Rates

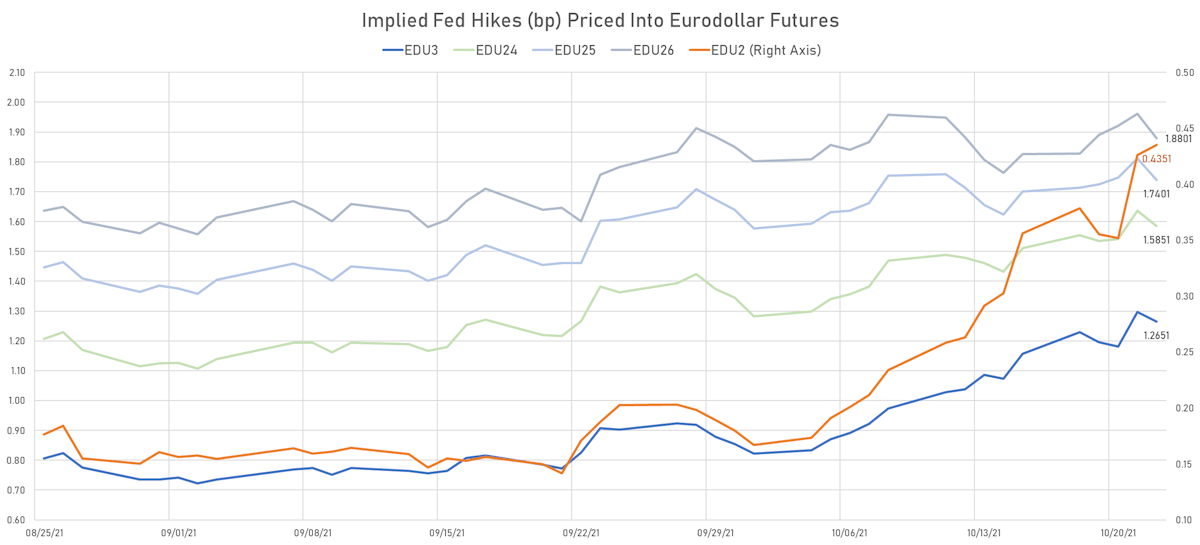

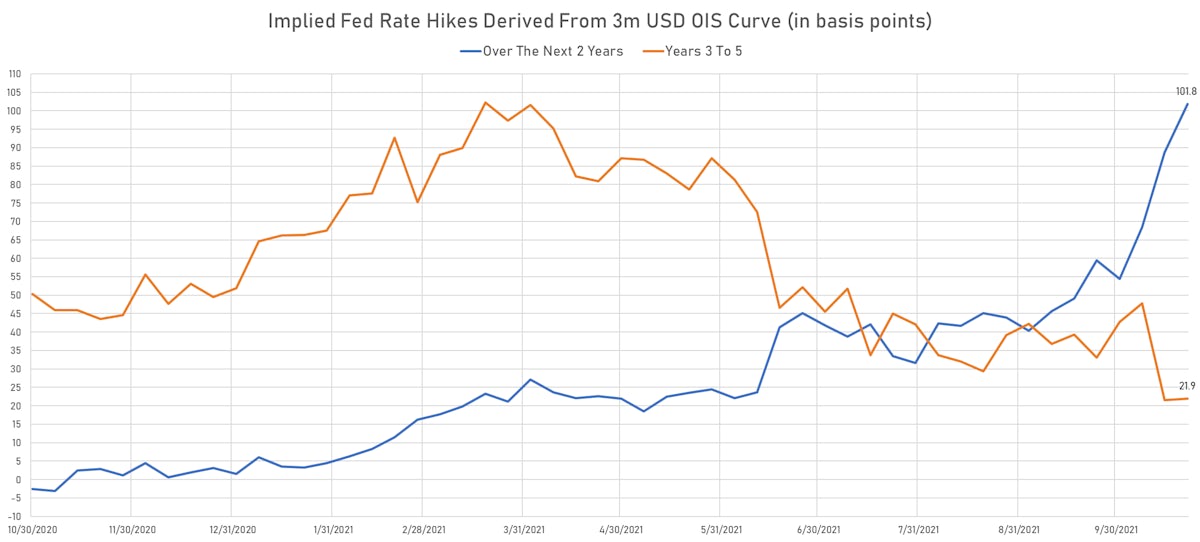

US Rates Volatility Keeps Rising, With Eurodollar Futures Implied Yields Getting Closer To Pricing 2 Full Hikes in 2022

