Rates

US Rates Rise After NFP Miss, Driven Up Mostly By Inflation Breakevens

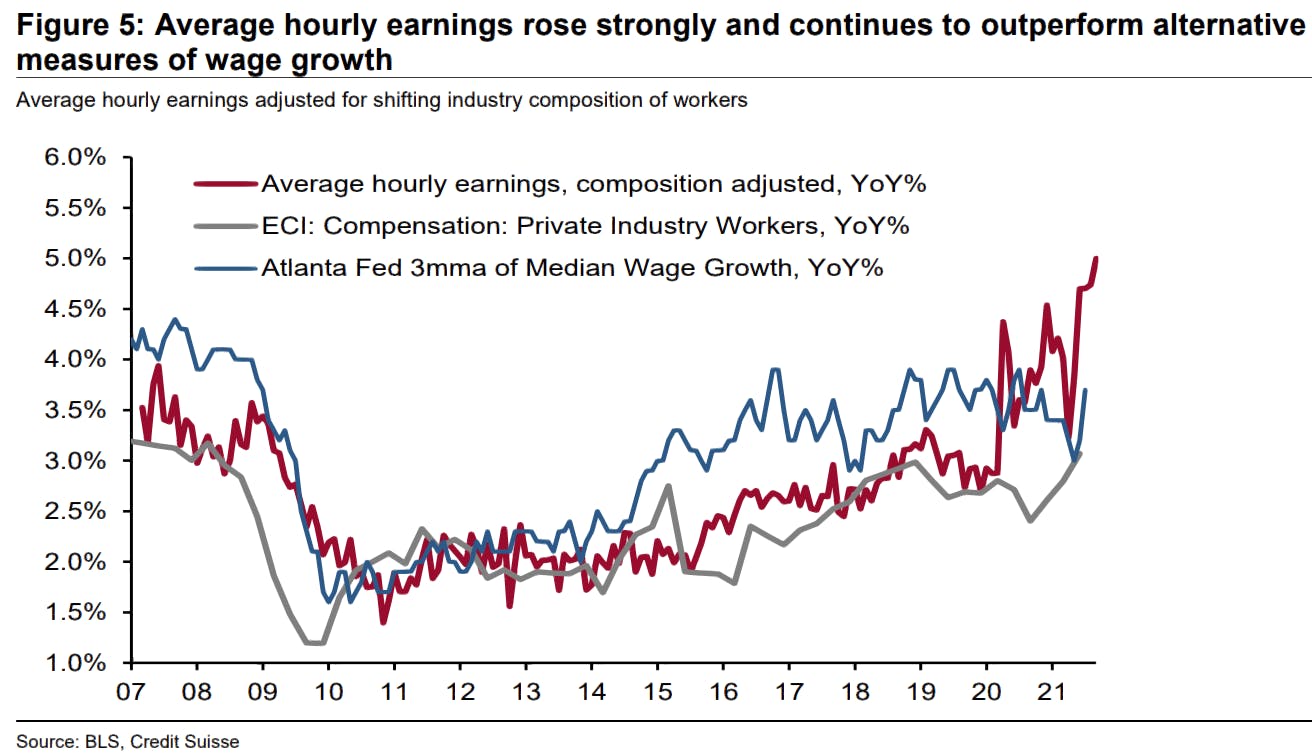

As bad as the headline numbers are, we think the latest NFP keeps the Fed on track for 3 Nov. taper announcement: full employment is widely expected to come back more slowly, but wage growth is accelerating and the Fed is watching the possible inflationary consequences very closely

Published ET

Short-Term Inflation Swap 2 Years & 4 Years Forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

