Rates

Front Yields Drop Slightly Along With Rates Volatility After Sharp Rise Last Week, Despite Big Moves In Short-Term Inflation Expectations

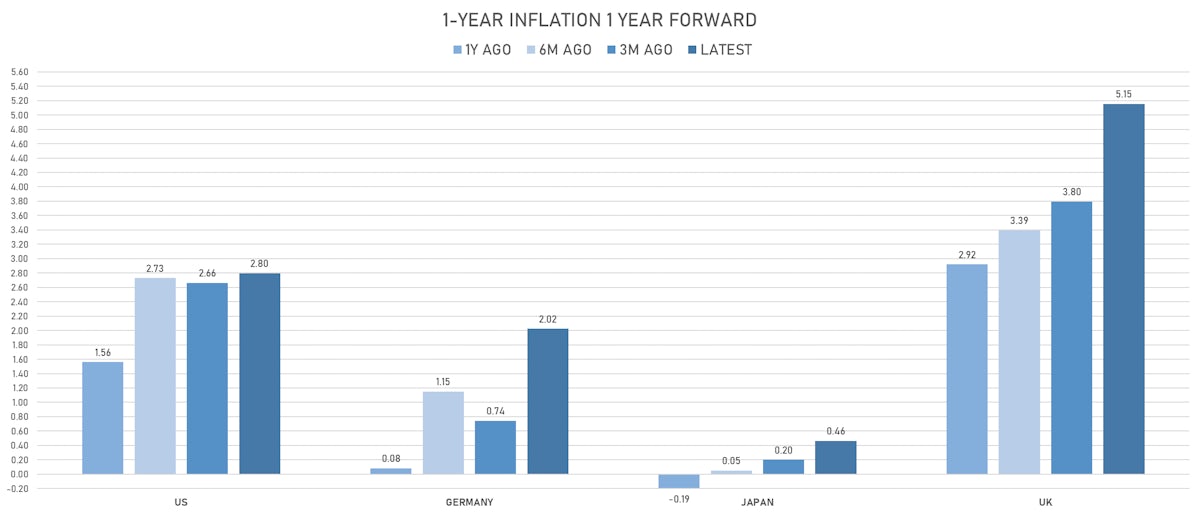

The 1-Year TIPS breakeven inflation rate rose 10bp today, with a of regional Fed studies pointing to broader inflationary pressures than the current official Fed statements, while real rates were down significantly (5Y TIPS yield down 8bp)

Published ET

6-Month CPI Swap Spot & 5 Years Forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

