Rates

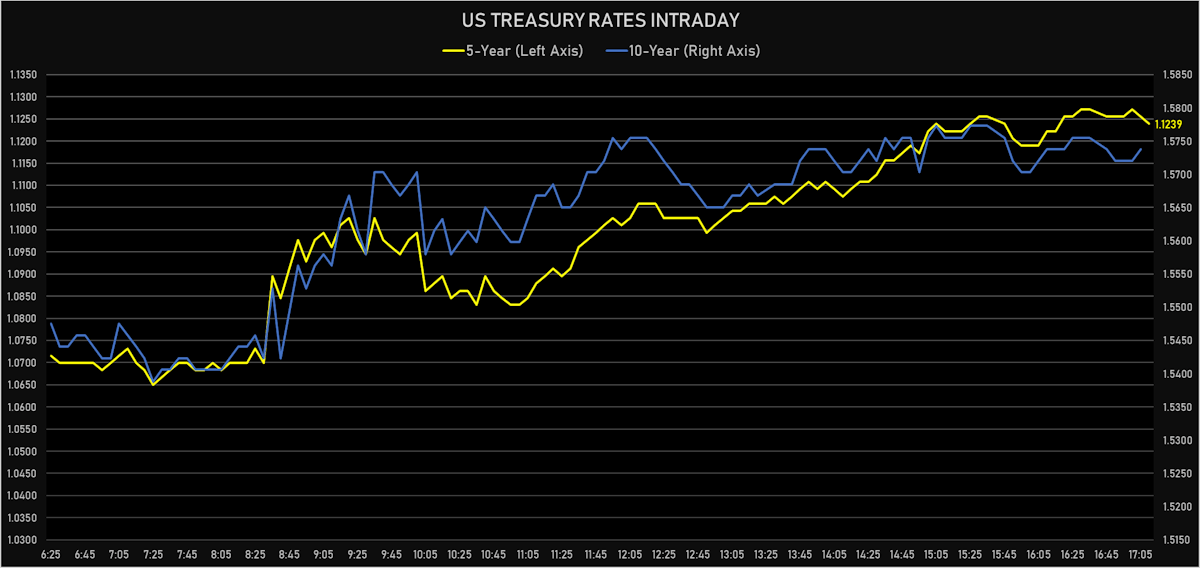

Strong Retail Sales Lift Rates Across The Treasury Curve, With The 5Y Closing At Highest Level Since Feb 2020

With Covid fears out of the way, macro risks are now mostly about inflation and policy errors, with major central banks potentially raising rates too soon, too fast (looking at the BOE for a proof of concept)

Published ET

US Treasuries Butterfly Spreads Showing The Front-Loaded Rises In Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

