Rates

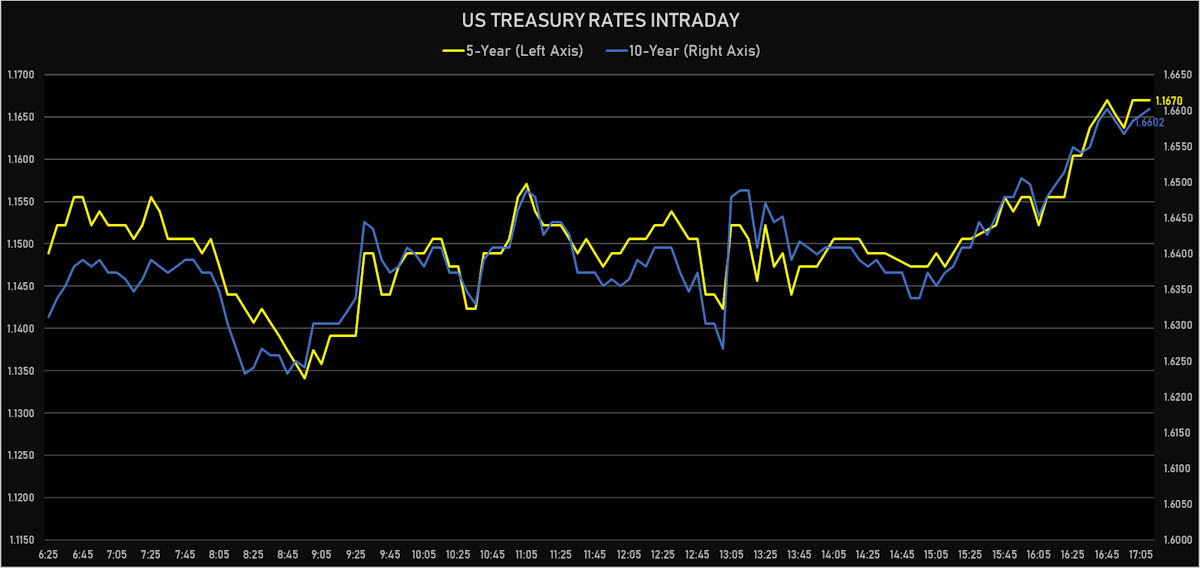

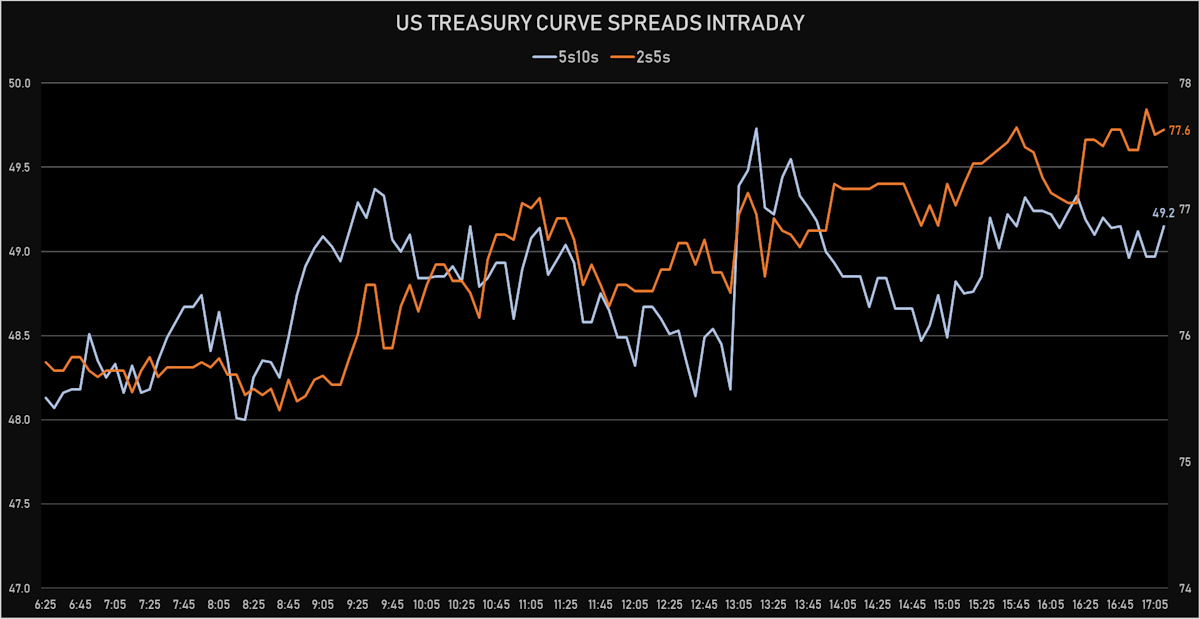

Revived Reflation Theme Today, With Steepening Treasury Curve On Lower Short Rates, Higher Long Rates

