Rates

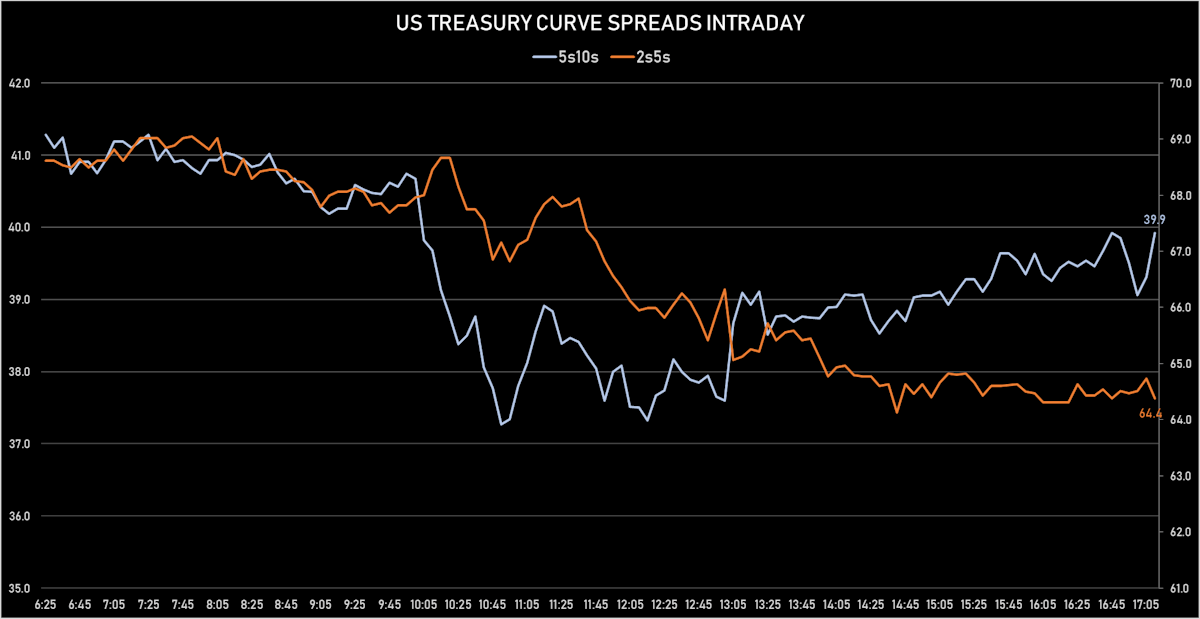

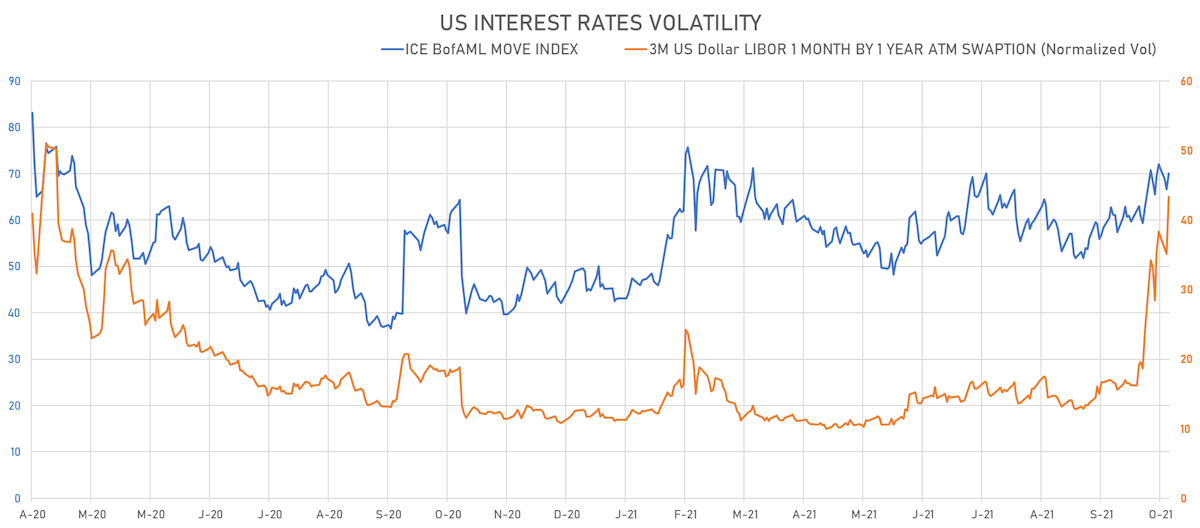

US Rates Volatility Surged As Short-Term Yields Rose While The 2s10s Treasury Curve Spread Tightened Close To 12 bp

