Rates

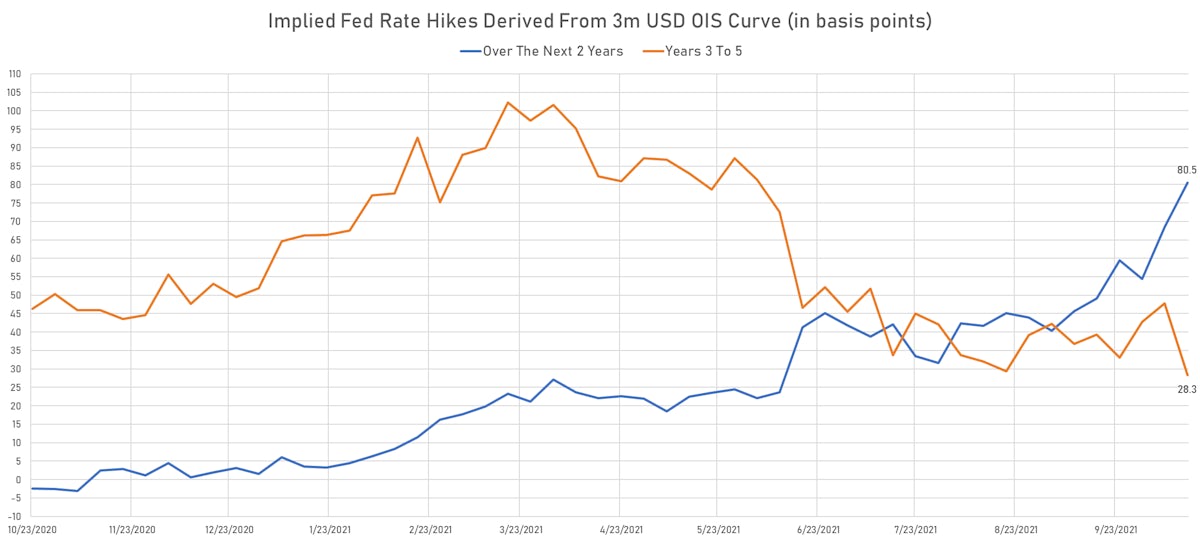

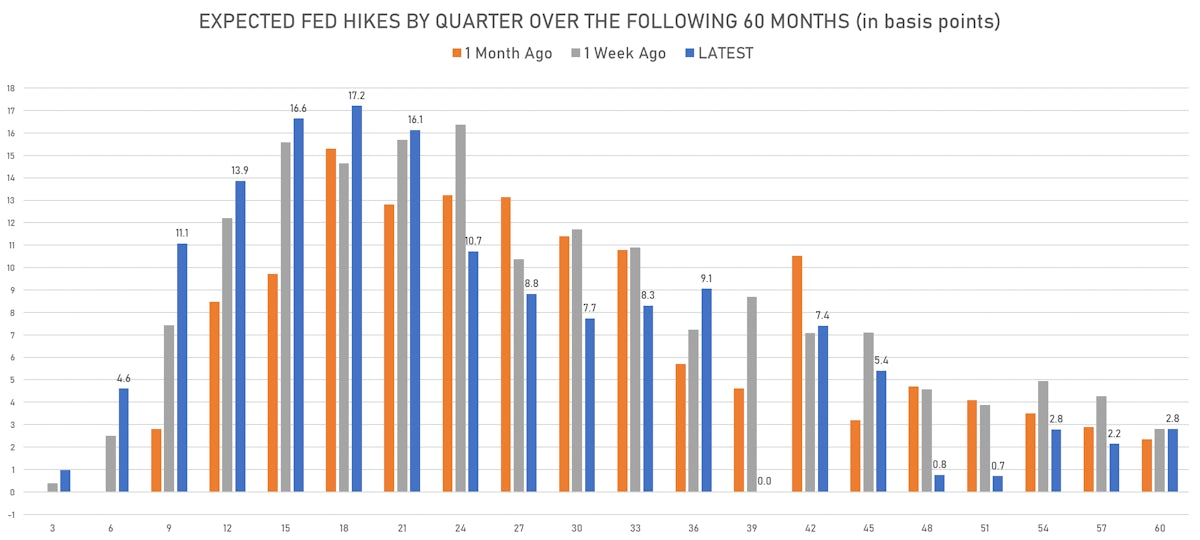

Short Forward Rates Rise Further, With Fed Now Expected To Hike Rates More Than Once In 2022