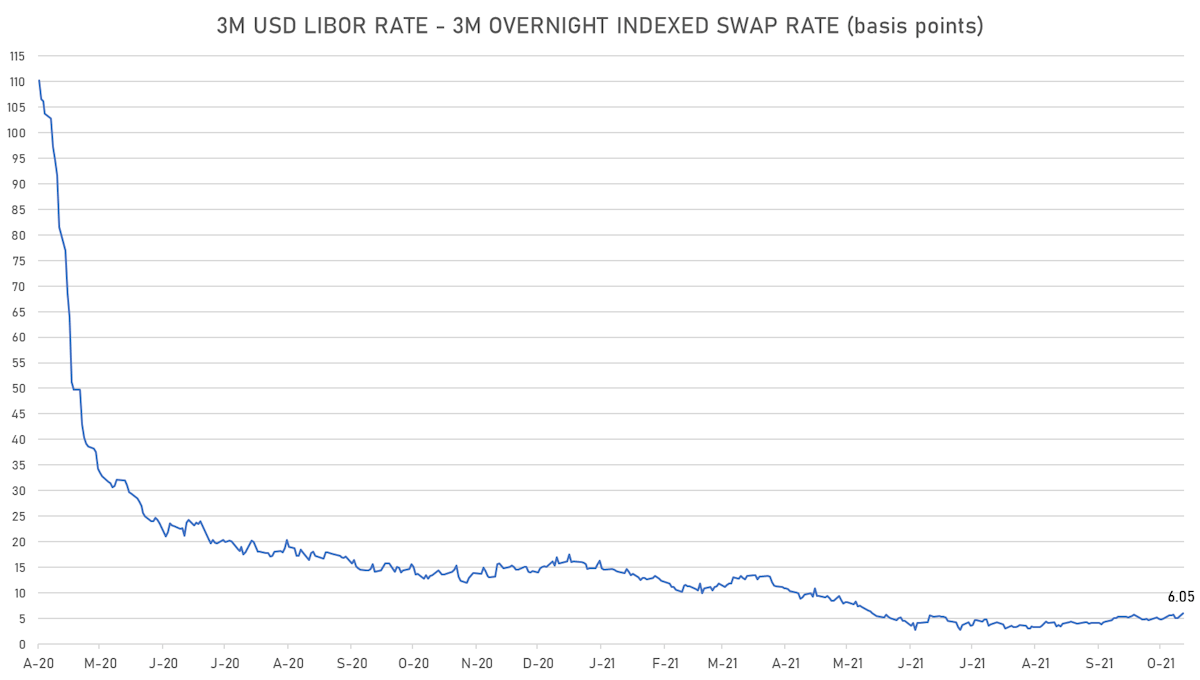

- 3-Month USD LIBOR +0.96bp today at 0.1345%; 3-Month OIS unchanged at 0.0740%

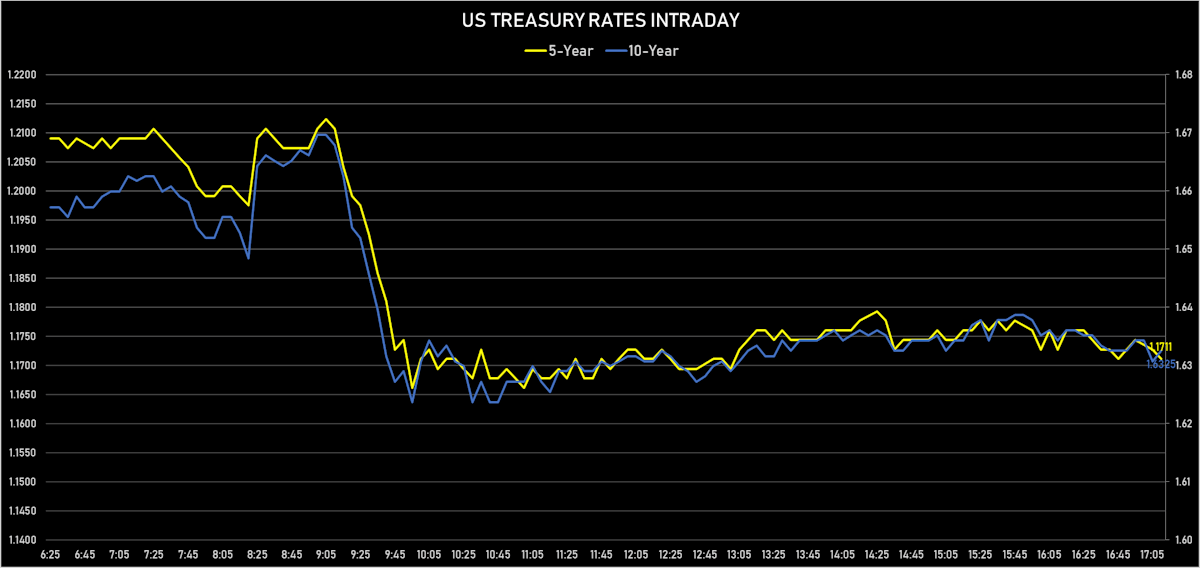

- The treasury yield curve flattened, with the 1s10s spread tightening -1.0 bp, now at 151.4 bp (YTD change: +70.9bp)

- 1Y: 0.1190% (up 0.5 bp)

- 2Y: 0.4353% (down 2.4 bp)

- 5Y: 1.1711% (down 2.9 bp)

- 7Y: 1.4617% (down 1.8 bp)

- 10Y: 1.6325% (down 0.5 bp)

- 30Y: 2.0826% (up 1.1 bp)

