Rates

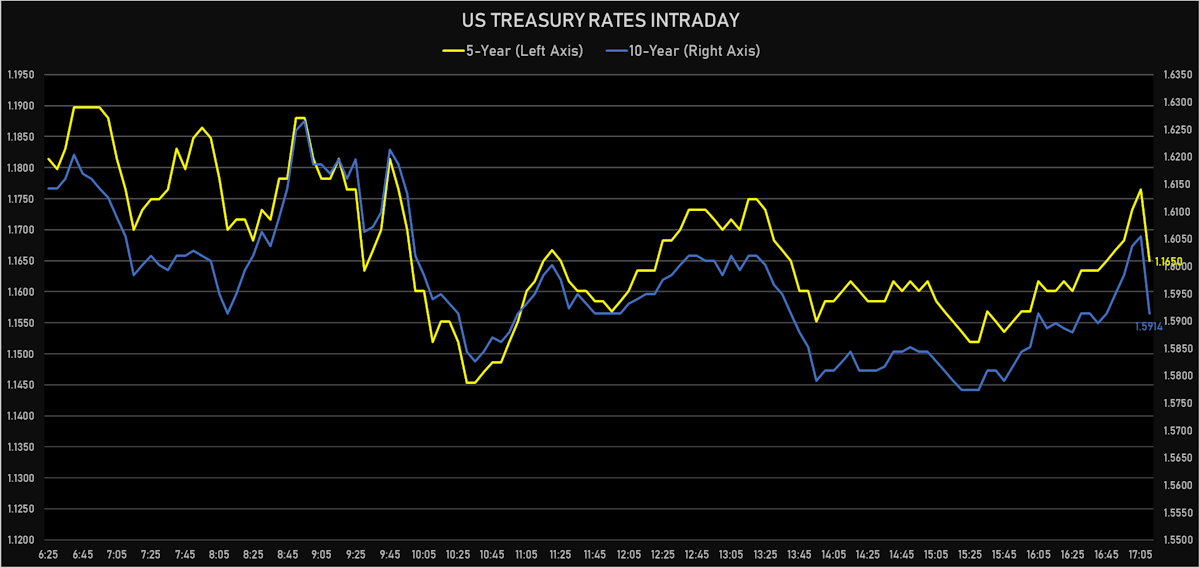

5Y US Treasury Yield Reaches 1.1930 With Rise In Real Yields, While The 5s10s Spread Tightens To 41.2bp

In macro news, US industrial production and capacity utilization disappointed, with the lingering impact of Hurricane Ida and continued supply chain issues making for a discouraging monthly report, but setting up for a likely reversal down the road