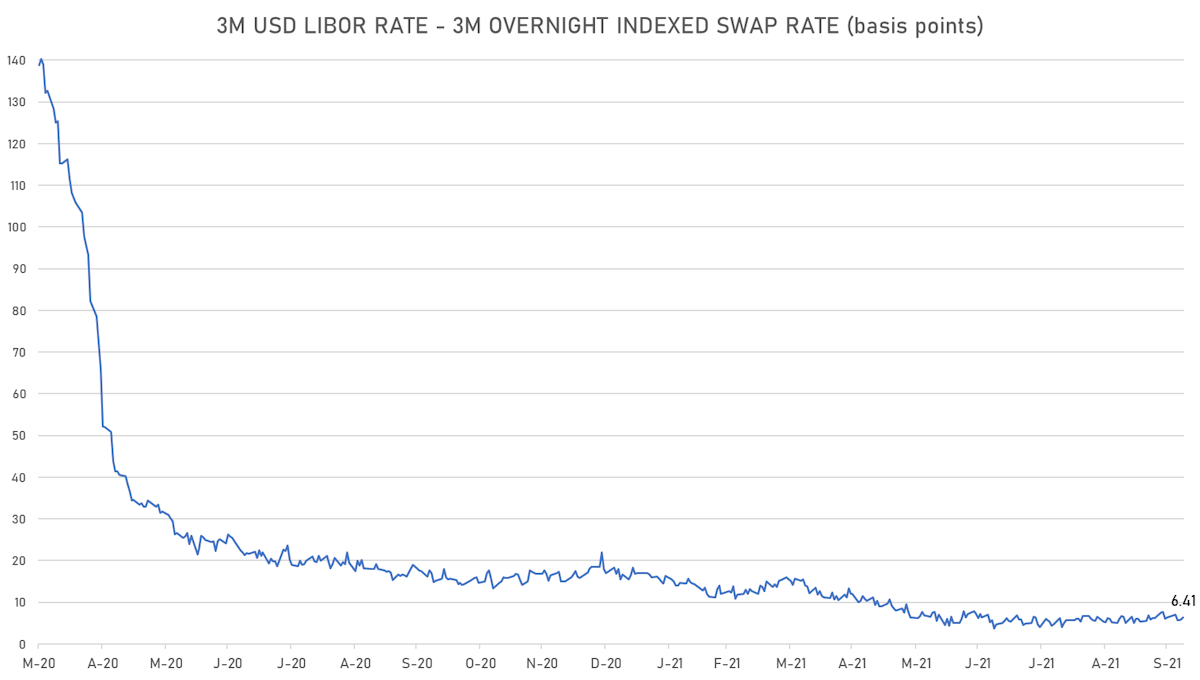

- Money markets: 3-Month USD LIBOR -0.25bp today, now at 0.1211%; 3-Month SOFR OIS -0.1bp today, now at 0.0520%