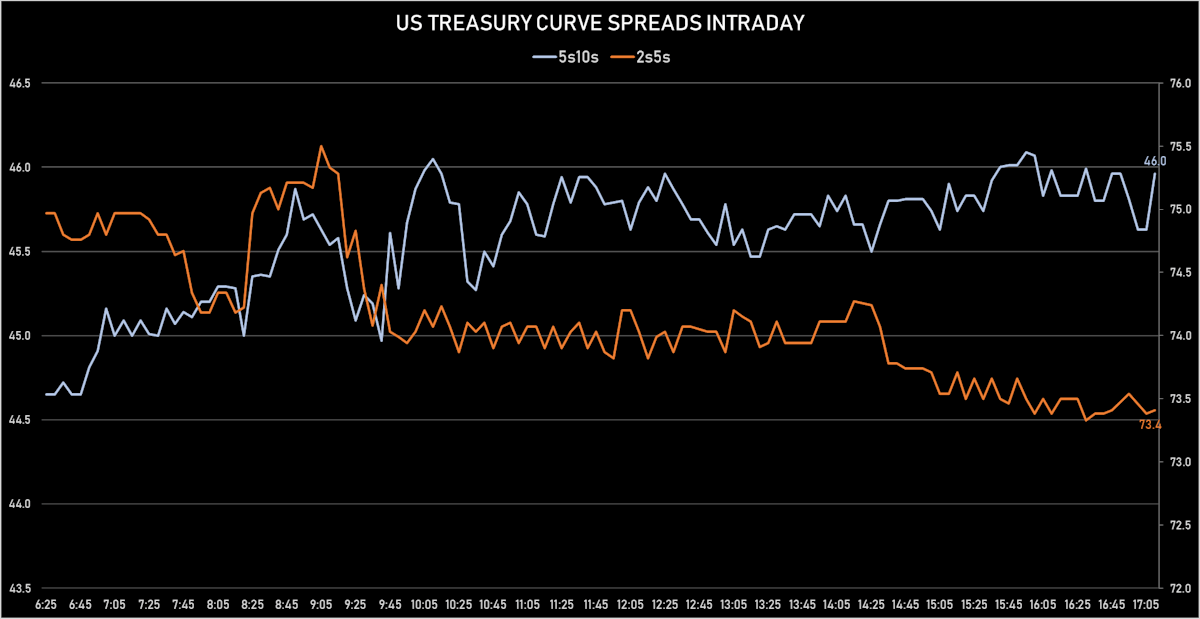

- US treasury curve spreads: 2s5s at 73.6bp (down -0.5bp), 5s10s at 46.1bp (up 2.4bp today), 10s30s at 45.0bp (up 1.6bp today)

- Treasuries butterfly spreads: 1s5s10s at -60.0bp (up 5.6bp today), 5s10s30s at -1.1bp (down -0.4bp)

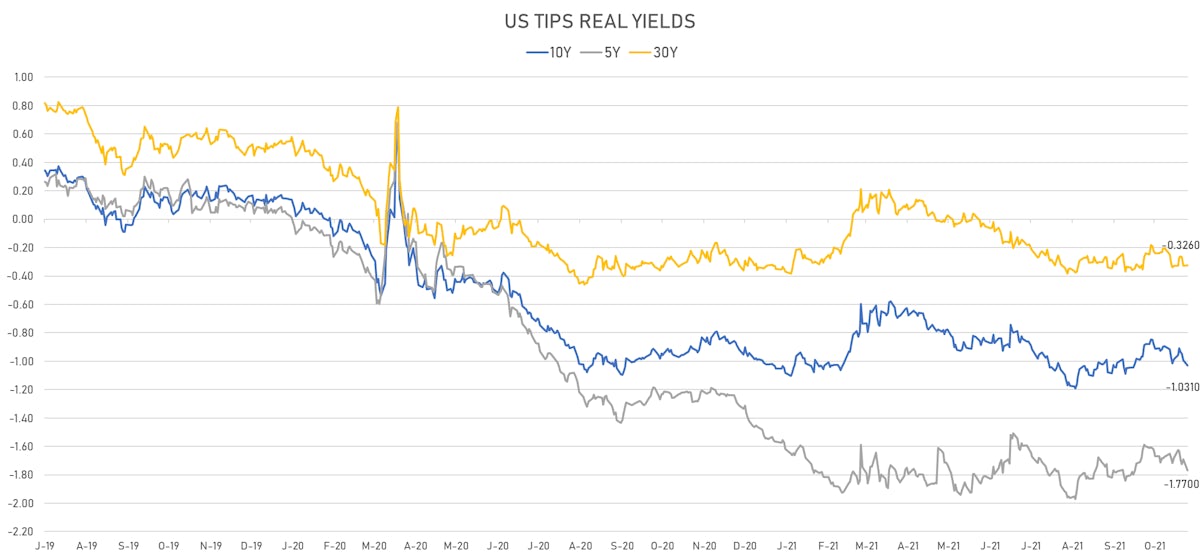

- US 5-Year TIPS Real Yield: -7.8 bp at -1.7700%; 10-Year TIPS Real Yield: -3.6 bp at -1.0310%; 30-Year TIPS Real Yield: +0.1 bp at -0.3260%