Long rates have been falling again, and with the short duration positioning of real money managers (at highest level since 2014), the pain trade is definitely towards lower long rates

Published ET

Fed Hikes Priced Into The 3m USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.15bp today, now at 0.1223%; 3-Month SOFR OIS unchanged at 0.0520%

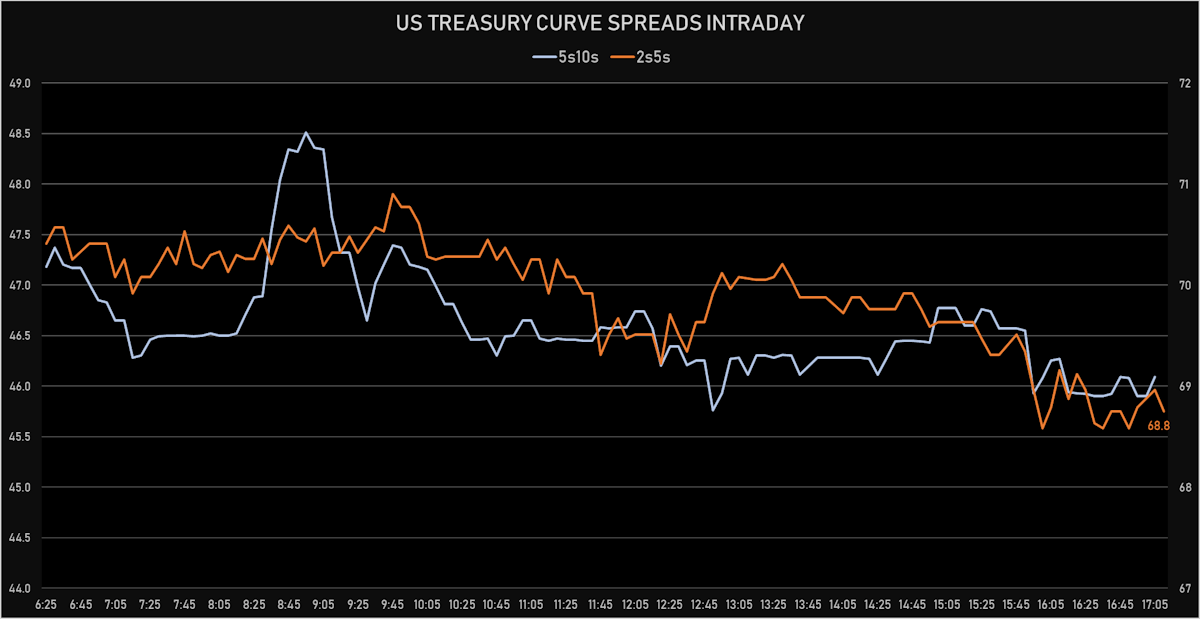

- The treasury yield curve flattened, with the 1s10s spread tightening -2.6 bp, now at 141.7 bp (YTD change: +61.3bp)