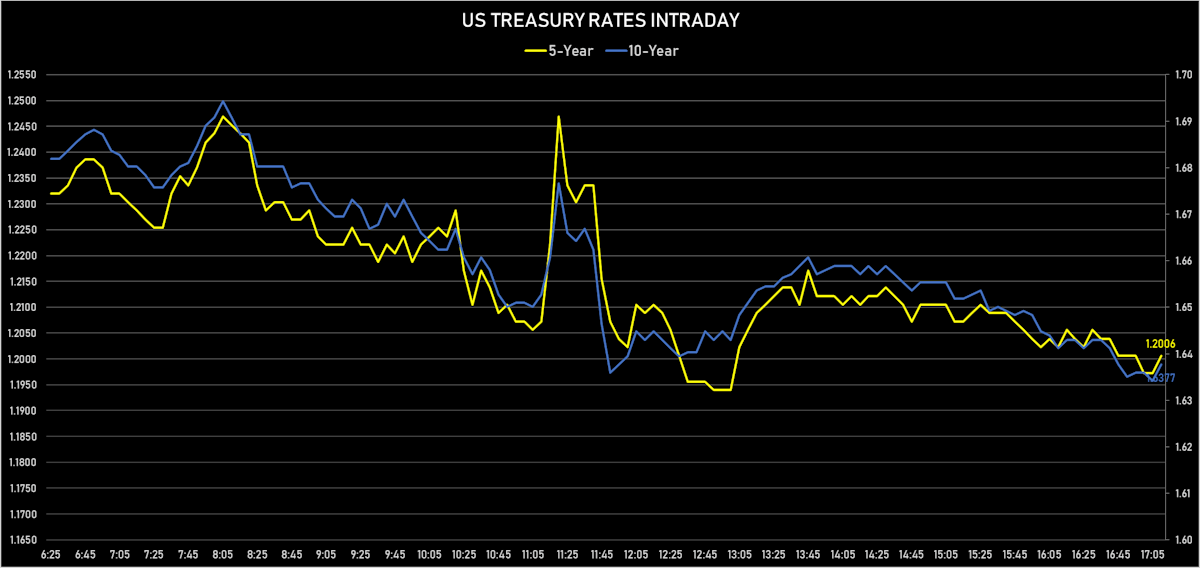

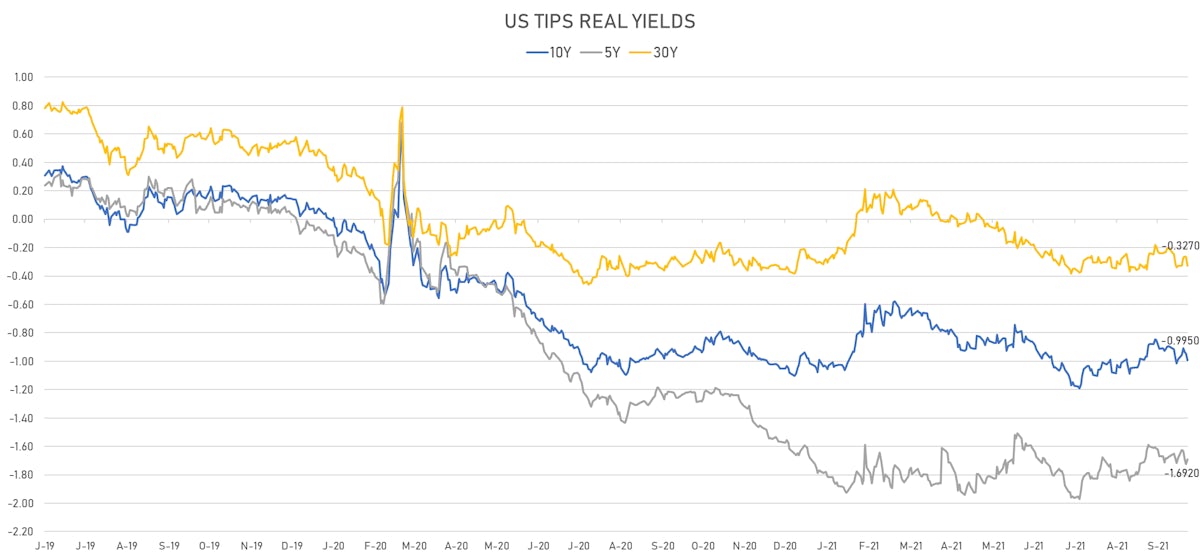

The Treasury yield curve rose at the front end, fell sharply at the long end, with the 2s10s spread down 6.5bp today, mostly driven by real yields (as opposed to breakevens)

