Rates

Positive Consumer Confidence Report Pushes Front Yields Higher, Flattening The Curve Further

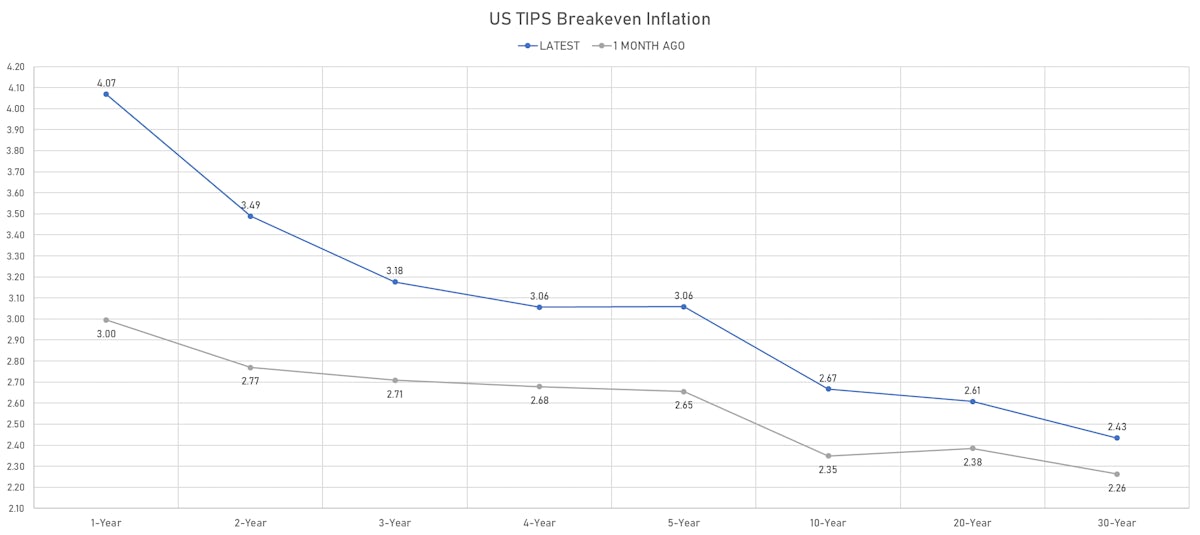

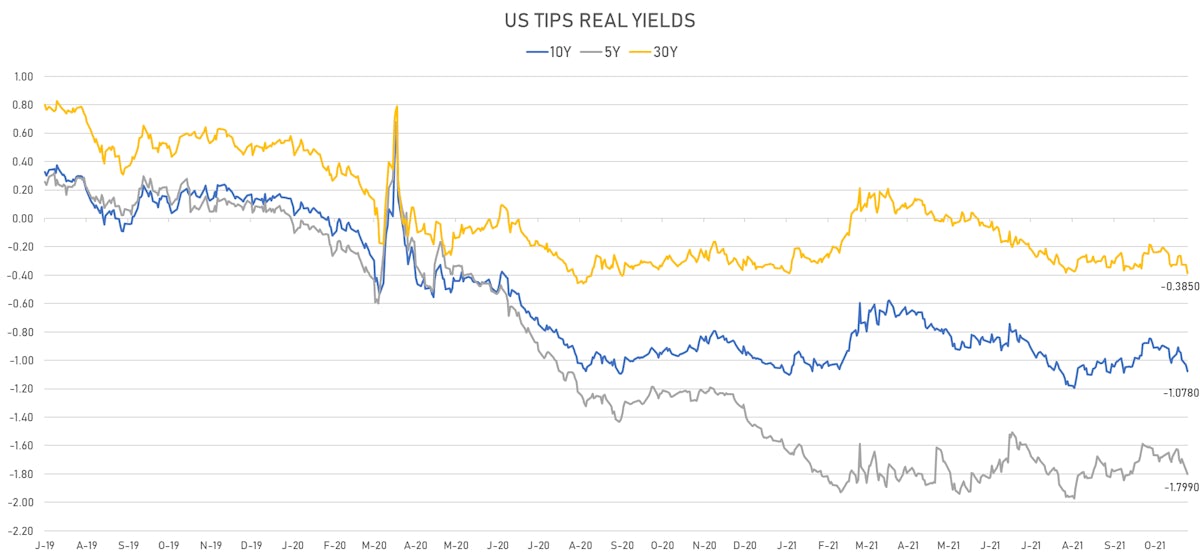

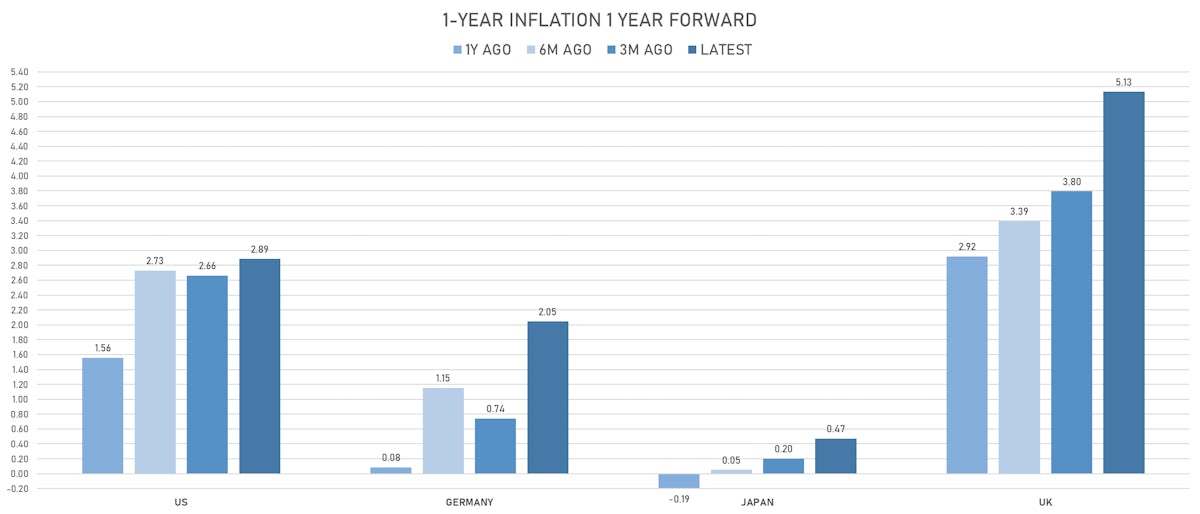

The Conference Board also reported a jump in 1-year inflation expectations, which got reflected in the TIPS curve through higher breakevens and lower real yields (stagflationary moves)