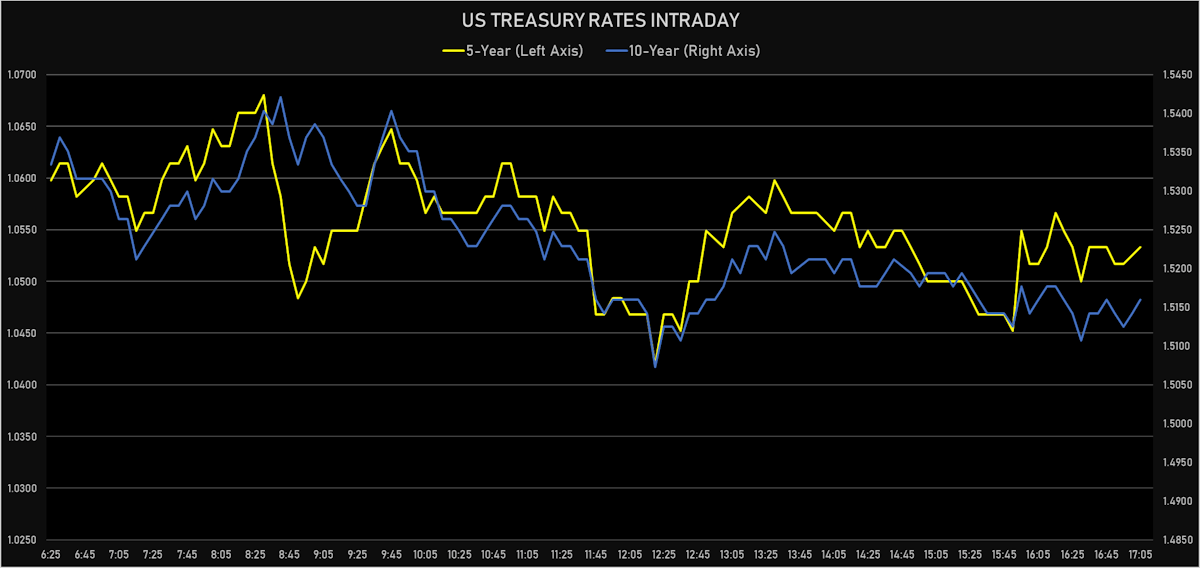

- 1Y: 0.0990% (unchanged)

- 2Y: 0.3642% (up 0.4 bp)

- 5Y: 1.0533% (down 2.1 bp)

- 7Y: 1.3420% (down 2.6 bp)

- 10Y: 1.5160% (down 2.6 bp)

- 30Y: 2.0202% (down 1.3 bp)

- US treasury curve spreads: 2s5s at 68.9bp (down -2.5bp), 5s10s at 46.3bp (down -0.3bp), 10s30s at 50.4bp (up 1.3bp today)

- Treasuries butterfly spreads: 1s5s10s at -50.1bp (up 1.8bp today), 5s10s30s at 3.7bp (up 1.5bp)