Published ET

Implied Fed Hikes Derived From The 3-month USD OIS Forward Curve (Weekly Prices) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.10bp today, now at 0.1249%; 3-Month OIS unchanged today, now at 0.0740%

- The treasury yield curve flattened, with the 1s10s spread tightening -5.6 bp, now at 153.1 bp (YTD change: +72.6bp)

- 1Y: 0.1070% (down 0.3 bp)

- 2Y: 0.4595% (up 0.7 bp)

- 5Y: 1.2006% (down 3.4 bp)

- 7Y: 1.4796% (down 5.1 bp)

- 10Y: 1.6377% (down 5.8 bp)

- 30Y: 2.0712% (down 7.3 bp)

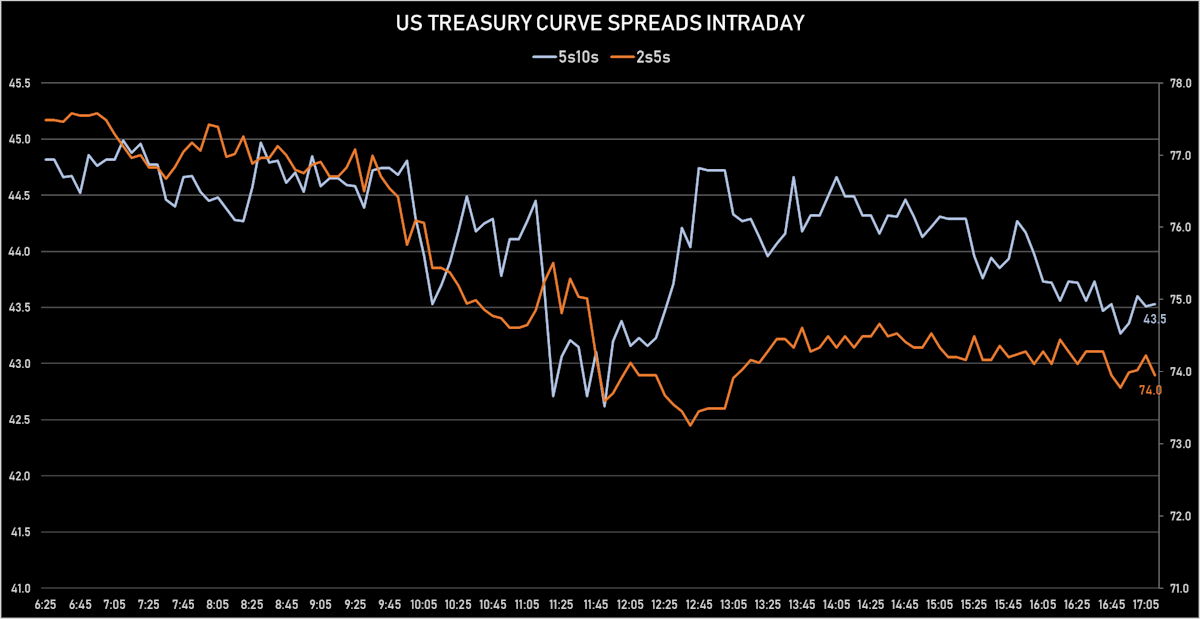

- US treasury curve spreads: 2s5s at 74.1bp (down -4.1bp), 5s10s at 43.7bp (down -2.4bp), 10s30s at 43.4bp (down -1.4bp)

- Treasuries butterfly spreads: 1s5s10s at -65.6bp (up 1.5bp today), 5s10s30s at -0.7bp (up 1.5bp)

- US 5-Year TIPS Real Yield: +3.3 bp at -1.6920%; 10-Year TIPS Real Yield: -4.9 bp at -0.9950%; 30-Year TIPS Real Yield: -6.1 bp at -0.3270%

US MACRO RELEASES

- PMI, Services Sector, Business Activity, Flash for Oct 2021 (Markit Economics) at 58.20 (vs 54.90 prior), above consensus estimate of 55.10