Published ET

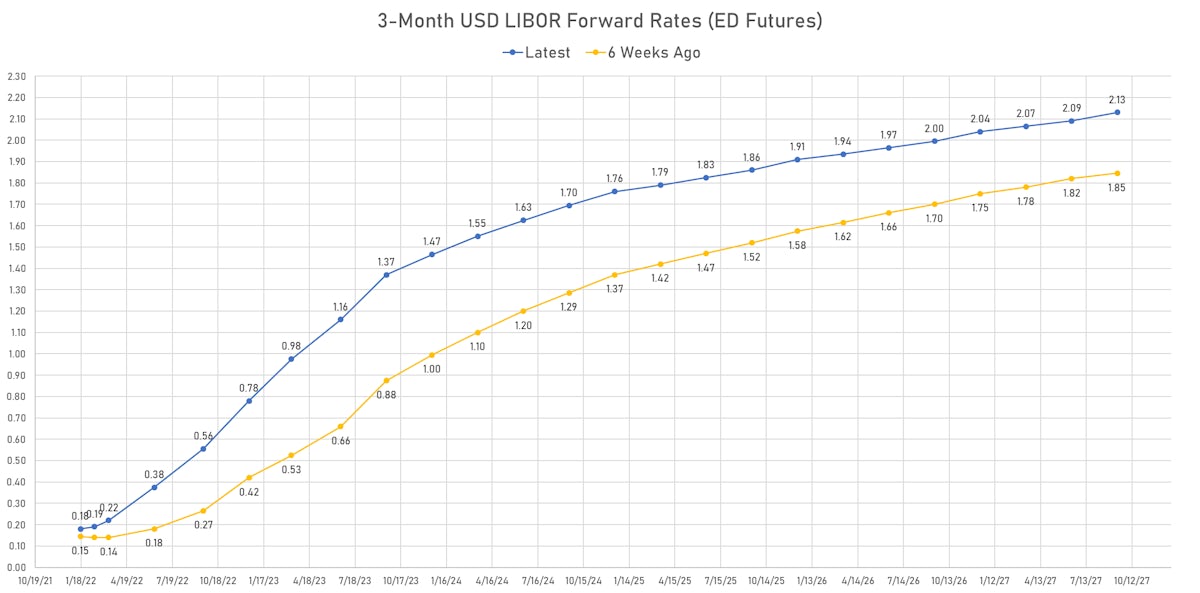

Recent Shift Up In The Rates Curve (3-month Eurodollar futures implied yields) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.96bp today, now at 0.1345%; 3-Month OIS unchanged at 0.0740%

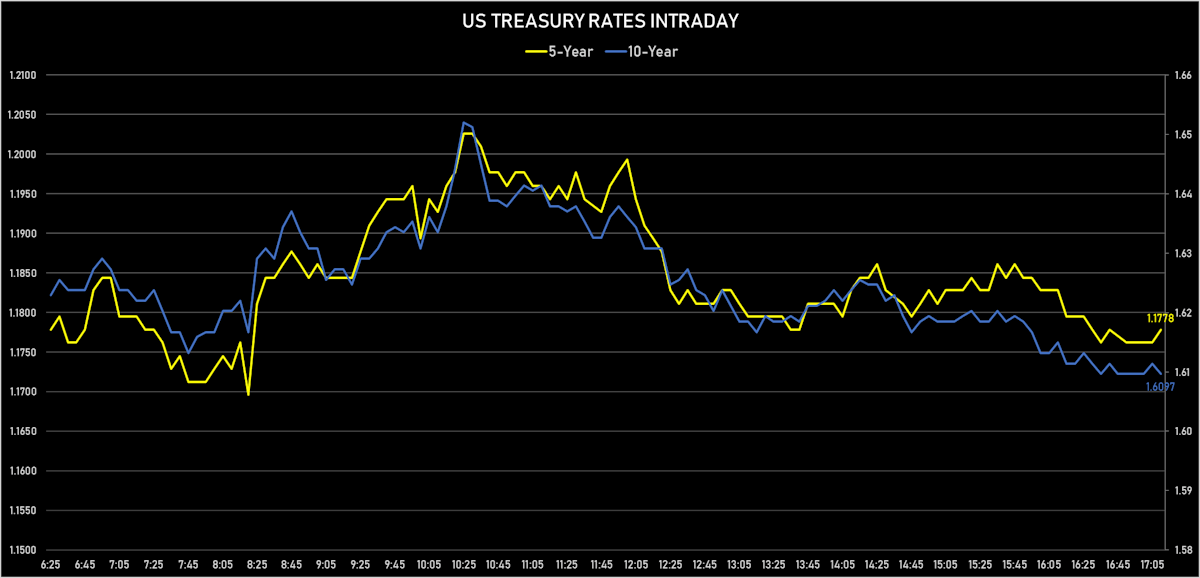

- The treasury yield curve flattened, with the 1s10s spread tightening -2.3 bp, now at 151.4 bp (YTD change: +70.9bp)