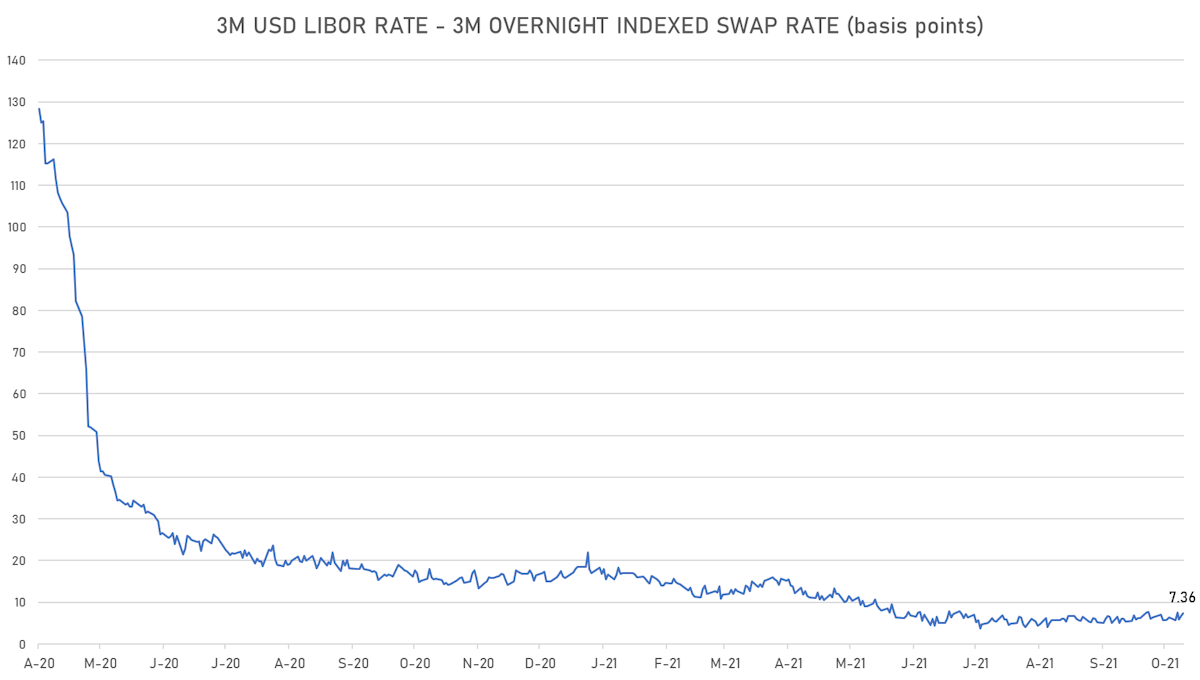

- 3-Month USD LIBOR +0.13bp today, now at 0.1236%; 3-Month SOFR OIS +0.1bp today, now at 0.0520%

- The treasury yield curve steepened, with the 1s10s spread widening 5.0 bp, now at 147.8 bp (YTD change: +67.3bp)

- 1Y: 0.0960% (up 0.8 bp)

- 2Y: 0.3949% (up 3.1 bp)

- 5Y: 1.1239% (up 7.1 bp)

- 7Y: 1.4110% (up 6.9 bp)

- 10Y: 1.5738% (up 5.8 bp)

- 30Y: 2.0456% (up 2.5 bp)

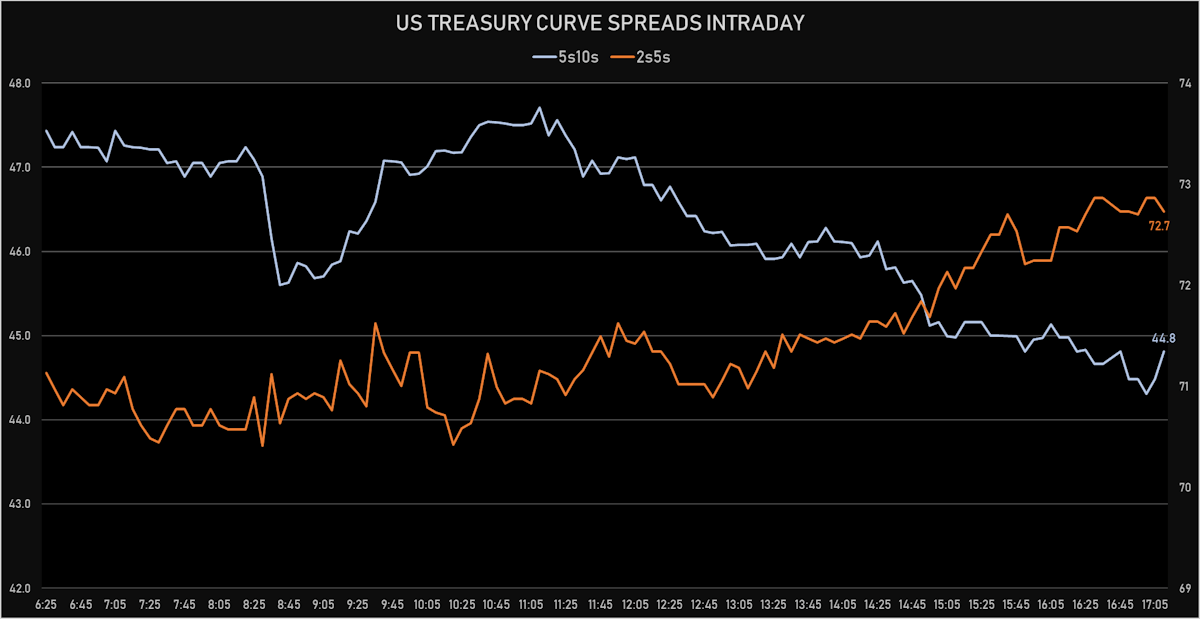

- US treasury curve spreads: 2s5s at 72.9bp (up 4.0bp today), 5s10s at 45.0bp (down -1.3bp), 10s30s at 47.2bp (down -3.2bp)