- PMI, Manufacturing Sector, Total, Flash for Oct 2021 (Markit Economics) at 59.20 (vs 60.70 prior), below consensus estimate of 60.30

- PMI, Composite, Output, Flash for Oct 2021 (Markit Economics) at 57.30 (vs 55.00 prior)

- Federal Budget, Current Prices for Sep 2021 (Fiscal Service, USA) at -62.00 Bln USD (vs -171.00 Bln USD prior), below consensus estimate of -60.00 Bln USD

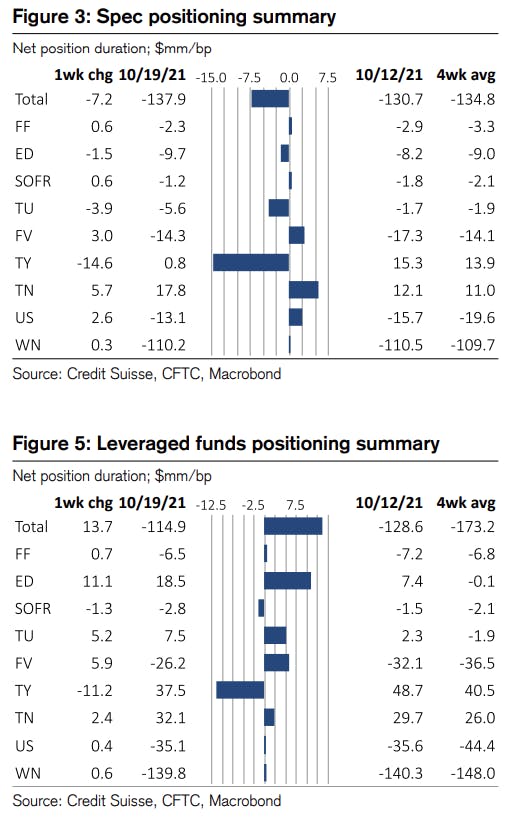

WEEKLY NET DURATION POSITIONING DATA

- Specs net short duration dropped slightly, mostly by closing the long position they held in TY. Largest position by far is still net short WN (Ultra 10Y)

- Leveraged funds increased their net long duration in Eurodollars, building a bet on a steepening of the yield curve, with their largest position largely unchanged (net short WN)

US FORWARD RATES

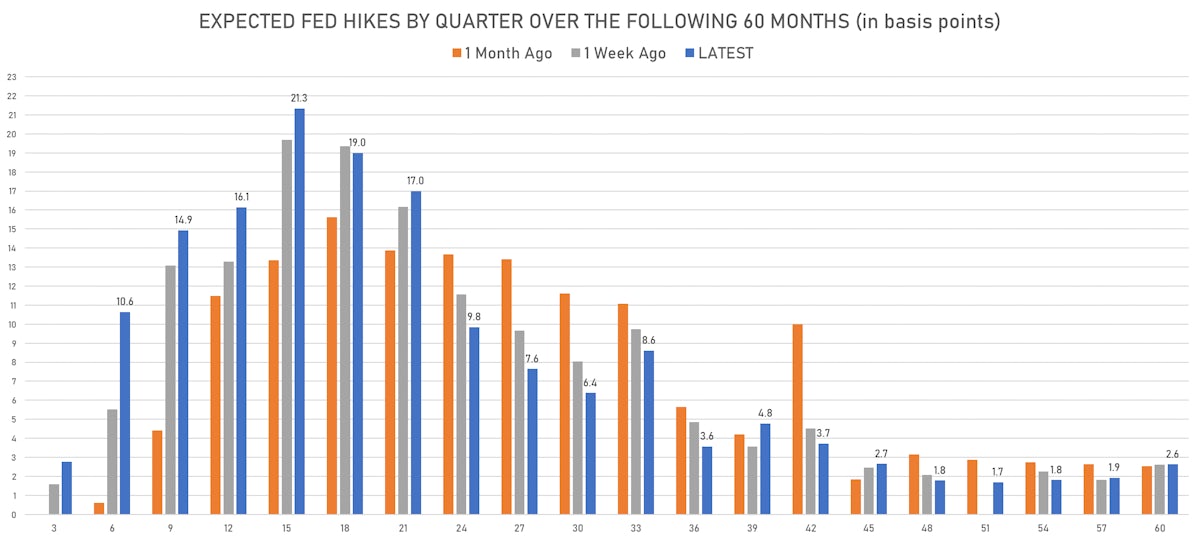

- 3-month Eurodollar future (EDU2) expected hike of 43.5 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), up 0.9 bp today