Published ET

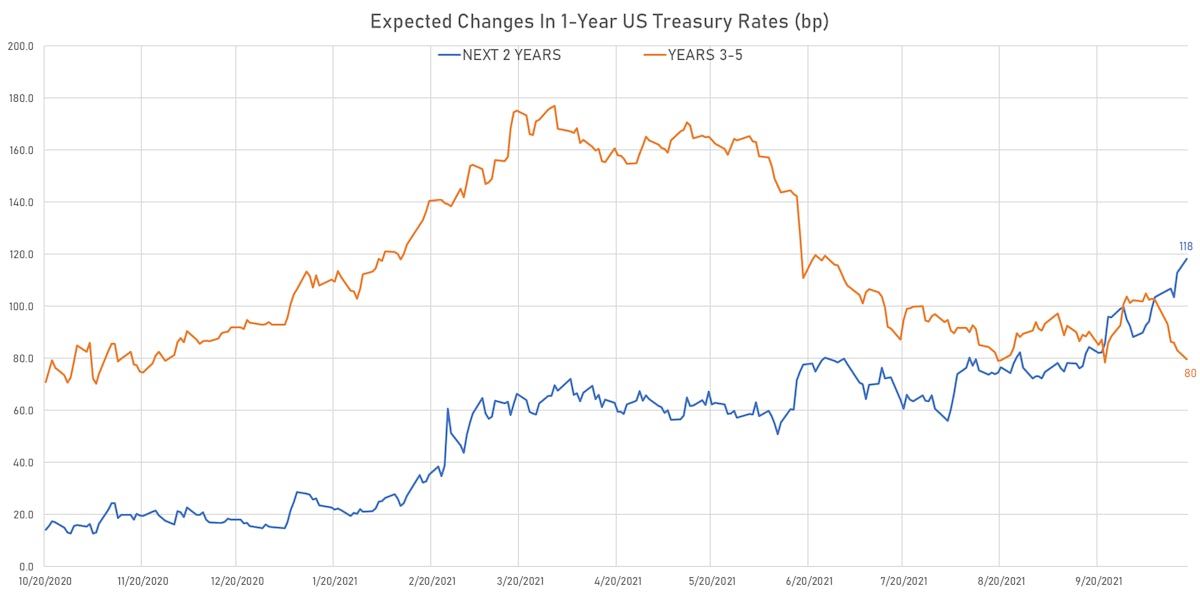

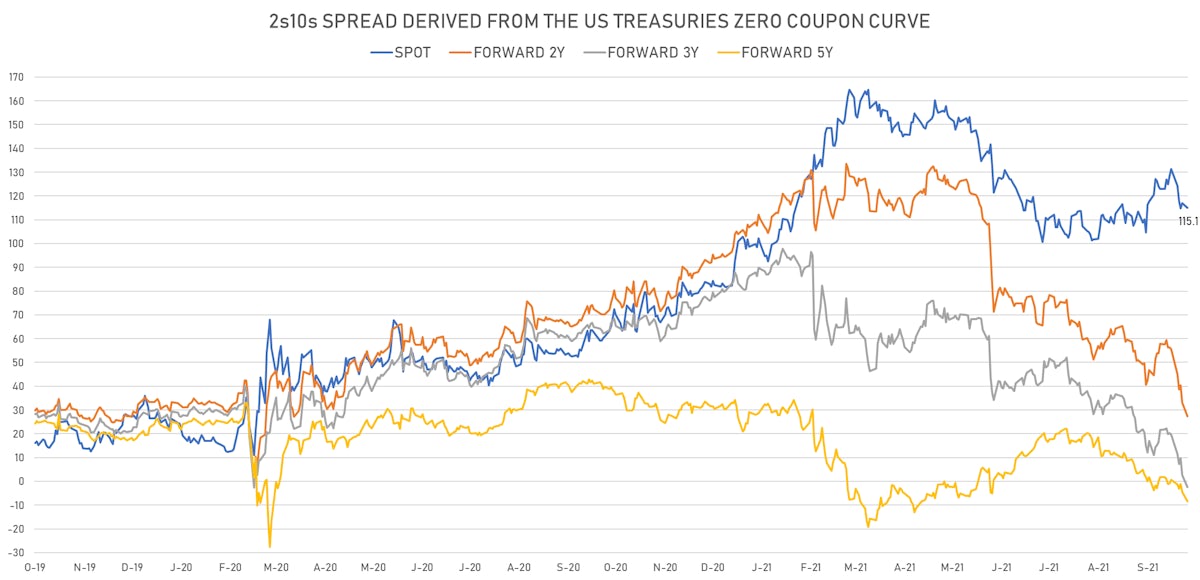

The US 2s10s spread 5 years forward is negative (2-10 inversion), as markets are increasingly pricing in a policy error | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.79bp today, now at 0.1315%; 3-Month SOFR OIS at 0.0490%

- The treasury yield curve steepened, with the 1s10s spread widening 1.8 bp, now at 149.0 bp (YTD change: +68.6bp)

- 1Y: 0.1010% (unchanged)

- 2Y: 0.4213% (up 2.6 bp)

- 5Y: 1.1650% (up 4.1 bp)

- 7Y: 1.4444% (up 3.3 bp)

- 10Y: 1.5914% (up 1.8 bp)

- 30Y: 2.0252% (down 2.0 bp)