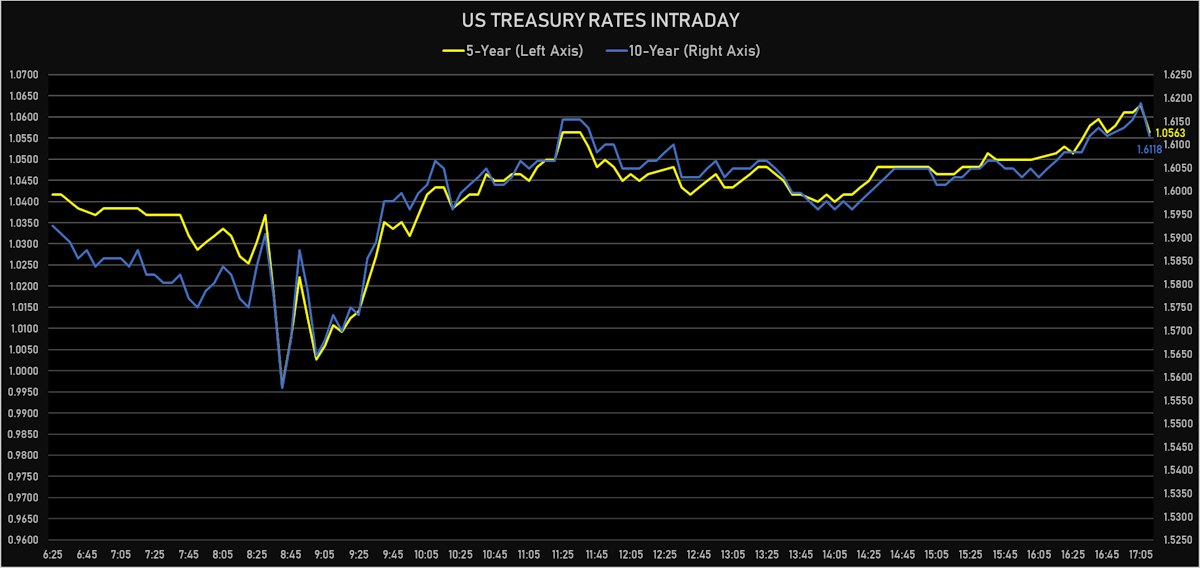

- The treasury yield curve steepened, with the 1s10s spread widening 3.3 bp, now at 151.8 bp (YTD change: +71.3bp)

- 1Y: 0.0940% (up 0.3 bp)

- 2Y: 0.3198% (up 1.0 bp)

- 5Y: 1.0563% (up 3.1 bp)

- 7Y: 1.3940% (up 3.1 bp)

- 10Y: 1.6118% (up 3.5 bp)

- 30Y: 2.1655% (up 3.7 bp)

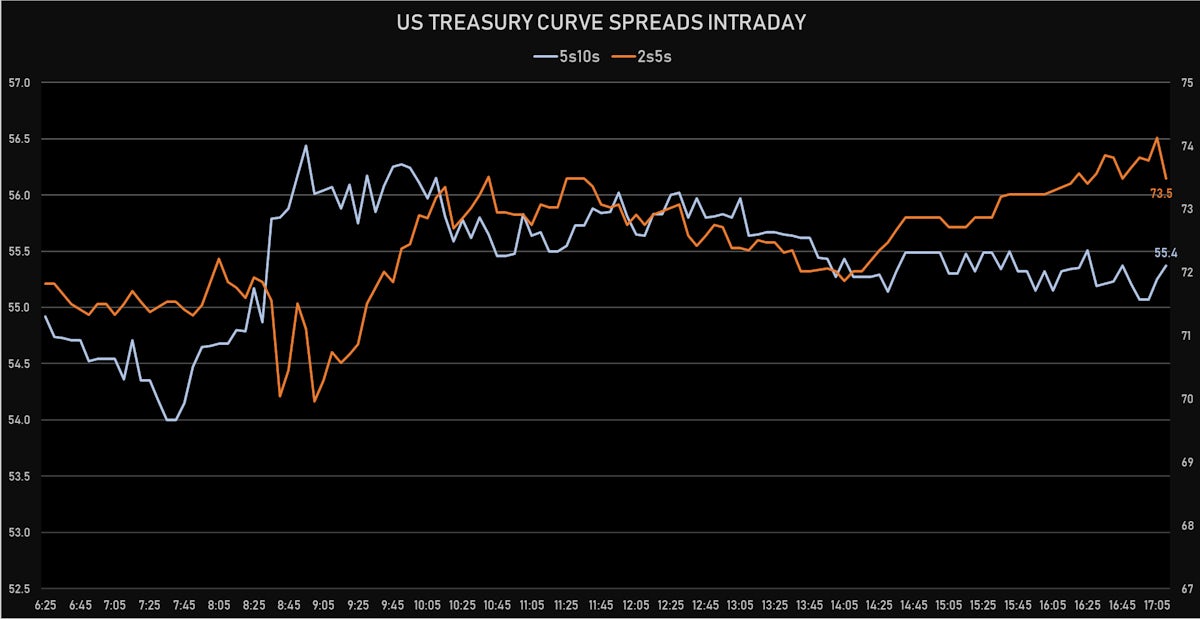

- US treasury curve spreads: 2s5s at 73.7bp (up 2.1bp today), 5s10s at 55.5bp (up 0.4bp today), 10s30s at 55.4bp (up 0.1bp today)

- Treasuries butterfly spreads: 1s5s10s at -41.6bp (down -3.0bp), 5s10s30s at -0.5bp (down -0.3bp)