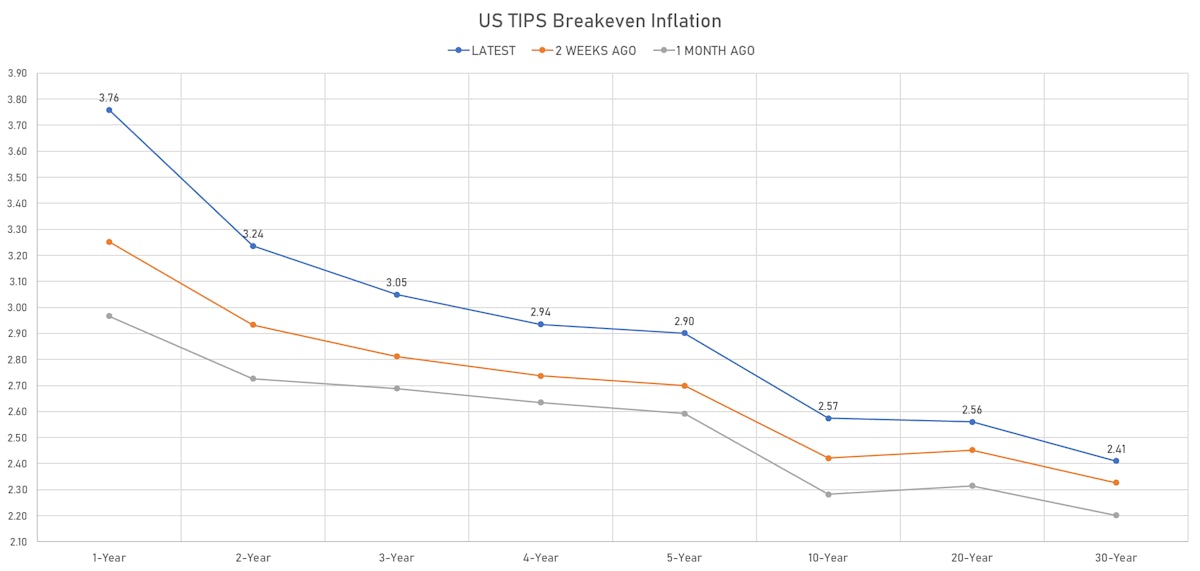

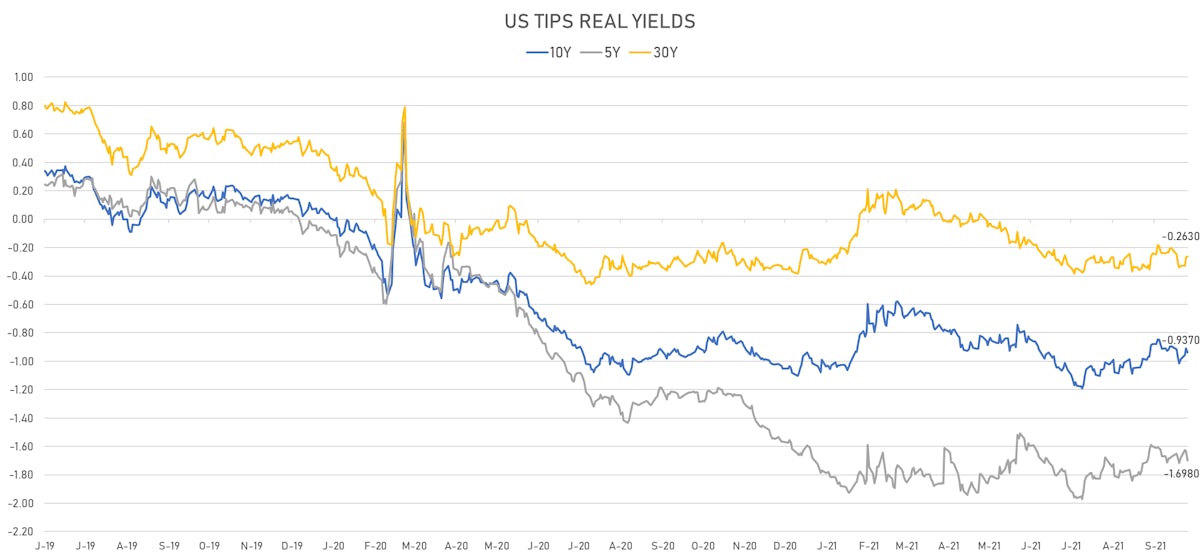

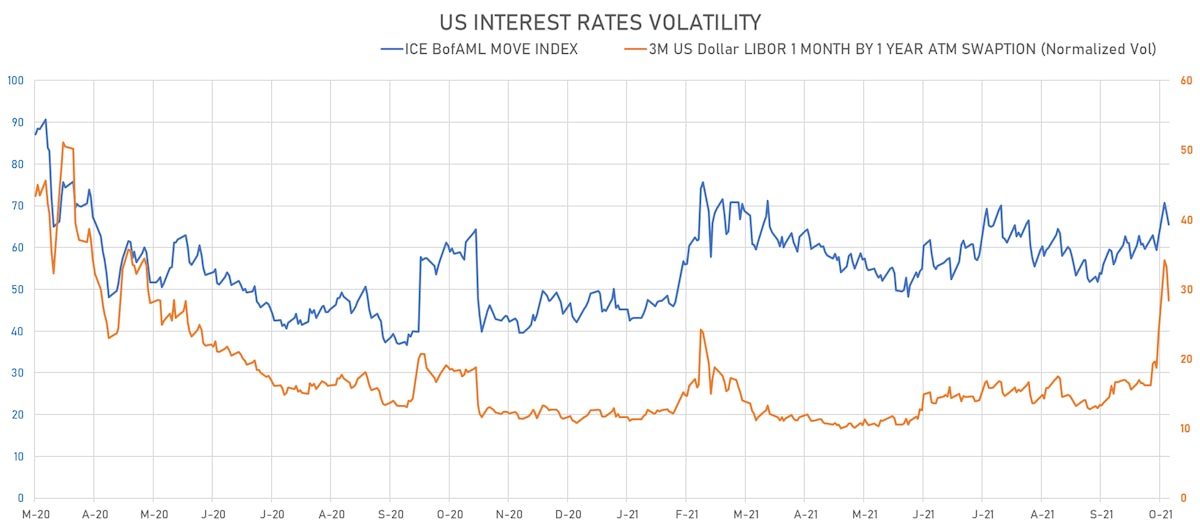

TIPS inflation breakevens were higher across the curve, real yields lower out to 30Y, market-implied rate hikes by the end of 2023 down 1.5 bp, and rates volatility dropped after the huge rise at the front end of the curve last week