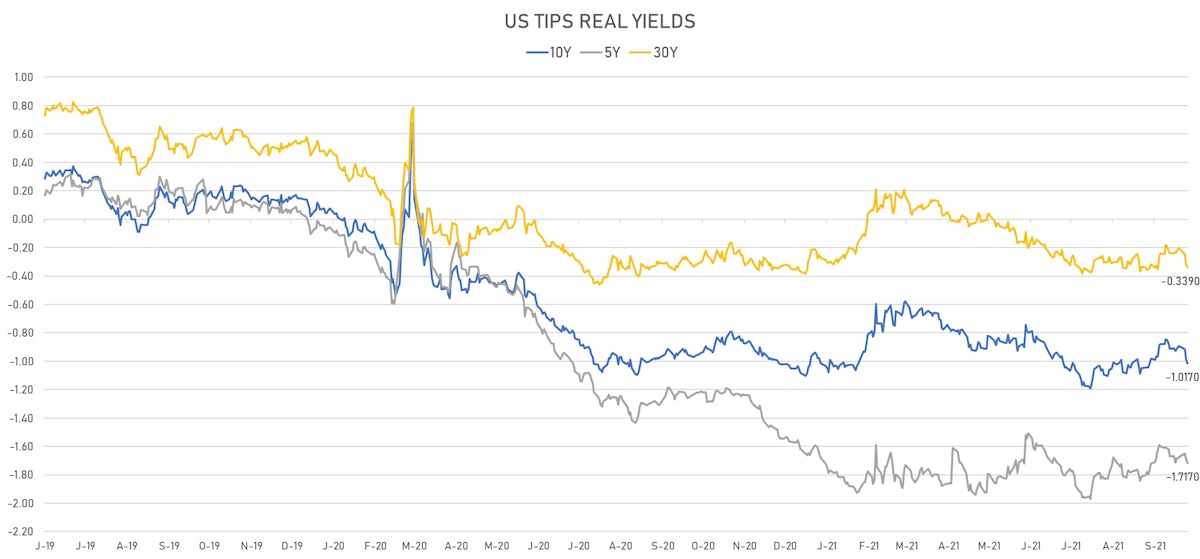

- US 5-Year TIPS Real Yield: -2.8 bp at -1.7170%; 10-Year TIPS Real Yield: -3.6 bp at -1.0170%; 30-Year TIPS Real Yield: -2.0 bp at -0.3390%

US MACRO RELEASES

- Producer Prices, Final demand less foods and energy, Change P/P for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.20 % (vs 0.60 % prior), below consensus estimate of 0.50 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Sep 2021 (BLS, U.S Dep. Of Lab) at 6.80 % (vs 6.70 % prior), below consensus estimate of 7.10 %

- PPI ex Food/Energy/Trade MM, Change P/P for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.10 % (vs 0.30 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Sep 2021 (BLS, U.S Dep. Of Lab) at 5.90 % (vs 6.30 % prior)

- Producer Prices, Final demand, Change P/P for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.50 % (vs 0.70 % prior), below consensus estimate of 0.60 %

- Jobless Claims, National, Initial, four week moving average for W 09 Oct (U.S. Dept. of Labor) at 334.25 k (vs 344.00 k prior)

- Jobless Claims, National, Initial for W 09 Oct (U.S. Dept. of Labor) at 293.00 k (vs 326.00 k prior), below consensus estimate of 319.00 k

- Producer Prices, Final demand, Change Y/Y for Sep 2021 (BLS, U.S Dep. Of Lab) at 8.60 % (vs 8.30 % prior), below consensus estimate of 8.70 %

- Jobless Claims, National, Continued for W 02 Oct (U.S. Dept. of Labor) at 2.59 Mln (vs 2.71 Mln prior), below consensus estimate of 2.68 Mln

US FORWARD RATES

- 3-month Eurodollar futures (EDU2) price in 30.0 bp of Fed hikes by the end of 2022

- 1-month USD LIBOR FRAs imply 36.9 bp hike by the end of 2022, meaning that the FRA market expects 1.5 full hike by then

- The 3-month USD OIS forward curve prices in 116.1 bp over the next 3 years (equivalent to 4.64 rate hikes)

- The 3-month Eurodollar zero curve prices in 138.7 bp over the next 3 years (equivalent to 5.55 rate hikes)