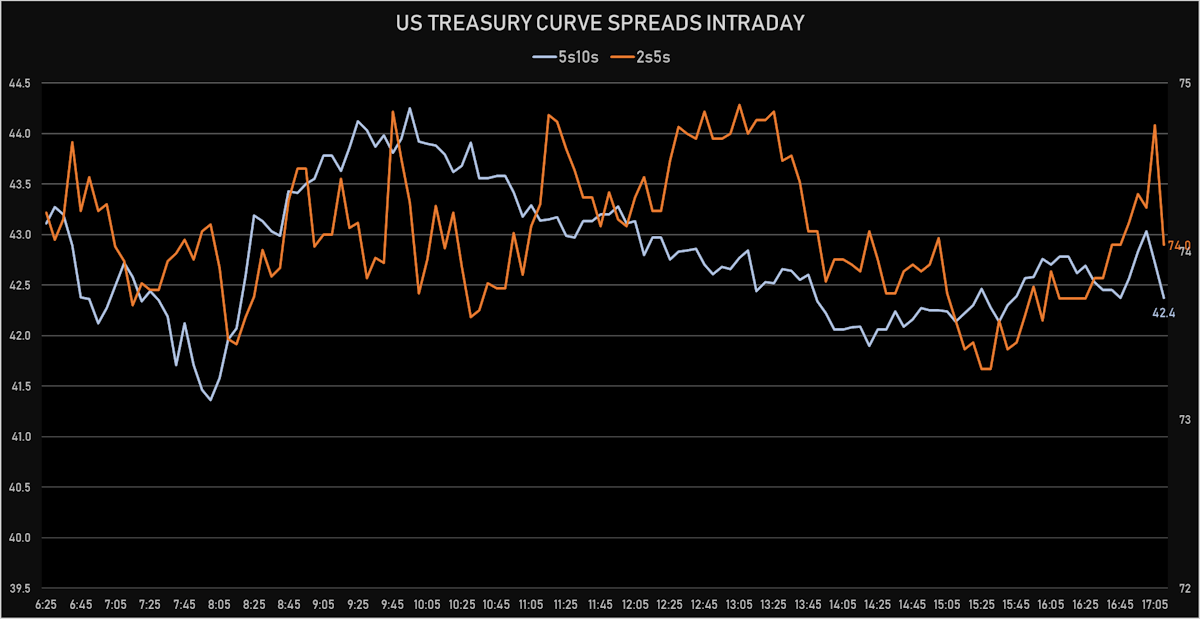

- US treasury curve spreads: 2s5s at 74.3bp (up 1.3bp today), 5s10s at 42.7bp (down -2.4bp), 10s30s at 43.4bp (down -3.9bp)

- Treasuries butterfly spreads: 1s5s10s at -64.5bp (down -6.0bp), 5s10s30s at -0.4bp (down -2.8bp)

- US 5-Year TIPS Real Yield: +5.5 bp at -1.6240%; 10-Year TIPS Real Yield: +3.0 bp at -0.9560%; 30-Year TIPS Real Yield: +0.1 bp at -0.3270%

US MACRO RELEASES

- Production, Manufacturing, Total (SIC), Change P/P for Sep 2021 (FED, U.S.) at -0.70 % (vs 0.20 % prior), below consensus estimate of 0.10 %

- Capacity Utilization, Total index, Change M/M for Sep 2021 (FED, U.S.) at 75.20 % (vs 76.40 % prior), below consensus estimate of 76.50 %

- Production, Change P/P for Sep 2021 (FED, U.S.) at -1.30 % (vs 0.40 % prior), below consensus estimate of 0.20 %

- NAHB/Wells Fargo Housing Market Index for Oct 2021 (NAHB, United States) at 80.00 (vs 76.00 prior), above consensus estimate of 76.00

- Net flows total, Current Prices for Aug 2021 (U.S. Dept. Treas.) at 91.00 Bln USD (vs 126.00 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Aug 2021 (U.S. Dept. Treas.) at 60.90 Bln USD (vs -68.00 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Aug 2021 (U.S. Dept. Treas.) at 79.30 Bln USD (vs 2.00 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Aug 2021 (U.S. Dept. Treas.) at 30.70 Bln USD (vs 10.20 Bln USD prior)

