Rates

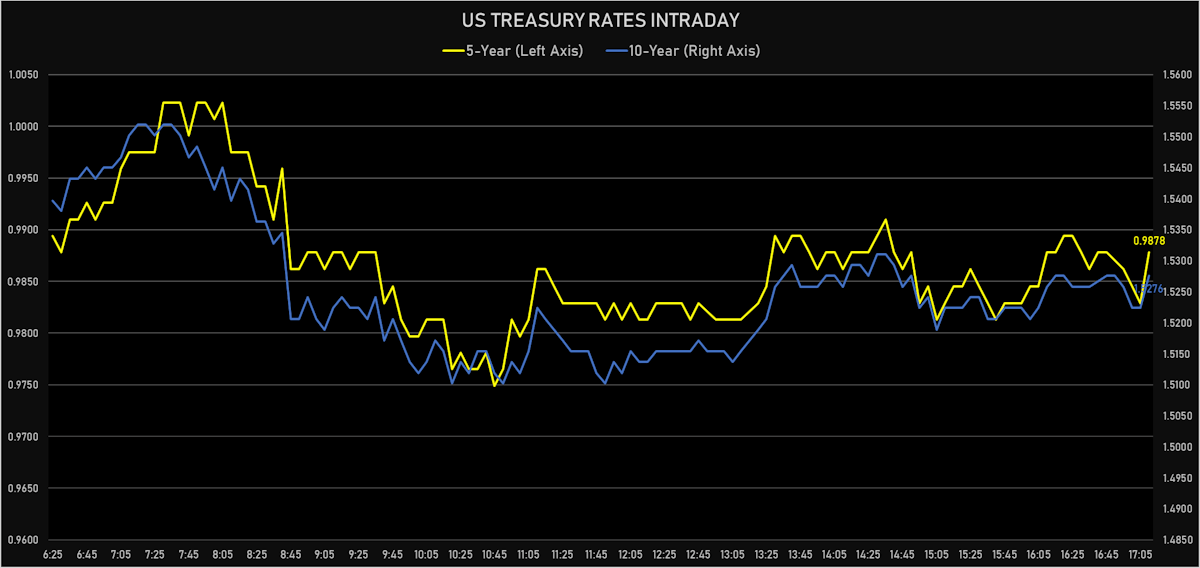

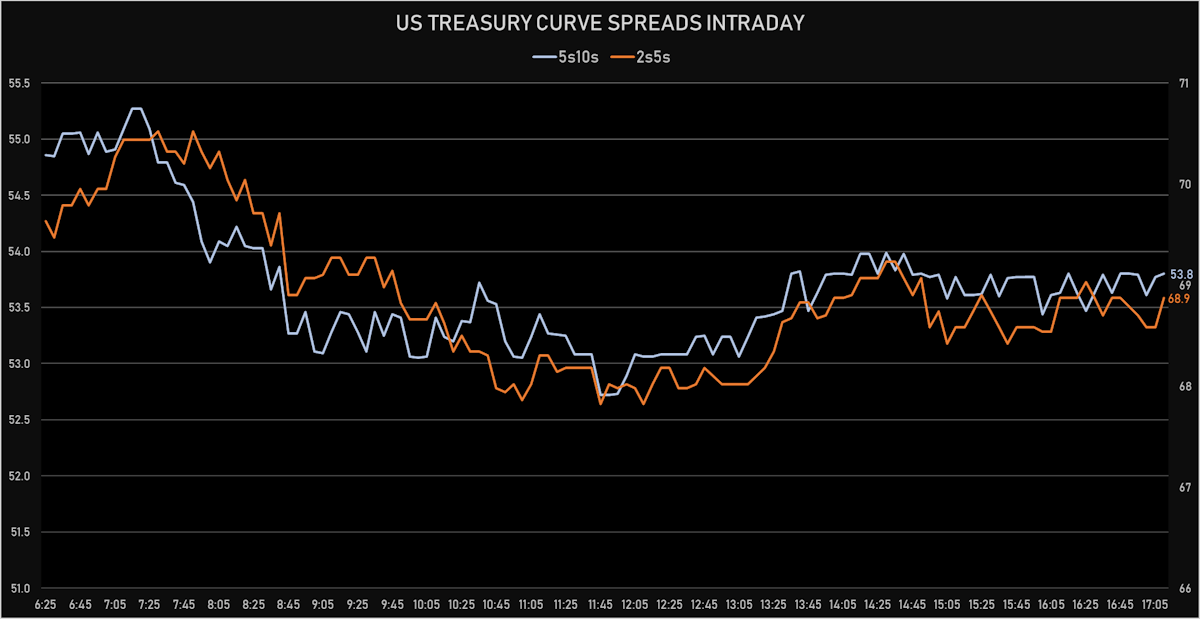

Slight Rise In US Rates Out To The Belly, With A Flattening In 5s10s That Is Particularly Visible In Real Yields