Published ET

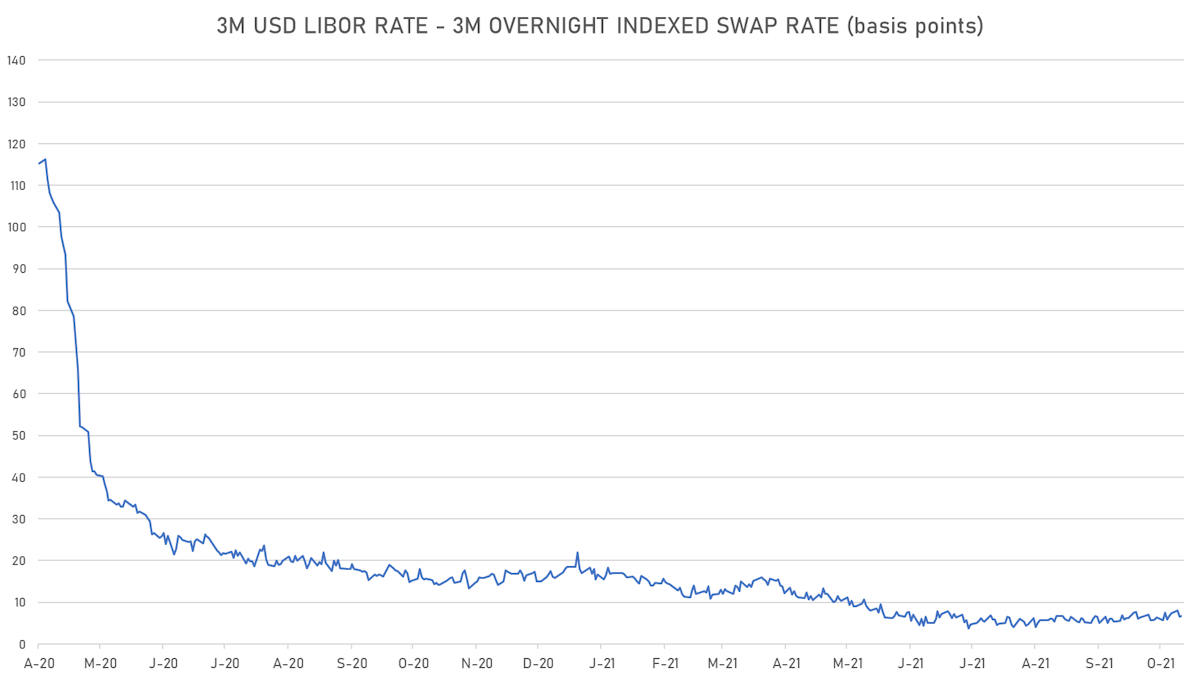

Spreads Between Spot 3M USD LIBOR and Eurodollar Futures Implied Yields | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR -0.12bp today, now at 0.1283%; 3-Month SOFR OIS at 0.0430%

- The treasury yield curve steepened, with the 1s10s spread widening 2.2 bp, now at 155.9 bp (YTD change: +75.5bp)

- 1Y: 0.1010% (down 0.3 bp)

- 2Y: 0.3874% (down 1.2 bp)

- 5Y: 1.1670% (up 0.2 bp)

- 7Y: 1.4805% (up 0.7 bp)

- 10Y: 1.6602% (up 1.9 bp)

- 30Y: 2.1365% (up 4.6 bp)

- US treasury curve spreads: 2s5s at 77.9bp (up 1.2bp today), 5s10s at 49.4bp (up 1.7bp today), 10s30s at 47.6bp (up 2.6bp today)

- Treasuries butterfly spreads: 1s5s10s at -58.7bp (up 1.0bp today), 5s10s30s at -1.6bp (up 1.9bp)

- US 5-Year TIPS Real Yield: -6.6 bp at -1.6980%; 10-Year TIPS Real Yield: -2.8 bp at -0.9370%; 30-Year TIPS Real Yield: +0.6 bp at -0.2630%