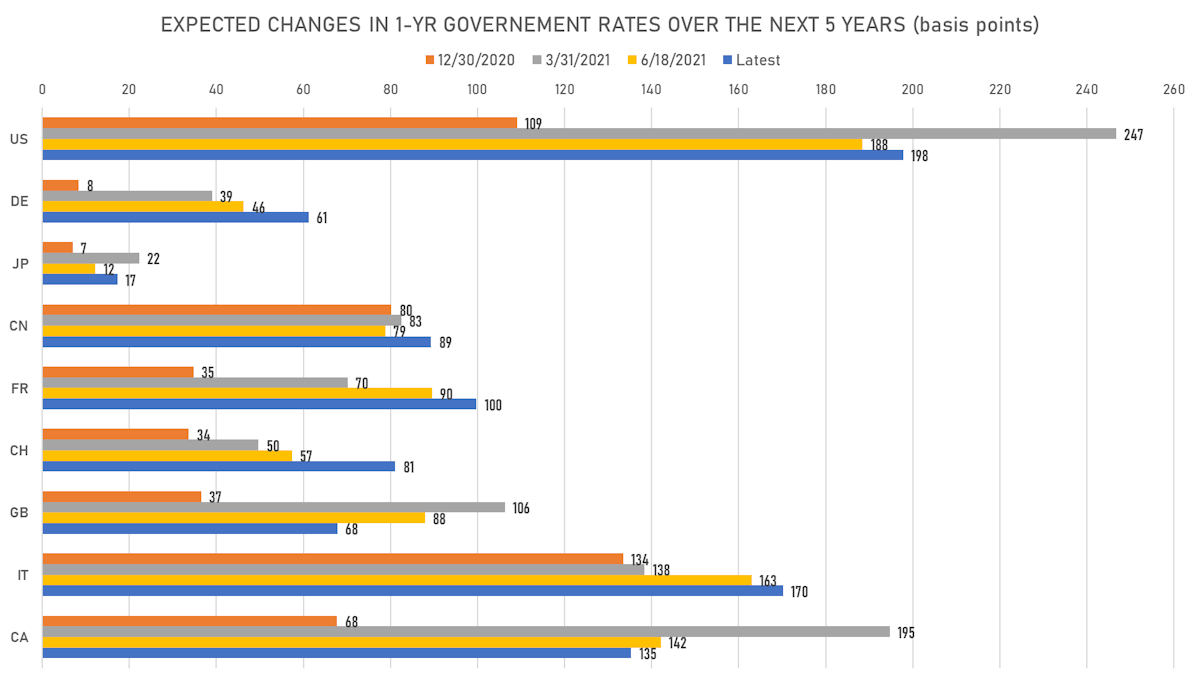

US FORWARD RATES

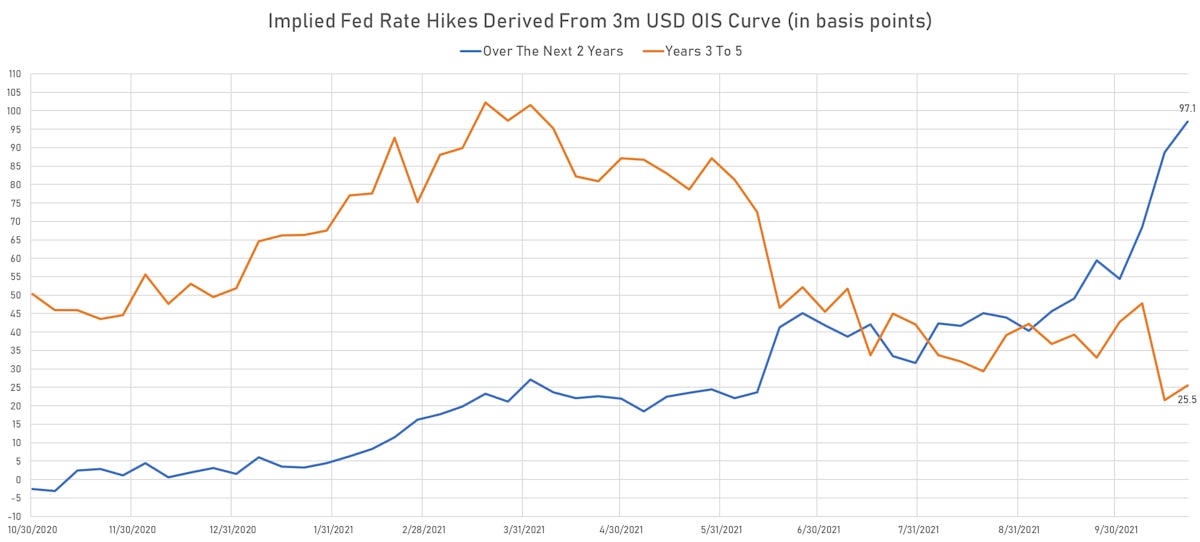

- 3-month Eurodollar future (EDU2) expected hike of 38.2 bp by the end of 2022 (meaning the market prices 152.8% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 127.3 bp over the next 3 years (equivalent to 5.09 rate hikes)