US MACRO RELEASES

- Chicago Fed CFMMI, National Activity Index for Sep 2021 (Federal Reserve, Chicago) at -0.13 (vs 0.29 prior)

- Dallas Fed, General Business Activity for Oct 2021 (Federal Reserve, Dallas) at 14.60 (vs 4.60 prior)

US WEEK AHEAD

- A few coupon-bearing Treasury notes auctions coming up this week, with 2Y tomorrow (91282CDD0), 5Y on Wednesday (91282CDG3), and 7Y on Thursday (91282CDF5)

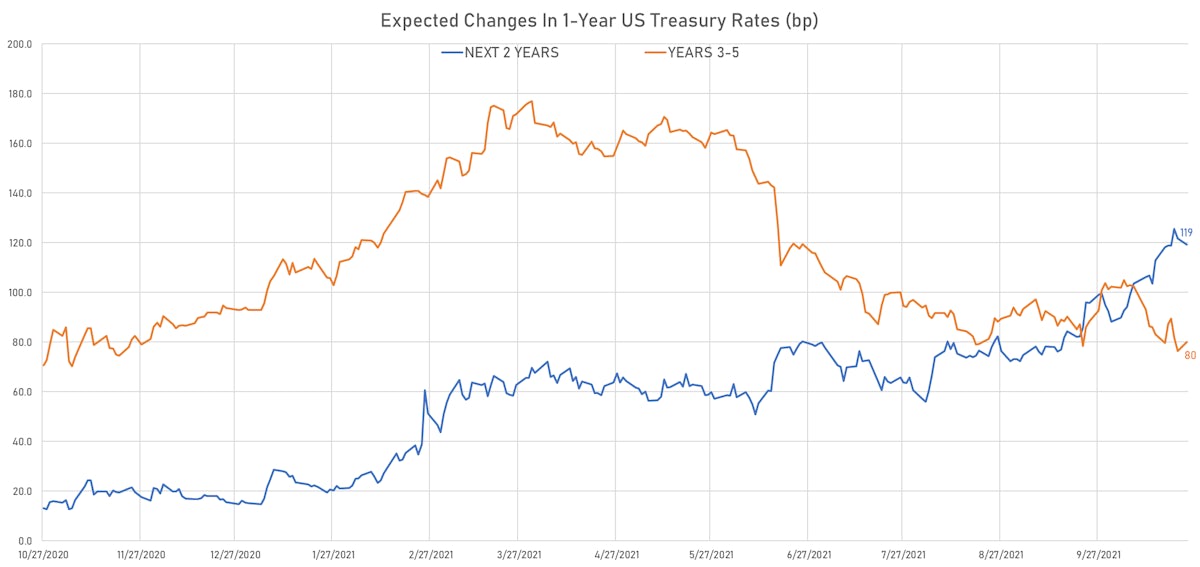

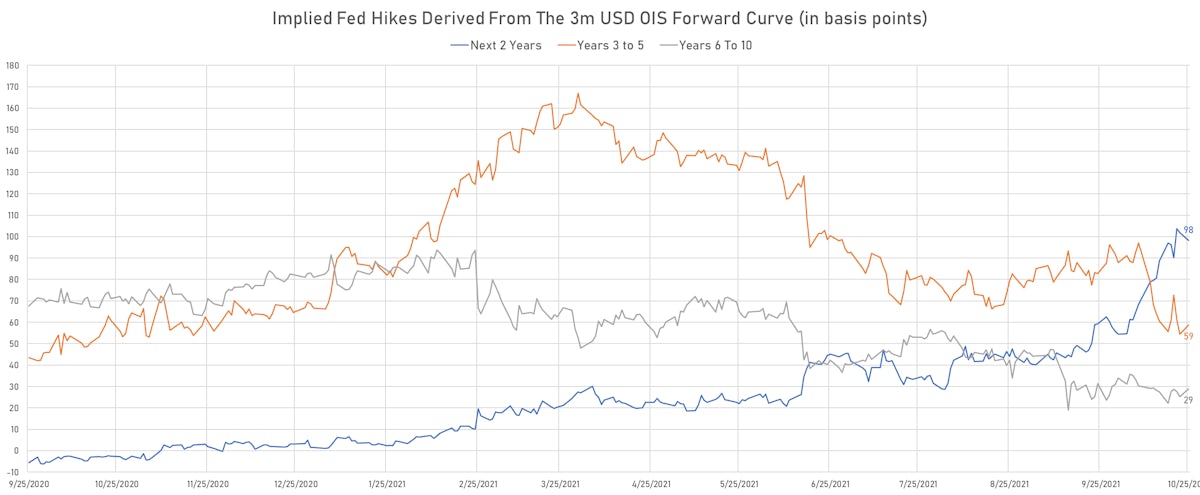