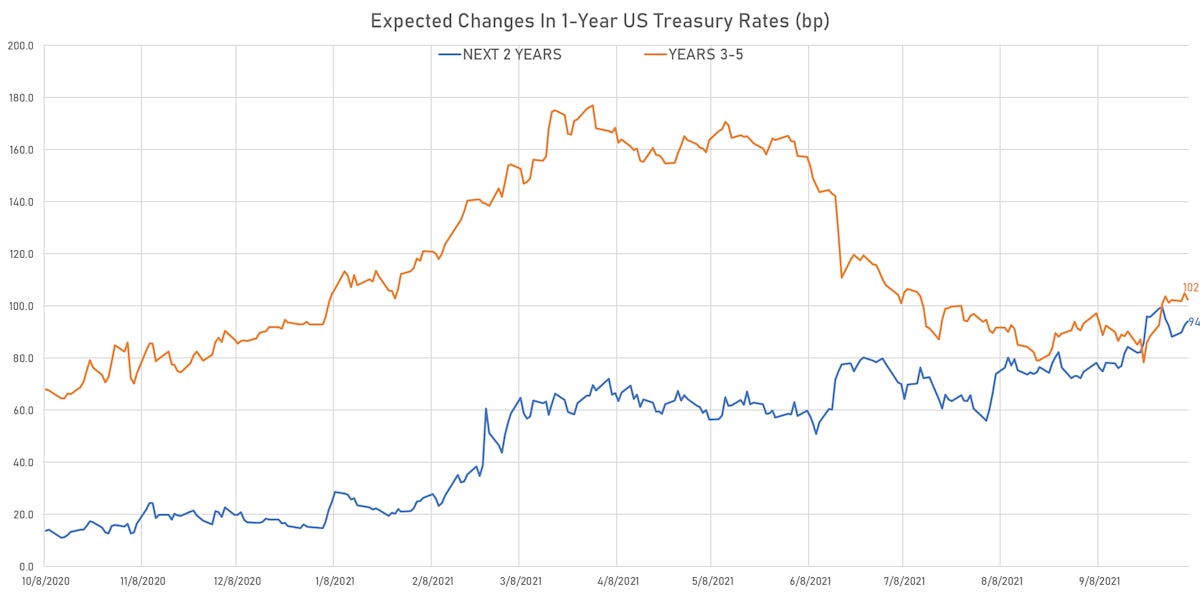

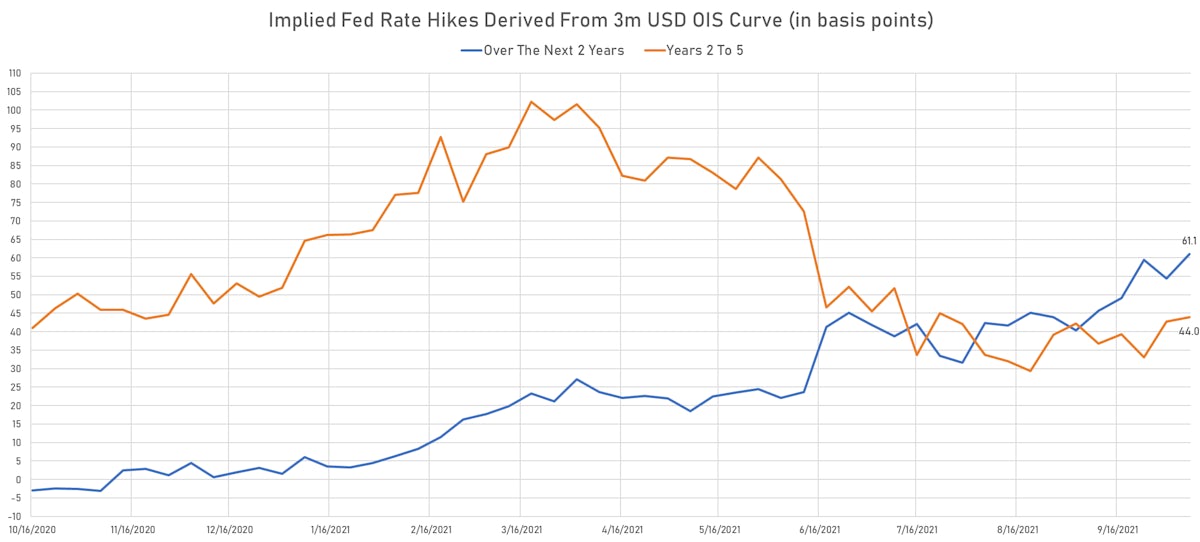

The adjustments in rates market expectations since the September FOMC have been very front-loaded: expected Fed hikes over the next 2 years are up about 15bp, with an almost parallel shift thereafter lifting the terminal rate by 25bp

Published ET

Implied Fed Hikes Derived From The 3m USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged at 0.1240%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.0 bp, now at 144.4 bp (YTD change: +63.9bp)

- 1Y: 0.0840% (up 1.0 bp)

- 2Y: 0.2975% (up 1.2 bp)

- 5Y: 0.9878% (up 1.1 bp)

- 7Y: 1.3181% (up 0.7 bp)

- 10Y: 1.5276% (unchanged)

- 30Y: 2.0825% (down 1.6 bp)

