Rates

Positive US Macro Data Pushes Rates Up At The Front End Of The Curve, 1s5s10s Treasury Butterfly Down 8bp Today

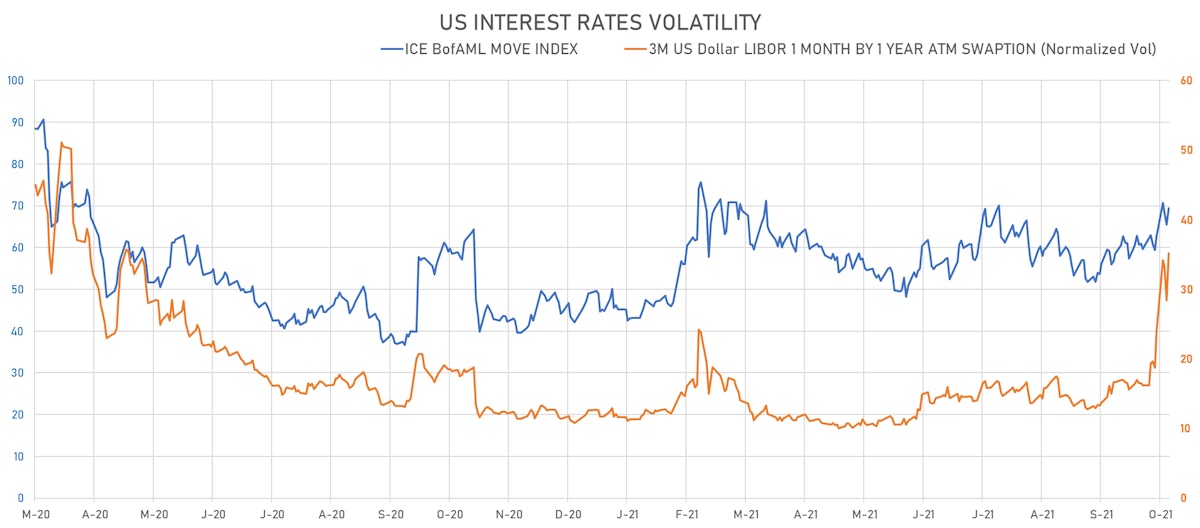

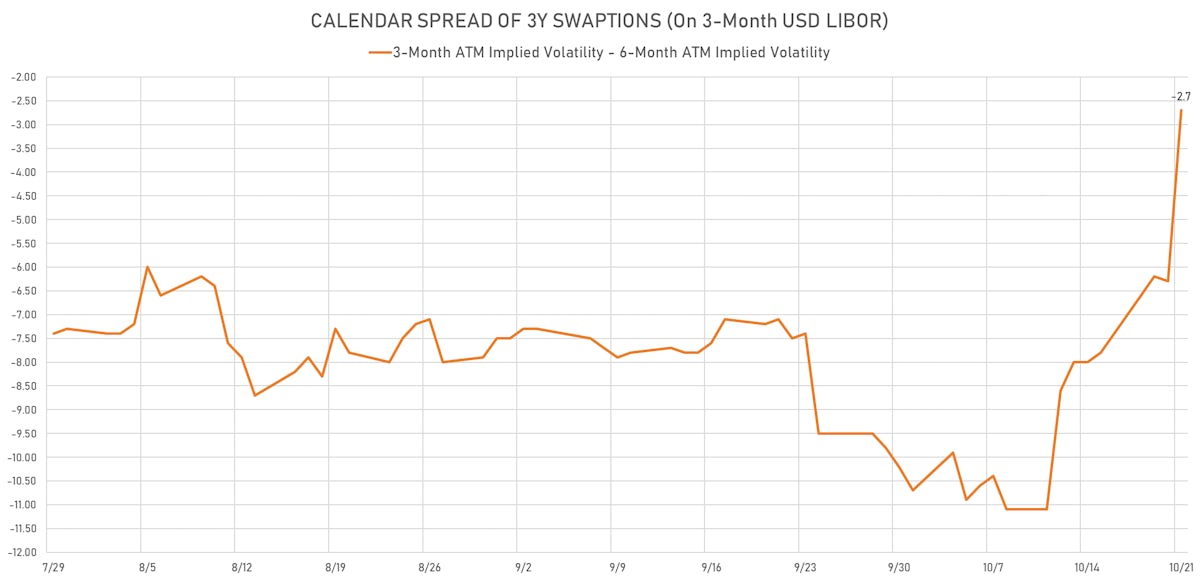

US rates volatility is up again in line with short-term inflation expectations; with the next FOMC only 2 weeks away short-term swaptions implied volatilities are rising even faster

Published ET

1 Month x 2Y Swaption Implied Volatility & 1m-3m Calendar Spread | Sources: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR -0.12bp today, now at 0.1283%; 3-Month OIS +0.3bp today, now at 0.0740%

