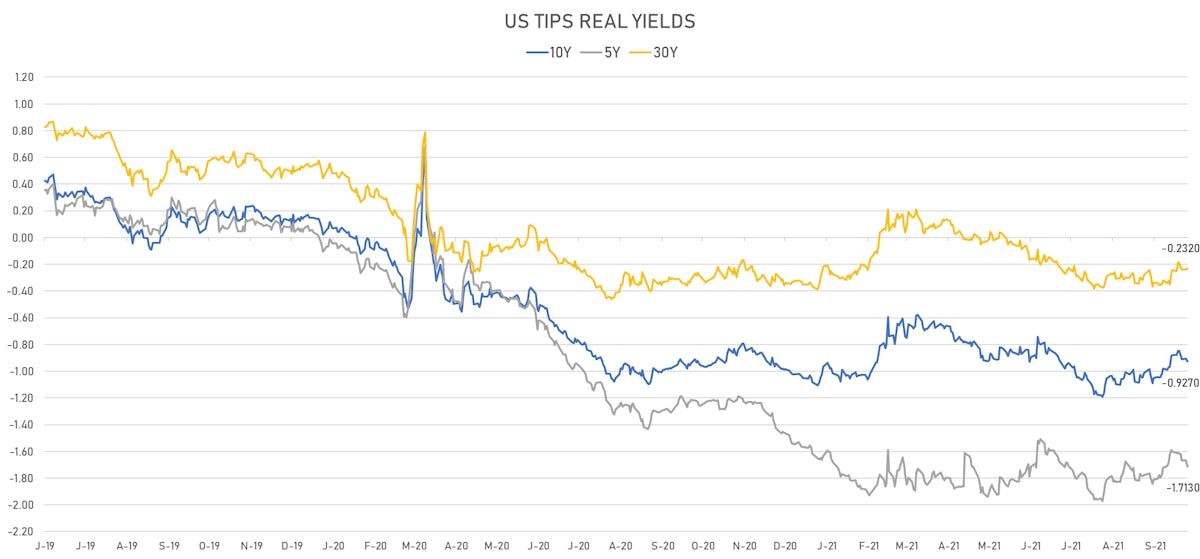

- US 5-Year TIPS Real Yield: -4.5 bp at -1.7130%; 10-Year TIPS Real Yield: -1.9 bp at -0.9270%; 30-Year TIPS Real Yield: +0.8 bp at -0.2320%

US MACRO RELEASES

- Trade Balance, Total, Goods and services for Aug 2021 (U.S. Census Bureau) at -73.30 Bln USD (vs -70.10 Bln USD prior), below consensus estimate of -70.50 Bln USD

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 02 Oct (Redbook Research) at 16.60 % (vs 16.50 % prior)

- PMI, Services Sector, Business Activity, Final for Sep 2021 (Markit Economics) at 54.90 (vs 54.40 prior)

- PMI, Composite, Output, Final for Sep 2021 (Markit Economics) at 55.00 (vs 54.50 prior)

- ISM Non-manufacturing, New orders for Sep 2021 (ISM, United States) at 63.50 (vs 63.20 prior)

- ISM Non-manufacturing, Prices for Sep 2021 (ISM, United States) at 77.50 (vs 75.40 prior)

- ISM Non-manufacturing, Employment for Sep 2021 (ISM, United States) at 53.00 (vs 53.70 prior)

- ISM Non-manufacturing, NMI/PMI for Sep 2021 (ISM, United States) at 61.90 (vs 61.70 prior), above consensus estimate of 60.00

- ISM Non-manufacturing, Business activity for Sep 2021 (ISM, United States) at 62.30 (vs 60.10 prior), above consensus estimate of 59.50

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 18.5 bp by the end of 2022 (meaning the market prices 74.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 102.7 bp over the next 3 years (equivalent to 4.11 rate hikes)

- The 3-month Eurodollar zero curve prices in 126.4 bp over the next 3 years (equivalent to 5.05 rate hikes)

- 1-year US Treasury rate 5 years forward up 6.4 bp, now at 2.0790%, meaning that the 1-year Treasury rate is now expected to increase by 197.5 bp over the next 5 years (equivalent to 7.9 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.35% (up 13.6bp); 2Y at 2.97% (up 8.9bp); 5Y at 2.72% (up 7.7bp); 10Y at 2.43% (up 6.5bp); 30Y at 2.34% (up 4.6bp)

- 6-month spot US CPI swap up 8.4 bp to 3.585%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7130%, -4.5 bp today; 10Y at -0.9270%, -1.9 bp today; 30Y at -0.2320%, +0.8 bp today