- US treasury curve spreads: 2s5s at 69.1bp (unchanged), 5s10s at 54.0bp (down -1.1bp), 10s30s at 55.5bp (down -1.6bp)

- Treasuries butterfly spreads: 1s5s10s at -36.4bp (down -1.0bp), 5s10s30s at 1.7bp (up 0.5bp)

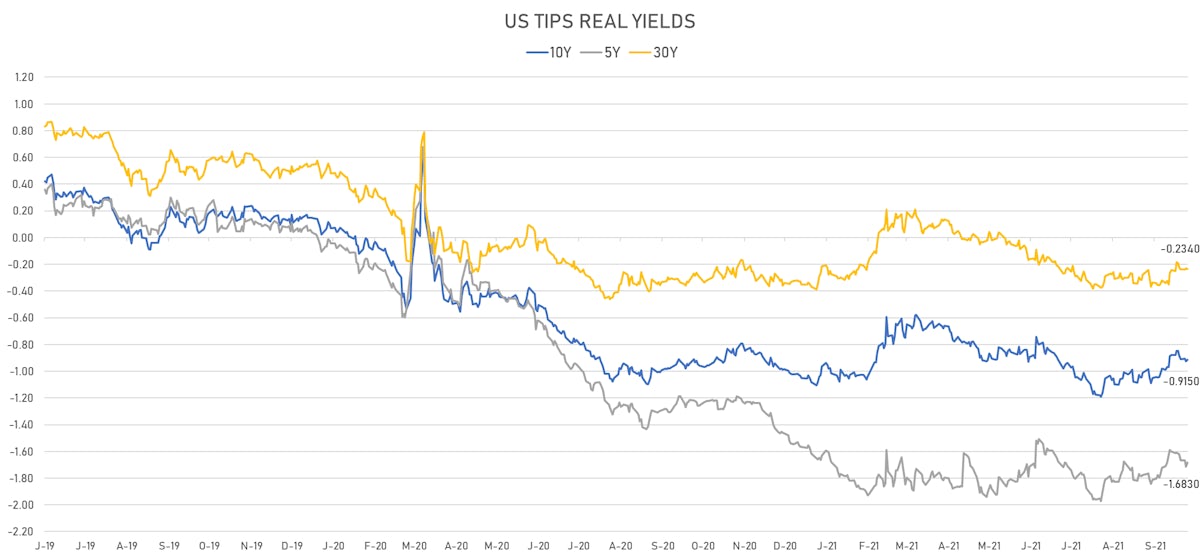

- US 5-Year TIPS Real Yield: +3.0 bp at -1.6830%; 10-Year TIPS Real Yield: +1.2 bp at -0.9150%; 30-Year TIPS Real Yield: -0.2 bp at -0.2340%

US MACRO RELEASES

- ADP total nonfarm private employment (estimate), Absolute change for Sep 2021 (ADP - Automatic Data) at 568.00 k (vs 374.00 k prior), above consensus estimate of 428.00 k

- Mortgage applications, market composite index, refinancing for W 01 Oct (MBA, USA) at 3037.60 (vs 3359.50 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 01 Oct (MBA, USA) at 3.14 % (vs 3.10 % prior)