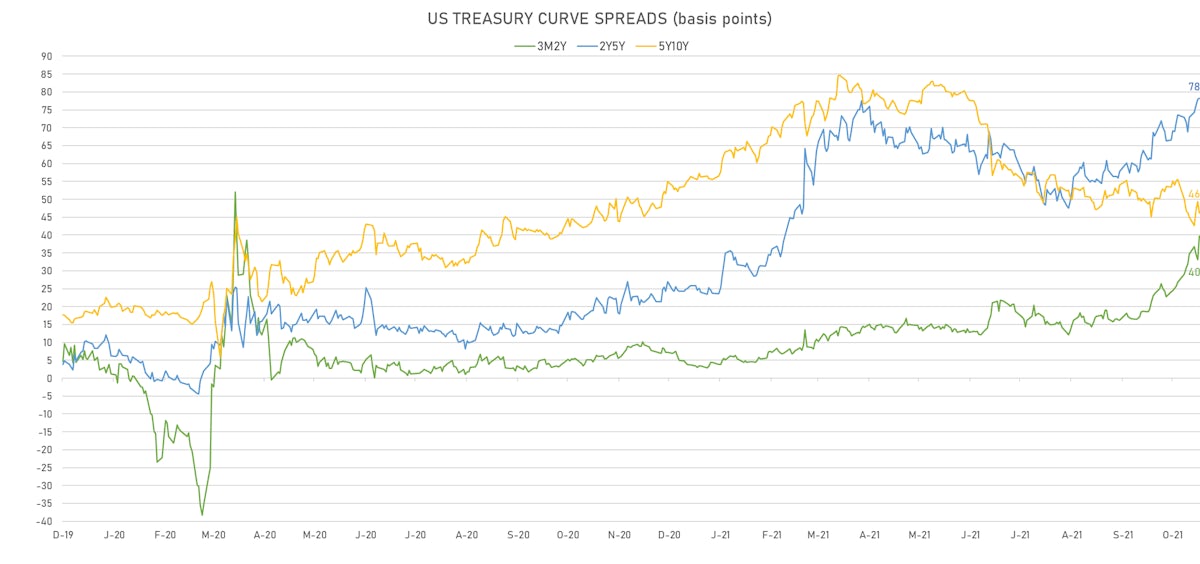

- The treasury yield curve steepened, with the 1s10s spread widening 1.3 bp, now at 156.6 bp (YTD change: +76.2bp)

- 1Y: 0.0940% (up 2.3 bp)

- 2Y: 0.3874% (up 6.5 bp)

- 5Y: 1.1670% (up 6.8 bp)

- 7Y: 1.4805% (up 5.1 bp)

- 10Y: 1.6602% (up 3.6 bp)

- 30Y: 2.1365% (up 0.7 bp)

- US treasury curve spreads: 2s5s at 78.4bp (up 0.4bp today), 5s10s at 46.1bp (down -3.2bp), 10s30s at 44.8bp (down -2.8bp)