RATES VOLATILITY & LIQUIDITY

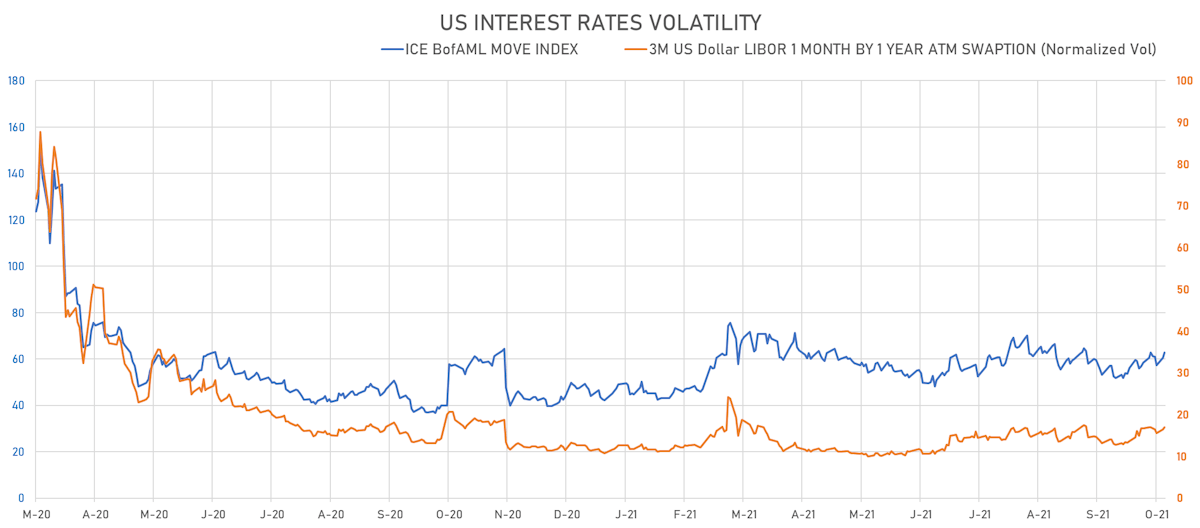

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.6% at 17.0%

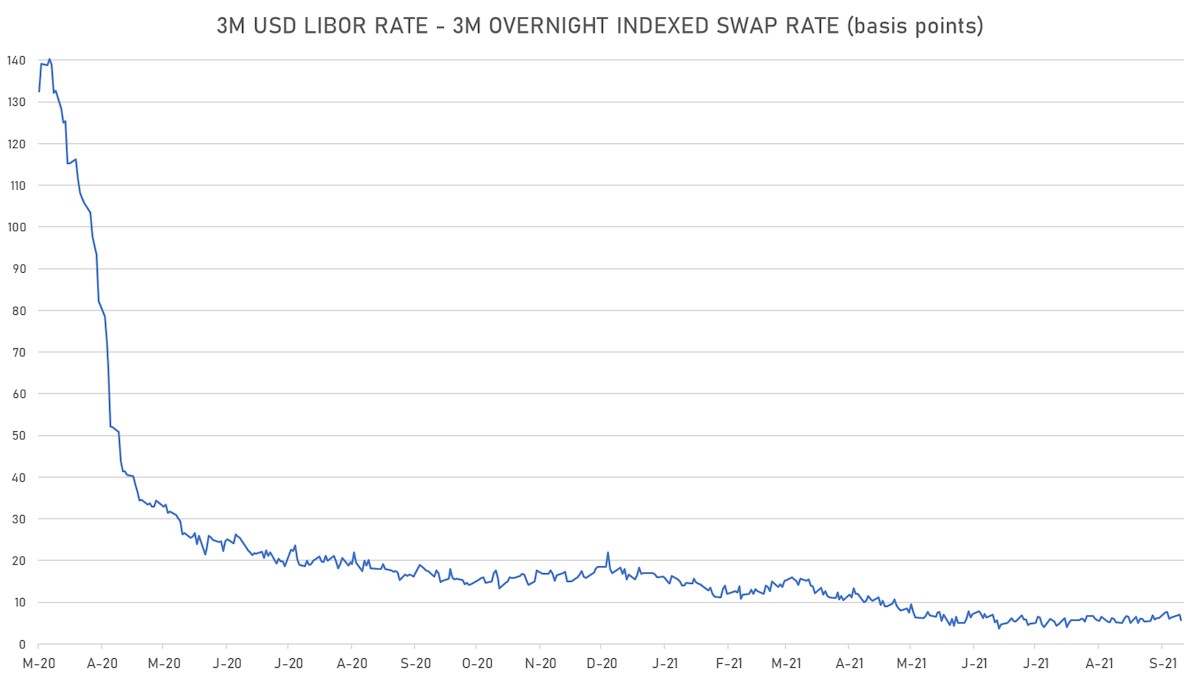

- 3-Month LIBOR-OIS spread down -1.3 bp at 5.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.553% (up 2.3 bp); the German 1Y-10Y curve is 3.0 bp steeper at 49.1bp (YTD change: +33.5 bp)

- Japan 5Y: -0.090% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 18.5bp (YTD change: +3.3 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.472% (up 2.9 bp); the Swiss 1Y-10Y curve is 1.5 bp steeper at 58.3bp (YTD change: +29.9 bp)