US MACRO RELEASES

- Mortgage applications, market composite index, refinancing for W 15 Oct (MBA, USA) at 2,807.90 (vs 3,023.00 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 15 Oct (MBA, USA) at 3.23 % (vs 3.18 % prior)

- Mortgage applications, market composite index, purchase for W 15 Oct (MBA, USA) at 266.20 (vs 279.80 prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 15 Oct (MBA, USA) at -6.30 % (vs 0.20 % prior)

- Mortgage applications, market composite index for W 15 Oct (MBA, USA) at 643.00 (vs 686.10 prior)

$24BN 20-YEAR 1.75% COUPON AUCTION (912810TA6)

- Terrible results, with a big 2.6bp tail and low bid-to-cover ratio

- High yield at 2.100%, a tail of 2.6bp compared to the 2.074% when issued at the bid deadline (vs 1.795% prior)

- Bid to cover ratio at 2.25 (vs 2.36 prior and 2.35 average), third lowest since May 2020

- Indirect bidders at 64.8% (vs 64.2% prior and 60.1% average)

- Direct bidders at 15.6% (vs 18.9% prior and 17.7% average)

- End-user demand at 80.4% (vs 83.1% prior and 77.8% average)

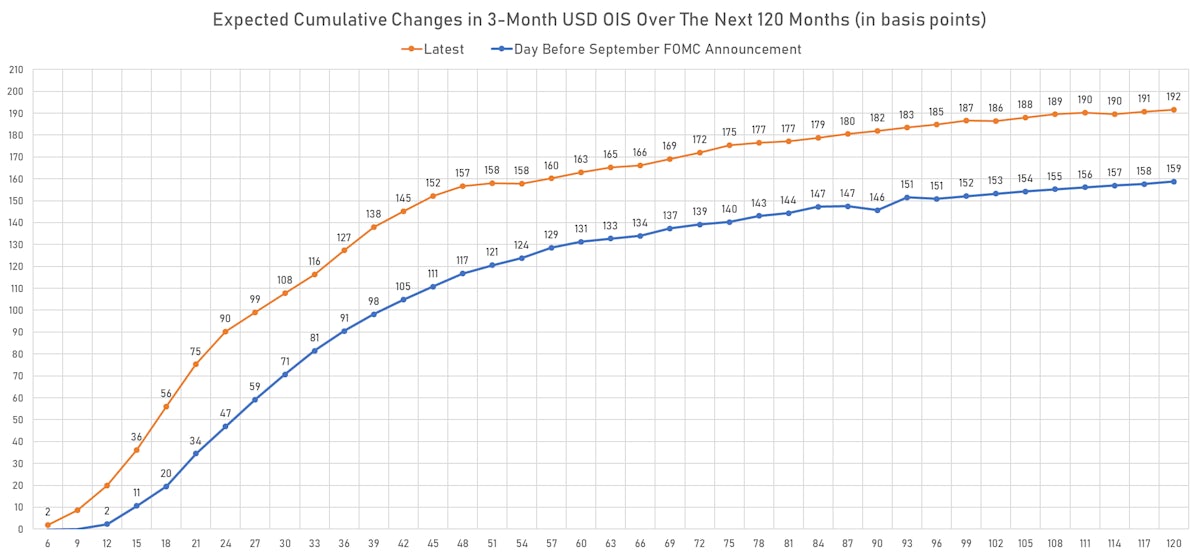

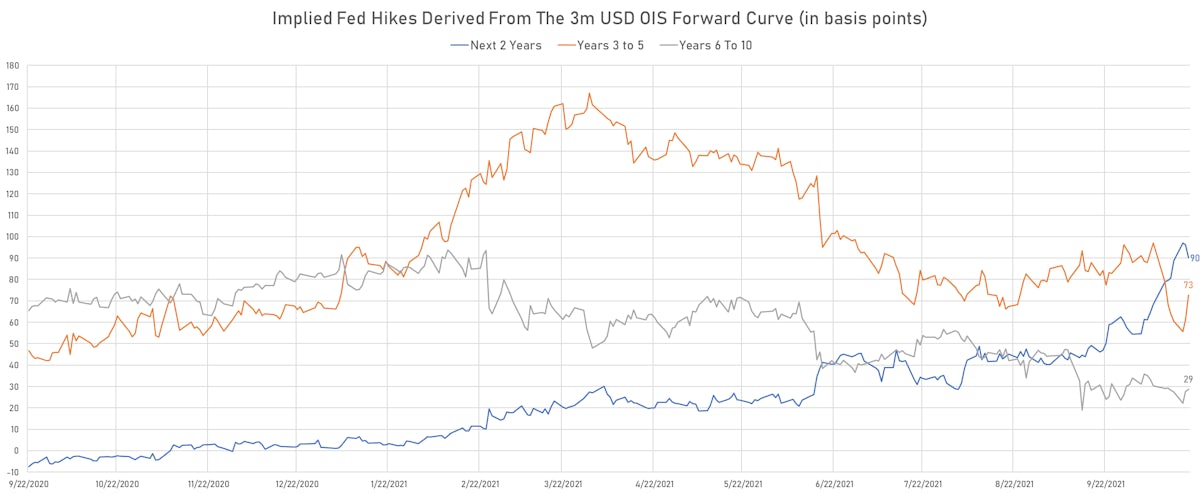

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike edged down to 35.2 bp by the end of 2022 (equivalent to 1.41 Fed hikes by the end of 2022)

- The 3-month USD OIS forward curve prices in 127.3 bp over the next 3 years (equivalent to 5.09 rate hikes)

- The 3-month Eurodollar zero curve prices in 150.4 bp over the next 3 years (equivalent to 6.02 rate hikes)