- Treasuries butterfly spreads: 1s5s10s at -67.1bp (down -8.5bp), 5s10s30s at -2.2bp (down -0.6bp)

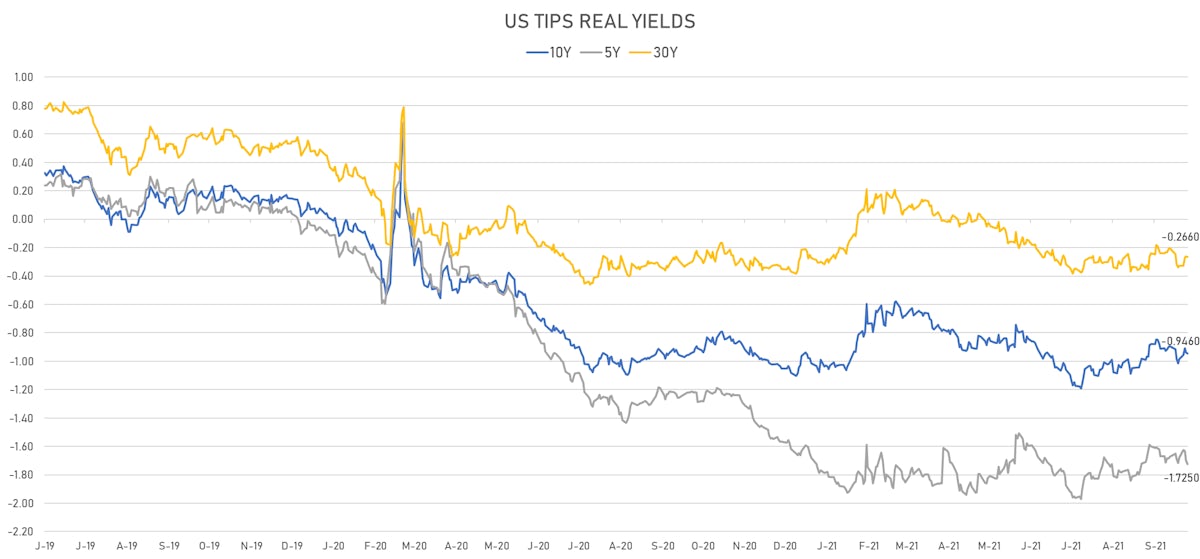

- US 5-Year TIPS Real Yield: -2.7 bp at -1.7250%; 10-Year TIPS Real Yield: -0.9 bp at -0.9460%; 30-Year TIPS Real Yield: -0.3 bp at -0.2660%

US MACRO RELEASES

- Philadelphia Fed, Future capital expenditures for Oct 2021 (FED, Philadelphia) at 32.40 (vs 23.60 prior)

- Philadelphia Fed, New orders for Oct 2021 (FED, Philadelphia) at 30.80 (vs 15.90 prior)

- Philadelphia Fed, Prices paid for Oct 2021 (FED, Philadelphia) at 70.30 (vs 67.30 prior)

- Philadelphia Fed, Future general business activity for Oct 2021 (FED, Philadelphia) at 24.20 (vs 20.00 prior)

- Jobless Claims, National, Initial, four week moving average for W 16 Oct (U.S. Dept. of Labor) at 319.75 k (vs 334.25 k prior)

- Jobless Claims, National, Initial for W 16 Oct (U.S. Dept. of Labor) at 290.00 k (vs 293.00 k prior), below consensus estimate of 300.00 k

- Philadelphia Fed, General business activity for Oct 2021 (FED, Philadelphia) at 23.80 (vs 30.70 prior), below consensus estimate of 25.00

- Jobless Claims, National, Continued for W 09 Oct (U.S. Dept. of Labor) at 2.48 Mln (vs 2.59 Mln prior), below consensus estimate of 2.55 Mln