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 41.6 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), down -2.0 bp today

- The 3-month USD OIS forward curve prices in 129.9 bp over the next 3 years (equivalent to 5.19 rate hikes)

- The 3-month Eurodollar zero curve prices in 151.9 bp over the next 3 years (equivalent to 6.08 rate hikes)

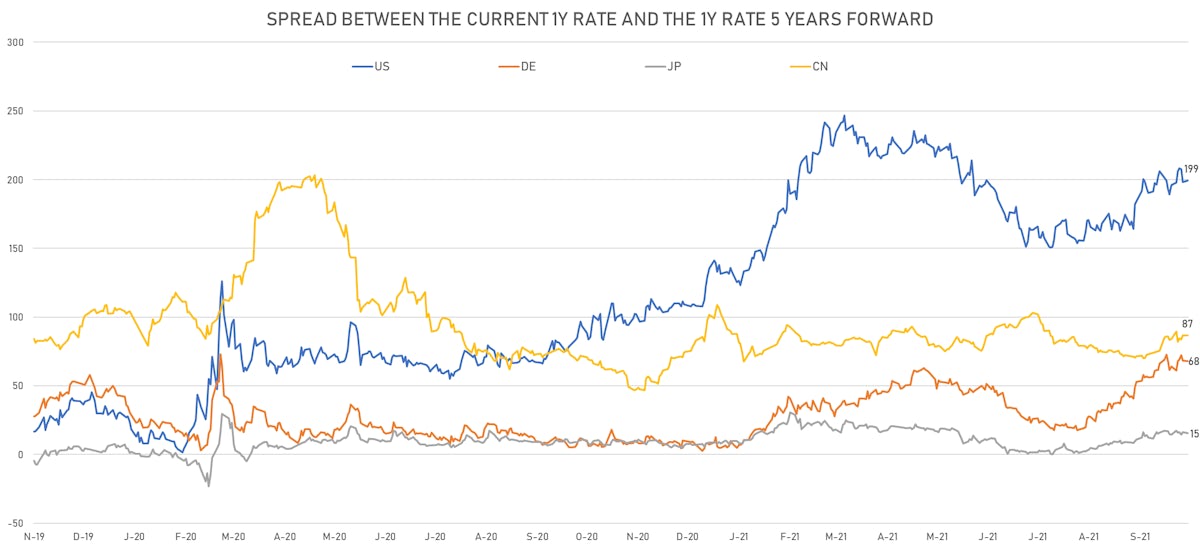

- 1-year US Treasury rate 5 years forward up 0.4 bp, now at 2.1398%, meaning that the 1-year Treasury rate is now expected to increase by 199.4 bp over the next 5 years (equivalent to 8.0 rate hikes)