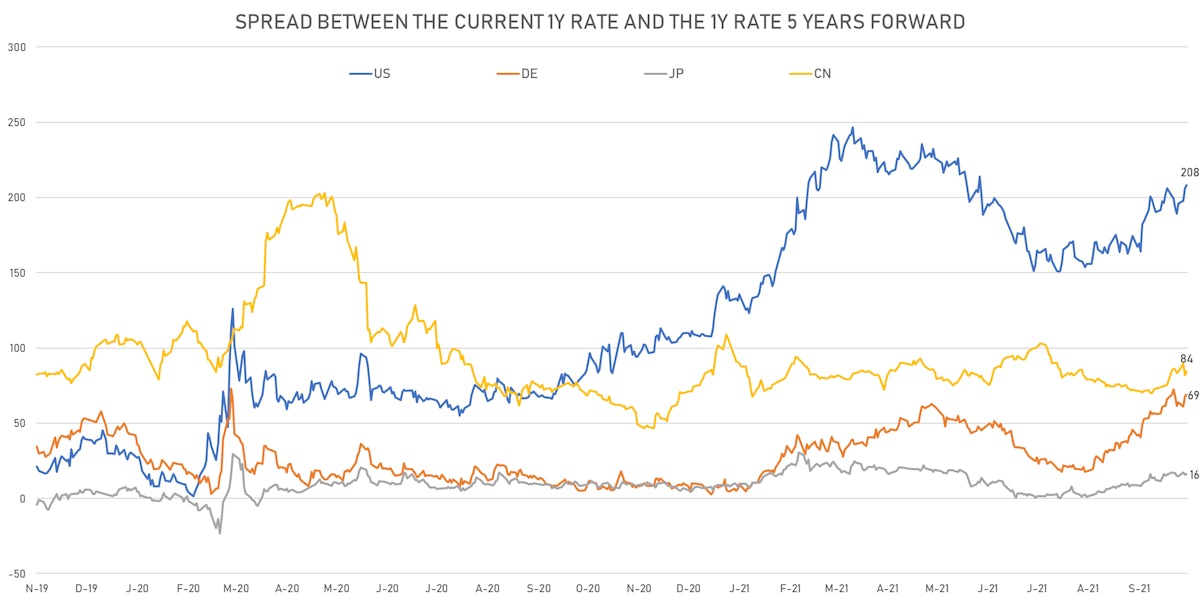

- 1-year US Treasury rate 5 years forward up 1.9 bp, now at 2.2066%, meaning that the 1-year Treasury rate is now expected to increase by 208.3 bp over the next 5 years (equivalent to 8.3 rate hikes)

US INFLATION & REAL RATES

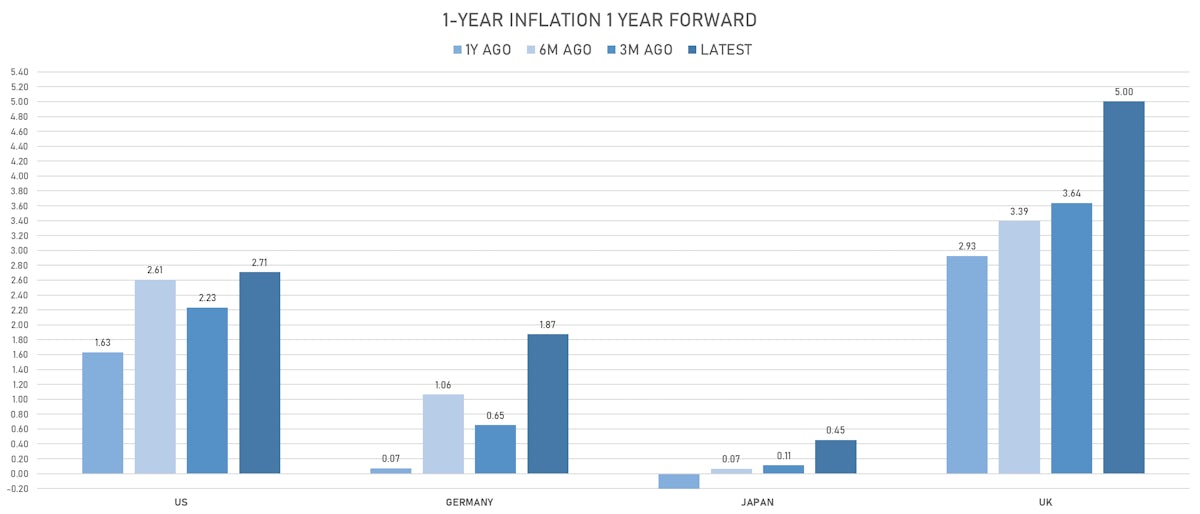

- TIPS 1Y breakeven inflation at 3.76% (up 15.0bp); 2Y at 3.24% (up 6.1bp); 5Y at 2.90% (up 6.9bp); 10Y at 2.57% (up 4.6bp); 30Y at 2.41% (up 4.0bp)

- 6-month spot US CPI swap up 9.3 bp to 3.658%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6980%, -6.6 bp today; 10Y at -0.9370%, -2.8 bp today; 30Y at -0.2630%, +0.6 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.8% at 28.4%

- 3-Month LIBOR-OIS spread up 0.2 bp at 6.7 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.470% (down -2.5 bp); the German 1Y-10Y curve is 0.8 bp flatter at 55.3bp (YTD change: +39.6 bp)

- Japan 5Y: -0.062% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 20.4bp (YTD change: +6.6 bp)

- China 5Y: 2.866% (up 0.3 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 70.1bp (YTD change: +23.7 bp)

- Switzerland 5Y: -0.401% (down -0.9 bp); the Swiss 1Y-10Y curve is 0.8 bp flatter at 62.8bp (YTD change: +34.1 bp)