- Treasuries butterfly spreads: 1s5s10s at -58.5bp (down -8.3bp), 5s10s30s at 2.4bp (down -1.3bp)

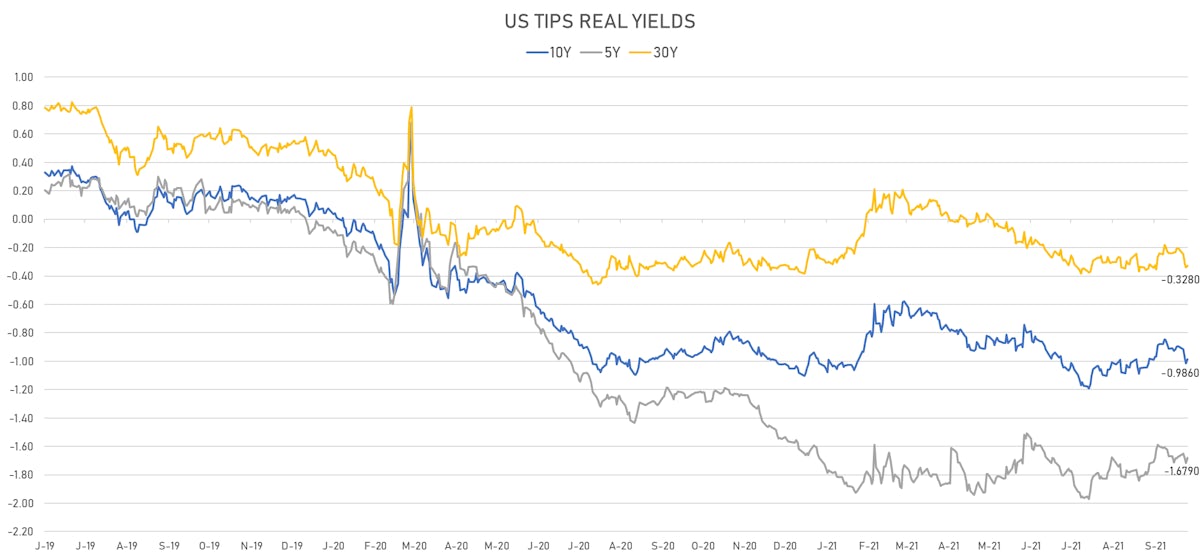

- US 5-Year TIPS Real Yield: +3.8 bp at -1.6790%; 10-Year TIPS Real Yield: +3.1 bp at -0.9860%; 30-Year TIPS Real Yield: +1.1 bp at -0.3280%

US MACRO RELEASES

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.80 % (vs 1.80 % prior), above consensus estimate of 0.50 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.70 % (vs 2.00 % prior)

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.80 % (vs 2.50 % prior), above consensus estimate of 0.40 %

- Retail Sales, Total including food services, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.70 % (vs 0.70 % prior), above consensus estimate of -0.20 %

- New York Fed, General Business Condition for Oct 2021 (FED, NY) at 19.80 (vs 34.30 prior), below consensus estimate of 27.00

- Import Prices, All commodities, Change P/P, Price Index for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.40 % (vs -0.30 % prior), below consensus estimate of 0.60 %

- Export Prices, All commodities, Change P/P, Price Index for Sep 2021 (BLS, U.S Dep. Of Lab) at 0.10 % (vs 0.40 % prior), below consensus estimate of 0.60 %

- University of Michigan, Total-prelim, Volume Index for Oct 2021 (UMICH, Survey) at 67.20 (vs 68.10 prior), below consensus estimate of 70.30