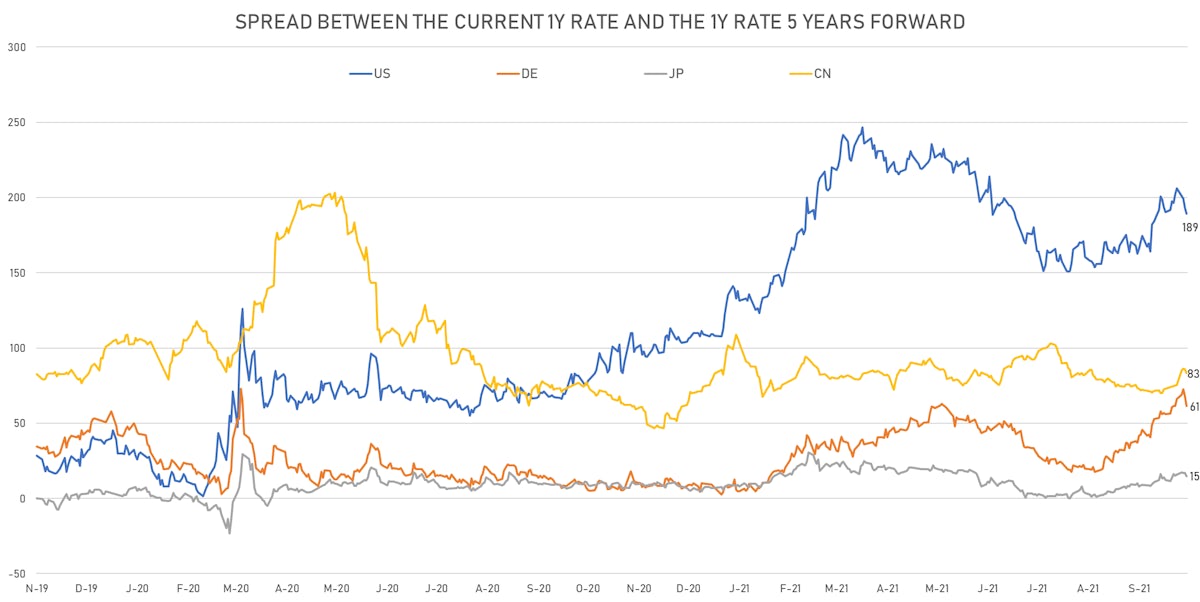

- 1-year US Treasury rate 5 years forward down 3.8 bp, now at 2.0166%, meaning that the 1-year Treasury rate is now expected to increase by 189.4 bp over the next 5 years (equivalent to 7.6 rate hikes)

US INFLATION & REAL RATES

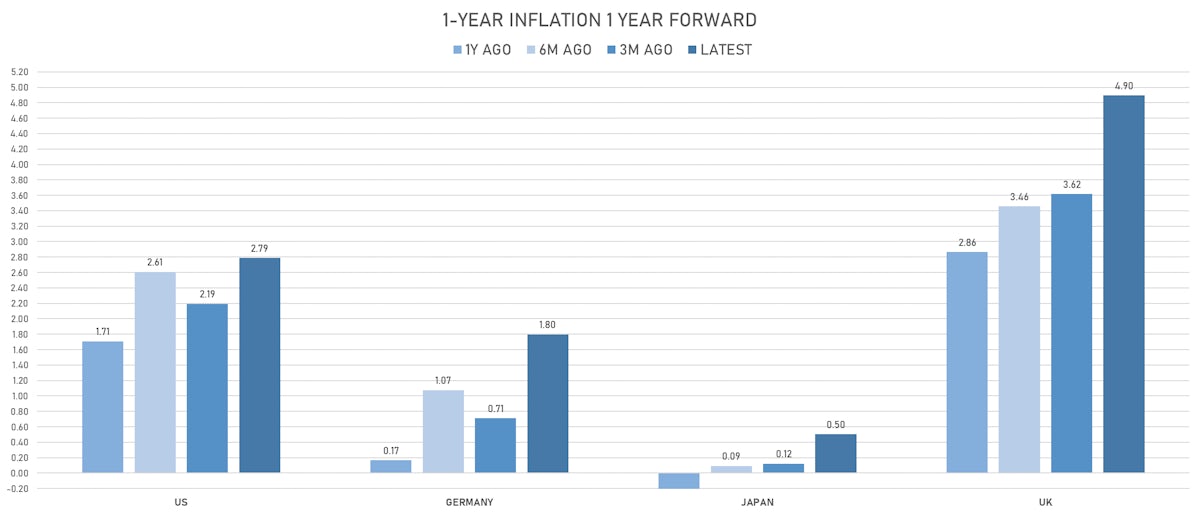

- TIPS 1Y breakeven inflation at 3.50% (up 4.2bp); 2Y at 3.15% (up 5.6bp); 5Y at 2.81% (up 0.8bp); 10Y at 2.51% (up 1.0bp); 30Y at 2.37% (up 0.7bp)

