Rates

Rates Rise Further, Still Led By The Belly, With The 5Y Closing Again Above 1%

Now that Washington has kicked the debt ceiling grenade down the road, rates markets will focus on these 3 events: 1) September's payrolls report tomorrow; 2) latest CPI data + FOMC minutes coming next Wednesday; 3) the QE tapering announcement on 3 November

Published ET

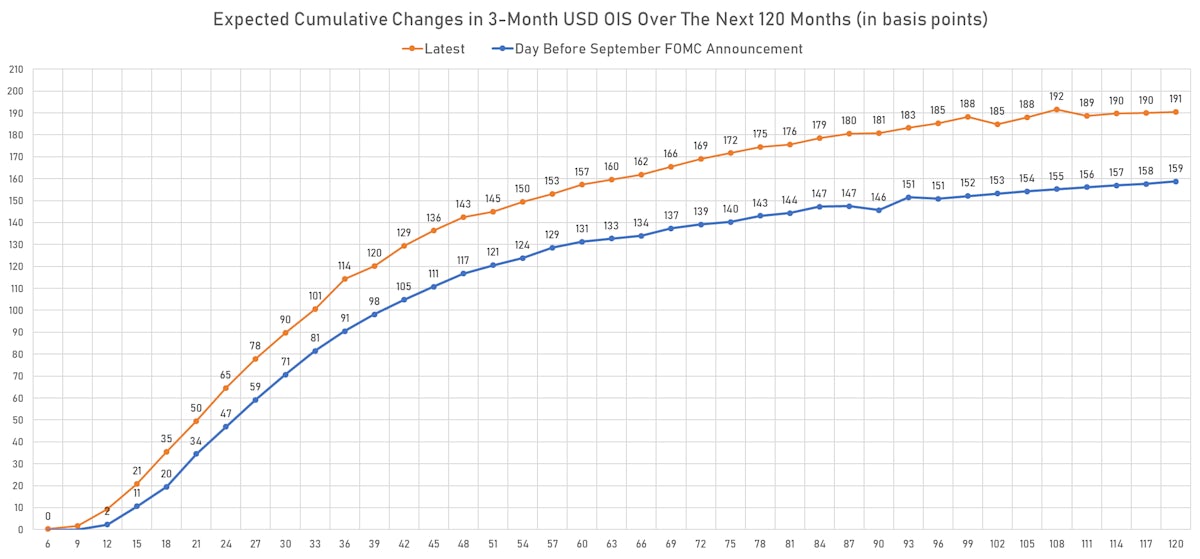

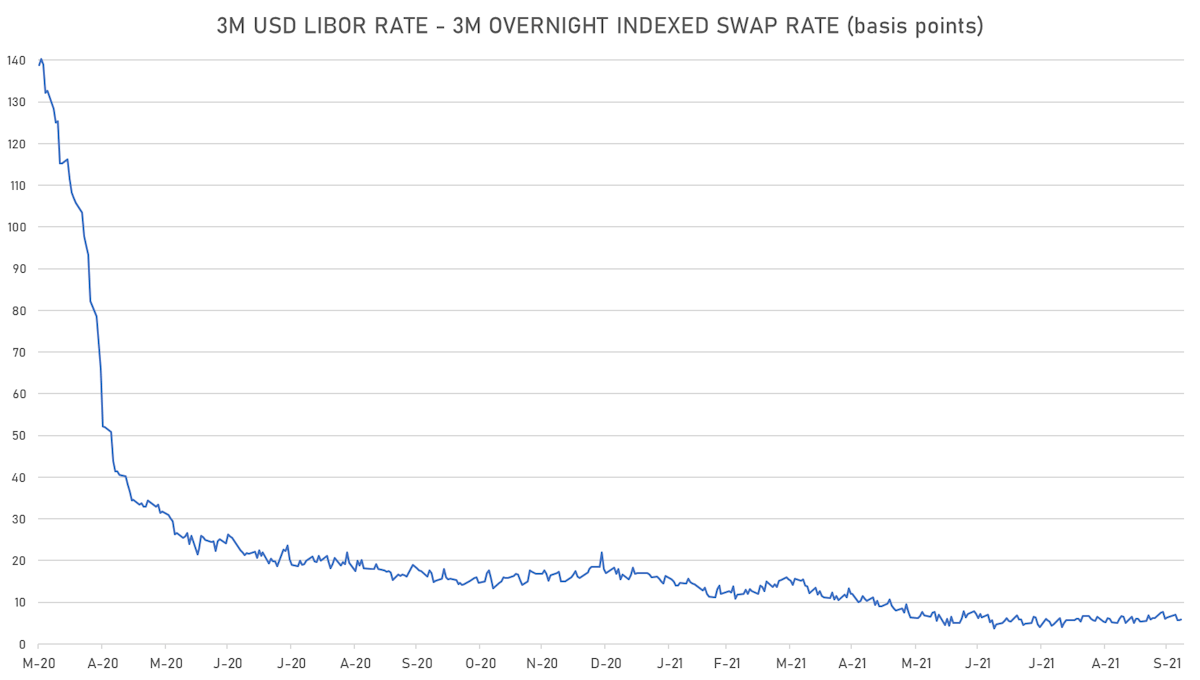

Implied Fed Hikes Derived From the 3-month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR unchanged at 0.1236%

- The treasury yield curve steepened, with the 1s10s spread widening 4.6 bp, now at 148.5 bp (YTD change: +68.1bp)