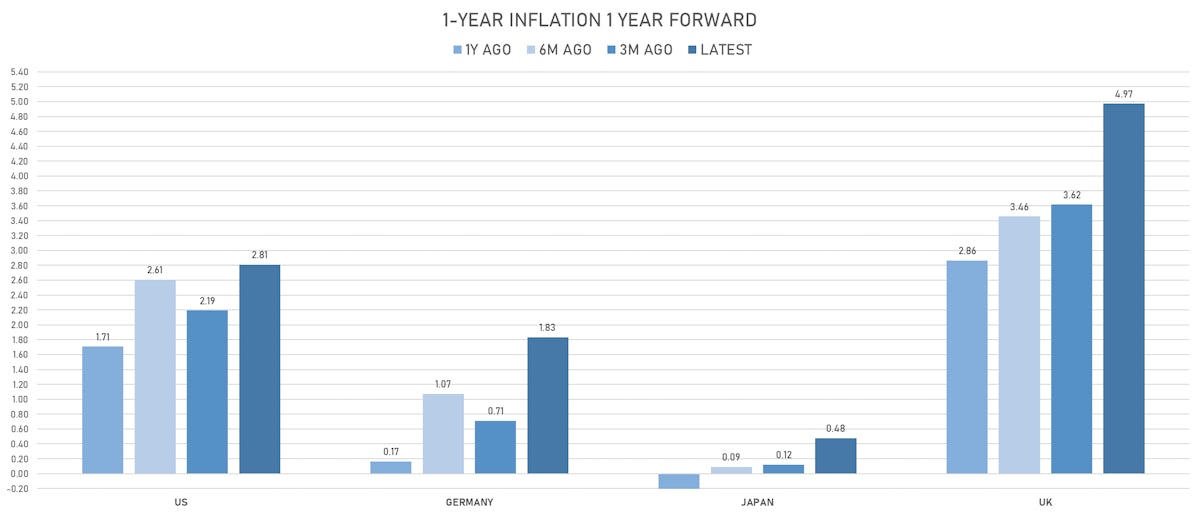

- 1 Year Inflation Expectations (median), preliminary for Oct 2021 (UMICH, Survey) at 4.80 % (vs 4.60 % prior)

- University of Michigan, Total-prelim, Change Y/Y for Oct 2021 (UMICH, Survey) at 2.80 % (vs 3.00 % prior)

- Overall, Total business inventories, Change P/P for Aug 2021 (U.S. Census Bureau) at 0.60 % (vs 0.50 % prior), in line with consensus estimate

- University of Michigan, Total-prelim, Volume Index for Oct 2021 (UMICH, Survey) at 71.40 (vs 72.80 prior), below consensus estimate of 73.10

- University of Michigan, Current Conditions Index-prelim, Volume Index for Oct 2021 (UMICH, Survey) at 77.90 (vs 80.10 prior), below consensus estimate of 82.00

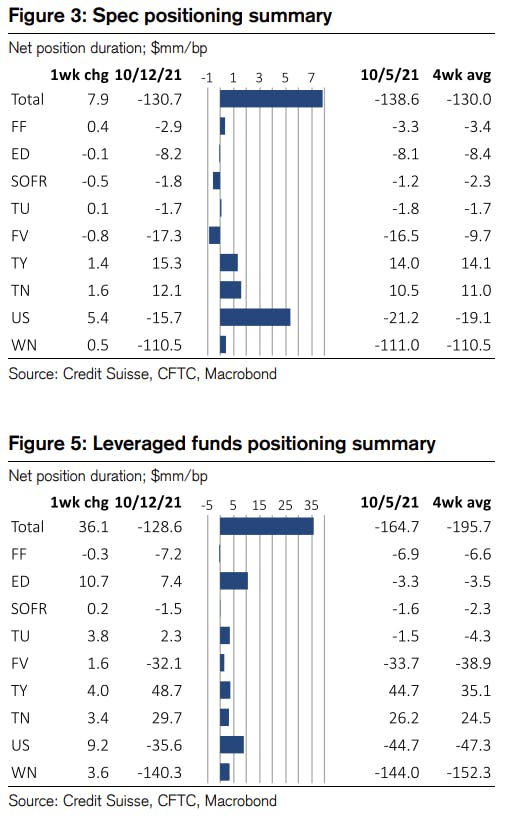

WEEKLY CFTC POSITIONING DATA

- Specs covered some shorts this week, mostly at the long end of the curve

- Leveraged funds also reduced their net short duration, and most notably turned net long in Eurodollars