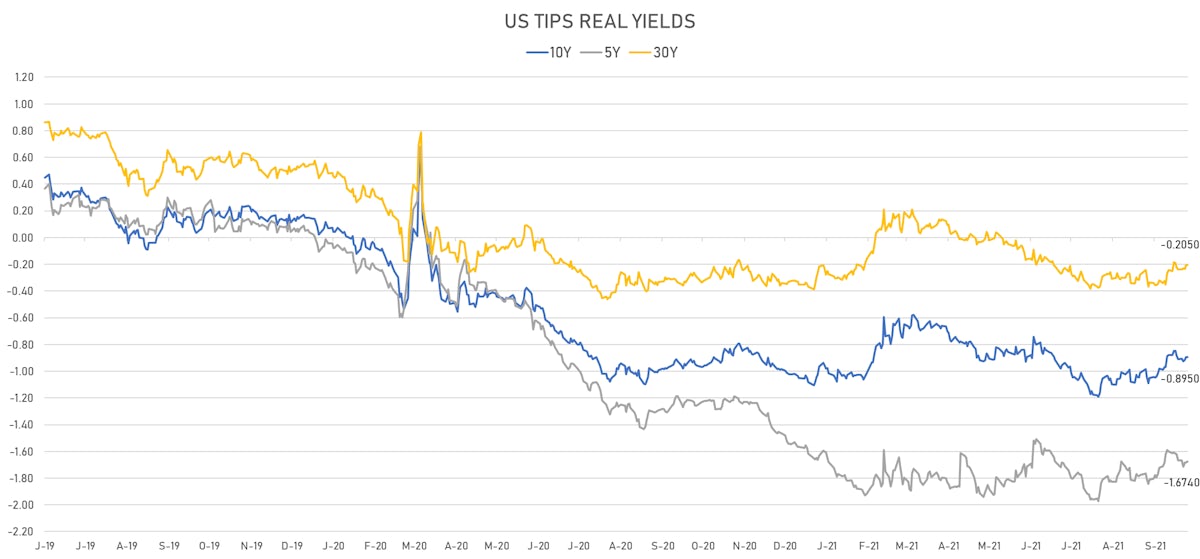

- US 5-Year TIPS Real Yield: +1.0 bp at -1.6740%; 10-Year TIPS Real Yield: +0.1 bp at -0.8950%; 30-Year TIPS Real Yield: +0.3 bp at -0.2050%

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for Sep 2021 (BLS, U.S Dep. Of Lab) at 4.60 % (vs 4.30 % prior), in line with Refinitiv consensus

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 0.60 % prior), above consensus estimate of 0.40 %

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Sep 2021 (BLS, U.S Dep. Of Lab) at 34.80 hrs (vs 34.70 hrs prior), above consensus estimate of 34.70 hrs

- Unemployment, Rate, Special (U-6) for Sep 2021 (BLS, U.S Dep. Of Lab) at 8.50 % (vs 8.80 % prior)

- Civilian participation, total for Sep 2021 (BLS, U.S Dep. Of Lab) at 61.60 % (vs 61.70 % prior)

- Nonfarm payroll, total private, Absolute change for Sep 2021 (BLS, U.S Dep. Of Lab) at 317.00 k (vs 243.00 k prior), below consensus estimate of 455.00 k

- Nonfarm payroll, total, Absolute change for Sep 2021 (BLS, U.S Dep. Of Lab) at 194.00 k (vs 235.00 k prior), below consensus estimate of 500.00 k

- Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for Sep 2021 (BLS, U.S Dep. Of Lab) at 26.00 k (vs 37.00 k prior), above consensus estimate of 25.00 k

- Nonfarm payroll, service-producing, government, Absolute change for Sep 2021 (BLS, U.S Dep. Of Lab) at -123.00 k (vs -8.00 k prior)

- Unemployment, Rate for Sep 2021 (BLS, U.S Dep. Of Lab) at 4.80 % (vs 5.20 % prior), below consensus estimate of 5.10 %

- Wholesale Trade, Change P/P for Aug 2021 (U.S. Census Bureau) at -1.10 % (vs 2.00 % prior), below consensus estimate of 1.00 %

- Wholesale Inventories, Change P/P for Aug 2021 (U.S. Census Bureau) at 1.20 % (vs 1.20 % prior), in line with Refinitiv consensus