- 1Y: 0.0910% (up 0.3 bp)

- 2Y: 0.3095% (up 1.2 bp)

- 5Y: 1.0251% (up 3.7 bp)

- 7Y: 1.3630% (up 4.5 bp)

- 10Y: 1.5764% (up 4.9 bp)

- 30Y: 2.1284% (up 4.6 bp)

- US treasury curve spreads: 2s5s at 71.6bp (up 2.5bp today), 5s10s at 55.1bp (up 1.2bp today), 10s30s at 55.3bp (down -0.2bp)

- Treasuries butterfly spreads: 1s5s10s at -38.7bp (down -2.3bp), 5s10s30s at -0.2bp (down -1.9bp)

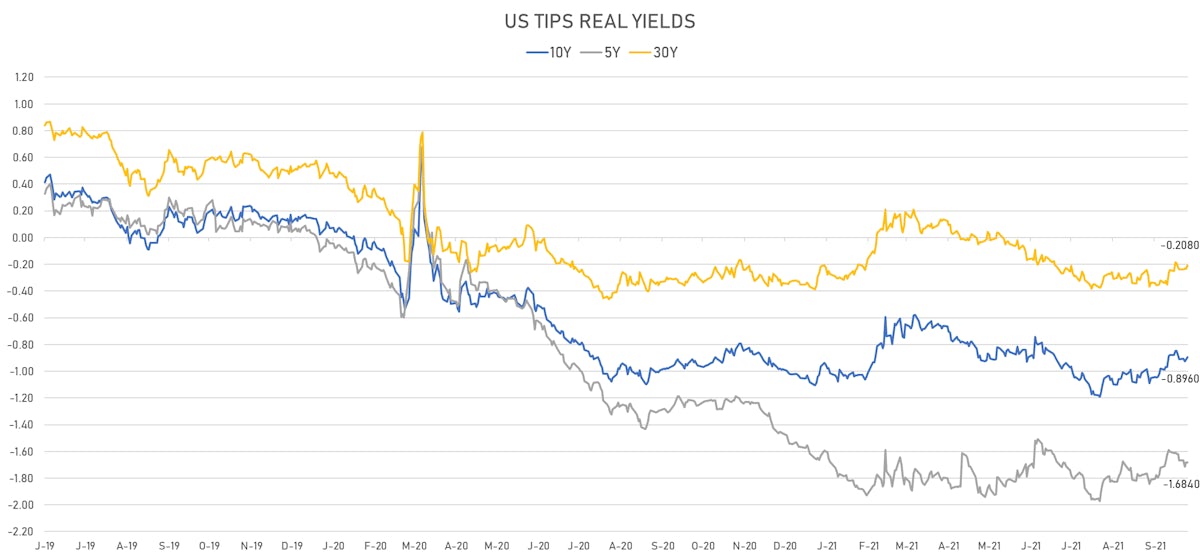

- US 5-Year TIPS Real Yield: -0.1 bp at -1.6840%; 10-Year TIPS Real Yield: +1.9 bp at -0.8960%; 30-Year TIPS Real Yield: +2.6 bp at -0.2080%