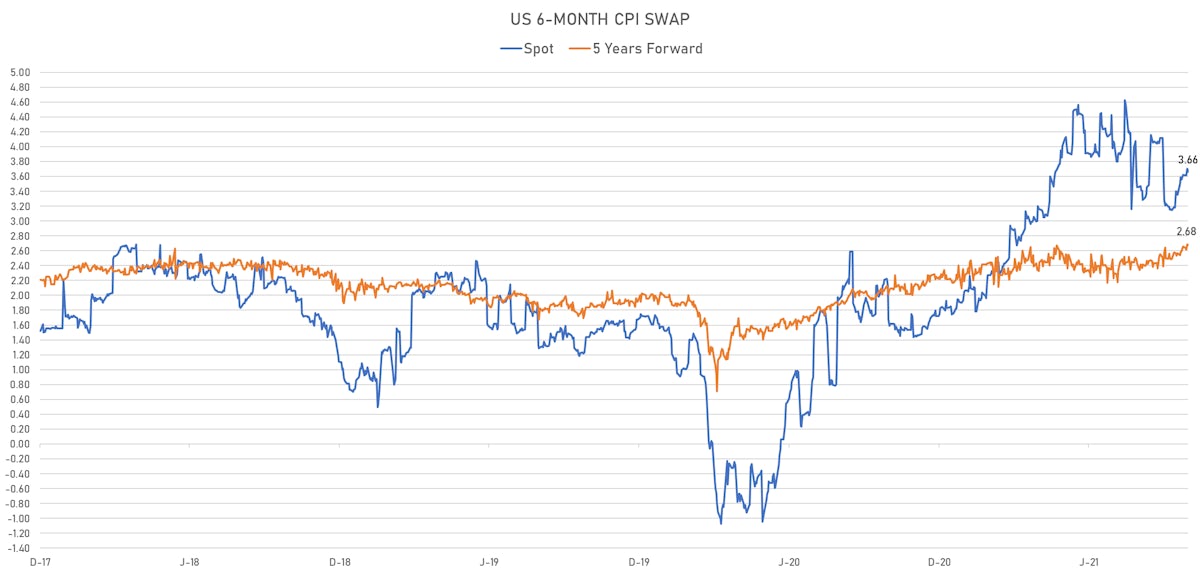

- 6-month spot US CPI swap down -4.0 bp to 3.665%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7170%, -2.8 bp today; 10Y at -1.0170%, -3.6 bp today; 30Y at -0.3390%, -2.0 bp today