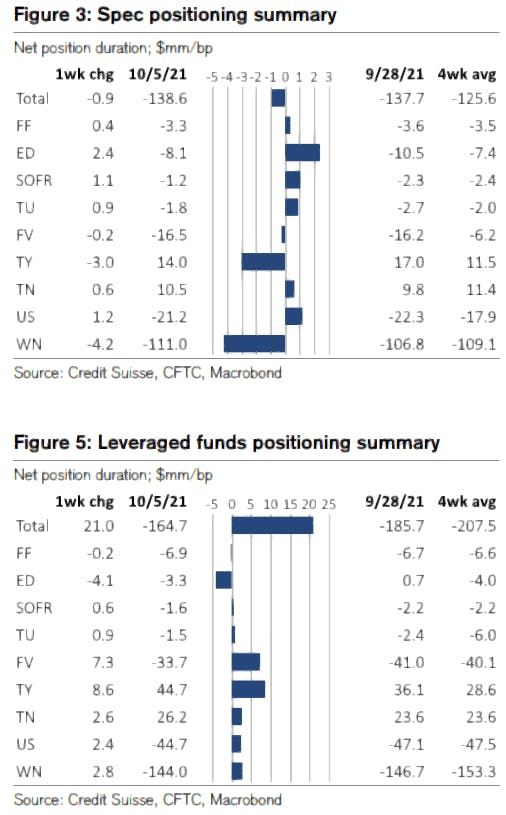

WEEKLY CFTC NET DURATION POSITIONING

US FORWARD RATES

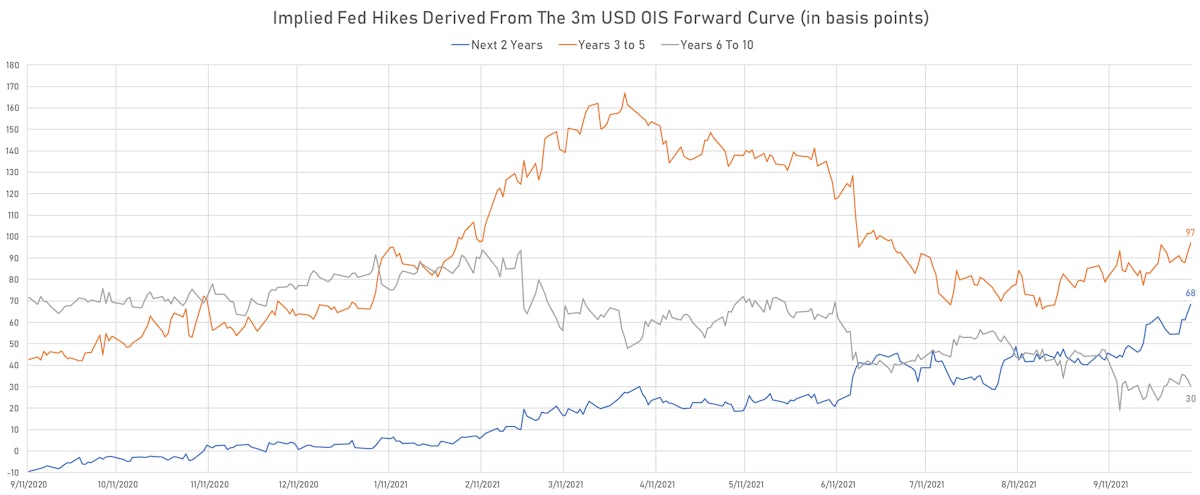

- 3-month Eurodollar future (EDU2) expected hike of 22.7 bp by the end of 2022 (meaning the market prices 90.8% chance of a 25bp hike by end of 2022)