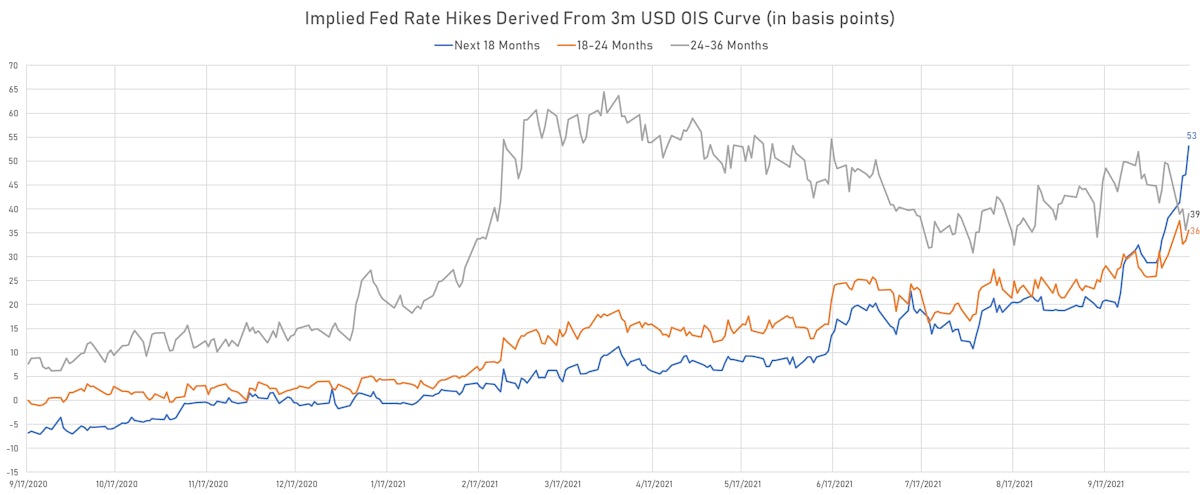

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 35.2 bp by the end of 2022 (meaning the market prices in 1.4 Fed hike by end of 2022)

- The 3-month USD OIS forward curve prices in 127.7 bp over the next 3 years (equivalent to 5.11 rate hikes)

- The 3-month Eurodollar zero curve prices in 149.0 bp over the next 3 years (equivalent to 5.96 rate hikes)