- Leading Index, Change P/P for Sep 2021 (The Conference Board) at 0.20 % (vs 0.90 % prior), below consensus estimate of 0.40 %

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Sep 2021 (NAR, United States) at 7.00 % (vs -2.00 % prior)

- Existing-Home Sales, Single-Family and Condos, total for Sep 2021 (NAR, United States) at 6.29 Mln (vs 5.88 Mln prior), above consensus estimate of 6.09 Mln

$19 BN 0.125% COUPON 5Y TIPS AUCTION (91282CDC2)

- Good results, with strong end-user takedown at 93.9% (vs 95.3% at previous auction in June)

- High Yield: -1.685%, 1bp stop-through (vs -1.675% WI at the bid deadline)

- Direct bids: 15.5% (vs 7.9% prior)

- Indirect bids: 78.4% (vs 87.3% prior)

- Bid-to-cover: 2.45 (vs 2.67 prior)

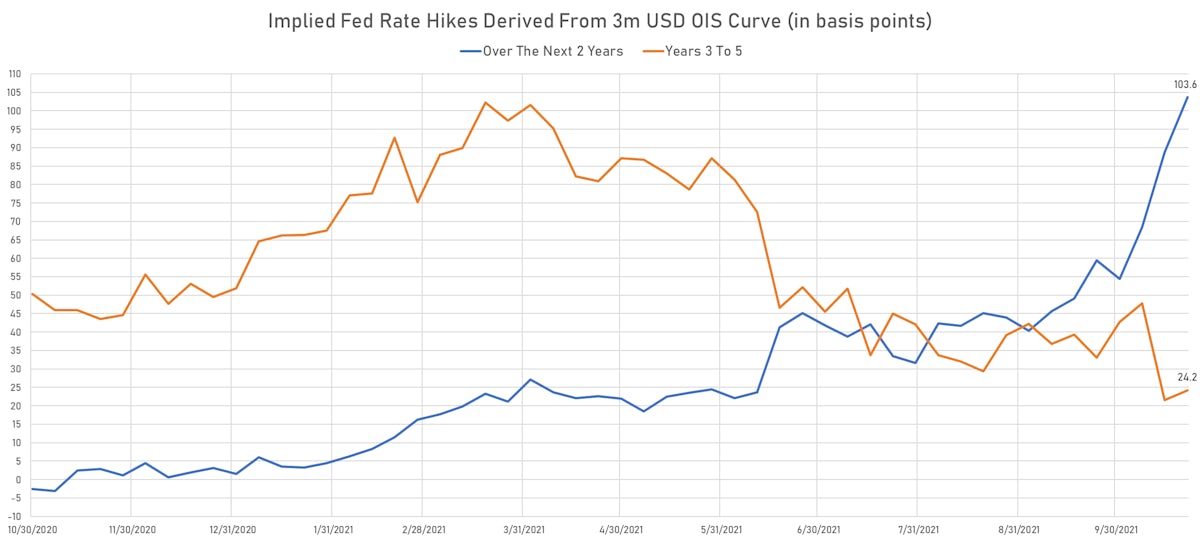

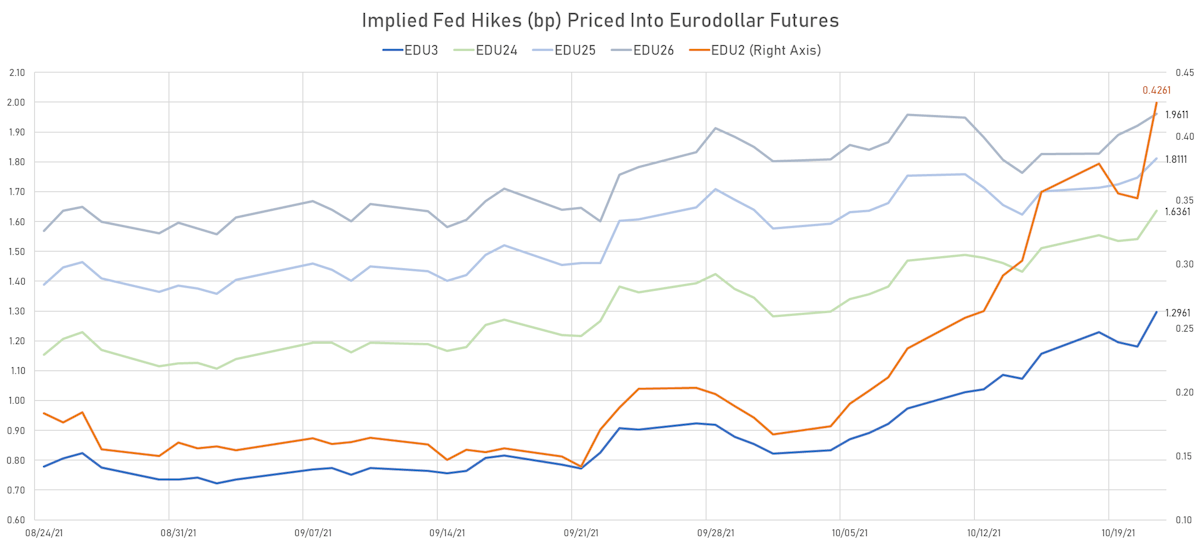

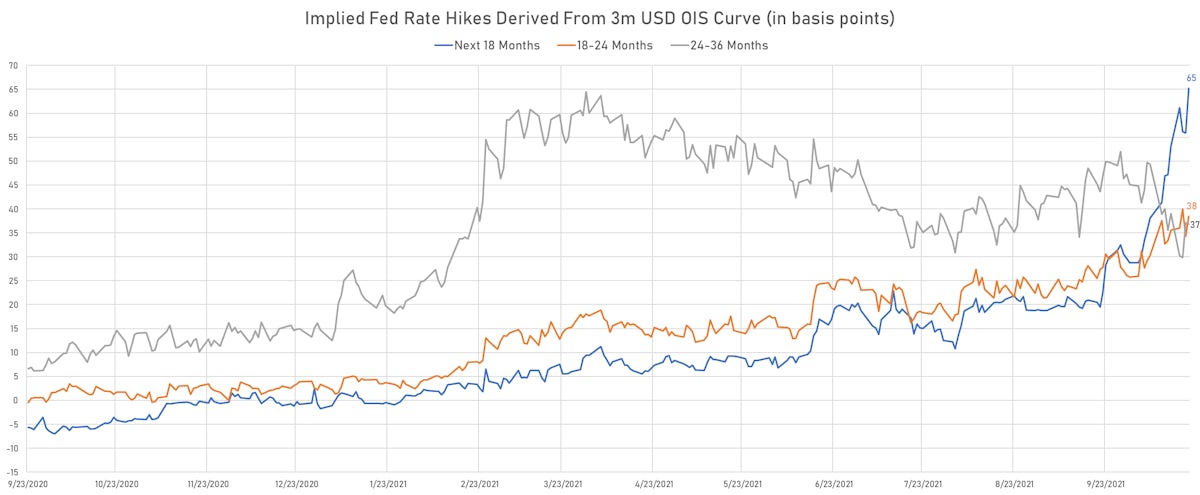

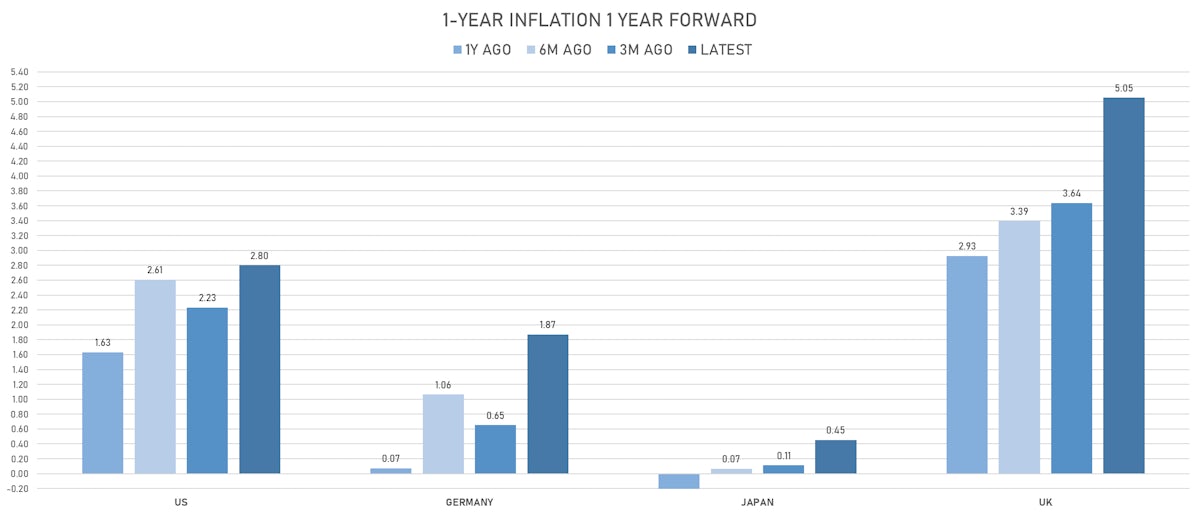

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 42.6 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), up 7.4 bp today