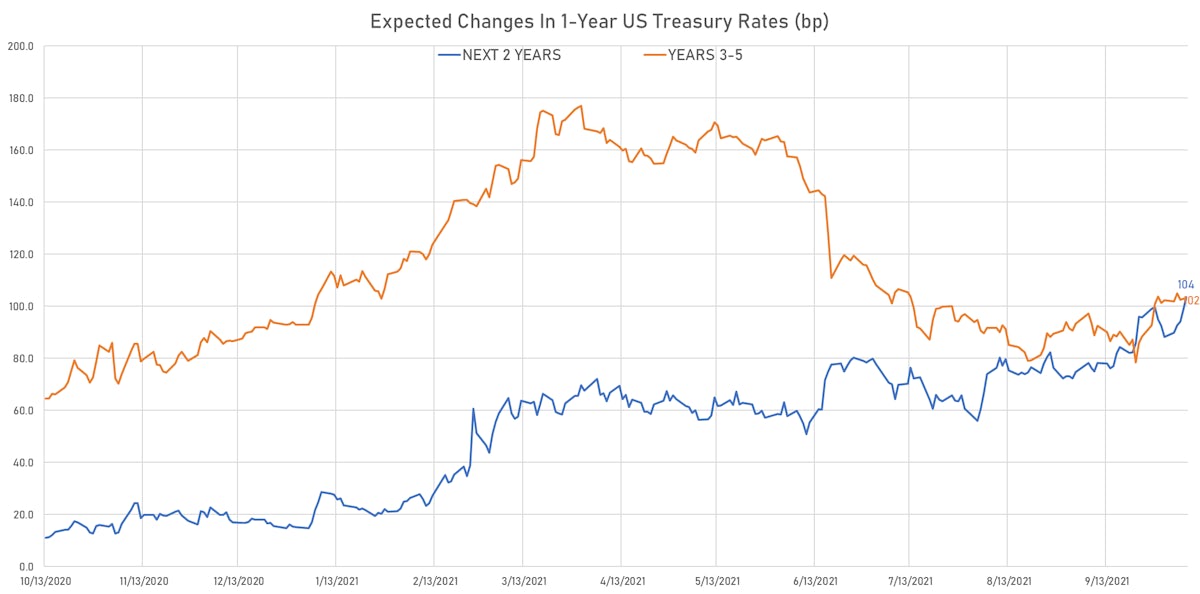

- The 3-month USD OIS forward curve prices in 117.8 bp over the next 3 years (equivalent to 4.71 rate hikes)

- The 3-month Eurodollar zero curve prices in 139.6 bp over the next 3 years (equivalent to 5.58 rate hikes)