US MACRO RELEASES

- Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Sep 2021 (Challenger) at 17.90 k (vs 15.72 k prior)

- Jobless Claims, National, Continued for W 25 Sep (U.S. Dept. of Labor) at 2.71 Mln (vs 2.80 Mln prior), below consensus estimate of 2.78 Mln

- Jobless Claims, National, Initial for W 02 Oct (U.S. Dept. of Labor) at 326.00 k (vs 362.00 k prior), below consensus estimate of 348.00 k

- Jobless Claims, National, Initial, four week moving average for W 02 Oct (U.S. Dept. of Labor) at 344.00 k (vs 340.00 k prior)

- Consumer credit, total, Absolute change for Aug 2021 (FED, U.S.) at 14.38 Bln USD (vs 17.00 Bln USD prior), below consensus estimate of 17.50 Bln USD

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 21.0 bp by the end of 2022 (meaning the market prices 84.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 114.2 bp over the next 3 years (equivalent to 4.57 rate hikes)

- The 3-month Eurodollar zero curve prices in 137.3 bp over the next 3 years (equivalent to 5.49 rate hikes)

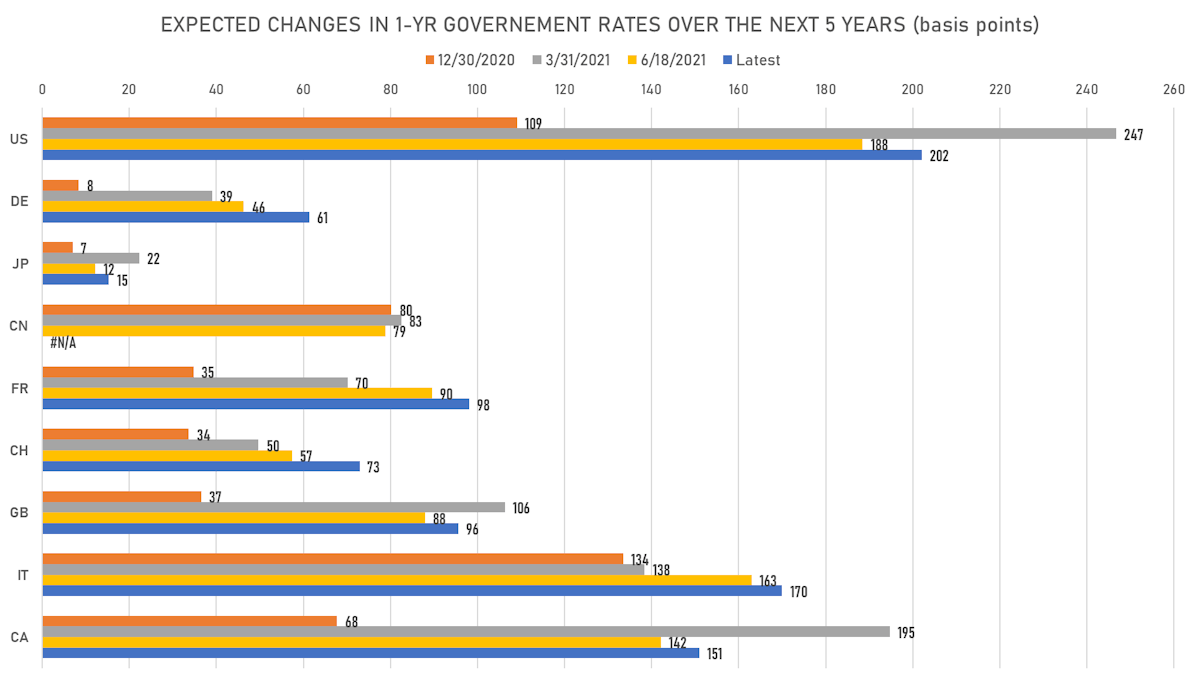

- 1-year US Treasury rate 5 years forward up 5.9 bp, now at 2.1307%, meaning that the 1-year Treasury rate is now expected to increase by 202.0 bp over the next 5 years (equivalent to 8.1 rate hikes)