- 1Y: 0.1190% (unchanged)

- 2Y: 0.4353% (up 1.3 bp)

- 5Y: 1.1711% (up 0.7 bp)

- 7Y: 1.4617% (down 0.7 bp)

- 10Y: 1.6325% (down 2.3 bp)

- 30Y: 2.0826% (down 4.4 bp)

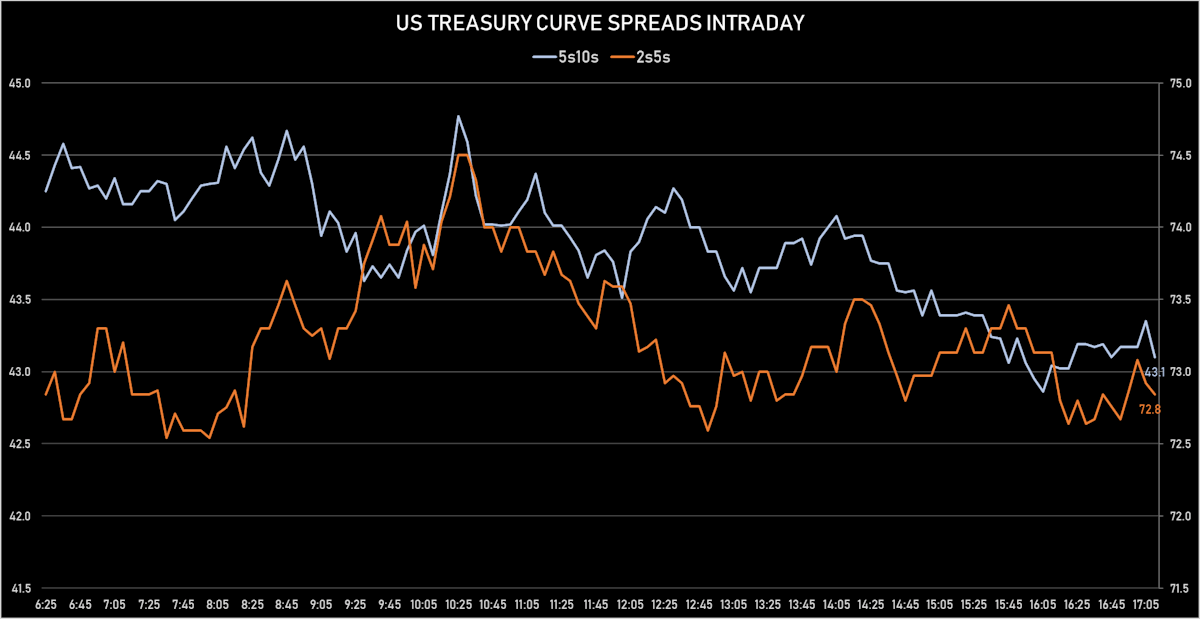

- US treasury curve spreads: 2s5s at 73.0bp (down -0.6bp), 5s10s at 43.2bp (down -2.9bp), 10s30s at 42.9bp (down -2.1bp)

- Treasuries butterfly spreads: 1s5s10s at -63.5bp (down -3.5bp), 5s10s30s at -0.4bp (up 0.7bp)

- US 5-Year TIPS Real Yield: -2.9 bp at -1.7990%; 10-Year TIPS Real Yield: -4.7 bp at -1.0780%; 30-Year TIPS Real Yield: -5.9 bp at -0.3850%

$60BN US TREASURY NOTE AUCTION: 2-YEAR, 0.375% COUPON (91282CDD0)

- Strong results, with good pricing and explosive demand

- High yield at 0.481% (vs 0.310% prior), a 0.1bp stop through compared to the when issued at the bid deadline

- Direct bids at 22.3% (vs 21.7% prior and 17.8% average)

- Indirect bids at 58.1% (vs 45.3% prior and 51.8% average)