- The 3-month USD OIS forward curve prices in 134.3 bp over the next 3 years (equivalent to 5.37 rate hikes)

- The 3-month Eurodollar zero curve prices in 157.3 bp over the next 3 years (equivalent to 6.29 rate hikes)

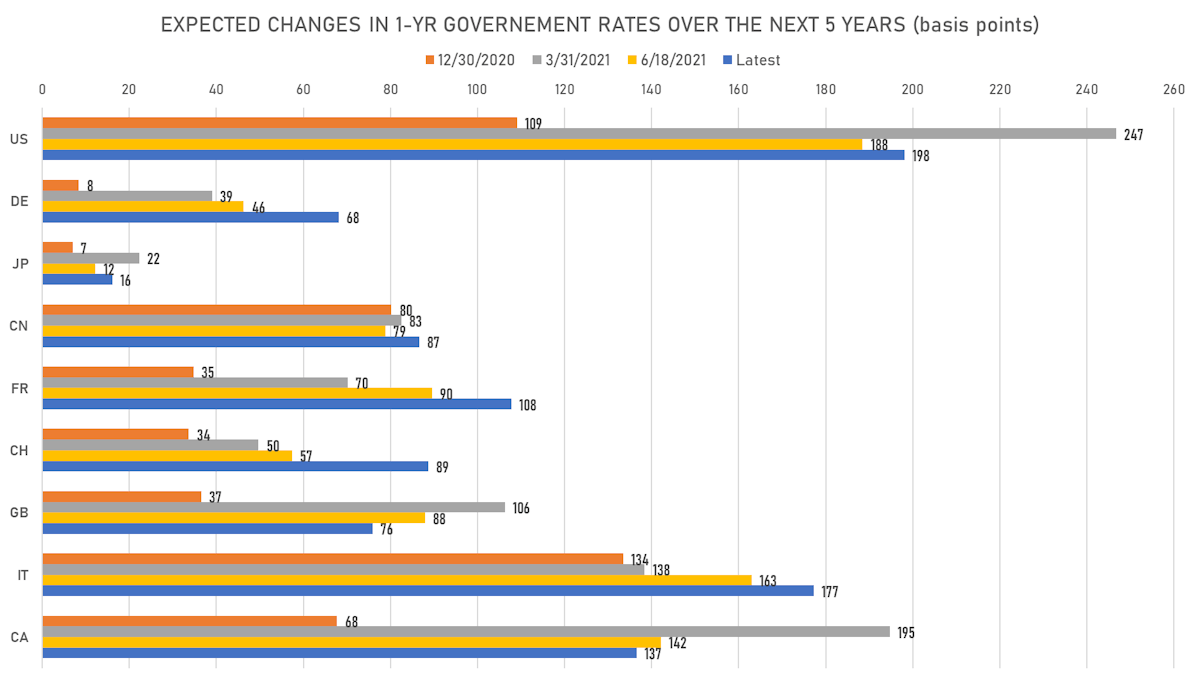

- 1-year US Treasury rate 5 years forward down 9.0 bp, now at 2.1354%, meaning that the 1-year Treasury rate is now expected to increase by 198.1 bp over the next 5 years (equivalent to 7.9 rate hikes)