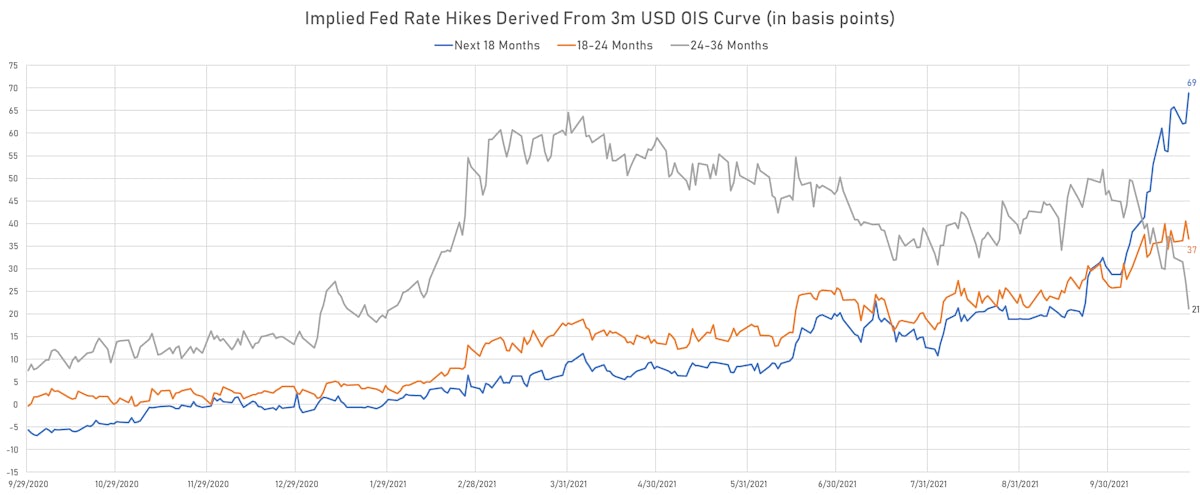

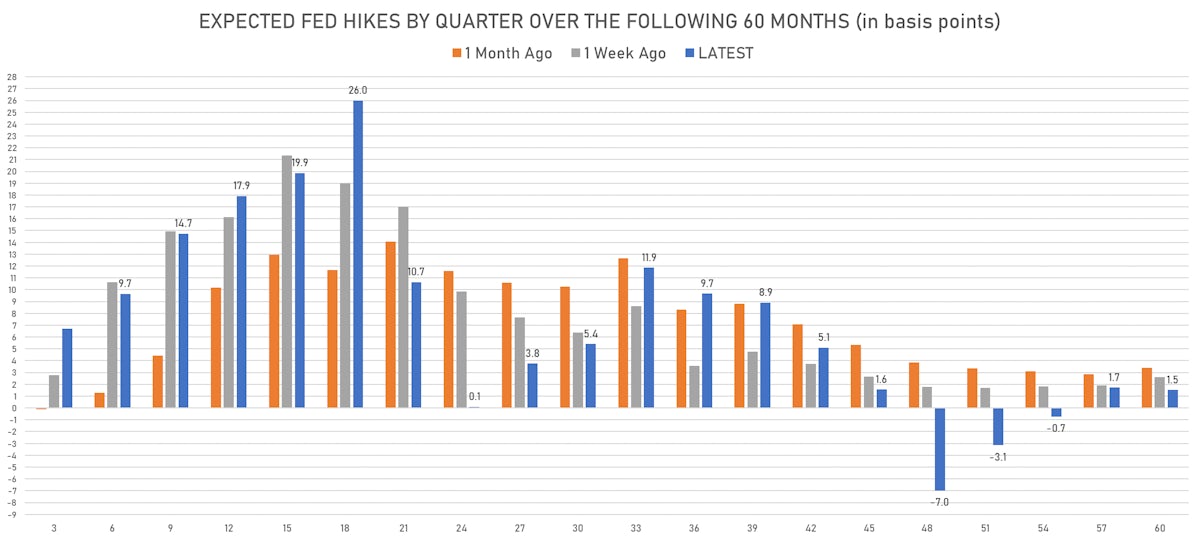

The recent rise in short rates has been mostly a case of bringing existing expectations forward rather than increasing expectations, with market-implied Fed hikes over the next 2 years up by 50 basis points, hikes over the 3 to 5 years horizon down by 50 bp, and a mostly unchanged terminal rate