- Bid-to-cover at 2.69 (vs 2.28 prior and 2.52 average)

- End-user demand at 80.4% (vs 67.0% prior and 69.6% average)

US MACRO RELEASES

- Building Permits for Sep 2021 (U.S. Census Bureau) at 1.59 Mln (vs 1.59 Mln prior)

- Building Permits, Change P/P for Sep 2021 (U.S. Census Bureau) at -7.80 % (vs -7.70 % prior)

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 23 Oct (Redbook Research) at 15.60 % (vs 15.40 % prior)

- House Prices, S&P Case-Shiller, Composite-20, Change P/P for Aug 2021 (Standard & Poor's) at 1.20 % (vs 1.50 % prior), below consensus estimate of 1.50 %

- House Prices, S&P Case-Shiller, Composite-20, Change P/P, Price Index for Aug 2021 (Standard & Poor's) at 0.90 % (vs 1.50 % prior), below consensus estimate of 1.50 %

- House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Aug 2021 (Standard & Poor's) at 19.70 % (vs 19.90 % prior), below consensus estimate of 20.00 %

- House Prices, FHFA, USA (Purchase-Only), Change P/P for Aug 2021 (OFHEO, United States) at 1.00 % (vs 1.40 % prior)

- House Prices, FHFA, USA (Purchase-Only), Change Y/Y for Aug 2021 (OFHEO, United States) at 18.50 % (vs 19.20 % prior)

- House Prices, FHFA, USA (Purchase-Only) for Aug 2021 (OFHEO, United States) at 351.70 (vs 348.40 prior)

- Richmond Fed Manufacturing, Manufacturing Index for Oct 2021 (FED, Richmond) at 12.00 (vs -3.00 prior)

- Richmond Fed Services, Revenues for Oct 2021 (FED, Richmond) at 9.00 (vs -3.00 prior)

- Richmond Fed Manufacturing, Shipments, current conditions for Oct 2021 (FED, Richmond) at 1.00 (vs -1.00 prior)

- Conference Board, Consumer confidence for Oct 2021 (The Conference Board) at 113.80 (vs 109.30 prior), above consensus estimate of 108.30

- New Home Sales for Sep 2021 (U.S. Census Bureau) at 0.80 Mln (vs 0.74 Mln prior), above consensus estimate of 0.76 Mln

- New Home Sales, Change P/P for Sep 2021 (U.S. Census Bureau) at 14.00 % (vs 1.50 % prior)

- Dallas Fed, Revenue (Sales for TROS) for Oct 2021 (Fed Resrv, Dallas) at 19.60 (vs 14.50 prior)

- Dallas Fed, General Business Activity for Oct 2021 (Fed Resrv, Dallas) at 20.70 (vs 8.30 prior)