- Mortgage applications, market composite index, purchase for W 01 Oct (MBA, USA) at 275.70 (vs 280.40 prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 01 Oct (MBA, USA) at -6.90 % (vs -1.10 % prior)

- Mortgage applications, market composite index for W 01 Oct (MBA, USA) at 684.50 (vs 734.90 prior)

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 20.0 bp by the end of 2022 (meaning the market prices 80.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 105.1 bp over the next 3 years (equivalent to 4.20 rate hikes)

- The 3-month Eurodollar zero curve prices in 128.5 bp over the next 3 years (equivalent to 5.14 rate hikes)

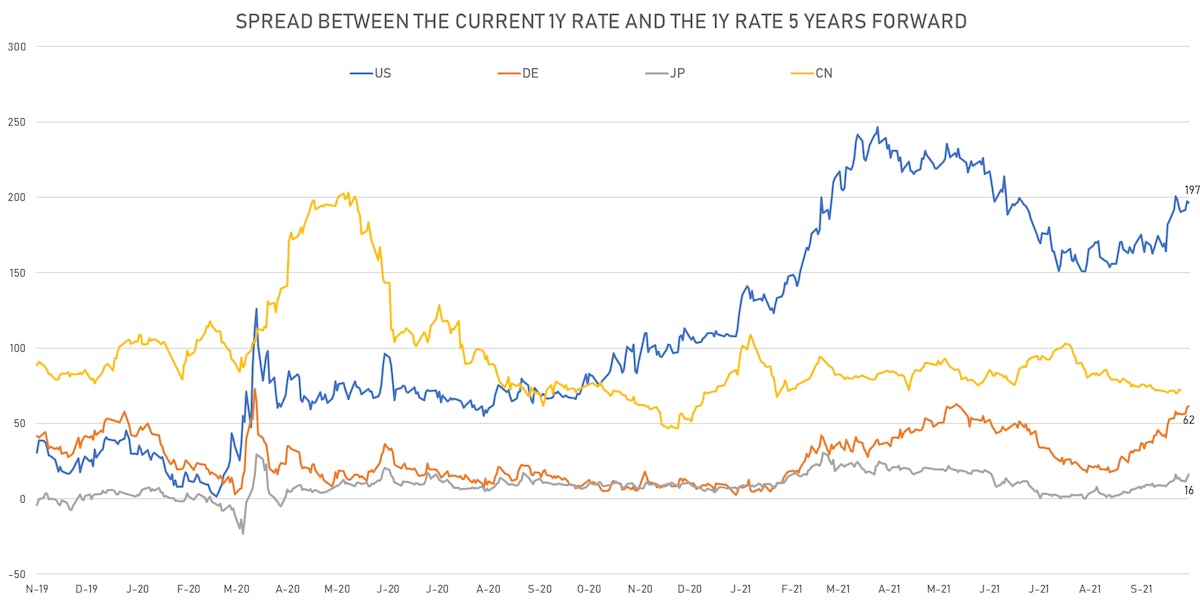

- 1-year US Treasury rate 5 years forward down 0.7 bp, now at 2.0718%, meaning that the 1-year Treasury rate is now expected to increase by 196.5 bp over the next 5 years (equivalent to 7.9 rate hikes)