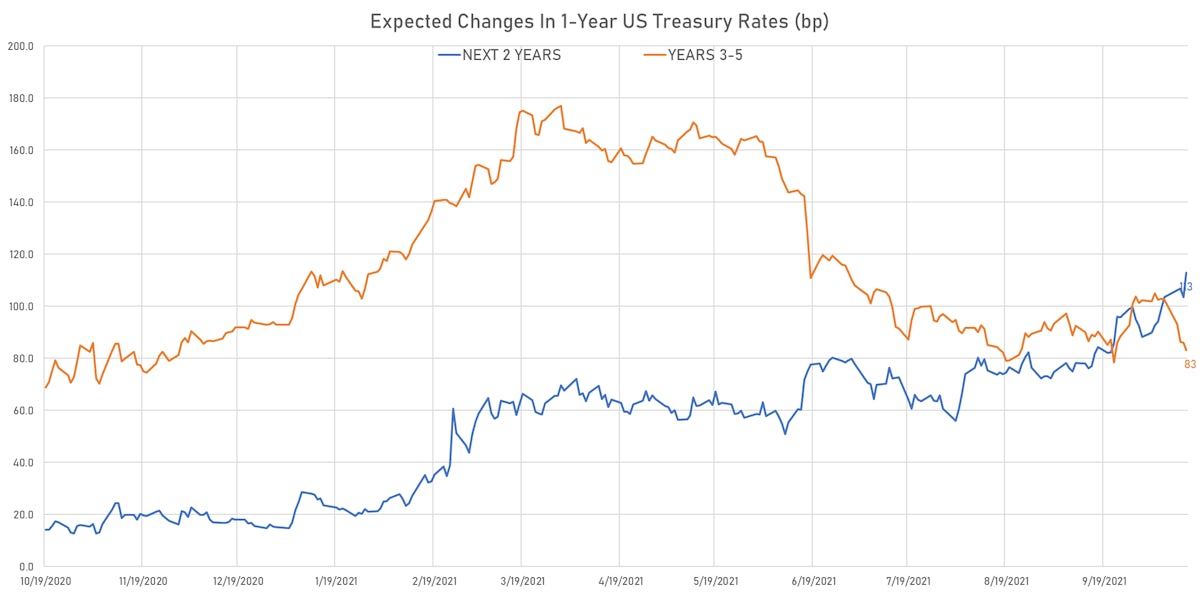

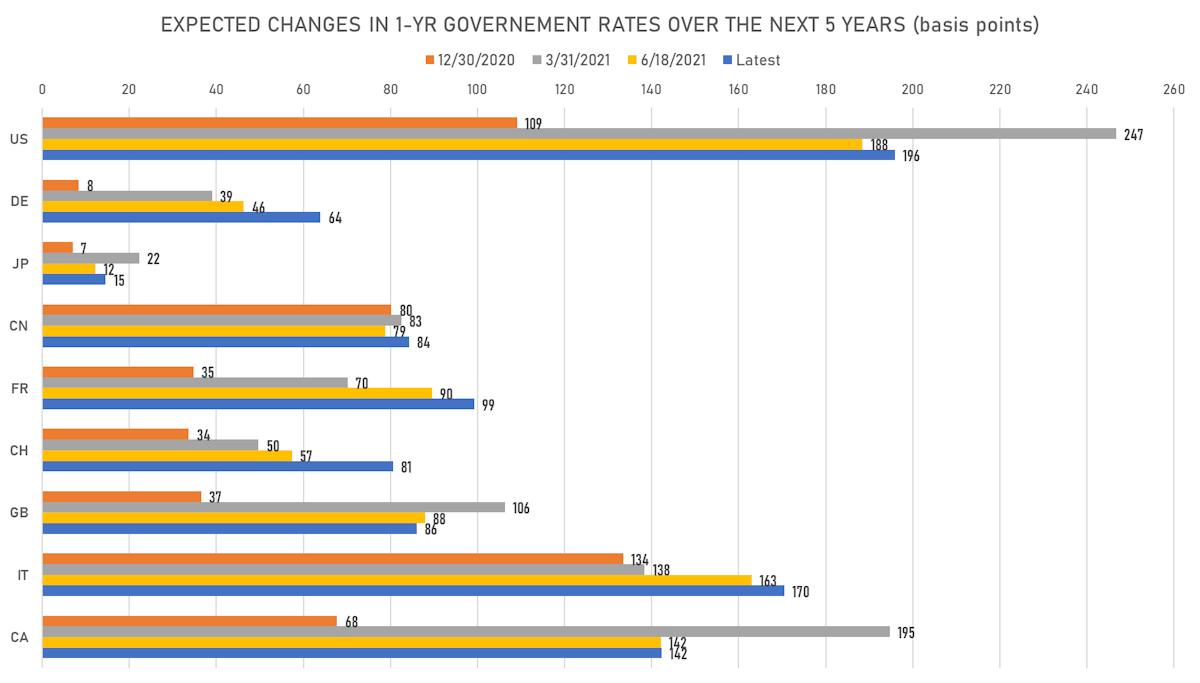

- 1-year US Treasury rate 5 years forward up 7.2 bp, now at 2.0883%, meaning that the 1-year Treasury rate is now expected to increase by 196.0 bp over the next 5 years (equivalent to 7.8 rate hikes)