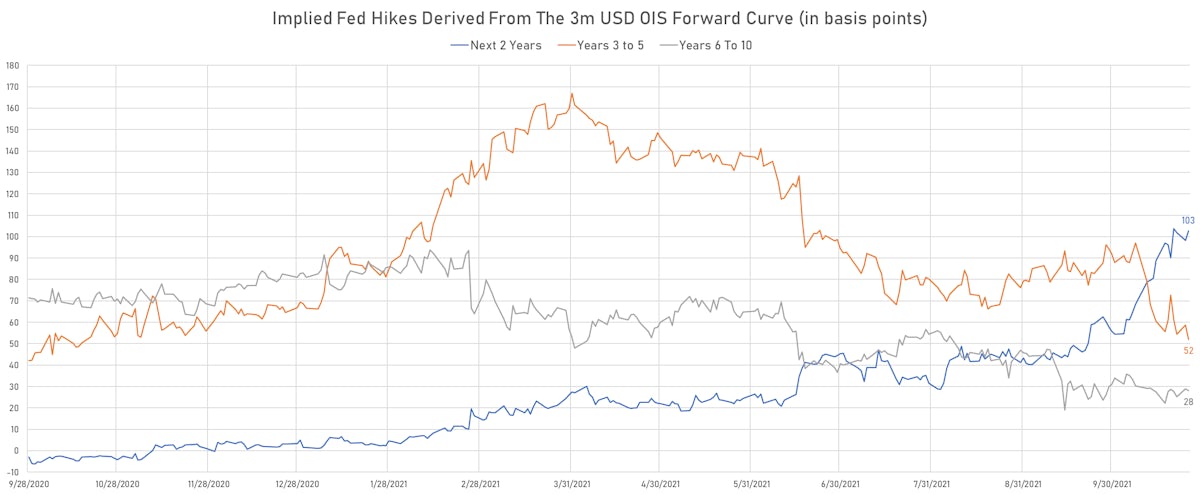

US FORWARD RATES

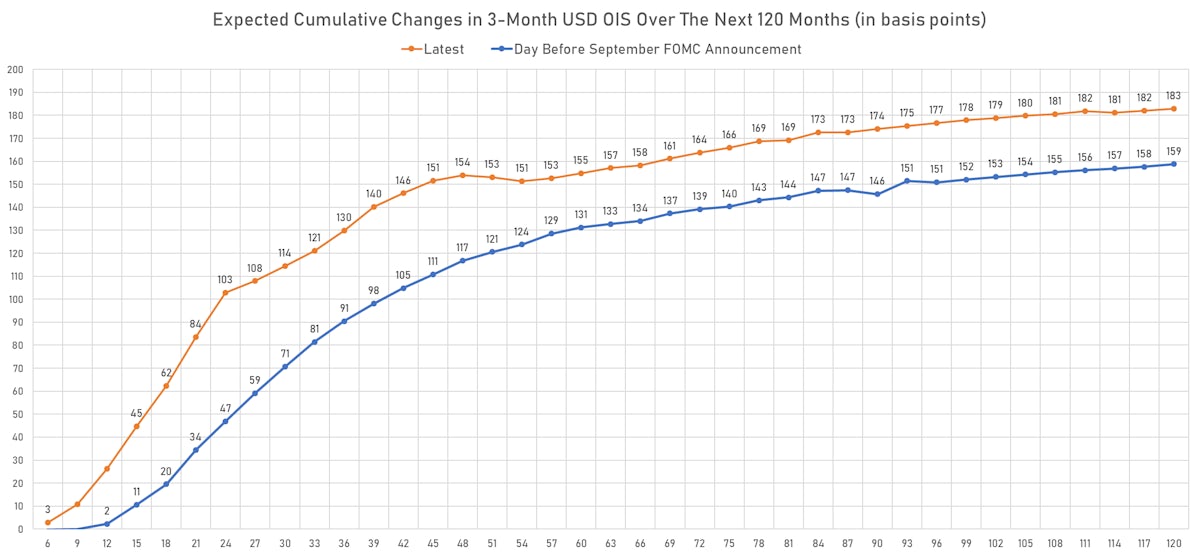

- 3-month Eurodollar future (EDU2) expected hike of 41.9 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), up 0.4 bp today

- The 3-month USD OIS forward curve prices in 129.9 bp over the next 3 years (equivalent to 5.20 rate hikes)

- The 3-month Eurodollar zero curve prices in 152.2 bp over the next 3 years (equivalent to 6.09 rate hikes)