- The 3-month USD OIS forward curve prices in 140.4 bp over the next 3 years (equivalent to 5.62 rate hikes)

- The 3-month Eurodollar zero curve prices in 160.5 bp over the next 3 years (equivalent to 6.42 rate hikes)

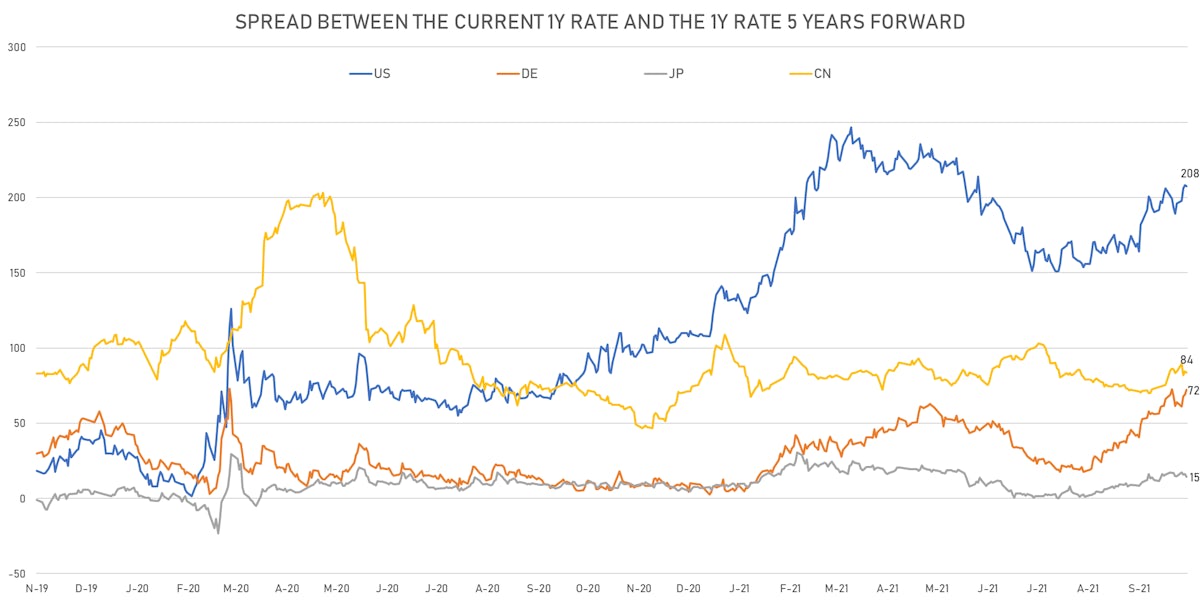

- 1-year US Treasury rate 5 years forward up 1.9 bp, now at 2.2258%, meaning that the 1-year Treasury rate is now expected to increase by 207.5 bp over the next 5 years (equivalent to 8.3 rate hikes)