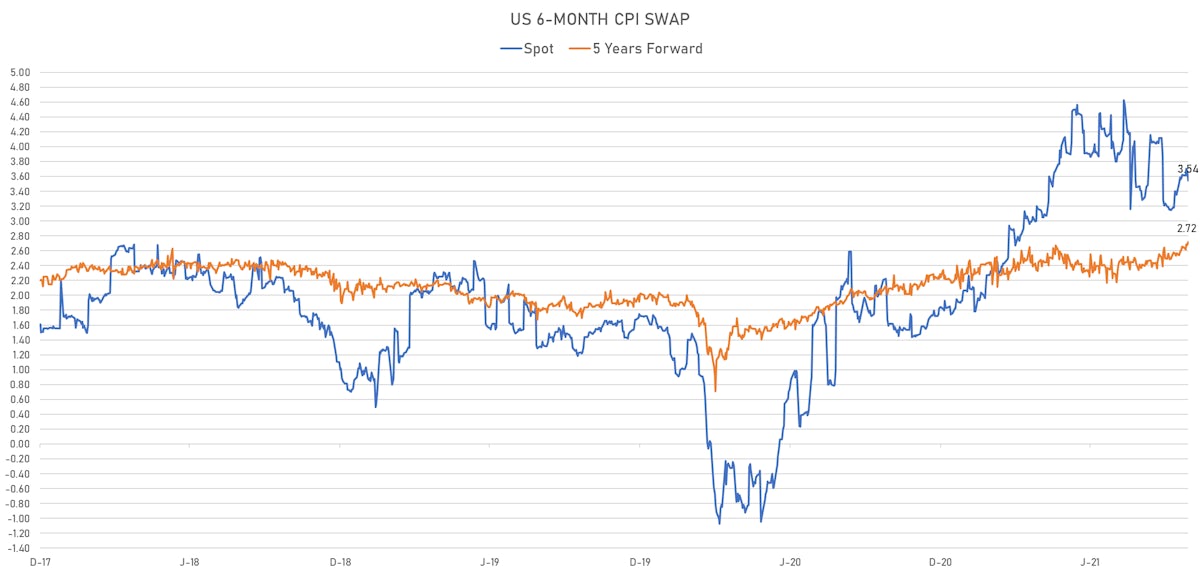

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.54% (up 3.1bp); 2Y at 3.18% (up 2.7bp); 5Y at 2.84% (up 2.9bp); 10Y at 2.54% (up 2.8bp); 30Y at 2.38% (up 1.4bp)

- 6-month spot US CPI swap down -12.2 bp to 3.542%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6790%, +3.8 bp today; 10Y at -0.9860%, +3.1 bp today; 30Y at -0.3280%, +1.1 bp today

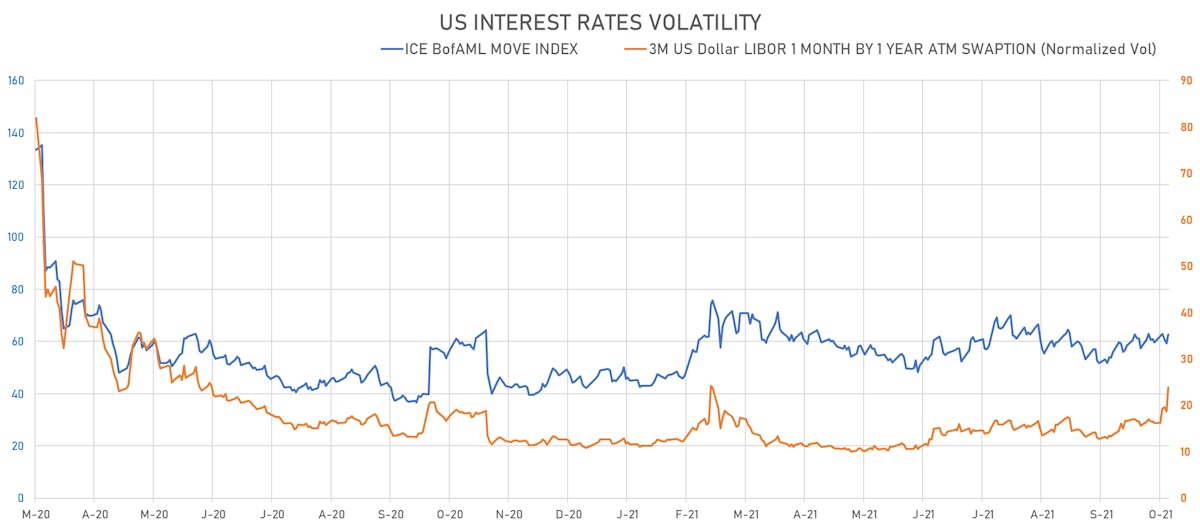

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 5.2% at 23.9%

- 3-Month LIBOR-OIS spread up 0.7 bp at 7.4 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.511% (up 0.8 bp); the German 1Y-10Y curve is 1.3 bp steeper at 52.0bp (YTD change: +35.7 bp)

- Japan 5Y: -0.072% (up 0.1 bp); the Japanese 1Y-10Y curve is unchanged at 19.3bp (YTD change: +5.4 bp)

- China 5Y: 2.861% (up 5.6 bp); the Chinese 1Y-10Y curve is 1.7 bp steeper at 68.2bp (YTD change: +21.8 bp)

- Switzerland 5Y: -0.453% (up 1.5 bp); the Swiss 1Y-10Y curve is 6.3 bp steeper at 59.3bp (YTD change: +36.9 bp)