- The 3-month Eurodollar zero curve prices in 151.3 bp over the next 3 years (equivalent to 6.05 rate hikes)

- 1-year US Treasury rate 5 years forward up 2.3 bp, now at 2.1118%, meaning that the 1-year Treasury rate is now expected to increase by 197.8 bp over the next 5 years (equivalent to 7.9 rate hikes)

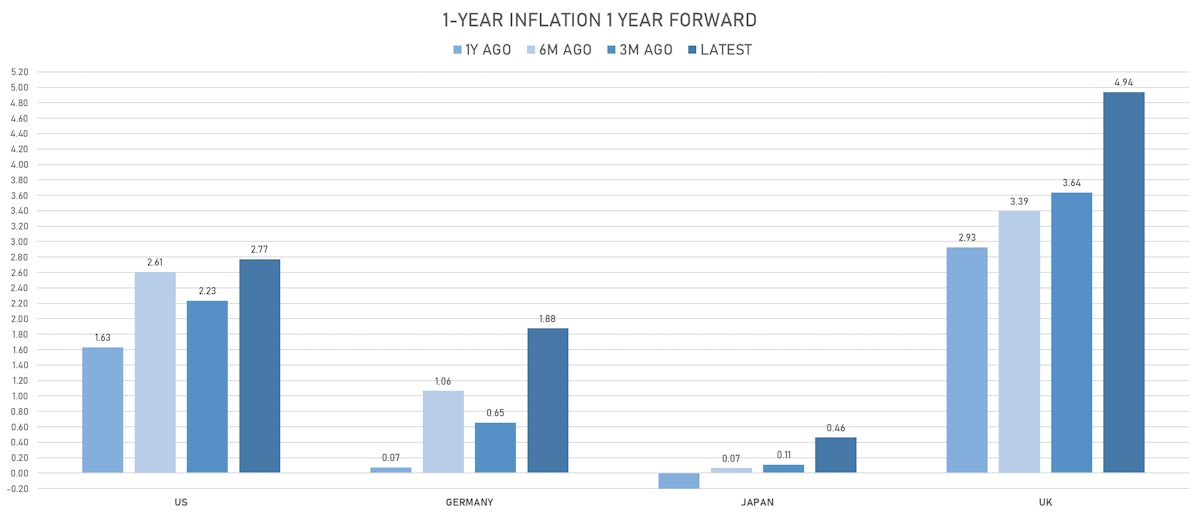

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.53% (down -0.3bp); 2Y at 3.16% (down -2.2bp); 5Y at 2.82% (down -1.3bp); 10Y at 2.53% (down -1.3bp); 30Y at 2.36% (down -2.1bp)

- 6-month spot US CPI swap up 8.2 bp to 3.624%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6240%, +5.5 bp today; 10Y at -0.9560%, +3.0 bp today; 30Y at -0.3270%, +0.1 bp today