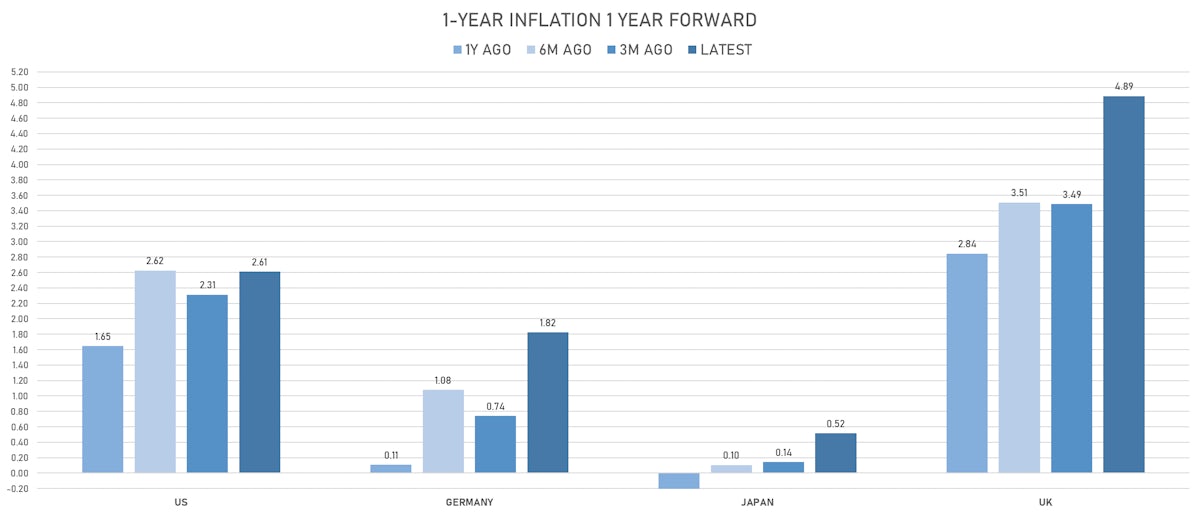

US INFLATION & REAL RATES

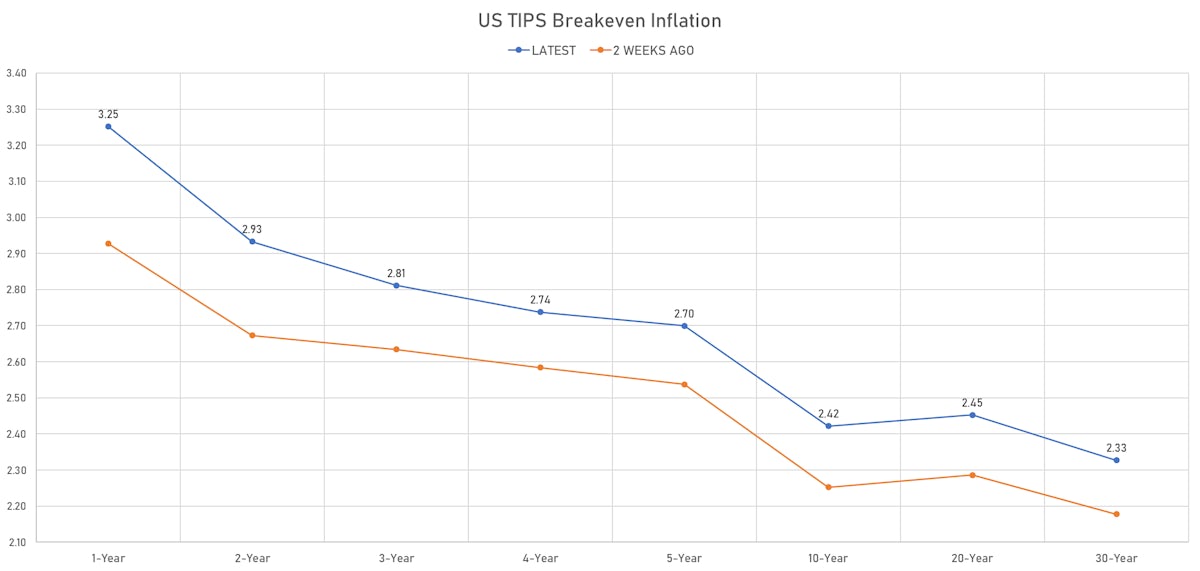

- TIPS 1Y breakeven inflation at 3.25% (down -9.6bp); 2Y at 2.93% (down -3.8bp); 5Y at 2.70% (down -2.4bp); 10Y at 2.42% (down -1.2bp); 30Y at 2.33% (down -1.4bp)

- 6-month spot US CPI swap down -2.6 bp to 3.559%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6830%, +3.0 bp today; 10Y at -0.9150%, +1.2 bp today; 30Y at -0.2340%, -0.2 bp today