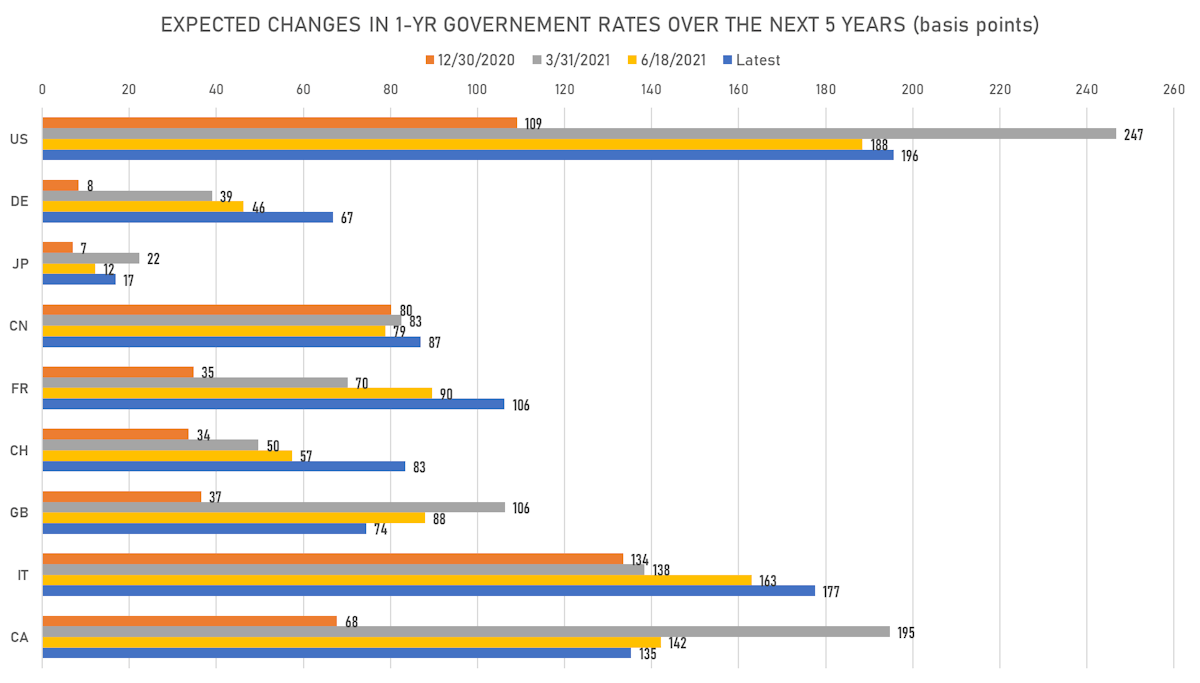

- 1-year US Treasury rate 5 years forward down 3.7 bp, now at 2.1030%, meaning that the 1-year Treasury rate is now expected to increase by 195.5 bp over the next 5 years (equivalent to 7.8 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.07% (down -1.2bp); 2Y at 3.49% (up 4.0bp); 5Y at 3.06% (up 3.7bp); 10Y at 2.67% (up 2.5bp); 30Y at 2.43% (up 1.5bp)

- 6-month spot US CPI swap up 5.4 bp to 3.912%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7990%, -2.9 bp today; 10Y at -1.0780%, -4.7 bp today; 30Y at -0.3850%, -5.9 bp today