US INFLATION & REAL RATES

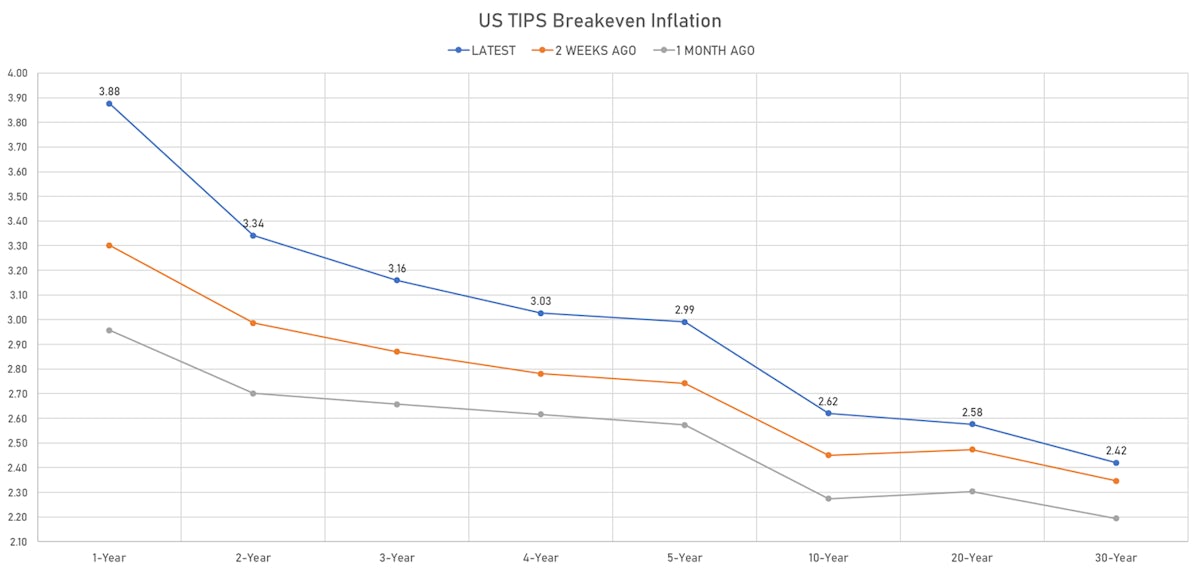

- TIPS 1Y breakeven inflation at 3.88% (up 11.8bp); 2Y at 3.34% (up 10.5bp); 5Y at 2.99% (up 9.0bp); 10Y at 2.62% (up 4.6bp); 30Y at 2.42% (up 1.0bp)

- 6-month spot US CPI swap up 9.0 bp to 3.747%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7250%, -2.7 bp today; 10Y at -0.9460%, -0.9 bp today; 30Y at -0.2660%, -0.3 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 6.8% at 35.2%

- 3-Month LIBOR-OIS spread up 0.2 bp at 5.7 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.414% (up 4.4 bp); the German 1Y-10Y curve is 2.4 bp flatter at 53.1bp (YTD change: +37.2 bp)

- Japan 5Y: -0.062% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 19.9bp (YTD change: +6.0 bp)

- China 5Y: 2.829% (down -3.7 bp); the Chinese 1Y-10Y curve is 2.5 bp flatter at 67.6bp (YTD change: +21.2 bp)

- Switzerland 5Y: -0.381% (up 2.0 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 63.2bp (YTD change: +35.8 bp)