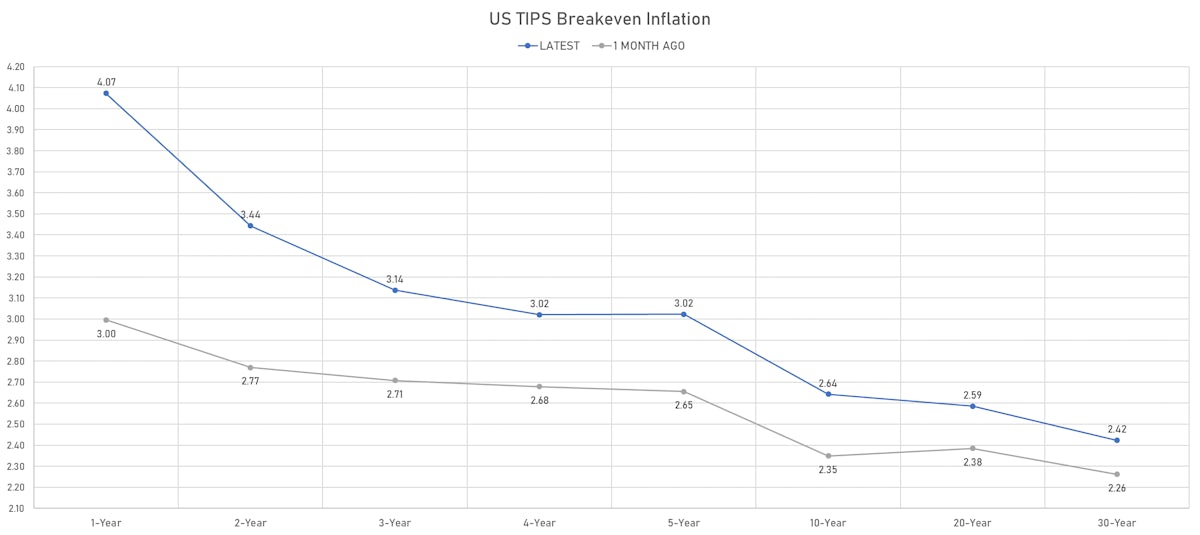

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.08% (up 10.5bp); 2Y at 3.45% (up 7.4bp); 5Y at 3.02% (up 3.9bp); 10Y at 2.64% (up 2.9bp); 30Y at 2.42% (up 1.0bp)

- 6-month spot US CPI swap up 14.6 bp to 3.858%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7700%, -7.8 bp today; 10Y at -1.0310%, -3.6 bp today; 30Y at -0.3260%, +0.1 bp today

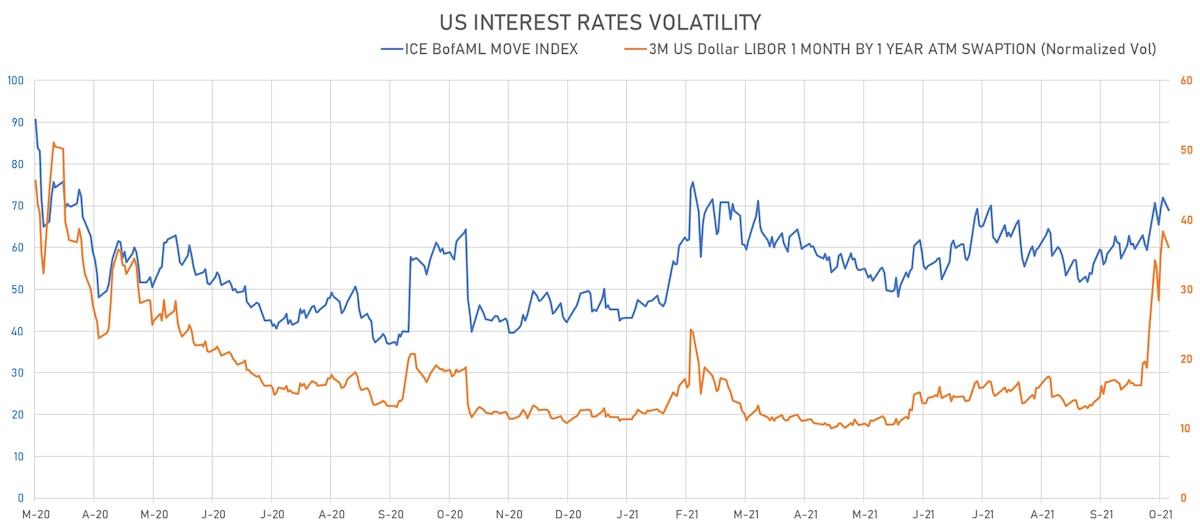

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.3% at 36.0%

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.1 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.453% (down -3.4 bp); the German 1Y-10Y curve is 1.8 bp steeper at 54.4bp (YTD change: +39.5 bp)

- Japan 5Y: -0.057% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 20.4bp (YTD change: +6.6 bp)

- China 5Y: 2.834% (down -0.9 bp); the Chinese 1Y-10Y curve is 1.1 bp flatter at 68.4bp (YTD change: +22.0 bp)

- Switzerland 5Y: -0.377% (down -1.1 bp); the Swiss 1Y-10Y curve is 1.7 bp flatter at 62.8bp (YTD change: +36.4 bp)