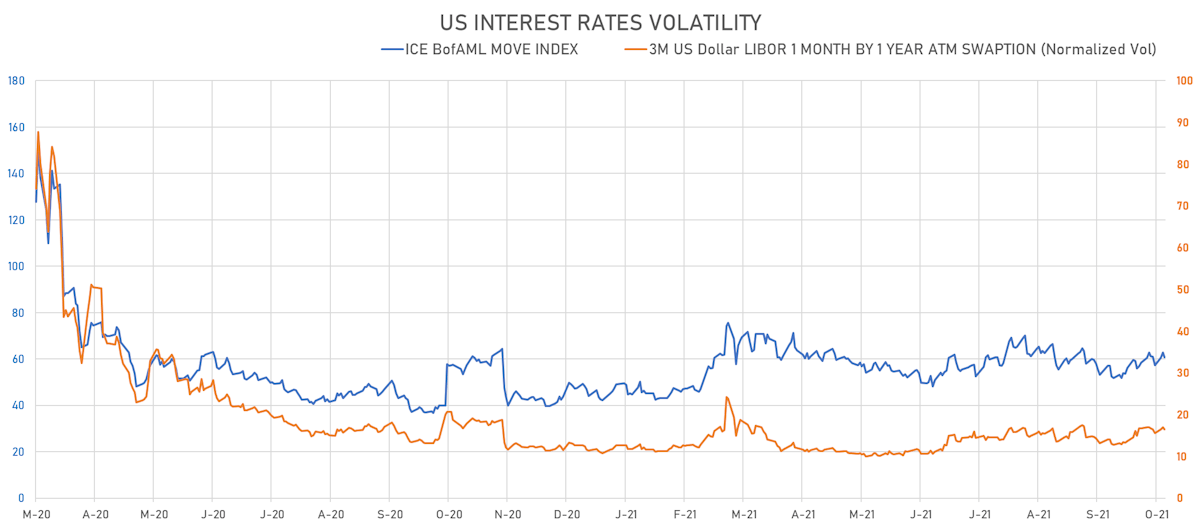

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.5% at 16.5%

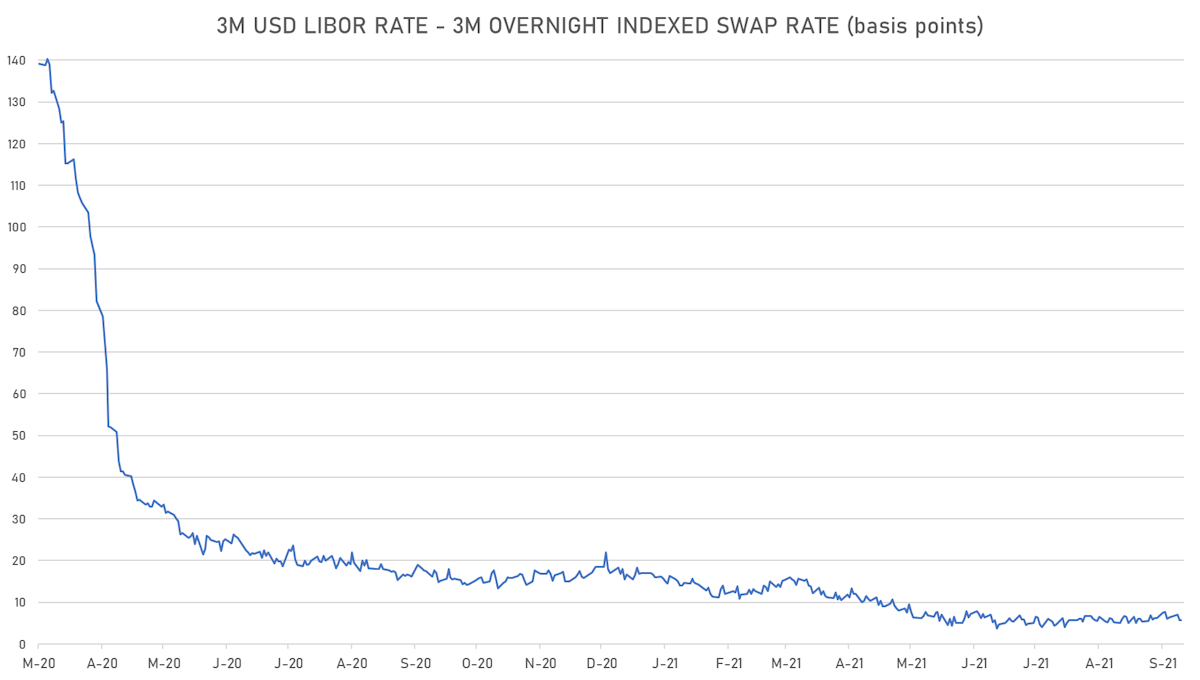

- 3-Month LIBOR-OIS spread unchanged at 5.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.551% (up 0.4 bp); the German 1Y-10Y curve is 0.6 bp steeper at 49.7bp (YTD change: +34.1 bp)

- Japan 5Y: -0.087% (up 1.0 bp); the Japanese 1Y-10Y curve is 2.9 bp steeper at 19.3bp (YTD change: +6.2 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.477% (down -0.9 bp); the Swiss 1Y-10Y curve is 0.1 bp steeper at 57.4bp (YTD change: +30.0 bp)