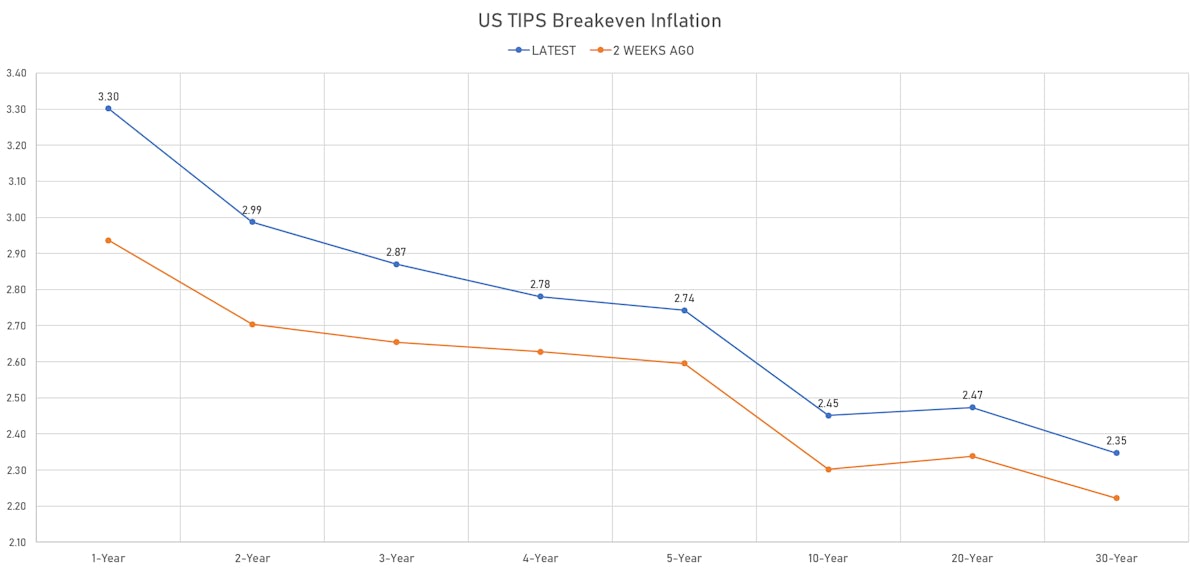

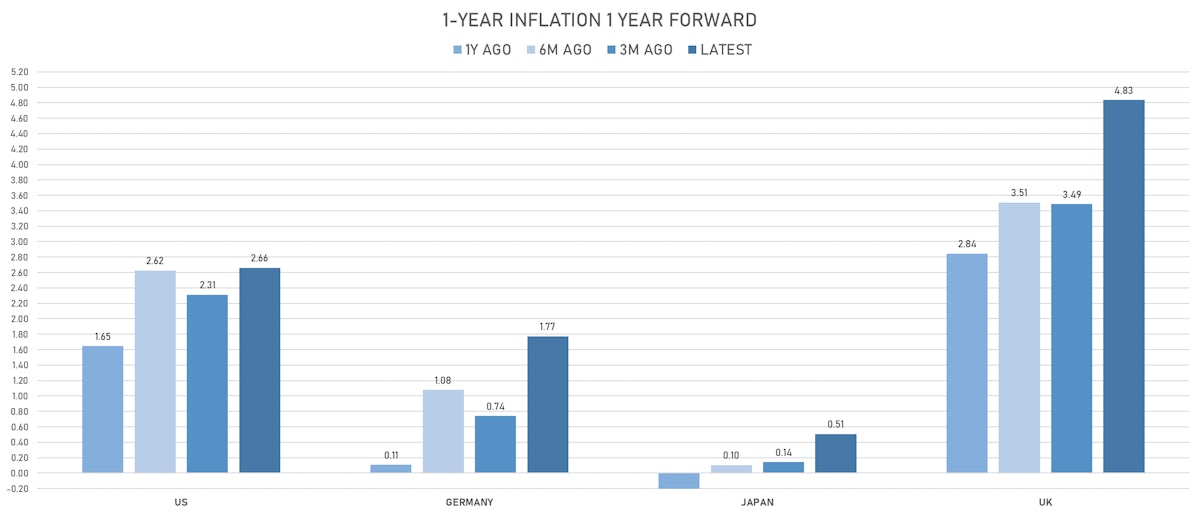

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.30% (up 5.0bp); 2Y at 2.99% (up 5.4bp); 5Y at 2.74% (up 4.3bp); 10Y at 2.45% (up 2.9bp); 30Y at 2.35% (up 2.0bp)

- 6-month spot US CPI swap up 3.1 bp to 3.589%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6840%, -0.1 bp today; 10Y at -0.8960%, +1.9 bp today; 30Y at -0.2080%, +2.6 bp today

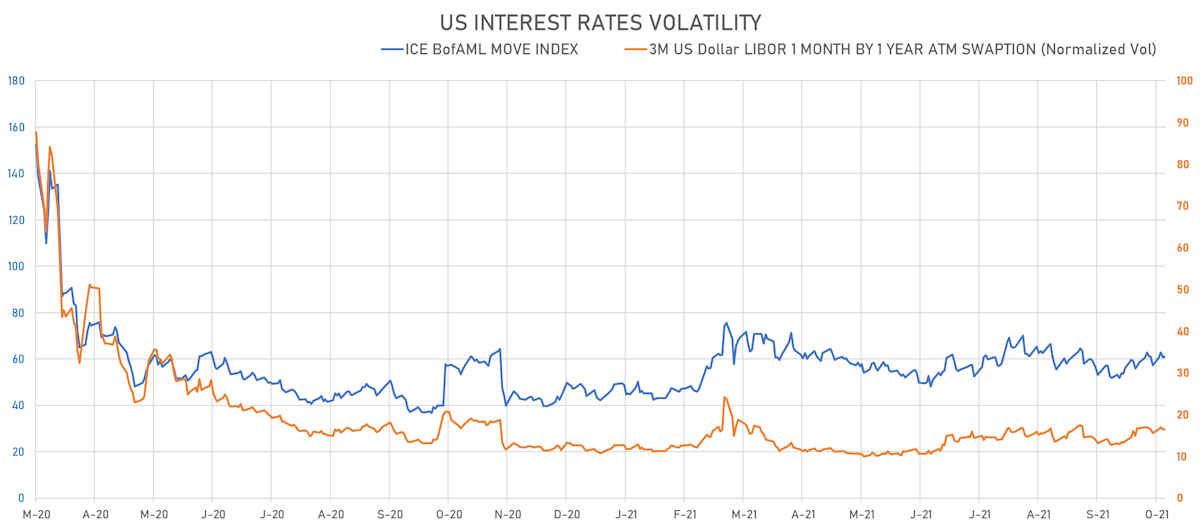

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 16.5%

- 3-Month LIBOR-OIS spread up 0.2 bp at 5.9 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.567% (down -1.1 bp); the German 1Y-10Y curve is 0.7 bp flatter at 48.7bp (YTD change: +33.4 bp)

- Japan 5Y: -0.088% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 19.5bp (YTD change: +5.6 bp)

- China 5Y: 2.697% (down -1.1 bp); the Chinese 1Y-10Y curve is 3.6 bp steeper at 57.9bp (YTD change: +11.5 bp)

- Switzerland 5Y: -0.488% (down -0.7 bp); the Swiss 1Y-10Y curve is 0.9 bp flatter at 56.5bp (YTD change: +29.1 bp)