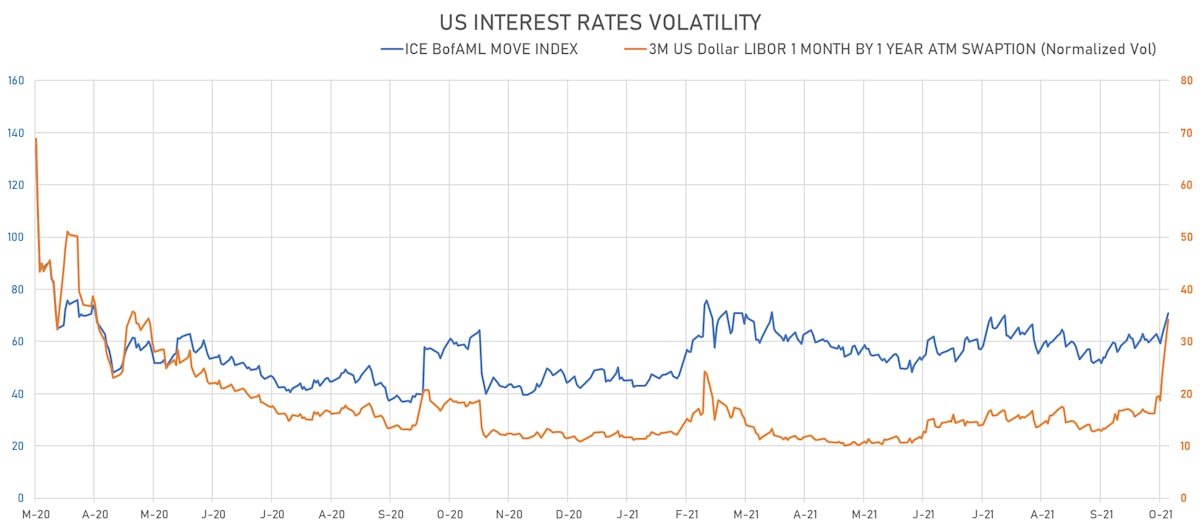

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 10.3% at 34.2%

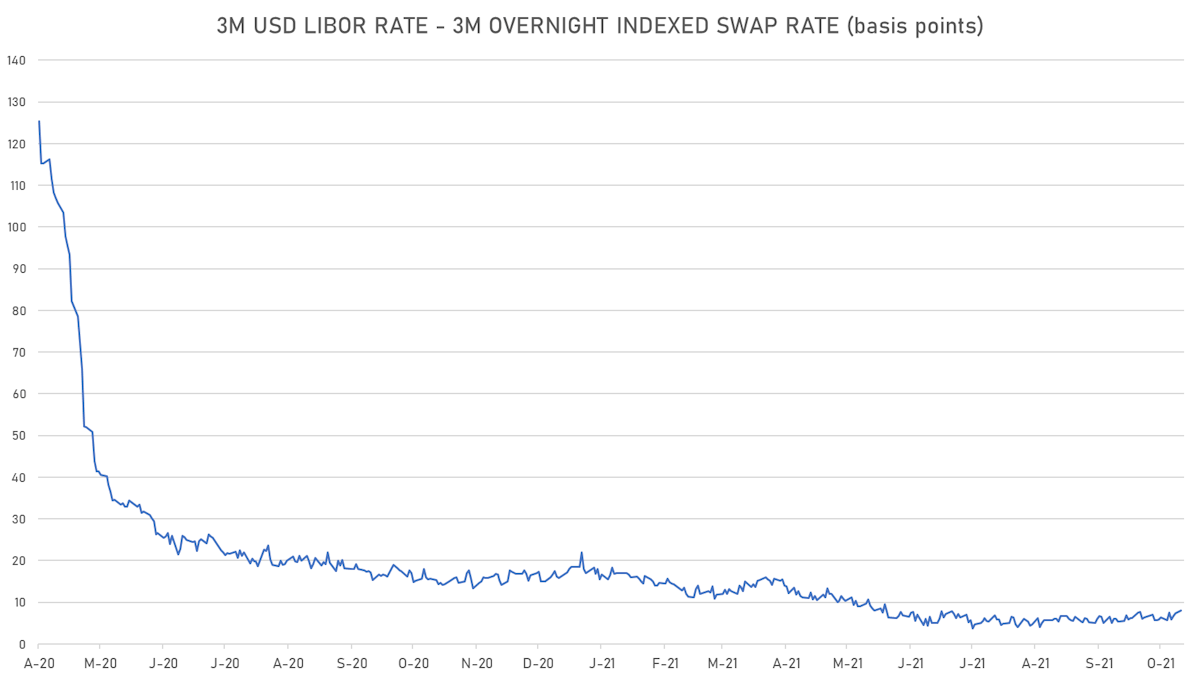

- 3-Month LIBOR-OIS spread up 0.7 bp at 8.1 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.452% (up 5.8 bp); the German 1Y-10Y curve is 1.3 bp steeper at 52.2bp (YTD change: +37.0 bp)

- Japan 5Y: -0.069% (up 0.8 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 21.1bp (YTD change: +6.2 bp)

- China 5Y: 2.885% (up 2.4 bp); the Chinese 1Y-10Y curve is 1.8 bp steeper at 70.0bp (YTD change: +23.6 bp)

- Switzerland 5Y: -0.401% (up 5.2 bp); the Swiss 1Y-10Y curve is 2.7 bp flatter at 59.6bp (YTD change: +34.2 bp)