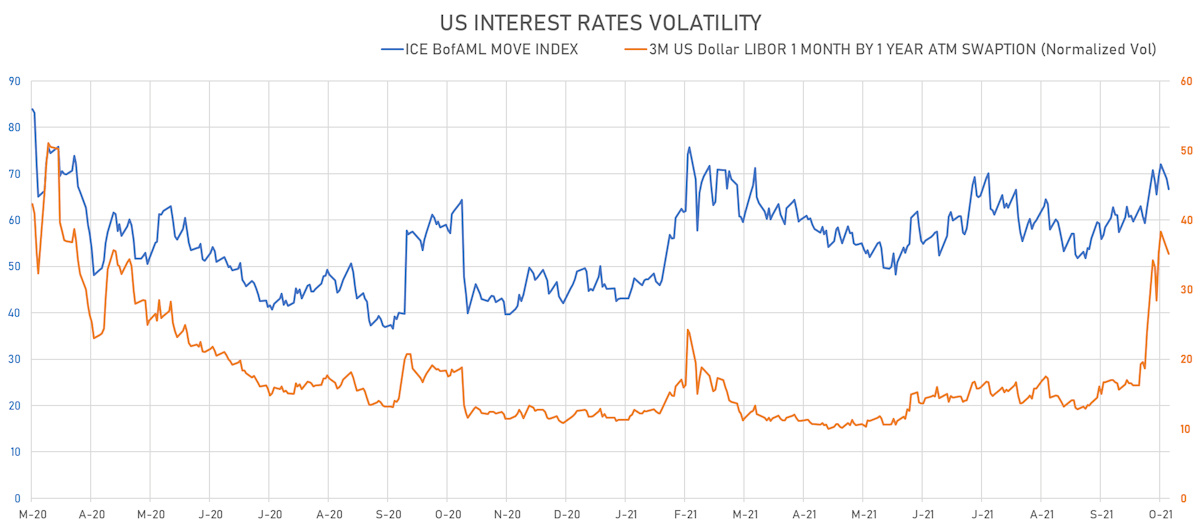

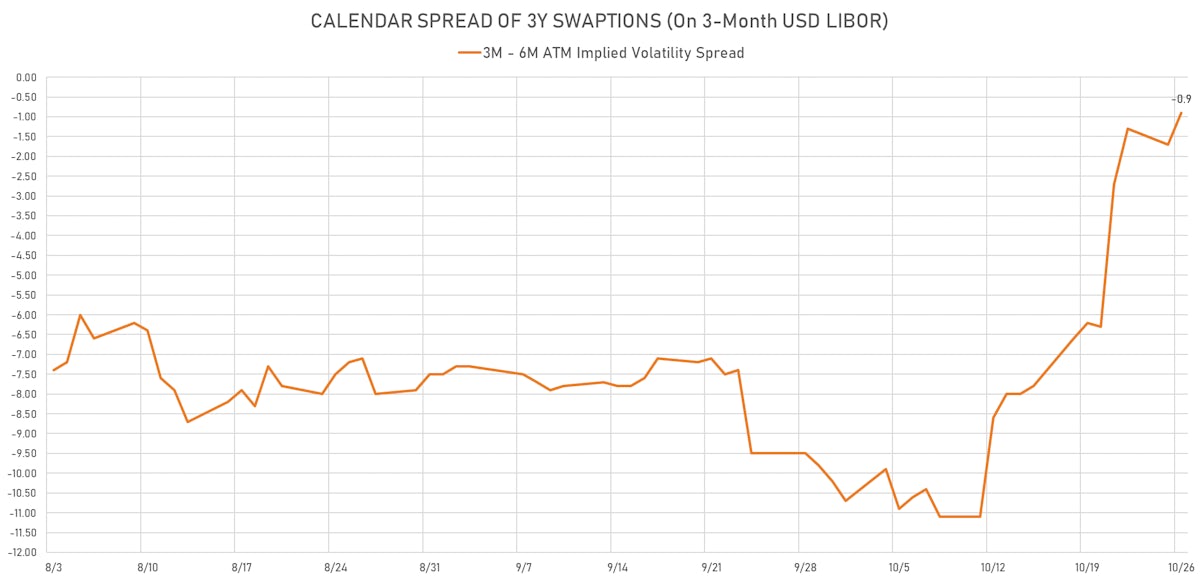

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.9% at 35.1%

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.1 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.451% (up 0.5 bp); the German 1Y-10Y curve is 0.6 bp steeper at 54.6bp (YTD change: +40.1 bp)

- Japan 5Y: -0.055% (up 0.9 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 21.5bp (YTD change: +6.7 bp)

- China 5Y: 2.829% (down -0.5 bp); the Chinese 1Y-10Y curve is 2.9 bp steeper at 71.3bp (YTD change: +24.9 bp)

- Switzerland 5Y: -0.384% (down -0.7 bp); the Swiss 1Y-10Y curve is unchanged at 59.8bp (YTD change: +36.4 bp)