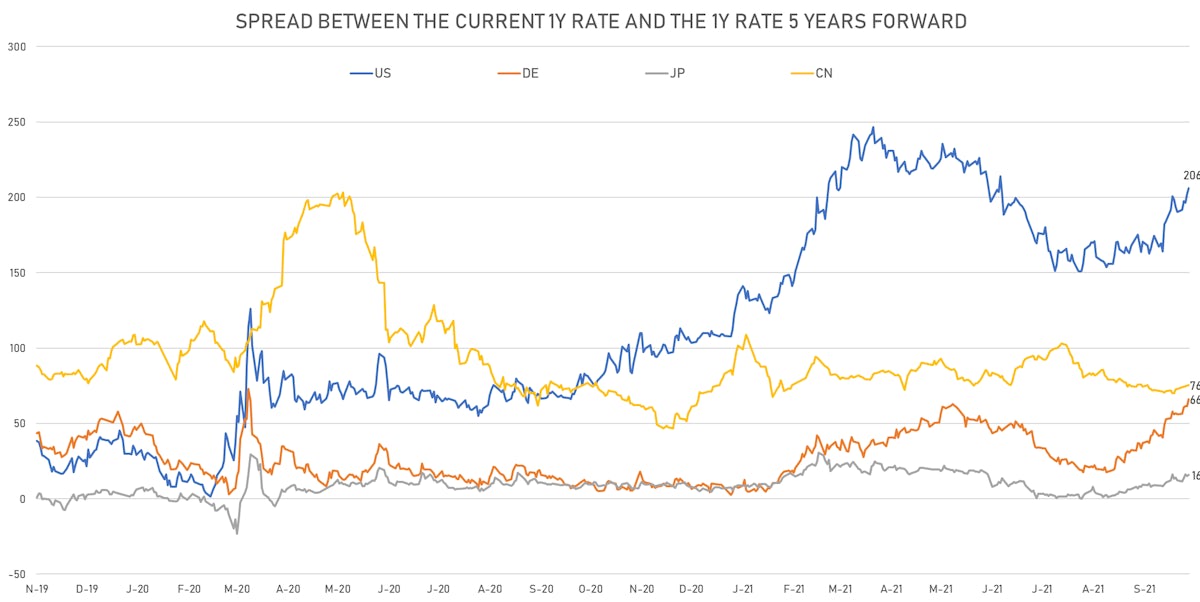

- 1-year US Treasury rate 5 years forward up 4.1 bp, now at 2.1719%, meaning that the 1-year Treasury rate is now expected to increase by 206.0 bp over the next 5 years (equivalent to 8.2 rate hikes)