Published ET

Implied Fed Hikes Priced Into The 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

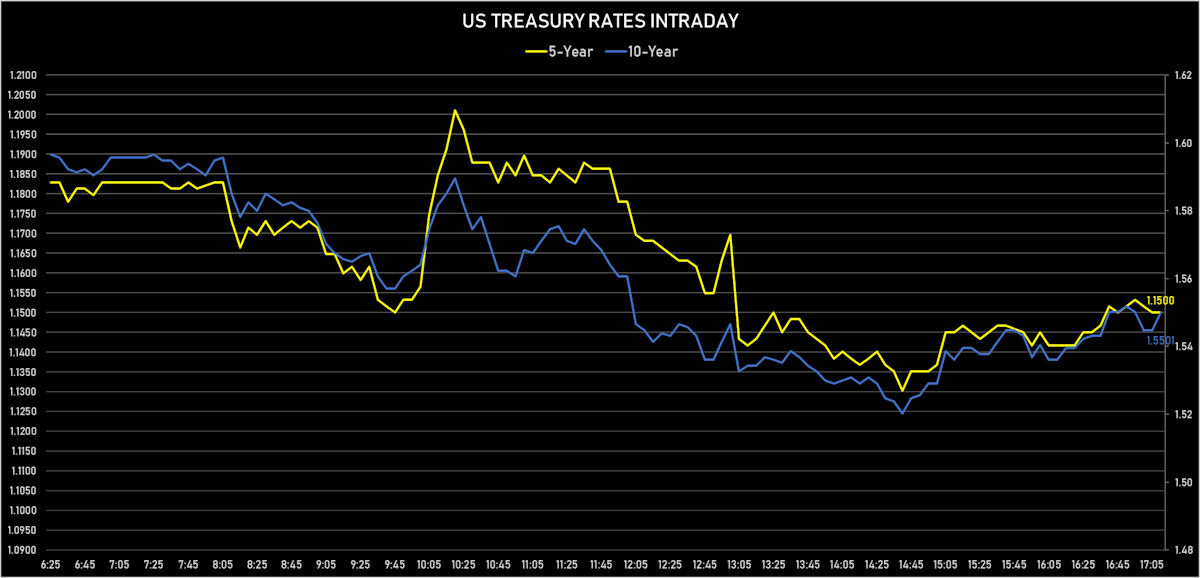

- 3-Month USD LIBOR down -0.73bp today, now at 0.1286%; 3-Month OIS +0.2bp today, now at 0.0760%

- The treasury yield curve flattened, with the 1s10s spread tightening -5.7 bp, now at 142.8 bp (YTD change: +62.4bp)