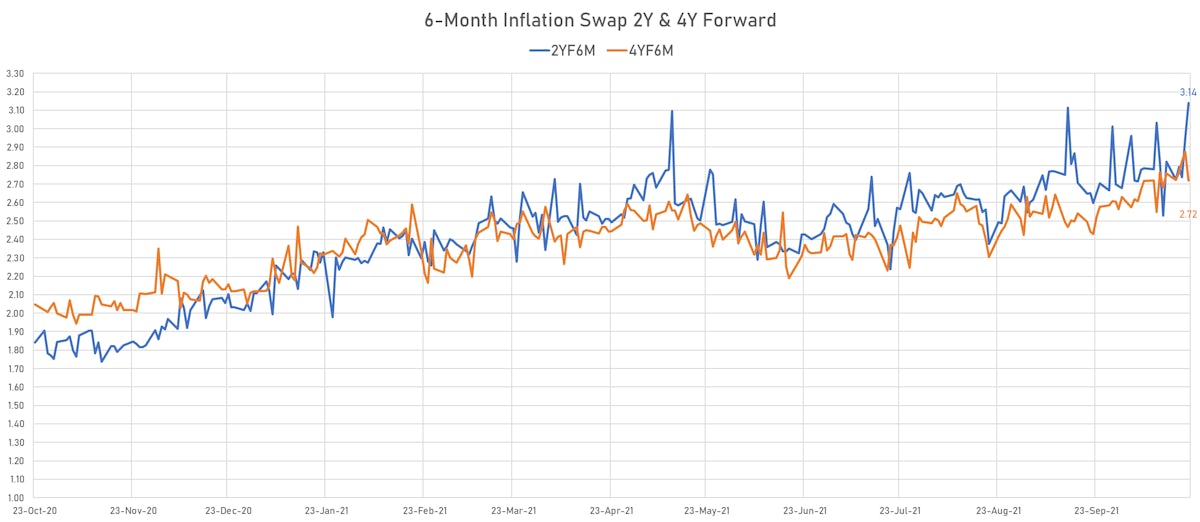

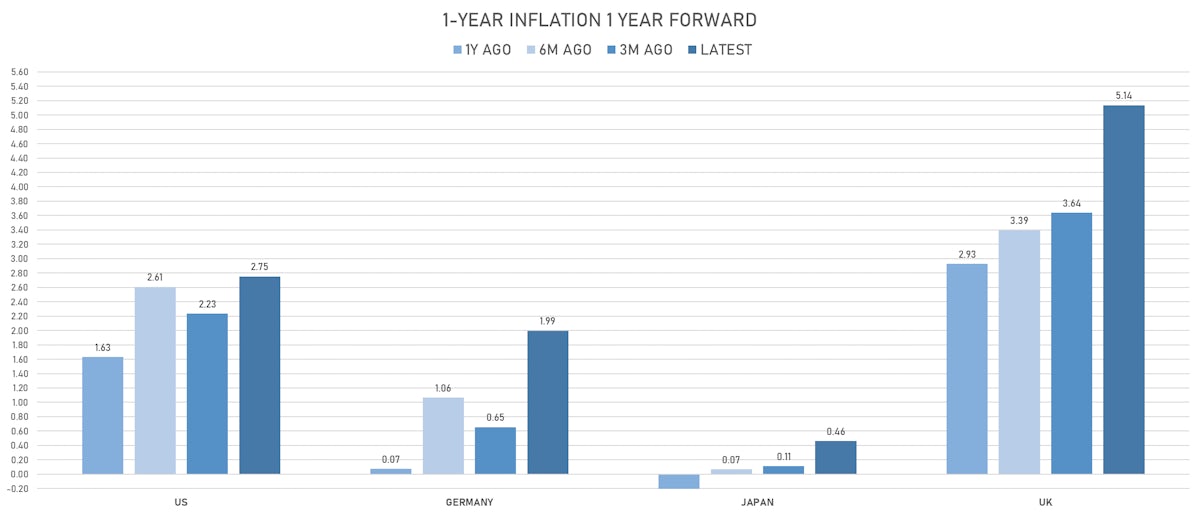

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.98% (up 10.1bp); 2Y at 3.37% (up 3.3bp); 5Y at 2.98% (down -0.8bp); 10Y at 2.61% (down -0.7bp); 30Y at 2.41% (down -1.1bp)

- 6-month spot US CPI swap down -3.5 bp to 3.712%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6920%, +3.3 bp today; 10Y at -0.9950%, -4.9 bp today; 30Y at -0.3270%, -6.1 bp today