RATES VOLATILITY & LIQUIDITY

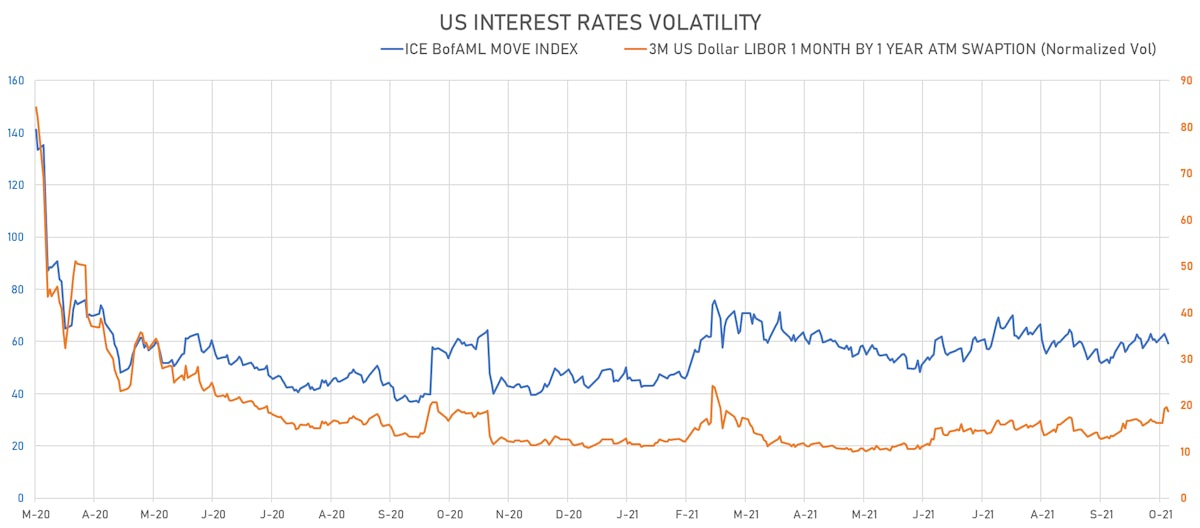

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.9% at 18.7%

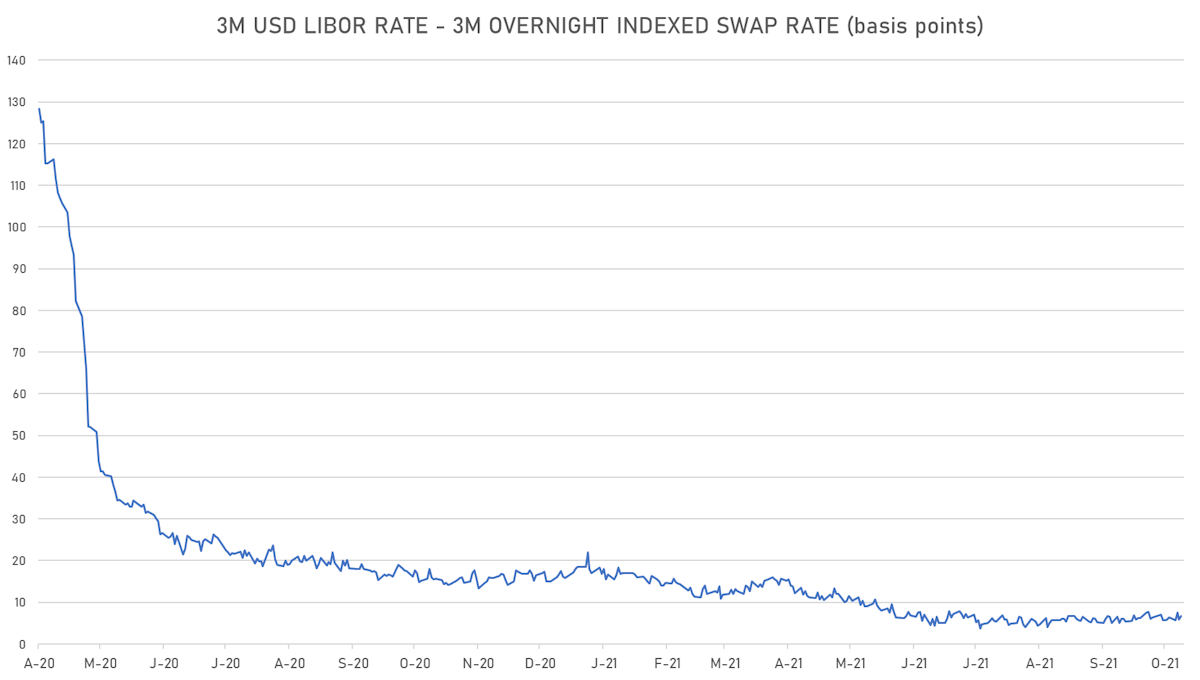

- 3-Month LIBOR-OIS spread up 0.8 bp at 6.6 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.539% (down -5.1 bp); the German 1Y-10Y curve is 5.2 bp flatter at 48.9bp (YTD change: +34.4 bp)

- Japan 5Y: -0.072% (down -0.1 bp); the Japanese 1Y-10Y curve is 1.1 bp flatter at 19.8bp (YTD change: +5.4 bp)

- China 5Y: 2.805% (up 0.2 bp); the Chinese 1Y-10Y curve is 0.2 bp flatter at 66.5bp (YTD change: +20.1 bp)

- Switzerland 5Y: -0.468% (down -2.5 bp); the Swiss 1Y-10Y curve is 5.3 bp steeper at 62.4bp (YTD change: +37.9 bp)