- 1Y: 0.1220% (down 0.3 bp)

- 2Y: 0.5029% (up 5.5 bp)

- 5Y: 1.1500% (down 2.8 bp)

- 7Y: 1.4116% (down 4.3 bp)

- 10Y: 1.5501% (down 6.0 bp)

- 30Y: 1.9596% (down 7.9 bp)

- US treasury curve spreads: 2s5s at 64.6bp (down -8.5bp), 5s10s at 40.1bp (down -3.2bp), 10s30s at 41.0bp (down -1.9bp)

- Treasuries butterfly spreads: 1s5s10s at -64.4bp (down -0.9bp), 5s10s30s at 1.1bp (up 1.5bp)

- US 5-Year TIPS Real Yield: -2.8 bp at -1.8270%; 10-Year TIPS Real Yield: -4.5 bp at -1.1230%; 30-Year TIPS Real Yield: -6.5 bp at -0.4500%

$60.8 BN 5-YEAR, 1.125% COUPON AUCTION (91282CDG3)

- Extremely strong results, both in terms of the pricing and demand for the offering, with end users grabbing 82.2% (vs 74.5% prior and 75.3% average)

- High Yield at 1.157%, a 2.5 bp stop-through compared to the when-issued at the bid deadline

- Bid-To-Cover Ratio at 2.55 (vs 2.37 prior and 2.36 average)

- Direct bidders at 17.4% (vs 20.2% prior and 16.4% average)

- Indirect bidders at 64.8% (vs 54.3% prior and 58.8% average)

- Primary dealers at 17.9% (vs 25.5% prior and 24.7% average)

US MACRO RELEASES

- Mortgage applications, market composite index, refinancing for W 22 Oct (MBA, USA) at 2,763.80 (vs 2,807.90 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 22 Oct (MBA, USA) at 3.30 % (vs 3.23 % prior)

- Mortgage applications, market composite index, purchase for W 22 Oct (MBA, USA) at 275.60 (vs 266.20 prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 22 Oct (MBA, USA) at 0.30 % (vs -6.30 % prior)

- Mortgage applications, market composite index for W 22 Oct (MBA, USA) at 645.10 (vs 643.00 prior)

- US Adv Goods Trade Balance, Current Prices for Sep 2021 (U.S. Census Bureau) at -96.25 Bln USD (vs -88.16 Bln USD prior)

- Wholesale Inventories Advance, Change P/P for Sep 2021 (U.S. Census Bureau) at 1.10 % (vs 1.20 % prior)

- Retail Inventories Advance, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.60 % (vs 0.60 % prior)

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.80 % (vs 0.60 % prior), above consensus estimate of 0.50 %

- Manufacturers New Orders, Durable goods total, Change P/P for Sep 2021 (U.S. Census Bureau) at -0.40 % (vs 1.80 % prior), above consensus estimate of -1.10 %

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.40 % (vs 0.30 % prior), in line with consensus estimate

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Sep 2021 (U.S. Census Bureau) at -2.00 % (vs 2.40 % prior)