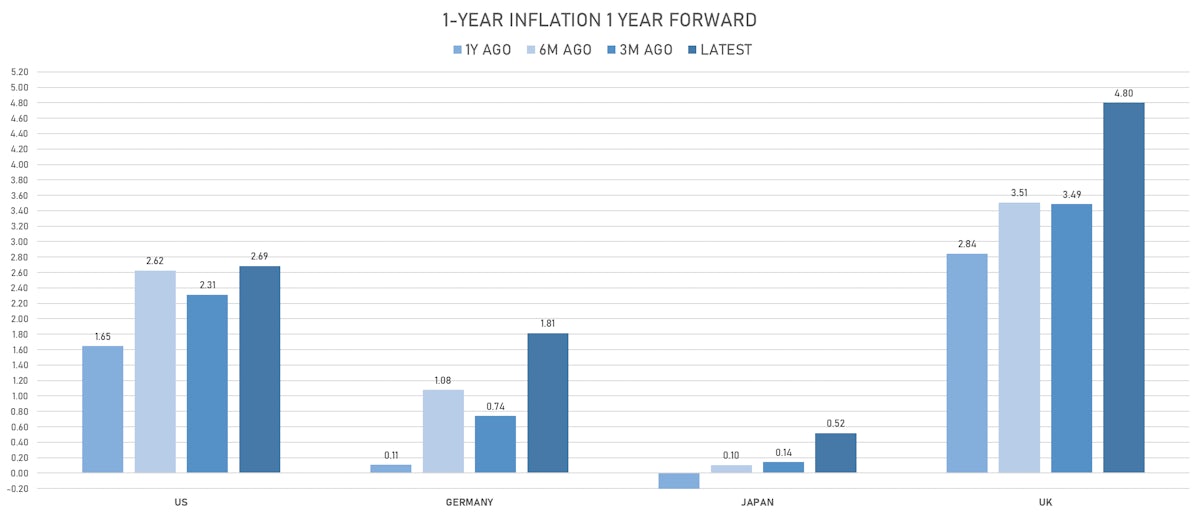

US INFLATION & REAL RATES

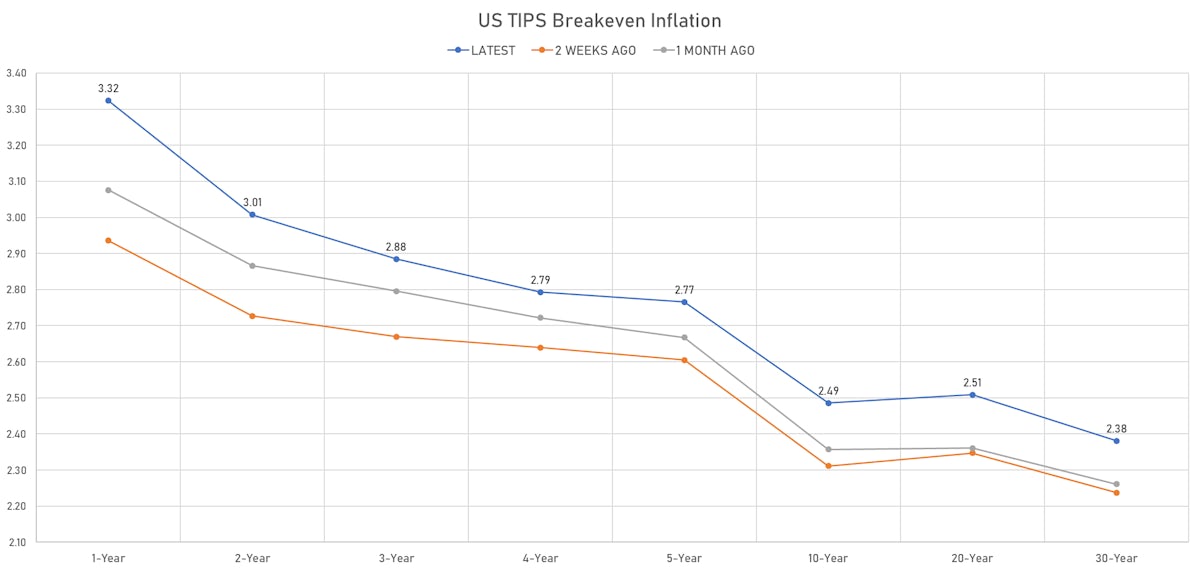

- TIPS 1Y breakeven inflation at 3.32% (up 2.2bp); 2Y at 3.01% (up 2.1bp); 5Y at 2.77% (up 2.3bp); 10Y at 2.49% (up 3.5bp); 30Y at 2.38% (up 3.4bp)

- 6-month spot US CPI swap up 2.9 bp to 3.619%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6740%, +1.0 bp today; 10Y at -0.8950%, +0.1 bp today; 30Y at -0.2050%, +0.3 bp today

RATES VOLATILITY & LIQUIDITY

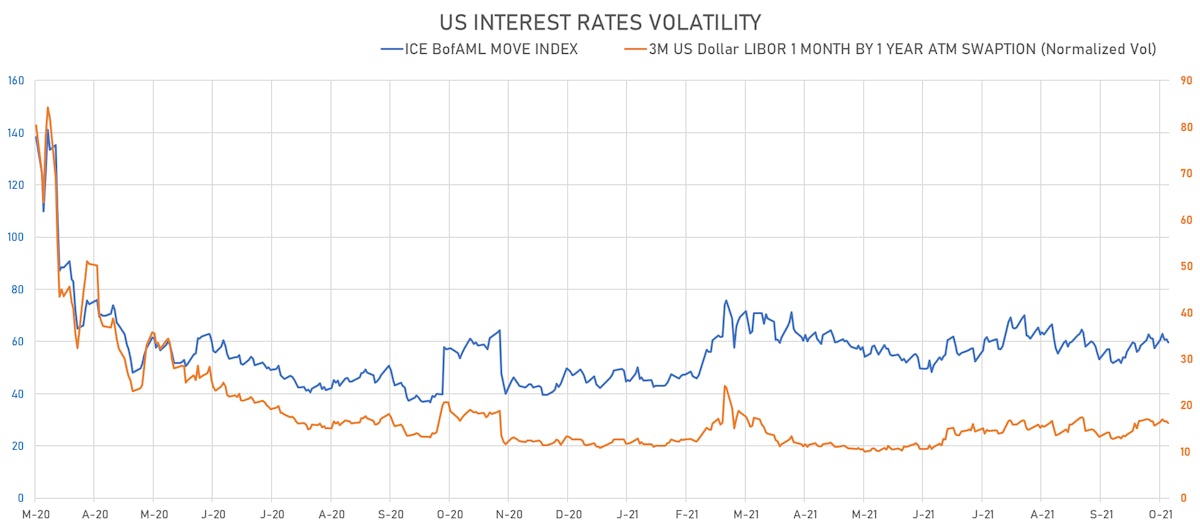

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.3% at 16.2%

- 3-Month LIBOR-OIS spread up 0.5 bp at 6.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.532% (up 3.3 bp); the German 1Y-10Y curve is 3.6 bp steeper at 52.0bp (YTD change: +37.0 bp)

- Japan 5Y: -0.072% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 19.8bp (YTD change: +5.8 bp)

- China 5Y: 2.723% (up 2.6 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 60.3bp (YTD change: +13.5 bp)

- Switzerland 5Y: -0.458% (up 3.0 bp); the Swiss 1Y-10Y curve is 5.6 bp steeper at 61.8bp (YTD change: +34.4 bp)