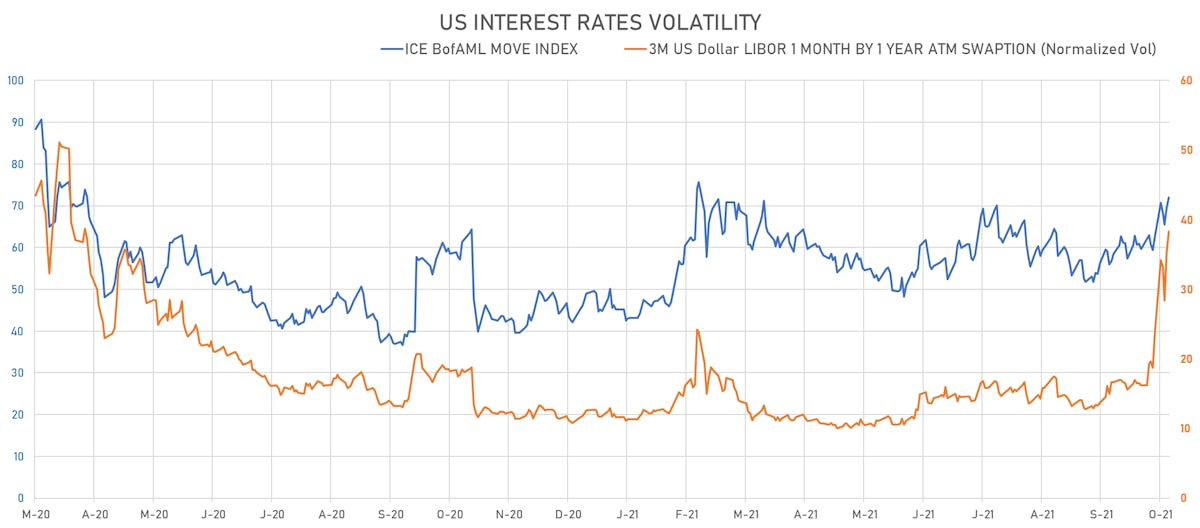

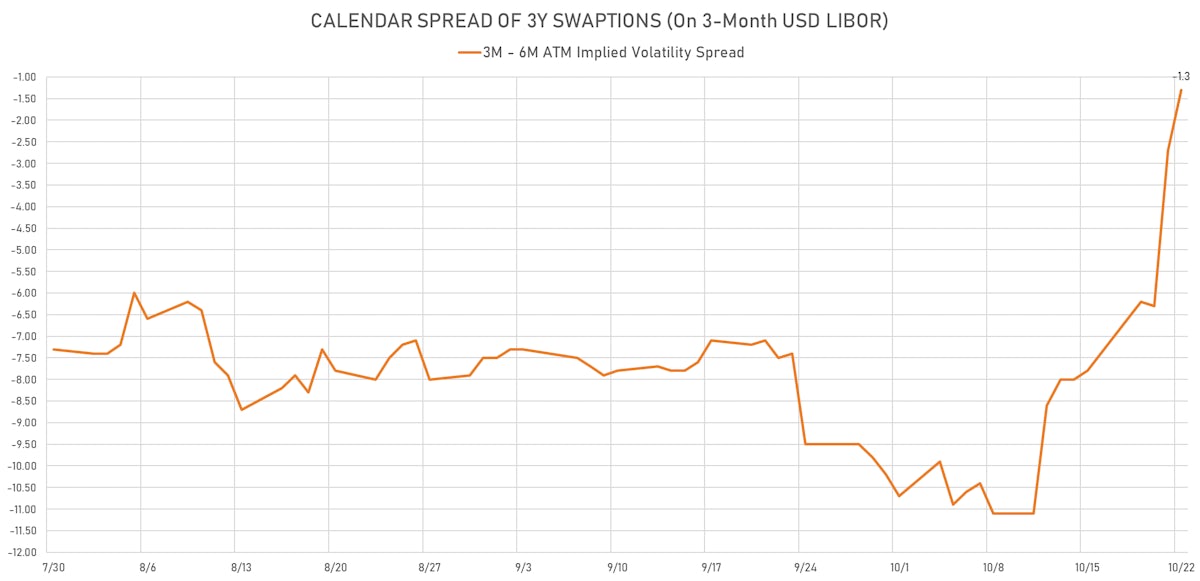

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.1% at 38.3%

- 3-Month LIBOR-OIS spread up 0.1 bp at 5.1 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.423% (up 1.3 bp); the German 1Y-10Y curve is 0.5 bp steeper at 51.9bp (YTD change: +37.7 bp)

- Japan 5Y: -0.057% (up 0.8 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 20.4bp (YTD change: +5.8 bp)

- China 5Y: 2.843% (up 1.4 bp); the Chinese 1Y-10Y curve is 1.9 bp steeper at 69.5bp (YTD change: +23.1 bp)

- Switzerland 5Y: -0.366% (up 1.5 bp); the Swiss 1Y-10Y curve is 2.3 bp steeper at 64.5bp (YTD change: +38.1 bp)