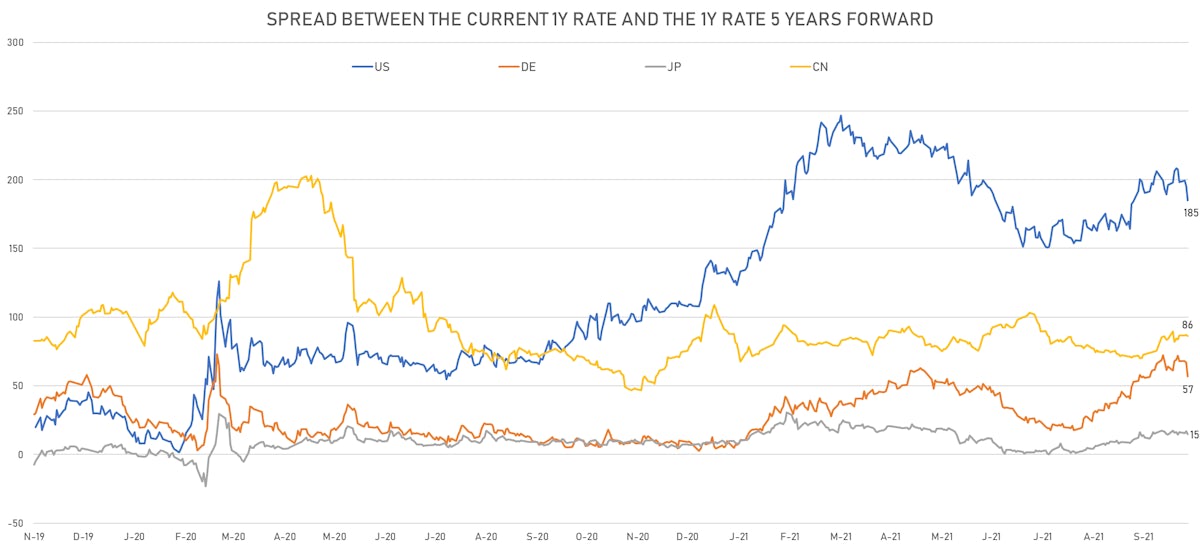

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 42.6 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), up 0.7 bp today

- The 3-month USD OIS forward curve prices in 126.6 bp over the next 3 years (equivalent to 5.07 rate hikes)

- The 3-month Eurodollar zero curve prices in 148.1 bp over the next 3 years (equivalent to 5.92 rate hikes)

- 1-year US Treasury rate 5 years forward down 9.5 bp, now at 2.01%, meaning that the 1-year Treasury rate is now expected to increase by 185.1 bp over the next 5 years (equivalent to 7.4 rate hikes)

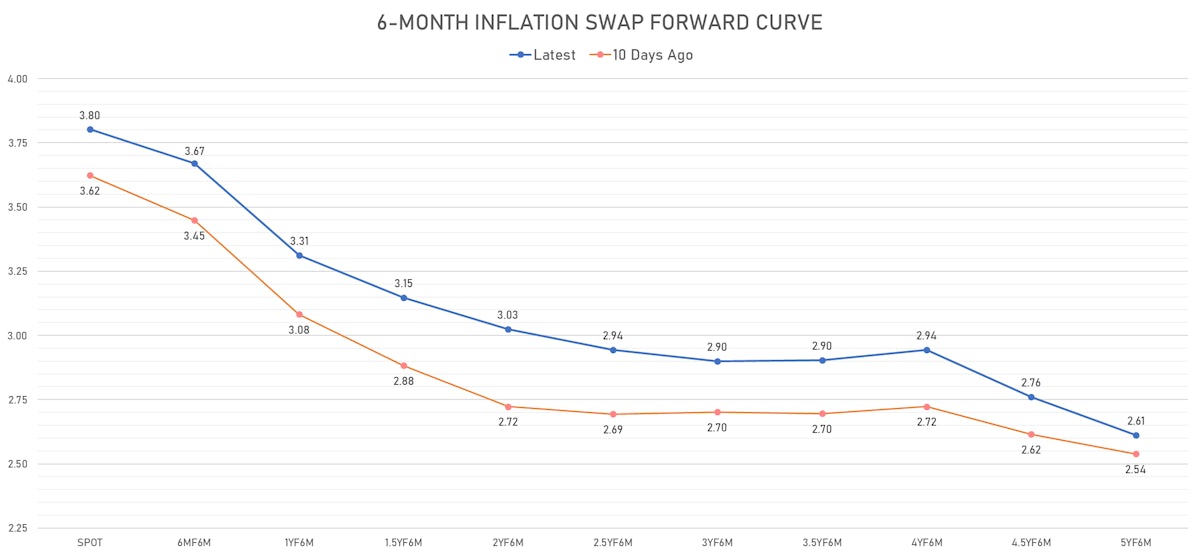

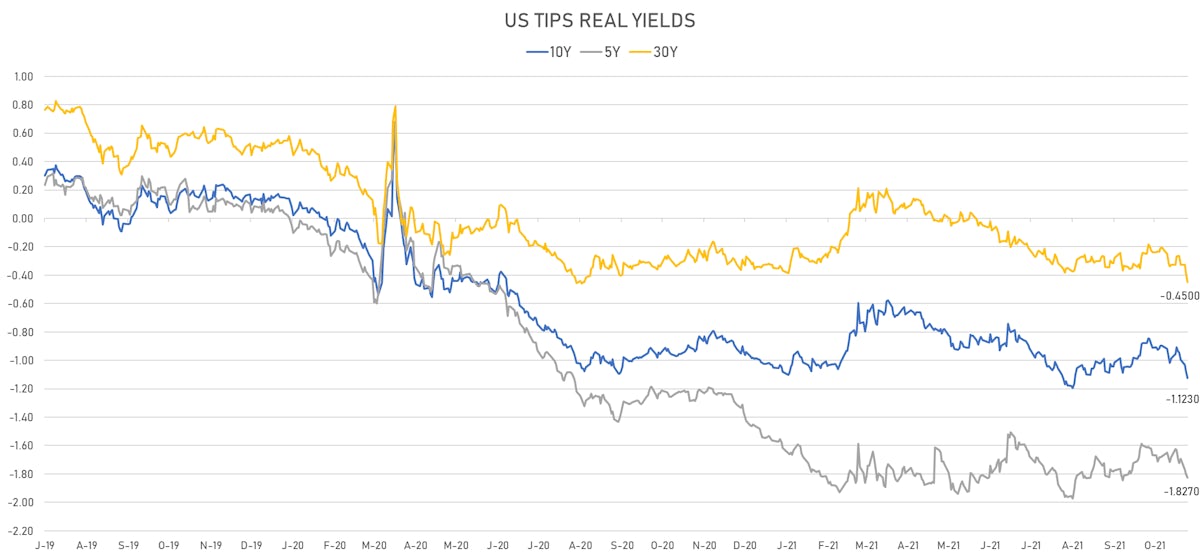

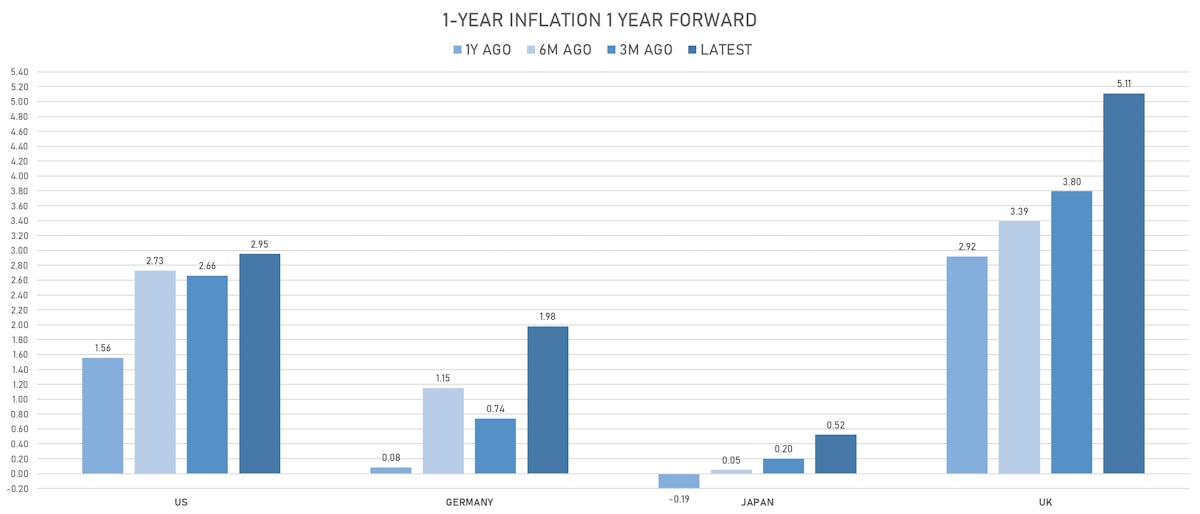

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.98% (down -8.9bp); 2Y at 3.48% (down -1.3bp); 5Y at 3.06% (up 0.4bp); 10Y at 2.65% (down -1.4bp); 30Y at 2.42% (down -1.4bp)

- 6-month spot US CPI swap down -11.0 bp to 3.802%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8270%, -2.8 bp today; 10Y at -1.1230%, -4.5 bp today; 30Y at -0.4500%, -6.5 bp today

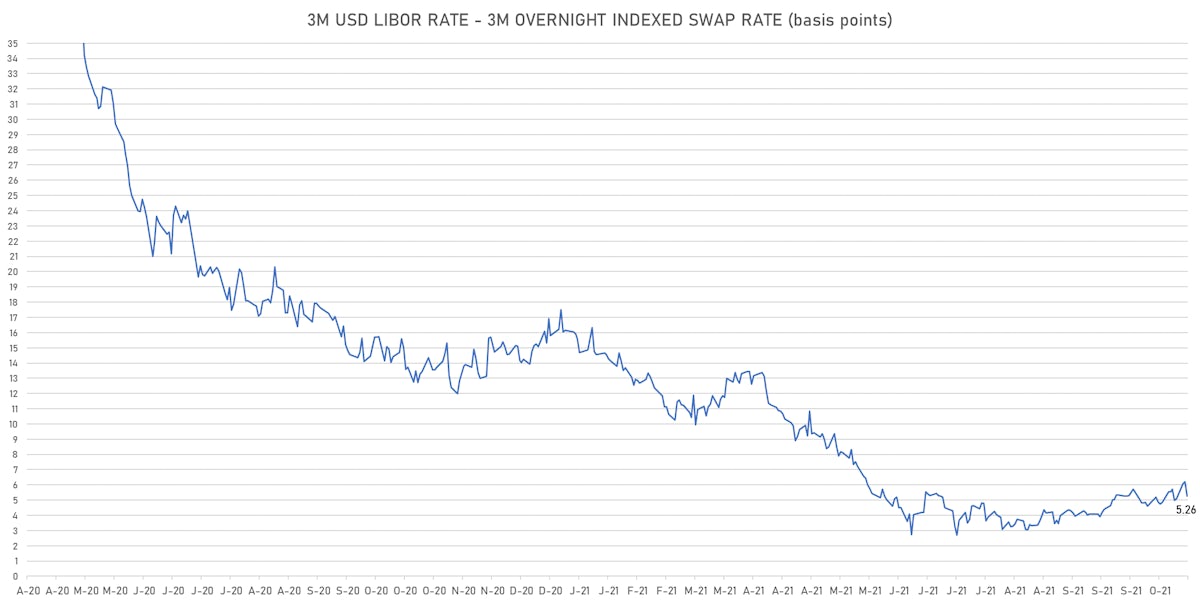

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 8.3% at 43.4%

- 3-Month LIBOR-OIS spread down -0.9 bp at 5.3 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.473% (down -3.6 bp); the German 1Y-10Y curve is 7.2 bp flatter at 47.2bp (YTD change: +32.9 bp)

- Japan 5Y: -0.070% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 18.8bp (YTD change: +6.2 bp)

- China 5Y: 2.827% (down -0.2 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 69.7bp (YTD change: +23.3 bp)

- Switzerland 5Y: -0.401% (down -1.7 bp); the Swiss 1Y-10Y curve is 6.4 bp flatter at 55.4bp (YTD change: +30.0 bp)